Best Columbia, South Carolina Auto Insurance in 2026 (Compare the Top 10 Companies)

State Farm, Geico, and USAA top the competition for the best Columbia, South Carolina auto insurance, with coverage starting at $27 per month. In Columbia, policies must meet South Carolina’s 25/50/25 liability and uninsured motorist coverage standards. Shopping around helps you find the best offer.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated October 2024

Company Facts

Full Coverage in Columbia South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Columbia South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Columbia South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

For as low as $27 per month, the best Columbia, South Carolina auto insurance providers are State Farm, Geico, and USAA. State Farm stands out as the top choice for coverage, safeguarding you and your car. Compare auto insurance quotes in Columbia, SC, to secure your best rate today.

Costs on insurance companies in Columbia, SC are higher than the state’s average but less than the national figure. You can find cheap South Carolina auto insurance by comparing rates. Shop around to secure the best deal for your commute.

Our Top 10 Company Picks: Best Columbia, South Carolina Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 17% B Reliable Service State Farm

#2 25% A++ Affordable Rates Geico

#3 10% A++ Military Members USAA

#4 10% A+ Snapshot Program Progressive

#5 13% A++ Green Vehicles Travelers

#6 20% A++ Customer Service Auto-Owners

#7 25% A+ Customizable Plans Nationwide

#8 12% A Custom Coverage Liberty Mutual

#9 10% A Comprehensive Coverage Farmers

#10 10% A+ Local Agents Allstate

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool above.

- State Farm stands out as the top insurance company in Columbia

- In Columbia, auto insurance costs less than it does across the country

- Drivers in Columbia face commutes that are a bit longer than the norm

#1 – State Farm: Top Overall Pick

Pros

- Wallet-Friendly Protection: State Farm’s $95 monthly rate in Columbia strikes an optimal balance between affordability and quality coverage, making it an attractive option for residents seeking to maximize their insurance dollar without compromising on essential protections. See our page State Farm auto insurance discounts for more details.

- Hometown Expertise: With a robust presence of Columbia-based representatives, State Farm ensures that policyholders receive personalized guidance tailored to local driving conditions, traffic patterns, and insurance requirements, enhancing the overall customer experience.

- Flexible Policy Crafting: Columbia motorists can fine-tune their State Farm policies to align with specific needs, from basic liability to more comprehensive plans, allowing for a customized approach to auto insurance that reflects individual risk profiles and preferences.

Cons

- Restricted Coverage Variability: State Farm in Columbia might provide a narrower range of coverage options relative to other insurers, potentially constraining policyholders’ capacity to customize their insurance according to individual requirements and preferences.

- Discount Transparency Issues: State Farm’s savings programs for Columbia residents lack clear communication, potentially leading to missed opportunities for premium reductions and creating confusion about available cost-cutting measures for loyal customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Market-Leading Affordability: Geico’s unmatched $90 monthly premium in Columbia positions it as the go-to choice for budget-conscious drivers, offering substantial savings without sacrificing essential coverage elements required for peace of mind on local roads. See our page Geico auto insurance review for more details.

- Cutting-Edge Digital Experience: Columbia residents benefit from Geico’s state-of-the-art online platform and mobile app, which streamline everything from quote comparisons to claims filing, catering to the city’s tech-savvy population seeking convenience and efficiency.

- Extensive Savings Opportunities: Geico presents Columbia drivers with a plethora of discount options, including safe driving incentives and multi-policy bundling, allowing policyholders to significantly reduce their insurance expenses through various qualifying factors and behaviors.

Cons

- Scarcity of Local Offices: The limited physical presence of Geico in Columbia may pose challenges for residents who prefer one-on-one interactions when discussing complex policy matters or filing claims, potentially affecting the personal touch in customer service.

- Inconsistent Support Experiences: Some Columbia policyholders report varying levels of satisfaction with Geico’s customer support, citing occasional difficulties in reaching representatives or resolving issues promptly, which could impact overall trust and loyalty.

#3 – USAA: Best for Military Members

Pros

- Unbeatable Military Rates: USAA’s remarkably low $82 monthly premium in Columbia offers unparalleled value for eligible service members, veterans, and their families, providing top-tier coverage at a fraction of competitors’ costs. See our page USAA auto insurance review for more details.

- Specialized Armed Forces Support: Columbia’s military community benefits from USAA’s deep understanding of service-related needs, offering tailored assistance that addresses unique challenges such as deployment-related coverage adjustments and military-specific discounts.

- High-Caliber Member Services: USAA consistently earns praise from Columbia’s service members for its exceptional support, featuring knowledgeable representatives who provide empathetic and efficient assistance tailored to the military lifestyle.

Cons

- Restrictive Eligibility Criteria: USAA’s exclusive focus on military personnel and their families limits access for a significant portion of Columbia’s driving population, excluding many residents from benefiting from its competitive rates and specialized services.

- Limited Physical Presence: The absence of USAA offices in Columbia may inconvenience members who prefer to get consultations in-person for complex insurance matters, potentially impacting the accessibility of personalized service for some policyholders.

#4 – Progressive: Best for Snapshot Program

Pros

- Customization Champions: Progressive empowers Columbia drivers to create highly personalized insurance plans, offering a wide array of coverage options that can be mixed and matched to suit individual needs, driving habits, and risk tolerances. See our page Progressive auto insurance review for more details.

- Innovative Savings Initiatives: Columbia residents can leverage Progressive’s forward-thinking discount programs, including the Snapshot usage-based insurance, which rewards safe driving habits with potential premium reductions, encouraging responsible road behavior.

- Digital-First Approach: Progressive’s advanced online tools and mobile app cater to Columbia’s tech-savvy drivers, offering seamless policy management, instant quote comparisons, and efficient claims processing at the touch of a button.

Cons

- Premium Pricing Consideration: Progressive’s $105 monthly rate in Columbia, while competitive, may not be the most economical option for drivers prioritizing rock-bottom prices, potentially pushing budget-conscious consumers to explore alternatives.

- Support Quality Variations: Some Columbia policyholders report inconsistent experiences with Progressive’s customer service and claims handling, noting occasional delays or communication gaps that can lead to frustration during stressful post-accident periods.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Green Vehicles

Pros

- Green Vehicle Advocates: Travelers stands out in Columbia for its dedication to environmentally friendly policies, offering specialized coverage options and discounts for hybrid and electric vehicle owners, promoting sustainable transportation choices. See our page Travelers auto insurance review for more details.

- Robust Financial Backbone: Columbia policyholders benefit from Travelers’ strong financial stability, ensuring reliable claim processing and the ability to meet financial obligations even in challenging economic times or after major local events.

- Diverse Protection Portfolio: Travelers offers Columbia drivers a comprehensive selection of coverage options, from standard policies to unique add-ons like accident forgiveness and new car replacement, catering to a wide range of insurance needs.

Cons

- Premium Price Point: With a monthly rate of $110 in Columbia, Travelers ranks among the more expensive options, potentially deterring cost-sensitive drivers seeking more affordable protection for their vehicles.

