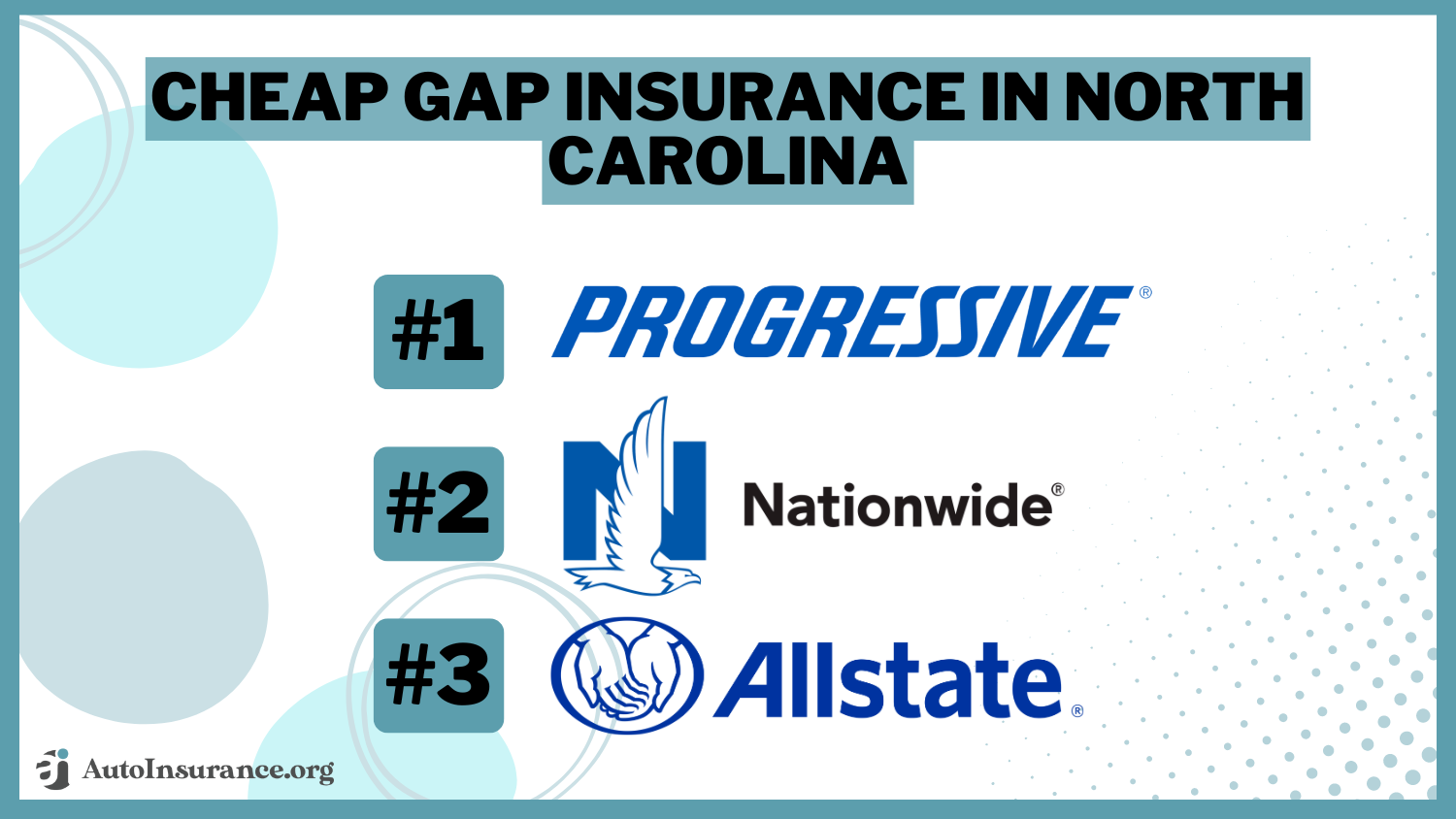

Cheap Gap Insurance in North Carolina (10 Best Companies for 2026)

Progressive, Nationwide, and Allstate are the leading providers of cheap gap insurance in North Carolina. These companies offers affordable North Carolina gap coverage starting at $5 per month, Nationwide and Allstate stand out with multi-policy savings and usage-based gap insurance discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated October 2024

13,283 reviews

13,283 reviewsCompany Facts

Gap Insurance in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,071 reviews

3,071 reviewsCompany Facts

Gap Insurance in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,638 reviews

11,638 reviewsCompany Facts

Gap Insurance in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best picks for cheap gap insurance in North Carolina are Progressive, Nationwide, and Allstate. Progressive leads the pack with low rates of just $5/month.

