Best Olathe, Kansas Auto Insurance in 2026

The cheapest auto insurance in Olathe, KS is from USAA, although rates will vary for each person. Olathe, KS auto insurance must meet the state minimum requirements with coverage levels of 25/50/10 for liability and $4,500 in PIP coverage, along with uninsured/underinsured motorist coverage. Compare Olathe, Kansas car insurance rates online to get the best price for you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated September 2024

- The cheapest auto insurance company in Olathe, KS is USAA

- Olathe, KS auto insurance rates are affected by driving record, credit, age, and location

- An increase in thefts in your city could increase comprehensive coverage rates

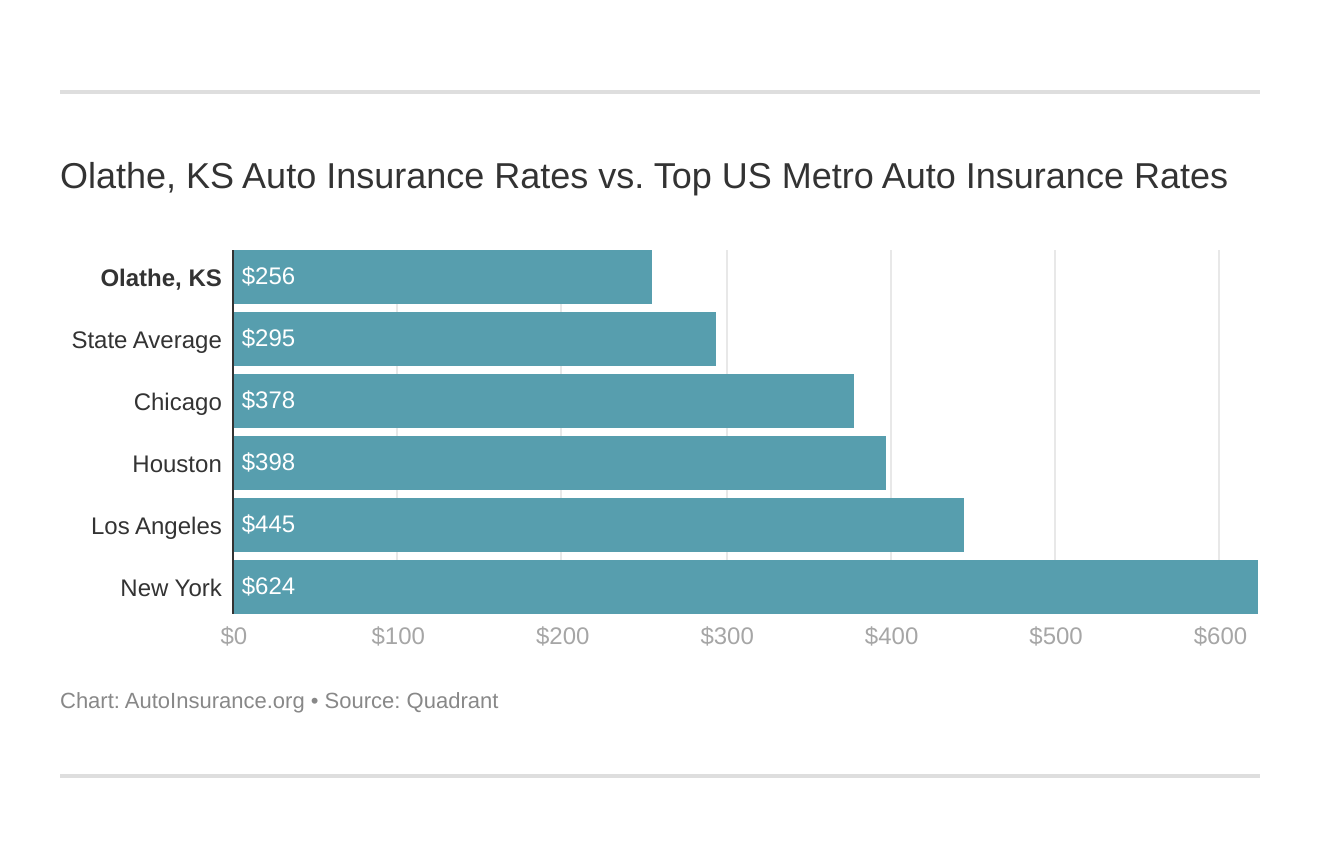

Olathe, KS auto insurance rates are $3,446 per year, which is $166 more expensive than the Kansas auto insurance average and $486 cheaper than the national average.

If you’re having concerns about Olathe, KS auto insurance savings, don’t worry – we’re here to help you shop around, compare rates, and secure cheap auto insurance.

