Is a local auto insurance company better than a national one?

On average, auto insurance costs $83.72/mo or $1,004.68 annually. Both national and local auto insurance agencies can offer premier services. Compare rates from insurers to find the best company and savings for your needs. Start here to find great affordable rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated December 2024

When you search for the best auto insurance policy, you will need several choices for your prospective policy. It is possible that you will have local and national insurers battling for your business when you compare policies.

Is a local auto coverage company better than a national one? You may find that either a national or a local company will work best for your needs.

Although your coverage and budgeting needs are the deciding factors, there are certain pros and cons to choosing a cheap local auto insurer. When considering local vs. national insurance, it’s essential to weigh these factors. If you’re searching for car insurance near me, evaluating the benefits and drawbacks of local options is crucial.

Ready to buy local auto insurance? Enter your zip code into our FREE car insurance comparison tool to start comparing affordable local car insurance rates now!

- Local U.S. insurers are able to offer more personalized service

- National insurance carriers typically have 24-hour customer service

- National carriers can offer a wide array of discounts

What are some advantages of using local auto insurance companies?

You may quickly find that local auto insurance companies can offer a more personable experience. Having a nearby agent can help ensure close contact. Are local insurance companies cheaper? In many cases, they can be, but it depends on various factors such as coverage needs, location, and personal driving history. Shopping around is key to finding the best rates.

Such a relationship is common of local insurers. Sometimes, national major auto insurance companies rely on toll-free numbers and call-in centers.

Local auto insurance companies and agencies can be a welcome change from national companies, particularly for those familiar with local banks and businesses. Is local insurance cheaper? Often, it can be, depending on your specific needs and circumstances.

Of course, the idea is that with local and state auto insurance companies, fewer locations mean minimal extension and more attention to individual users.

Naturally, communication can be much easier. It also leads to some other welcomed benefits that should be considered when you compare premiums:

- Competitive Rates – With less overhead, your local insurer might be able to offer promising insurance rates. With the ability to customize quotes from the local car insurer, a more personal quote could mean increased savings.

- Special Features – Are you in need of car insurance and have a bad track record? Local insurers may be able to grant a second chance that standardized, national insurers might not offer you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are some disadvantages of local insurers?

Some factors lead many people to opt for major national insurers. While some preferences are subjective, other practical considerations need attention when evaluating convenience. For instance, let’s consider the following example related to local car insurance companies and local vehicle insurance.

Your auto insurance coverage plan includes comprehensive insurance which covers windshield protection. After getting a chip in your windshield while on a road trip, you call your insurer to get it filled and start a claim.

With local insurance companies near you, finding the closest auto insurance can be more convenient, and opting for cheap local auto insurance might also make it easier to set up an appointment when you’re away from home.

Indeed, the strong and extensive national network of such a car insurer offers its advantages. And while it’s not as easy to talk to your local agent, the wide-reaching dynamic of a national insurer has other conveniences that must be considered:

- Communication – A local insurer might be better in terms of customer service. However, it’s hard to argue with 24-hour operators and other convenient perks.

- Technology – With national insurers, you may find online systems similar to those with online banking platforms. Apps for mobile devices and other tech-based conveniences provide a very strong set of advantages for national auto insurers.

- Discount Standards – Discounts are far more standardized so you may end up with the cheapest insurer. If you’re counting on commonly advertised discounts and accompanying schemes, you’ll likely have an easier time with national companies.

How can you decide what is right for you?

Are you interested in collision coverage and insurance? What’s your credit score like, and do you have any past at-fault accidents on your driving record? Determine the level of coverage you need for your vehicle: are you looking for bodily injury liability only, or full coverage? Also, which national auto insurance companies offer the most competitive rates for teen drivers or for your entire family? Find out who provides national car insurance near you and explore options available online.

You may be drawn to either type of car insurer before you even compare different policies. If you notice some features or dynamics that you must have, you may do well to subscribe to either local or national insurers.

