Best Coral Gables, Florida Auto Insurance in 2026 (Find the Top 10 Companies Here)

The top picks for the best Coral Gables, Florida auto insurance are State Farm, Geico, and Allstate, with State Farm offering the best rate at $50 per month. These companies excel in customer service, affordable rates, and coverage options, ensuring you find a car insurance plan that fits your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated August 2025

Company Facts

Full Coverage in Coral Gables Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Coral Gables Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Coral Gables Florida

A.M. Best Rating

Complaint Level

Pros & Cons

These companies stand out for their exceptional customer service, affordable rates, and extensive coverage options. To gain further insights, consult our comprehensive guide titled “Best Florida Auto Insurance.”

Our Top 10 Company Picks: Best Coral Gables, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 17% B Customer Service State Farm

![]()

#2 25% A++ Affordable Rates Geico

![]()

#3 10% A+ Coverage Options Allstate

#4 10% A++ Military Members USAA

#5 12% A+ Custom Policies Progressive

#6 10% A Unique Discounts Liberty Mutual

#7 20% A+ Coverage Variety Nationwide

#8 15% A Comprehensive Coverage Farmers

#9 13% A++ Flexible Policies Travelers

#10 15% A+ Customer Support Amica

State Farm’s strong performance in all these areas makes it the top choice for comprehensive car insurance coverage in Coral Gables. Explore these options to find the ideal insurance plan that meets your needs.

Get the car insurance at the best price — enter your ZIP code above to shop for right coverage from the top insurers.

- State Farm provides competitive rates and discounts in Coral Gables

- State Farm offers customized coverage for diverse needs in Coral Gables

- Save more and get great coverage with State Farm’s wide range of discounts

#1 – State Farm: Top Overall Pick

Pros:

- Competitive Rates: State Farm offers highly competitive rates for the best Coral Gables, Florida auto insurance.

- Exceptional Service: State Farm’s customer service excels in Coral Gables, Florida, consistently demonstrating high levels of support and reliability, as highlighted in our State Farm review.

- Comprehensive Coverage Options: State Farm offers a diverse selection of coverage options in Coral Gables, catering to a variety of insurance needs.

Cons:

- Limited Discounts: State Farm provides fewer discount opportunities compared to other providers in Coral Gables.

- Mixed Online Experience: Online service in Coral Gables may not be as streamlined as other options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable rates

Pros:

- Affordable Rates: Geico’s competitive rates stand out in Coral Gables, Florida, featuring some of the lowest premiums available, which you can explore further in our Geico review.

- User-Friendly Online Tools: Geico offers outstanding online tools and resources for managing auto insurance policies in Coral Gables.

- Strong Financial Stability: Geico is renowned for its financial stability and dependable service in Coral Gables, Florida.

Cons:

- Limited Local Agents: Geico has fewer local agents in Coral Gables, which may impact personalized service.

- Basic Coverage Options: Coverage options in Coral Gables, Florida, may be less comprehensive compared to other leading providers.

#3 – Allstate: Best for Coverage Options

Pros:

- Strong Claims Service: Allstate has a reputation for reliable claims processing in Coral Gables.

- Numerous Discounts: Allstate offers numerous discounts to lower premiums, making it a strong choice for affordable auto insurance in Coral Gables, Florida.

- Comprehensive Coverage: Allstate presents a wide range of coverage options in Coral Gables, Florida, showcasing extensive policy choices to meet diverse needs, detailed in our Allstate review.

Cons:

- Higher Premiums: Allstate’s premiums in Coral Gables, Florida may be higher compared to those of some other insurers.

- Inconsistent Customer Service: Customer service experiences in Coral Gables, Florida, can vary.

#4 – USAA: Best for Military Benefits

Pros:

- Exclusive Military Discounts: USAA proudly offers exceptional benefits for military members in Coral Gables, Florida, showcasing unique discounts and support, as spotlighted in our USAA review.

- High Customer Satisfaction: USAA consistently achieves top rankings for customer satisfaction in Coral Gables, Florida auto insurance.

- Comprehensive Coverage: USAA offers comprehensive coverage options tailored to diverse needs in Coral Gables, Florida.

