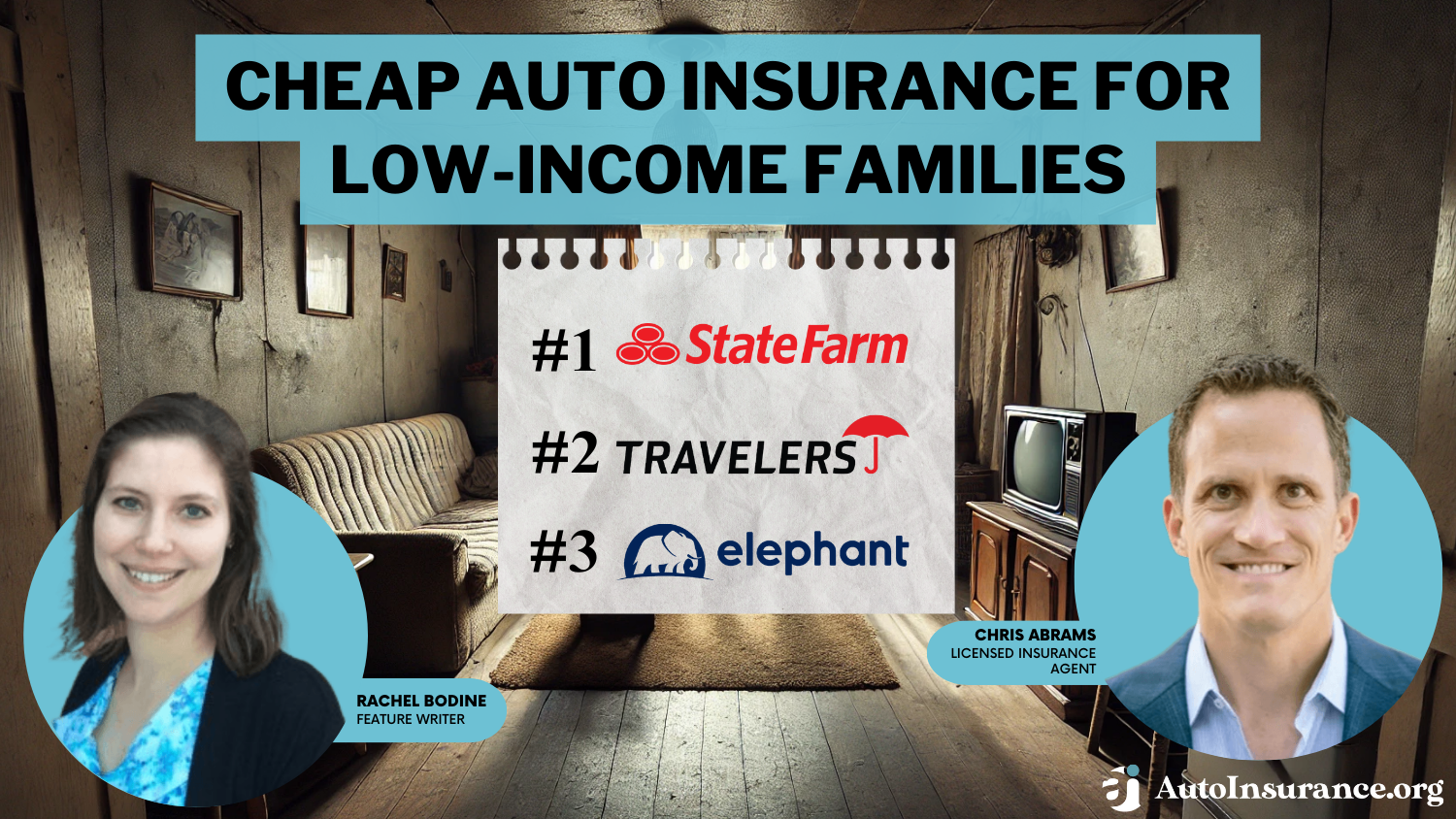

Cheap Auto Insurance for Low-Income Families in 2026 (Save With These 10 Companies!)

State Farm has lowest rates for cheap auto insurance for low-income families, as does Travelers and Elephant. State Farm's minimum auto insurance is only an average of $33 per month, and the other affordable companies on our list have similar rates in addition to multiple discounts for low-income families.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Avg. Monthly Rate for Low-Income Families

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Avg. Monthly Rate for Low-Income Families

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 190 reviews

190 reviewsCompany Facts

Avg. Monthly Rate for Low-Income Families

A.M. Best Rating

Complaint Level

Pros & Cons

190 reviews

190 reviewsState Farm is the top provider of cheap auto insurance for low-income families, followed by the companies Travelers and Elephant.

