Best Chester, Texas Auto Insurance in 2026 (See the Top 10 Companies Here!)

Erie, Farmers, and Allstate are the top picks for the best Chester, Texas auto insurance providers. Starting with just a $42 monthly rate, they offer comprehensive discounts, wide coverage, and Drivewise programs. Compare their options to find the best fit for your unique needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Shawn Laib

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Chester Texas

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Chester Texas

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Chester Texas

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best Chester, Texas auto insurance providers are Erie, Farmers, and Allstate. Erie provides comprehensive discounts, Farmers excels in having wide coverage, while Allstate is known for their Drivewise programs.

Learning how to get auto insurance for the first time is essential when looking for suitable coverage for your vehicle. You must consider factors beyond rates, such as deductibles, discounts, coverage types, and limits.

Our Top 10 Company Picks: Best Chester, Texas Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Discounts | Erie |

| #2 | 20% | A | Wide Coverage | Farmers | |

| #3 | 25% | A+ | Drivewise Programs | Allstate | |

| #4 | 10% | A+ | Flexible Options | Progressive | |

| #5 | 25% | A++ | Military Benefits | Geico | |

| #6 | 25% | A | Safety Incentives | Liberty Mutual |

| #7 | 13% | A++ | Eco-Friendly Discounts | Travelers | |

| #8 | 20% | A+ | Smart Technology | Nationwide |

| #9 | 17% | B | Accident Forgiveness | State Farm | |

| #10 | 25% | A | Low Mileage | American Family |

These 10 providers are ranked based on their financial ratings, bundling discounts, and benefits offered. Erie is the top pick overall, with its 25% bundling discount and an A+ financial rating from A.M. Best. Shop for the best auto insurance by entering your ZIP code above into our free quote tool.

- Erie provides the best Chester, Texas auto insurance

- The minimum auto insurance required in Chester, Texas is 30/60/25

- Having a clean driving record significantly reduces auto insurance premiums

#1 – Erie: Top Overall Pick

Pros

- Comprehensive Discounts: As discussed in our Erie review, it provides a wide range of discounts and is the top pick for the best Chester, Texas auto insurance.

- Reliable Customer Service: Offers excellent customer service for drivers in Chester, Texas.

- Affordable Rates: Provides competitive pricing at just $44 monthly in Chester, Texas.

Cons

- Limited Local Agents: Erie has fewer local representatives in Chester, Texas, than others.

- Basic Digital Tools: Digital tools for policy management may not be as advanced as competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Wide Coverage

Pros

- Roadside Assistance: Offers service to policyholders who encounter problems while on the roads of Chester, Texas.

- Wide Coverage Options: Our Farmers review highlights extensive policy options as one of the best Chester, Texas auto insurance companies.

- Strong Financial Stability: Has an A rating for financial stability from A.M. Best, ensuring smooth claims processing.

Cons

- Higher Premiums: Rates are often higher than other providers in Chester, Texas.

- Limited Discount Range: Discounts are fewer compared to some competitors in Chester.

#3 – Allstate: Best for Drivewise Programs

Pros

- Personalized Service: Offers a vast network of agents for tailored assistance in Chester.

- Bundling Discounts: Offers a 25% discount for combining auto insurance with other policies in Chester.

- Drivewise Program: Rewards drivers with safe driving records with discounts. Read our Allstate review for more info.

Cons

- Higher Rates: Premiums can be expensive for drivers with poor records in Chester, Texas.

- Variable Claims Processing: Claims response times in Chester may fluctuate depending on complexity.

#4 – Progressive: Best for Flexible Options

Pros

- Flexible Policy Options: Our Progressive review discusses allowing customizable plans ideal for the best Chester, Texas auto insurance needs.

- Snapshot Program: Discounts for Chester drivers’ safe driving habits through data tracking.

- Digital Convenience: Has a user-friendly mobile app and website for managing policies available to drivers in Chester, Texas.

Cons

- Inconsistent Customer Support: Service quality may vary across representatives in Chester, Texas.

- High Rates Without Discounts: Premiums can be less competitive for drivers in Chester without applying discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Military Benefits

Pros

- Affordable Premiums: Geico is known for its competitive rates and multiple discounts in Chester, Texas.

- Military Benefits: Our Geico review spotlights significant savings and special programs for military families in Chester, Texas.

