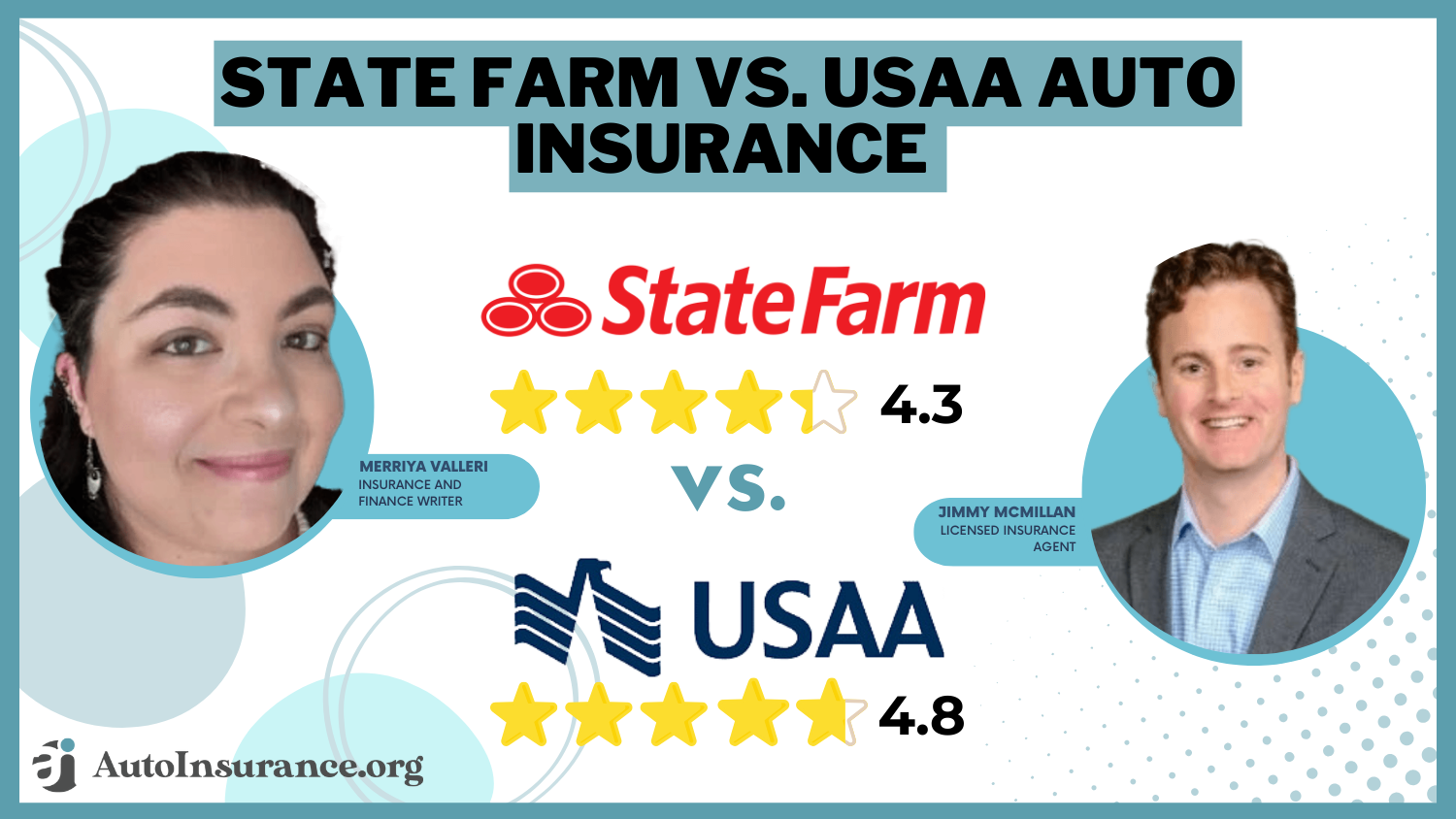

State Farm vs. USAA Auto Insurance in 2026 (Best Value Revealed)

State Farm vs. USAA reveals that USAA offers lower rates, starting at $22 per month, but is exclusive to military families, while State Farm averages $33 per month and is open to all drivers. This comparison breaks down coverage, customer service, and pricing in detail for USAA vs. State Farm auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated December 2024

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsState Farm vs. USAA auto insurance compares two main advantages, USAA offers military families lower rates, at $86 per month, whereas State Farm provides the most affordable coverage to all drivers.