Monthly Olathe, KS Car Insurance Rates by ZIP Code

Find more info about the monthly Olathe, KS car insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Olathe, KS Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Olathe, Kansas against other top US metro areas’ auto insurance rates.

Are you ready to find affordable Olathe, KS auto insurance? Enter your ZIP code above to get started comparing multiple companies in your area.

What is the cheapest Olathe, KS auto insurance company?

The cheapest Olathe, KS car insurance company is USAA. But USAA is only available to military veterans and their immediate families. Therefore, non-veterans will have to shop with other companies. For more information, check out our USAA auto insurance review.

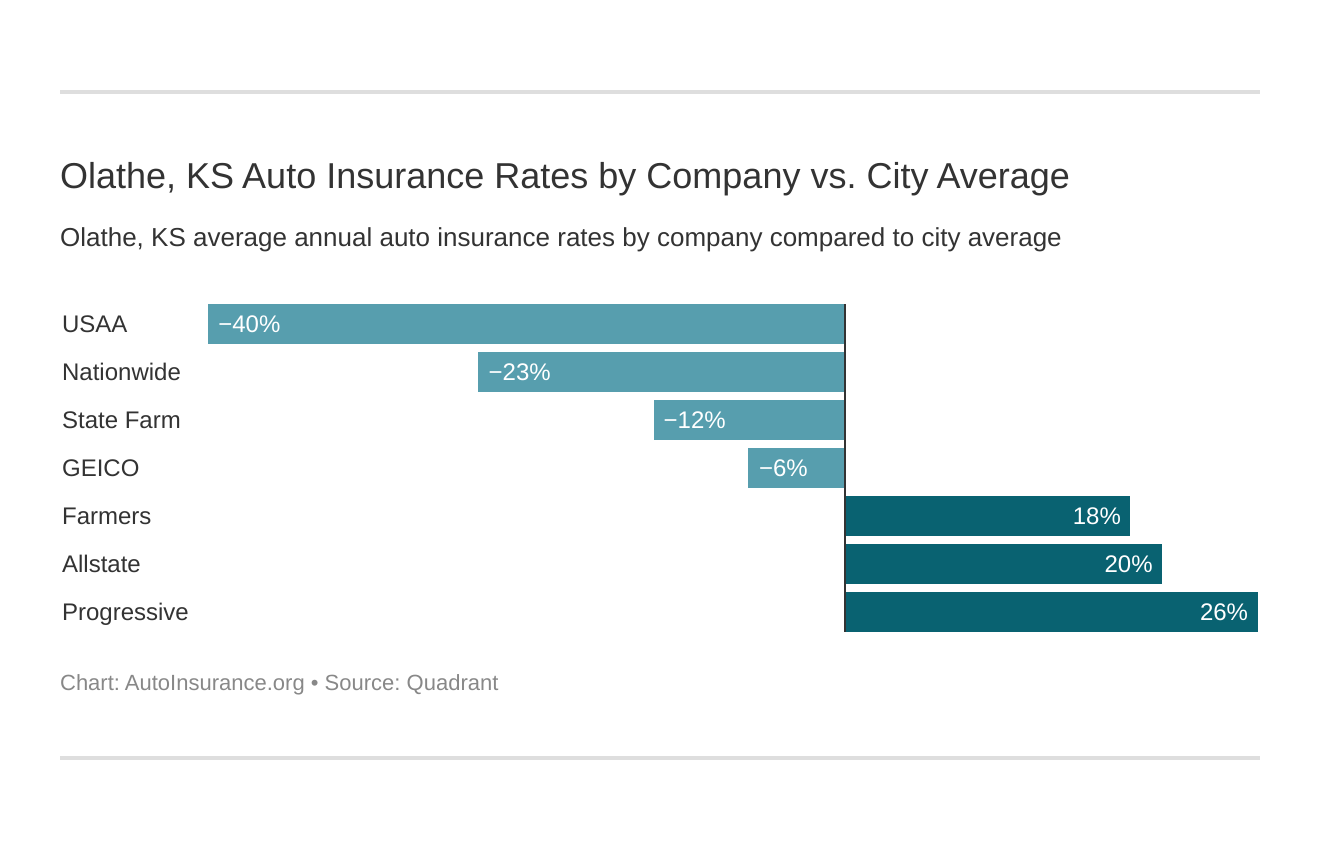

The cheapest Olathe, KS auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Kansas auto insurance company rates?” We cover that as well.

