Best Windshield Replacement Coverage in Kansas (Top 10 Companies in 2026)

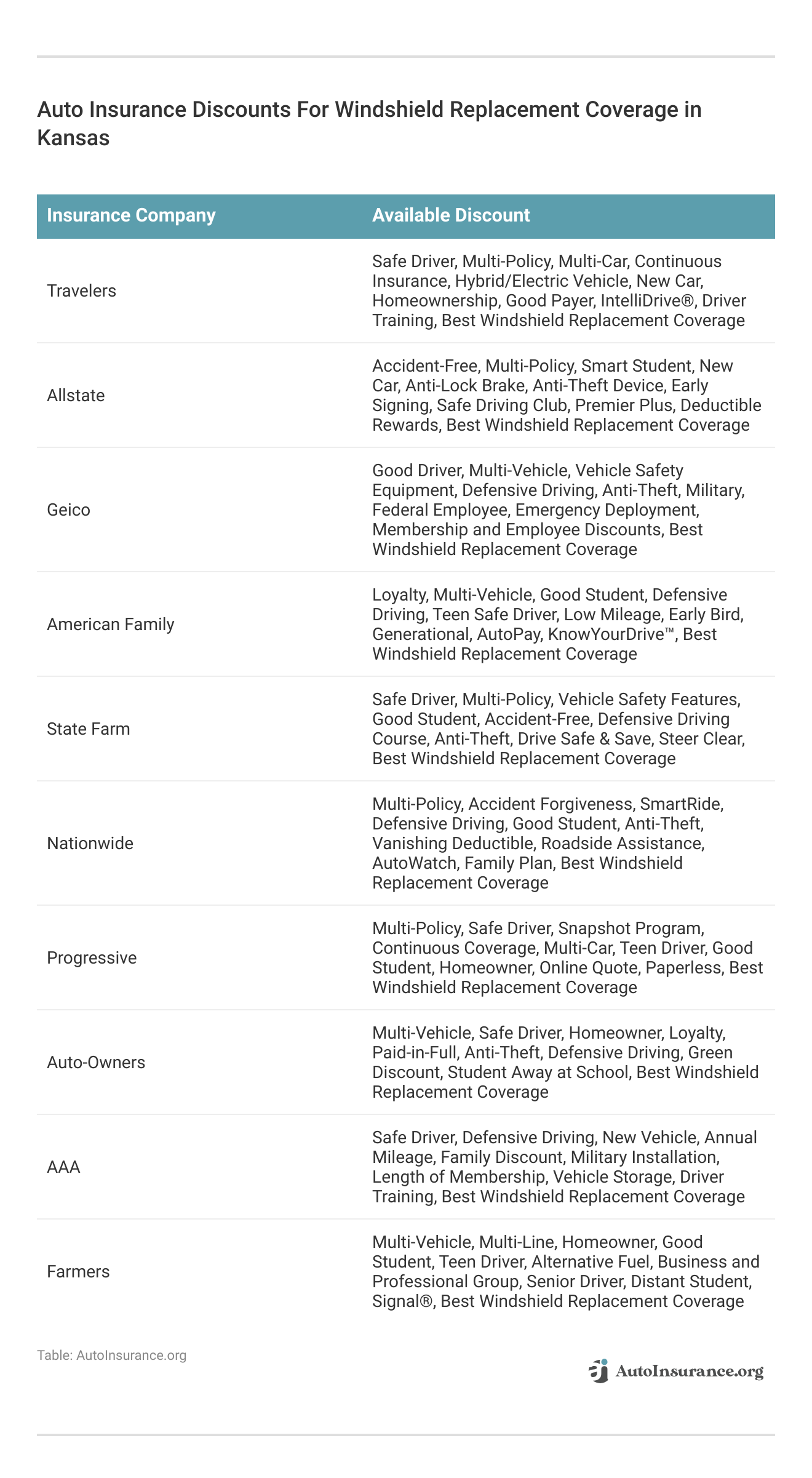

Travelers, Allstate, and Geico provide the best windshield replacement coverage in Kansas, beginning at only $100 per month. Our goal is to aid in comparing quotes from these reputable insurers, enabling you to obtain the perfect coverage and benefit from tailored discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated February 2026

Company Facts

Full Coverage Windshield Replacement in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

- Travelers provides competitive rates starting at $100 per month

- Top insurance companies offer options for windshield replacement

- Multiple discounts are available for replacement coverage

#1 – Travelers: Top Overall Pick

Pros

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, including windshield replacement coverage, ensuring customers can tailor their policies to suit their needs.

- Strong Financial Stability: With high ratings from financial rating agencies like A.M. Best, Travelers provides peace of mind to policyholders regarding the company’s financial strength and ability to fulfill claims.

