Cheapest Teen Driver Auto Insurance in Missouri (Top 10 Affordable Companies in 2026)

Geico, Progressive, and Travelers have the cheapest teen driver auto insurance in Missouri for $67/mo. Good students get 10% discounts from Progressive. Geico has the cheapest MO insurance for drivers aged 16. If you’re a high-risk driver, Progressive has the lowest auto insurance rates after accidents for drivers under 25.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Teen Drivers in Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Teen Drivers in Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Teen Drivers in Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsGeico, Progressive, and Travelers have the cheapest teen driver auto insurance in Missouri.

Missouri auto insurance plans will be the most affordable if you shop at any of the following companies.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Missouri

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $67 | A++ | Affordable Rates | Geico | |

| #2 | $70 | A+ | Safe-Driving Discounts | Progressive | |

| #3 | $72 | A++ | Bundling Policies | Travelers | |

| #4 | $75 | A | Loyalty Rewards | American Family | |

| #5 | $75 | A++ | Personalized Policies | State Farm | |

| #6 | $78 | A | Family Plans | Farmers | |

| #7 | $80 | A+ | Add-on Coverages | Allstate | |

| #8 | $82 | A+ | Widespread Availability | Nationwide |

| #9 | $85 | A | Business Vehicles | Liberty Mutual |

| #10 | $90 | A | High-Risk Coverage | The General |

Read on to learn more about Missouri auto insurance for teens. You can also compare rates quickly with our free tool to find cheap Missouri insurance quotes.

- Geico is the cheapest Missouri car insurance company for teens

- Progressive and Travelers also have cheap Missouri insurance for teens

- Teens will need to fulfill Missouri car insurance coverage requirements

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico has the cheapest Missouri state auto insurance quotes on average. We review rates in-depth in our Geico review.

- Mobile App: The company’s app has good ratings and helps customers with simple policy changes and online claims.

- Teen Discounts: Teens can save with student discounts at Geico.

Cons

- Local Support: Geico has limited local agents.

- Good Driver Discount Availability: Teens may not have Geico’s good driver discount in their state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Save-Driving Discounts

Pros

- Safe-Driving Discounts: Teens can save up to 30% with Progressive’s Snapshot program. Learn more in our Progressive Snapshot review.

- Online Quotes: You can quickly and easily get quotes directly from Progressive.

- Add-On Coverages: Progressive sells less common add-ons, such as gap coverage.

Cons

- Snapshot Rate Increases: Teens who drive poorly should avoid participating in Snapshot, as Progressive may raise rates.

- Customer Service Reviews: There are a few negative reviews and below-average ratings for Progressive.

#3 – Travelers: Best for Bundling Policies

Pros

- Bundling Policies: You can bundle multiple types of insurance at Travelers, and some combinations will earn you a discount.

- Financial Ratings: Travelers’ financial ratings contribute to rate stability. Learn about its ratings in our review of Travelers auto insurance.

- Good Student Discounts: Travelers offers discounts specifically for teen drivers.

Cons

- Good Driver Program Rate Increases: Teens with poor driving skills shouldn’t try to get a discount through Travelers’ UBI program.

- Average Customer Ratings: Travelers didn’t have outstanding reviews and ratings for customer service.

#4 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Sticking with American Family as a provider will earn customers a discount.

- Teen Driving Program: American Family’s teen program coaches teens on safe driving skills.

- Customer Ratings: Read about American Family’s positive ratings in our review of American Family.

Cons

- Availability: American Family’s availability is limited.

- No Rideshare Insurance: Teens wanting to get rideshare insurance will have to shop elsewhere.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Personalized Policies

Pros

- Personalized Policies: Teens can adjust their policies easily at State Farm. Learn about State Farm’s policy options in our State Farm review.

- Teen Driver Program: State Farm’s Steer Clear program helps educate teens on safe driving and offers discounts.

- Local Agents: Teens can get personalized assistance from an agent.

Cons

- Limited Online Quotes: You can only get a limited quote online before having to complete the process with an agent.

- High-Risk Driver Rates: State Farm’s rates may be too expensive for drivers with multiple accidents or tickets.

#6 – Farmers: Best for Family Plans

Pros

- Family Plans: Farmers is great for drivers looking to buy family auto insurance. Read more about the company in our Farmers review.

- Good Driver Program: Teens who demonstrate good driving can earn a discount.

- Comprehensive Coverage: Teens can be better protected in accidents if they purchase a comprehensive policy.

Cons

- Customer Satisfaction: Farmers didn’t have better-than-average ratings.

- Bad Driving Record Rates: Farmers is best for teens with good driving records.

