How to Buy Auto Insurance Online Instantly in 2026 (Simple Step-by-Step Guide)

The way you buy auto insurance online instantly is by gathering driver and vehicle info, comparing auto insurance quotes, and selecting the best coverage. Use tools to find rates, often almost 50% lower, and look for discounts. Finalize your policy online and get proof of insurance immediately after payment.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Buying auto insurance online instantly is simple and convenient. Start by gathering your personal and vehicle details, then use comparison tools to review quotes from multiple insurers.

Analyze coverage options, check for available discounts, and finalize your policy online in minutes. Get proof of insurance instantly. Enter your ZIP code into our free quote tool above to compare rates.

- Step #1: Gather Information – Prepare driver details, vehicle info, and history

- Step #2: Compare Quotes – Use comparison tools to review various insurers

- Step #3: Analyze Coverage – Check liability, comprehensive, & collision choices

- Step #4: Check Discounts – Look for offers based on driving history or others

- Step #5: Finalize Coverage – Sign up, make payment, and get proof of insurance

Get Auto Insurance Coverage Now With These 5 Easy Steps

Step #1: Gather Personal Information

Before you start searching for instant auto insurance, make sure to have all necessary details on hand. You’ll need full names, driver’s license numbers, birth dates for all drivers, and specific vehicle details such as the make, model, and VIN number.

Insurance companies will also ask about your driving history, including past violations or accidents, especially if you’re looking for cheap auto insurance after an accident. Having this information ready ensures that your quotes will be accurate and saves you time during the application process.

Step #2: Compare Multiple Quotes

Once you have your information, use an online comparison tool to getting multiple auto insurance quotes from multiple insurance companies. These tools allow you to input your details once and see rates from different providers side by side.

Comparing multiple quotes helps you find the best balance between price and coverage. It’s also a great way to identify any available discounts or special offers. Make sure to review coverage details carefully, not just the price.

Step #3: Analyze Coverage Options

When comparing quotes, it’s important to review the types of auto insurance coverage offered by each insurer. Basic liability is required by law, but you may need additional protection like comprehensive, collision, or personal injury protection depending on your situation.

Be sure to check how much of your premium goes toward each type of coverage and consider adjusting deductibles or policy limits to suit your needs. Understanding your coverage options will help you make an informed decision.

Step #4: Check for Discounts

Insurance companies often offer auto insurance discounts that can significantly lower your premium. Look for discounts based on good driving records, vehicle safety features, bundling policies, or even your profession.

Many comparison tools will highlight these discounts, but it’s also worth asking the insurer directly to ensure you’re getting the best rate. Taking advantage of discounts can help you save money while still getting the coverage you need.

Step #5: Finalize and Purchase Coverage

After selecting the best quote, proceed to finalize your coverage by signing up online. You’ll typically need to provide electronic signatures and make a payment to activate your policy. Some insurers may offer cheap auto insurance with no down payment, while others will require a down payment to start coverage.

Once your payment is processed, you should receive your proof of insurance electronically. Make sure to print or save this documentation for future reference.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Instant Car Insurance Online Coverage Explained

If you need to buy cheap car insurance online quickly, you can save almost 50% by learning how to compare auto insurance quotes from different companies. Many insurance companies now collaborate with comparison sites to provide quotes in seconds. When requesting a quote online, be ready to share basic details about your life and driving habits.

The company will verify your information, so accuracy is crucial to avoid higher rates or loss of coverage. Your quote depends on your needs, budget, and driving record. You can now get auto insurance instantly without waiting for a representative. With online tools, finding and securing the best prices has never been easier.

Key Factors Beyond Price When Choosing Instant Auto Insurance

Because it is so quick and easy to compare competitive quotes, insurers have been forced to offer competitive prices to attract new customers. Of course, customers should not just shop for coverage by price. It is important to find an auto insurance company that has a good record of paying claims quickly and reasonably, too. Compare auto insurance rates to get the very best deals.