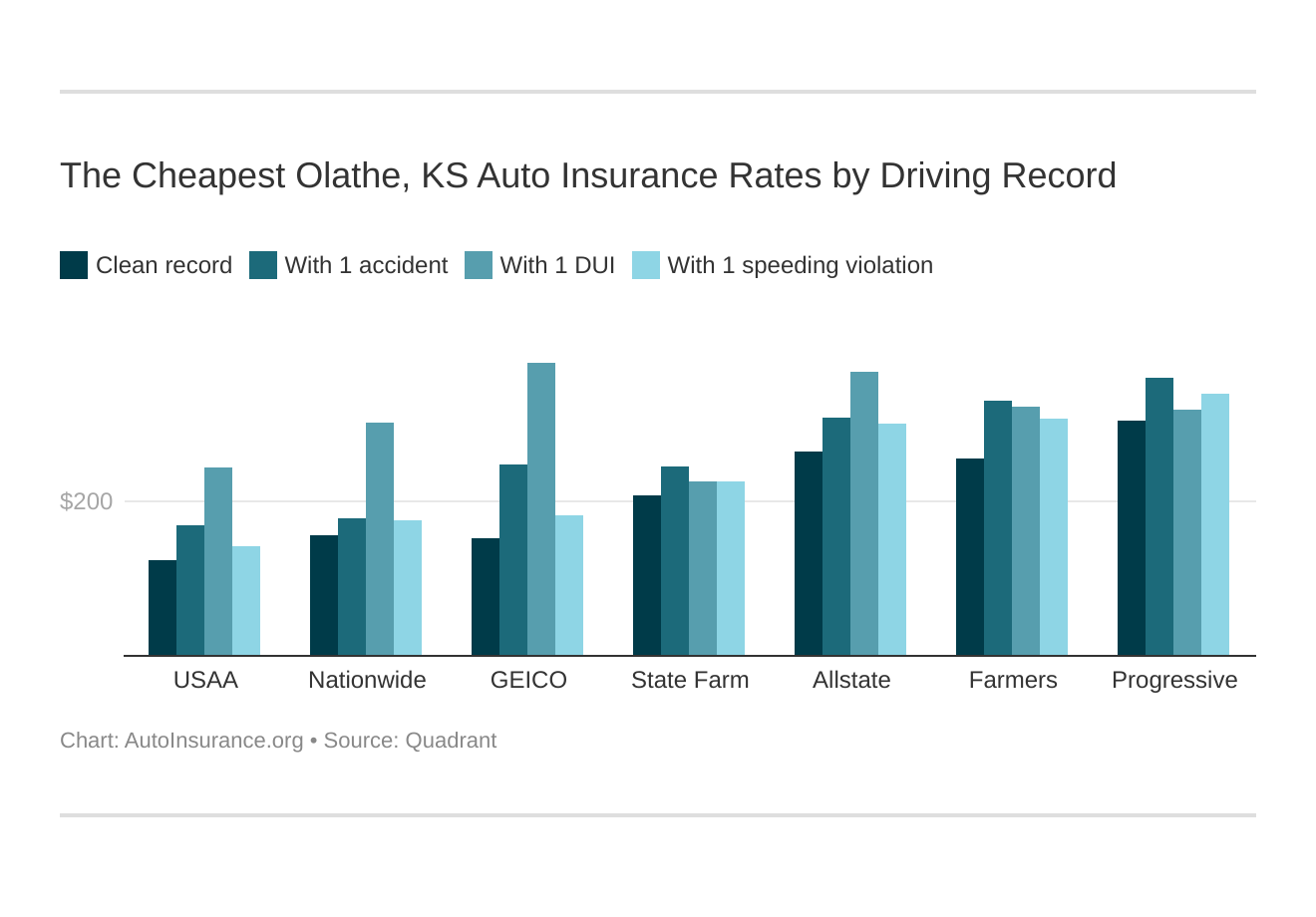

Here are the best auto insurance companies in Olathe, KS, ranked from cheapest to most expensive:

- USAA auto insurance – $2,038

- American Family auto insurance – $2,112

- Nationwide auto insurance – $2,440

- State Farm auto insurance – $2,726

- Geico auto insurance – $2,897

- Farmers auto insurance – $3,662

- Allstate auto insurance – $3,736

- Progressive auto insurance – $3,981

- Travelers auto insurance – $4,113

- Liberty Mutual auto insurance – $4,655

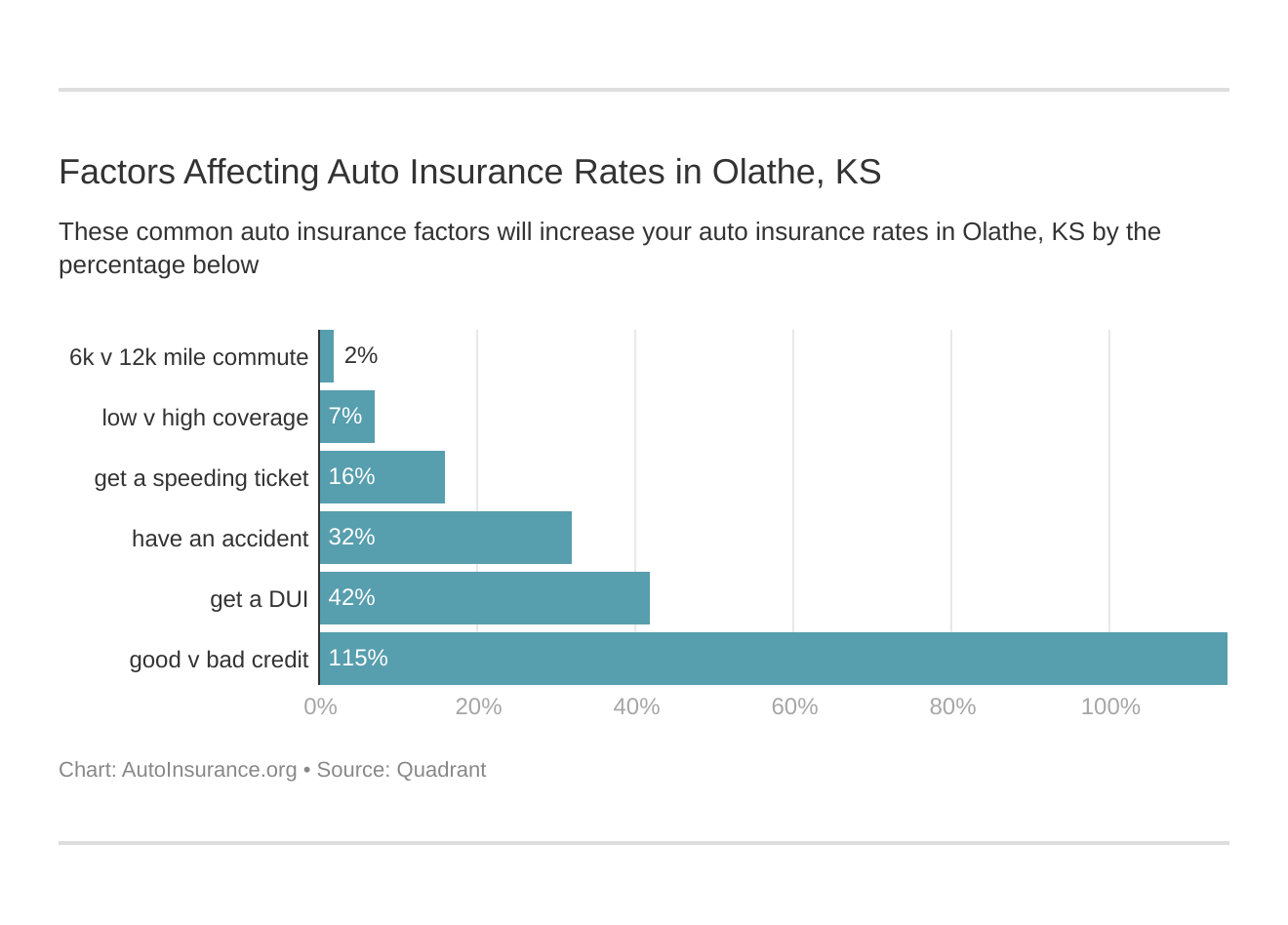

Several factors determine your auto insurance rates. To secure an affordable Olathe, KS car insurance policy, you’ll need to maintain a clean driving record. If you need high-risk auto insurance, it will cost a lot more.