- Mixed Service Feedback: Some Columbia clients report challenges with Travelers’ claim processing and customer support, citing occasional delays or difficulties in resolution that can impact overall satisfaction and trust in the insurer.

#6 – Auto-Owners: Best for Customer Service

Pros

- Local Market Mastery: Auto-Owners’ deep understanding of Columbia’s unique driving landscape allows for tailored policies that address specific regional risks, from seasonal weather challenges to local traffic patterns, enhancing overall protection for city residents. See our page Auto-Owners auto insurance review for more details.

- Competitive Value Proposition: With a monthly premium of $97 in Columbia, Auto-Owners offers a balanced combination of quality coverage and affordability, appealing to drivers seeking reliable protection without stretching their budgets too thin.

- Personalized Policy Crafting: Columbia motorists benefit from Auto-Owners’ flexible approach to coverage design, allowing for the creation of bespoke insurance solutions that align perfectly with individual needs, driving habits, and risk preferences.

Cons

- Geographic Coverage Limitations: Auto-Owners’ primary focus on regional markets may pose challenges for Columbia drivers who frequently travel out of state or plan to relocate, potentially requiring policy adjustments or new insurance providers.

- Technology Integration Gaps: Some Columbia policyholders find Auto-Owners’ digital tools and online services less advanced compared to larger national insurers, which may impact convenience for tech-savvy customers accustomed to seamless digital experiences.

#7 – Nationwide: Best for Customizable Plans

Pros

- Adaptive Coverage Solutions: Nationwide excels in offering Columbia drivers a diverse range of policy options, from basic protection to specialized add-ons, enabling the creation of highly tailored insurance plans that evolve with changing life circumstances. See our page Nationwide auto insurance review for more details.

- Financial Fortitude: Columbia residents can rely on Nationwide’s robust financial standing, ensuring consistent claim fulfillment and long-term stability, even in the face of widespread disasters or economic downturns affecting the local area.

- Innovative Discount Structure: Nationwide’s creative approach to savings, including usage-based programs and bundling options, provides Columbia policyholders with multiple avenues to reduce premiums while maintaining comprehensive coverage.

Cons

- Premium Pricing Considerations: At $102 per month in Columbia, Nationwide’s rates may be less appealing to drivers prioritizing lowest-cost options, potentially pushing budget-conscious consumers to explore more economical alternatives in the local market.

- Service Consistency Challenges: Some Columbia clients report varying experiences with Nationwide’s support services, noting occasional delays or communication issues that can lead to frustration, especially during time-sensitive claim situations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Custom Coverage

Pros

- Customization Expertise: Liberty Mutual stands out in Columbia for its ability to create highly personalized insurance plans, offering a wide array of coverage options and add-ons that cater to the diverse needs of local drivers. See our page Liberty Mutual auto insurance review for more details.

- Multi-Faceted Savings Approach: Columbia policyholders benefit from Liberty Mutual’s comprehensive discount program, which includes incentives for safe driving, vehicle safety features, and policy bundling, maximizing opportunities for premium reductions.

- Accident Forgiveness Pioneer: Liberty Mutual’s accident forgiveness program provides peace of mind to Columbia drivers, protecting them from rate increases after their first at-fault accident and promoting long-term customer loyalty.

Cons

- Mid-Range Cost Structure: With a monthly premium of $99 in Columbia, Liberty Mutual may not be the most budget-friendly option for all drivers, potentially limiting its appeal to those seeking the absolute lowest rates in the local market.

- Support Quality Fluctuations: Some Columbia policyholders report inconsistent experiences with Liberty Mutual’s customer service and claims processing, citing occasional difficulties that can impact overall satisfaction and trust in the insurer.

#9 – Farmers: Best for Comprehensive Coverage

Pros

- Expansive Coverage Spectrum: Farmers offers Columbia drivers an extensive array of insurance options, from standard policies to unique protections like rideshare coverage, ensuring that even niche insurance needs are met with tailored solutions. See our page Farmers auto insurance review review for more details.

- Localized Expertise: With a robust presence in Columbia, Farmers’ agents provide invaluable local insights, helping policyholders navigate specific city and state insurance requirements while offering personalized advice based on regional driving conditions.

- Flexible Policy Building: Columbia residents appreciate Farmers’ modular approach to policy creation, allowing for the easy addition or removal of coverage elements to create a perfectly tailored insurance plan that aligns with individual priorities and budgets.

Cons

- Premium Price Positioning: Farmers’ monthly rate of $100 in Columbia places it in the higher range of local options, which may deter cost-conscious drivers looking for more affordable insurance solutions in a competitive market.

- Digital Platform Limitations: Some Columbia policyholders find Farmers’ online tools and mobile app less intuitive or feature-rich compared to tech-forward competitors, potentially impacting the convenience of policy management for digitally savvy customers.

#10 – Allstate: Best for Local Agents

Pros

- Community-Centric Approach: Allstate’s strong local presence in Columbia ensures that policyholders receive personalized service from agents familiar with the city’s unique insurance landscape, traffic patterns, and community needs. See our page Allstate auto insurance review for more details.

- Innovative Protection Options: Columbia drivers benefit from Allstate’s forward-thinking coverage options, including new car replacement and accident forgiveness programs, which provide added layers of financial security and peace of mind.

- Holistic Savings Strategy: Allstate offers Columbia residents a comprehensive suite of discounts, ranging from safe driving rewards to home and auto bundling, allowing policyholders to significantly reduce their insurance costs through various qualifying factors.

Cons

- Above-Average Cost Structure: With a monthly premium of $106 in Columbia, Allstate’s pricing may be a barrier for drivers seeking the most economical insurance options, potentially limiting its appeal in a price-sensitive market.

- Service Inconsistency Reports: Some Columbia policyholders report varying experiences with Allstate’s customer support and claims handling, noting occasional delays or communication gaps that can lead to frustration during critical moments.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Rates for Drivers in Columbia, South Carolina

Columbia drivers, we’ve analyzed insurance rates from the best insurers in Columbia to help you make an informed decision about your auto coverage. Each insurer offers unique benefits, whether you get minimum or full coverage. Thus, it is imperative to take into account factors beyond merely the cost.

Columbia, South Carolina Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $35 $106

Auto-Owners $41 $97

Farmers $30 $100

Geico $27 $90

Liberty Mutual $38 $99

Nationwide $34 $102

Progressive $43 $105

State Farm $32 $95

Travelers $36 $110

USAA $29 $82

For those prioritizing cheap car insurance in Columbia, SC, Geico and USAA emerge as top contenders. However, drivers should carefully consider the recommended auto insurance coverage levels, as opting for minimum coverage may leave them financially vulnerable in the event of a serious accident.

