How much car insurance do I need?

If you are asking how much car insurance do I need, the insurance amount needed depends on your state’s requirements. In almost every state, drivers must carry at least minimum liability insurance to drive legally. The cost of a minimum liability insurance policy is an average of $44 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Aremu Adams Adebisi graduated from college with a B.Sc in Economics. He's currently pursuing his MBA while writing insurance features covering trending topics in the car insurance industry. He's fascinated by the surges of insurtech in an era of decentralized finance (DeFi). Aremu has written for several insurance agencies and companies. He profiles startups on Insideropedia and serves as a con...

Aremu Adams Adebisi

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated October 2024

Do you ask yourself, “How much car insurance do I need?” The answer is that you will have to carry the required car insurance coverage required by your state at the bare minimum.

You can then choose whether or not you want to carry additional car insurance coverages beyond just the basic cheap auto insurance policies. Remember, all drivers must carry the required coverages in their state or risk fines and loss of driving privileges.

Continue reading to learn which coverages you must carry in your state, optional coverages you may wish to add to your policy, and more.

- Required coverages and limits will vary from state to state, but commonly required coverages are liability, MedPay, or PIP insurance

- Drivers should usually carry more than the state minimum car insurance for better protection after an accident

- Drivers caught driving without insurance face fines, increased insurance rates, loss of driving privileges, and more