- Excellent Customer Service: Our Travelers auto insurance review reveals that Travelers is known for its responsive customer service, making it easy for policyholders to get assistance and resolve any issues quickly.

Cons

- Higher Premiums: While Travelers offers comprehensive coverage, its premiums may be slightly higher compared to some other insurers, which could be a drawback for budget-conscious customers.

- Limited Availability: Travelers may not be available in all states, limiting access to its services for customers residing in certain regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program offers potential savings for safe drivers by tracking their driving habits and rewarding them with discounts based on their safe driving behavior.

- User-Friendly Mobile App: Allstate’s mobile app provides convenient access to policy information, claims filing, and roadside assistance, enhancing the overall customer experience.

- Nationwide Availability: Allstate operates nationwide, ensuring accessibility to its insurance products and services for customers across the country.

Cons

- Limited Discounts: While Allstate offers various discounts, some customers may find that it provides fewer discount opportunities compared to other insurers, potentially resulting in higher premiums.

- Mixed Customer Service Reviews: While Allstate has made efforts to improve its customer service, some policyholders have reported dissatisfaction with the responsiveness and handling of claims.

#3 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico is known for offering competitive rates, making it an attractive option for budget-conscious customers seeking affordable auto insurance coverage.

- Online Convenience: Geico provides a user-friendly online platform for policy management, claims filing, and obtaining quotes, offering convenience and accessibility to its customers.

- Extensive Coverage Options: Geico offers a wide range of coverage options, including windshield replacement coverage, allowing customers to customize their policies to meet their specific needs.

Cons

- Limited Agent Support: Geico primarily operates online and over the phone, which may be a disadvantage for customers who prefer in-person interactions with insurance agents. Read more through our Geico auto insurance review.

- Average Customer Service: While Geico offers competitive rates and convenient online services, some customers have reported average satisfaction with its customer service, citing issues with responsiveness and claims processing.

#4 – American Family: Best for Discount Availability

Pros

- Discount Availability: American Family offers a variety of discounts, allowing policyholders to potentially save money on their premiums. Read more through our American Family auto insurance review.

- Flexible Coverage Options: American Family provides flexible coverage options, allowing customers to customize their policies to meet their specific needs.

- Strong Community Involvement: American Family is known for its commitment to supporting local communities through various initiatives and sponsorships.

Cons

- Limited Availability: American Family may have limited availability in certain regions, which could restrict access to its services for some customers.

- Mixed Customer Service Reviews: While American Family strives to provide excellent customer service, some policyholders have reported dissatisfaction with responsiveness and claims handling.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Business Owners

Pros

- Business Owner Benefits: State Farm offers specialized coverage options for business owners, providing comprehensive protection for their commercial vehicles.

- Excellent Claims Handling: State Farm is known for its efficient claims handling process, ensuring prompt resolution and payment for covered claims.

- Strong Agent Network: State Farm has a vast network of agents nationwide, offering personalized assistance and guidance to policyholders.

Cons

- Potentially Higher Premiums: State Farm’s premiums may be higher compared to some other insurers, particularly for certain coverage options. Find out more in our State Farm auto insurance review.

- Limited Online Tools: While State Farm has made efforts to improve its online services, some customers may find its online tools and resources lacking compared to other insurers.

#6 – Nationwide: Best for Simple Claims

Pros

- Simple Claims Process: Nationwide offers a straightforward claims process, making it easy for policyholders to report and resolve claims efficiently. Read more through our Nationwide auto insurance review.

- Combining Discounts: Nationwide allows customers to combine multiple discounts, potentially leading to significant savings on their premiums.

- Extensive Network of Agents: Nationwide has a large network of agents across the country, providing personalized assistance and support to policyholders.

Cons

- Average Customer Service: While Nationwide offers a simple claims process, some policyholders have reported average satisfaction with its overall customer service.

- Limited Coverage Options: Nationwide’s coverage options may be more limited compared to some other insurers, which could be a drawback for customers seeking specialized coverage.

#7 – Progressive: Best for Combining Discounts

Pros

- Combining Discounts: In our Progressive auto insurance review, Progressive offers the option to combine multiple discounts, allowing policyholders to maximize their savings on premiums.

- Convenient Online Tools: Progressive provides a range of online tools and resources, making it easy for customers to manage their policies and obtain quotes.

- Strong Financial Stability: Progressive has a strong financial standing, providing reassurance to policyholders regarding the company’s ability to fulfill claims.

Cons

- Potentially Complex Claims Process: Progressive’s claims process may be more complex compared to some other insurers, which could result in delays or confusion for policyholders.

- Limited Agent Support: While Progressive offers online tools for policy management, some customers may prefer more personalized assistance from insurance agents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Add-Ons

Pros

- Add-On Options: Auto-Owners offers a variety of add-on options, allowing customers to enhance their coverage with additional protections. Read more through our Auto-Owners auto insurance review.