Cons:

- Eligibility Restrictions: USAA offers its services exclusively to military members and their families in Coral Gables, Florida.

- Limited Local Presence: USAA has fewer physical locations in Coral Gables.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Custom Plans

Pros:

- Competitive Rates: Known for competitive pricing, Progressive offers some of the best rates in Coral Gables.

- Flexible Coverage Plans: Progressive offers adaptable coverage options to meet diverse needs in Coral Gables, Florida.

- Custom Policies: Progressive features customizable insurance plans in Coral Gables, Florida, allowing tailored coverage options to fit specific needs, reviewed in our Progressive review.

Cons:

- Higher Premiums for High-Risk Drivers: Drivers with poor driving records may face higher rates for auto insurance in Coral Gables, Florida.

- Customer Service Variability: Customer service experiences in Coral Gables, Florida can vary, leading to inconsistent satisfaction.

#6 – Liberty Mutual: Best for Unique Discounts

Pros:

- Unique Discounts: Liberty Mutual flaunts a variety of exclusive discounts in Coral Gables, Florida, enhancing savings opportunities with distinctive offers, highlighted in our Liberty Mutual review.

- Customizable Policies: Liberty Mutual offers extensive customization options for insurance policies in Coral Gables, Florida.

- Strong Support Network: Offers robust 24/7 customer support in Coral Gables, Florida.

Cons:

- Higher Premiums: Liberty Mutual’s premiums in Coral Gables, Florida, may be on the higher side.

- Complex Claims Process: In Coral Gables, Florida, Liberty Mutual’s claims process may be intricate and take time to navigate.

#7 – Nationwide: Best for Coverage Variety

Pros:

- Usage-Based Discounts: Nationwide offers discounts based on driving behavior, benefiting safe drivers in Coral Gables.

- Coverage Variety: Nationwide demonstrates extensive coverage options in Coral Gables, Florida, offering a broad spectrum of choices to suit different preferences, as outlined in our Nationwide review.

- Strong Reputation: Renowned for its strong reputation in the insurance industry, Coral Gables, Florida offers reliable coverage options.

Cons:

- Average Customer Service: Customer service in Coral Gables, Florida may not be as exceptional compared to other leading insurance providers.

- Higher Rates for Some Drivers: Drivers with less-than-perfect records may face higher rates for auto insurance in Coral Gables, Florida.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Comprehensive Coverage

Pros:

- Comprehensive Coverage: Farmers delivers thorough coverage options in Coral Gables, Florida, presenting a well-rounded range of protections, detailed in our Farmers review.

- Local Agents: Farmers has a strong local agent presence in Coral Gables for personalized service.

- Strong Local Reputation: Renowned for its strong community involvement and excellent local reputation in Coral Gables, Florida.

Cons:

- Higher Premiums: Premiums in Coral Gables, Florida may be higher than those of some competitors.

- Limited Discounts: Limited discount options are available in Coral Gables, Florida.

#9 – Travelers: Best for Flexible Policies

Pros:

- Accident Forgiveness: Travelers provides accident forgiveness in Coral Gables, Florida, which benefits drivers by covering minor incidents without affecting their rates.

- Strong Financial Stability: Recognized for its financial stability and reliability in Coral Gables, Florida.

- Flexible Policies: Travelers exhibits adaptable insurance policies in Coral Gables, Florida, allowing flexible coverage plans to match varied requirements, covered in our Travelers review.

Cons:

- Higher Premiums for High-Risk Drivers: Drivers with risk factors may see higher rates for auto insurance in Coral Gables, Florida.

- Complex Policy Details: Policy details can be complex and difficult to grasp, especially when navigating auto insurance options in Coral Gables, Florida.

#10 – Aimica: Best for Customer Support

Pros:

- Outstanding Support: Amica showcases superior customer support in Coral Gables, Florida, providing exceptional service and assistance, as featured in our Amica review.

- Competitive Rates: Offers competitive rates for the best Coral Gables, Florida auto insurance.

- Comprehensive Coverage: Offers diverse coverage options to suit different needs for Coral Gables, Florida drivers.

Cons:

- Limited Local Presence: Amica has fewer physical locations in Coral Gables.

