Best Infiniti Q50 Auto Insurance in 2026 (Check Out These 10 Companies)

Secure the best Infiniti Q50 auto insurance with Geico, State Farm, and Progressive, offering rates from $85 per month. These top providers offer affordable, tailored insurance for Infiniti Q50 with strong coverage. Get a quote now to compare the best rates and lower your insurance cost for Infiniti Q50.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated July 2024

Company Facts

Full Coverage for Infiniti Q50

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Infiniti Q50

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Infiniti Q50

A.M. Best Rating

Complaint Level

Pros & Cons

The best Infiniti Q50 auto insurance providers are Geico, State Farm, and Progressive, with rates starting as low as $85 per month. If you’re asking, “Are Infiniti cars expensive to insure?” Geico stands out for affordability and comprehensive coverage. Choose Geico for the best value and protection.

The article also explores how the average insurance cost for Infiniti Q50 can vary based on the vehicle’s price. It answers the question, “Does the price of a car affect auto insurance rates?” and reveals that higher vehicle values generally lead to higher premiums.

Our Top 10 Company Picks: Best Infiniti Q50 Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% A++ Affordable Rates Geico

![]()

#2 20% B Local Agent State Farm

#3 15% A+ Snapshot Program Progressive

#4 12% A++ Customer Service USAA

#5 20% A+ Drivewise Program Allstate

#6 10% A+ Vanishing Deductible Nationwide

#7 8% A Customizable Policies Liberty Mutual

#8 15% A++ IntelliDrive Discounts Travelers

#9 15% A+ Customer Satisfaction Amica

#10 10% A+ Specialized Coverage The Hartford

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code above in our free quote comparison tool.

- The price of a car significantly impacts auto insurance rates

- Geico is the top choice for affordable, comprehensive coverage

- Older Infiniti Q50 models typically have lower insurance costs

#1 – Geico: Top Overall Pick

Pros

- Affordable Monthly Premium: As mentioned in our Geico auto insurance review, Geico offers a competitive monthly rate of $165 for Infiniti Q50 insurance, which is lower than the average rate of $132 per month. This can be an attractive option for those looking to save on insurance costs while still obtaining comprehensive coverage.

- Strong Discounts: Geico provides a variety of discounts that can help reduce your Infiniti Q50 insurance premium. These include multi-car discounts, good driver discounts, and savings for having safety features such as anti-lock brakes and airbags, which can lead to further cost savings.

- User-Friendly Online Tools: Geico’s online platform is highly rated for ease of use, allowing Infiniti Q50 owners to easily manage their policies, file claims, and access customer support. Their efficient online tools make it convenient for drivers to handle their insurance needs quickly.

Cons

- Limited Coverage Options: Geico’s policies might offer fewer optional coverages or add-ons compared to other insurers. Infiniti Q50 owners seeking specialized coverage, such as enhanced roadside assistance or gap insurance, may find Geico’s options more limited.

- Mixed Customer Service Feedback: Geico has received varied reviews regarding customer service. While some customers are satisfied, others have reported challenges with claims processing and customer support, which could impact the overall insurance experience for Infiniti Q50 owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agent

Pros

- Comprehensive Coverage: As mentioned in our State Farm auto insurance review, State Farm provides extensive coverage options for Infiniti Q50 owners, including liability, collision, and comprehensive insurance. Their policies often come with additional benefits such as accident forgiveness and rental car reimbursement.

- Good Discounts: State Farm offers a range of discounts that can help lower your Infiniti Q50 insurance premium. These include multi-policy discounts, safe driver discounts, and discounts for using their Drive Safe & Save program, which monitors driving behavior to reward safe driving.

- Flexible Payment Plans: State Farm offers flexible payment options, allowing Infiniti Q50 owners to choose from various payment schedules that fit their financial needs. This flexibility can help manage insurance costs more effectively.

Cons

- Higher Premiums: At $170 per month, State Farm’s rates are slightly higher compared to some competitors. This could be a drawback for Infiniti Q50 owners looking for more budget-friendly insurance options. Higher premiums may impact overall affordability.

- Customer Service Variability: While State Farm has a solid reputation, customer service experiences can vary by location. Some Infiniti Q50 owners might encounter inconsistent service or slower claims processing, which could affect overall satisfaction.