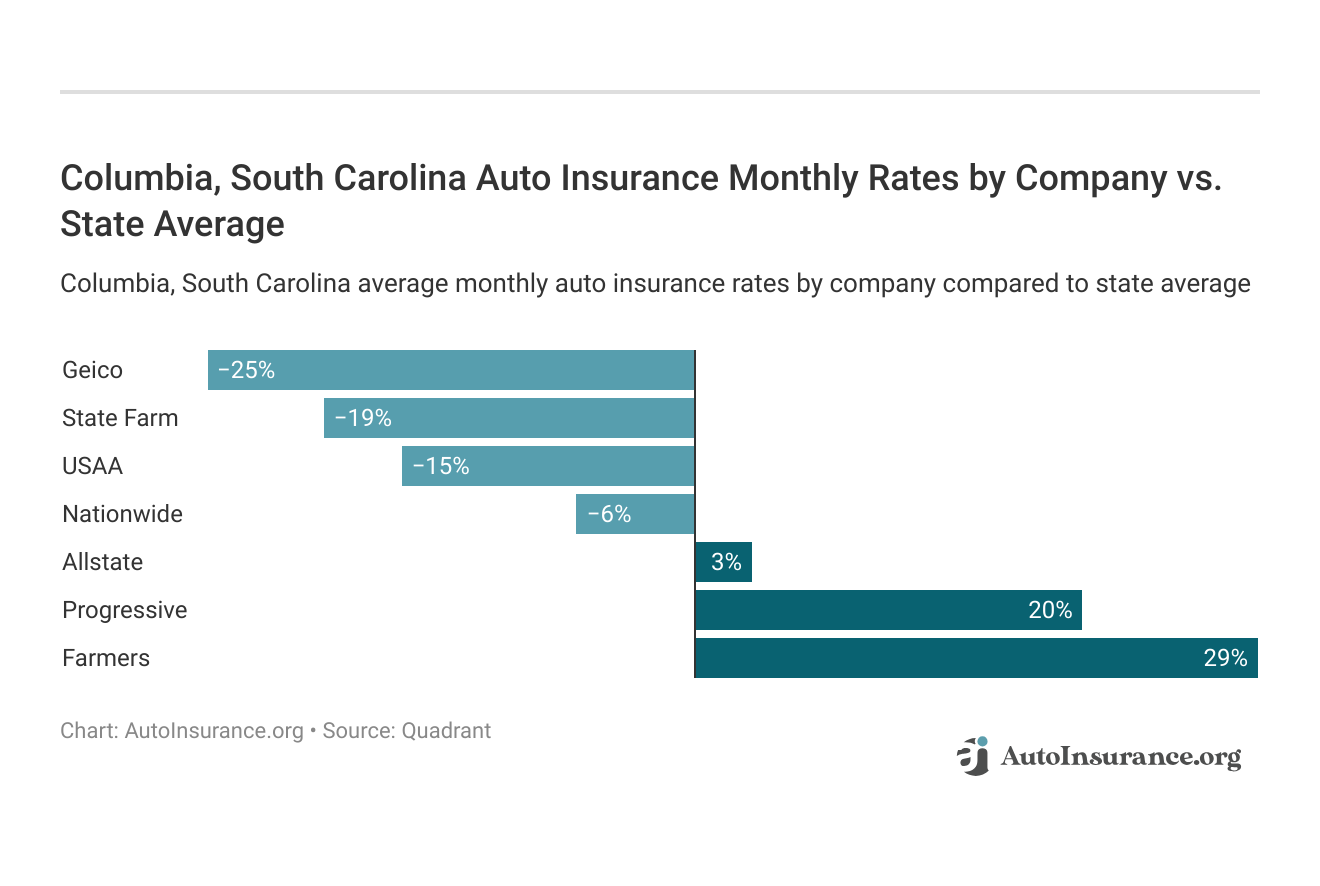

Check car insurance quotes in Columbia, SC to get the best policy. Geico and State Farm offer lower rates, with reductions of 25% and 19% below the state average. Farmers and Progressive are higher, but a local auto insurance company can often provide better service than a national one.