While some states have state-sponsored car insurance for low-income families, most low-income families will have to find cheap car insurance on their own.

Luckily, there are plenty of affordable companies to pick from.

Take a look at the cheapest auto insurance companies that provide low-cost auto insurance quotes below.

Our Top 10 Company Picks: Cheap Auto Insurance for Low-Income Families

| Company | Rank | Monthly Rates | Multi-Car Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $33 | Up to 25% | Cheap Rates | State Farm | |

| #2 | $36 | 8-10% | Accident Forgiveness | Travelers | |

| #3 | $37 | 8-12% | Online Convenience | Elephant | |

| #4 | $38 | Up to 10% | Budgeting Tools | Progressive | |

| #5 | $43 | Up to 30% | Pay-Per-Mile Savings | Metromile | |

| #6 | $45 | Up to 25% | Roadside Assistance | Nationwide |

| #7 | $49 | Up to 20% | Loyalty Discounts | American Family | |

| #8 | $53 | Up to 25% | 24/7 Support | Farmers | |

| #9 | $61 | Up to 10% | Usage-Based Discount | Allstate | |

| #10 | $67 | Up to 25% | Customizable Coverage | Liberty Mutual |

After you learn more about auto insurance for low-income families, enter your ZIP code in the free online quote tool to compare multiple companies near you.

- State Farm has the cheapest auto insurance for low-income families

- Travelers and Elephant also have affordable rates for low-income families

- Four states have state-sponsored auto insurance for families with low-income

#1 – State Farm: Top Pick Overall

Pros

- Affordable rates: State Farm has the most affordable car insurance for low-income families (read more: State Farm auto insurance review).

- Local agents: One of State Farm’s best features besides its rates is its wide spread of local agents, which allows families to easily get in-person assistance with their policies.

- Multiple discounts: There is a good selection of State Farm auto insurance discounts that can help families save on low-income car insurance.

Cons

- Customer reviews vary: Because State Farm is one of the largest auto insurance companies, there are naturally a few disgruntled customers who have negative reviews of State Farm’s claims handling and customer service. For the most part, however, reviews from customers are positive.

- Fewer add-on coverages: State Farm provides all the basic auto insurance coverages needed, but it lacks a few specialty coverages like modified car insurance or new car replacement insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Accident Forgiveness

Pros

- Accident forgiveness: If low-income families have clean driving records, Travelers offers accident forgiveness for the family’s first accident.

- Good customer service reviews: Travelers has decent customer service reviews. Read more about Traveler’s ratings in our Traveler’s auto insurance review.

- Multiple discounts: Travelers’ discounts, like its multi-policy discount, can help low-income families save.

Cons

- Few local agents: Travelers doesn’t offer many local agents, limiting interaction to phone or online conversations.

- Regional coverage limitations: Travelers’ add-on coverages, such as rideshare insurance, aren’t available in every state.

#3 – Elephant: Best for Online Convenience

Pros

- Easy-to-use app: Elephant’s app and website are user-friendly, so families can easily view and change their policies anytime.

- Multiple coverages: Elephant has some great add-on coverages, like roadside assistance or loan-lease payoff, that aren’t always offered at insurance companies.

- Accident forgiveness: Elephant offers accident forgiveness and diminishing deductibles to qualifying drivers.

Cons

- Limited local agents: Like most insurance companies, Elephant doesn’t have many local agents for in-person policy assistance.

- Limited availability: Elephant auto insurance is not available in every state. Read more about Elephant’s availability in our Elephant auto insurance review.

#4 – Progressive: Best for Budgeting Tools

Pros

- Name Your Price: Progressive has an online tool called Name Your Price that allows families to see how much coverage they can purchase on their set budget.

- Usage-based program: Progressive’s Snapshot program gives discounts to good drivers, which can help families save even more on their policy (read more: Progressive Snapshot Review).

- User-friendly app: Progressive’s app and website are easy to navigate, so families can easily manage their policies.

Cons

- Ratings for customer service vary: Progressive has mixed reviews regarding claims handling and customer service. Read more in our Progressive auto insurance review.