#3 – Progressive: Best for Snapshot Program

Pros

- Flexible Coverage Options: As mentioned in Progressive auto insurance review, Progressive offers a wide range of coverage options for Infiniti Q50 owners, including customizable policies with various add-ons. This flexibility allows drivers to tailor their insurance to fit specific needs and preferences.

- Discount Opportunities: Progressive provides numerous discount opportunities that can help lower your Infiniti Q50 insurance premium. These include multi-car discounts, bundling discounts, and savings for having safety features and good driving habits.

- Snapshot Program: Progressive’s Snapshot program monitors driving behavior and offers potential discounts based on your driving habits. Infiniti Q50 owners who demonstrate safe driving practices can benefit from reduced rates through this innovative program.

Cons

- Premium Rate Variability: Progressive’s monthly premium of $168 might not be the lowest available, which could be a disadvantage for Infiniti Q50 owners seeking the most cost-effective insurance. Rates can vary based on individual risk factors and location.

- Mixed Customer Service Reviews: Progressive has received mixed feedback regarding customer service, with some customers reporting issues with claims handling and customer support. Infiniti Q50 owners may experience variability in service quality, affecting their overall satisfaction.

#4 – USAA: Best for Customer Service

Pros

- Best Rates for Military Members: USAA offers the lowest average rate of $155 for Infiniti Q50 insurance, making it an excellent option for military members and their families. This rate provides significant savings for eligible drivers.

- Exceptional Customer Satisfaction: USAA consistently ranks high in customer satisfaction surveys, offering reliable service and support. Infiniti Q50 owners benefit from top-notch customer service and smooth claims handling.

- Comprehensive Coverage Options: As outlined in our USAA auto insurance review, USAA provides extensive coverage options tailored to the needs of Infiniti Q50 owners, including additional protections for military-related situations.

Cons

- Eligibility Restrictions: USAA insurance is exclusively available to military members, veterans, and their families. This limits access for non-military Infiniti Q50 owners, excluding them from these competitive rates and excellent service.

- Limited Availability for Non-Military Drivers: As USAA’s services are restricted to military-affiliated individuals, Infiniti Q50 owners outside this group won’t be able to access their low rates and coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Drivewise Program

Pros

- Robust Coverage Options: Allstate offers comprehensive coverage for Infiniti Q50 owners, including accident forgiveness and new car replacement options. These features provide added protection and value for your insurance policy.

- Numerous Discounts Available: As outlined in our Allstate auto insurance review, Allstate provides a variety of discounts that can lower your Infiniti Q50 insurance costs, such as multi-policy discounts and safe driver incentives.

- Local Agent Network: With a strong network of local agents, Allstate offers personalized service and local expertise. Infiniti Q50 owners benefit from direct interactions and tailored advice.

Cons

- Higher Premiums: Allstate’s average premium of $175 is on the higher side compared to other providers. This might be less attractive for Infiniti Q50 owners seeking more budget-friendly insurance options.

- Mixed Customer Reviews: Allstate has received mixed feedback regarding its customer service and claims process. Infiniti Q50 owners might face challenges with claim handling and customer support.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Variety of Coverage Options: Nationwide provides a range of coverage options for the Infiniti Q50, including accident forgiveness and vanishing deductibles, which add value and protection for policyholders.

- Competitive Discounts: Nationwide offers several discounts that can help reduce Infiniti Q50 insurance rates, including bundling policies and multi-car discounts. For more information, read our Nationwide auto insurance review.

- Strong Financial Stability: Nationwide is known for its financial stability and reliability, providing peace of mind to Infiniti Q50 owners regarding their insurance coverage and company longevity.

Cons

- Average Premiums: Nationwide’s average premium of $172 is higher than some competitors, which might be a drawback for Infiniti Q50 owners looking for more cost-effective insurance solutions.

- Customer Service Variability: Customer service experiences with Nationwide can vary, and some Infiniti Q50 owners might encounter issues with response times or claim processing.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Extensive Coverage Options: Liberty Mutual offers a wide range of coverage options for the Infiniti Q50, including accident forgiveness and new car replacement. This flexibility allows for customized insurance plans.

- Discount Opportunities: Liberty Mutual provides various discounts, such as bundling policies and safe driver discounts, which can help reduce insurance costs for Infiniti Q50 owners.