- Easy Policy Access: Policyholders in Chester get advanced digital tools to simplify managing policies and filing claims.

Cons

- Limited Agent Network: Geico has fewer local agents in Chester, Texas.

- Less Personalized Service: Customer experience may feel less tailored compared to local insurers in Chester.

#6 – Liberty Mutual: Best for Safety Incentives

Pros

- Customizable Coverage: Offers flexible policies that let policyholders match their specific needs.

- Financial Strength: Has dependable claim payouts backed by substantial resources.

- Safety Discounts: Our Liberty Mutual review emphasizes rewarding drivers for prioritizing safety in Chester, Texas.

Cons

- Higher Premiums: Fees without discounts cost more than the average in Chester, Texas.

- Discount Qualifications: Some savings require meeting specific eligibility criteria.

#7 – Travelers: Best for Eco-Friendly Discounts

Pros

- Eco-Friendly Discounts: Travelers rewards drivers with hybrid or electric vehicles in Chester, Texas. Read More: Travelers Auto Insurance Review

- Robust Coverage: Travelers offers tailored policies for environmentally conscious drivers in Chester, Texas.

- Top Customer Satisfaction: Consistently receives high service ratings from Chester residents.

Cons

- Limited Discounts: Some savings options may not be accessible to all Chester drivers.

- Higher Costs for Older Cars: Premiums may be less favorable for Chester drivers with non-hybrid vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Smart Technology

Pros

- Vanishing Deductible: Safe drivers see reduced deductibles over time.

- Smart Technology Integration: Our Nationwide review demonstrates policies enhanced with SmartRide and Smartmiles offer value in Chester, Texas.

- Bundling Savings: Significant discounts are available for combining auto with other policies.

Cons

- Less Customization: Policies may not be as flexible to unique needs in Chester, Texas.

- Slower Claims Process: Some auto insurance claims may take longer to resolve than those of competitors in Chester.

#9 – State Farm: Best for Accident Forgiveness

Pros

- Personalized Service: Strong local presence with experienced agents in Chester, Texas.

- Multi-Policy Discounts: Offers 17% savings for bundling home, auto, and other policies.

- Accident Forgiveness: Protects against rate hikes after the first accident in Chester, Texas. Learn more in our State Farm review.

Cons

- Limited Discounts: Fewer discount opportunities than other providers in Chester, Texas.

- Unfavorable Rates for High-Risk Drivers: Premiums can be costly for Chester drivers who have violations.

#10 – American Famly: Best for Low Mileage

Pros

- Low Mileage Discounts: As mentioned in our AMFAM review, it rewards drivers with reduced usage in Chester, Texas.

- Family-Oriented Service: Focused on customer-centric care and family needs in Chester.

- Optional Coverages: Flexible policy add-ons like accident forgiveness, roadside assistance, and gap insurance for specialized requirements in Chester.

Cons

- Fewer Local Agents: Limited presence in Chester, Texas, compared to other insurers.

- Higher Premiums: Comprehensive coverage plans can be more expensive than competitors in Chester.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Chester, Texas

For drivers seeking the best Chester, Texas auto insurance, the minimum auto insurance in Texas is 30/60/25. $30,000 is for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for damages on property per accident.

Chester, Texas Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $58 | $145 |

| American Family | $60 | $143 |

| Erie | $44 | $105 |

| Farmers | $53 | $128 |

| Geico | $42 | $100 |

| Liberty Mutual | $63 | $158 |

| Nationwide | $53 | $133 |

| Progressive | $49 | $118 |

| State Farm | $48 | $115 |

| Travelers | $59 | $147 |

Auto insurance rates in Chester, Texas, vary depending on the provider and coverage level. The premiums for minimum insurance coverage range from $42 to $63, provided by Geico and Liberty Mutual, and $100 to $158 for full coverage from the same companies.

Full coverage auto insurance is a combination of liability, collision, and comprehensive coverage, which provides an extensive protection for you and your vehicle.Jeff Root Licensed Auto Insurance Agent

There is a noticeable number of uninsured drivers in Chester, contributing to the city’s rise in auto insurance rates. However, some factors reduce premiums.

