Best Vancouver, Washington Auto Insurance in 2026 (Check Out the Top 10 Companies)

Geico, State Farm, and Progressive are among the reputable insurers offering the best Vancouver, Washington auto insurance, with rates starting at $59 per month. These companies cover local factors like Vancouver's rainy weather, which worsens road conditions and increases accident rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated August 2025

Company Facts

Full Coverage in Vancouver WA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Vancouver WA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Vancouver WA

A.M. Best Rating

Complaint Level

Pros & Cons

If you are in search for the best Vancouver, WA auto insurance then Geico, State Farm, and Progressive are great choices with starting price of $59 per month. These top insurers offer a basic form of insurance that is customizable to fit into the various factors that surround the drivers of Vancouver and give them the best insurance coverage.

The basic policies can be adjusted to the desired coverage limit and Vancouver-specific factors like weather, traffic, and accident frequency. For more information, read our article titled “What are the recommended auto insurance coverage levels?”

Our Top 10 Company Picks: Best Vancouver, Washington Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 24% A++ Extensive Discounts Geico

#2 20% B Local Agents State Farm

#3 17% A+ Competitive Rates Progressive

#4 15% A+ Comprehensive Coverage Allstate

#5 13% A Accident Forgiveness Liberty Mutual

#6 9% A++ Financial Standing Travelers

#7 13% A+ Vanishing Deductible Nationwide

#8 12% A+ Claims Service Amica

#9 11% A+ Customizable Policies Farmers

#10 19% A++ Military Personnel USAA

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Geico, State Farm, and Progressive have the best auto insurance in Vancouver, WA

- Insurers consider local weather and traffic conditions in Vancouver, WA

- It’s essential to compare Vancouver, WA against other top US metro areas

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates for Vancouver drivers: Geico offers one of the most affordable monthly premiums at $145 for Vancouver, Washington residents, making it an attractive option for budget-conscious drivers in the area.

- Extensive Online Tools: Vancouver motorists can benefit from Geico’s user-friendly website and mobile app, which allow for easy policy management and claims filing, catering to the tech-savvy population in this part of Washington.

- Variety of Discounts: Geico provides numerous discounts for Vancouver drivers, including safe driver, multi-policy, and vehicle safety feature discounts, helping residents maximize their savings on auto insurance. Discover more insights in our detailed Geico auto insurance review.

Cons

- Limited Local Agents: Vancouver residents might find it challenging to get personalized service, as Geico primarily operates online and has fewer local agents compared to some other insurers in the area.

- Potentially Higher Rates for High-Risk Drivers: While Geico offers competitive rates overall, Vancouver drivers with poor credit scores or multiple violations may face significantly higher premiums compared to other insurers in the city.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agents

Pros

- Strong Local Presence: State Farm has numerous agents in Vancouver, Washington, providing personalized service and local expertise to help residents navigate the specific insurance needs of the area.

- Competitive Rates: At $150 per month, State Farm offers Vancouver drivers affordable coverage that’s on par with other top insurers in the city, making it a solid choice for budget-conscious consumers.

- Accident Forgiveness Program: Vancouver motorists can benefit from State Farm’s accident forgiveness program, which can help prevent rate increases after a first-time accident in the area’s sometimes challenging driving conditions. For further information, visit our extensive State Farm auto insurance review.

Cons

- Limited Rideshare Coverage: Vancouver drivers who work for ride-sharing services may find State Farm’s options lacking compared to some competitors, potentially necessitating additional coverage.

- Fewer Online Tools: While State Farm has improved its digital offerings, Vancouver residents accustomed to comprehensive online services may find the company’s digital platform less robust than some competitors.

#3 – Progressive: Best for Competitive Rates

Pros

- Name Your Price tool: Vancouver drivers can use Progressive’s unique Name Your Price tool to find coverage that fits their budget, particularly useful in a city where insurance rates can vary significantly.

- Snapshot Program: Progressive’s usage-based insurance program can help safe Vancouver drivers save money by monitoring their driving habits, which is especially beneficial in the city’s varied traffic conditions.

- Pet Injury Coverage: For Vancouver pet owners, Progressive offers pet injury coverage as part of their collision insurance, providing added peace of mind for those who frequently travel with their animals. Explore additional details in our thorough Progressive auto insurance review.