- Strong Online Tools: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual has robust online tools and resources, making it easy for Infiniti Q50 owners to manage their policies and file claims online efficiently.

Cons

- Higher Cost: With an average premium of $178, Liberty Mutual is one of the more expensive options for Infiniti Q50 insurance, which may be less appealing to budget-conscious drivers.

- Mixed Customer Satisfaction: Liberty Mutual has received mixed reviews regarding customer service and claims handling, potentially leading to less satisfactory experiences for Infiniti Q50 owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive Discounts

Pros

- Competitive Rates: Travelers offers a competitive monthly rate of $169 for Infiniti Q50 insurance, making it a cost-effective option compared to the average rate of $132 per month. This rate can be advantageous for budget-conscious drivers seeking reliable coverage without compromising on quality.

- Comprehensive Coverage Options: Travelers provides a range of coverage options for Infiniti Q50 owners, including liability, collision, and comprehensive coverage. Their policies often come with features like roadside assistance and rental car reimbursement, enhancing the overall value of the insurance.

- Discounts and Savings: As mentioned in our Travelers auto insurance review, Travelers offers several discounts that can further reduce your Infiniti Q50 insurance premium. These include multi-policy discounts, safe driver discounts, and discounts for having advanced safety features in your vehicle, potentially lowering your annual premium even more.

Cons

- Limited Customization: Some drivers may find Travelers’ policy options for the Infiniti Q50 to be less flexible compared to other insurers. While they offer a variety of standard coverages, there may be fewer options for customizing your policy to fit specific needs or preferences.

- Customer Service Concerns: Travelers has received mixed reviews regarding customer service, which can be a concern for Infiniti Q50 owners needing timely assistance or support. Issues such as slow claims processing or difficulty reaching customer service can impact the overall insurance experience.

#9 – Amica: Best for Customer Satisfaction

Pros

- Affordable Premiums: Amica’s monthly rate of $166 for Infiniti Q50 insurance is slightly lower than the average rate, providing an affordable option for comprehensive coverage. This pricing can help drivers save money while still receiving robust protection for their vehicle.

- Strong Customer Satisfaction: As outlined in our Amica auto insurance review, Amica consistently ranks high in customer satisfaction surveys, particularly for claims handling and customer support. Infiniti Q50 owners can benefit from Amica’s reputation for excellent service and efficient claims processing, ensuring a smoother insurance experience.

- Flexible Coverage Options: Amica offers a range of customizable coverage options for Infiniti Q50 owners, including add-ons like gap insurance and enhanced roadside assistance. This flexibility allows drivers to tailor their insurance policy to their specific needs and preferences.

Cons

- Limited Discounts: Amica may not offer as many discounts as some competitors, which could result in a higher overall premium for Infiniti Q50 owners who do not qualify for available savings. The lack of extensive discount options might make it less appealing for budget-conscious drivers.

- Higher Deductibles: Amica’s policies might come with higher deductibles compared to other insurers, which could mean more out-of-pocket expenses in the event of a claim. This aspect may be less favorable for Infiniti Q50 owners looking to minimize their financial risk.

#10 – The Hartford: Best for Specialized Coverage

Pros

- Comprehensive Coverage: The Hartford provides extensive coverage options for Infiniti Q50 owners, including high levels of liability, collision, and comprehensive coverage. Their policies often include perks like accident forgiveness and new car replacement, which can offer additional peace of mind.

- Discounts for Safe Driving: In our The Hartford auto insurance review they offer competitive discounts for safe driving and having advanced safety features on your Infiniti Q50. These discounts can help lower your monthly premium and reward drivers who maintain a clean driving record.

- Good for Seniors: The Hartford is known for offering favorable rates and benefits for senior drivers. If you are an older Infiniti Q50 owner, you may find The Hartford’s policies particularly advantageous due to their focus on providing tailored coverage for mature drivers.

Cons

- Higher Premiums: At $173 per month, The Hartford’s rates are higher than some competitors. This could be a disadvantage for Infiniti Q50 owners looking for more affordable insurance options. Higher premiums may impact budget considerations for those seeking cost-effective coverage.

- Mixed Customer Service Reviews: The Hartford has received mixed feedback regarding customer service, which may affect the overall satisfaction for Infiniti Q50 owners. Issues such as slower response times or less helpful customer support could be a concern for some policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Infiniti Q50 Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Infiniti Q50 from various providers.

