10 Auto Insurance Companies With the Best Customer Service in 2026

Amica Mutual, USAA, and State Farm are our top auto insurance companies with the best customer service. These companies have the best auto insurance reviews, highest customer satisfaction ratings, and quick claims. Amica Mutual also tends to be affordable, with minimum insurance policies costing $92 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2025

768 reviews

768 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe auto insurance companies with the best customer service are Amica Mutual, USAA, and State Farm because they have stellar customer satisfaction ratings and quick claims handling.

Amica Mutual earns the highest marks for customer service by focusing on personalized service. Drivers also enjoy Amica Mutual because it pays dividends to eligible policyholders when the company does well.

Our Top 10 Picks: Auto Insurance Companies With the Best Customer Service

| Company | Rank | NAIC Rating | BBB Rating | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 0.92 | A+ | Superb Service | Amica Mutual | |

| #2 | 2.77 | NR | Military Members | USAA | |

| #3 | 1.18 | A+ | Personalized Service | State Farm | |

| #4 | 1.23 | A+ | Affordable Rates | Geico | |

| #5 | 1.45 | A+ | Budgeting Tools | Progressive | |

| #6 | 2.7 | A+ | Full Coverage | Allstate | |

| #7 | 2.66 | A+ | Claims Service | Liberty Mutual |

| #8 | 0.58 | A+ | Customer Satisfaction | Erie Insurance |

| #9 | 0.65 | A+ | Deductible Savings | Nationwide |

| #10 | 0.11 | A+ | Responsive Claims | Travelers |

Read on to explore the best auto insurance companies with the highest customer satisfaction. Then, enter your ZIP code into our free comparison tool above to see how much insurance costs in your area.

- Several third-party companies offer customer service ratings for providers

- Customer service ratings give valuable information about claims processing

- Amica Mutual and USAA offer the best customer service

#1 – Amica Mutual: Top Overall Pick

Pros

- Personalized Customer Service: Amica Mutual offers personalized customer service to its policyholders through its extensive network of local agents.

- High Customer Satisfaction: The customer service representatives at Amica Mutual consistently earn high satisfaction ratings.

- Policyholder Dividends: As a mutual company, Amica Mutual pays eligible policyholders dividends when it does well. Learn more about dividend payouts in our Amica auto insurance review.

Cons

- Limited Availability: Amica Mutual is available in most states, but residents of Hawaii will need to find a different provider.

- Rates Aren’t the Cheapest: While Amica Mutual is one of the best insurance companies with the highest customer satisfaction, its rates are not the lowest.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Consistent Customer Service Ratings: USAA earns its spot as one of the auto insurance companies with consistently high customer service ratings.

- Specialized Military Coverage: As a company specializing in car insurance for military members, you’ll find special military programs and discounts.

- Low Rates: No matter what type of driver you are or where you live, USAA typically has the lowest rates. Learn how USAA keeps rates low in our USAA auto insurance review.

Cons

- Eligibility Requirements: Not all drivers qualify for the highest-rated car insurance from USAA. Only military members and their families are eligible for USAA membership.

- Limited Physical Locations: USAA has fewer physical offices compared with its competitors, which means it can be harder to get help from an agent.

#3 – State Farm: Best for Personalized Service

Pros

- Vast Network of Agents: If you’re looking for face-to-face help, State Farm has a huge network of agents spanning the country.

- Wide Range of Coverage Options: State Farm offers a lot more than the basic types of insurance. To learn more about your coverage options, read our State Farm auto insurance review.

- Strong Financial Responsibility: State Farm has an A++ rating from A.M. Best, which means you won’t have to worry about your claims being paid.

Cons

- Rates Can Be High: While some see affordable rates, drivers with bad credit scores will see much higher rates with State Farm.

- Limited Digital Tools: Since State Farm focuses on selling policies through agents, its digital tools aren’t as robust as its competitors.

#4 – Geico: Best for Affordable Coverage

Pros

- Efficient Customer Service: Geico’s customer service representatives are known for being efficient at handling issues.

