Best Pay-As-You-Go Auto Insurance in South Carolina (Top 10 Companies for 2026)

Progressive, Metromile, and State Farm have the best pay-as-you-go auto insurance in South Carolina, averaging $45/mo. The risk of weather-related claims is high in SC, and Progressive has the best comprehensive auto insurance for low-mileage drivers. State Farm has the best comprehensive claims service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 150 reviews

150 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

150 reviews

150 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best pay-as-you-go auto insurance in South Carolina comes from Progressive, Metromile, and State Farm.

Progressive is our top pick for low-mileage South Carolina auto insurance because it offers drivers a variety of ways to save. However, drivers looking for a genuine pay-per-mile plan should consider Metromile instead.

Our Top 10 Picks: Best Pay-As-You-Go Auto Insurance in South Carolina

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Snapshot Program | Progressive | |

| #2 | 25% | A- | Personalized Service | Metromile | |

| #3 | 20% | B | Nationwide Coverage | State Farm | |

| #4 | 25% | A+ | Drivewise Program | Allstate | |

| #5 | 25% | A++ | Competitive Rates | Geico | |

| #6 | 20% | A+ | SmartRide Program | Nationwide |

| #7 | 25% | A | Customized Policies | Liberty Mutual |

| #8 | 8% | A++ | Usage-Based Insurance | Travelers | |

| #9 | 20% | A | Pay-Per-Mile | Farmers | |

| #10 | 10% | A+ | Safe Drivers | Root |

Read on to learn where to get pay-per-mile insurance in South Carolina. Then, enter your ZIP code into our free comparison tool above to see personalized base rates from multiple companies.

- Pay-per-mile and usage-based insurance programs help low-mileage drivers save

- Pay-as-you-go insurance is ideal if you drive fewer than 7,500 miles annually

- Progressive has the best South Carolina pay-per-mile auto insurance reviews

#1 – Progressive: Top Overall Pick

Pros

- Snapshot Program: Progressive doesn’t offer a straight pay-per-mile auto insurance option. Instead, low-mileage drivers can save by enrolling in the usage-based insurance (UBI) program Snapshot.

- Discounts for Safe Driving: Progressive offers 13 discounts, including potentially significant savings for safe drivers.

- Easy Integration: Snapshot is easy to set up through the mobile app or plug-in device. Learn more about setting Snapshot up in our Progressive auto insurance review.

Cons

- Snapshot Rate Increases: Snapshot is one of the few UBI programs that can actually increase your rates if you don’t drive well enough.

- Higher Initial Rates: You’ll need to go through a monitoring period before your Snapshot discount applies to your account.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Metromile: Best for Dedicated Pay-As-You-Go Insurance

Pros

- Pay-Per-Mile Pricing: Metromile is a true pay-as-you-go company with a direct correlation between mileage and premium costs.

- Low Base Rates: Get the cheapest pay-as-you-go insurance with Metromile’s affordable base rates. See how Metromile crafts your rates in our Metromile auto insurance review.

- Smart Driving App: Metromile offers detailed trip data and insights to help manage your driving habits in its mobile app.

Cons

- High Mileage Costs: Metromile offers some of the cheapest pay-per-mile insurance for low-mileage drivers, but it can become expensive for high-mileage drivers.

- Claims Process: Some Metromile drivers report a slower claims process.

#3 – State Farm: Best for Personalized Low-Mileage Coverage

Pros

- Drive Safe & Save Program: State Farm’s UBI plan offers savings based on driving performance and habits. Good drivers can save up to 30% with Drive Safe & Save.

- Good Student Discount: State Farm offers a variety of ways to save, especially for teen students with good grades. See all your discount opportunities in our State Farm auto insurance review.

- Local Agents: Buy a State Farm policy to access its vast network of local agents for personalized service.

Cons

- Privacy Issues: It may offer some of the best pay-per-mile insurance, but continuous monitoring through Drive Safe & Save might be seen as invasive.

- High Rates for Low Credit: State Farm has a low average cost of car insurance in South Carolina unless you have a low credit score.

#4 – Allstate: Best for Full Coverage Options

Pros

- Milewise Program: See why Milewise has some of the best South Carolina pay-per-mile car insurance reviews in our Allstate Milewise review.

- Easy Monitoring: It’s simple to start driving with Milewise. Just plug the device into your car or download the mobile app.

- Discount Opportunities: Allstate offers 12 discounts to keep South Carolina auto insurance costs down, including safe driver and new car savings.

