How to Spot a Fake Insurance Card in 2026 (5 Simple Steps)

Learn how to spot a fake insurance card, with around 16% of drivers using fraudulent cards. To spot a fake car insurance card, you should examine the card for inconsistencies, review the policy, contact insurance regulators, and consult authorities. This will protect you from fraud and legal complications.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated December 2024

How to spot a fake insurance card is a crucial skill, especially with 16% of drivers estimated to use fraudulent cards, putting others at risk. An individual can identify a fake insurance card by checking for inconsistencies and typos, verifying the policy number with the insurance provider, and consulting insurance regulators.

Detecting fake insurance cards could help reduce an individual’s legal and financial risks while ensuring all drivers carry the recommended auto insurance coverage levels.

This article provides an in-depth guide on identifying such a fake insurance card, the considerations involved in detection, and preventive measures for an individual against all forms of insurance fraud.

Get fast and cheap auto insurance coverage today with our quote comparison tool.

- Step #1: Examine the Card – Check for typos, quality, and logo accuracy

- Step #2: Review Policy Details – Verify the policy number and coverage dates

- Step #3: Inspect QR Codes or Barcodes – Scan to ensure the insurer’s website

- Step #4: Contact the Insurance Company – Use official channels for validity

- Step #5: Consult Authorities – Reach out to insurance regulators for verification

5 Steps to Spot a Fake Insurance Card

One of the most essential identities one should have is an insurance card, which allows one to access certain services. However, the forgery of insurance card templates the card is rife, especially in the case of insurance. Knowing how to spot a fake insurance card protects one from scam threats.

Step #1: Examine the Card’s Physical Appearance

The first and easiest way to identify a fake insurance card is to inspect its physical features. A genuine insurance card, made from good quality plastic and durable materials, displays clear and accurate printing.

A fake card may appear thin or show marks from different finishes. You should also look for printing flaws like irregular text, patchy colors, or distorted pictures. A changed logo design or poor production quality often suggests forgery. Knowing the types of auto insurance cards can further assist in identifying inconsistencies that indicate a fake insurance ID card.

Step #2: Review Policy Details

The most important thing to check on an insurance card is policy details, such as auto insurance policy numbers, the insured’s name, and coverage dates. Thus, a genuine insurance card should contain consistent, concise, and coherent information corresponding with the official documents provided by the insurer.

Fake cards often accompany fake car insurance policies featuring incorrect or mismatched details. Look for misspellings, anomalies, or missing information. If something seems suspicious, confirm it directly with the policyholder.

Step #3: Inspect QR Codes or Barcodes

Some insurance card creators nowadays include a QR code or barcode that allows users to validate them quickly. Mobile scanning of such barcodes or QR codes using a smartphone or scanner app will redirect the user securely onto the insurance site or platform to validate the card’s authenticity.

The card is likely genuine if the scan provides accurate policy information on a legitimate site. On the other hand, a code that fails to work or redirects to a fake car insurance app is a vital warning sign that the card could be fraudulent. To check if an auto insurance company is legitimate, ensure the website is secure and the policy details match those provided by the insurer.

Step #4: Contact the Insurance Company

If the references on physical appearance and policy terms need to clarify everything, the best option is to get ahold of the auto insurance companies. Use the official phone number or email address found on the insurance company’s webpage and not the contact number on the card itself.

Verify the policy number and other relevant details to confirm the card’s validity. Genuine insurers have robust customer support systems in place and can quickly verify the authenticity of any card. A quick call or email could save you from potential issues with fraud.

Step #5: Consult Authorities or Experts

If you need help with the insurance card from the insurer or are still trying to decide, your next best option is to find auto insurance agents in your area or professionals in the insurance field.

Government insurance regulators often have resources available to help individuals check the authenticity of insurance policies and cards. Only a licensed insurance agent can assist by cross-checking the information on the card against the standard data or even offering an expert opinion. Visiting such consultants will give one peace of mind and help reduce the chances of being scammed.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Role of Insurance Cards in Compliance

Car or auto insurance cards are essential requirements for all drivers. They act as proof of financial responsibility, helping drivers comply with the requirements set forth by auto insurance laws in their state.

Be it understood that a driver produces evidence of having active insurance or insurance coverage by law. Coverage is required in most areas of the world. Without or without it, there could be stringent penalties, such as fines, driver’s license suspension, or other associated penalties.