- Affordable Coverage: For most drivers, Geico is one of the most affordable coverage options. See how much you might pay in our Geico auto insurance review.

- Convenient Digital Tools: Geico makes it easy to manage your policy and start claims online with its convenient digital tools.

Cons

- Limited Agents: With Geico’s focus on online policy management, it can be difficult to find a local agent for help.

- Slow Claims Reports: Some customers report that Geico takes a longer time than expected to resolve claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Drivers on a Budget

Pros

- Innovative Budgeting Tools: No matter how much you want to spend, Progressive has budgeting tools that can help. Learn more in our Progressive auto insurance review.

- Responsive Customer Service: When it comes to customer service responsiveness, Progressive has some of the best auto insurance reviews.

- Ample Discounts: Progressive has plenty of discounts to help lower your policy costs, including good student and safe driver savings.

Cons

- Low Customer Loyalty: Despite being one of the best-rated auto insurance companies, Progressive struggles to retain customers.

- Unexpected Rate Increases: Many Progressive customers report unexpected rate increases, even when nothing in their policy or driving record has changed.

#6 – Allstate: Best Full Coverage Service

Pros

- Strong Network of Agents: Allstate has a robust network of local agents ready to help with any policy questions you might have.

- Diverse Coverage Options: Allstate offers plenty of ways to customize your coverage, including rideshare insurance and rental car reimbursement coverage.

- Excellent Discount Opportunities: Allstate offers a variety of discounts to help keep your insurance costs down. See how you can save by reading our Allstate auto insurance review.

Cons

- Higher Rates: Generally speaking, Allstate is one of the most expensive options for car insurance.

- Mixed Customer Reviews: Allstate might have some of the best car insurance for customer service, but not all customers are happy. The company struggles with its claims resolution ratings.

#7 – Liberty Mutual: Best for Claims Service

Pros

- Excellent Customer Reviews: When it comes to insurance companies ranked by customer satisfaction, Liberty Mutual earns its spot with superb service.

- 24/7 Claims Support: One of the ways Liberty Mutual offers some of the best customer service car insurance is by offering 24/7 support.

- Customizable Policies: Customize your policy with Liberty Mutual’s extensive list of coverage options, which you can explore in our Liberty Mutual auto insurance review.

Cons

- Rates Can Be High: Although many drivers find affordable prices, others report much higher rates.

- Poor Claims Handling: Liberty Mutual offers car insurance with good customer service, but it doesn’t have the same reputation for its claims resolution process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie Insurance: Best for Customer Satisfaction

Pros

- Personalized Service: As a smaller provider, Erie keeps up with larger auto insurance companies with the highest customer satisfaction by focusing on personalized service for its customers.

- Competitive Rates: Erie Insurance often offers the cheapest insurance rates in the areas it sells policies in.

- Stellar Customer Service Ratings: When you’re looking for auto insurance with the best customer service, Erie is one of the best options. Erie customer service representatives have a stellar reputation.

Cons

- Limited Availability: Erie is only available in 12 states. To see if Erie sells coverage where you live, read our Erie auto insurance review.

- Fewer Discounts: Erie doesn’t have the longest list of discounts, especially compared to its competitors. However, Erie still offers low rates regardless of discounts.

#9 – Nationwide: Best for Deductible Savings

Pros

- Vanishing Deductible Program: You can have your deductible reduced by up to $500 for every year you spend without making a claim if you sign up for Nationwide’s Vanishing Deductible program.

- Many Discounts: Nationwide offers plenty of coverage options for drivers who want to customize their policies.

- SmartRide: Save up to 40% by signing up for Nationwide’s usage-based insurance program, SmartRide. To learn more about SmartRide, read our Nationwide auto insurance review.

Cons

- Expensive for Some: While Nationwide isn’t usually the cheapest auto insurance provider, it’s also not the most expensive. However, drivers with a DUI will likely find cheaper coverage elsewhere.

- Not Available Everywhere: Despite its name, Nationwide is only available in 49 states.

#10 – Travelers: Best for Responsive Claims Representatives

Pros

- Responsive Customer Representatives: Travelers has some of the best customer service car insurance by ensuring its representatives offer fast and efficient service.