Infiniti Q50 Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $175

Amica $86 $166

Geico $85 $165

Liberty Mutual $92 $178

Nationwide $89 $172

Progressive $88 $168

State Farm $90 $170

The Hartford $91 $173

Travelers $87 $169

USAA $80 $155

When choosing insurance for your Infiniti Q50, comparing rates for both minimum and full coverage can help you find the best deal. Consider the options available to ensure you get the coverage that meets your needs at a price that fits your budget.

Infiniti Q50 Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $132 |

| Discount Rate | $78 |

| High Deductibles | $114 |

| High Risk Driver | $282 |

| Low Deductibles | $166 |

| Teen Driver | $483 |

Understanding how different deductible levels and driver profiles impact your Infiniti Q50 insurance rates can help you make informed decisions. Comparing these factors will ensure you choose the best coverage that balances cost and protection.

Read More: Auto Insurance Deductibles

Why Infiniti Q50s Insurance are Expensive

The chart below details how Infiniti Q50 insurance rates compare to other sedans like the Honda Accord, Audi S3, and Kia Forte.

Infiniti Q50 Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi S3 | $30 | $62 | $22 | $123 |

| Cadillac ATS | $25 | $47 | $33 | $118 |

| Ford Taurus | $29 | $50 | $33 | $125 |

| Honda Accord | $23 | $42 | $31 | $109 |

| Kia Forte | $27 | $42 | $31 | $113 |

| Toyota Camry | $25 | $48 | $33 | $118 |

The Infiniti Q50 tends to have higher insurance rates compared to other sedans due to its comprehensive and collision coverage costs.

Comparing these figures with similar vehicles can help you understand the factors driving your insurance premiums and explore ways to reduce them.

Read More: Cheap Toyota Auto Insurance

Factors that Impact the Cost of Infiniti Q50 Insurance

The Infiniti Q50 trim and model significantly influence your insurance premiums. Higher trims with advanced features or greater horsepower may lead to increased repair costs and higher risk, raising your insurance rates.

Newer models often cost more to insure due to their higher value and advanced technology, while older models may be less expensive.Kristen Gryglik LICENSED INSURANCE AGENT

Choosing a trim with more safety features could potentially lower your premiums by reducing the risk of accidents and enhancing the vehicle’s overall safety profile.

Age of the Vehicle

Older Infiniti Q50 models generally cost less to insure. For example, auto insurance for a 2018 Infiniti Q50 costs $11 per month, while insurance for a 2014 Infiniti Q50 costs $10 per month, resulting in a difference of $9 per month.

Infiniti Q50 Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Infiniti Q50 | $33 | $63 | $33 | $139 |

| 2023 Infiniti Q50 | $32 | $61 | $32 | $137 |

| 2022 Infiniti Q50 | $31 | $60 | $32 | $135 |

| 2021 Infiniti Q50 | $30 | $58 | $31 | $133 |

| 2020 Infiniti Q50 | $31 | $60 | $31 | $135 |

| 2019 Infiniti Q50 | $30 | $58 | $33 | $133 |

| 2018 Infiniti Q50 | $29 | $57 | $33 | $132 |

| 2017 Infiniti Q50 | $28 | $56 | $35 | $131 |

| 2016 Infiniti Q50 | $27 | $53 | $36 | $129 |

| 2015 Infiniti Q50 | $25 | $52 | $37 | $127 |

As your Infiniti Q50 ages, you may see a reduction in insurance premiums, with older models generally costing less to insure. This trend reflects the lower repair and replacement costs associated with older vehicles, providing potential savings over time.

Driver Age

Driver age can have a significant effect on the cost of Infiniti Q50 auto insurance. For example, a 20-year-old driver could pay around $13 more each month for their Infiniti Q50 auto insurance than a 30-year-old driver.

Infiniti Q50 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $650 |

| Age: 18 | $483 |

| Age: 20 | $300 |

| Age: 30 | $138 |

| Age: 40 | $132 |

| Age: 45 | $125 |

| Age: 50 | $121 |

| Age: 60 | $118 |

Driver age plays a crucial role in determining Infiniti Q50 insurance rates, with younger drivers often facing significantly higher premiums. As drivers age and gain experience, insurance costs typically decrease, reflecting lower risk and fewer claims.