- Local agents limited: Progressive relies more on phone and online communication to talk to customers than in-person agents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Metromile: Best for Pay-Per-Mile Savings

Pros

- Pay-per-mile insurance: Metromile is unique in that it charges by the mile, which can result in significantly lower rates for families who drive fewer miles than the average. Learn more about Metromile’s unique pay-per-mile insurance in our Metromile auto insurance review.

- Multiple discounts: In addition to its already low rates, Metromile offers discounts to customers, such as multi-car discounts and paperless discounts.

- Basic and add-on coverages: Despite being a smaller company, Metromile still offers all the basics and add-on coverages like roadside assistance.

Cons

- Limited availability: Metromile is not available in every U.S. state.

- Higher rates for families that drive often: If families drive more than 10,000 miles per year, Metromile won’t be the cheapest option.

#6 – Nationwide: Best for Roadside Assistance

Pros

- Vanishing deductibles: Nationwide reduces deductibles for accident-free drivers, so families that stay accident-free can get more affordable insurance over time.

- Roadside assistance: Nationwide offers roadside assistance 24/7, whether families need a tow or a jump. Learn about Nationwide’s other coverages in our Nationwide auto insurance review.

- Multiple agents: Nationwide has a number of agents, making it easier for families to get personal assistance.

Cons

- Mixed claim reviews: Nationwide has some negative customer reviews about the company’s claims handling.

- Limited regional availability: Nationwide auto insurance is only in 47 states, so there are a few states where families won’t be able to get Nationwide as an insurer.

#7 – American Family: Best for Loyalty Discounts

Pros

- Loyalty discount: Families that stick with American Family can become eligible for a loyalty discount.

- Positive reviews: American Family has mostly positive customer reviews. Learn more in our American Family auto insurance review.

- Usage-based discount: American Family KnowYourDrive offers a discount to save drivers (Read more: American Family KnowYourDrive Review).

Cons

- Limited availability: American Family is not available in every state.

- High-risk drivers charged more: American Family may not be the cheapest company for families with one or more high-risk drivers in the family.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for 24/7 Support

Pros

- 24/7 customer service: Farmers offers assistance 24/7 on claims, roadside assistance, policies, and more.

- Multiple coverages: Farmers’ auto insurance coverages provide complete protection for families. Learn more about Farmers’ coverage options in our Farmers auto insurance review.

- Multiple discounts: Farmers’ auto insurance discounts, from good student discounts to multi-car discounts, can help families with a low income save on car insurance.

Cons

- Mixed ratings from customers: Farmers’ customers had some negative reviews regarding Farmers’ claims processing.

- Local agents limited: Farmers does have local agents, but not as many as companies like State Farm, limiting the areas where families can get in-person assistance.

#9 – Allstate: Best for Usage-Based Discount

Pros

- Usage-based discount: Allstate’s Drivewise program can help families with safe drivers save money (learn more: Allstate Drivewise review).

- Coverage options: Allstate boasts a great selection of coverages and add-ons, so families can pick and choose what they need.

- Discount options: In addition to Drivewise, Allstate has multi-car discounts, good student discounts, and many more. Learn more in our Allstate auto insurance review.

Cons

- Mixed claims handling reviews: Customer reviews about Allstate’s claims handling are mixed.

- Higher rates for high-risk drivers: Allstate is one of the more expensive companies for high-risk drivers, so it may not be the best choice for families with high-risk drivers.

#10 – Liberty Mutual: Best for Customizable Coverage

Pros

- Coverage options: Liberty Mutual has many coverages and add-ons, so families have plenty of options to customize their policies with as little or as much coverage as they need.

- Discount options: Liberty Mutual offers multiple discounts, with the biggest one being its RightTrack usage-based discount (read more about it in our Liberty Mutual RightTrack review).

- User-friendly: Liberty Mutual’s app and website are easy to navigate for policy management and claims filing (read more: Liberty Mutual App Review).

Cons

- Higher rates for high-risk drivers: Liberty Mutual may not be the cheapest company for families with one or more high-risk drivers.

- Varying customer reviews: Liberty Mutual has some negative claims handling reviews from customers. Learn more in our Liberty Mutual auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Auto Insurance Companies for Low-Income Families

Technically, you can locate affordable car insurance for low-income drivers anywhere in the United States. However, various factors determine whether cheap family auto insurance is available to you.

One of those factors includes what company provides you with car insurance coverage. If you get insurance from one of the companies below, you are more likely to get affordable rates for your family.

Full coverage will cost more, but it will provide more protection for your family. You can get a quick quote from companies like State Farm to determine how much full coverage will cost for your family.