Beyond legal compliance, an insurance card plays a critical role in protecting the driver and others in the event of an accident. The card includes details like the policyholder’s name, the policy number, and coverage information, which is very important for claims, medical treatments, and dispute resolution.

In an emergency, this will ease and speed up the entire process in a workplace accident. It is a straightforward way to confirm whether or not a driver is covered by accident insurance.

Whether or not the policy includes the repair cost, medical expenses, or liability protection, the insurance card certifies the driver as having proper financial safekeeping measures taken. It is more than just a piece of paper in layperson’s terms. It is about considering his legal and economic aspects on the road.

Penalties for Having a Fake Insurance Card

Fraudulent use of an insurance card amounts to insurance fraud. It is not only unlawful but often also incurs grave punishment owing to the violation of a state’s compulsory auto insurance mandate.

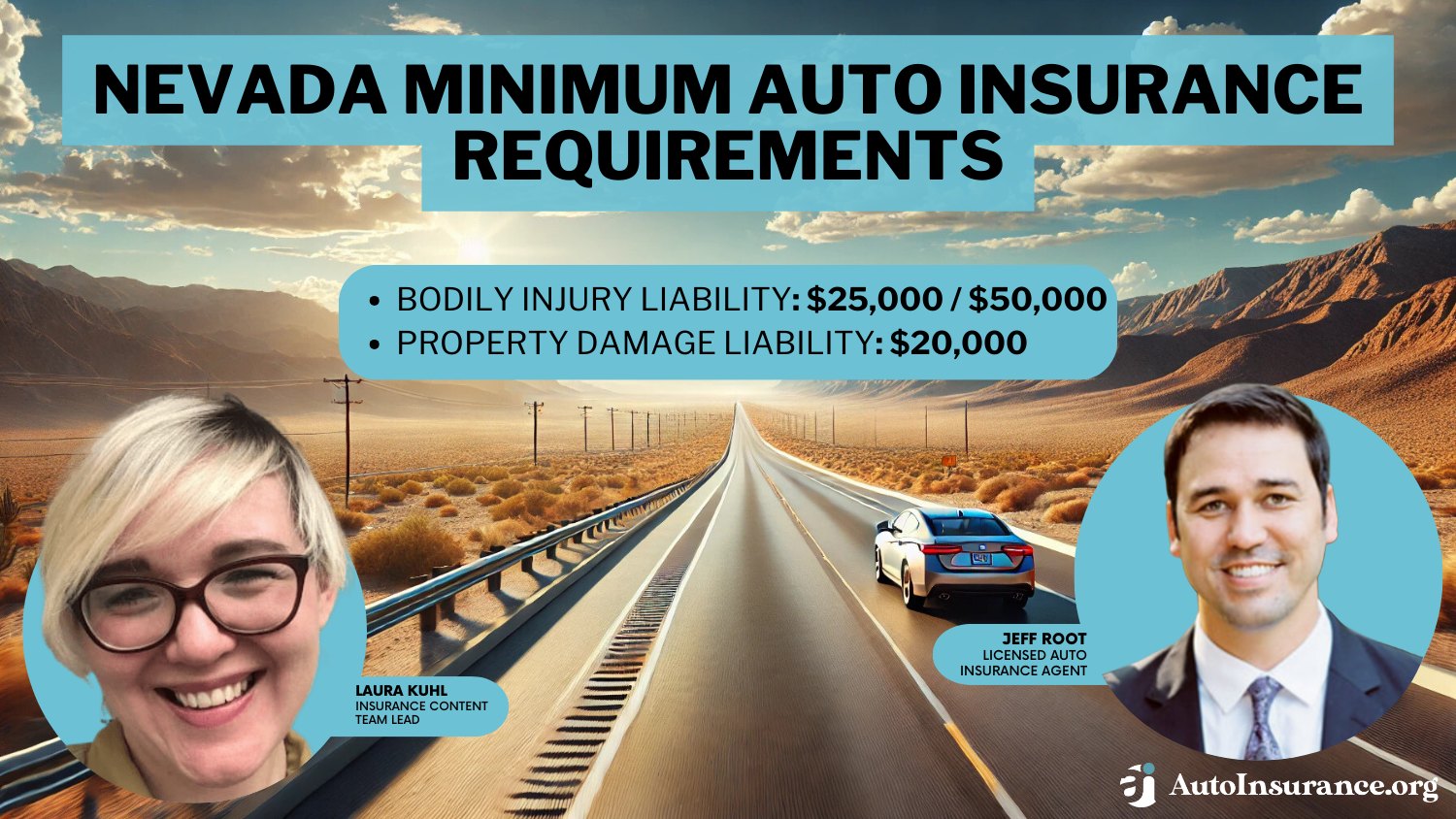

Each state has also stipulated minimum liability insurance levels to satisfy the financial responsibility laws for having a driver on its roads. For instance, Alabama requires 25/50/25 for bodily injury liability (BIL) auto insurance and property damage liability, while California mandates lower limits of 15/30/5. All driving offenses breach these rules and result in severe penalties.

Penalties for Using a Fake Insurance Card: Legal and Financial Consequences

| Offense | Penalties | Notes |

|---|---|---|

| First Offense | Fines ranging from $500 to $2,000; possible community service | Penalties may vary by state, with harsher penalties for repeat offenses |

| Repeat Offenses | Increased fines ($1,000+); license suspension or revocation | May include mandatory court appearance and higher fees |

| Vehicle Impoundment | Vehicle may be impounded until proof of valid insurance is provided | Common in stricter jurisdictions |

| Jail Time | Possible jail time (up to 6 months) for severe cases, especially involving fraud | Determined based on intent and state laws |

| Criminal Charges | Possible misdemeanor or felony charges; fraud charges may apply | Felony charges often result in a criminal record |

| Increased Premiums | Higher insurance premiums after conviction; SR-22 insurance may be required | Significant financial repercussions lasting years |

| Civil Penalties | Liabilities for damages in accidents without proper insurance coverage | Victims can file lawsuits for recovery of damages |

A fine for possessing a fake auto insurance card could be not more than $2,000 or imprisonment for a term of six months or both. Moreover, jurisdictions can impose mandatory, non-cancellable insurance policies for compliance after that date. It’s more than just a fine or, worse, litigation.

