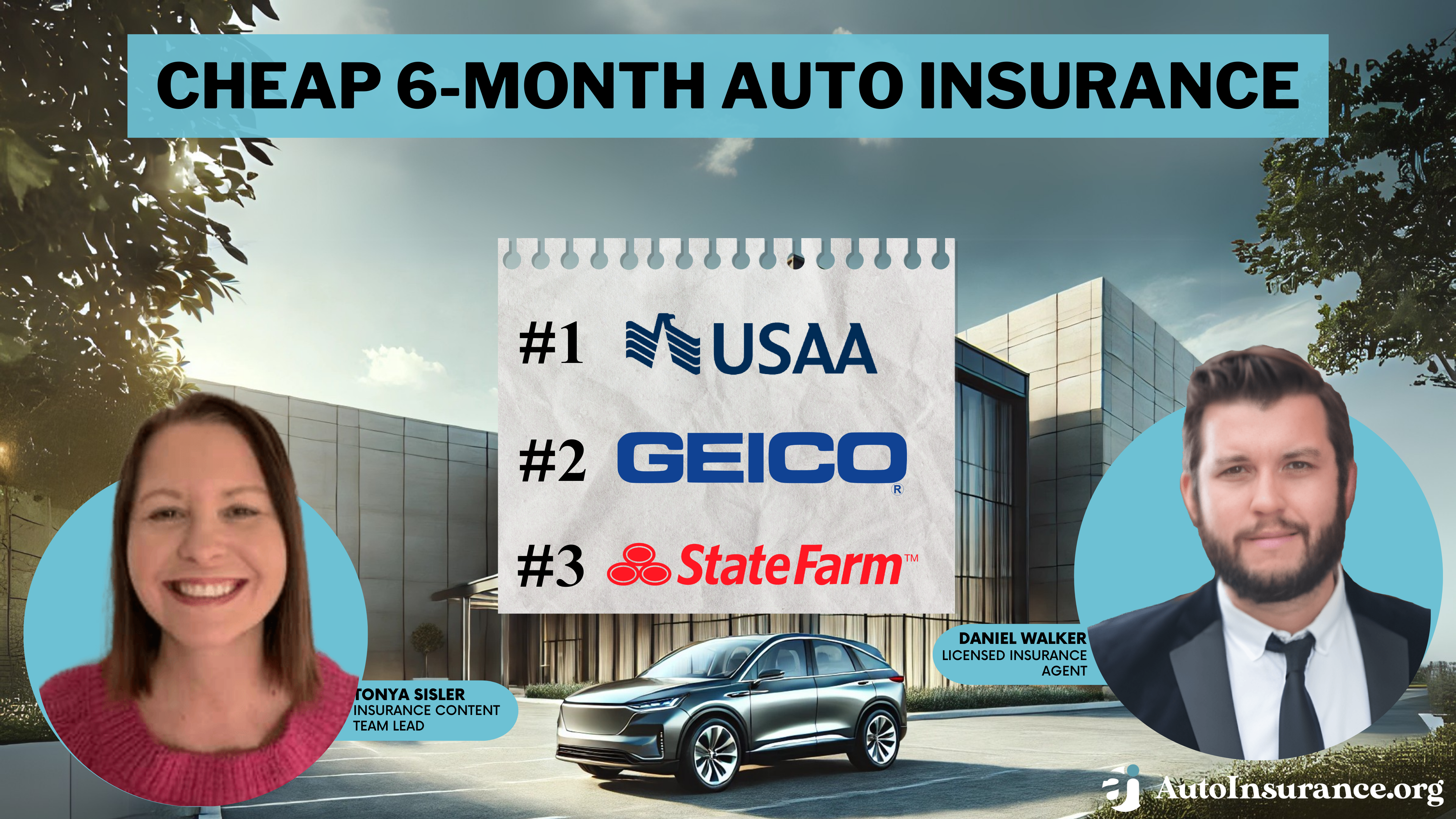

Cheap 6-Month Auto Insurance in 2026 (Save Big With These 8 Companies!)

USAA, Geico, and State Farm have the lowest possible rates for cheap 6-month auto insurance policies. USAA's average rate is only $133 for six months of minimum coverage. Non-military drivers who don't qualify for USAA will find similarly low rates at Geico and State Farm for six-month insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for 6 Months

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for 6 Months

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for 6 Months

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm have cheap 6-month auto insurance rates for most drivers. Because USAA is for military and veterans, however, most drivers must shop at Geico and State Farm.