- Strong Customer Satisfaction: Auto-Owners consistently receives high ratings for customer satisfaction, indicating a positive overall experience for policyholders.

- Personalized Service: Auto-Owners provides personalized service through its network of independent agents, ensuring tailored recommendations and support.

Cons

- Limited Availability: Auto-Owners may have limited availability in certain regions, which could restrict access to its services for some customers.

- Potentially Higher Premiums: Auto-Owners’ premiums may be higher compared to some other insurers, particularly for customers seeking comprehensive coverage options.

#9 – AAA: Best for Teens

Pros

- Benefits for Teens: AAA offers specialized programs and benefits for teen drivers, providing additional support and resources to promote safe driving habits.

- Extensive Roadside Assistance: AAA’s roadside assistance coverage is comprehensive, offering services such as towing, battery jump-starts, and tire changes to policyholders.

- Discount Opportunities: AAA provides various discount opportunities, allowing customers to save money on their premiums through safe driving habits and other qualifying factors.

Cons

- Limited Availability: AAA’s auto insurance may only be available to members of the AAA club, which could restrict access to its services for non-members. Read more through our AAA auto insurance review.

- Mixed Coverage Options: While AAA offers comprehensive coverage options, some customers may find its coverage offerings to be less customizable compared to other insurers.

#10 – Farmers: Best for Signal App

Pros

- Signal App Benefits: Farmers offers benefits for policyholders who use the Signal app, including potential discounts and rewards for safe driving behaviors.

- Flexible Coverage Options: Farmers provides flexible coverage options, allowing customers to tailor their policies to meet their specific needs.

- Strong Agent Support: Farmers has a strong network of agents who can provide personalized assistance and guidance to policyholders. Find out more through our Farmers auto insurance review.

Cons

- Potentially Higher Premiums: Farmers’ premiums may be higher compared to some other insurers, particularly for customers seeking comprehensive coverage options.

- Limited Online Tools: While Farmers offers agent support, some customers may find its online tools and resources to be less comprehensive compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Cover a Cracked Windshield in Kansas

Law for Zero-Deductible Windshield Replacement Service

Kansas Auto Insurance Company Request Aftermarket Glass

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Glass Service Provider in Kansas: The Bottom Line

Frequently Asked Questions

Will my auto insurance cover a cracked windshield in Kansas?

Yes, in Kansas, auto insurance policies may cover the cost of repairing or replacing a cracked windshield. However, coverage may vary depending on your specific policy and the extent of the damage. It’s recommended to review your policy or contact your insurance provider to understand the coverage details for windshield replacement.

Does Kansas have a law for zero-deductible windshield replacement service?

No, Kansas does not have a specific law mandating zero-deductible windshield replacement. Insurance companies in Kansas have the flexibility to establish their own policies regarding deductibles for windshield replacement. It’s important to check your policy or consult with your insurance provider to understand the deductible requirements for windshield replacement in Kansas. Enter your ZIP code now to start.

Can your Kansas auto insurance company request aftermarket glass?

Who selects your auto glass service provider in Kansas?

In Kansas, your auto insurance company has the authority to select the service provider for windshield replacement. They also have the right to choose the type of material used for the replacement. If you want the freedom to choose your own provider or material, you would need to pay for the replacement without filing a claim.

How can I save money on windshield replacement in Kansas?

To save money on windshield replacement in Kansas, you can consider the following options:

- Review your insurance policy to understand the coverage and deductible requirements for windshield replacement.

- Compare quotes from different insurance providers to find the most affordable coverage with favorable deductible terms.

- Evaluate the cost of filing a claim versus paying for the replacement out of pocket, considering potential rate increases in the future.

- Upgrade your auto insurance policy to include comprehensive coverage, which typically covers windshield damage from projectiles like rocks or birds.

- Prioritize the safety of yourself and others by addressing windshield damage promptly to avoid potential risks while driving.

What is the windshield law in Kansas?

The windshield law in Kansas states that drivers can’t drive if there is anything obstructing their vision, whether it’s snow or cracks in the windshield.

What are the top three companies offering the best windshield replacement coverage in Kansas?

The top three companies offering the best windshield replacement coverage in Kansas, according to the article, are Travelers, Allstate, and Geico. Enter your ZIP code now to begin.

How does the Drivewise program benefit customers who choose Allstate for their auto insurance?

What are two potential drawbacks of choosing Geico as your auto insurance provider?

Two potential drawbacks of choosing Geico as your auto insurance provider, according to the article, are limited agent support and average customer service.

How does Auto-Owners stand out among the listed providers in terms of customer satisfaction?

Auto-Owners stands out among the listed providers in terms of customer satisfaction, as it consistently receives high ratings for customer satisfaction, indicating a positive overall experience for policyholders. Enter your ZIP code now to start.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.