Cons

- Higher Than Average Rates: At $155 per month, Progressive’s rates are slightly above average for Vancouver, which might deter some cost-conscious drivers in the area.

- Mixed Customer Service Reviews: Some Vancouver customers have reported inconsistent experiences with Progressive’s customer service, which could be a concern for those who prioritize reliable support.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Drivewise Program: Vancouver drivers can potentially earn discounts through Allstate’s Drivewise program, which rewards safe driving habits – a valuable feature in a city with varying road conditions.

- Extensive Agent Network: Allstate boasts a strong presence in Vancouver, Washington, with numerous local agents who can provide personalized service and insights into the area’s specific insurance needs.

- Claim Satisfaction Guarantee: Vancouver residents can feel secure with Allstate’s claim satisfaction guarantee, which promises a credit to your premium if you’re unsatisfied with your claim experience. Find out more by reading our complete Allstate auto insurance review.

Cons

- Higher Premiums: At $160 per month, Allstate’s rates are on the higher end for Vancouver, potentially making it less attractive for budget-conscious drivers in the area.

- Complex Policy Structure: Some Vancouver customers find Allstate’s policy structure and add-ons confusing, which could lead to unexpected costs or coverage gaps if not carefully reviewed.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- RightTrack Program: Vancouver drivers can save up to 30% with Liberty Mutual’s RightTrack program, which monitors driving habits and rewards safe behavior – particularly beneficial in the city’s diverse driving conditions.

- Teacher’s Auto Insurance: Liberty Mutual offers special rates and perks for Vancouver educators, recognizing the importance of this profession in the community.

- New Car Replacement Coverage: For Vancouver residents with new vehicles, Liberty Mutual’s new car replacement coverage can provide extra peace of mind in case of a total loss. Check out our full Liberty Mutual auto insurance review for more information.

Cons

- Higher Than Average Rates: At $165 per month, Liberty Mutual has the highest rates among the listed providers for Vancouver, which may be a deterrent for cost-conscious drivers.

- Mixed Customer Service Reviews: Some Vancouver customers have reported inconsistent experiences with Liberty Mutual’s claims process, which could be a concern for those prioritizing smooth claim handling.

#6 – Travelers: Best for Financial Standing

Pros

- IntelliDrive Program: Vancouver drivers can save up to 20% with Travelers’ IntelliDrive program, which monitors driving habits and rewards safe behavior – particularly useful in the city’s varied traffic conditions.

- Affinity Discounts: Travelers offers discounts to members of certain groups and organizations in Vancouver, potentially leading to significant savings for qualifying residents.

- New Car Replacement Coverage: For Vancouver residents with newer vehicles, Travelers offers new car replacement coverage, providing added protection in the event of a total loss. Learn more by exploring our in-depth Travelers auto insurance review.

Cons

- Limited Local Presence: Travelers has fewer local agents in Vancouver compared to some other insurers, which might make it challenging for residents who prefer in-person service.

- Complex Policy Structure: Some Vancouver customers find Travelers’ policy options and add-ons confusing, potentially leading to coverage gaps if not carefully reviewed.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- On Your Side Review: Vancouver drivers benefit from Nationwide’s annual On Your Side Review, which ensures their coverage stays up-to-date with their changing needs in the evolving city landscape.

- SmartRide Program: Nationwide’s usage-based insurance program can help safe Vancouver drivers save up to 40% on their premiums, rewarding good driving habits in the city’s diverse traffic conditions.

- Vanishing Deductible: Vancouver residents can reduce their deductible by $100 each year they maintain a clean driving record, up to $500, providing added incentive for safe driving in the area. Get the full scoop in our detailed Nationwide auto insurance review.

Cons

- Limited Local Presence: Nationwide has fewer local agents in Vancouver compared to some competitors, which might be a drawback for residents who prefer face-to-face interactions.

- Mixed Customer Service Reviews: Some Vancouver customers have reported inconsistent experiences with Nationwide’s claims process, which could be a concern for those prioritizing reliable support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Amica: Best for Claims Service

Pros

- Dividend Policies: Vancouver drivers can opt for dividend policies, potentially receiving up to 20% of their annual premium back as a dividend, offering unique savings opportunities.

- Platinum Choice Auto: This package offers Vancouver residents additional benefits like Advantage Points and accident forgiveness, providing comprehensive coverage for the area’s diverse driving needs.

