Best Auto Insurance for Uber Eats Delivery Drivers in 2026 (Find the Top 10 Companies Here)

Progressive, USAA, and Geico have the best auto insurance for Uber Eats delivery drivers, with Progressive offering the lowest rate at $58 per month. These companies provide essential coverage options tailored for Uber Eats delivery drivers, ensuring compliance and protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated January 2025

Company Facts

Full Coverage for Uber Eats Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Uber Eats Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Uber Eats Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance for Uber Eats delivery drivers are Progressive, USAA, and Geico, known for their reliable coverage tailored to the unique needs of delivery drivers.

These providers offer comprehensive policies that protect both drivers and their vehicles, ensuring compliance with Uber Eats’ requirements. With options designed specifically for rideshare and delivery services, these insurers give peace of mind while on the road. Unlock details in our guide titled “Best Rideshare Auto Insurance.”

Our Top 10 Company Picks: Best Auto Insurance for Uber Eats Delivery Drivers

Company Rank UBI Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 9% A+ Loyalty Rewards Progressive

![]()

#2 8% A++ Military Benefits USAA

#3 10% A++ Cost Savings Geico

#4 7% A Loyalty Discounts American Family

#5 9% A+ Local Agents Allstate

#6 10% A+ Accident Forgiveness Nationwide

#7 8% A 24/7 Support Liberty Mutual

#8 11% B Teen Discounts State Farm

#9 7% A Safe-Driving Discounts Farmers

#10 8% A++ Safe Drivers Travelers

Whether you’re looking for liability coverage or more extensive protection, these top three companies provide the best solutions for Uber Eats drivers.

Instantly compare rideshare insurance options from the top providers near you by entering your ZIP code into our free quote tool above.

- Progressive offers the best auto insurance for Uber Eats delivery drivers

- Uber Eats drivers need coverage for liability and vehicle damage

- Rideshare insurance is essential for Uber Eats delivery drivers

#1 – Progressive: Top Overall Pick

Pros

- Loyalty Benefits: Progressive provides loyalty perks for Uber Eats delivery drivers, reducing their premiums over time and rewarding long-term customers. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

- Telematics-Based Discounts: Uber Eats delivery drivers can benefit from Progressive’s telematics programs, offering up to a 9% discount based on driving behavior.

- Flexible Coverage Options: Progressive allows Uber Eats delivery drivers to customize their insurance policies, catering to the specific needs of rideshare drivers, including options for comprehensive and collision coverage.

Cons

- Higher Initial Rates for New Drivers: New Uber Eats delivery drivers may face higher starting premiums with Progressive compared to more established drivers, making it potentially less affordable initially.

- Limited In-Person Support: Due to fewer physical offices, Uber Eats delivery drivers might have limited opportunities for face-to-face assistance and consultations with Progressive representatives.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: USAA offers specialized pricing and exclusive insurance options for military Uber Eats delivery drivers, providing significant savings for those who qualify. Check out insurance savings for military members and their families in our complete USAA auto insurance review.

- Comprehensive Rideshare Coverage: USAA offers robust rideshare insurance options specifically designed for Uber Eats delivery drivers, covering personal injury, liability, and property damage while on the job.

- Telematics-Based Savings Opportunities: Through USAA’s telematics program, Uber Eats delivery drivers can access an 8% discount by maintaining safe driving habits, promoting lower premiums.

Cons

- Restricted Eligibility: USAA’s insurance options are available only to military members, veterans, and their families, excluding non-military Uber Eats delivery drivers from these benefits.

- Lack of Physical Branches: Due to USAA’s primarily digital service model, Uber Eats delivery drivers may find it difficult to receive in-person support and may miss out on direct consultations.

#3 – Geico: Best for Cost Savings

Pros

- Telematics Discount Program: Uber Eats delivery drivers can take advantage of Geico’s telematics program, offering a 10% discount for safe driving habits, which helps to lower insurance costs. Learn more by reading our Geico auto insurance review.

- Extensive Online Management Tools: Geico provides a comprehensive online platform, allowing Uber Eats delivery drivers to easily manage their policies, file claims, and access customer service digitally.