- Quick Claims Processing: Another aspect of offering car insurance with the best customer service is handling claims quickly. Learn more about Travelers’ claims handling process in our review of Travelers auto insurance.

- Discount Availability: Travelers offers a selection of 15 discounts to help drivers save as much as possible.

Cons

- Coverage Varies by Region: While Travelers offers a variety of coverage options, some add-ons vary in availability. Speak with a representative to see what’s available where you live.

- Average Rates: While ranking auto insurance companies, drivers will notice that Travelers’ rates stay towards the middle.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Most Responsive Auto Insurance Companies

The best way to determine the most responsive auto insurance company is by looking at which companies respond best to consumer claims. According to the J.D. Power 2019 Auto Claims Satisfaction Study, the top three picks for the most responsive company and customer satisfaction are Geico, Progressive, and Allstate. These companies kept their customers satisfied with auto claims in 2019.

A.M. Best has a different outlook. Let’s examine this list to determine each company’s financial rating.

Top 10 Car Insurance Companies by Market Share

| Insurance Company | A.M. Best Rating | Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| A++ (Superior) | $41.9 billion | 17.01% | 63% | |

| A++ (Superior) | $33.1 billion | 13.41% | 71% | |

| A+ (Superior) | $27.1 billion | 10.97% | 62% | |

| A+ (Superior) | $22.7 billion | 9.19% | 56% | |

| A++ (Superior) | $14.5 billion | 5.87% | 77% | |

| A (Excellent) | $11.8 billion | 4.77% | 62% |

| A (Excellent) | $10.5 billion | 4.26% | 61% | |

| A+ (Superior) | $6.7 billion | 2.73% | 58% |

| A (Excellent) | $4.7 billion | 1.90% | 69% | |

| A++ (Superior) | $4.7 billion | 1.90% | 60% |

The financial rating reveals more than how well a company is doing. The A.M. Best grades show how companies meet obligations to customers – you’ll notice that the 10 best auto insurance companies for paying claims all have high A.M. Best ratings.