- Free Lock Replacement: Amica offers free lock replacement if your keys are lost or stolen, a valuable perk for Vancouver drivers navigating the city’s bustling urban areas. For a comprehensive overview, see our Amica auto insurance review.

Cons

- Limited Online Tools: Vancouver residents accustomed to comprehensive digital services may find Amica’s online platform less robust compared to some competitors in the area.

- Potentially Higher Rates for High-Risk Drivers: While Amica offers competitive rates overall, Vancouver drivers with poor credit scores or multiple violations may face significantly higher premiums.

#9 – Farmers: Best for Customizable Policies

Pros

- Signal App: Vancouver drivers can save up to 15% with Farmers’ Signal app, which monitors driving habits and rewards safe behavior – particularly beneficial in the city’s varied traffic conditions.

- Rideshare Coverage: Farmers offers comprehensive rideshare coverage for Vancouver drivers working for services like Uber or Lyft, addressing a growing need in the city’s gig economy.

- Incident Forgiveness: Vancouver residents can benefit from Farmers’ incident forgiveness, which can prevent rate increases for certain types of claims, providing added financial security. Read our detailed Farmers auto insurance review for more insights.

Cons

- Higher Than Average Rates: At $157 per month, Farmers’ rates are slightly above average for Vancouver, which might deter some cost-conscious drivers in the area.

- Complex Policy Structure: Some Vancouver customers find Farmers’ policy options and add-ons confusing, potentially leading to coverage gaps if not carefully reviewed.

#10 – USAA: Best for Military Personnel

Pros:

- Lowest Rates in Vancouver: USAA offers the most competitive rates at $140 per month for Vancouver, Washington residents, making it an excellent choice for eligible military members and their families.

- SafePilot Program: Vancouver drivers can save up to 30% with USAA’s SafePilot program, which monitors driving habits and rewards safe behavior – particularly beneficial in the city’s diverse driving conditions.

- Military-Specific Benefits: USAA provides unique perks for Vancouver’s military community, such as flexible payment options during deployment and coverage for uniforms in the event of a car accident. Delve deeper with our complete USAA auto insurance review.

Cons:

- Limited Eligibility: USAA’s services are exclusively available to military members, veterans, and their immediate families, which excludes a significant portion of Vancouver’s population.

- Limited Local Presence: USAA operates primarily online and by phone, which might be a drawback for Vancouver residents who prefer in-person interactions with their insurance provider.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Vancouver, WA Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Vancouver, WA auto insurance rates by ZIP Code below:

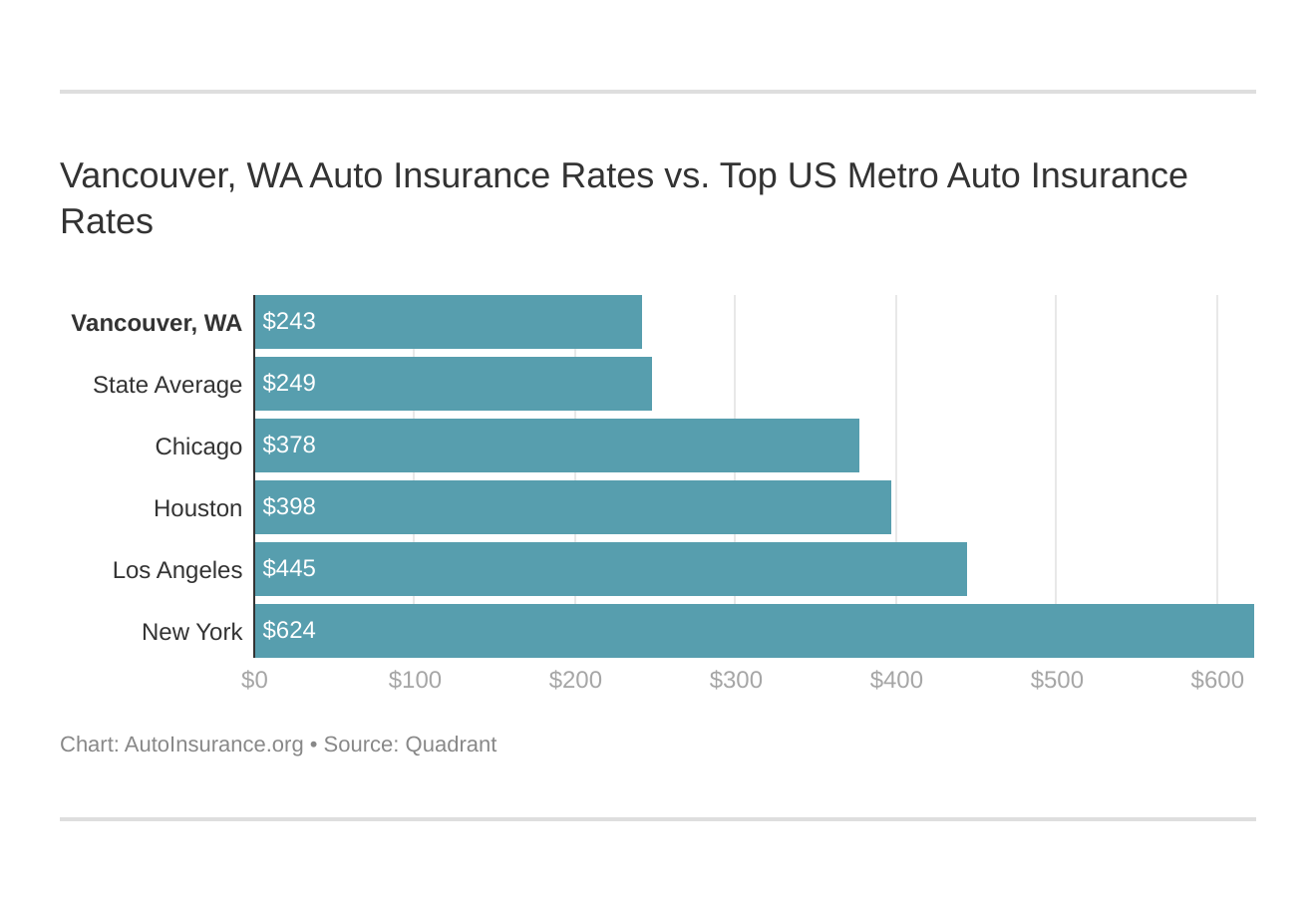

What city you reside in will impact your car insurance. That’s why it’s essential to compare Vancouver, WA against other top US metro areas’ auto insurance costs.

Are you ready to find affordable Vancouver, WA auto insurance right now? Enter your ZIP code above to get started.

Getting Cheapest Auto Insurance in Vancouver, Wa

Knowing the rates from different providers helps a person make an economical and comprehensive decision in Vancouver, Washington. In order to get cheap auto insurance in Vancouver, Washington, there are several companies the consumers can approach. See table below:

Vancouver, Washington Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $65 $160

Amica $61 $150

Farmers $66 $157

Geico $60 $145

Liberty Mutual $68 $165

Nationwide $62 $152

Progressive $64 $155

State Farm $62 $150

Travelers $63 $155

USAA $59 $140

USAA stands out with the most competitive rates, offering basic coverage for $59 per month and comprehensive coverage for $140. However, it’s important to note that USAA’s services are exclusive to military members, veterans, and their immediate families. For more information, check out our USAA auto insurance review.

The cheapest Vancouver, WA car insurance providers can be found below. You also might be wondering, “How do those Vancouver, WA rates compare against the average Washington car insurance company rates?” We uncover that too.

Vancouver, Washington car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group. Auto insurance for teens and young drivers is usually the most expensive.

Your credit score will play a major role in your Vancouver, WA car insurance costs since auto insurance companies use credit scores to determine rates. Find the cheapest Vancouver, WA car insurance costs by credit score below.

Your driving record will affect your Vancouver, WA car insurance costs. For example, a Vancouver, Washington DUI may increase your car insurance costs 40 to 50 percent. Cheap auto insurance for drivers with a DUI is not easy to find. Find the cheapest Vancouver, Washington car insurance costs by driving record.

Controlling these risk factors will ensure you have the cheapest Vancouver, Washington car insurance. Factors affecting car insurance rates in Vancouver, WA may include your commute, coverage level, tickets, DUIs, and credit.

Age is a significant factor for Vancouver, WA car insurance rates. Young drivers are often considered high-risk. This Vancouver, Washington does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Vancouver, WA. Car insurance rates are more for males on average.

There are a lot of factors that determine your car insurance rates. The cheapest company for you will depend on personal factors, including what part of the city you call home, your driving record, what kind of vehicle you drive, and the coverage level you choose.