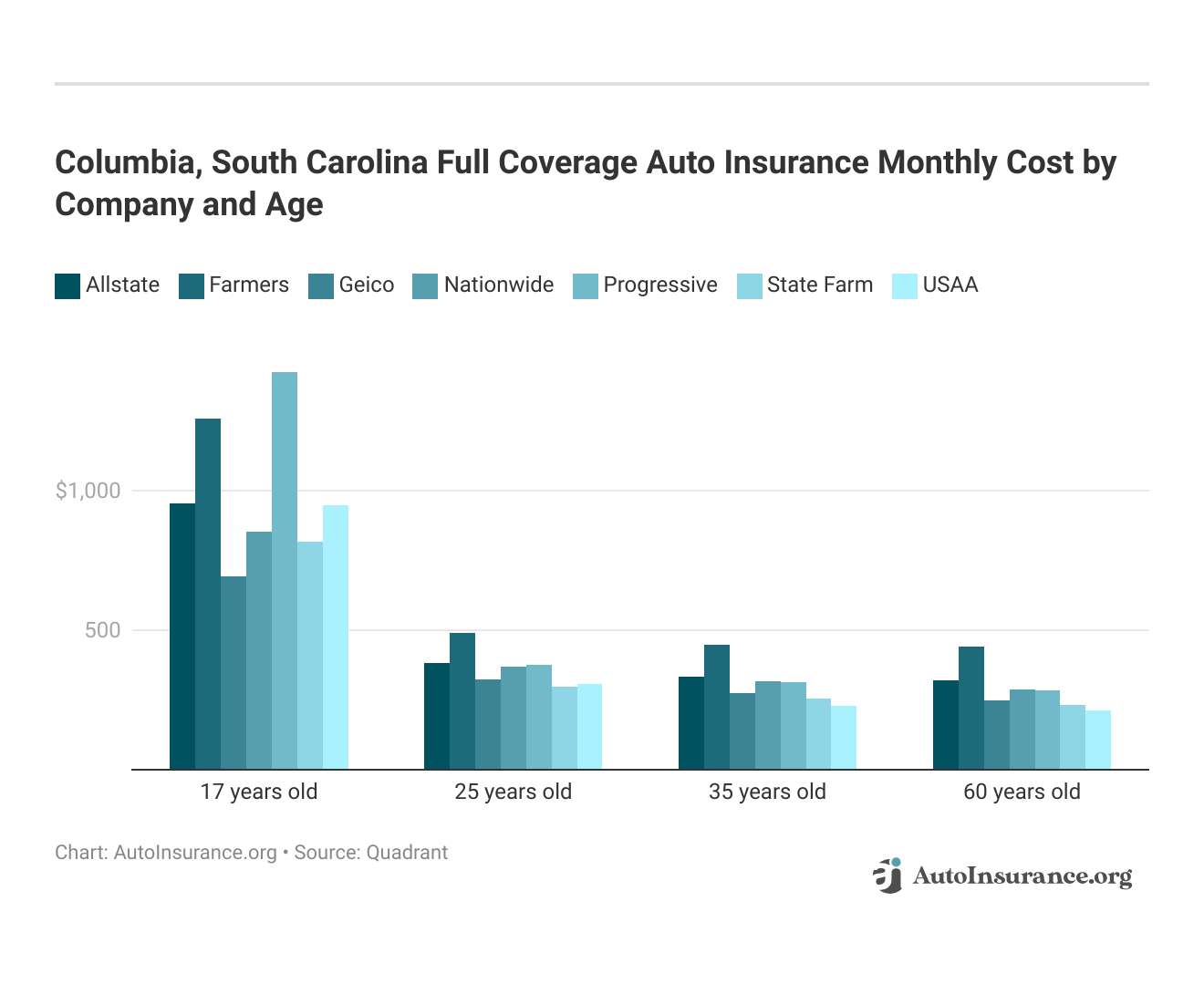

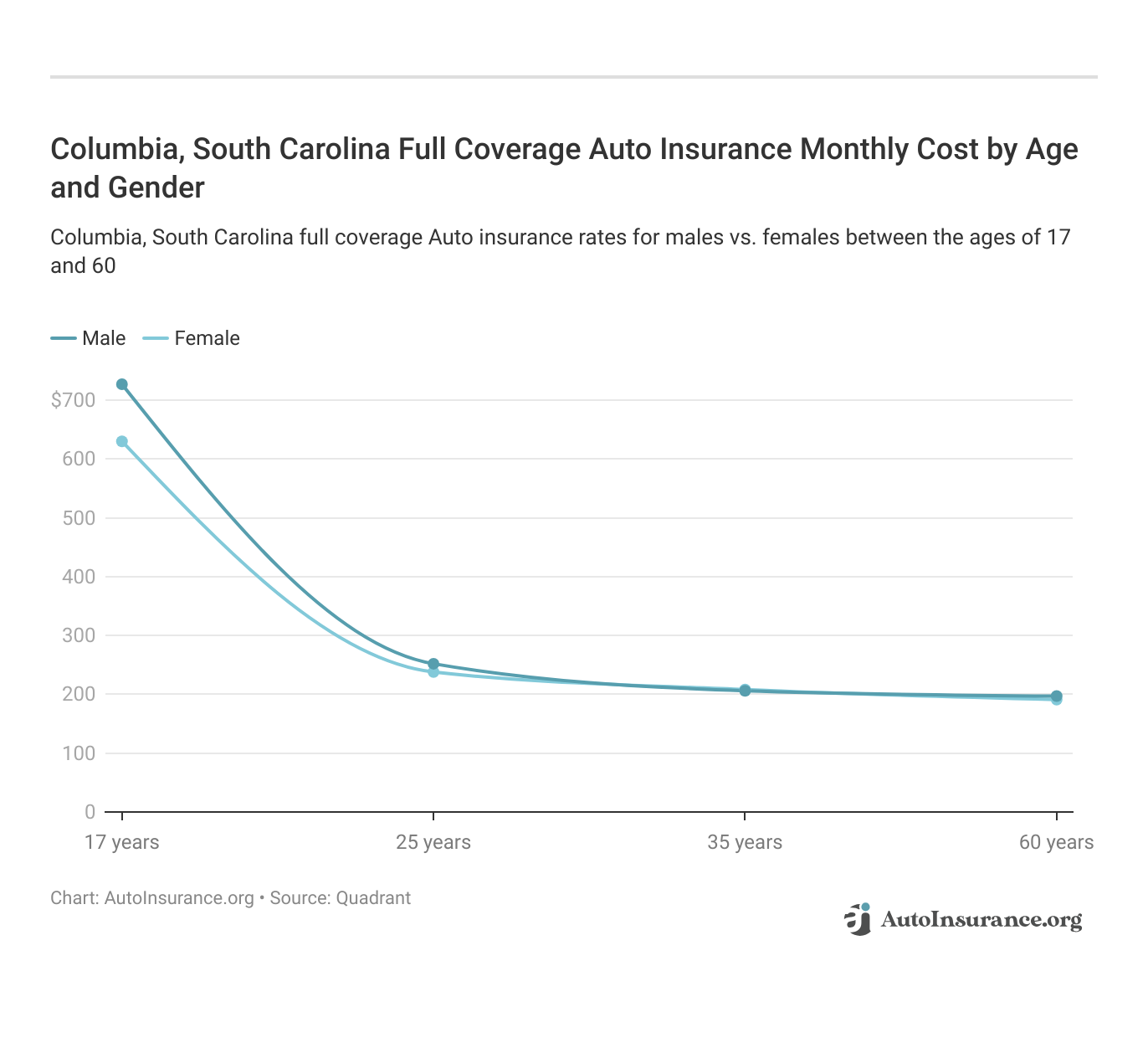

Below are the monthly auto insurance premiums in Columbia, SC, segmented by age and provider. Evaluate offerings from Allstate, Farmers, Geico, and other insurers to identify the optimal choice for your requirements.