Read More: Cheap Auto Insurance for 20-Year-Olds

Driver Location

Where you live can have a large impact on Infiniti Q50 insurance rates. For example, drivers in Los Angeles may pay $9 a month more than drivers in Indianapolis.

Infiniti Q50 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $175 |

| Columbus, OH | $110 |

| Houston, TX | $207 |

| Indianapolis, IN | $112 |

| Jacksonville, FL | $192 |

| Los Angeles, CA | $226 |

| New York, NY | $209 |

| Philadelphia, PA | $177 |

| Phoenix, AZ | $153 |

| Seattle, WA | $128 |

Your location greatly affects Infiniti Q50 insurance rates, with significant variations between cities. Living in high-cost areas can lead to much higher premiums compared to more affordable locations.

Your Driving Record

Your driving record can have an impact on the cost of Infiniti Q50 auto insurance. Teens and drivers in their 20’s see the highest jump in their Infiniti Q50 auto insurance with violations on their driving record.

Infiniti Q50 Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $650 | $975 | $1,150 | $850 |

| Age: 18 | $483 | $724 | $864 | $681 |

| Age: 20 | $300 | $450 | $540 | $425 |

| Age: 30 | $138 | $208 | $250 | $195 |

| Age: 40 | $132 | $198 | $238 | $186 |

| Age: 45 | $125 | $188 | $226 | $177 |

| Age: 50 | $121 | $181 | $217 | $170 |

| Age: 60 | $118 | $176 | $211 | $165 |

Your location can significantly affect the cost of insuring your Infiniti Q50, with some cities seeing much higher premiums due to factors like local accident rates and repair costs. Comparing rates across different areas can help you find the most affordable insurance options based on where you live.

Safety Ratings

Your Infiniti Q50 auto insurance rates are influenced by the Infiniti Q50’s safety ratings. See the breakdown below:

Infiniti Q50 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The safety ratings of your Infiniti Q50, such as good scores in moderate overlap front, side, roof strength, and head restraints, can positively impact your insurance premiums by reducing perceived risk. Ensuring your vehicle’s safety features are up-to-date can help lower insurance costs and provide better protection on the road.

Crash Test Ratings

The crash test ratings for the Infiniti Q50 can significantly influence your auto insurance rates. The table below shows the ratings for various Infiniti Q50 models, highlighting their overall safety performance.

Infiniti Q50 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2024 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Infiniti Q50 Hybrid 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Infiniti Q50 Hybrid 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Infiniti Q50 Hybrid 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Infiniti Q50 Hybrid 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Infiniti Q50 4 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Infiniti Q50 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

The Infiniti Q50’s consistent 5-star rollover ratings suggest robust safety features, potentially lowering your insurance rates. For more precise rate adjustments, consider additional safety and crash test data.

Infiniti Q50 Safety Features

Infiniti Q50 safety features can lower the cost of your insurance. The safety features for the 2020 Infiniti Q50 include:

- Comprehensive Air Bag System: Includes driver, passenger, front head, rear head, and front side air bags.

- Advanced Brake Features: Equipped with 4-wheel ABS, 4-wheel disc brakes, and brake assist.

- Enhanced Safety Technologies: Features electronic stability control and traction control.

- Visibility and Safety Enhancements: Includes daytime running lights and integrated turn signal mirrors.

- Child Safety and Locking: Equipped with child safety locks for added protection.

The 2020 Infiniti Q50’s advanced safety features contribute to lower insurance costs and enhanced protection. With comprehensive air bags, advanced braking, and cutting-edge safety technologies, this vehicle offers peace of mind on the road.

Loss Probability

Insurance loss probability on the Infiniti Q50 fluctuates between each type of coverage. The lower percentage means lower Infiniti Q50 auto insurance rates; higher percentages mean higher Infiniti Q50 auto insurance rates.

Infiniti Q50 Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | 2% |

| Collision | 48% |

| Comprehensive | 51% |

| Medical Payment | 23% |

| Personal Injury | -3% |

| Property Damage | -15% |

The Infiniti Q50’s insurance loss probabilities vary by coverage type, influencing overall insurance rates. Lower loss rates in categories like property damage and personal injury can lead to more affordable premiums, while higher rates in collision and comprehensive coverage may increase costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Infiniti Q50 Finance and Insurance Cost

If you are financing an Infiniti Q50, you will pay more if you purchase Infiniti Q50 auto insurance at the dealership, so be sure to shop around and compare Infiniti Q50 auto insurance quotes from the best companies using our free tool below.