- Multi-Policy Discounts Available: Uber Eats delivery drivers can save even more by bundling their auto insurance with other Geico policies, such as home or renters insurance, maximizing their overall savings.

Cons

- Limited Rideshare-Specific Options: While Geico offers general insurance policies, it may lack some of the specialized rideshare coverage options that are more tailored to the needs of Uber Eats delivery drivers.

- Reduced In-Person Assistance: With fewer local offices, Geico offers limited opportunities for Uber Eats delivery drivers to receive face-to-face service, relying more on digital and phone support.

#4 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Rewards Program: American Family offers substantial loyalty discounts for Uber Eats delivery drivers who stay with the company, rewarding long-term commitment with lower premiums.

- Flexible Policy Options: Uber Eats delivery drivers can customize their coverage, selecting from a range of options to suit their specific needs, including collision, comprehensive, and liability coverage.

- Telematics Savings: Uber Eats delivery drivers can benefit from a 7% discount through American Family’s telematics program, which rewards safe driving habits with lower rates. Find out more about American Family in our American Family auto insurance review.

Cons

- Limited Coverage Availability: American Family’s insurance offerings may not be available in all states, potentially restricting access for some Uber Eats delivery drivers.

- Higher Rates for Urban Drivers: Uber Eats delivery drivers operating in high-traffic urban areas may face higher premiums due to increased risk factors, such as accidents and theft.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Local Agents

Pros

- Accident Forgiveness: Allstate includes accident forgiveness in their policies, helping Uber Eats delivery drivers avoid premium increases after their first at-fault accident.

- Telematics Discount Program: Uber Eats delivery drivers can save up to 9% through Allstate’s telematics program, which rewards safe driving behavior with lower premiums. Find more information about Allstate’s rates in our review of Allstate auto insurance.

- Customizable Rideshare Coverage: Allstate allows Uber Eats delivery drivers to add specialized rideshare coverage to their policies, ensuring comprehensive protection while on the job.

Cons

- Discount Limitations: The availability and size of discounts can vary by state, potentially limiting savings opportunities for some Uber Eats delivery drivers.

- Complex Policy Options: Navigating Allstate’s range of coverage options may be challenging for some Uber Eats delivery drivers, requiring detailed consultation with an agent.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness Coverage: Nationwide offers accident forgiveness, protecting Uber Eats delivery drivers from premium increases after their first at-fault accident. You can learn more in our Nationwide auto insurance review.

- Usage-Based Discounts: Uber Eats delivery drivers can benefit from a 10% discount through Nationwide’s telematics program, encouraging safer driving habits and reducing insurance costs.

- Comprehensive Rideshare Insurance: Uber Eats delivery drivers can obtain extensive rideshare coverage through Nationwide, including liability, collision, and medical payments.

Cons

- Higher Base Rates: Nationwide’s base premiums can be higher, making it potentially more expensive for Uber Eats delivery drivers compared to other insurers.

- Discount Variability: Discounts and benefits offered by Nationwide may vary significantly by region, limiting their accessibility for some Uber Eats delivery drivers.

#7 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Customer Assistance: Liberty Mutual offers round-the-clock customer support, ensuring Uber Eats delivery drivers can get help at any time.

- Usage-Based Discount: Uber Eats delivery drivers can save up to 8% through Liberty Mutual’s telematics program, rewarding safe and responsible driving. To see monthly premiums and honest rankings, read our Liberty Mutual auto insurance review.

- Wide Range of Coverage Options: Liberty Mutual provides a variety of coverage choices, allowing Uber Eats delivery drivers to tailor their policies to their specific needs.

Cons

- Higher Premiums for High-Risk Drivers: Uber Eats delivery drivers with previous incidents or violations may face higher premiums with Liberty Mutual.

- Limited Local Agents: While Liberty Mutual offers extensive online support, in-person access to local agents may be limited for some Uber Eats delivery drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Best for Teen Discounts

Pros

- Teen Driver Discounts: State Farm offers significant discounts for Uber Eats delivery drivers who are younger or have teen drivers on their policy, helping reduce costs.

- High Telemetry Discount: Uber Eats delivery drivers can benefit from an 11% discount through State Farm’s telematics program, which rewards safe driving habits. See the reviews and rankings in our full State Farm auto insurance review.