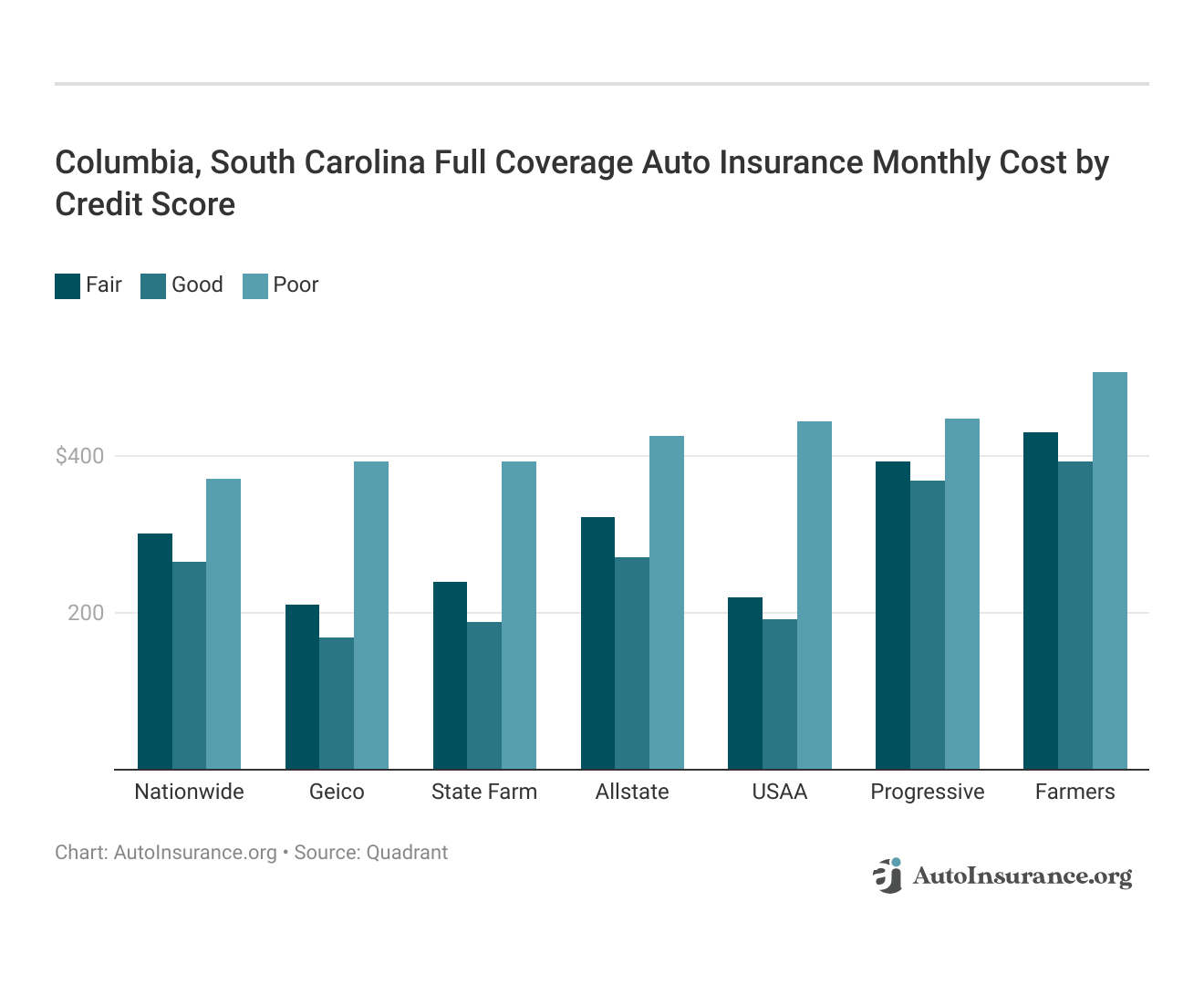

If you want the best car insurance in Columbia, South Carolina, how much you pay can change based on your credit score. Geico has the cheapest prices if you have a good or okay credit score. Farmers usually costs the most no matter what your credit score is. If your credit score isn’t very good, Nationwide has the best prices, but Farmers is still the most expensive.

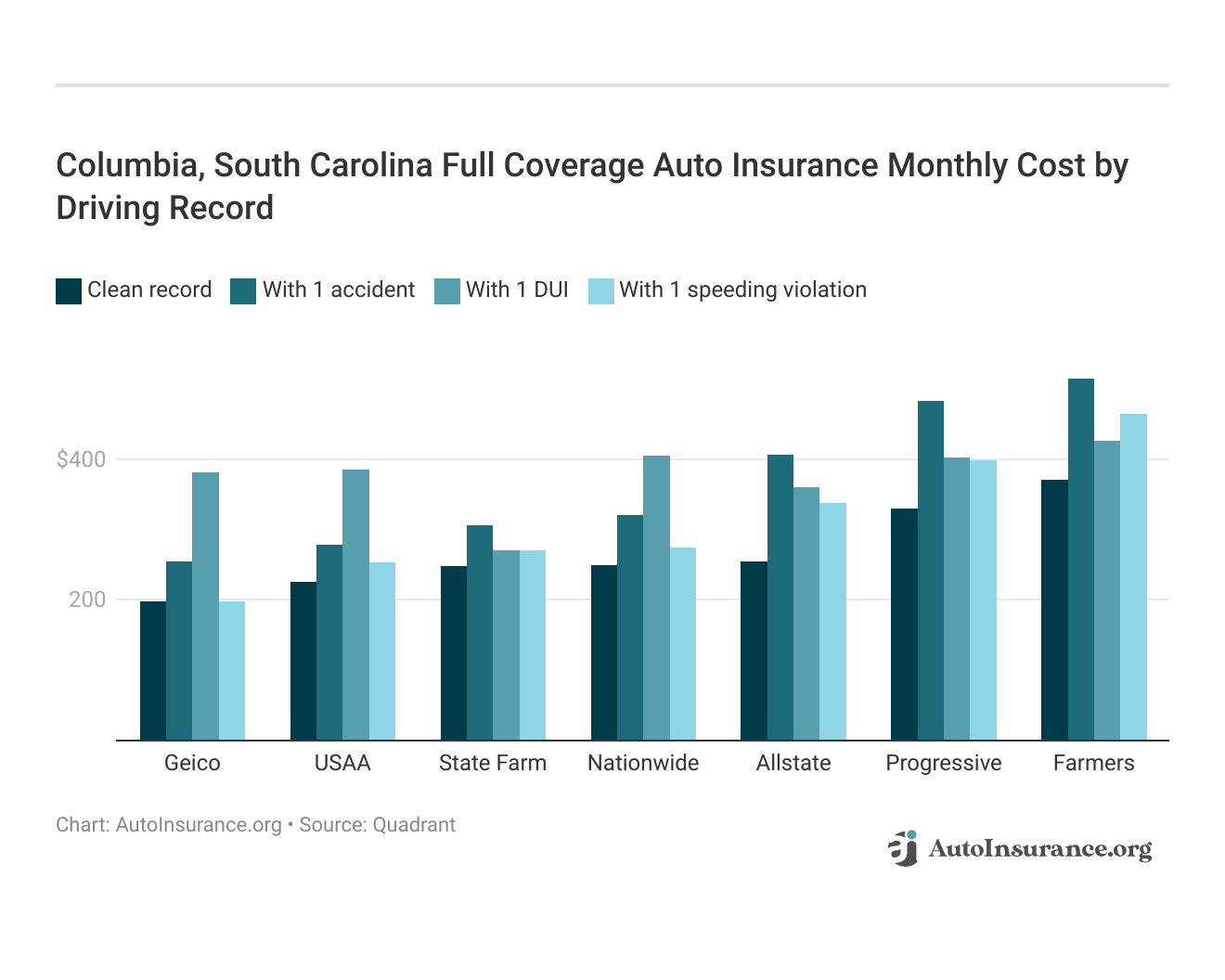

Your driving record speaks. In Columbia, a DUI will make your car insurance rates rise, perhaps by 40 to 50 percent. Seek the lowest rates in Columbia, South Carolina, by keeping a clean driving record.