Read More: Do I need full coverage insurance to finance a car?

5 Ways to Save on Infiniti Q50 Insurance

Drivers can end up saving more money on their Infiniti Q50 auto insurance rates by employing any one of the following strategies.

- Ask about loyalty discounts.

- Ask about Infiniti Q50 low mileage discounts.

- Park your Infiniti Q50 somewhere safe – like a garage or private driveway.

- Ask about Infiniti Q50 safety discounts.

- Use an accurate job title when requesting Infiniti Q50 auto insurance.

By applying these strategies, you can potentially reduce your Infiniti Q50 insurance costs significantly. Explore these options to find the best savings for your policy.

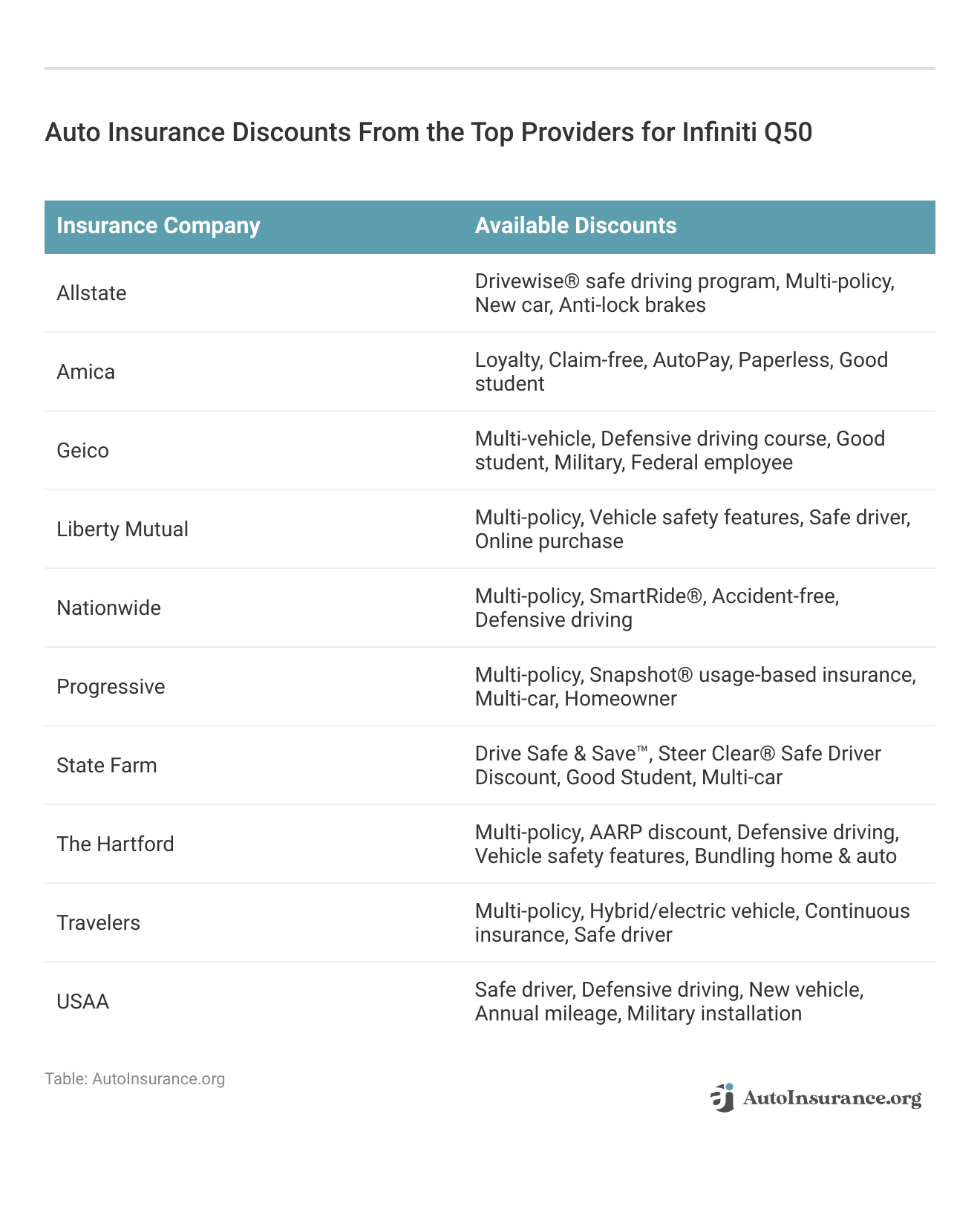

These auto insurance discounts from top insurance providers for Infiniti Q50 offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Infiniti Q50 Insurance Companies