- Higher Rates for Some Drivers: Drivers in Coral Gables, Florida, might face higher rates depending on their individual profiles..

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

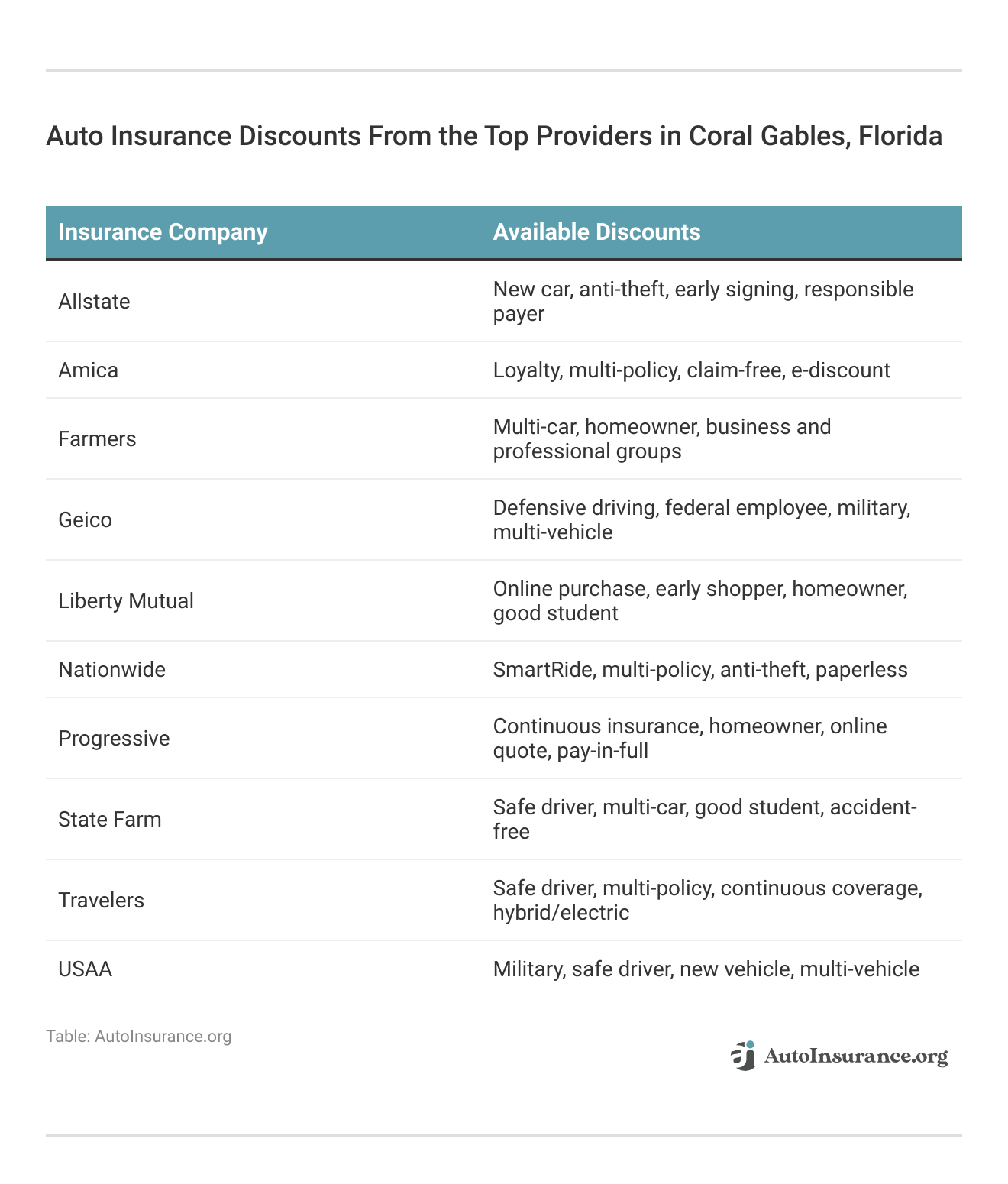

Minimum Auto Insurance in Coral Gables, Florida

Best Coral Gables, Florida Auto Insurance Rates by Coverage Level

Coral Gables, Florida Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $152

Amica $46 $148

Farmers $52 $150

Geico $45 $137

Liberty Mutual $65 $160

Nationwide $48 $146

Progressive $57 $145

State Farm $50 $140

Travelers $55 $142

USAA $40 $120

This analysis helps you understand how different coverage options affect the overall cost of auto insurance in Coral Gables, ensuring you make an informed decision. For additional details, explore our comprehensive resource titled “What are the recommended auto insurance coverage levels?”