- Established Industry Presence: As a long-standing player in the insurance market, State Farm offers stability and experience, giving Uber Eats delivery drivers confidence in their coverage choices.

Cons

- Lower Financial Rating: With a B rating from A.M. Best, State Farm’s financial stability may be a concern for some Uber Eats delivery drivers compared to higher-rated competitors.

- Limited Online Services: State Farm’s digital tools and online management options may be less comprehensive than those offered by other insurers, potentially affecting convenience for Uber Eats delivery drivers.

#9 – Farmers: Best for Safe-Driving Discounts

Pros

- Safe Driving Rewards: Farmers offers discounts for Uber Eats delivery drivers who maintain a clean driving record, helping lower insurance costs.

- Telematics-Based Savings: Uber Eats delivery drivers can save up to 7% through Farmers’ usage-based program, which incentivizes safe driving behavior.

- Customizable Rideshare Options: Farmers offers tailored rideshare insurance options for Uber Eats delivery drivers, covering both personal and professional driving needs. Find out more in our review of Farmers auto insurance.

Cons

- Limited Online Resources: While Farmers offers local support, their online tools may not be as comprehensive, potentially affecting convenience for Uber Eats delivery drivers.

- Inconsistent Discount Availability: Discounts and special offers from Farmers can vary by state, limiting savings opportunities for some Uber Eats delivery drivers.

#10 – Travelers: Best for Safe Drivers

Pros

- Safe Driver Discounts: Travelers provides discounts for Uber Eats delivery drivers who have a clean driving record, rewarding responsible driving habits.

- Telematics-Based Savings: Uber Eats delivery drivers can benefit from an 8% discount through Travelers’ telematics program, which encourages safe driving practices.

- 24/7 Customer Support: Travelers provides around-the-clock support, ensuring Uber Eats delivery drivers have access to assistance whenever needed. Read our full review of Travelers auto insurance for more information.

Cons

- Limited Local Agent Presence: Travelers may have fewer local agents, potentially limiting in-person support options for Uber Eats delivery drivers.

- Complex Policy Terms: Some Uber Eats delivery drivers may find Travelers’ policy options and terms complex, requiring detailed explanations and consultations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

