Guaranteed Auto Protection (Gap) Insurance in 2026 (Coverage Explained)

Guaranteed Auto Protection (GAP) insurance coverage helps cover the difference between the amount you owe on your car loan or lease and the car's actual cash value (ACV) if your vehicle is totaled or stolen. GAP insurance costs range from $7 to $33 per month when added to your existing auto insurance policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated February 2026

Guaranteed Auto Protection (Gap) insurance safeguards drivers from financial loss if their vehicle is totaled and they owe more than the car’s current value.

This essential coverage can help bridge the gap between your insurance company’s payment and the remaining balance on your loan or lease, ensuring you’re not left with a large debt. Gap insurance, with prices ranging from $7 to $33 per month, is a cost-effective way to protect your investment, especially for those with new or financed vehicles.

The best auto insurance companies offer competitive rates and flexible terms, making it easier for drivers to balance affordability and comprehensive coverage. Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

- Guaranteed Auto Protection (Gap) insurance covers loan differences in total losses

- Gap insurance rates start at $7/month for affordable coverage

- Factors like customer service are vital in choosing the best Gap insurance provider

Pros and Cons of Guaranteed Auto Protection Insurance

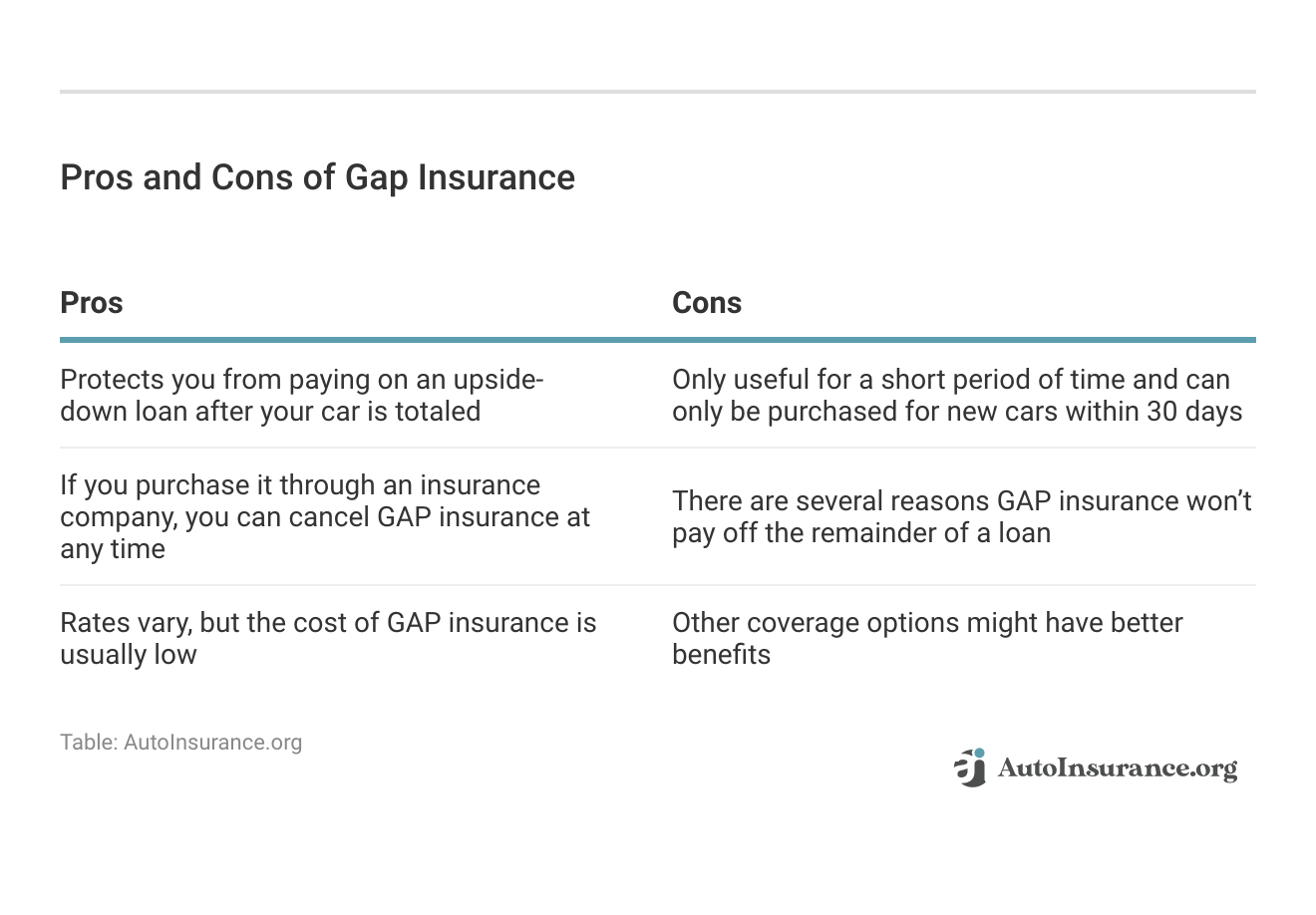

Guaranteed Auto Protection (Gap) insurance is a financial safety net for vehicle owners, covering the difference between the amount owed on a car loan and its actual cash value in the event of a total loss. Find out what are the recommended auto insurance coverage levels.

While it offers peace of mind for those financing or leasing a vehicle, weighing its benefits against potential downsides is essential. Understanding the pros and cons of Gap insurance can help you make an informed decision that aligns with your financial goals and needs.

Are you wondering if Gap insurance coverage is right for you? Consider the following reasons to buy it, as well as the reasons why you may not want to:

In conclusion, Gap insurance can be a valuable addition to your auto insurance policy, particularly for those with high loan balances on their vehicles. Considering the advantages and disadvantages, you can determine if Gap insurance is the right choice. Always evaluate your circumstances and consult an insurance professional to ensure you make the best financial protection decision.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding More About Gap Auto Insurance Coverage

Gap insurance, or guaranteed asset protection, is an important add-on for individuals with an auto loan or lease, designed to protect against financial loss if their car is totaled. In case of a car theft or total loss, Gap insurance covers the difference between what you owe on the loan and the vehicle’s actual cash value (ACV).

During the first few years of ownership, vehicle owners may be in an upside-down loan situation where the amount owed exceeds the car’s worth. Although this may not pose an issue initially, it becomes problematic if the car is totaled, as standard auto insurance only reimburses the ACV, leaving you responsible for any outstanding loan balance.

You may have heard 👂that comparing car🚗 insurance quotes can lead to savings🤑, but are you intimidated by the process? It’s time to figure it out so you can save. We have the step-by-step guide for you right here👉:https://t.co/7c2R2bodbp pic.twitter.com/8vc6ZXcmhX— AutoInsurance.org (@AutoInsurance) October 1, 2024

While it is a common misconception that a new car loses half its value the moment it leaves the dealership, according to Kelley Blue Book, it generally depreciates by about 20% in the first year. Gap insurance addresses this depreciation. For instance, if your car is valued at $10,000 after an accident but you owe $15,000 on your loan, Gap insurance will cover the remaining $5,000 after your deductible is paid.

However, not everyone qualifies for Gap insurance; eligibility often requires having collision and comprehensive coverage, and you may need to be the first owner or leaser of the vehicle.

Requirements can vary among insurance providers, so it’s essential to consult with an insurance representative for specific details. Read here for additional information about the different types of auto insurance.

Gap Insurance on an Auto Loan

Although you can buy Gap coverage as an add-on to your car insurance policy, many dealers and lenders include it when you purchase your vehicle. If you get Gap coverage this way, the price is included in your monthly car payment. But, while convenient, it’s not as affordable — you’ll pay interest on the Gap coverage along with everything else in your loan.