#7 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Take a look at our Allstate review for a list of add-ons, like roadside assistance.

- Safe Driver Program: Allstate will reward teens who do well in the program.

- Pay-Per-Mile Rates: Teens who only drive occasionally may wish to look into Allstate’s pay-per-mile insurance.

Cons

- Customer Complaints: Allstate’s number of complaints is higher than the average.

- Discount Availability: Some states may offer lower discount amounts or be missing discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Widespread Availability

Pros

- Widespread Availability: You can find Nationwide auto insurance in most locations.

- Vanishing Deductible: See your Nationwide deductibles decrease for each claims-free policy period.

- Good Driver Program: Nationwide offers a large discount through its SmartRide program. Learn more in our Nationwide SmartRide Review.

Cons

- Customer Reviews: Nationwide has varying reviews, some positive and some negative, resulting in average ratings.

- Bad Driving Record Rates: Nationwide’s rates are best for young drivers with good driving records.

#9 – Liberty Mutual: Best for Business Vehicles

Pros

- Business Vehicles: Liberty Mutual has great coverage for business vehicles.

- RightTrack Program: Teens may qualify for a large discount with RightTrack. Read more in our review of Liberty Mutual RightTrack.

- Coverage Options: Teens will have several choices of coverage for their cars.

Cons

- Discount Availability: Not all policyholders will qualify for some of Liberty Mutual’s discounts.

- Bad-Driving Record Rates: Liberty Mutual’s rates are the cheapest for good drivers.

#10 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General will insure most high-risk teens who can’t get insurance elsewhere. Read more in The General Review.

- Good Driver Program: The General’s program stresses the importance of good driving practices and offers discounts.

- Quick Quotes: The General offers quick quotes online.

Cons

- Customer Service: Most reviews are mixed for The General, with no outstanding ratings from most customers.

- Coverage Options: The General’s options can be more limited.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Missouri Auto Insurance Laws & Requirements

Missouri auto insurance requirements only require drivers to have minimum coverage. It is illegal to drive without insurance, although there is a small Missouri auto insurance grace period for teens who have permits.

Missouri auto insurance coverage requirements require all drivers to carry 25/50/10 of bodily injury and property damage liability coverageDani Best Licensed Insurance Producer

Take a look at the average rates below to see the difference in cost between full and minimum coverage.

Missouri Auto Insurance Monthly Rates by Age, Gender & Coverage Levell

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $173 | $510 |

| 16-Year-Old Male | $194 | $546 |

| 17-Year-Old Female | $163 | $480 |

| 17-Year-Old Male | $183 | $516 |

| 18-Year-Old Female | $142 | $352 |

| 18-Year-Old Male | $166 | $416 |

| 19-Year-Old Female | $135 | $330 |

| 19-Year-Old Male | $158 | $390 |

| 20-Year-Old Female | $128 | $310 |

| 20-Year-Old Male | $150 | $368 |

| 21-Year-Old Female | $122 | $295 |

| 21-Year-Old Male | $144 | $350 |

While full coverage is much more than minimum coverage, it often pays itself off after an accident. Without full coverage, teens will have to pay their own repair bills in most accident situations.

View this post on Instagram

If the price is daunting, make sure you are shopping for quotes to help you find the cheapest full coverage auto insurance in Missouri. Enter your ZIP code above to see rates from local companies.

Compare Teen Driver Auto Insurance Quotes in Missouri

In addition to coverage type, the average car insurance cost in Missouri for teenagers will also vary by age, gender, and driving record.

Missouri Auto Insurance Monthly Rates by Age, Gender & Driving Record

| Age & Gender | One Ticket | One Accident | One DUI |

|---|---|---|---|

| 16-Year-Old Female | $350 | $400 | $500 |

| 16-Year-Old Male | $400 | $450 | $550 |

| 25-Year-Old Female | $180 | $220 | $300 |

| 25-Year-Old Male | $200 | $250 | $350 |

| 35-Year-Old Female | $150 | $200 | $250 |

| 35-Year-Old Male | $170 | $220 | $270 |

| 60-Year-Old Female | $130 | $180 | $230 |

| 60-Year-Old Male | $140 | $190 | $240 |

Teens with good driving records will have a much easier time getting affordable Missouri teen insurance rates, as it is much harder to find cheap auto insurance for teens after an accident, DUI, or ticket. Where a teen lives could also affect rates in Missouri, though not as much as a bad driving record.