Finding cheap online auto insurance quotes online is very easy and nearly instantaneous in most cases. It is more about what you do with quotes and how you analyze the lines of coverage in proposed policies that makes the difference. Let’s begin comparing the average annual rates of companies with the highest market share in auto insurance.

Auto Insurance Average Rates by Term Length

| Insurance Company | Monthly Rates | 6-Month Rates | Annual Rates |

|---|---|---|---|

| $34 | $204 | $407 | |

| $24 | $144 | $287 | |

| $29 | $175 | $350 | |

| $22 | $134 | $268 | |

| $42 | $253 | $506 |

| $24 | $144 | $288 |

| $28 | $168 | $336 | |

| $23 | $136 | $272 | |

| $31 | $185 | $370 |

USAA auto insurance has the cheapest auto insurance rates in the U.S., but it carries a smaller market share than State Farm. If you go through each company’s website, you will be able to get auto insurance instantly.

Most companies require that you make a down payment, while some don’t. If you do buy auto insurance online instantly with no down payment, you will have to pay the policy amount to start immediate auto insurance coverage.

A down payment on your auto insurance policy will lower monthly payments.

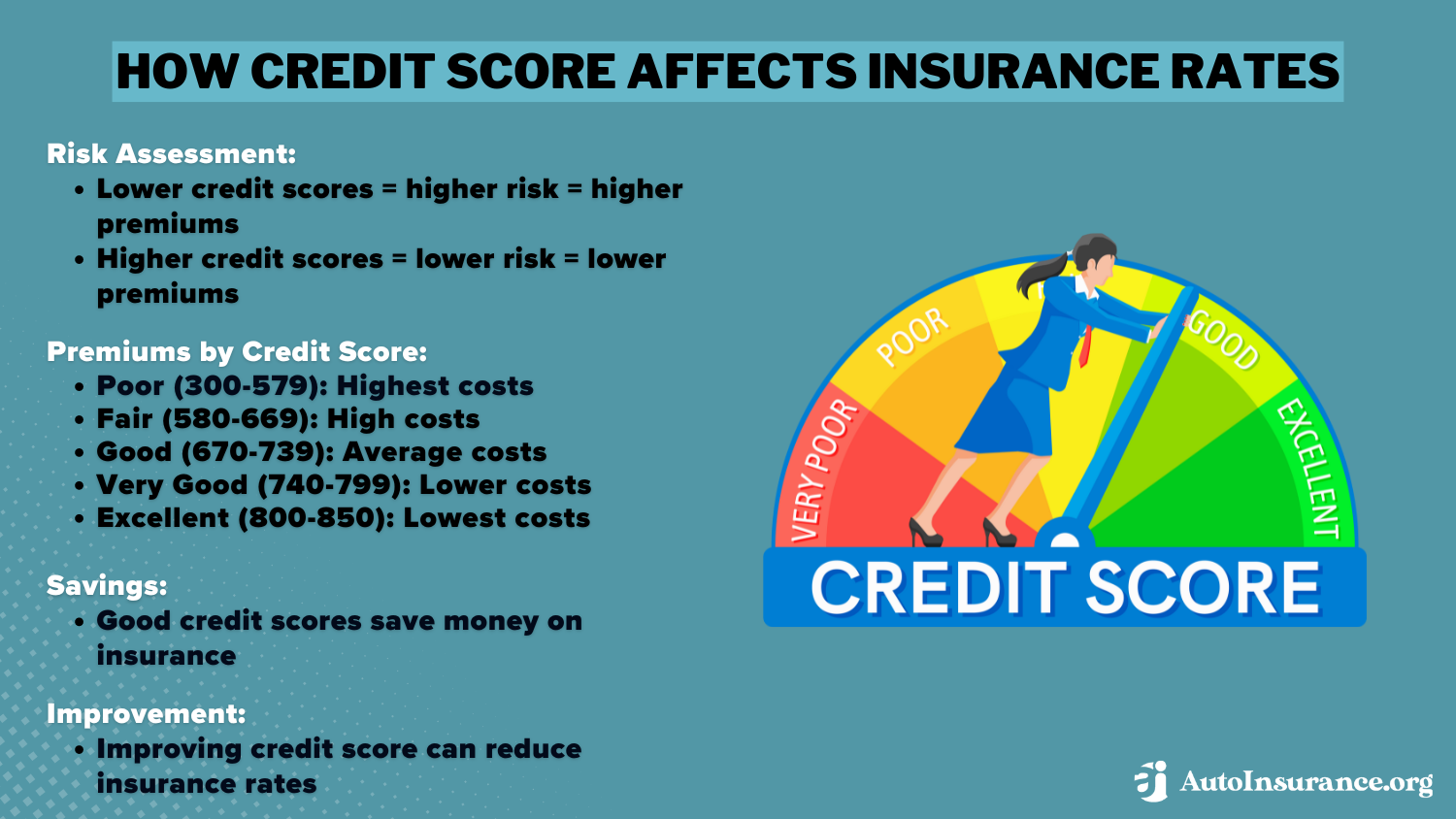

Did you know that auto insurance companies will give you a discount for having good credit? According to the Federal Trade Commission, companies offer lower prices to consumers if they have good credit. That’s because people who maintain a good credit score are less likely to file a claim.

It never pays to save a few bucks on rates only to find that claims handling and customer service are lacking. However, it is much easier to figure out which insurer will offer you the best deal. Get instant car insurance quote online by comparing quotes to find the best deal.

This ability to get instant auto insurance quote helps consumers save money, and it also probably keeps insurers very competitive with each other.

Instant Online Car Insurance Quotes Offer Transparency and Competition

Today’s online auto insurance quotes have helped consumers get the best prices and have made car insurance more transparent for average consumers. Consumers can get online and see how much of their rate goes toward different types of coverage. For example, you might be trying to decide if you should just purchase liability insurance or if you should also add in comprehensive and collision auto insurance coverage.

These instant auto insurance quotes help you see how much of your rate goes towards each type of coverage.