Best Coral Gables, Florida Auto Insurance by Age, Gender, and Marital Status

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Coral Gables, Florida Auto Insurance by Driving Record

In Coral Gables, a clean driving record will generally secure you the lowest rates, while any infractions can significantly increase your costs.

Best Coral Gables, Florida Auto Insurance by Credit History

Credit history can significantly impact auto insurance costs. Explore how insurance providers determine rates in Coral Gables, Florida, by comparing annual auto insurance rates based on credit history.

By comparing annual auto insurance rates based on credit history, you can gain valuable insights into how different credit tiers are treated by insurers, helping you make informed decisions when selecting the best Coral Gables, Florida auto insurance for your needs.

Best Coral Gables, Florida Auto Insurance Rates by ZIP Code

Understanding how ZIP codes influence auto insurance rates can help you find the best Coral Gables, Florida auto insurance rates tailored to your specific location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Coral Gables, Florida Auto Insurance Rates by Commute

The length of your daily commute can significantly influence your auto insurance premiums. In Coral Gables, Florida, shorter commutes generally result in lower rates, while longer drives may lead to higher costs.

Your daily commute plays a crucial role in determining the best Coral Gables, Florida auto insurance rates, with longer drives often leading to higher premiums.

Best by Category: Best Auto Insurance in Coral Gables, Florida

State Farm stands out for offering the Best insurance for drivers with one DUI. This highlights how specific insurance needs and driving histories influence the best options for affordable coverage

The Best Coral Gables, Florida Auto Insurance Companies

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Coral Gables, Florida?

There are several factors that affect auto insurance rates in Coral Gables, Florida, such as your driving history, age, gender, and marital status. The coverage level you choose, your vehicle’s make and model, and even your credit score also contribute to premium costs.

State Farm consistently delivers the best auto insurance rates and customer service in Coral Gables, Florida, making it the top choice for drivers.Brad Larson Licensed Insurance Agent

Local elements like traffic conditions and crime rates further influence how much you’ll pay for auto insurance in Coral Gables. By understanding these factors, you can find the most affordable coverage options available.

Compare Coral Gables, Florida Auto Insurance Quotes

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

Who is the best car insurance company in Florida?

The best car insurance company in Florida is State Farm, known for its comprehensive coverage options and competitive rates.

Which insurance company has the highest customer satisfaction?

According to recent surveys, State Farm has the highest customer satisfaction among insurance companies in Florida, thanks to its reliable service and support.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

What is full coverage car insurance in Florida?

Full coverage auto insurance in Florida includes liability, collision, and comprehensive coverage, providing extensive protection for drivers.

What is the best car insurance for seniors in Florida?

For seniors in Florida, USAA offers the best car insurance, providing excellent rates and benefits tailored to older drivers.

What is the best type of car insurance to get?

The best type of car insurance to get depends on your needs, but a combination of liability, collision, and comprehensive coverage often provides the most protection.

How to lower Florida auto insurance?

To lower Florida auto insurance, consider increasing your deductible, taking advantage of discounts, maintaining a clean driving record, and comparing quotes.

Who is the most trustworthy insurance company?

USAA is considered the most trustworthy insurance company, especially for military members and their families, due to its high customer satisfaction and reliable service.

Which insurance company has the most complaints?

Progressive has received a higher volume of complaints compared to other insurers, which may impact its reputation for customer service.

Do you need collision insurance in Florida?

While not legally required, collision insurance is recommended in Florida if you want coverage for damage to your vehicle in the event of an accident.

How much should I be paying for car insurance in Florida?

On average, drivers in Florida should expect to pay around $1,500 to $2,000 annually for car insurance, though rates vary based on coverage and personal factors.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.