The best auto insurance companies for Infiniti Q50 auto insurance rates will offer competitive rates, discounts, and account for the Infiniti Q50’s safety features. The following list of auto insurance companies outlines which companies hold the highest market share.

Infiniti Q50 Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 6% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

These top insurers provide competitive rates and a range of discounts for Infiniti Q50 owners. Choosing the right company can help you maximize savings and benefit from comprehensive coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Infiniti Q50 Insurance Quotes Online

Compare free Infiniti Q50 insurance quotes online to secure the best rates and coverage tailored for your vehicle. By exploring offers from multiple providers, you can identify savings opportunities and choose a policy that aligns with your Infiniti Q50’s unique insurance needs. Finding cheap Infiniti auto insurance allows you to maximize coverage while minimizing costs.

Take advantage of comparison tools to find discounts and benefits that suit your driving profile and vehicle features, ultimately helping you make an informed decision for your Infiniti Q50’s insurance.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

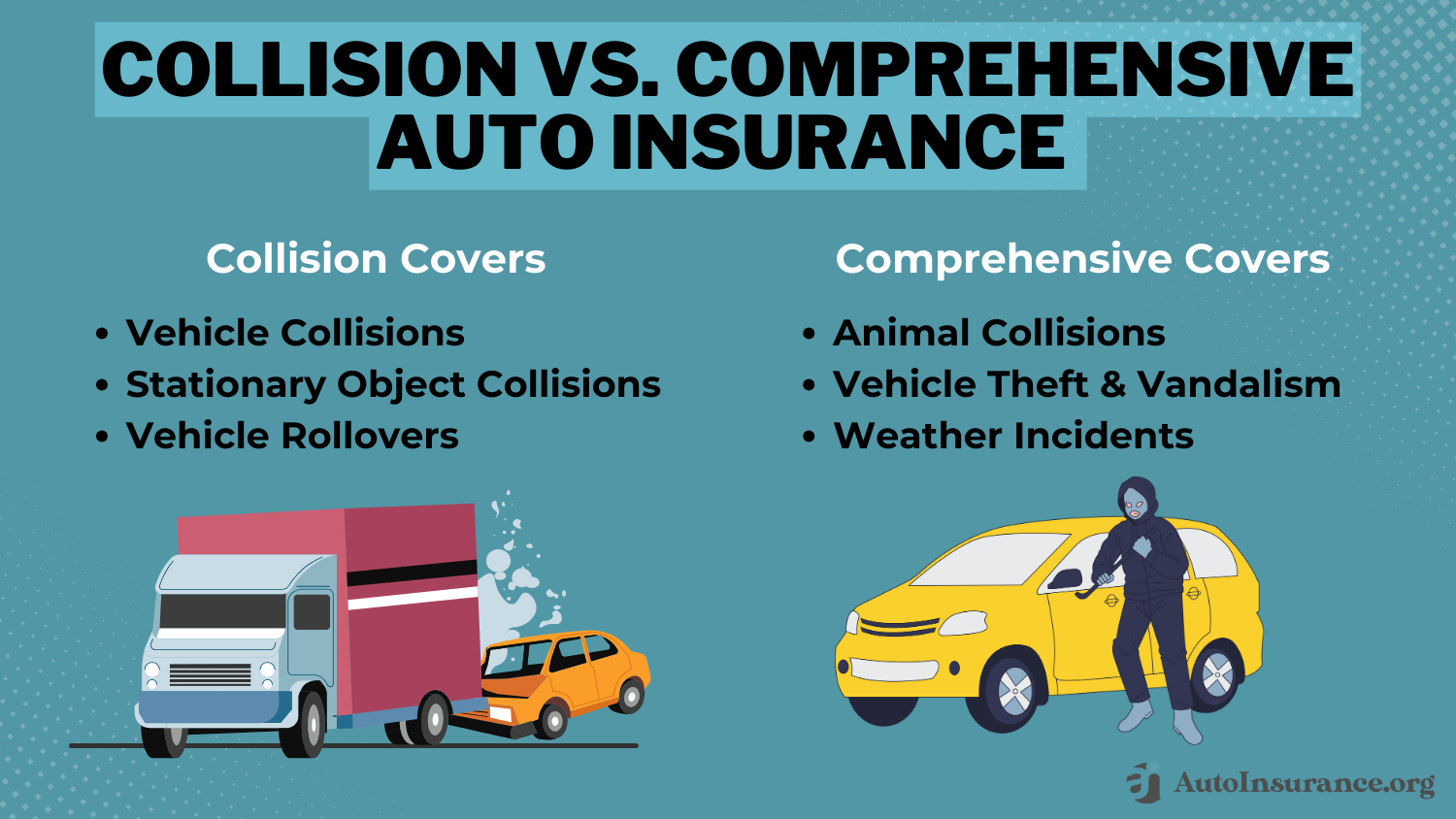

Should I consider comprehensive and collision coverage for my Infiniti Q50?

Comprehensive and collision coverage are optional insurance coverages that can be beneficial for protecting your Infiniti Q50. Comprehensive coverage helps cover damages not caused by collisions, such as theft, vandalism, or natural disasters.

Collision coverage pays for repairs or replacement if your vehicle is damaged in a collision. Considering the value of your Infiniti Q50, it may be wise to include these coverages to provide comprehensive protection.

Read More: Does auto insurance cover vandalism?

What factors can affect the cost of auto insurance for an Infiniti Q50?

Several factors can influence the cost of auto insurance for an Infiniti Q50. These may include the driver’s age, driving record, location, annual mileage, coverage options, deductible amount, and the model year and value of the Infiniti Q50.

Is the cost of insurance higher for a new Infiniti Q50 compared to an older model?

Generally, insuring a new Infiniti Q50 may be more expensive than an older model due to its higher value. Newer vehicles tend to have higher repair or replacement costs, which can affect insurance premiums. However, other factors like safety features and anti-theft devices present in newer models may help offset these costs.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