Missouri Auto Insurance Monthly Rates by Age, Gender & City

| Age & Gender | Columbia | Independence | Kansas City | Springfield | St. Louis |

|---|---|---|---|---|---|

| 16-Year-Old Female | $320 | $350 | $400 | $370 | $420 |

| 16-Year-Old Male | $370 | $400 | $450 | $420 | $470 |

| 25-Year-Old Female | $150 | $170 | $200 | $180 | $220 |

| 25-Year-Old Male | $160 | $180 | $210 | $190 | $230 |

| 35-Year-Old Female | $100 | $120 | $150 | $130 | $160 |

| 35-Year-Old Male | $110 | $130 | $160 | $140 | $170 |

| 60-Year-Old Female | $90 | $100 | $120 | $110 | $130 |

| 60-Year-Old Male | $95 | $105 | $125 | $115 | $135 |

Insurance in St. Louis and Kansas City costs slightly more.

How to Add Missouri Teens to a Parent’s Policy

Adding a driver to car insurance is easy. Most insurance companies let customers add a driver online, or customers can call the company to add the driver.

If teens have permits, then insurance companies may not even need the teen added. Just make sure to check your company's rules on permit driver auto insurance in Missouri and ask about the Missouri car insurance grace period once a teen gets a license.Zach Fagiano Licensed Insurance Broker

While some parents may be considering having teens purchase their own policy, the rates below show how much more economical it is for teens to join a parents’ policy.

Missouri Auto Insurance Monthly Rates by Age, Gender & Policy Type

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $300 | $600 |

| 16-Year-Old Male | $350 | $650 |

| 25-Year-Old Female | $120 | $250 |

| 25-Year-Old Male | $130 | $270 |

| 35-Year-Old Female | $90 | $180 |

| 35-Year-Old Male | $95 | $190 |

| 60-Year-Old Female | $80 | $160 |

| 60-Year-Old Male | $85 | $170 |

Teens can stay on a parents’ policy even when they go away to college. Some insurance companies even offer a student-away discount on family policies.

Progressive is our top pick for teen auto insurance discounts for its huge savings and rewards for safe drivers. See how much your teen driver can save in our Progressive Snapshot review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Teen Driver Auto Insurance in Missouri

There are a number of ways to save on teen insurance in Missouri. The first step is to shop at the cheapest companies.

Teen Driver Auto Insurance in Missouri: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $80 | $180 |