However, most of those comparing the cheapest car insurance policies will want to do just that – compare one’s option before giving much weight to whether the company is local or national.

After all, many of the typical advantages and disadvantages may not be present with specific companies.

Similar to policies that you consider, you must approach each company on a case-by-case basis.

Observe the rates quoted for policies that fit your needs.

If and when it becomes relevant, follow through on the characteristics of the car insurer.

Perhaps you’ll find a local auto insurer that minimizes typical disadvantages. Or maybe you’ll find a national company that offers exceptional customer service.

Comparing car insurance providers is crucial. It’s essential to compare both the companies themselves and their policies to ensure you’re making a choice that satisfies your needs, whether you’re considering national car insurance or evaluating national car insurance companies.

Looking for local auto insurance quotes? Our FREE car insurance comparison tool can help you compare the best local auto insurance policies when you enter your zip code below!

Frequently Asked Questions

Should I consult with an insurance agent when choosing between local and national auto insurance companies?

Consulting with an insurance agent can be beneficial when selecting an auto insurance company. An agent can provide guidance, explain policy details, help assess your coverage needs, and assist in comparing options from both local and national insurers. They can offer personalized advice based on your specific circumstances, making the decision-making process easier.

Does the size of an insurance company affect its claims processing and payout?

The size of an insurance company does not necessarily dictate the efficiency or effectiveness of their claims processing or payout. It is more crucial to consider an insurer’s reputation, customer reviews, and their track record in handling claims. Reputable companies, whether local or national, prioritize prompt and fair claims settlement processes.

Are local auto insurance companies more reliable than national ones?

Reliability varies from company to company, regardless of whether they are local or national. It’s crucial to assess an insurance company’s reputation, financial strength, and customer reviews to gauge their reliability. Both local and national insurers can provide reliable coverage, but thorough research is essential in making an informed decision.

Which type of auto insurance company should I choose?

The choice between a local and national auto insurance company depends on your individual needs and preferences. Consider factors such as customer service, coverage options, cost, convenience, and the level of personalization you desire. It’s important to research and compare multiple insurers, taking into account their reputation, financial stability, and the specific coverage they offer in your area.

Is it better to go with a local insurance company?

It depends on your preferences for personalized service and community involvement versus the resources and wide network offered by national insurers.

What is the most trusted car insurance company?