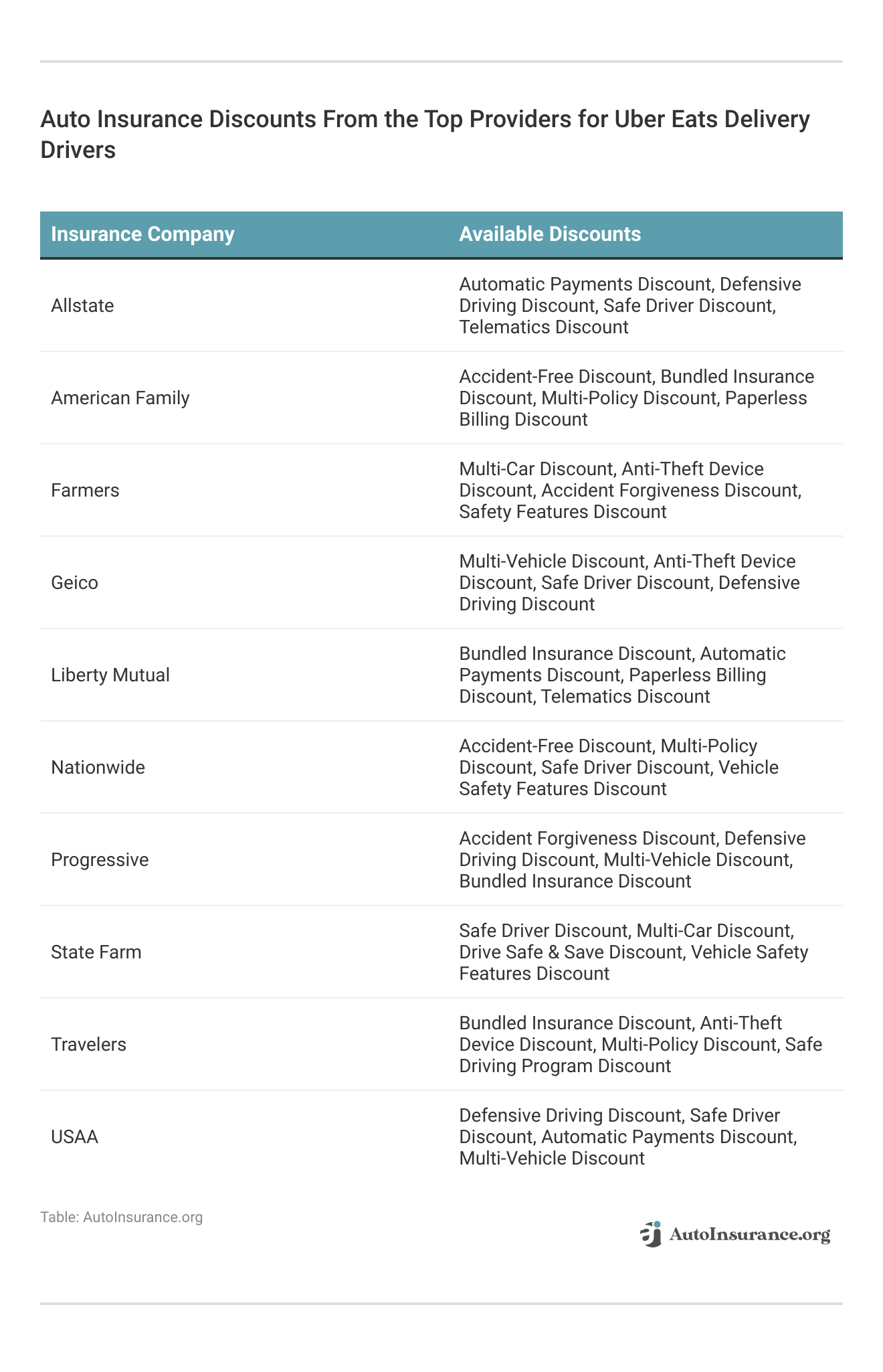

Monthly Insurance Costs for Uber Eats Delivery Vehicles

For Uber Eats delivery drivers, selecting the appropriate car insurance is essential to ensure compliance and safeguard their livelihood. Insurance costs for basic and comprehensive coverage can vary widely based on the insurer. Below, we provide a comprehensive overview of monthly rates for both coverage types from leading insurance companies, aiding Uber Eats delivery drivers in making well-informed choices.

Uber Eats delivery drivers have several insurance options, with monthly rates for basic coverage starting as low as $58 with Progressive, making it the most economical option. For those who require comprehensive coverage, Progressive also presents competitive rates at $133 per month.

Geico is a close contender, with pricing at $63 for basic coverage and $136 for comprehensive, striking a balance between cost-effectiveness and broad protection. USAA is a favorable choice for military personnel and their families, offering basic coverage at $62 and comprehensive coverage at $135.

Although insurers like Allstate, State Farm, and Travelers have higher premiums, ranging from $73 to $158 depending on the coverage level, they provide strong customer support and extensive coverage tailored to the needs of Uber Eats delivery drivers. Each of these insurance companies offers a distinct combination of rates and features, enabling drivers to pick a plan that aligns with their budget and coverage requirements.

Read More: What are the Uber car requirements?

Uber Eats Insurance Cost

Insurance costs for Uber Eats drivers vary, but Uber Eats provides liability coverage at no extra cost for third-party injuries and property damage during deliveries.

Uber Eats Delivery Driver Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $73 $146

American Family $69 $142

Farmers $72 $157

Geico $63 $136

Liberty Mutual $72 $152

Nationwide $67 $149

Progressive $58 $133

State Farm $76 $153

Travelers $75 $158

USAA $62 $135

However, to cover your own vehicle and medical expenses, you’ll need to purchase a separate rideshare insurance policy, which typically adds an extra fee to your existing auto insurance.

So if you’re wondering, “How much will my insurance go up if I drive for Uber Eats,” check out the table below to compare Uber food delivery insurance cost from the top providers:

Monthly Rideshare Auto Insurance Rates by Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $135 | $180 | |

| $130 | $175 |

| $140 | $185 | |

| $120 | $165 | |

| $125 | $170 |

| $145 | $190 | |

| $135 | $180 |

| $140 | $185 | |

| $130 | $175 | |

| $125 | $170 | |

| $120 | $160 |

As you can see, rideshare car insurance for Uber Eats drivers is cheap, so compare quotes from the best auto insurance companies to find the best deal for you.