| American Family | $75 | $170 |

| Farmers | $78 | $175 |

| Geico | $67 | $145 |

| Liberty Mutual | $85 | $190 |

| Nationwide | $82 | $188 |

| Progressive | $70 | $160 |

| State Farm | $75 | $175 |

| The General | $90 | $200 |

| Travelers | $72 | $165 |

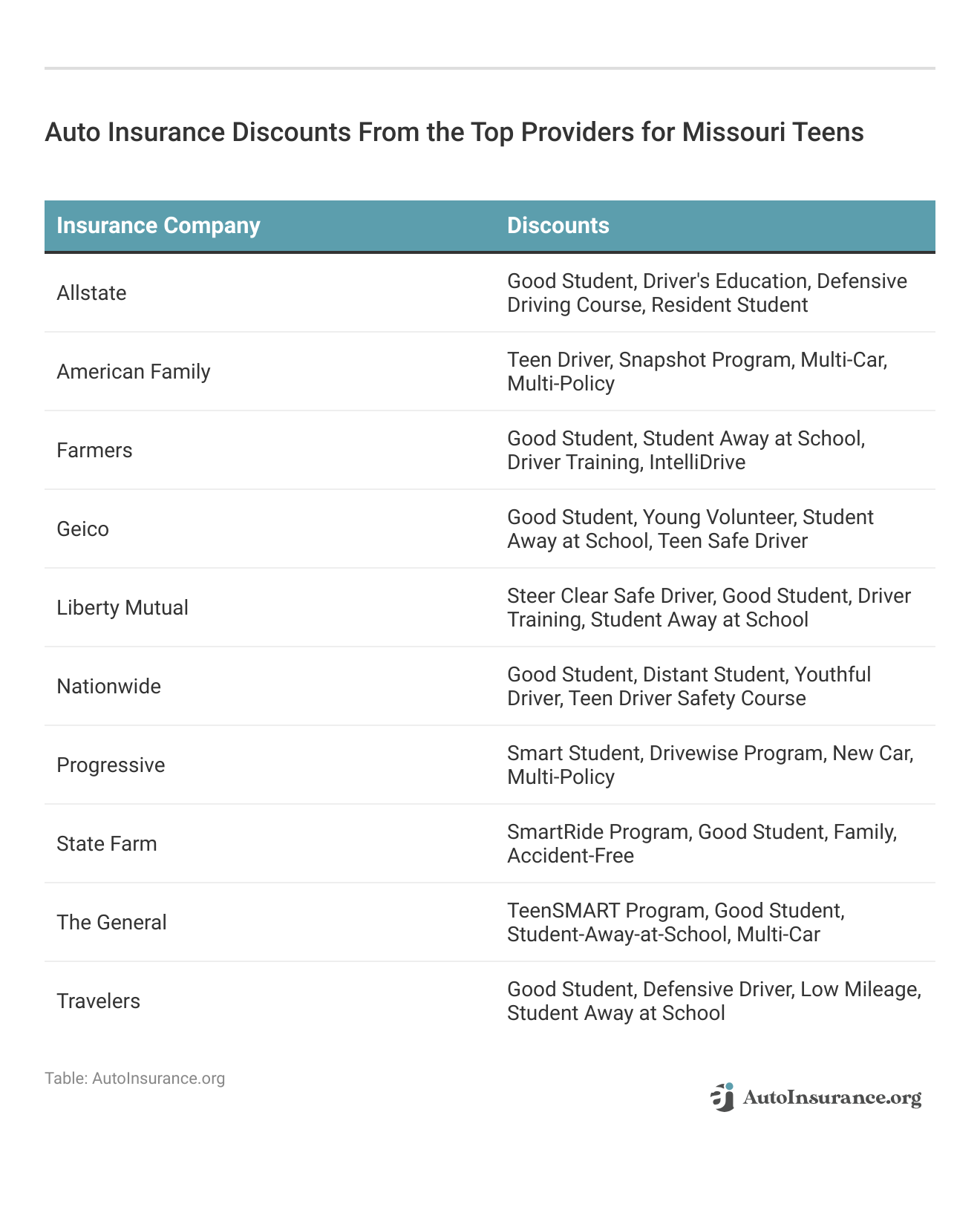

When shopping at the companies with the cheapest teen auto insurance, take a look at what discounts they offer.

Most insurance companies offer discounts tailored exclusively to teens, such as a good student or student-away discount.

The Cheapest Missouri Auto Insurance Companies for Teens

While teen insurance is expensive due to how auto insurance rates by age are calculated, this doesn’t mean teen auto insurance has to break the bank. Teens can qualify for discounts and get quotes at the cheapest Missouri companies to reduce auto insurance costs. Joining a parent’s policy will also help keep rates reasonable.

Ready to start saving on teen insurance in Missouri? Enter your ZIP code into our free tool for free Missouri auto insurance quotes today.

Frequently Asked Questions

How much is auto insurance for a 16-year-old per month in Missouri?

Minimum coverage in Missouri averages $184 per month for 16-year-old drivers. This is expensive, but it doesn’t mean you can’t get cheap auto insurance for 16-year-olds. Comparing rates from companies in your area will help you quickly find the cheapest insurance for a 16-year-old in Missouri.

At what age is Missouri auto insurance most expensive?

16-year-old drivers have the most expensive rates, followed by 17-year-old and 18-year-old drivers. Having teenagers join a parent’s policy will get you the best auto insurance for drivers under 25.

What is the cheapest Missouri auto insurance company for a 17-year-old?

Geico is the cheapest Missouri auto insurance company for 17-year-old drivers.

How much is car insurance for a 17-year-old in Missouri?

Minimum coverage in Missouri averages $173 per month for 17-year-old drivers. This is expensive, so make sure to read up on how to find cheap auto insurance for 17-year-olds.

How much is auto insurance for an 18-year-old per month in Missouri?

The average minimum coverage rate for 18-year-old drivers in Missouri is $154 per month. However, the cheapest insurance for an 18-year-old in Missouri is available at Geico, Progressive, and Travelers.

What are Missouri’s minimum requirements for auto insurance?

The Missouri Department of Insurance requires drivers to carry 25/50/25 of liability insurance.

How much are car tags in Missouri?

The cost of car tags depends on what type of vehicle you drive. Most tags for cars are under $30.

How much does the average car cost in Missouri?

The average car costs around $33,000 in Missouri.

Do all Missouri insurance companies charge the same rates?

No, the rates for Missouri car insurance plans will be different among companies, especially for younger drivers. Learn more about why young drivers are charged more in our article: Six Reasons Auto Insurance Costs More for Young Drivers

Which is better, AAA or Geico auto insurance in Missouri?

Geico has the best auto insurance rates in Missouri. See who has the best Missouri insurance rates in your city with our free comparison tool.

Is Allstate auto insurance cheaper than Geico in Missouri?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.