Not all dealerships offer Gap insurance, so it’s a good idea to ask when you buy a new car. Leased vehicles depreciate at the same rate as any other car, which means it’s not difficult to owe more than it’s worth after an accident.

Due to this financial risk, you should consider getting Gap coverage for the first part of your lease. Like car loans, many dealerships build Gap coverage directly into the lease. However, you’ll pay less overall if you get Gap coverage through your insurance company instead.

What Gap Insurance Doesn’t Cover

Gap insurance does not cover regular maintenance expenses, personal items inside the vehicle, or the deductible from your primary auto insurance policy. While it is a valuable financial tool, it will not pay overdue payments or late fees on your lease or loan, auto insurance deductibles, penalties for excessive mileage, security deposits, down payments on new vehicles, or extended warranties.

Additionally, Gap insurance typically won’t cover leased vehicles beyond the gap amount or any missed payments on your auto loan. Despite these limitations, Gap coverage can be a crucial safeguard, helping you avoid paying off the remainder of your loan or lease if your car is totaled.

Read our guide if you want to know more about leasing with auto insurance.

How to Know Whether You Have Gap Insurance Coverage

Determining whether you have Gap coverage is straightforward, and you can check in two main ways. Start by reviewing your car insurance policy. You can likely find this information online, but you can also contact an insurance representative for assistance. For additional guidance, consider how to manage your auto insurance policy.

Another option is to examine the terms of your car loan or lease to see if Gap coverage is included. If sifting through paperwork isn’t appealing, contact the dealership where you purchased or leased your vehicle for help. Find out what proper auto insurance covers for more information.

Deciding Whether Guaranteed Auto Protection Insurance is Worth it

While Gap coverage can save you a lot of money if you buy a brand-new car, it isn’t necessary for everyone. You won’t need it if you own your car outright or have paid your loan down below the value of your vehicle. Learn more about what standard auto insurance covers.

You’ll benefit from Gap coverage if you:

- Choose to finance for 60 months or longer

- Put less than 20% for a down payment

- Have a lease on your car

- Bought a vehicle that depreciates faster than average

- Rolled over negative equity from an old car loan

Insurance companies determine the value of totaled cars by calculating the Actual Cash Value (ACV), which considers factors such as age, mileage, condition, and market trends. They often reference sources like Kelley Blue Book and Edmunds to ensure fair compensation when a vehicle is deemed a total loss.

Gap coverage can protect you from the burden of paying whatever is left on your loan if you total your car. However, Gap coverage isn’t always a good purchase, particularly if you:

- You will be paid off your loan in less than five years

- Put more than 20% down

- Bought a car that depreciates slower than the average vehicle

If you’re unsure if Gap insurance suits you, you can always speak with an insurance representative. They’ll be able to help you decide how much coverage you need.

Gap Insurance vs. Full Coverage

Gap insurance and full coverage serve distinct purposes in protecting your vehicle investment. While full coverage insurance safeguards against damages to your car and liability for injuries, Gap insurance fills the financial void if you owe more on your auto loan than your car’s actual cash value. Understanding the differences between these two types of coverage can help you make informed decisions about your insurance needs.

Full coverage includes the following policies:

- Liability Liability Auto Insurance

- Comprehensive Liability Auto Insurance

- Collision Liability Auto Insurance

- Uninsured Motorist Coverage

- Medical Payments Coverage

You’ll probably need full coverage if you have a car loan or lease. While full coverage auto insurance protects your car from most of what life can throw, it won’t help you pay off your auto loan. That’s why we recommend you buy Gap coverage until you pay down your loan.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Gap Insurance

Although Gap coverage can save you thousands of dollars, it’s usually very affordable. Most Gap insurance policies cost as little as $20 a year. However, insurance companies charge different amounts for their coverage options and types of auto insurance. Get more information on the average auto insurance cost per month.

Your second option for Gap insurance is with the dealership you buy or lease your car from. You’ll pay much more for Gap insurance if you choose this option, as dealerships usually charge a flat fee of $500-$700.