Chester, Texas Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A | Theft rates are below the national average, improving insurance premiums. |

| Traffic Density | A- | Low traffic levels reduce the likelihood of accidents. |

| Average Claim Size | B+ | Claims are average compared to national figures due to repair costs. |

| Uninsured Drivers Rate | C+ | A noticeable percentage of drivers are uninsured, increasing overall costs. |

A significant contributing factor that reduces rates for auto insurance in Chester is the low theft rate compared to the national average, which gets an A in our detailed report card.

Best Chester, Texas Auto Insurance Discounts

The best Chester, Texas, auto insurance companies offer many discounts for policyholders. For example, Erie, the top pick, offers discounts for safe drivers, multi-policy, anti-theft, and pay-in-full (Read more: Best Pay-in-Full Auto Insurance Discounts).

Auto Insurance Discount Rates by Top Providers in Chester, Texas

| Insurance Company | Safe Driver | Multi-Policy | Good Student | Anti-Theft | Low Mileage |

|---|---|---|---|---|---|

| 15% | 25% | 10% | 5% | 5% | |

| 10% | 20% | 10% | 5% | 5% | |

| 12% | 20% | 10% | 5% | 5% |

| 10% | 20% | 10% | 5% | 5% | |

| 15% | 20% | 15% | 5% | 5% | |

| 10% | 25% | 10% | 5% | 5% |

| 10% | 20% | 10% | 5% | 5% |

| 12% | 20% | 10% | 5% | 5% | |

| 15% | 25% | 10% | 5% | 5% | |

| 10% | 20% | 10% | 5% | 5% |

These discounts allow drivers in Chester to lower their auto insurance premiums without reducing the quality of the policies they get. Giving customers who are on a budget the opportunity to afford auto insurance for their vehicles at a lower price.

