How to Cancel USAA Auto Insurance in 2026 (Follow These 6 Steps)

The way to cancel USAA auto insurance involves a straightforward process that ensures you avoid unexpected fees, which can be up to 10% of your remaining balance. Start by reviewing your USAA insurance policy and reach out to USAA's customer service to discuss auto insurance cancellation options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated October 2024

Quickly find affordable auto insurance coverage today by using our quote comparison tool above to learn how to cancel USAA auto insurance.

- Step #1: Review Your Policy – Understand your coverage and potential fees

- Step #2: Contact USAA – Inform customer service about your cancellation

- Step #3: Submit a Written Request – Formalize your intent with a written request

- Step #4: Confirm Cancellation Date – Ensure you know when coverage ends

- Step #5: Review Final Billing – Check for any outstanding balances or refunds

- Step #6: Seek New Coverage – Find new insurance to maintain protection

6 Steps to Cancel USAA Auto Insurance

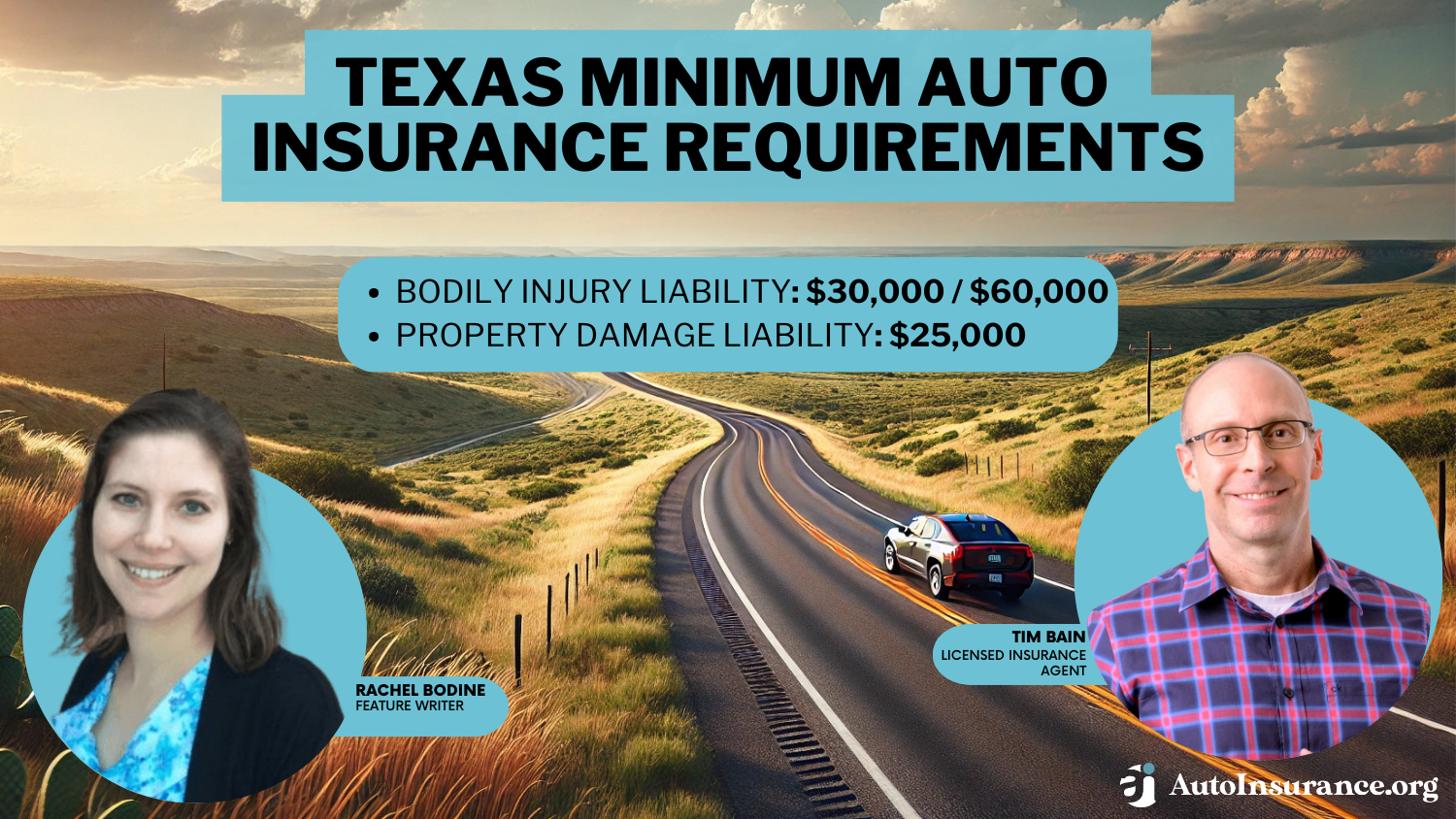

Canceling USAA auto insurance can be a straightforward process if you follow the right steps. To avoid potential fees of up to 10%, it’s important to review your policy, contact USAA’s customer service to confirm your cancellation, and submit a written request. To avoid coverage gaps, make sure to find new coverage before completing the cancellation.

Step #1: Review Your Policy

Step #2: Contact USAA

Step #3: Submit a Written Request

Step #4: Confirm Cancellation Date

Step #5: Review Final Billing

Step #6: Seek New Coverage

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Avoiding Common Mistakes During USAA Auto Insurance Cancellation

Maintaining Continuous Auto Insurance Coverage With USAA

Simplified Guide to Cancelling USAA Auto Insurance

Frequently Asked Questions

How to cancel USAA auto insurance on the app?

Simply log in to your USAA account, head to the auto insurance section, choose the cancel policy option, and follow the steps to confirm your request. While you’re here, you might also be asking, “Can auto insurance companies check your phone records?” It’s essential to know since it can affect how claims are handled.

How to cancel a USAA membership?

To cancel your USAA membership, contact USAA customer service directly or log in to your account to submit a cancellation request, as membership typically requires direct interaction with USAA.

How to cancel USAA auto insurance?

To cancel USAA auto insurance, review your policy, contact USAA customer service to express your intent to cancel, submit a written cancellation request, confirm your cancellation date, review your final billing statement, and seek new coverage to ensure continuous protection.

Can I cancel USAA auto insurance anytime?

Yes, you can cancel USAA auto insurance anytime, but it’s advisable to review your policy for any potential fees or obligations before proceeding.

Can you cancel USAA auto insurance at any time?

Does USAA charge a cancellation fee?

USAA may charge a cancellation fee, which can be up to 10% of your remaining balance, depending on the terms of your policy. Discover budget-friendly auto insurance rates from leading providers by entering your ZIP code below and understanding how to cancel USAA auto insurance.

How to cancel USAA auto insurance without calling?

You can cancel USAA auto insurance without calling by submitting a written cancellation request via email or traditional mail and then confirming your cancellation through the USAA website or app.

How to cancel USAA homeowners insurance online?

To cancel USAA homeowners insurance online, log in to your USAA account, go to the insurance section, select homeowners insurance, and follow the prompts to submit your cancellation request.

How to cancel USAA renters insurance online?

To cancel USAA renters insurance online, log into your USAA account and navigate to the renters insurance section. Follow the provided instructions to complete your cancellation. Understanding this process is important for those looking to get free online auto insurance quotes.

What is USAA’s customer service number??

The USAA customer service number is 1-800-531-8722.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.