You can also experiment by raising or lowering your deductible or your policy limits. It is relatively simple to request quick car insurance online quotes from the best auto insurance companies to figure out which one has discounts that benefit you and your family.

Preparing for Instant Online Car Insurance Shopping

Start by optimizing your savings by making sure you are getting the best deal for your money. While it is a competitive market for car insurers, they do not always follow logic and reasoning. Just because you have had the same insurance company for 10 years does not guarantee that you are being rewarded for your loyalty.

Here are some tips for how you can look for quotes:

- Shop around yearly

- Check your credit report

- Fix mistakes in your credit report three months before you shop for car insurance

- Check the creditworthiness of the auto insurers you are comparing

Yes, many carriers reward loyalty and customers who have no accidents. But it is not always the case. Shop around yearly and you might just save yourself a good amount of money buying comparable policy coverage elsewhere. When you know that your coverage is coming up for renewal in a few months, that is the best time to check your credit report. Learn more details: What is an auto insurance score?

Your credit report will show how much you are borrowing compared to your credit limits and the timeliness of recurring payments. If you are like many former homeowners, you need to make sure that any short sales or foreclosures are recorded accurately.

Insurers view a lower credit score as a risk, assuming you may not pay in the future. If your closing paperwork shows “settled for less than owed” and lists you as delinquent, it can impact you. However, you can assess the insurance companies’ ability to pay claims by reviewing their creditworthiness. Look for A-ratings to ensure their financial reliability.

Where to Look for Instant Cheap Auto Insurance Quotes

If you need to quickly find instant and accurate auto insurance quotes, you can easily compare multiple options online. By using a website that screens out companies that cannot offer you coverage, you can save time and effort in your search. Car insurance can be costly, with the average driver paying between $50-$120 monthly, but online quotes tend to be lower due to increased competition.

It’s essential to check for available discounts, as many drivers can reduce their auto insurance premiums by 20% or more simply by comparing quotes.