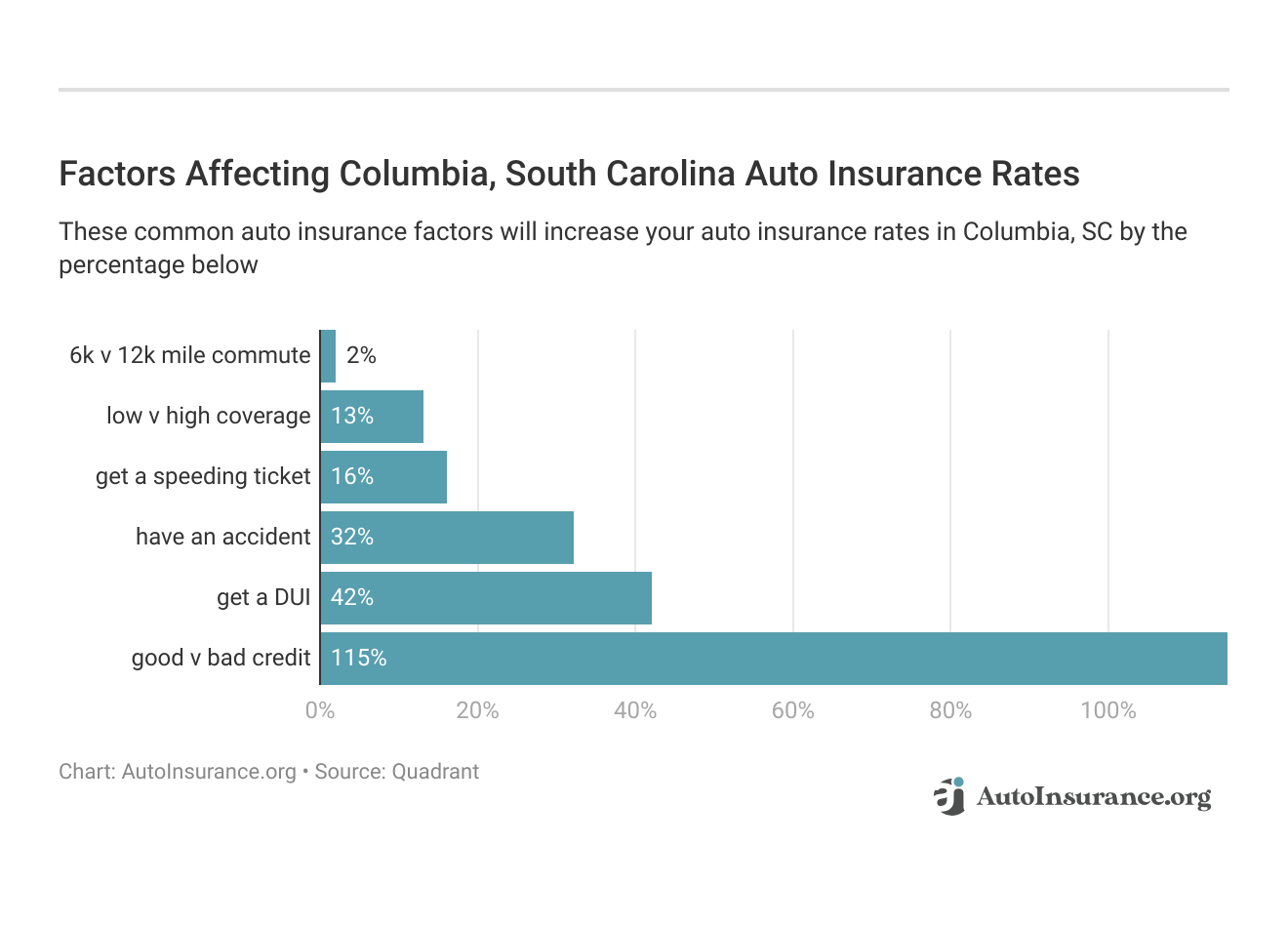

In Columbia, South Carolina, the cost of car insurance is influenced by various factors such as your annual mileage, selected coverage options, driving history, and credit score. By managing these elements effectively, you can secure the most affordable car insurance rates available.

This infographic elucidates the considerable influence of diverse factors on automobile insurance premiums in Columbia, South Carolina. Notably, infractions such as a DUI or suboptimal credit scores can precipitate substantial cost escalations.

But age still plays a big role. Young drivers, they’re seen as high-risk in Columbia. SC looks at gender too, so take a look at the average monthly car insurance rates by age and gender in Columbia, SC.

Columbia, South Carolina’s Minimum Auto Insurance Requirements

Roaming the streets of Columbia, where Five Points and the tranquil Lake Murray beckon, it’s vital your insurance stands up to South Carolina’s demands. Your coverage must meet the set limits for injuries and property damage. Make sure your policy holds fast to these state lines, keeping you safe as you drive through the heart of town. Here’s the breakdown:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $25,000 per incident for property damage

- $25,000 per incident for uninsured/underinsured motorist property damage coverage

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist bodily injury coverage

To stay compliant with Columbia’s insurance rules means you’re covered on the roads and when visiting places. Look at your policy to be sure it protects against bodily harm and damage to property.

It’s important to thoroughly review your insurance policy to confirm that it offers protection against bodily injuries and property damage. By doing so, you can navigate through Columbia, SC, with peace of mind, knowing that you are fully insured.

Columbia, South Carolina Auto Insurance and Cost Factors

In Columbia, traffic thickens and swells, pushing auto insurance rates higher. More cars mean more accidents. It’s simple. Columbia stands 54th in the nation for congestion, says INRIX. The roads are clogged, especially near Five Points and downtown. The drivers here know the struggle.

Read More: Does your job affect auto insurance rates?

City-Data shows that folks in Columbia spend about 35 minutes getting to work. It’s a stretch longer than what most folks across the country deal with. This extra time on the road drives up their insurance bills.

While many drivers commute alone, a notable number rely on public transit or walk, potentially influencing overall traffic patterns.Scott W. Johnson LICENSED INSURANCE AGENT