These providers offer competitive rates, flexible coverage options, and additional savings through multi-policy discounts and cheap usage-based auto insurance (UBI) plans.

Our Top 10 Company Picks: Cheap Gap Insurance in North Carolina

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $5 | A+ | Coverage Options | Progressive | |

| #2 | $7 | A+ | Multi-Policy Savings | Nationwide |

| #3 | $8 | A+ | UBI Savings | Allstate | |

| #4 | $9 | A | Discount Availability | American Family | |

| #5 | $10 | A++ | Online Tools | Geico | |

| #6 | $11 | A++ | Military Savings | USAA | |

| #7 | $12 | A++ | Specialized Coverage | Travelers | |

| #8 | $13 | B | Personalized Policies | State Farm | |

| #9 | $14 | A | 24/7 Support | Liberty Mutual |

| #10 | $15 | A | Safe Drivers | Farmers |

If you’re looking for dependable and affordable gap insurance in North Carolina, these top providers deliver exceptional value, making them strong candidates for your insurance needs.

Enter your ZIP code above to start comparing free gap insurance quotes today.

- Find cheap gap insurance in North Carolina with rates starting at $5/month

- Progressive offers gap coverage with flexible options and excellent customer service

- Save more on NC gap insurance through multi-policy discounts and UBI programs

#1 – Progressive: Top Overall Pick

Pros

- Cheapest Rates: Progressive provides the cheapest gap insurance rates in North Carolina for both minimum and full coverage insurance.

- Comprehensive Coverage: Progressive offers a wide range of gap coverage options in North Carolina, allowing you to tailor your policy to fit your needs. Check out our Progressive review.

- Flexible Terms: Progressive gap insurance in North Carolina comes with flexible terms and conditions, making it easier to find a policy that fits your specific circumstances.

Cons

- Customer Service Concerns: Some customers have reported issues with Progressive’s customer service when managing gap insurance claims in North Carolina.

- Limited In-Person Support: Progressive primarily offers online and phone support for gap insurance in North Carolina, which may not be ideal if you prefer in-person assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Cheapest With Multi-Policy Savings

Pros

- Multi-Policy Savings: Nationwide offers substantial discounts on gap insurance in North Carolina if you bundle it with other policies, potentially saving drivers up to 20%.

- Strong Financial Stability: Nationwide’s strong financial stability provides peace of mind that your gap insurance coverage in North Carolina will be reliable.

- Customer Satisfaction: Nationwide generally receives high marks for customer satisfaction regarding gap insurance in North Carolina. Find the full list in our Nationwide review.

Cons

- Higher Base Rates: While discounts are available, the base rates for gap insurance in North Carolina may be higher compared to some competitors.

- Complex Discount Structure: The multi-policy savings can be complex to navigate, potentially making it harder to understand the full benefits of gap insurance in North Carolina.

#3 – Allstate: Cheapest With UBI Savings

Pros

- UBI Savings: Allstate Drivewise offers discounts on North Carolina gap insurance by monitoring safe driving habits. Learn how to reduce your premiums in our Drivewise review.

- Flexible Coverage Options: Allstate provides flexible gap insurance options in North Carolina for drivers to tailor their policies.

- Strong Customer Support: Allstate has a reputation for excellent customer service, which can be helpful for managing gap insurance claims in North Carolina.

Cons

- Higher Premiums for Certain Drivers: Drivers with less favorable driving records may face higher premiums for gap insurance in North Carolina with Allstate.

- Limited Availability of Some Discounts: Some UBI gap insurance discounts may not be available in all areas of North Carolina or for all drivers.

#4 – American Family: Best Discount Availability

Pros

- Discount Availability: American Family provides a variety of discounts on North Carolina gap insurance to help all types of drivers save money.

- Customizable Coverage: AmFam offers a range of customizable options for NC gap insurance to suit different needs and budgets. Check out our American Family review for insights.

- Good Claims Handling: American Family is known for effective claims handling, which can be reassuring when dealing with gap insurance claims in North Carolina.

Cons

- Coverage Limitations: Some North Carolina coverage options for gap insurance may have limitations or exclusions that might not fit every situation.

- Varied Customer Service Experiences: Customer service quality can vary, which may affect your experience with gap insurance in North Carolina.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best Online Tools

Pros

- Easy Online Management: Geico’s user-friendly online platform makes managing your gap insurance in North Carolina simple and convenient.