USAA has better customer services, though its products are limited to military members alone, while State Farm caters to a wider circle of clients.

State Farm vs. USAA Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.8 |

| Business Reviews | 5.0 | 4.5 |

| Claim Processing | 4.3 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.7 |

| Customer Satisfaction | 4.1 | 4.7 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.9 | 4.6 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 3.8 | 4.7 |

| Savings Potential | 4.3 | 4.7 |

| State Farm Review | USAA Review |

Drivers who qualify for USAA compared to State Farm will find lower rates and perks, but those outside the military can enroll in State Farm and find competitive rates. Compare quotes to determine which is the best offer to meet your needs.

Pay for car insurance. Enter your ZIP code above to see if State Farm vs. USAA auto insurance can save you money.

- State Farm vs. USAA auto insurance spotlights USAA military benefits

- USAA vs. State Farm auto insurance shows wider eligibility at State Farm

- USAA offers military family members rates from $86 a month

Coverage Cost Comparison: State Farm vs. USAA

In comparing the State Farm vs. USAA car insurance coverage costs, it’s good to compare how several factors influence the coverage costs, especially how auto insurance companies check the driving record.

State Farm vs. USAA Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | 311 | $245 |

| Age: 16 Male | 349 | $249 |

| Age: 30 Female | $94 | $74 |

| Age: 30 Male | $103 | $79 |

| Age: 45 Female | $86 | $59 |

| Age: 45 Male | $86 | $59 |

| Age: 60 Female | $76 | $53 |

| Age: 60 Male | $76 | $53 |

Given a rating of 3.9, State Farm has competitive prices that favor several younger drivers and those with clean driving records. However, rates might be increased due to minor infractions or because drivers fall into other higher-risk categories.

With a competitive monthly rate of $86, State Farm consistently demonstrates strong value in the State Farm vs. USAA auto insurance landscape.Michelle Robbins Licensed Insurance Agent

On the other hand, USAA has a 4.6 rating and tends to present more affordable premiums for military families and veterans, which also come with discounts for safe driving as well as long-term loyalty. This way, this illustrates USAA vs. State Farm in that rewarding responsible drivers is indeed unique through loyal customer discounts.

Ultimately, such information is helpful to future policyholders in making informed choices about auto insurance. As such, in determining final insurance costs, attention ought to be paid to reputation and driving history individually for USAA insurance vs. State Farm.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Options: A Detailed Look at State Farm and USAA

Overall coverage review of USAA vs. State Farm car insurance would show that both companies carry policies that should meet the needs of the different clients. But with a rating of 3.8, State Farm provided a lot of options including gap insurance and additional add-ons, making it top among personalization for the same coverage.

USAA, however, excels at 4.7, and this is especially due to its specialized military-centric additions fortifying its policies-an important feature for the military family who needs all-rounded support.

State Farm vs. USAA Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $86 | $59 |

| Not-At-Fault Accident | $102 | $78 |

| Speeding Ticket | $96 | $67 |

| DUI/DWI | $112 | $108 |

Prospective customers considering Allstate vs. USAA or American Family vs. USAA can also look up the companies through the Better Business Bureau (BBB) platforms for user satisfaction and service quality information.

In the last case, understanding how to check whether a vehicle has auto insurance coverage can be vital in making a decision that matches your needs.