Forging fake proof of car insurance might leave a driver empty during an accident since it does not insure him against legitimate protection. Know how to spot a fake insurance card so as not to fall into scams and be protected by legitimate coverage to prevent these severe penalties.

Risks and Consequences of Using a Fake Insurance Card

Using a fake insurance card may seem like a way to dodge insurance costs, but the risks far outweigh any perceived benefit. While a fake card might initially appear legitimate to the untrained eye, law enforcement and insurance verification processes are designed to catch such deceptions.

While conducting regular inspections or traffic stops, the police also establish an insurance status other than the physical card. If tuition needs to be updated, insurance companies notify the DMV about such lapses.

If you find your name tagged as one of the uninsured drivers, it could even suggest the illegitimacy of your card, which consequently increases the chances of litigation. Insurance providers thoroughly investigate claims; any mismatched or fake information is a red flag.

Even if you unknowingly purchased a counterfeit card, the burden of proof and the financial responsibility for damages fall on you. It can lead to fines, legal penalties, and the cost of covering damages out of pocket. Driving without auto insurance increases these risks, making it crucial to ensure your coverage is legitimate and current.

It is always advisable to have genuine insurance coverage rather than be subject to the dire consequences of availing it incorrectly. Knowing how to spot a fake insurance card helps one avoid scams while keeping safe from legal and financial entrapment.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Distinguishing Between Fake and Genuine Insurance Cards

Knowing how to spot a fake insurance card is essential for every driver to ensure they are adequately covered and legally compliant. An authentic insurance card is one of the vital documents justifying a driver’s valid insurance coverage under the law and financial protection in such an event.

Some essential features are the policyholder’s name, the policy number, coverage dates, and contact details from the insurance company. An insurance card maker typically uses quality materials to manufacture physical cards, often incorporating anti-counterfeiting security features such as holograms or QR codes.

On the other hand, a fake insurance card is a forged or fraudulent document that appears to be legitimate but does not provide the actual insurance coverage. These cards may include incorrect or missing details, fake insurance policy numbers, misspelled names, or poorly printed logos and may need more security features found in genuine cards.