Cons

- Higher Rates for Frequent Drivers: Milewise is expensive for those driving long distances. If you’re a high-mileage driver, consider the UBI program Drivewise instead.

- Mixed Customer Service Reviews: Some Allstate drivers leave reports of inconsistent customer service quality.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Affordable Rates for All Drivers

Pros

- DriveEasy Program: Earn savings based on real-time driving data by signing up for Geico’s UBI program DriveEasy.

- User-Friendly App: Get the best pay-as-you-go insurance discount with ease, as DriveEasy comes on Geico’s user-friendly mobile app.

- Competitive Rates: Geico generally has low base rates combined with usage-based pricing. Learn more in our Geico auto insurance review.

Cons

- Rate Volatility: Geico premiums can change frequently based on driving behavior.

- Limited Agent Interaction: You get predominantly online service with Geico, meaning less personal interaction with agents.

#6 – Nationwide: Best for UBI Savings

Pros

- SmartMiles Program: SmartMiles offers accurate premiums reflecting your actual mileag, but you can also save up to 40% with SmartRide if you’re not always a low-mileage driver.

- Accident Forgiveness: Get protection from rate increases after your first at-fault accident with this Nationwide add-on.

- Flexible Payments: SmartMiles offers monthly premiums based on the previous month’s mileage. Explore all of Nationwide’s payment options in our Nationwide auto insurance review.

Cons

- High Base Rates: Liberty Mutual’s higher base rates might offset your per-mile savings.

- Limited Availability: SmartMiles may not be available in all areas — check with a representative to see if you can sign up in your ZIP code.

#7 – Liberty Mutual: Best for Unique Coverage Options

Pros

- RightTrack Program: Liberty Mutual offers some of the best car insurance for low-mileage drivers with savings of up to 30% with RightTrack.

- Customizable Coverage: There are plenty of options to tailor Liberty Mutual coverage to your individual needs.

- Good Driver Discounts: You can get additional savings for maintaining a clean driving record. Explore all 17 car insurance discounts Liberty Mutual offers in our review of Liberty Mutual auto insurance.

Cons

- Cost for High Mileage: High-mileage drivers will not get as big a discount from RightTrack as low-mileage drivers.

- Customer Service: Liberty Mutual gets mixed reviews for its customer service experiences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best Customer Service Experience

Pros

- IntelliDrive Program: Earn a discount of up to 30% for your safe driving habits, including being a low-mileage driver.

- Excellent Customer Service: Travelers consistently receives high ratings for its customer service experience. See what customers have to say in our Travelers auto insurance review.

- Discounts for Good Driving: Travelers offer 15 discounts, including additional savings for maintaining a clean driving record.

Cons

- Limited Digital Options: Travelers sells insurance the old-fashioned way, so its online tools aren’t as robust as many of its competitors.

- Some Drivers Pay More: Travelers is a great option for low-mileage car insurance for seniors, but you’ll see higher rates if you have a low credit score.

# 9 – Farmers: Best Selection of Discounts

Pros

- Signal Program: Download the Signal app to enroll in Farmers’ UBI program and save up to 30%.

- Customizable Policies: Get the best comprehensive auto insurance in South Carolina with Famers’ additional coverage options.

- Ample Discounts: Farmers has an impressive 23 opportunities to save. Get the full discount list in our Farmers auto insurance review.

Cons

- Higher Premiums: Farmers is only a cheap option if you earn a good discount through Signal. Otherwise, the average cost of auto insurance in South Carolina at Farmers can be high.

- Rate Increases With Signal: Signal can actually increase your rates if you don’t drive well enough.

#10 – Root: Best for Safe Drivers

Pros

- App-Based Assessment: Drivers need to pass an initial driving behavior assessment for personalized premiums. Learn more about the process in our Root auto insurance review.

- Competitive Rates: As long as you drive well enough, you can see affordable car insurance rates.

- Simple Process: Root’s tracking program is easy to set up. Simply download the Root app, follow the setup instructions, and you’ll be ready to drive.

Cons

- Initial Assessment Period: You’ll have to pass the initial assessment period before Root will determine your quotes.

- Limited Coverage Options: Root is best if you want to meet South Carolina car insurance minimums, as the company does not offer many coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

South Carolina Pay-As-You-Go Auto Insurance: How It Works

Traditional coverage and pay-per-mile insurance work in similar ways, with the major difference being how you’re charged. Standard car insurance plans charge you a flat fee every month that doesn’t change, while pay-as-you-go policies charge you for the miles you drive.