Regularly checking your rates every few months ensures you never overpay for your coverage. Sometimes, emergencies arise that make it necessary to purchase auto insurance quickly, such as needing proof of insurance for a court date, realizing your policy has expired, purchasing a new car, or meeting lender requirements.

Technology now allows you to compare insurance rates from different providers quickly. Car insurance is mandatory and essential for safe driving. While cars are safer, the financial impact of accidents is still significant. Buying insurance online is a convenient way to find a reliable, affordable plan.

Required Auto Insurance Information for a Quote

To get an accurate car insurance quote, you need to provide detailed information. This includes the full names, driver’s license numbers, and birth dates of all drivers, as well as the exact addresses and ownership status of your home and vehicles. You’ll also need an estimate of your credit rating, along with details of each driver’s driving record, including violations and accidents.

Make sure to provide information about any previous claims and the amounts paid, along with the make, model, and VIN of all vehicles you own. You must specify who primarily drives each vehicle and provide the annual miles driven. Social Security numbers for each driver are also required. When obtaining a quote online, be ready to input this data, as it will be used to generate an accurate estimate.

Obtain more knowledge on our guide “Do auto insurance companies need your Social Security number?”

Keep in mind that any misrepresentation of the information can lead to higher rates or loss of coverage once verified. If you’re unsure of your driving record, you can request a copy from your local bureau of motor vehicles for a small fee.

Comparing and Evaluation Auto Insurance Policies

When receiving and evaluating quotes, make sure the coverage is the amount you need. Too low and you can get sued if you cause an accident. Or, you may find that your insurance only pays you enough to buy a car 30 years ago because you did not increase your coverage.

If you want to maximize savings, add on renter’s insurance. It might save you a good chunk of change. In short, be sure you compare policies before signing up for coverage. Buy the right amounts of insurance and choose deductibles. You could pay more than once over. Only agree to policies where you have assured quality repairs, efficient claims handling, and a high degree of customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Auto Insurance Coverage

Once you know what the lines of coverage are, then you can decide what you need. There are two sides of the same coin.

One side includes the damage and injuries you cause to others and the other side is what damage and injuries others can cause you and your loved ones.

Beyond that, there are two more main distinctions: Bodily injury liability and property damage are the other basic elements. Injury liability covers you if you cause harm to other people. Property damage might cover against damages you cause if your car skids off the road in the next ice storm right into your neighbor’s fence.