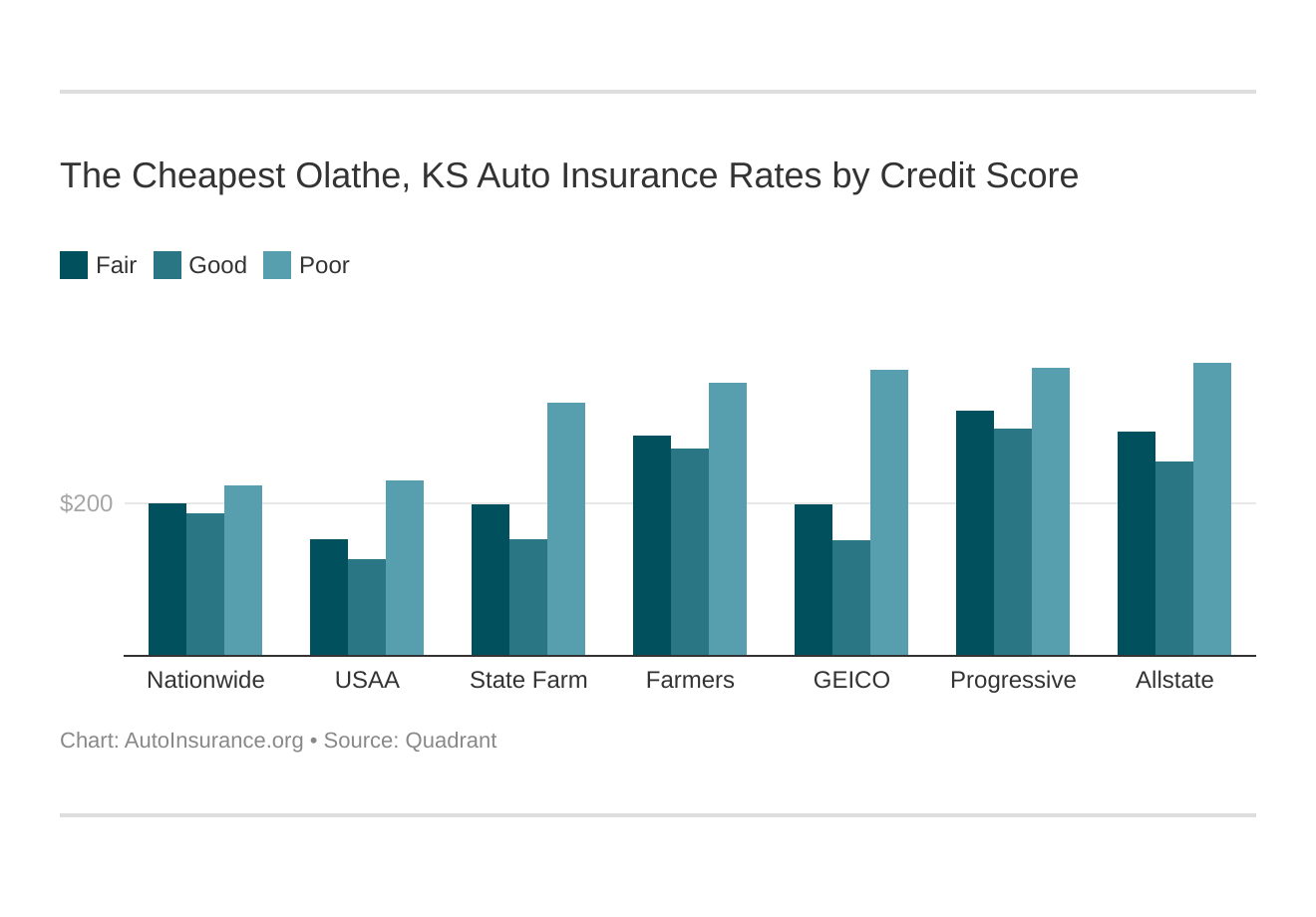

You can stack your discounts even further by improving your credit score. Good and excellent credit scores generate cheap Olathe, KS auto insurance quotes.