Not sure where to start? We recommend shopping around at the cheapest auto insurance companies listed below.

Our Top 8 Company Picks: Cheap 6-Month Auto Insurance

| Company | Rank | 6-Month Rates | Good Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $133 | 30% | Military Members | USAA | |

| #2 | $181 | 26% | Various Discounts | Geico | |

| #3 | $199 | 25% | Agency Network | State Farm | |

| #4 | $225 | 10% | Comprehensive Coverage | Travelers | |

| #5 | $234 | 30% | Online Management | Progressive | |

| #6 | $262 | 25% | Loyalty Discounts | American Family | |

| #7 | $264 | 40% | Usage-Based Savings | Nationwide |

| #8 | $319 | 30% | Occupational Discounts | Farmers |

Read through our brief guide on six-month insurance policies to learn how your rates are calculated. You can also use our free tool at any time to get quotes for six-month car insurance.

- USAA has the cheapest 6-month auto insurance rates

- Geico and State Farm also have affordable 6-month auto insurance

- Shopping for 6-month insurance quotes will help drivers get the lowest rates

#1 – USAA: Top Pick Overall

Pros

- Military Members: Because USAA has a specific customer base, military members will find the cheapest rates at USAA.

- Customer Service: USAA has high ratings for customer satisfaction, which you can read about in our review of USAA.

- Widely Available: USAA insurance is sold in all 50 states.

Cons

- Military and Veteran Exclusive: Non-military and non-veteran drivers cannot qualify for USAA insurance.

- UBI Discount Not Available in 3 States: USAA’s UBI program isn’t available in the three states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Various Discounts

Pros

- Various Discounts: Geico’s variety of discounts offer great saving opportunities for drivers. You can read more about Geico’s discount options in our Geico review.

- Convenient Policy Management: Geico makes policy details easy to manage online.

- Financially Strong Ratings: Gieco is one of the largest companies on the market, with a high financial standing that allows the company to keep rates reasonable.

Cons

- Missing Gap Insurance: If you have a new car and want gap insurance, you won’t be able to buy it at Geico.

- Virtual Communication: Local Geico agents are few, so in-person assistance generally isn’t available.

#3 – State Farm: Best for Agency Network

Pros

- Agency Network: Drivers looking for 6-month policies should be able to easily locate an in-person agent.

- UBI Discount: Safe drivers can get cheaper rates with State Farm’s UBI program. Learn more in our State Farm review.

- Financially Strong Ratings: State Farm’s financial stability allows it to keep rates reasonable for six-month insurance policies.

Cons

- High DUI Rates: If you have a DUI on your record, State Farm’s rates will likely be higher than the average.

- Can’t Purchase Online: While you can get quotes online, you can’t complete your transaction online.

#4 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers offers great comprehensive coverage to customers, as well as several other coverage options.

- Financial Ratings: Travelers is financially stable according to its ratings, which helps the company avoid having to increase rates.

- Accident Forgiveness: Travelers offers accident forgiveness to qualifying customers.

Cons

- Customer Satisfaction: J.D. Power rated Travelers’ customer satisfaction as slightly below average (read more: Travelers Review).

- Sold in 42 States: Travelers’ auto insurance isn’t sold in eight states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Online Management

Pros

- Online Management: Progressive’s app allows customers to manage their policies online.

- Widely Available: Progressive sells auto insurance in all 50 states.

- Accident Forgiveness: Progressive has three different accident forgiveness levels, which helps customers keep rates low.

Cons

- Virtual Communication: Progressive has few in-person agents compared to other companies, so communication is mostly virtual.

- Customer Satisfaction: Some customers gave Progressive negative reviews, which you can learn more about in our Progressive review.

#6 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Discounts: American Family offers a loyalty discount to customers who stick with the company.

- Coverage Options: Despite being a smaller company, American Family offers a wide range of coverages. Learn more in our review of American Family.

- Local Agents: American Family has local agents, so customers aren’t limited to virtual communication.

Cons

- Availability: American Family auto insurance isn’t sold in many states.

- Customer Service: American Family has a few negative reviews from customers.

#7 – Nationwide: Best for Usage-Based Savings

Pros

- Usage-Based Savings: Nationwide offers discounts to safe drivers with its usage-based savings program.

- Financial Stability: Nationwide is a firmly established company. You can learn about its financial ratings in our Nationwide review.

- Coverages: Nationwide has a great selection of coverages for six-month car insurance policies.