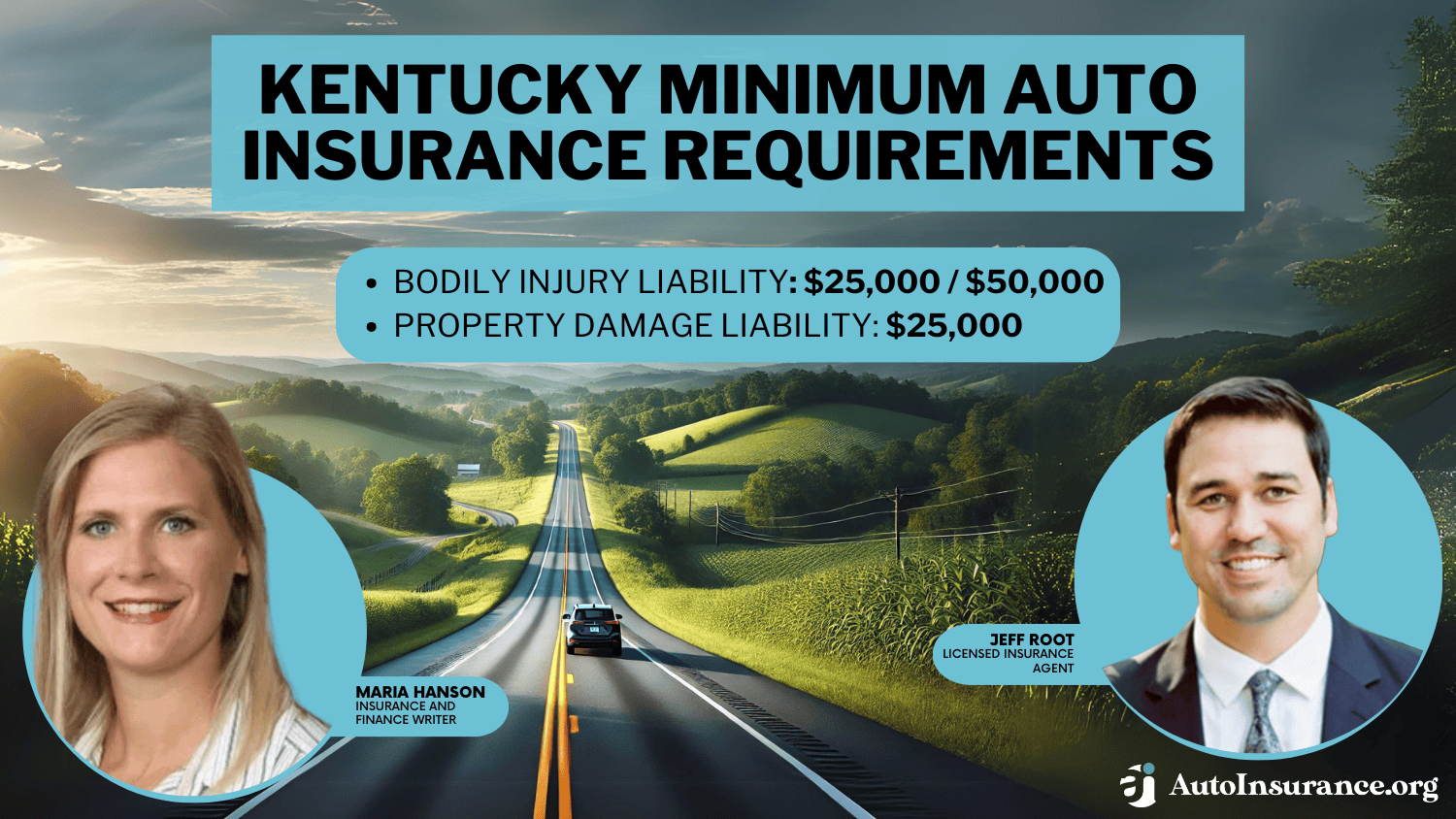

Minimum Auto Insurance Requirements by State

Every state is different in terms of what coverages it requires drivers to carry. Some states have much more extensive coverage requirements than others, meaning the cost of car insurance may be more expensive.

Below, you can see which minimum coverage car insurance is required in each state according to the Insurance Information Institute (III).

Auto Insurance Minimum Legal Requirements by State

| State | Minimum BI & PD Liability Limits | Required Insurance Policies |

|---|---|---|

| Alabama | 25/50/25 | BI + PD Liability |

| Alaska | 50/100/25 | BI + PD Liability |

| Arizona | 15/30/10 | BI + PD Liability |

| Arkansas | 25/50/25 | BI + PD Liability, PIP |

| California | 15/30/5 | BI + PD Liability |

| Colorado | 25/50/15 | BI + PD Liability |

| Connecticut | 25/50/20 | BI + PD Liability, UM, UIM |

| Delaware | 25/50/10 | BI + PD Liability, PIP |

| District of Columbia | 25/50/10 | BI + PD Liability, UM |

| Florida | 10/20/10 | BI + PD Liability, PIP |

| Georgia | 25/50/25 | BI + PD Liability |

| Hawaii | 20/40/10 | BI + PD Liability, PIP |

| Idaho | 25/50/15 | BI + PD Liability |

| Illinois | 25/50/20 | BI + PD Liability, UM, UIM |

| Indiana | 25/50/25 | BI + PD Liability |

| Iowa | 20/40/15 | BI + PD Liability |

| Kansas | 25/50/25 | BI + PD Liability, PIP |

| Kentucky | 25/50/25 | BI + PD Liability, PIP, UM, UIM |

| Louisiana | 15/30/25 | BI + PD Liability |

| Maine | 50/100/25 | BI + PD Liability, UM, UIM, Medpay |

| Maryland | 30/60/15 | BI + PD Liability, PIP, UM, UIM |

| Massachusetts | 20/40/5 | BI + PD Liability, PIP |

| Michigan | 20/40/10 | BI + PD Liability, PIP |

| Minnesota | 30/60/10 | BI + PD Liability, PIP, UM, UIM |

| Mississippi | 25/50/25 | BI + PD Liability |

| Missouri | 25/50/25 | BI + PD Liability, UM |

| Montana | 25/50/20 | BI + PD Liability |

| Nebraska | 25/50/25 | BI + PD Liability, UM, UIM |

| Nevada | 25/50/20 | BI + PD Liability |

| New Hampshire | 25/50/25 | Financial Responsibility only |

| New Jersey | 15/30/5 | BI + PD Liability, PIP, UM, UIM |

| New Mexico | 25/50/10 | BI + PD Liability |

| New York | 25/50/10 | BI + PD Liability, PIP, UM, UIM |

| North Carolina | 30/60/25 | BI + PD Liability, UM, UIM |

| North Dakota | 25/50/25 | BI + PD Liability, PIP, UM, UIM |

| Ohio | 25/50/25 | BI + PD Liability |

| Oklahoma | 25/50/25 | BI + PD Liability |

| Oregon | 25/50/20 | BI + PD Liability, PIP, UM, UIM |

| Pennsylvania | 15/30/5 | BI + PD Liability, PIP |

| Rhode Island | 25/50/25 | BI + PD Liability |

| South Carolina | 25/50/25 | BI + PD Liability, UM, UIM |

| South Dakota | 25/50/25 | BI + PD Liability, UM, UIM |

| Tennessee | 25/50/15 | BI + PD Liability |

| Texas | 30/60/25 | BI + PD Liability, PIP |

| Utah | 25/65/15 | BI + PD Liability, PIP |

| Vermont | 25/50/10 | BI & PD Liab, UM, UIM |

| Virginia | 25/50/20 | BI + PD Liability, UM, UIM |

| Washington | 25/50/10 | BI + PD Liability |

| West Virginia | 25/50/25 | BI + PD Liability, UM, UIM |

| Wisconsin | 25/50/10 | BI + PD Liability, UM, Medpay |

| Wyoming | 25/50/20 | BI + PD Liability |

- How Much Auto Insurance You Need

- Adding a Driver to Auto Insurance: What You Should Know (2026)

- Do I need full coverage insurance to finance a car?