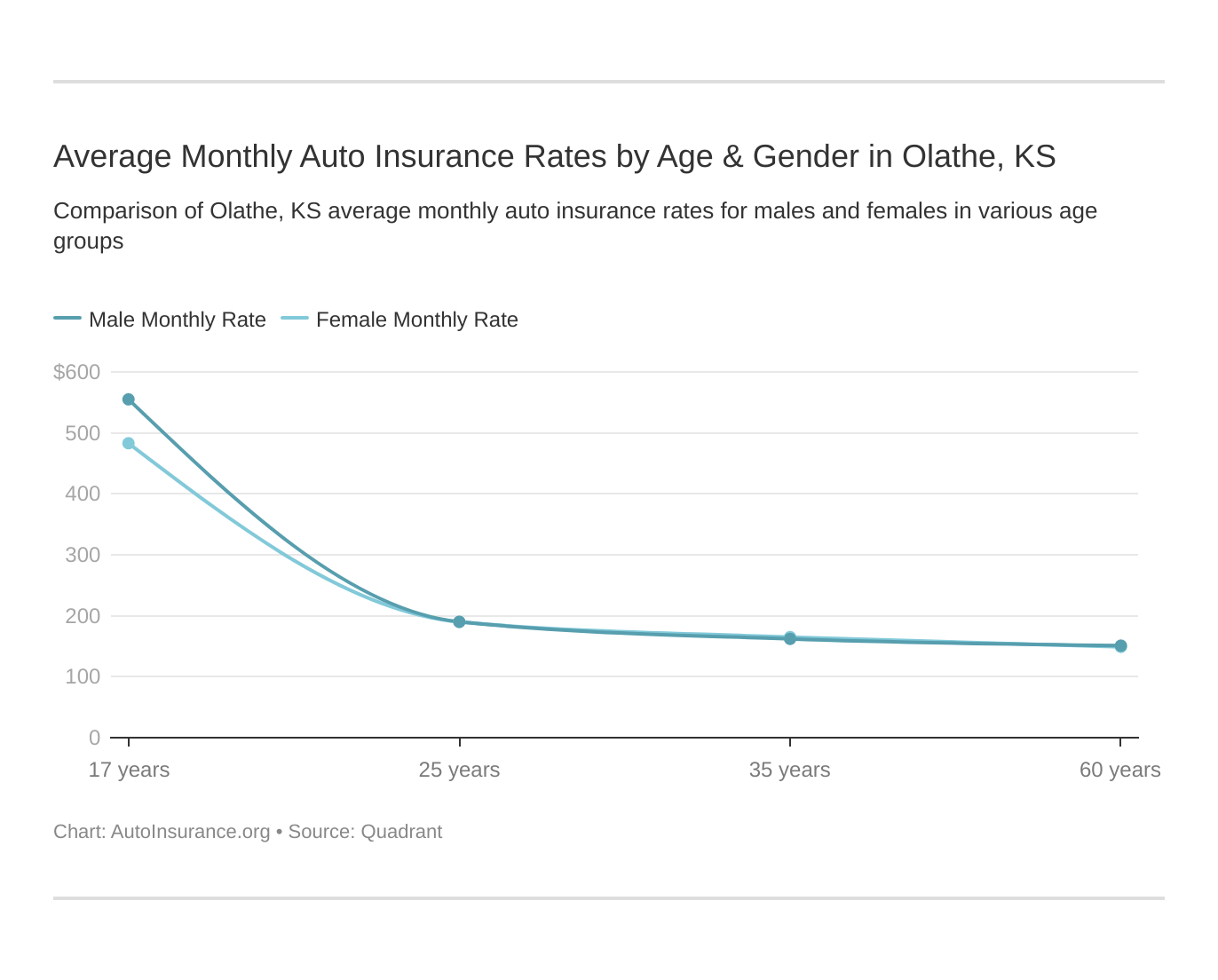

Take advantage of any bargain to lower Olathe, KS car insurance rates. Factors such as age and gender can drive up your Olathe, KS car insurance quotes.

Even your ZIP code is a factor. The cheapest ZIP code in Olathe is 66061, but the most expensive ZIP code is 66062.