States With Most Affordable Auto Insurance for Low-Income Families

Where you live plays a significant role in car insurance for low-income single mothers, seniors, and other drivers who have a limited income. (Read More: Cheap Auto Insurance for Drivers Over 70)

But you can save hundreds of dollars per year if you buy liability-only auto insurance coverage.

However, you could pay more or less depending on the state where you live. Let’s compare the monthly car insurance rates by state.

Liability Auto Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $37 |

| Alaska | $47 |

| Arizona | $48 |

| Arkansas | $36 |

| California | $45 |

| Colorado | $49 |

| Connecticut | $59 |

| Delaware | $69 |

| Florida | $76 |

| Georgia | $55 |

| Hawaii | $39 |

| Idaho | $32 |

| Illinois | $40 |

| Indiana | $34 |

| Iowa | $27 |

| Kansas | $32 |

| Kentucky | $47 |

| Louisiana | $73 |

| Maine | $30 |

| Maryland | $55 |

| Massachusetts | $52 |

| Michigan | $72 |

| Minnesota | $39 |

| Mississippi | $41 |

| Missouri | $38 |

| Montana | $34 |

| Nebraska | $33 |

| Nevada | $64 |

| New Hampshire | $35 |

| New Jersey | $76 |

| New Mexico | $44 |

| New York | $71 |

| North Carolina | $31 |

| North Dakota | $25 |

| Ohio | $35 |

| Oklahoma | $40 |

| Oregon | $53 |

| Pennsylvania | $43 |

| Rhode Island | $68 |

| South Carolina | $50 |

| South Dakota | $26 |

| Tennessee | $37 |

| Texas | $49 |

| U.S. Average | $48 |

| Utah | $45 |

| Vermont | $30 |

| Virginia | $38 |

| Washington | $53 |

| Washington D.C. | $58 |

| West Virginia | $43 |

| Wisconsin | $33 |

| Wyoming | $29 |

North Dakota, South Dakota, and Iowa are the cheapest states for liability car insurance. Meanwhile, Florida, New Jersey, and Louisiana are the most expensive states.

States With Government Auto Insurance for Low-Income Families

Four states have government auto insurance for low income drivers: California, Hawaii, Maryland, and New Jersey.

CLCA

California’s government auto insurance assistance is called CLCA, or California’s Low-Cost Auto Insurance Program. Monthly rates for California low cost auto insurance are based on your county.

However, there’s a limit to how much you can earn per year if you want to qualify for California’s low-income car insurance coverage.

For example, a household of one must earn $30,350 or less to be eligible for California’s auto insurance coverage. The more people in your home, the higher the income limit.

AABD

Hawaii provides state-sponsored car insurance assistance through the Assistance to the Aged, Blind, and Disabled (AABD) program.

The AABD covers the cost of necessities such as food, clothing, shelter, and even auto insurance for people who qualify for government benefits.

SAIP

New Jersey’s state-sponsored car insurance coverage is called Special Automobile Insurance Policy (SAIP).

SAIP insurance targets medical coverage, but it may not provide coverage if a New Jersey resident has Medicaid.

Drivers in New Jersey can establish SAIP coverage through companies that have Personal Automobile Insurance Plans (PAIP).

Maryland Automobile Insurance Fund

The Maryland Automobile Insurance Fund (formerly known as MAIF) was established in 1972. It’s designed to provide coverage for drivers who can’t buy auto insurance at insurance companies.

Also, the Maryland Automobile Insurance Fund provides coverage for people who have canceled their car insurance policy and drivers who’ve been denied coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Produce Affordable Auto Insurance for Low-Income Families

Getting low-cost auto insurance quotes depends on several factors, such as your driving record, vehicle, and age.

Low-income auto insurance is possible if your personal factors line up with a low risk of filing claims.Daniel Walker Licensed Auto Insurance Agent

Here’s a list of characteristics that correlate to cheap low-income auto insurance:

- You’re older than 24

- You carry the minimum auto insurance requirement (liability coverage)

- Driving less during the policy

- Good credit

- A clean driving record

- High deductible

- Older vehicle make and model year

These factors not only correlate to affordable car insurance for low-income families, but they also qualify you for discounts.