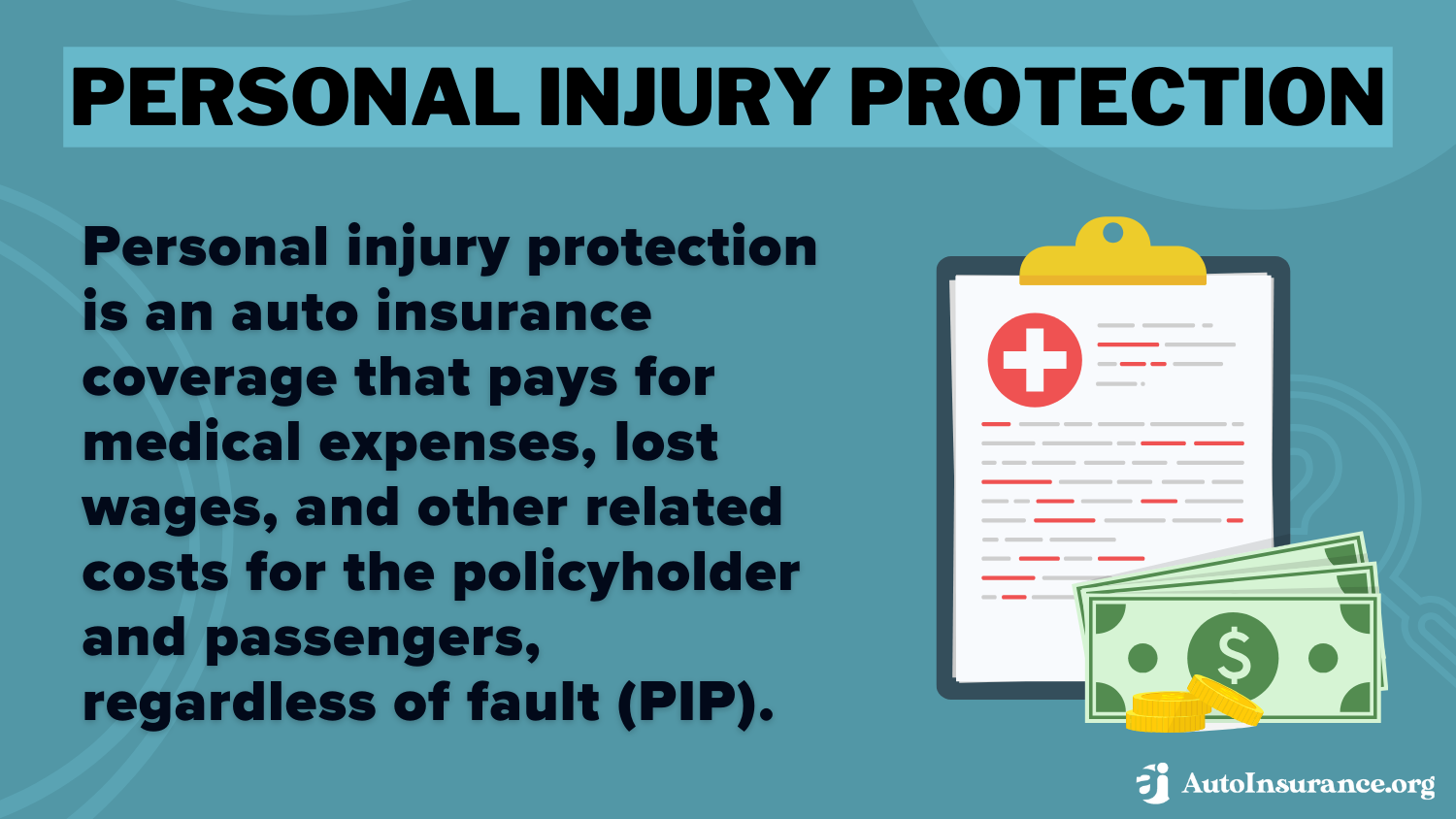

Some states do not play around with defining who caused the injuries or property damage. Personal injury protection auto insurance (PIP), as it’s called, provides added medical benefits, pay if you cannot go to work, therapies, and other insurer-defined policy details.

Some states require PIP. Others allow residents to decide what they want. Typically you will see three dollar figures listed next to every line of coverage. For instance, bodily injury liability might read $100,000/$300,000/$100,000. This means that there is up to $100,000 in benefits per injured person at a total of $300,000 maximum per accident.

The third number indicates the maximum property damage coverage on the policy. Buying and comparing auto insurance is not a simple “one size fits all” process. The right kind of insurance you need depends on many things, including:

- What type of car you drive

- How much you drive your car

- What you can afford

Ultimately, car insurance provides you with financial protection if you get involved in an auto accident, paying for related repairs and medical expenses and saving you from potential lawsuits that could put your assets in jeopardy. Let’s talk about the most basic auto insurance — liability — and three other types of auto insurance coverage we would highly recommend.

Liability Auto Insurance

All but three states require you to carry a minimum amount of liability auto insurance if you want to drive legally and register your vehicle. If you drive an older car, liability insurance may be the only type of car insurance you want or need to purchase.

Liability is the least expensive form of auto insurance for most people. However, the minimum mandatory amount of liability insurance provides very little protection for you if you cause an accident. Liability auto insurance coverage pays for repairs to damage from accidents that you cause and also for medical expenses related to accidents you cause.

Delve more details on our guide “Cheapest Liability-Only Auto Insurance.”