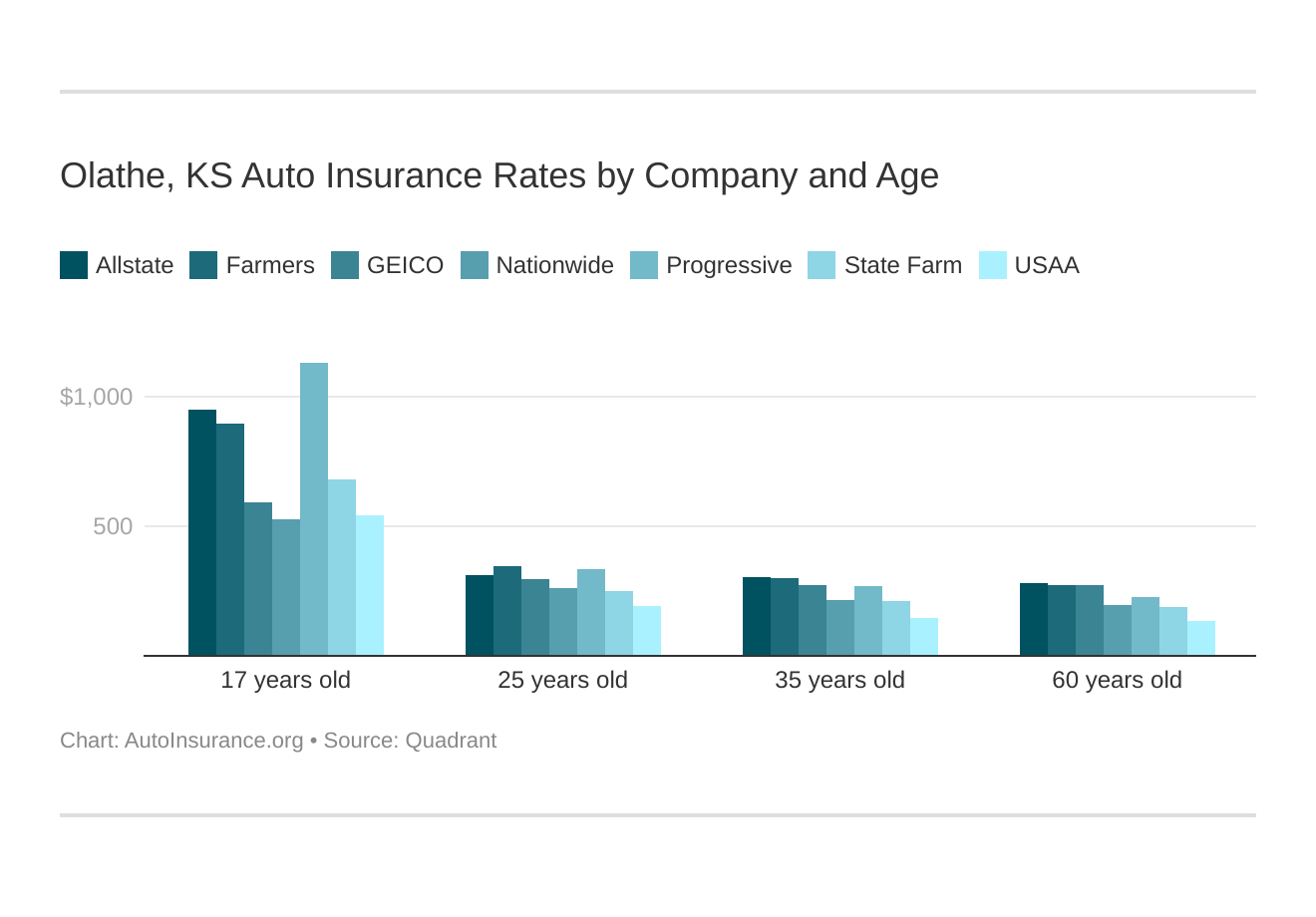

Olathe, Kansas auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group. Auto insurance for teens and young drivers is usually the most expensive.