When you buy Gap coverage from a dealership, it lasts as long as the loan. If you get Gap coverage from an insurance company, it lasts until you cancel it. You typically only need Gap coverage for your loan’s first year or two. Once you’ve paid the loan down to the point where your car’s ACV is more than you owe, you can cancel your Gap coverage.

The Best Gap Auto Insurance Providers

Finding the right Gap auto insurance provider is essential for safeguarding your finances in the event of a total loss. The best providers offer comprehensive coverage that bridges the gap between what you owe on your auto loan and your vehicle’s actual cash value. In this guide, we’ll explore top Gap auto insurance providers to help you make an informed choice for your protection.

While Gap coverage is affordable and valuable protection, not all insurance companies offer it. If buying Gap coverage from an insurance company sounds appealing, consider the following options and read the following reviews on them:

- State Farm Auto Insurance

- American Family Auto Insurance

- Auto-Owners Auto Insurance

- USAA Auto Insurance

- Liberty Mutual Auto Insurance

- Nationwide Auto Insurance

- Travelers Auto Insurance

For example, State Farm offers Payoff Protector, and USAA has Total Loss Protection, but only for auto insurance policyholders who get a car loan through those companies. Progressive offers loan/lease payoff protection, similar to Gap coverage.

Remember that Gap protection is usually not available as a stand-alone policy. If you’re interested in Gap insurance but your company doesn’t sell it, you might have to look for alternative insurance companies.

How Insurance Companies Decide to Total a Car

A key component of your Gap coverage is that your car needs to be declared a total loss. A vehicle is considered totaled when the price of repairing it crosses a threshold compared to its value.

While every company differs, a car is declared totaled when repair costs reach 75%—90% of its value. However, companies must follow state laws before declaring a car totaled. Continue reading about how insurance companies value totaled cars.

When a vehicle is declared totaled, its original clean title is replaced with a salvage title. Car insurance companies often sell vehicles with a salvage title to recoup some of their losses. If a salvage car is repaired and passes state inspection, it will be issued a rebuilt title. Vehicles with a rebuilt title can be resold, driven, and insured.

Read more: Rebuilt Title Auto Insurance

How Depreciation Affects Gap Insurance

Vehicles lose some of their value every year except for some classic cars. In the first five years, the highest loss of value is seen, and then depreciation tends to slow. The amount of time you need to pay for Gap insurance depends on how quickly your car depreciates — if your vehicle loses value quickly, you should keep Gap coverage longer.

You might notice that many cars that lose value the quickest are luxury cars with hefty price tags. Luxury cars depreciate faster because people buying them often trade them back after a few years for a newer model. Drivers looking for a used car don’t usually want to pay for the higher cost of an outdated luxury car. The best auto insurance for luxury cars is also expensive.

Many cars with the slowest depreciation are popular regardless of year. Jeep Wranglers and Chevrolet Corvettes are the top choices for new and used vehicles. No matter how quickly your car depreciates, car loan insurance can keep you safe if you total your car. However, you should carefully monitor your car’s value compared to your loan so you can cancel as soon as possible.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alternatives to Gap Insurance

Exploring alternatives to Gap insurance can help you protect your finances in case of a total loss without purchasing a separate policy. Options such as loan forgiveness programs, increasing your down payment, or selecting a vehicle with slower depreciation rates can be effective substitutes.

This article will discuss these alternatives and their benefits to help you make informed decisions about your coverage needs. Although Gap insurance offers excellent protection, it’s not the only thing that can help people with a loan or lease. Get more insights by reading our article about new car replacement insurance.

If you’re trying to decide which coverage is best for you, consider the following options:

- Replacement Value Insurance: Also called new car replacement, this optional insurance pays for a replacement car of the same make and model instead of your vehicle’s ACV.

- Loan-Lease Coverage: Loan-lease and Gap coverage are similar, but loan-lease insurance covers a broader range of cars. You can purchase loan-lease insurance anytime, and used vehicles are eligible for coverage.