How does the age of my Infiniti Q50 affect insurance premiums?

The age of your Infiniti Q50 affects insurance premiums, with older models generally costing less to insure. This is because older vehicles typically have lower repair or replacement costs compared to newer models, which can result in reduced premiums.

Does the insurance cost for an Infiniti Q50 vary by location?

Yes, insurance costs for an Infiniti Q50 can vary significantly by location. Factors such as local accident rates, theft rates, and repair costs influence premiums. Urban areas typically see higher rates compared to rural regions.

Read More: Motorcycle vs. Car Accident Statistics

Are there any specific safety features in the Infiniti Q50 that can impact insurance rates?

Yes, the presence of certain safety features in an Infiniti Q50 may influence insurance rates. Common safety features that insurers consider include anti-lock brakes (ABS), airbags, stability control, adaptive cruise control, lane departure warning, blind-spot monitoring, and forward collision warning systems. These features can reduce the risk of accidents and may lead to lower insurance premiums.

How can I reduce the insurance cost for an Infiniti Q50?

To lower insurance costs for an Infiniti Q50, consider increasing your deductible, maintaining a clean driving record, and taking advantage of discounts such as safe driver or multi-policy savings. Comparing quotes from multiple insurers can also help find the most cost-effective coverage.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Are there any specific insurers that offer specialized coverage for Infiniti vehicles?

While many insurance companies provide coverage for Infiniti vehicles, it’s a good idea to research and compare quotes from different insurers to find the one that best suits your needs. Some insurers may have specific programs or discounts for luxury vehicle owners, so it’s worth exploring options tailored to Infiniti owners.

Why might Geico be a top choice for Infiniti Q50 insurance?

Geico is a top choice for Infiniti Q50 insurance due to its competitive rates, extensive discounts, and high customer satisfaction ratings. Their strong financial stability and efficient claims process make them a preferred provider.

Read More: Geico Auto Insurance Discounts

Does accident forgiveness affect my Infiniti Q50 insurance premium?

Yes, accident forgiveness can impact your Infiniti Q50 insurance premium. It prevents your first at-fault accident from increasing your rates, helping to keep premiums stable. However, it may come with a higher policy cost or specific eligibility requirements.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.