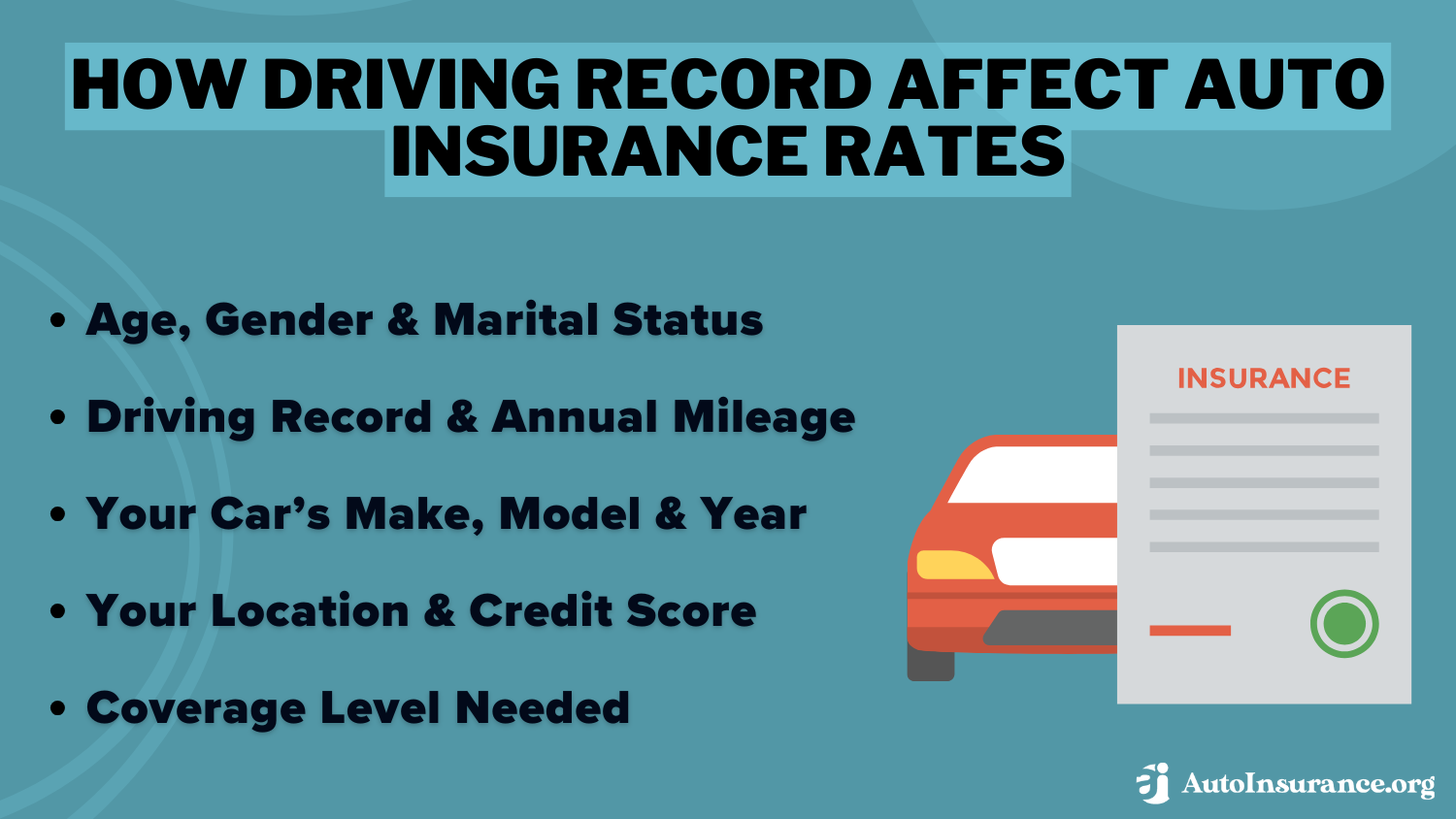

Factors That Affect Auto Insurance Rates in Chester, Texas

Several factors affect rates of the best Chester, Texas auto insurance, like your driving record, vehicle type, and coverage options. Safe drivers with no violations typically enjoy lower premiums.

Your vehicle’s age, make, and model also impact costs, with newer or luxury cars often requiring higher rates. Additional factors include your credit score and the amount of coverage you select.

Chester, Texas Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | 250 |

| Claims Per Year | 200 |

| Average Claim Cost | $4,500 |

| Percentage of Uninsured Drivers | 18% |

| Vehicle Theft Rate | 2 per 1,000 vehicles |

| Traffic Density | Low |

| Weather-Related Incidents | 15 annually |

Additionally, having too many claims affects auto insurance rates, as insurers view it as a sign of higher risk. The table above shows the number of accidents and claims per year, the average claim cost, and other factors influencing premiums in Chester.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Chester, Texas Auto Insurance Companies

The best Chester, Texas auto insurance companies are Erie, Farmers, and Allstate, providing customers with competitive rates and specialized coverage options. Erie is the best overall, with its comprehensive discounts that give drivers more savings opportunities.

At the same time, Farmers provides wide coverage options for Chester auto insurance, offering protection for diverse needs. Allstate’s Drivewise program rewards safe driving, making it ideal for cost-conscious drivers.

Stop overpaying for car insurance and start saving money by entering your ZIP code below into our free comparison tool to find affordable coverage near you.

Frequently Asked Questions

Who are the best car insurance companies in Texas?

Erie, Farmers, and Allstate are the best Chester, Texas auto insurance providers, known for competitive rates and excellent coverage options.

How many insurance companies are there in Texas?

Texas has numerous insurance companies, with over 200 licensed providers offering auto insurance policies. Enter your ZIP code below to compare quotes form multiple auto insurance providers in your area.

What auto insurance coverage should I have in Texas?

Texas requires a minimum of liability coverage, but comprehensive and collision coverage is recommended for greater protection.

Is Texas expensive for car insurance?

Texas has moderately high car insurance rates compared to the national average, influenced by population density and accident rates.

Who has the best full coverage car insurance in Texas?

Erie offers the best full coverage car insurance in Texas, with reliable policies and rates starting at just $44 per month.

How many people in Texas do not have car insurance?

Approximately 20% of drivers in Texas are uninsured, making it one of the states with the highest uninsured motorist rates.

How much is car insurance in Texas per month?

The average cost of car insurance in Texas is around $130 per month, depending on coverage, driving history, and vehicle type. Find Chester’s best auto insurance providers by entering your ZIP code below.

Who has the best car insurance in Texas for seniors?

State Farm and Geico are often praised as the best car insurance in Texas for seniors. They also have cheap car insurance in Chester.

What car insurance is mandatory in Texas?

Liability insurance is mandatory in Texas, covering at least $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage. Read more: Texas Minimum Auto Insurance Requirements

Who normally has the cheapest car insurance in Texas?

Geico provides the cheapest car insurance in Texas, with rates starting at just $42 per month.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.