However, do you need insurance to do Uber Eats? Keep reading to learn more about optional and required coverages for food delivery drivers.

Uber Eats Driver Insurance Requirements

So, do I need insurance for Uber Eats deliveries? Yes, to meet Uber Eats car insurance requirements, you must carry a personal auto insurance policy that includes your state’s minimum auto insurance requirements.

See how much car insurance your state requires here:

Auto Insurance Minimum Legal Requirements by State

| State | Minimum BI & PD Liability Limits | Required Insurance Policies |

|---|---|---|

| Alabama | 25/50/25 | BI + PD Liability |

| Alaska | 50/100/25 | BI + PD Liability |

| Arizona | 15/30/10 | BI + PD Liability |

| Arkansas | 25/50/25 | BI + PD Liability, PIP |

| California | 15/30/5 | BI + PD Liability |

| Colorado | 25/50/15 | BI + PD Liability |

| Connecticut | 25/50/20 | BI + PD Liability, UM, UIM |

| Delaware | 25/50/10 | BI + PD Liability, PIP |

| Florida | 10/20/10 | BI + PD Liability, PIP |

| Georgia | 25/50/25 | BI + PD Liability |

| Hawaii | 20/40/10 | BI + PD Liability, PIP |

| Idaho | 25/50/15 | BI + PD Liability |

| Illinois | 25/50/20 | BI + PD Liability, UM, UIM |

| Indiana | 25/50/25 | BI + PD Liability |

| Iowa | 20/40/15 | BI + PD Liability |

| Kansas | 25/50/25 | BI + PD Liability, PIP |

| Kentucky | 25/50/25 | BI + PD Liability, PIP, UM, UIM |

| Louisiana | 15/30/25 | BI + PD Liability |

| Maine | 50/100/25 | BI + PD Liability, UM, UIM, Medpay |

| Maryland | 30/60/15 | BI + PD Liability, PIP, UM, UIM |

| Massachusetts | 20/40/5 | BI + PD Liability, PIP |

| Michigan | 20/40/10 | BI + PD Liability, PIP |

| Minnesota | 30/60/10 | BI + PD Liability, PIP, UM, UIM |

| Mississippi | 25/50/25 | BI + PD Liability |

| Missouri | 25/50/25 | BI + PD Liability, UM |

| Montana | 25/50/20 | BI + PD Liability |

| Nebraska | 25/50/25 | BI + PD Liability, UM, UIM |

| Nevada | 25/50/20 | BI + PD Liability |

| New Hampshire | 25/50/25 | Financial Responsibility only |

| New Jersey | 15/30/5 | BI + PD Liability, PIP, UM, UIM |

| New Mexico | 25/50/10 | BI + PD Liability |

| New York | 25/50/10 | BI + PD Liability, PIP, UM, UIM |

| North Carolina | 30/60/25 | BI + PD Liability, UM, UIM |

| North Dakota | 25/50/25 | BI + PD Liability, PIP, UM, UIM |

| Ohio | 25/50/25 | BI + PD Liability |

| Oklahoma | 25/50/25 | BI + PD Liability |

| Oregon | 25/50/20 | BI + PD Liability, PIP, UM, UIM |

| Pennsylvania | 15/30/5 | BI + PD Liability, PIP |

| Rhode Island | 25/50/25 | BI + PD Liability |

| South Carolina | 25/50/25 | BI + PD Liability, UM, UIM |

| South Dakota | 25/50/25 | BI + PD Liability, UM, UIM |

| Tennessee | 25/50/15 | BI + PD Liability |

| Texas | 30/60/25 | BI + PD Liability, PIP |

| Utah | 25/65/15 | BI + PD Liability, PIP |

| Vermont | 25/50/10 | BI & PD Liab, UM, UIM |

| Virginia | 25/50/20 | BI + PD Liability, UM, UIM |

| Washington | 25/50/10 | BI + PD Liability |

| Washington D.C. | 25/50/10 | BI + PD Liability, UM |

| West Virginia | 25/50/25 | BI + PD Liability, UM, UIM |

| Wisconsin | 25/50/10 | BI + PD Liability, UM, Medpay |

| Wyoming | 25/50/20 | BI + PD Liability |

So, if you’re wondering, “Can you drive Uber Eats without insurance,” the answer is no. Uber will ask you to submit insurance documents to your account before allowing you to ride with the program, and you’ll need to submit new documentation when your policy renews.