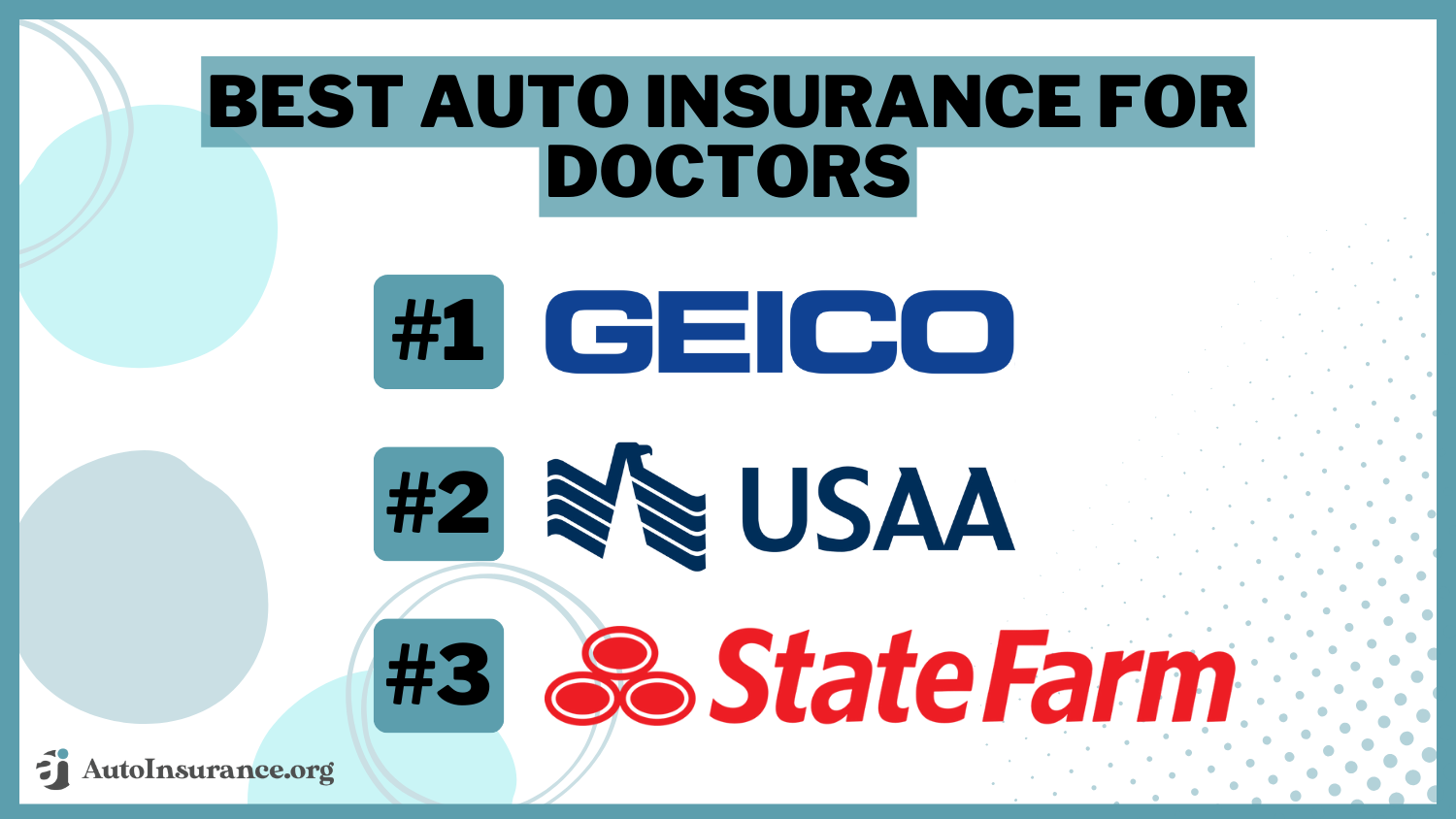

Trust in insurance companies can vary based on customer experiences and ratings. Companies like State Farm, Geico, and USAA often rank highly for trustworthiness.

Which type of car insurance is the best?

The best type of car insurance depends on your needs. Comprehensive coverage offers the most protection, including theft and damage not caused by a collision.

Which type of auto insurance coverage is most important?

Liability insurance is typically the most important, as it covers damages to others in accidents you’re responsible for.

Is it better to stay with the same insurance company?

Staying with the same insurer can sometimes lead to loyalty discounts, but it’s important to shop around periodically to ensure you’re getting the best rates and coverage.

Why work with a local insurance agent?

Local agents offer personalized service, local knowledge, and often stronger community ties, which can be beneficial when navigating insurance needs.

Which insurance company has the most complaints?

What are the top 5 insurance companies?

What is the most reliable car company?

What is the best and cheapest car insurance?

What type of car insurance is the cheapest?

What is the best insurance for high-risk drivers?

What is the most common type of insurance plan?

Is it OK to have multiple insurance?

Why should you avoid duplicate insurance?

Is it worth it to shop around for insurance?

Why do I need an agent to get insurance?

Which insurance company denies most claims?

Which insurance companies have the best claims?

Which car insurer is the best?

What is the biggest auto insurance company in the U.S.?

What car has the worst reputation?

What car brand has the least problems?

What car brand lasts the longest?

Which value is the best for car insurance?

How much can you save by shopping around for car insurance?

Can I switch between a local and a national auto insurance company?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.