Recognizing a fake insurance card is crucial for safeguarding yourself against fraud, ensuring you're properly covered, and avoiding serious legal and financial repercussions.Justin Wright Licensed Insurance Agent & Agency Owner

Fake insurance cards can expose drivers to serious legal repercussions, such as fines, suspension of driver’s licenses, or even jail time, especially if caught during a random check on the road or at the scene of an accident. Fake cards can also render a driver financially naked as they would not be protective even in case of a road accident.

Fake and actual insurance cards differ primarily in the truthfulness and accuracy of the information they provide. Protect yourself by learning to spot a fake through its physical appearance, identifying discrepancies in the policy, and obtaining accurate details directly from the insurance provider.

To further safeguard against fraud, you can get instant proof of your auto insurance policy online, ensuring you always have access to legitimate and up-to-date documentation.

Indicators to Help Spot a Fake Insurance Card

You should check several significant indicators to detect fake car insurance cards from original ones. Look at the card quality, inspect card details, and contact the insurance provider.

Identifying a real insurance card from a phony goes beyond checking for apparent signs like blurry text and incorrect information, which are clear fraud indicators. Swindlers often use fake proof of insurance cards to defraud individuals or healthcare institutions, leading to losses that extend beyond money and into legal trouble.

It is one thing to check the cards; a different aspect is knowing where one gets them. If someone offers you an insurance card without proper documentation or through unofficial channels, it’s a major red flag.

Additionally, it’s wise to regularly check your insurance provider’s website or app for updated coverage information. Most providers allow you to access a digital version of your insurance card, which provides a backup method for verification.

Finally, stay alert and closely monitor your claims against an insurance company and medical bills to learn how to spot a fake insurance card. If you notice inconsistencies, such as incorrect claim processing or outright denial, it could indicate that someone is using your card to commit fraud.

To protect yourself, always get a copy of your auto insurance card directly from your insurer and ensure the details are accurate. This proactive step prevents fraud and protects you from being victimized regarding your insurance.

Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

Can you fake proof of insurance?

No, faking proof of insurance is illegal and considered fraud. Making fake insurance cards can result in severe penalties, including fines, suspension of your driving license, or even criminal charges. Always provide legitimate documentation.

How to check if a life insurance company is legitimate?

To verify a life insurance company’s legitimacy, check its licensing through your state’s insurance department, review ratings from agencies like AM Best or Moody’s, and search for complaints on the NAIC website.

Enter your ZIP code into our free auto insurance quote comparison tool to protect your vehicle at the best prices.

Can I check my policy status online?

Yes, most insurance companies provide online portals or auto insurance apps where policyholders can log in to view policy details, check status, make payments, or download documents.

What is an example of a car insurance card?

A car insurance card typically includes:

- Insurance company name and logo

- Policyholder’s name and address

- Policy number

- Vehicle details (make, model, VIN)

- Coverage period (start and expiration dates)

What does an insurance card look like?

Insurance cards are wallet-sized documents with the policyholder’s name, insurer details, policy number, coverage dates, and vehicle information. An example of an auto insurance card includes all these key details.

Does insurance have an expiration date?

Yes, all insurance policies have an expiration date, which marks the end of the coverage period. To maintain uninterrupted coverage, you must know when my auto insurance renews and ensure the renewal is completed before expiration.

What is a valid certificate for insurance?

A valid certificate of insurance (COI) proves that an individual or business holds active insurance coverage. It typically includes the policyholder’s name, policy details such as the policy number and type of coverage, the effective and expiration dates of the policy, and the insurance company’s information.

What is a copy of an insurance policy?

A copy of an insurance policy outlines all terms, conditions, coverage details, exclusions, and endorsements of your insurance agreement. The insurer provides it when the policy is issued.

What is an example of an insurance expiration date?

For example, if your policy term starts on January 1, 2024, and is valid for six months, the expiration date would be June 30, 2024. To determine when my auto insurance begins, refer to the effective date indicated in your policy documents, as this marks the start of your coverage.

Which app is used to check insurance status?

Apps vary by region and insurer. Many insurance companies have their own apps, such as Geico Mobile, State Farm, or Allstate Mobile in the U.S. Additionally, some regions may have centralized government or industry apps for checking policy status.

Enter your ZIP code to explore which companies have the cheapest auto insurance rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.