Read More: How to Get Instant Proof of Your Auto Insurance Policy Online

You may also wonder, “Does Uber Eats have insurance?” Yes, Uber Eats accident insurance is included for all drivers, but you’ll still need a personal policy. In addition, Uber Eats’ website says it partners with certain rideshare insurance providers that automatically upload insurance documents to the Uber platform when your policy renews.

Keep reading to see what Uber Eats accident insurance is included for drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Insurance for Uber Eats Drivers

So, does Uber Eats cover insurance? Uber Eats maintains third-party liability auto insurance coverage for drivers while using the app. The coverage limits depend on whether you’re waiting for a delivery request or are actively working on an order.

Remember, Uber Eats insurance coverage only applies when the app is on and you are available as a driver.

Uber Eats delivery drivers need specific insurance coverage to protect themselves while on the job. Understanding the coverage options available ensures drivers are safeguarded against potential risks. When you’re waiting for a delivery, Uber Eats insurance offers these third-party liability limits:

- Bodily Injury Liability per Person/Accident: $50,000/$100,000

- Property Damage Liability per Accident: $25,000

When you’re actively driving to pick up a food order or transporting an order to a customer’s location, Uber Eats provides specific insurance coverage to protect you during these parts of the delivery process. This coverage includes the following:

- Third-Party Liability: $1,000,000

- Comprehensive and Collision Coverages

To access Uber Eats’ comprehensive and collision coverages, you are required to have a personal auto insurance policy that already includes these types of coverages. Without a personal policy that provides comprehensive and collision insurance, you will not be eligible for Uber Eats to extend these coverages to you during deliveries.

Progressive offers the lowest rate for Uber Eats delivery drivers at just $58 per month, making it the top choice for budget-conscious drivers.Michelle Robbins Licensed Insurance Agent

Uber Eats insurance coverage in California includes personal injury protection insurance, which can include medical expenses, survivor benefits, and disability payments in the event of an accident.

Do you need vehicle insurance for Uber Eats in New York? Unfortunately, Uber Eats insurance doesn’t apply to accidents in New York. So, if you need a New York auto insurance policy, ensure it covers any accidents while driving for the app.

Importance of Extra Coverage for Uber Eats Drivers

Do you need special insurance for Uber Eats? Uber Eats insurance provides liability coverage, which only covers injuries and damages to the other drive and vehicle. You’ll still need a personal policy to cover your car damage and injuries, though California drivers automatically receive injury coverage.

So, do I need to tell my insurance I drive for Uber Eats? Yes, you’ll want to inform your insurance company to ensure you’re adequately covered.

Check with your insurer to see if your personal auto insurance policy covers you while driving for Uber Eats.Brad Larson Licensed Insurance Agent

Many states or insurance companies will require you to purchase rideshare coverage or commercial auto insurance to cover these situations. The risk assessment is different when you drive a car for business use rather than for personal reasons. Even if you’re not required to purchase commercial insurance, extra protection for you and your vehicle may be a smart choice.

However, does driving for Uber Eats raise insurance premiums? If you choose to add rideshare insurance to your policy, you’ll likely see higher rates, but it’s worth the added protection.

Read More: How to Get an Uber Driver Auto Insurance Discount

Pros and Cons of Uber Eats Auto Insurance

The pros of having an Uber Eats auto insurance policy include coverage for third-party liability, protecting other drivers and their vehicles in case of an accident. Additionally, it provides peace of mind knowing that your rideshare activities are covered while you’re on the app.

- Ensures coverage during your delivery activities, providing peace of mind and protection against potential liabilities.

- Complies with Uber Eats’ insurance requirements, preventing potential issues with the platform.

However, Uber Eats car insurance coverage has significant limitations. The biggest drawbacks of Uber Eats insurance include these restrictions.