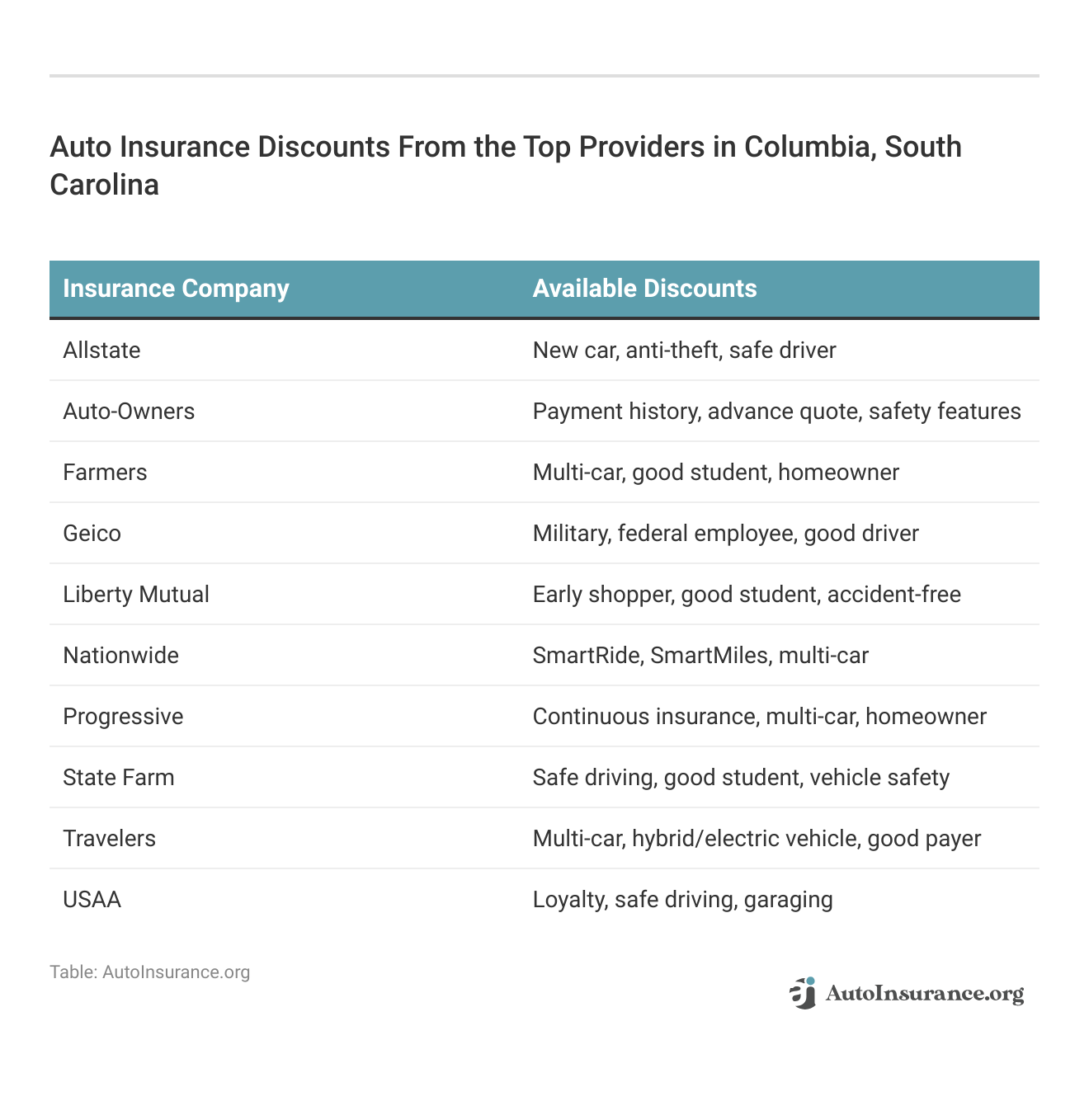

Moreover, the theft of cars troubles the city. The FBI says there were 791 stolen vehicles in Columbia last year. This is just another reason why insurance rates are high here. Find out what discounts you can get from the best Columbia, South Carolina car insurance companies, and save some money on your premiums.

By exploring these options, you can find the best discounts on car insurance in Columbia, whether you’re driving through the Vista, around the University of South Carolina campus, or enjoying Lake Murray. Tailor discounts to your vehicle type, driving record, and local habits.

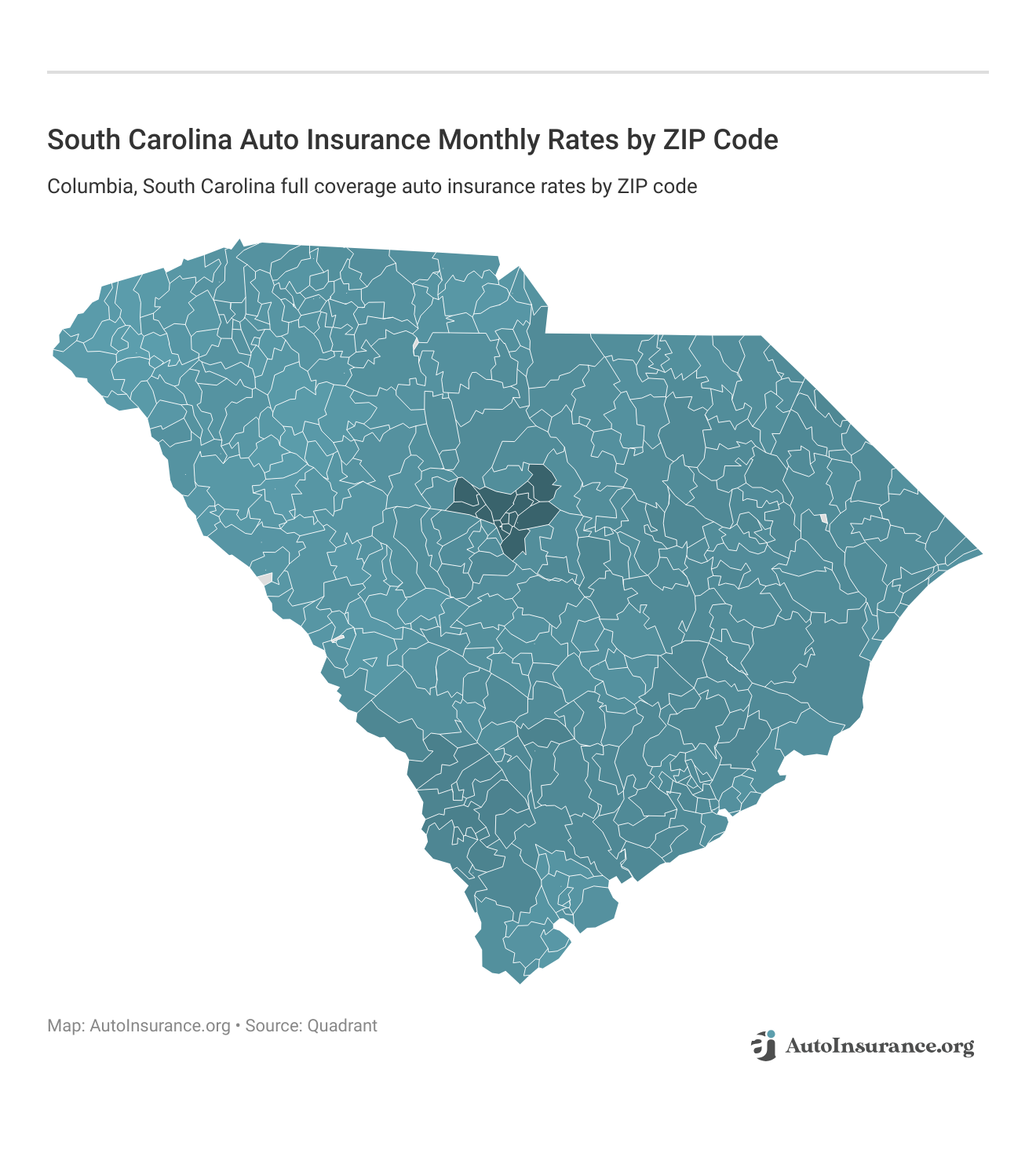

ZIP Code’s Impact on Columbia, SC Car Insurance Rates

Learn how where you live in Columbia, SC, shapes what you pay for car insurance. By looking at differences in rates in places like Shandon or Forest Acres, you can choose your coverage wisely.

Look hard at the monthly rates. Find the best deal for your area. Make sure the coverage fits your budget and the way you live in Columbia.