- Better Car Replacement Coverage:Some insurance companies sell an add-on to replace your totaled car with a newer model. This add-on usually has mileage limitations. You can find usage-based auto insurance if you have mileage limitations.

If you’re interested in protecting yourself from paying an upside-down loan after totaling your car, an insurance representative can help you decide which option is right for you.

Read more: Replacement Cost vs. Actual Cash Value: Car Insurance

Find the Best Guaranteed Auto Protection Insurance for Your Car

Buying a new car should be exciting, but that can quickly become a nightmare if you have the misfortune of totaling your vehicle. To get back behind the wheel of a new car as soon as possible, you should consider Gap coverage to help pay off your loan.

Gap insurance is a smart investment for those financing or leasing a car, as it protects against the unexpected depreciation that can leave you financially vulnerable.Travis Thompson Licensed Insurance Agent

While you can buy it from a dealership, you’ll pay less for Gap coverage from an insurance company. Start comparing auto insurance rates online with as many companies as possible to find the best Gap coverage for your car. Getting an instant auto insurance comparison online is quick and easy. Enter your ZIP code below to compare Gap insurance quotes for free.

Frequently Asked Questions

What is stand-alone Gap insurance?

Stand-alone Gap insurance is a specialized policy you purchase independently, separate from your primary auto insurance. It covers the difference between your vehicle’s market value and the remaining balance on your loan or lease in case your car is totaled.

Who is the best Gap insurance provider?

The best Gap insurance provider varies based on your needs, such as pricing, customer service, and the level of coverage provided. It’s important to compare different options, read reviews, and consider each company’s reputation to make an informed decision.

How much is Gap insurance a month on average?

Gap insurance costs vary, but monthly premiums range from $20 to $60 on average. The exact amount depends on whether you purchase it through auto insurance that offers Gap coverage or as a stand-alone policy. Discover how to compare auto insurance quotes.

What are Gap auto insurance companies?

Auto insurance companies offer Gap insurance either as an add-on to your auto insurance policy or as a stand-alone option. These companies help cover the difference between your car’s actual cash value and the amount you still owe on a loan or lease.

Does auto insurance offer Gap coverage?

Auto insurance that offers Gap coverage provides an additional layer of protection, bridging the gap between your car’s depreciated value and the amount still owed on the loan if the vehicle is totaled or stolen.

How does auto loan/lease coverage work?

Auto loan/lease coverage ensures that if your leased vehicle is declared a total loss, the remaining lease balance is covered, protecting you from having to pay out-of-pocket for the difference between your insurance payout and lease amount.

For further details, check out whether you can return a financed car without getting a penalty.

What are the best Gap insurance companies?

The best Gap insurance companies offer affordable premiums, responsive customer service, and customizable coverage options that meet the specific needs of car owners and vehicle types.

How can I find the best Gap insurance deals?

To find the best Gap insurance deals, compare quotes from multiple providers, read customer feedback, and look for discounts or bundled offers that may lower your overall premium cost.

What is the best Gap insurance for new cars?

The best Gap insurance for newer vehicles typically includes policies that offer comprehensive coverage at a low premium rate, providing peace of mind by covering the full difference between the car’s value and loan balance for newer vehicles.

Is there a best Gap insurance for used cars?

The best Gap insurance for used cars should provide affordable options and flexible terms to cover the difference between the car’s value and the remaining loan amount, even as the vehicle depreciates.

You can get instant car insurance quotes from top providers by entering your ZIP code below.

What should I know about the best Gap insurance policies?

Can Gap insurance be canceled at any time?

Can I buy Gap insurance on my own without involving a dealership?

Can you add Gap insurance after you buy a car?

Can you get Gap insurance through your insurance company?

How is Gap car insurance explained?

How do I compare Gap insurance prices effectively?

What is the coverage Gap discount program?

What is the typical cost of Gap insurance at a dealership?

How can I find my gap insurance provider online?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.