At Metromile, telematics is at the core of our pay-per-mile insurance.

Sr. Product Manager of Telematics, YewYin N., shares how we use telematics to accurately measure risk and help make our streets safer for everyone:

— Metromile (@Metromile) July 7, 2022

Pay-as-you-go South Carolina mileage rates consist of two parts. The first is a base rate that you’ll pay each month, no matter what. The second is a per-mile fee, which usually stays under $.10 per mile.

Pay-per-mile insurance differs from finding a low-mileage auto insurance discount or signing up for a UBI program. These offer a discount on standard insurance, whereas a pay-per-mile insurance policy’s rates are determined specifically by your mileage.

To get a better idea of how annual mileage affects auto insurance rates, check the rates below.

South Carolina Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $280 | $300 | $320 | $340 |

| 16-Year-Old Male | $300 | $320 | $340 | $360 |

| 20-Year-Old Female | $240 | $255 | $270 | $285 |

| 20-Year-Old Male | $260 | $275 | $290 | $305 |

| 30-Year-Old Female | $190 | $200 | $210 | $220 |

| 30-Year-Old Male | $200 | $210 | $220 | $230 |

| 40-Year-Old Female | $170 | $180 | $190 | $200 |

| 40-Year-Old Male | $180 | $190 | $200 | $210 |

| 50-Year-Old Female | $160 | $170 | $180 | $190 |

| 50-Year-Old Male | $170 | $180 | $190 | $200 |

| 60-Year-Old Female | $150 | $160 | $170 | $180 |

| 60-Year-Old Male | $160 | $170 | $180 | $190 |

| 70-Year-Old Female | $160 | $170 | $180 | $190 |

| 70-Year-Old Male | $170 | $180 | $190 | $200 |

As you can see, low-mileage drivers typically pay less for their insurance. This is because insurance providers see them as less of a risk for filing a claim, so they charge smaller rates.

South Carolina Auto Insurance Requirements

South Carolina minimum auto insurance requirements are relatively simple. All you need is a plan with 25/50/25 coverage for both liability and uninsured motorist coverage.

If you’re looking for the cheapest coverage possible, a plan that just meets the South Carolina car insurance requirements is your best bet.Laura D. Adams Insurance & Finance Analyst

Check the rates below to see how much of a difference South Carolina auto insurance rates can be based on coverage level.

South Carolina Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $260 | $550 |

| 16-Year-Old Male | $280 | $590 |

| 20-Year-Old Female | $220 | $460 |

| 20-Year-Old Male | $240 | $500 |

| 30-Year-Old Female | $170 | $350 |

| 30-Year-Old Male | $180 | $370 |

| 40-Year-Old Female | $150 | $310 |

| 40-Year-Old Male | $160 | $330 |

| 50-Year-Old Female | $140 | $290 |

| 50-Year-Old Male | $150 | $310 |

| 60-Year-Old Female | $130 | $270 |

| 60-Year-Old Male | $140 | $290 |

| 70-Year-Old Female | $140 | $290 |

| 70-Year-Old Male | $150 | $310 |

Although full coverage costs more, it’s usually worthwhile if it fits your budget. Full coverage insurance offers much better protection for your vehicle than a policy that only meets state requirements.

Factors Affecting South Carolina Auto Insurance Rates

Annual mileage isn’t the only factor that affects your car insurance rates. For example, finding cheap auto insurance for drivers over 60 takes into account age as well as mileage.

Another important factor is where you live. Cities that have higher theft and vandalism rates, more accidents, and denser traffic pay higher rates. Check below to see the average rates of drivers in South Carolina’s biggest cities.

South Carolina Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Charleston | Columbia | Greenville | Mount Pleasant | Myrtle Beach |

|---|---|---|---|---|---|

| 16-Year-Old Female | $280 | $270 | $260 | $250 | $275 |

| 16-Year-Old Male | $300 | $290 | $280 | $270 | $295 |

| 20-Year-Old Female | $240 | $230 | $220 | $210 | $235 |

| 20-Year-Old Male | $260 | $250 | $240 | $230 | $255 |

| 30-Year-Old Female | $190 | $180 | $170 | $160 | $185 |

| 30-Year-Old Male | $200 | $190 | $180 | $170 | $195 |

| 40-Year-Old Female | $170 | $160 | $150 | $140 | $165 |

| 40-Year-Old Male | $180 | $170 | $160 | $150 | $175 |

| 50-Year-Old Female | $160 | $150 | $140 | $130 | $155 |

| 50-Year-Old Male | $170 | $160 | $150 | $140 | $165 |

| 60-Year-Old Female | $150 | $140 | $130 | $120 | $145 |

| 60-Year-Old Male | $160 | $150 | $140 | $130 | $155 |

| 70-Year-Old Female | $150 | $140 | $130 | $120 | $145 |

| 70-Year-Old Male | $160 | $150 | $140 | $130 | $155 |

Insurance companies keep detailed information for each ZIP code in South Carolina. Moving even one ZIP code over can drastically impact your rates.