However, it does not pay for damages to your car or for medical expenses that you or your passengers receive if you caused the accident.

Since repairs for property damage average more than $60,000 per incident and medical expenses can be in amounts greater than $100,000 per incident, it is important to purchase additional liability insurance if you can afford it.

Personal Injury Protection Auto Insurance

Personal injury protection auto insurance is another kind of auto insurance that may be mandatory coverage since it is required in 14 states.

Personal injury protection, also known as PIP or “no-fault insurance,” pays for medical expenses related to an accident, regardless of who is at fault.

In addition to hospital bills, it can be used for rehabilitation costs, lost wages, and legal expenses related to an accident.

Comprehensive Auto Insurance

Comprehensive auto insurance is voluntary unless your car is leased or financed with an auto loan, in which case the lender requires it. Comprehensive insurance provides coverage for repairs not related to moving accidents, including damage that is the result of:

- Hail

- Flying rocks

- Storms

- Fire

It also provides coverage if your car is stolen or vandalized.

Collision Auto Insurance

Collision auto insurance provides coverage for your vehicle if it is involved in an accident.

No matter who is driving the car or if you are actually in the car, the damage will be covered.

For example, if your car is parked on the street and you return to find it has been involved in a hit and run accident, repairs will probably be covered by collision insurance.

Limits of Auto Insurance Minimum Liability

Determine the limits of liability that your state requires for adequate insurance coverage. Each has minimum auto insurance requirements by state, which set the legal limits of liability that you need to meet or exceed. However, the state minimum is usually a very low number and is not guaranteed to fully protect you and your family.

Make sure you get the insurance you need to keep your family and property protected. If you have a loan on your vehicle, the lender will require you to carry physical damage in the form of comprehensive and collision with a deductible. This will protect your interest and their interest in your car.

Recommended Auto Insurance Liability Limits for Optimal Coverage

Even though each state has its own requirements, we will describe each type of auto insurance coverage and our suggested range of coverage:

- Bodily Injury Liability: This insurance protects you against legal liability for bodily injury to others ($100,000 per person and $300,000 per accident).

- Property Damage Liability: This insurance protects you against legal liability for property damage to property owned by others ($50,000 per accident).

- Medical Payments: This pays for related medical coverage such as emergency services or ambulance costs for you if you are involved in an accident ($10,000 per person).

- Uninsured Motorists Coverage: Uninsured/underinsured motorist coverage pays for bodily injury or property damage to you if you are involved in an accident with someone who does not have insurance ($100,000 per person/$300,000 per accident bodily injury).

- Comprehensive Coverage: This type of coverage is not required by law, but is necessary if you have a loan. This provides damage coverage to your car like theft, vandalism, animal damage, or weather damage ($500 per accident).

Watch this video to learn more about the types of auto insurance coverage available.

The best auto insurance companies will offer other coverage options such as towing and labor, rental reimbursement, accident forgiveness, and disappearing deductibles. Be aware of this when you’re examining quotes and ask about what types of insurance each company offers. Make sure to do your research in advance to ensure you get the best deal that is right for you.

Quick Tips for Lowering Instant Online Car Insurance Rates

By comparing insurance quotes, drivers can see how coverage options differ from one insurance provider to the next. This makes it easy to find a cheaper auto insurance option or better coverage, even if you’re a high-risk auto insurance driver. We will list approximate prices and coverage amounts of various companies almost immediately after you enter your information.

This list is sorted by price, allowing you to quickly identify which company offers the lowest rates. If you’re seeking a specific type or amount of coverage, you can use the quote comparison tool to find a suitable insurance plan tailored to your needs. To keep auto insurance costs low, consider asking about discount programs. Many companies offer discounts for good students, homeowners, and other low-risk groups.

By comparing quotes from multiple providers, drivers can immediately see potential savings. Whether you’re high-risk or just looking for better coverage, the key is exploring your options and asking about discounts.Tracey L. Wells Licensed Insurance Agent & Agency Owner

Taking a state-sponsored driving course can provide an additional discount. Additionally, obtaining quotes for various deductibles and levels of coverage can help manage costs. Lowering coverage may be a good option if you don’t drive frequently, though it’s often better to explore other alternatives.