- Do you need insurance on a car that doesn’t run?

- The Three-Tire Rule Defined (2026)

- Does auto insurance cover passengers in an accident?

- Is full coverage auto insurance required to lease a car?

- Can you drive a car if your name is not on the insurance?

- Do you need medical payment coverage on auto insurance?

- When to Buy More Than Minimum Auto Insurance in 2026 (Coverage Advice)

- What is needed for adequate auto insurance coverage? (2026 Driver’s Guide)

- What are the recommended auto insurance coverage levels?

- Top 5 Auto Insurance Myths (2026)

If you don’t carry the insurance coverage required by your state, you are driving illegally. If caught, you face suspended licenses, fines, and increased insurance rates. For a detailed explanation of these required coverages and how they protect you and other drivers, take a look at the next section that goes over the state-required coverages.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Required Auto Insurance Coverages Explained

Why do you need car insurance required by the state? The coverages required by different states serve one of two purposes. They either work to protect the driver by paying for their medical bills, or they work to protect other drivers by paying for other parties’ medical bills and property damage bills. We’ve outlined each insurance coverage type below, so you know what you purchase when applying for your state’s minimum policies.

Bodily Injury Liability Insurance

Bodily injury liability insurance is required in almost every state except for Florida and New Jersey. If you cause a crash, bodily injury liability will pay for the other party’s medical bills. There are usually two limits to bodily injury liability insurance.

One limit is how much an insurance company will pay per person for medical bills, such as $20,000. The other limit is how much an insurance company will pay per accident, such as $40,000. If you cause a crash that injures multiple people, bodily injury liability insurance won’t pay up to the per-person amount if it exceeds the per-accident limit.

Property Damage Liability Insurance

Like bodily injury liability insurance, property damage liability insurance pays for other parties’ bills in an accident you cause. However, instead of medical bills, property damage liability insurance pays for property repairs, such as car repairs or fixing broken fences.

Just as with bodily injury liability insurance, there will be a limit on what your insurance company will pay for damages. Keep in mind that you can always choose to purchase more liability coverage than what is required by your state. So if your state has low limits for either liability insurance coverage, you can choose to purchase a higher limit to protect yourself better.

Check out the best property damage liability auto insurance companies.

Uninsured Motorist/Underinsured Motorist Insurance

Uninsured motorist and underinsured motorist insurance are often sold as a package deal, but you can also purchase them separately if your state only requires one of these coverages. Generally, states with a high number of uninsured drivers or that don’t require car insurance will require drivers to carry this insurance to protect drivers better.

With uninsured motorist coverage, you will be protected if the driver who caused the accident doesn’t have insurance. With an underinsured motorist, you will be protected if the driver who caused the accident doesn’t have enough insurance to cover your accident costs.

For example, a driver may only have $10,000 of property damage liability insurance, but they totaled your new car worth $15,000. In this case, underinsured motorist insurance will help pay the rest of the bill, so you aren’t financially responsible for damages that weren’t your fault.

Medical Payments (MedPay) Insurance

MedPay isn’t required in most states, but it is a useful coverage that ensures your medical bills are paid after an accident. It is commonly required in no-fault states.

It will pay for the policyholder’s and the passenger’s medical bills, regardless of who was at fault for the accident. As with all other insurance coverages, there is a limit on how much MedPay will cover the medical bills.

Personal Injury Protection (PIP) Insurance

Personal injury protection insurance is similar to MedPay, as it will cover the policyholder’s and passengers’ medical bills regardless of who was at fault for the accident and is usually required by no-fault states.

However, unlike Medpay insurance, PIP insurance also covers the following:

- Childcare

- Funeral costs

- Lost wages

- Rehabilitation

Even if PIP isn’t required in your state, it can be useful insurance coverage to carry to lessen the financial burden after a crash.