- Wide Accessibility: Geico gap insurance in North Carolina is widely available, providing easy access to coverage for many drivers. Discover details in our Geico review.

- Affordable Rates: Geico is known for offering some of the most affordable rates for gap insurance in North Carolina, making it an economical choice.

Cons

- Limited Personalization: Geico gap insurance in North Carolina may offer fewer customization options compared to some competitors.

- Customer Service Issues: Some customers have reported issues with Geico’s customer service, which could impact your experience with gap insurance in North Carolina.

#6 – USAA: Best for Military Savings

Pros

- Military Savings: USAA provides specialized discounts on gap insurance in North Carolina for military members. Learn more in our USAA review.

- High Customer Satisfaction: USAA generally receives high ratings for customer service and satisfaction with gap insurance in North Carolina.

- Comprehensive Coverage: North Carolina drivers can choose from robust gap coverage options that are tailored to meet the needs of military families.

Cons

- Eligibility Restrictions: USAA gap insurance in North Carolina is only available to military members and their families, limiting access for others.

- Higher Premiums for Some: Some drivers may find the premiums for gap insurance in North Carolina to be higher compared to other providers.

#7 – Travelers: Cheapest Specialized Coverage

Pros

- Specialized Coverage: Travelers offers specialized gap insurance coverage in North Carolina that can be tailored to specific needs and circumstances.

- Strong Financial Stability: With strong financial ratings, Travelers provides reliable gap insurance coverage in North Carolina.

- Flexible Terms: Travelers’ flexible terms for gap insurance in North Carolina allow you to adjust coverage as needed. Read our Travelers review for more.

Cons

- Potentially Higher Rates: Traveler’s gap insurance in North Carolina may come with higher rates compared to some competitors.

- Complex Policy Details: The details of Traveler’s gap insurance policies in North Carolina can be complex, requiring careful review to understand fully.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Cheapest Personalized Policies

Pros

- Personalized Policies: State Farm offers highly personalized gap insurance policies in North Carolina, tailored to individual needs and driving habits. See our State Farm review for details.

- Strong Local Presence: With a strong local network, State Farm provides excellent customer service and support for gap insurance in North Carolina.

- Comprehensive Coverage Options: State Farm gap insurance in North Carolina comes with a variety of coverage options, ensuring you can find a policy that fits your needs.

Cons

- Potentially Higher Premiums: State Farm gap insurance in North Carolina may be more expensive compared to other providers.

- Discount Availability: Some gap insurance discounts in North Carolina might not be as extensive as those offered by other insurers.

#9 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual provides 24/7 customer support for North Carolina gap insurance customers, ensuring help is available whenever you need it.

- Comprehensive Coverage Options: Liberty Mutual customizes gap insurance with a wide range of coverage options not available with other North Carolina insurance companies.

- New Car Replacement: Beyond gap insurance, Liberty Mutual will replace your totaled vehicle with a brand new similar make and model with this North Carolina add-on.

Cons

- Higher Premiums: Liberty Mutual gap insurance in North Carolina can be on the higher side compared to other options.

- Customer Service Variability: Experiences with customer service can vary, which may affect your experience with gap insurance in North Carolina.

#10 – Farmers: Cheapest for Safe Drivers

Pros

- Safe Drivers Discounts: Farmers rewards safe drivers with discounts and cheaper North Carolina gap insurance rates.

- Customizable Coverage: Farmers provides flexible and customizable coverage options for gap insurance in North Carolina. Explore your options in our Farmers Insurance review.

- Strong Reputation: Known for its strong reputation in the insurance industry, Farmers offers reliable gap insurance coverage in North Carolina.

Cons

- Potentially Higher Base Rates: Base rates for gap insurance may be higher compared to some other North Carolina insurance companies on this list.

- Discount Complexity: The structure for safe driver discounts and other savings can be complex, potentially making it harder to maximize gap insurance savings in North Carolina.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Rates on North Carolina Gap Insurance

Below is a table showing the monthly rates for gap insurance from various major insurers in the state, offering an affordable way to bridge the gap in your vehicle’s value.

North Carolina Gap Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $8 | |

| $9 | |

| $15 | |

| $10 | |

| $14 |

| $7 |

| $5 | |

| $13 | |

| $12 | |

| $11 |

By comparing these rates, you can find the most cost-effective gap insurance that suits your budget and needs. Be sure to reach out to your preferred provider for more details on coverage options.