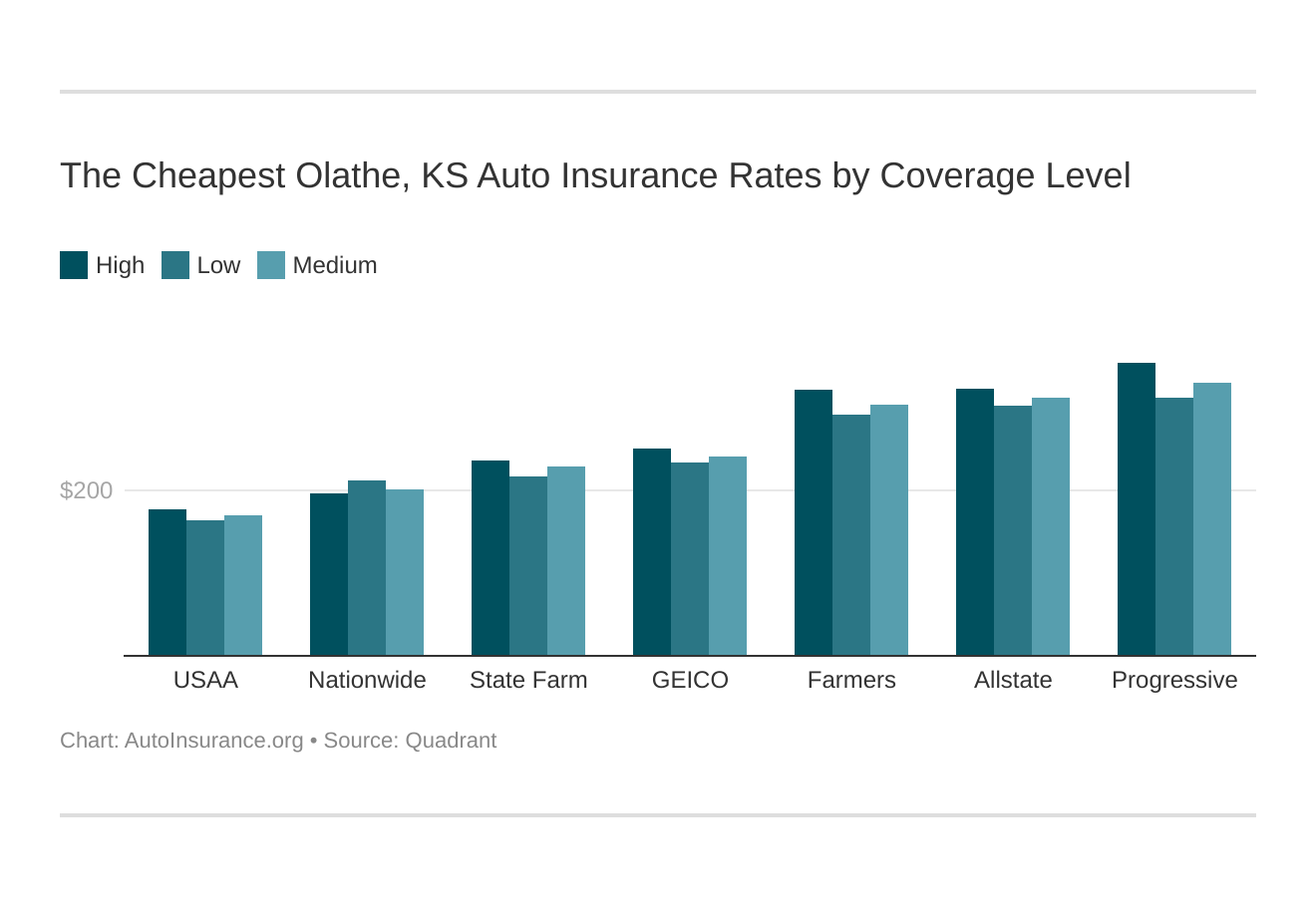

Your coverage level will play a significant role in your Olathe, KS auto insurance rates. The types of car insurance you choose will impact your rates. Find the cheapest Olathe, Kansas auto insurance rates by coverage level below:

Your credit score will play a significant role in your Olathe insurance rates since auto insurance companies use credit scores to determine rates. Find the cheapest Olathe, Kansas car insurance rates by credit score below.

Your driving record will affect your Olathe auto insurance rates. For example, a Olathe, Kansas DUI may increase your auto insurance rates 40 to 50 percent. Cheap auto insurance for drivers with a DUI is not easy to find. Find the cheapest Olathe, Kansas auto insurance rates by driving record.

Factors affecting auto insurance rates in Olathe, KS may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Olathe, Kansas auto insurance.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Olathe. Kansas does use gender, so check out the average monthly auto insurance rates by age and gender in Olathe, KS. Car insurance rates are more for males on average.

What are the auto insurance requirements in Kansas City, KS?

All Olathe drivers need the minimum requirements for Kansas auto insurance to operate a motor vehicle in the state. Here’s a list of what you should have:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $10,000 per incident for property damage

- $4,500 in personal injury protection (PIP) coverage (medical benefit)

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist coverage

Kansas is a no-fault state, which is why PIP coverage is required. It’s recommended that most drivers carry more than the state minimum to avoid out-of-pocket costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What other factors affect auto insurance rates in Olathe, KS?

Age correlates to the driving experience. Therefore, auto insurance rates are more expensive for teens and young adults. Meanwhile, older and married drivers pay significantly less.

You can lower your rates by driving less. According to City-Data, the average commute time in Olathe, KS is 20 minutes.

Did you know vehicle thefts in your area affect your comprehensive auto insurance rates? According to FBI statistics, 191 auto thefts were reported in 2019.

This could be considered a minimal risk for car insurance companies. Therefore, you may pay cheaper than average rates for comprehensive coverage.

Olathe, KS Auto Insurance: What’s the bottom line?

Olathe, KS auto insurance is cheaper than the national average, but only in specific ZIP codes and auto insurance providers. However, particular factors could increase your rates.

Before you buy Olathe, KS auto insurance, be sure you’ve checked rates with the best companies. Enter your ZIP code below to get fast, free auto insurance quotes.

Frequently Asked Questions

What is Olathe auto insurance?

Olathe auto insurance refers to the insurance coverage specifically designed for vehicles registered and driven in the city of Olathe, Kansas. It provides financial protection in case of accidents, damage to the vehicle, or injuries to individuals involved in a car accident while driving in Olathe.

What are the minimum auto insurance requirements in Olathe, KS?

The minimum auto insurance requirements in Olathe, KS are the same as the state of Kansas. Drivers are required to have liability coverage with limits of at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident. This is commonly referred to as 25/50/25 coverage.

Can I choose higher coverage limits than the minimum requirement in Olathe?

Yes, you can choose higher coverage limits for your auto insurance in Olathe, KS. While the minimum coverage meets the legal requirements, it may not provide sufficient protection in more serious accidents. It’s advisable to consider higher coverage limits to better safeguard your assets and financial well-being.

What other types of coverage are available in Olathe auto insurance?

In addition to liability coverage, you can also opt for other types of coverage such as collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP). These additional coverages can provide added protection for your vehicle and yourself in different situations

How can I find affordable auto insurance in Olathe, KS?

To find affordable auto insurance in Olathe, KS, it’s recommended to shop around and compare quotes from different insurance providers. Factors such as your driving record, location, age, and the type of vehicle you drive can impact the cost of insurance. Additionally, you can inquire about available discounts, such as safe driver discounts or multi-policy discounts, to potentially reduce your premiums.

Are there any specific considerations for auto insurance in Olathe?

Olathe is located in Johnson County, Kansas, which has a relatively high population density and traffic volume. It’s important to consider factors like traffic congestion, road conditions, and the prevalence of accidents when selecting your auto insurance coverage. Additionally, you may want to assess the need for comprehensive coverage to protect against incidents like theft or damage from severe weather.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.