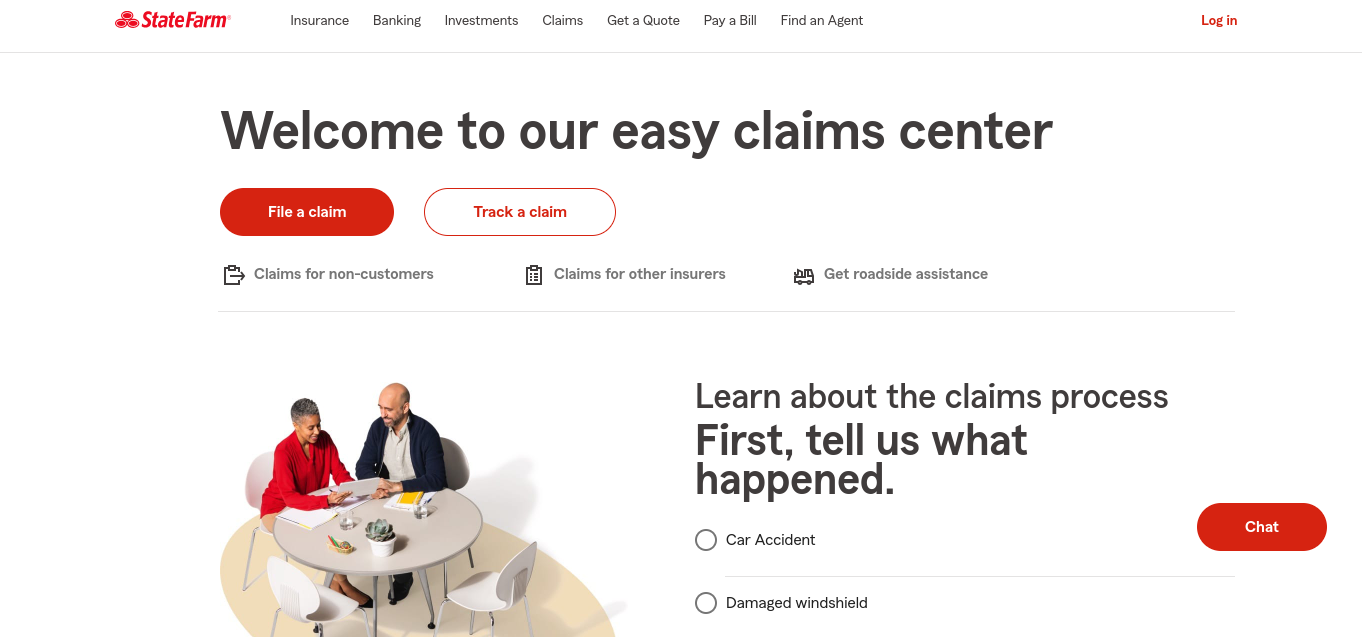

Another important consideration for claims service is how easy it is to start a claim. It doesn’t matter how responsive a company is if it’s too challenging to start a claim, after all. Consider State Farm’s easy claims center below to get an idea of what to look for.

So far, the top auto insurance companies have a stable outlook and superior ability to meet obligations to their customers.

Car Insurance Company Ratings

With so many auto insurance companies in the marketplace, the average consumer would find it unreasonable to spend time sorting through each company’s profile.

When figuring out how to switch auto insurance companies, customers can benefit from checking the different company rankings and customer satisfaction auto insurance ratings available online.

Several third-party ranking companies offer valuable insight into insurance providers, including A.M. Best, the NAIC, and the J.D. Power.

When assessing a company’s responsiveness to customer concerns, any number of areas can qualify as a customer concern. Some of the more common areas include:

- Coverage rates

- Coverage options

- Customer service

Fortunately, the rating and auto insurance company rankings show company results and assign individual ratings. The individual scores are used to rank each company in comparison with its competitors.

Some rating sources assign letter grades that indicate a company’s overall status. Letter designations may be listed as:

- A+ = Superior

- B = Fair

- C = Weak

- S = Suspension or Rating Suspended

While ranking sources may include other characteristics of a company besides responsiveness to customers, company scores provide an overall quality rating for each particular company.

Auto Insurance Customer Complaint Reports

Customer complaint reports are another area where customers can get information on how responsive a company is to the needs of its customers. Each state within the U.S. has laws regulating auto insurance practices and a State Department of Insurance. If you’ve ever had to figure out how to file a complaint against an insurance company, chances are the State Department of Insurance knows about it.

The State Department of Insurance monitors insurance practices within its state borders and keeps track of company performance ratings.

The State Departments of Insurance tracks customer satisfaction ratings for different companies. These reports also track the number of customer complaints each company receives within any given year. Also known as the customer complaint ratio, a company’s complaint score is listed as a ratio made of the number of complaints filed for every 1,000 claim filings.

Knowing a company’s complaint ratio can go a long way toward determining its customer responsiveness practices. State Departments of Insurance also keep track of company performance ratings that allow customers to make company comparisons when shopping for auto insurance coverage.

Another good place to look at how many complaints a company gets is the National Association of Insurance Commissioners (NAIC). The NAIC rates companies on the number of complaints they receive compared to their size - the smaller the rating, the better.Zach Fagiano Licensed Insurance Broker

Performance ratings are based on a company’s overall profile characteristics, such as:

- Financial stability

- Number of claims filed

- Subsidiaries and affiliated companies

- Number of customers

Performance ratings can provide customers with additional information regarding a company’s position and strength in the marketplace.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Insurance for Customer Service Based on Surveys

Survey-based rankings, generated by companies that specialize in tracking customer satisfaction ratings across different industries, provide another method for customers to find the best auto insurance companies in their areas. J. D. Power and Associates provide survey-based information on different auto insurers within the United States.

The criteria used to determine customer satisfaction include all of the areas that a particular company performs in, such as:

- Customer service

- Claims payments

- Claim filings

You can find surveys completed by customers who’ve had direct experience with different companies that can help you determine whether a company is personal.

J. D. Power and Associates focus on gathering information regarding customer satisfaction trends with different insurers.