Other factors providers consider include your gender, marital status, the car you drive, education status, and credit score. Most major companies look at the same factors but have different quote formulas, which is why it’s important to compare multiple companies.Travis Thompson Licensed Insurance Agent

Although there are many factors that affect your rates, you have plenty of opportunities to save on your insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Lower South Carolina Auto Insurance Costs

The best pay-as-you-go insurance companies can help you save a significant amount of money on your insurance, but there are other ways to save.

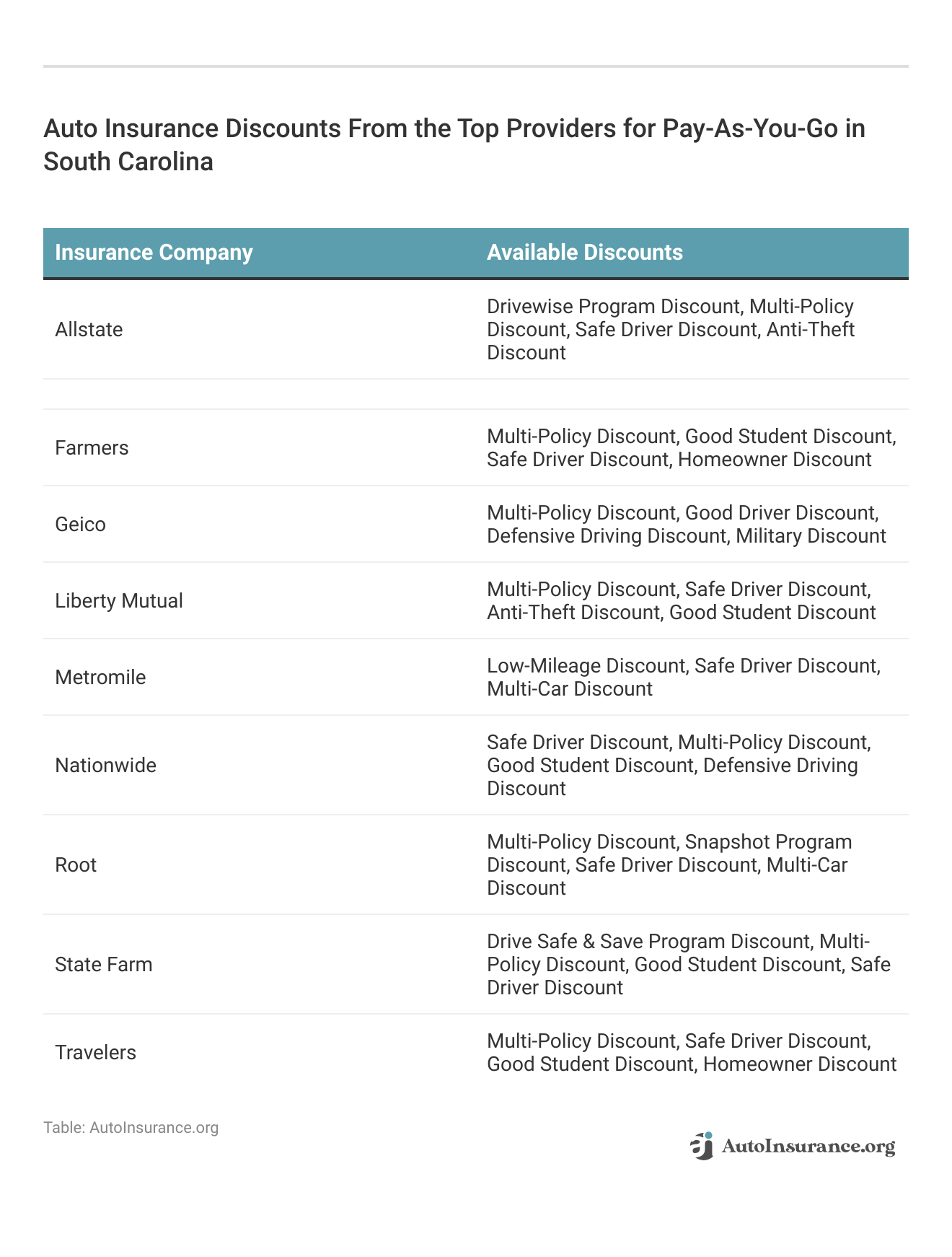

One of the easiest ways to reduce your rates is to take advantage of discounts. Most insurance companies offer a variety of ways to save. You can find some discount options from our top companies that might appeal to low-mileage drivers below.

Other ways to save include lowering your coverage to the minimum, choosing a larger deductible, and comparing quotes. Check below to see the average car insurance rates from our top companies to get an idea of how much price variation there can be.

Pay-As-You-Go Auto Insurance in South Carolina: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $60 | $155 |

| Farmers | $47 | $128 |

| Geico | $48 | $130 |

| Liberty Mutual | $52 | $140 |

| Metromile | $45 | $125 |

| Nationwide | $50 | $135 |

| Progressive | $50 | $135 |

| Root | $53 | $142 |

| State Farm | $55 | $145 |

| Travelers | $49 | $132 |

If you skip the step of comparing auto insurance quotes from multiple companies, you might drastically overpay for your insurance.

Get The Best Pay-As-You-Go Auto Insurance in South Carolina

Pay-per-mile auto insurance is more than just cheap usage-based auto insurance that gives low-mileage drivers a discount. If you shop with the best South Carolina auto insurance companies for pay-per-mile coverage, you can find significant savings.

Like all other types of coverage, finding the right company for your pay-as-you-go insurance needs in South Carolina depends on comparing quotes. Enter your ZIP code into our free comparison tool below to get started.

Frequently Asked Questions

What is the average cost of auto insurance in South Carolina?

The average driver in South Carolina pays $136 per month for insurance. However, rates depend on the type of auto insurance you purchase, your age, where you live, and a host of other factors.

Does South Carolina have no-fault insurance?

No, South Carolina is not a no-fault state. Instead, any injuries you suffer or damage caused to your property will be paid for by the responsible driver’s liability insurance.