What are the recommended auto insurance coverage levels? All drivers must meet North Carolina’s minimum liability requirements, but if you’re buying gap insurance for a new or leased vehicle, your auto loan or lease may also require full coverage.

Carrying full coverage auto insurance will raise your North Carolina gap insurance rates, but regularly adjusting your coverage to reflect your vehicle’s current value ensures you only pay for the protection you need.

Auto Insurance Claims in North Carolina: Common Risks and Costs Explained

When it comes to auto insurance in North Carolina, certain types of claims are more common than others. Understanding the most frequent claims can help you better prepare and ensure you have the right coverage. Below are the five most common auto insurance claims in North Carolina, along with the typical costs associated with each claim.

5 Most Common Auto Insurance Claims in North Carolina

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 34% | $3,700 |

| Comprehensive | 23% | $2,600 |

| Property Damage | 19% | $4,000 |

| Bodily Injury Liability | 15% | $15,000 |

| Personal Injury Protection (PIP) | 9% | $8,500 |

Being aware of the most common auto insurance claims in North Carolina can help you make informed decisions about your coverage. Whether it’s collision or personal injury protection, knowing the risks can keep you better protected on the road.

Understanding accident and claim trends in North Carolina’s major cities can offer valuable insight into local traffic patterns and insurance needs. Below is a table summarizing the number of accidents and claims per year in five key cities across the state.

North Carolina Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Charlotte | 11,200 | 8,500 |

| Durham | 4,200 | 3,000 |

| Greensboro | 4,600 | 3,300 |

| Raleigh | 5,700 | 4,200 |

| Winston-Salem | 3,500 | $2,600 |

By analyzing these figures, drivers and policymakers alike can better anticipate insurance demands and take action to improve road safety in North Carolina’s urban areas.

Cutting Gap Insurance Costs in North Carolina

Reduce the cost of gap insurance in North Carolina by using online comparison tools to find the best rates across different providers. You’ll be able to compare rates and explore popular discounts you could qualify for.

This table highlights key savings opportunities from leading North Carolina companies, including discounts for safe driving, multi-policy bundling, and UBI.

Auto Insurance Discounts From the Top Providers for Gap in North Carolina

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver Discount, Multi-Vehicle Discount, Paperless Billing Discount, Telematics Discount | |

| Accident-Free Discount, Bundled Insurance Discount, Vehicle Safety Features Discount, Defensive Driving Discount | |

| Anti-Theft Device Discount, Automatic Payments Discount, Multi-Policy Discount, Vehicle Safety Equipment Discount | |

| Bundled Insurance Discount, Defensive Driving Discount, Multi-Car Discount, Safety Features Discount | |

| Telematics Discount, Paperless Billing Discount, Automatic Payments Discount, Safe Driver Discount |

| Multi-Policy Discount, Anti-Theft Device Discount, Bundled Insurance Discount, Accident-Free Discount |

| Defensive Driving Discount, Safe Driving Program Discount, Paperless Billing Discount, Safety Features Discount | |

| Multi-Vehicle Discount, Drive Safe & Save Discount, Accident-Free Discount, Anti-Theft Device Discount | |

| Telematics Discount, Bundled Insurance Discount, Safe Driver Discount, Multi-Policy Discount | |

| Safe Driver Discount, Automatic Payments Discount, Vehicle Safety Features Discount, Multi-Car Discount |

Discounts for bundling multiple insurance policies can lead to significant savings. Additionally, consider enrolling in usage-based insurance programs that reward safe driving with lower premiums.

Enhancing your credit score and opting for a higher deductible can also help lower your costs. By employing these strategies, you can secure affordable gap insurance while maintaining comprehensive coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies for Reducing North Carolina Gap Insurance Costs

In North Carolina, savvy drivers are employing various strategies to achieve substantial savings while maintaining essential gap coverage.

- Case Study #1 – Maximize Savings with Multi-Policy Bundling: Jessica needed gap insurance for her new car while having home insurance with the same provider. She bundled her auto and home insurance with Nationwide to get multi-policy discounts and saved 20%.

- Case Study #2 – Cutting Costs with Usage-Based Insurance: Michael had a clean driving record and wanted to lower his gap insurance costs. He used Allstate Drivewise UBI to track his driving habits and saved 30%.

- Case Study #3 – Leveraging a Higher Deductible for Lower Premiums: Sarah needed to cut gap insurance costs for her new car. She selected a higher deductible, balancing affordability with coverage needs. This choice lowered her premium by 20% while maintaining coverage.