Ultimately, comparing insurance quotes online is the most efficient way to secure lower rates, as it provides instant quotes from major providers, enabling accurate comparisons to find the best policy.

Auto Insurance Discounts Available

You may qualify for various discounts. Take the time to read the questions that are asked on the comparison site before finally submitting your information. It only takes a few minutes, but it can help you save money for years to come. Possible discounts include:

- Certain professions, including teachers, firefighters, and healthcare professionals

- Multi-policy discounts if you also switch your homeowners, renters, or life insurance

- Multi-vehicle car insurance discounts for more than two or three vehicles on one insurance plan

- Discounts for special safety features or a good driving record

Discounts are an easy way to save money. Most companies will also allow you to bundle your discounts to maximize your savings.

Important Considerations for Auto Insurance Deductibles

The insurance company is going to ask what deductible level you want. The amount you choose depends on your needs, your budget, and your driving record. You can save money every month by choosing a higher deductible, but you’ll have to come up with the cash if you have an accident and need to file a claim.

Lowering the auto insurance deductible saves you money when filing a claim, but it can put a dent in your monthly budget. Ideally, you should choose the higher deductible amount and then put that money in a savings account so that you’ll have it on hand if you ever need it.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Final Steps to Securing the Right Auto Insurance Online

Buying auto insurance online is a quick and effective way to get coverage tailored to your needs. By gathering your details and comparing quotes, you can find the best policy at a competitive rate. Don’t forget to look for discounts, which can significantly reduce your premium. Once you’ve selected a policy, finalizing your coverage and receiving proof of insurance takes just minutes.

Explore more insights on our “How to Get an Auto Insurance Quote Without Giving Personal Information.”

This process ensures you’re protected on the road without the hassle of lengthy applications. With online tools, getting affordable, reliable coverage has never been easier. Enter your ZIP code below and shop for affordable auto insurance premiums from the top companies.

Frequently Asked Questions

Can I get auto insurance online now?

Yes. Many auto insurance companies have made it possible for customers to get an auto insurance quote from their websites.

Who has the cheapest online auto insurance?

USAA auto insurance is the cheapest auto insurance in the nation. However, only members of the military and their immediate families are eligible for USAA policies. Learn more about this provider on our USAA auto insurance review.

How quickly can I get auto insurance?

You can get auto insurance in 15 minutes or less. Have your personal information and vehicle information ready to get through the process as quickly as possible.

Can I get auto insurance online?

Auto insurance online sales are available across the internet.

Is it cheaper to buy auto insurance online?

It depends. If you do shop for auto insurance online, you’ll be able to monitor discounts more closely. Find out more details on our “Cheap Online-Only Auto Insurance.”

What is “InsuranceOnline.com?”

InsuranceOnline.com is an insurance comparison website. Enter your ZIP code below to compare quotes for getting an auto insurance coverage from leading providers in your area.

Can I buy auto insurance online instantly with a checking account?

Yes, many insurers allow you to buy auto insurance online instantly with a checking account. Simply enter your checking account information during the payment process, and your coverage will be activated upon confirmation of payment.

What is the shortest time you can instantly insure a car?

Short-term car insurance, also known as cheap temporary auto insurance, covers you to legally drive a car for anything from one hour up to 28 days.

What is the most basic car insurance if you’re buying instantly?

The most basic car insurance you can purchase instantly is liability insurance, which covers damages to others if you’re at fault in an accident. It’s often the minimum legal requirement in most states.

What is the lowest form of car insurance for instant buying?

The minimum amount of car insurance you’ll typically need is state-required liability coverage. This allows you to pay for some, if not all, injuries and damages you’re liable for in an accident.

What is the lowest deductible for car insurance?

Which type of auto insurance coverage is most important?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.