Who has the cheapest pay-as-you-go auto insurance in South Carolina?

The cheapest pay-per-mile auto insurance in South Carolina comes from Metromile, which has rates starting at $135 per month. That makes Metromile one of the best auto insurance companies for telecommuters looking to save.

Is Root auto insurance available in South Carolina?

Yes, you can purchase a Root auto insurance policy in South Carolina. You can compare Root auto insurance quotes with other companies by entering your ZIP code into our free comparison tool today.

Is Geico pay-as-you-go auto insurance cheaper than Progressive?

Geico is slightly cheaper than Progresive in general, especially if you want low-mileage auto insurance for seniors. However, it depends on the type of coverage you want. For example, comprehensive auto insurance from Progressive might be cheaper than what Geico offers.

Is Allstate pay-as-you-go auto insurance cheaper than Geico?

Allstate is more expensive than Geico for almost every type of driver. However, Allstate offers an actual pay-per-mile option, which can help low-mileage drivers save. In contrast, Geico only offers a UBI discount.

Is Allstate or USAA better for pay-as-you-go insurance?

Allstate offers Milewise, which is a genuine pay-per-mile insurance plan that offers low-mileage drivers affordable rates. USAA does not offer a direct pay-as-you-go option. Instead, it has a UBI program that offers low-mileage drivers a discount on their standard insurance.

What is the South Carolina state minimum auto insurance?

South Carolina minimum insurance requirements are relatively basic. You only need a 25/50/25 plan for liability and uninsured motorist insurance.

What is full coverage auto insurance in South Carolina?

Full coverage auto insurance includes liability, comprehensive, collision, and uninsured motorist insurance. It costs more than minimum insurance, but it offers your vehicle much better protection. For example, you can make comprehensive auto insurance claims with a full coverage policy for things like weather damage and theft.

Can you drive without insurance in South Carolina?

It’s illegal to drive without insurance in South Carolina. Drivers who hit the road without the right coverage face fines, license suspension, and other legal trouble. However, you can take advantage of the South Carolina auto insurance grace period when you first buy your vehicle. After the initial sale, you have 30 days to purchase coverage for your car.

Can you register a car without insurance in South Carolina?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.