- Only provides liability coverage and does not pay for drivers’ injuries or property damages.

- Limited coverage from personal auto insurance may leave you exposed to potential financial risks if an accident occurs during delivery.

Dedicated commercial auto insurance, specialized rideshare insurance, and delivery driver auto insurance policies offer additional benefits specific to Uber Eats drivers, but monthly rates for commercial auto insurance or specialized rideshare insurance policies may be higher than personal auto insurance.

So, do you need car insurance for Uber Eats? Yes, you’ll need a personal policy to benefit from Uber Eats’ liability protections. Finding the right car insurance for Uber Eats and food delivery drivers can be time-consuming, as you may need to compare multiple providers and their offerings to ensure the best fit for your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comprehensive Insurance Options for Uber Eats Drivers

So, does Uber Eats insure their drivers? Uber Eats insurance protects other drivers and vehicles if you’re in an accident while delivering food through the app, thanks to its third-party liability coverage.

However, unless you have auto insurance in California, you won’t have coverage for your injuries while working for Uber Eats. So, check if your insurer requires commercial coverage so you’re protected while you drive.

To find the best vehicle insurance for Uber Eats drivers, enter your ZIP code into our free quote comparison tool below to instantly buy cheap rideshare insurance near you.

Frequently Asked Questions

Does Uber Eats cover accidents?

Food delivery drivers may be wondering, “Does Uber Eats offer car insurance?” While the company includes liability protection for drivers, you’ll still need to get a personal policy to cover yourself and your vehicle.

Why does Uber ask for auto insurance?

Auto insurance is required by law, and Uber will not employ someone who doesn’t meet the car insurance requirements in their state.

Of course, each state has different auto insurance laws, meaning coverage requirements differ. So, research your state’s requirements to know exactly what you need.

Why is getting separate Uber Eats vehicle insurance necessary?

You may wonder, “Do I need insurance to do Uber Eats?” If you’re delivering food for Uber Eats, you’ll need to have a personal insurance policy, and some companies may require you to get rideshare insurance.

Do you need insurance for Uber Eats?

Yes, Uber Eats drivers must carry their state’s minimum coverage requirements.

So, what insurance do I need for Uber Eats? The specific requirements may vary depending on your location, so it’s essential to review the requirements in your area and obtain the necessary coverage.

What type of insurance do I need for Uber Eats?

A top question delivery drivers ask is, “What kind of insurance do I need for Uber Eats?” You must carry a personal liability auto insurance policy to drive for Uber Eats.

While full coverage auto insurance isn’t required, we recommend carrying it to protect yourself and your vehicle.

Can I do Uber Eats without insurance?

So, can you do Uber Eats without insurance? No, for those wondering how to bypass Uber Eats insurance, the company requires a personal insurance policy.

Is Uber injury protection worth it?

Having Uber Eats auto insurance will provide injury protection to anyone you injure in an accident, which is worth it if you cannot afford to pay someone else’s medical bills.

Does Uber Eats raise your insurance rates?

Yes, Uber Eats drivers will generally see higher rates due to the increase risk associated with commercial activities.

Commercial auto insurance or specialized rideshare insurance policies are designed to account for this added risk. It’s best to compare rates to find the most suitable coverage for your needs.

Discover insights in our guide titled, “Is it possible to have a rideshare car rental?“

How much is Uber Eats insurance?

You won’t pay anything for the company’s included liability coverage, though you still need to secure personal rideshare coverage. You can get cheap Uber Eats insurance with the top companies, ranging from $2-$27 monthly.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Does Uber actually check your insurance?

Yes, Uber completes a background check on each driver that includes criminal history, driving history, and insurance history.

Can I do Uber Eats with someone else’s car?

How long does Uber take to verify auto insurance?

Can I Uber if I’m on my parents’ auto insurance?

How does Prop 22 work on Uber Eats auto insurance in California?

Does Uber Eats report your income?

What does Uber Eats insurance coverage in California include?

Does Uber Eats cover accidents for its drivers?

How can I find cheap Uber Eats insurance?

Does Uber Eats raise your insurance rates?

What does Uber Eats liability insurance cover?

What is the best insurance for Uber Eats drivers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.