Cons

- Not Sold in a Few States: While Nationwide is widely available, you can’t purchase it in a few states.

- Customer Service: Nationwide has some negative claims reviews from customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Occupational Discounts

Pros

- Occupational Discounts: Farmers offers discounts to certain occupations, such as military members.

- UBI Discount: Farmers’ Signal UBI program offers discounts to safe drivers (read more: Farmers’ Signal Review).

- Financial Stability: Farmers have high ratings for financial strength. Learn more in our Farmers review.

Cons

- Poor Credit Rates: In states where credit scores can be used to calculate rates, Farmers’ auto insurance rates may not be the cheapest.

- Customer Service: Farmers does have some negative reviews from customers.

How Six-Month Auto Insurance Policies Work

Auto insurance is legally required in 49 states. Depending on what state you live in, you will be expected to purchase at least a minimum level of coverage to drive on the roads.

Most providers sell six-month auto insurance policies. However, some will sell 12-month policies.

How does six-month auto insurance work? A six-month insurance policy simply means that you will be covered by your agreed-upon limits at whatever rate your insurer provided for you in your contract for six full months.

When that six-month term ends, your provider will reevaluate your rates.

You can purchase a term length of six months for auto insurance but make monthly payments for the duration of your policy. You do not have to pay for all six-months upfront. But some companies will provide you with a small discount if you do choose to pay for your policy in full.Dani Best Licensed Insurance Producer

Depending on your driving record, the number of claims you filed, and a few other major factors, your rates will either increase, decrease, or stay the same. You also have the opportunity to change providers without paying cancellation fees if you are not satisfied with your current provider.

Just be careful. You must maintain continuous coverage or else you risk getting caught driving without insurance. Therefore, if you are considering changing providers, it is better to secure your new policy first before canceling your old policy.

Cost of Six-Month Auto Insurance

What is the average 6-month auto insurance premium? At the cheapest companies, your rates may be similar to the following.

Top 6-Month Auto Insurance Rates From the 8 Cheapest Provider

Insurance Company Minimum Coverage Full Coverage

$262 $699

$319 $831

$181 $481

$264 $688

$234 $630

$199 $516

$225 $593

$133 $352

In the following table, we compare the average cost for six-month rates compared to annual and monthly rates. Check them out below.

Auto Insurance Average Rates by Term Length

| Insurance Company | Monthly Rates | 6-Month Rates | Annual Rates |

|---|---|---|---|

| $34 | $204 | $407 | |

| $24 | $144 | $287 | |

| $29 | $175 | $350 | |

| $22 | $134 | $268 | |

| $42 | $253 | $506 |

| $24 | $144 | $288 |

| $28 | $168 | $336 | |

| $23 | $136 | $272 | |

| $31 | $185 | $370 |

What is the average cost of six months of auto insurance? According to the National Association of Insurance Commissioners, the national average cost for full coverage auto insurance is $1,030 per year. Therefore, the national average for six months of insurance is $515.

You can break these rates down further to discover the average monthly cost for full coverage auto insurance by dividing the annual average by 12, making the estimated monthly rate about $86 per month.

Factors That Affect 6-Month Rates

However, your actual six-month auto insurance quote could look very different depending on a variety of factors.

Auto insurance companies will charge you based on where you live, your age, gender, ZIP code, the type of vehicle you drive, your credit score, and your driving record.

As you’ve learned, there are many different factors that go into calculating auto insurance rates. To complicate things further, each state has different laws and regulations surrounding how companies can determine costs.

For example, some states have banned providers from using gender, credit history, and ZIP codes. However, your driving record will impact your rates most across almost all states.

Learn more about your driving record and rates: How Auto Insurance Companies Check Driving Records

The policies themselves can also vary and will affect the rate. So think of these numbers as helpful guidelines. For example, we provided you with average six-month full coverage rates, but there is no universal definition for what a full coverage policy actually is or if the policy included bodily injury coverage. The only way to know exactly what you’ll pay is to get quotes from top companies like Geico.

Customarily, full coverage implies that you are carrying your state’s minimum car insurance requirements, along with collision and comprehensive coverage. However, the deductible you choose for collision and comprehensive coverage can change, which will impact your rates. The levels you purchase can also be different.

You might even have additional coverage options on your policy that are unique to your company, like roadside assistance, gap insurance, or rental auto reimbursement.

Auto Insurance Discounts at the Cheapest 6-Month Companies

Auto insurance discounts are one of the best ways to save on your six-month auto insurance policy. As the table below shows, discounts at the cheapest companies can reach up to 25%.