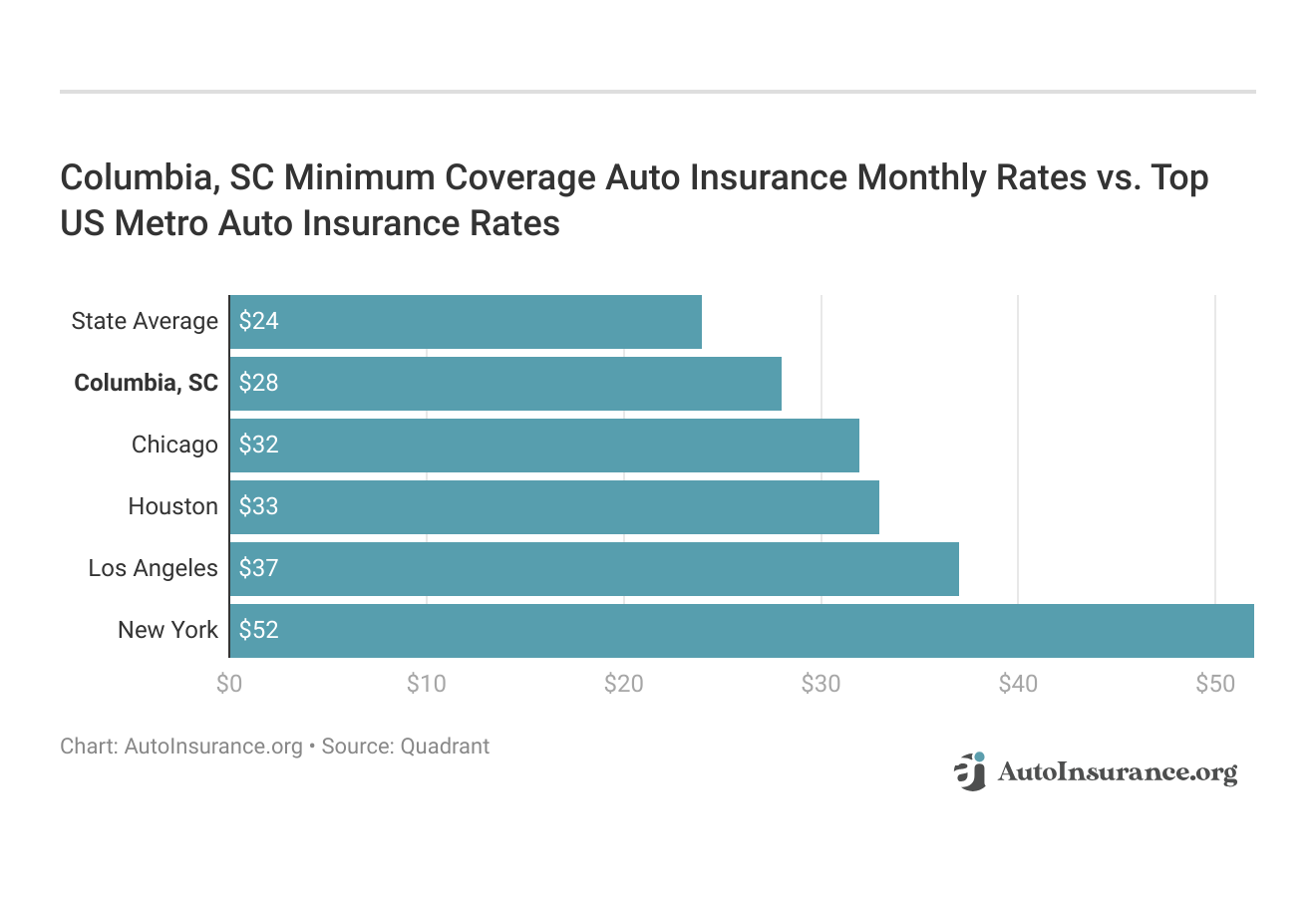

Comparison of Columbia, SC Car Insurance Rates vs. Top U.S. Metro Areas

In Columbia, South Carolina, the cost of auto insurance is $331 a month. It’s cheaper than places like Chicago and New York. Statewide, the price drops to $289. If you’re looking for solid auto insurance in Columbia, these prices are a bargain.

As you can see, rates for auto insurance in Columbia are lesser than in many big American cities, but they remain above the state average. By comparing prices, you gain a clearer picture of Columbia’s standing and discover ways to save more.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Deal on Columbia, SC Auto Insurance

In Columbia, car insurance comes dear. It’s the traffic, the theft, the way folks drive. But there’s a way to save. You must hunt for it, compare the numbers. Think about your drive through Five Points, the safety of your car.

Don’t just buy the first policy you see. Look at your options, find the best deal. For more savings, learn how to lower your auto insurance rates. Use discounts, keep your driving clean, tailor your coverage for Columbia. Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Frequently Asked Questions

How can I save money on Columbia, SC auto insurance?

To save money on your auto insurance in Columbia, SC, consider increasing your deductible, bundling your auto insurance with other policies, maintaining a clean driving record, and exploring discounts for low mileage, safe driving, or being a good student.

Do I need to notify my insurance company if I move within Columbia, SC?

Yes, it’s crucial to notify your insurance company if you change your address within Columbia, SC. Your location can affect your premium rates, and having the correct address on file ensures your coverage is valid. Failure to update your address may lead to complications when filing claims or could even result in policy cancellation.

Can I temporarily suspend my Columbia, SC auto insurance coverage if I won’t be using my vehicle for a certain period?

No, in Columbia, SC, you generally cannot suspend your auto insurance if your vehicle is registered. South Carolina law requires continuous insurance coverage for all registered vehicles, even if they are not in use. If you no longer need coverage, you might consider canceling your policy or discussing other options with your insurance company.

Can I get auto insurance coverage if I have a poor driving record or past accidents in Columbia, SC?

Yes, it is possible to obtain auto insurance coverage in Columbia, SC, even with a poor driving record or a history of accidents. However, insurers may consider you a higher risk, resulting in higher premiums. It is advisable to shop around and compare quotes from different companies to find the most affordable option.

What should I do if my auto insurance rates in Columbia, SC increase significantly?

If you notice a significant increase in your auto insurance rates, you should first contact your insurer to understand the reasons for the hike. Consider adjusting your coverage options, increasing your deductible, or seeking out discounts. Read up in our article titled “Why does my auto insurance go up every year?”

Can I use my Columbia, SC auto insurance coverage when driving in other states?

Yes, your auto insurance coverage from Columbia, SC, typically extends to other states within the United States. However, it is always a good idea to review your policy or consult with your insurance provider to confirm the specifics of your coverage when driving out of state.

What factors influence auto insurance rates in Columbia, SC?

Several factors influence auto insurance rates in Columbia, SC, including your age, driving history, credit score, type of vehicle, annual mileage, and location within the city. Local crime rates and traffic density also play a role in determining premiums. Managing these factors effectively can help you secure better rates.

How does my ZIP code affect car insurance rates in Columbia, SC?

Your ZIP code can significantly impact your car insurance rates in Columbia, SC. Areas with higher crime rates, more frequent accidents, or higher traffic congestion may result in higher premiums. Conversely, living in a safer, less congested area could lead to lower insurance costs. It’s essential to consider these factors when choosing where to live.

Are there specific insurance requirements for drivers in Columbia, SC?

Yes, drivers in Columbia, SC, must meet South Carolina’s minimum car insurance requirements, which include liability coverage for bodily injury and property damage. This coverage ensures that you are financially protected in case of an accident. It’s important to review your policy regularly to ensure it meets or exceeds these state-mandated requirements.

Can I get discounts on auto insurance in Columbia, SC?

Yes, many insurance companies offer various discounts to Columbia, SC residents. Discounts may be available for safe driving, having multiple policies with the same insurer, being a good student, or installing anti-theft devices in your vehicle. It’s a good idea to ask your insurer about available discounts and how you can qualify for them.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.