These case studies showcase practical and effective strategies for lowering gap insurance costs in North Carolina with different companies and strategies. Whether through multi-policy bundling, usage-based programs, or adjusting deductibles, each approach demonstrates how you can optimize your NC gap insurance coverage.

Read More: Buying Auto Insurance for a New Car

In North Carolina, auto insurance providers offer a variety of discounts that can help drivers save money on their premiums. This report card evaluates the most common discounts available, grading them based on potential savings and the number of participating providers.

From average premiums to discount availability and customer satisfaction, this report highlights areas of strength and potential improvement for drivers in the state.

North Carolina Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Good Driver | A | 23% | Geico, State Farm, Allstate, Nationwide |

| Good Student | A | 16% | State Farm, Allstate, Liberty Mutual |

| Bundling | A- | 20% | USAA, Liberty Mutual, Nationwide |

| Defensive Driving | B+ | 12% | Allstate, The Hartford, Geico |

| Low Mileage | B | 10% | Progressive, Nationwide, Travelers |

By taking advantage of these discounts, North Carolina drivers can significantly reduce their insurance costs. It’s worth checking with your provider to see which discounts you’re eligible for and how much you can save.

North Carolina Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Discount Availability | A- | Strong for Safe Drivers & Multi-Policy |

| Customer Satisfaction | B+ | Positive Claims Feedback |

| Average Premiums | B | Moderate Rates, Slightly Above Average |

| Regional Variation | B- | Higher Urban Rates |

| Premiums for High-Risk Drivers | C+ | Higher Premiums for Accidents/Violations |

While rates may vary based on location and risk factors, the state maintains a competitive standing in most categories.

Get Affordable Gap Insurance in North Carolina

Progressive, Nationwide, and Allstate are the top choices for cheap gap insurance, in North Carolina. Progressive is the top pick for its competitive rates, starting at $5/month.

Progressive offers the best overall gap insurance in North Carolina with unbeatable rates and comprehensive coverage options.Daniel Walker Licensed Auto Insurance Agent

North Carolina drivers can save money by bundling insurance policies. Other effective ways to lower costs involve utilizing comparison tools, bundling multiple policies, and signing up for usage-based programs.

To get tailored quotes and discover the most competitive rates, it’s advisable to use the comparison tool provided. Enter your ZIP code below into our free tool today to see what quotes might look like for you.

Frequently Asked Questions

How much is gap insurance in North Carolina?

The cost of gap insurance in North Carolina varies depending on the provider and the coverage level. On average, you can expect to pay around $5 per month for minimum coverage with gap through Progressive.

Is gap insurance mandatory in North Carolina?

No, gap insurance is not mandatory in North Carolina. It is optional coverage that can be beneficial if you owe more on your vehicle than its current value.

Is gap insurance price negotiable in North Carolina?

Can you negotiate car insurance rates? While the base price of gap insurance is generally set by the insurance provider, there may be room for negotiation depending on your overall policy and driving record. It’s worth discussing potential discounts with your insurance agent.

What is a gap vehicle in North Carolina?

A gap vehicle refers to a car or truck for which the amount owed on the loan is higher than the vehicle’s current market value. Gap insurance helps cover the difference between these amounts in the event of a total loss.

How many claims can you make on gap insurance in North Carolina?

Typically, you can only make one claim on gap insurance per vehicle. This claim would be used if your car is declared a total loss, covering the difference between your loan balance and the insurance payout.

What is the average price of gap insurance in North Carolina?

The average price of gap insurance varies by state and provider. In North Carolina, it generally ranges from $5 to $15 per month, depending on the coverage level and insurer. Learn more by comparing auto insurance rates by state.

What is gap pricing in North Carolina?

Gap pricing refers to the cost of purchasing gap insurance. This price can differ based on the insurance provider, coverage level, and any discounts you may qualify for. Compare insurance rates today by entering your ZIP code into our free comparison tool below.

What does a gap plan cover in North Carolina?

A gap insurance plan covers the difference between what you owe on your car loan and the actual cash value (ACV) of your vehicle if it is totaled or stolen. This ensures you are not financially responsible for the remaining loan balance.

What is the most gap insurance will pay?

Gap insurance typically covers up to the full remaining loan balance on your vehicle, minus any auto insurance deductibles. It does not generally have a set maximum payout, but it will not exceed your loan balance.

Will gap insurance cover a blown engine in North Carolina?

No, gap insurance will not cover mechanical failures such as a blown engine. Gap insurance is designed to cover the difference between your vehicle’s value and your loan balance in case of total loss, not repairs or mechanical issues.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.