Discounts Available: State Farm vs. USAA

Assuming you know what the discounts are, then you will know how much your auto insurance generally costs. Comparisons of Farmers vs. USAA and Liberty Mutual vs. USAA prove both State Farm and USAA top out at 5.0, which means a really great discount selection that offers many savings opportunities, thus making coverage more affordable for clients.

USAA is only available to military personnel and their family members, thereby providing unique discounts that may be much wider than the competition.

For a person who needs car insurance cheaper than what USAA provides, browsing through State Farm may leave attractive offers, but USAA is the best auto insurance for military families and veterans due to its unique benefits and resources.

Lastly, this all comes down to assessing these discounts in a way to ensures that one makes the right decision for their own financial goals while ensuring adequate coverage.

Customer Reviews: Insights from State Farm and USAA Users

Compared to USAA, some light bulb moments emerge from customer feedback about State Farm. Users reveal some important differences here that may sway a future policyholder’s decision. State Farm has a 4.1 rating; it is noted for good customer service and more agency locations, with some complaining that the claims are rather slow.

USAA rated 4.7, is particularly favored by military men and women and their families, who appreciate easy claims and the general level of support the company offers. This may also extend to comparisons such as Progressive vs. USAA and Travelers vs. USAA, where a reputation for superior service by USAA might be a determining factor.

This is especially true when contemplating USAA auto insurance companies specializing in specific needs for military men and women. Disabled veterans seeking the best auto insurance, plans, and personal services offered by USAA may just be what they have in mind.

Overall, USAA tends to score higher on customer satisfaction while State Farm offers a much wider reach but seems to need improvement in its entire claims processing system.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Reviews: A Look at Ratings for State Farm and USAA

It is necessary to understand the standing of State Farm and USAA in the insurance landscape before evaluating their business scores. State Farm has decent ratings on multiple platforms. Its J.D. Power score is 877 which indicates good consumer satisfaction.

Insurance Business Ratings & Consumer Reviews: State Farm vs. USAA

| Agency | ||

|---|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction | Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: C- Below Avg. Business Practices | Score: A++ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 96/100 High Customer Satisfaction |

|

| Score: 0.78 More Complaints Than Avg. | Score: 1.74 More Complaints Than Avg. |

|

| Score: B Fair Financial Strength | Score: A++ Superior Financial Strength |

USAA scores better with a score of 882 which reflects excellent customer acceptance. In addition, State Farm scores a mere C- from the Better Business Bureau for business. On the other hand, USAA boasts an impressive A++ score. Therefore, it is more than relevant in comparing USAA vs. Allstate and USAA vs. Farmers.

The Consumer Reports, USAA scored a high rating of 96 out of 100, whereas State Farm obtained a rating of 75. Potential policyholders would also be able to compare USAA auto insurance rates and get a free quote from USAA, in comparison to other options such as USAA vs. Safe Auto.

This study is not only better insight into coverage and pricing but also part of a larger question of how to check if an auto insurance company is legitimate. In the end, USAA’s stellar ratings and consumer trust solidly place it as a major player in the auto insurance industry.

State Farm Pros and Cons

Different providers have pros and cons. On this, I consider the advantages and disadvantages of State Farm as viewed in the following main points.

Pros

- Comprehensive Agent Network: Provide a wide range of agents to offer personalized service.

- Comprehensive Coverage Options: Provides a wide range of coverage choices to fit various needs.

- Good Discounts: The company offers the best car insurance discounts that can reduce the premium.

Cons

- Slower Processing of Claims: In some cases, clients say claims processing is a bit slow.

- Premiums are Higher for Specific Profiles: USAA tends to be pricey for certain groups, hence inaccessible.

State Farm tends to overcharge certain demographics, so this is not one of the most attractive options to those groups.

USAA Pros and Cons

When you are thinking of your car insurance, it would be essential to weigh the advantages and disadvantages of USAA. Here are some of the pros and cons of the company:

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Pros

- Excellent Customer Care: It is believed that USAA offers quality services, especially targeting military families.