Deciding if Your State Minimum Insurance Is Enough

Because you only have to carry the state minimum to drive legally, you may wonder if you have to carry anything besides the required coverages. The answer is that it depends upon the individual driver. While one driver may not be putting themselves at financial risk by just carrying minimum coverage, another driver could face huge financial losses by just carrying what is required in their state.

Generally, your state minimum liability insurance won’t be enough coverage unless you have an older vehicle whose overall value is significantly depreciated. If you have a newer car, you should carry full coverage so that your policy will cover your repairs if you cause an accident that is outside your control, such as hitting an animal or fire.

Most drivers should also carry more than the minimum liability limits set in their state, especially if they live in a high-risk area or have low state limits. Higher liability limits on your insurance will ensure you aren’t stuck with out-of-pocket bills after causing an accident.

Optional Auto Insurance Coverage

There are a few other car insurance coverages you may want to consider carrying from the best companies in your area, depending on your individual needs.

Some common types of optional car insurance coverages are as follows:

- Collision auto insurance. Collision insurance will pay for your repairs if you cause an accident by crashing into another car or an object like a telephone pole.

- Comprehensive auto insurance. Comprehensive insurance pays for repairs from animal collisions, falling objects, weather damage, theft, and vandalism.

- GAP insurance. If your car is totaled, GAP insurance will pay the difference between what is left on your lease or loan and the depreciated value of your car.

- Modified car insurance. If you have any modifications to your car, such as a custom paint job, modified car insurance will pay for damages to the modifications after an accident.

- Rental car reimbursement insurance. If your car is in the repair shop after a covered claim, rental reimbursement insurance will pay for a rental car.

- Roadside assistance insurance. Roadside assistance insurance will help drivers who lock themselves out of their car, run out of gas, get a flat tire, and other common situations.

These are some of the common car insurance coverages that drivers add depending on their budget and coverage needs.

What Deductible You Should Choose

An auto insurance deductible is an amount you agree to pay out-of-pocket towards your car repairs. So if you pick a $500 deductible and have $3,000 worth of damages, insurance will give you only $2,500 because you agreed to pay $500.

You can usually choose which deductible you want for each insurance coverage on your policy, which makes it easy to customize by changing deductibles by your risk level. For example, suppose there is a high chance of you filing a collision claim but not a comprehensive claim. In that case, you can make your comprehensive deductible higher to lower your rates but keep your collision deductible low.

A good rule of thumb when choosing a deducible, no matter the coverage, is to select an amount you can readily pay for out of pocket. If you can’t pay your deductible, you won’t be able to get your car fixed until you can save up the money.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Final Word on How Much Auto Insurance You Need

All drivers must carry the minimum insurance required by their state, but any coverage after that is up to the discretion of the drivers. However, we recommend that if you can afford it, you should carry more than what is required in your state, as carrying just the minimum amount could cause financial ruin after a serious accident.

Now that you know the answer to how much car insurance do I need, you can start shopping for coverage. To find savings on car insurance in your area, use our free quote comparison tool to find rates from different insurance companies.

Frequently Asked Questions

Is car insurance required?

Yes, car insurance is a requirement in all states except for New Hampshire, but you must still show proof of financial ability to pay for accident costs to opt out of carrying traditional auto insurance coverage. What coverages and limits you must carry will vary from state to state.

What happens if drivers don’t get insurance?

If caught driving without insurance, drivers face fines, suspended licenses, increased insurance rates, and more. Drivers will also be solely responsible for the cost of an accident if they cause an accident, in addition to the penalties listed.

How long do drivers need car insurance?

Do you have to have car insurance? The answer is that drivers need car insurance as long as they own a car and are driving. If you’ve sold your car and are no longer driving, then you don’t need car insurance anymore.

What states don’t require car insurance?

New Hampshire doesn’t require car insurance for drivers to drive legally, but you must show proof of financial capability to pay off expensive bills to opt out of car insurance.

What are the minimum car insurance requirements in my state?

The minimum car insurance requirements vary from state to state. You should check with your local Department of Motor Vehicles (DMV) or consult with an insurance agent to understand the specific requirements in your state.

What are the different types of car insurance coverage?

Car insurance typically includes several types of coverage, such as liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP). Each type of coverage provides different levels of protection.

What is a good amount of coverage?

Full coverage insurance is a good amount of coverage for most drivers. Full coverage consists of the state-required coverages, plus collision and comprehensive insurance.

What do car insurance limits mean?

Car insurance limits are the maximum amount insurance will pay after an accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.