Policy bundling can be a quick way to save money if you need more than one type of insurance, such as homeowners insurance. Purchasing them at one company also makes policy management more simple.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Auto Insurance Policy Length & Coverage Period Relate

The length of your car insurance policy is going to dictate the coverage period. In other words, how long you are protected by your insurer. There is no standard length of time as to how long a policy is going to be written. However, the most common term length is six months.

Some auto insurance companies can write you a policy that is in effect for just a day, while others may write you a policy that is in effect for one year or even longer in some instances.

For example, if you rent a vehicle, the agency will likely ask if you want to also purchase an auto insurance package to protect the rental car. This policy will last for as long as you are renting the car, which could be anywhere from one day to six months.

Read more: Best Companies for Cheap Rental Car Insurance

All in all, how much you pay for auto insurance depends more on the company you use and your individual demographics as a driver and less so on the term length you choose. However, some companies will provide you with a deal if you’re able to pay for your policy in full.

It is often easier for most consumers to pay for a six-month policy in full compared to a 12-month policy.

In the table below, we provide you with details about what auto insurance companies give this kind of discount. If the specific savings amounts are available, they’ve been included.

Full Payment Auto Insurance Discounts Available By Provider

| Insurance Company | Discount Available |

|---|---|

| NA |

| NA |

| 10% | |

| 20% | |

| NA | |

| 4% | |

| NA |

| 10% | |

| 10% | |

| 10% | |

| 12% |

| NA | |

| 15% |

| 15% | |

| 5% |

| 15% | |

| 15% | |

| 25% | |

| 15% | |

| 20% |

| 7.5% | |

| NA |

Of the 22 providers we compared, 17 offer a pay-in-full discount.

Read more: Ameriprise Auto Insurance Discounts for Members

Remember, your discounts stack. Take advantage of these savings to get the cheapest car insurance for 6 months. If your provider does not offer this discount, consider comparison shopping to see if a different company might be a better fit for you.

Auto Insurance Policy Effective Dates

The length of your auto insurance policy is driven by its effective dates. Therefore, if you have a six-month policy that goes into effect on January 1st, then you’ll be covered by that policy until June 30th of the same year—a full six months. A 12-month policy will terminate on December 31st of the same year.

When you submit an auto insurance payment, you are basically paying for coverage in advance. Let’s say you purchase a six-month policy and are able to pay for the full term upfront.

For the next half-year, you’ll be covered by a policy you’ve already paid for.

Now let’s imagine you purchase a six-month policy but decide to make monthly payments; the same logic applies. If you pay your fee on January 1st, you are covered for the full month of January. In February, you will have to submit another payment to keep your coverage for that month.

Your rate will not change, however, because you’ve entered a contract with your insurance provider guaranteeing that you will receive the agreed-upon level of coverage for the agreed-upon rate. It will be set in stone until your policy term ends at the end of the six months.

Payment Dates on Six-Month Policies

Your payments can be due on any random day of the month. This means some effective dates are not going to be as black and white in terms of starting on an easy date like January 1st. Make sure you know your specific due dates so you never miss a payment. If you miss a payment, you risk losing your coverage because of a breach of your contract.

Most companies will give you a limited number of days to make your payment before dropping you. You must make the grace period car insurance payments on time in order to maintain coverage.

That being said, don’t worry too much about a surprise termination of coverage. According to the Insurance Information Institute, your provider legally must send you a letter ahead of time explaining to you exactly why your coverage is being terminated, and on what date.

Pros & Cons of Policy Terms

Insurance policies come with different coverages, terms, and effective periods. When shopping for your insurance policy, be sure to ask what the length of your policy term is and when it will go into effect. Not sure which policy is best for you? We go over all the pros and cons to consider with each policy.

Pros & Cons of Six-Month Policies

A con to a six-month insurance policy is your rates can change after that six months. A common complaint we hear is, “Why do my auto insurance rates go up every six months?” If you invest in a 12-month policy, you will no longer feel that frustration. Your rates will be re-evaluated by your insurance agents every 12 months instead.

During rate reevaluations, auto insurance companies will increase your rates because the company might be dealing with more claims from other customers. Your driving choices can also cause your rates to go up. For example, if you committed any traffic violations, your rates will likely increase.

Learn more: How Auto Insurance Companies Check Driving Records

An advantage to a six-month policy, however, is that you can get a discount faster if your circumstances change. Your policy is much more flexible with a shorter term.