Best Auto Insurance Discounts for Low-Income Drivers

Auto insurance discounts save hundreds of dollars for drivers with a limited income. Let’s look at the top auto insurance deals for low-income drivers:

Low-Income Families Auto Insurance Discounts

| Insurance Company | Defensive Driving Discount | Good Student Discount | Multi-Car Discount | Multi-Policy Discount | Safe Driver Discount |

|---|---|---|---|---|---|

| Allstate | 10% | 20% | 10% | 25% | 25% |

| American Family | 5% | 15% | 20% | 25% | 30% |

| Elephant | 5% | 10% | 10% | 15% | 20% |

| Farmers | 5% | 10% | 25% | 15% | 30% |

| Liberty Mutual | 5% | 15% | 25% | 20% | 30% |

| Metromile | 5% | 10% | 15% | 10% | 25% |

| Nationwide | 5% | 15% | 20% | 20% | 25% |

| Progressive | 5% | 10% | 10% | 12% | 30% |

| State Farm | 5% | 25% | 25% | 17% | 30% |

| Travelers | 10% | 8% | 8% | 13% | 23% |

Usage-based car insurance provides a discount based on your driving habits. However, discount values vary for each company. If you’re a student, try to pick up as many student bargains from auto insurance companies.

Auto Insurance For Low-Income Families: The Bottom Line

The best thing for your car insurance budget is selecting affordable coverage. However, cheap auto insurance for low-income families depends on where you live and what company has your auto insurance policy.

Other factors that determine family car insurance can generate discounts. Qualifying for multiple auto insurance deals can help budget while you’re insured.

Now that you know how to buy auto insurance for low-income families, use our free online quote tool to compare multiple insurance companies in your area.

Frequently Asked Questions

Can low-income families afford auto insurance?

Affordability can be a concern for low-income families, but there are options available to help make auto insurance more accessible.

What are the pros of auto insurance for low-income families?

- Financial protection: Auto insurance provides coverage for accidents, repairs, and theft, reducing the financial burden on low-income families.

- Legal compliance: Owning auto insurance ensures compliance with state or country laws, avoiding potential fines or legal issues.

- Peace of mind: Having insurance coverage offers peace of mind, knowing that any unforeseen accidents or damages will be taken care of.

What are the cons of auto insurance for low-income families?

- Cost: The cost of auto insurance premiums can be a burden for low-income families, especially if their budget is already stretched thin.

- Limited coverage options: Some low-cost insurance options may provide limited coverage, which could leave families vulnerable in certain situations.

- Difficulty finding affordable options: Finding affordable auto insurance tailored for low-income families can be challenging, as many insurance providers may have higher premiums.

Are there any options for low-income families to find affordable auto insurance?

Yes, there are several options available:

- State assistance programs: Some states offer auto insurance assistance programs specifically for low-income individuals and families.

- Low-cost auto insurance providers: Some insurance companies specialize in providing coverage options for low-income families at reduced rates.

- Discounts and flexible payment plans: Many insurance providers offer discounts or flexible payment plans to help reduce the financial burden for low-income families.

How can low-income families save on auto insurance?

- Shop around: Compare quotes from multiple insurance providers to find the most affordable option.

- Choose a higher deductible: Opting for a higher deductible can lower monthly premiums, but it means paying more out of pocket in case of an accident.

- Take advantage of discounts: Inquire about available discounts such as multi-policy, good driver, or low mileage discounts.

- Maintain a clean driving record: A good driving record can help lower insurance premiums over time.

- Consider usage-based insurance: Some insurance providers offer usage-based insurance programs where premiums are based on actual driving habits, potentially reducing costs for safe drivers.

Do seniors have cheaper auto insurance rates?

The answer is yes — affordable low-income auto insurance for seniors is more likely than any other age group in the United States.

Seniors are low-risk drivers. In other words, people who are 60 and older are less likely to file a car insurance claim. On average, seniors pay $50-$120 less than younger drivers.

Why should I avoid letting my auto insurance policy lapse?

A lapse in coverage means you’ve lost your car insurance at some point. Gaps in auto insurance coverage appear on your insurance record, and it increases your risk.

An increase in overall risk means more expensive auto insurance rates in the future.

Even if you went to get auto insurance quotes from different companies, your lapse in coverage drives up your rates. It’s more profitable to decrease your coverage than to have a coverage gap.

Who has the absolute cheapest auto insurance?

State Farm has the cheapest auto insurance rates for low-income families.

What is the cheapest form of auto insurance?

The cheapest form of auto insurance for low-income families is minimum coverage.

How can you lower family car insurance?

Families can find cheap, reliable auto insurance companies with cheaper rates by shopping around. Families can also lower rates by applying for discounts and keeping clean driving records.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.