Other Auto Insurance Company Considerations

A company’s responsiveness to its customers’ needs carries a lot of weight when comparing auto insurance company providers. Equally important is a company’s financial stability in terms of its ability to pay the claim filed.

When it comes time to pay on a claim, a non-responsive auto insurer can become a customer’s worst nightmare. Paying attention to rating information regarding a company’s financial status can help consumers avoid doing business with companies on the brink of financial ruin.

The company performance ratings kept up to date by the State Departments of Insurance list information on claim filings, affiliate companies, and the number of customers each auto insurer has.

A company that files an unusually large number of claims within a given period may run into financial problems down the line. Auto insurers with strong affiliate or subsidiary ties are more likely to have the financial resources needed to survive the high claims filing period.

The largest auto insurance companies in the U.S. are also better able to cover claims filings as large customer bases enable companies to spread or share their customers’ risk. Listed below are a few good places to look when considering if a company is the right choice:

- A.M. Best

- The Better Business Bureau

- J.D. Power

- The NAIC

- Moody’s

As a general rule, customers should regularly review auto insurance company ratings to ensure their company maintains good customer satisfaction ratings and a strong financial profile.

As the auto insurance marketplace can experience change regularly, checking company rankings every six months can help customers stay up-to-date on their insurance company’s performance in the marketplace.

The Responsive Auto Insurance Company

There’s a company called The Responsive Auto Insurance Company. Response Auto Insurance is a different company, but it’s a subsidiary of Unitrin. It’s an extension of Responsive Holdings LLC. It has auto insurance companies appointed in Florida and carries two stars on Google Reviews.

The Responsive Auto Insurance customer login is found on their website known as Sr.Responsive Auto. They’ll be able to access the Responsive Auto Insurance bill pay.

Customers can also reach Responsive Auto Insurance claims phone number by calling 1-866-300-0080.

It bears the name “responsive”, but is it really? Read this Responsive Auto Insurance review for more information.

If you want to check rates in your local area, use our FREE auto insurance quote tool to see the latest rates and find a truly responsive auto insurance company.

Frequently Asked Questions

Can I contact an auto insurance company directly to inquire about their responsiveness?

Yes, you can contact the company’s customer service department for information or to address any concerns.

How often should I review my auto insurance company’s ratings and performance?

Review ratings and performance at least once a year, and consider updates every six months. It’s also worthwhile to compare quotes to ensure you’re not overpaying. Enter your ZIP code into our free tool to see how much you might pay for coverage.

Can I switch auto insurance companies if I am unhappy with the responsiveness of my current insurer?

Yes, you can switch insurers if you’re unsatisfied. Learning how to evaluate auto insurance companies can help you find the perfect provider for your needs.

How does an insurance company’s financial stability affect its responsiveness?

Financial stability ensures the company can meet its obligations, including timely claim payments.

Are customer complaint reports reliable in evaluating an insurance company’s responsiveness?

Customer complaint reports provide insights but should be considered along with other factors. Learning how to get multiple auto insurance quotes can help you save money and find the right customer service.

How can I find customer satisfaction ratings for auto insurance companies?

Refer to reputable sources like J.D. Power, A.M. Best, and Consumer Reports for customer satisfaction ratings.

Which insurance company has the highest customer satisfaction ratings?

While many factors must be considered when judging customer satisfaction ratings, Amica Mutual is our top pick for customer service.

Which car insurance company has the most complaints?

The National Association of Insurance Commissioners (NAIC) rates companies based on the number of complaints they receive compared to the company’s size. According to the NAIC, United Automobile Insurance has the highest number of complaints in the U.S.

Which companies offer the best customer service in auto insurance?

Every driver will have a different experience, but Amica Mutual, USAA, and State Farm generally offer the best customer service.

Which company offers the best-rated car insurance for filing claims?

Amica Mutual is our top pick because it resolves claims quickly. Other companies that offer quick claims resolution include Erie Insurance, The Hartford, and State Farm. The companies make it easy to learn how to file an auto insurance claim and typically resolve claims quickly.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.