Saving on Your Vancouver, WA Auto Insurance

Insurance companies in Vancouver, Washington providing auto insurance have various offers for discounts to their clients. Knowledge the available and possible discounts can therefore mean massive difference on the costs incurred on car insurance.

Each major auto insurer in Vancouver offers unique discount opportunities. Common discounts include safe driving, multi-policy, and early signing incentives. Military personnel, students, and homeowners may qualify for additional savings.

To maximize potential discounts, drivers should compare offers from multiple providers and inquire about all available savings options when getting quotes. Read our article titled “Can you have two auto insurance policies?” for more information.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Vancouver, WA Auto Insurance Requirements

All Vancouver, WA drivers have to meet the Washington state law minimum requirements for car insurance.

In Washington, you have to carry at least:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $10,000 per incident for property damage liability

Washington is an at-fault state. Therefore, you’ll need to use your auto insurance policy when you’re at fault in an accident.

Driving uninsured will subject you to a stiff fine and infraction against your license and registration.

Vancouver, WA Auto Insurance: The Bottom Line

Vancouver, WA auto insurance quotes may be higher than the Washington state average, but you can take advantage of companies’ car insurance discounts to lower your premium.

Drivers under 25 may have to pay double the average cost, so they should stay under a parent’s policy. Even your vehicle’s anti-theft and safety features can get a deal on auto insurance.

Overall, the best way to secure cheap car insurance in Vancouver, WA is through a clean driving record and good credit.

Before you buy auto insurance in Vancouver, WA, be sure you’ve checked rates from the top auto insurance companies near you. Use our free comparison tool below to get fast, free auto insurance quotes today.

Frequently Asked Questions

How often should I review my auto insurance policy in Vancouver, WA?

It’s recommended to review your auto insurance policy at least once a year in Vancouver, WA. This helps ensure that your coverage still meets your needs, particularly if you’ve had changes in your life such as moving, buying a new car, or experiencing significant changes in your driving habits.

What factors should I consider when choosing an auto insurance policy in Vancouver, WA?

When choosing an auto insurance policy in Vancouver, WA, consider factors such as coverage options, deductibles, premiums, the insurer’s reputation for customer service, claims process efficiency, and any available discounts that could reduce your overall cost.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Can I customize my auto insurance coverage in Vancouver, WA to better suit my needs?

Yes, most insurance companies in Vancouver, WA offer customizable auto insurance policies. You can choose from different types of coverage, set your deductible levels, and add optional coverages like roadside assistance or rental car reimbursement to tailor the policy to your specific needs and preferences.

Read More: What does proper auto insurance cover?

How are auto insurance premiums determined in Vancouver, WA?

Auto insurance premiums in Vancouver, WA are influenced by several factors, including a driver’s age, driving history, credit score, type of vehicle, coverage level, and location within the city.

Are there any discounts available for auto insurance in Vancouver, WA?

Yes, many insurance companies in Vancouver, WA offer discounts to reduce the cost of premiums. Common discounts include safe driver, multi-policy, good student, military, and low mileage discounts.

What is the average cost of auto insurance in Vancouver, WA?

The average cost of auto insurance in Vancouver, WA varies depending on the provider and coverage type. For basic liability coverage, rates start around $59 per month, while full coverage can cost significantly more depending on individual factors. For more information, read our article titled “What is the average auto insurance cost per month?”

How does weather impact auto insurance rates in Vancouver, WA?

Vancouver’s rainy weather can increase auto insurance rates due to higher risks of accidents caused by slippery roads and poor visibility. Insurance companies factor in local weather conditions when determining rates.

Can I get car insurance in Vancouver, WA with a DUI on my record?

Yes, you can get car insurance in Vancouver, WA even with a DUI on your record, but it may come with significantly higher premiums. Some companies specialize in providing coverage for high-risk drivers.

How can I find the cheapest auto insurance in Vancouver, WA?

To find the cheapest auto insurance in Vancouver, WA, it is recommended to compare quotes from multiple insurance providers, consider different coverage levels, and inquire about available discounts.

What should I do if I am involved in a car accident in Vancouver, WA?

If you are involved in a car accident in Vancouver, WA, you should first ensure everyone’s safety, contact the police, exchange information with the other driver(s), and notify your insurance company to start the claims process.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.