Pros & Cons of 12-Month Policies

The real benefits of a 12-month policy are not about cheaper upfront rates. What actually draws drivers to purchase a year-long auto insurance term length is the lack of surprises compared to cheap month-to-month insurance.

For a full year, you know with certainty that your auto insurance costs will not change. For drivers who pay for auto insurance in monthly installments, this can be a huge plus.

One downside to a 12-month policy term, however, is that you’ll have to wait longer to apply for discounts to your policy. This might mean you’ll be stuck paying slightly higher rates until your policy is up for renewal and reevaluation after a year’s time.

For example, if you now work from home and are considered a low-mileage driver, you will have to wait until the end of your year-long term to qualify for this discount. Do some comparison shopping so that you can find a policy that is packed with value, coverage, payment terms, and the customer service you deserve.

Find an Affordable 6-Month Car Insurance Policy Today

By taking some time to consider the pros and cons of each term length when determining how often auto insurance is paid, you’ll be able to choose the policy that best fits your individual needs. Refer back to this guide as much as needed while you comparison shop for your best six-month car insurance quotes.

Want to get started on finding affordable six-month car insurance companies today? Use our free tool to get a 6-month car insurance quote from companies in your area.

Frequently Asked Questions

What should I do if I’m involved in an accident?

Ensure safety, call emergency services if needed, exchange information with others involved, take photos, file a police report if required, and notify your insurance company.

Can I add someone to my auto insurance policy?

Yes, you can add additional drivers to your policy, typically family or household members. Adding high-risk drivers may increase premiums.

What is an insurance deductible?

Auto insurance deductibles are the amount you pay out of pocket before insurance coverage applies. Choosing a higher deductible can lower premiums but means paying more when making a claim.

Do I need auto insurance if I don’t own a car?

If you drive regularly, even if you don’t own a car, you’ll likely need auto insurance. Consider non-owner car insurance for coverage when driving a vehicle you don’t own.

What’s the difference between liability insurance and full coverage?

Liability insurance covers damages you cause to others. Full coverage includes liability insurance and coverage for your own vehicle, including collision and comprehensive coverage.

Can I get auto insurance with a bad driving record?

Yes, you can get auto insurance with a bad driving record, but premiums may be higher. Shopping around for high-risk auto insurance quotes is recommended.

Is a six-month or 12-month auto insurance policy cheaper?

When it comes to a six-month vs. 12-month auto insurance policy, the term length you choose for your car insurance may have a small impact on your rates, however, it will be minor. Therefore, choosing a six-month policy over a 12-month policy will not necessarily help you substantially lower your costs.

To find a progressive rate quote, make sure to shop around and compare rates and levels of coverage between companies.

What auto insurance companies offer 12-month policies?

Some auto insurance companies that offer 12-month policies include:

- Allstate

- Erie

- The General

- The Hartford

- Infinity

- Kemper Speciality

- Liberty Mutual

- MetLife

- Nationwide

- Safeco

- State Farm

- USAA

Progressive has recently adopted 12-month policies for its customers. However, you have the option to also choose a Progressive six-month policy.

When you get a Geico quote, it will be for a six-month policy. Geico has stopped using 12-month policies.

Why do most policies only last for six months?

When you seek out an auto insurance quote, you’ll find most companies will provide you with a six-month term length. In fact, it can be quite difficult to find a 12-month policy. Some major companies, like Geico, will not even sell them.

Ultimately, six-month policies are the norm because of the ability to perform routine price evaluations and make regular updates and changes to your driving profile. Therefore, the shorter six-month term policy length often ends up being more beneficial for both the driver and the provider.

What are some benefits of six-month auto insurance policies?

There are a few reasons why six-month policies are beneficial, some of which benefit the provider, and some benefit you as the consumer.One major reason that benefits the provider is that it allows your rates to be reevaluated more often. In some cases, your rates might increase.

For example, if you’ve filed multiple claims, or if you com mitted a driving violation, your rate will go up. In other instances, your rates might actually go down. This is, of course, a benefit to you, the consumer. The shorter-policy length allows you to qualify for discounts sooner, and readjust your types of auto insurance coverage.

Rather than waiting a full year to readjust your rates, the provider will be able to do it after only six months.

Similarly, if you want to change providers without paying any cancellation fees, it’s easier to wait until the end of a six-month policy than a 12-month one.

Can you pay car insurance every 6 months?

Are all auto insurance policies 6 months?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.