- Competitive Rate Offers: USAA provides premium discounts with huge savings.

- Good Financial Standing: USAA boasts a great reputation for being reliable and trustworthy.

Cons

- Military Exclusive: They will only sell to military personnel and veterans

- Restricted Availability: Insurers cannot be accessed in all states, thus some customers have no access to the insurance.

USAA is a winner in terms of services and competitive pricing for military and veterans, though its services are only available to very particular people. All of this plays into determining options such as USAA vs. State Farm home insurance and USAA vs. State Farm homeowners insurance.

State Farm vs. USAA Auto Insurance offers strong coverage, but State Farm excels in affordability, while USAA is the top choice for military families.Justin Wright Licensed Insurance Agent

It is for this reason that the best auto insurance for federal employees is a must-use guide to help identify the other options available for those not qualified through USAA.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Detailed Comparison of State Farm and USAA Auto Insurance

In a discussion on how to manage your auto insurance policy, it is of importance in the State Farm vs. USAA auto insurance debate that the unique benefits are considered by each provider. State Farm shines with a huge network of agents, as well as full coverage for a lot of discounts, making it accessible to a great number of customers.

USAA is also rated highly in customer satisfaction, and while the company is not necessarily the lowest-priced insurance quotes available, USAA has competitive rates for military families and veterans.

In the comparison of State Farm vs. USAA auto insurance, USAA offers a standout monthly rate of just $86, making it an excellent choice for budget-conscious drivers.

Because of its discounts and specialized coverage available to only eligible members, USAA makes it extremely attractive to those who qualify in USAA vs. Travelers.

Both companies have good business ratings and excellent financial health, so it is a question of personal needs and preferences which one to choose from. If you are seeking quotes to compare full coverage auto insurance, simply enter your ZIP code below to find out the current cost per quote at USAA and State Farm.

Frequently Asked Questions

Does State Farm offer a military discount?

State Farm provides a military discount for both active-duty service members and veterans. The specifics of this discount can differ depending on personal situations. For those interested in saving money, it’s worth looking into the best auto insurance discounts available to see how you can benefit from them.

Does State Farm offer gap insurance?

Yes, State Farm does offer gap insurance, which helps cover the difference between the amount owed on a car loan and the vehicle’s actual cash value in the event of a total loss.

Does USAA have local agents?

Yes, USAA has local agents, but their availability may vary by location. USAA primarily operates online and through phone services, but members can sometimes meet with agents in person at designated locations.

Who is qualified for USAA automobile insurance?

USAA automobile insurance is available primarily to active duty military members, veterans, and eligible family members. To qualify, individuals must meet USAA’s membership requirements. Compare full coverage auto insurance rates now. Just enter your ZIP code below to get started with USAA vs. State Farm auto insurance options.

How much is USAA car insurance full coverage?

Who qualifies for USAA auto insurance?

Qualification for USAA auto insurance includes active duty military personnel, veterans, and certain family members of those individuals. Membership is limited to those who have served in the military and their eligible dependents.

What discounts does USAA offer for car insurance?

USAA offers various discounts, including safe driver discounts, multi-policy discounts (for bundling auto and home insurance), good student discounts, and discounts for having anti-theft devices or low annual mileage.

Can I get car insurance from USAA if I am not in the military?

Generally, USAA is limited to military members, veterans, and their eligible family members. However, if you are related to someone who qualifies, you may also be able to apply for coverage under their membership.

How does State Farm’s coverage compare to USAA’s coverage?

What is the claims process like with USAA and State Farm?

Both companies offer streamlined claims processes. USAA provides a mobile app and online tools for filing claims, while State Farm also allows claims to be filed online or through its mobile app, as well as via local agents. Both companies are known for responsive customer service during the claims process.

Is State Farm cheaper than USAA?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.