Best Modesto, California Auto Insurance in 2025

The average annual auto insurance rates in Modesto, CA are around $3,797.96. The cheapest auto insurance company in Modesto, CA is Progressive, although rates will vary for each person. Modesto, CA auto insurance must meet the state minimum requirements with coverage levels of 15/30/5 for liability. Compare Modesto, California car insurance rates online to get the best price for you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Sep 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The average annual auto insurance rates for Modesto, CA are $3,797.96

- The cheapest auto insurance company in Modesto, CA is Progressive

- Modesto, CA rates are affected by the traffic that is shared with Stockton

- The average commute time in Modesto is 26.6 min

Modesto, CA auto insurance rates are actually fairly low when compared to other cities in California.

You can save on Modesto, California auto insurance by shopping around, comparing rates, and looking for discounts, and we can help. Below you’ll find information on how to get cheap auto insurance in Modesto, California for every age, credit history, and driving record.

Monthly Modesto, CA Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Modesto, California auto insurance rates by ZIP Code below:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

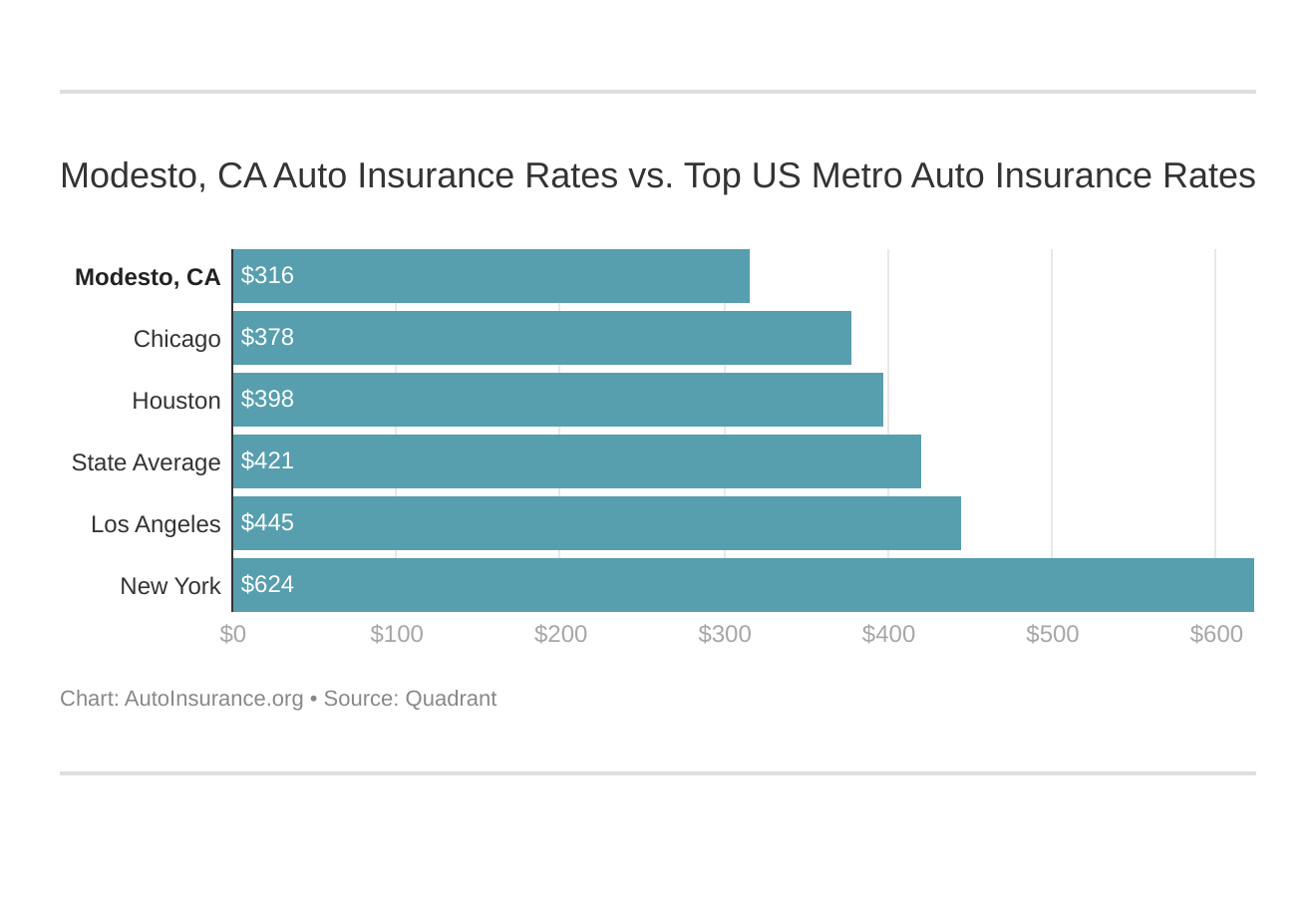

Modesto, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Modesto, California stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

Ready to find affordable auto insurance in Modesto, CA? Enter your ZIP code above to get started.

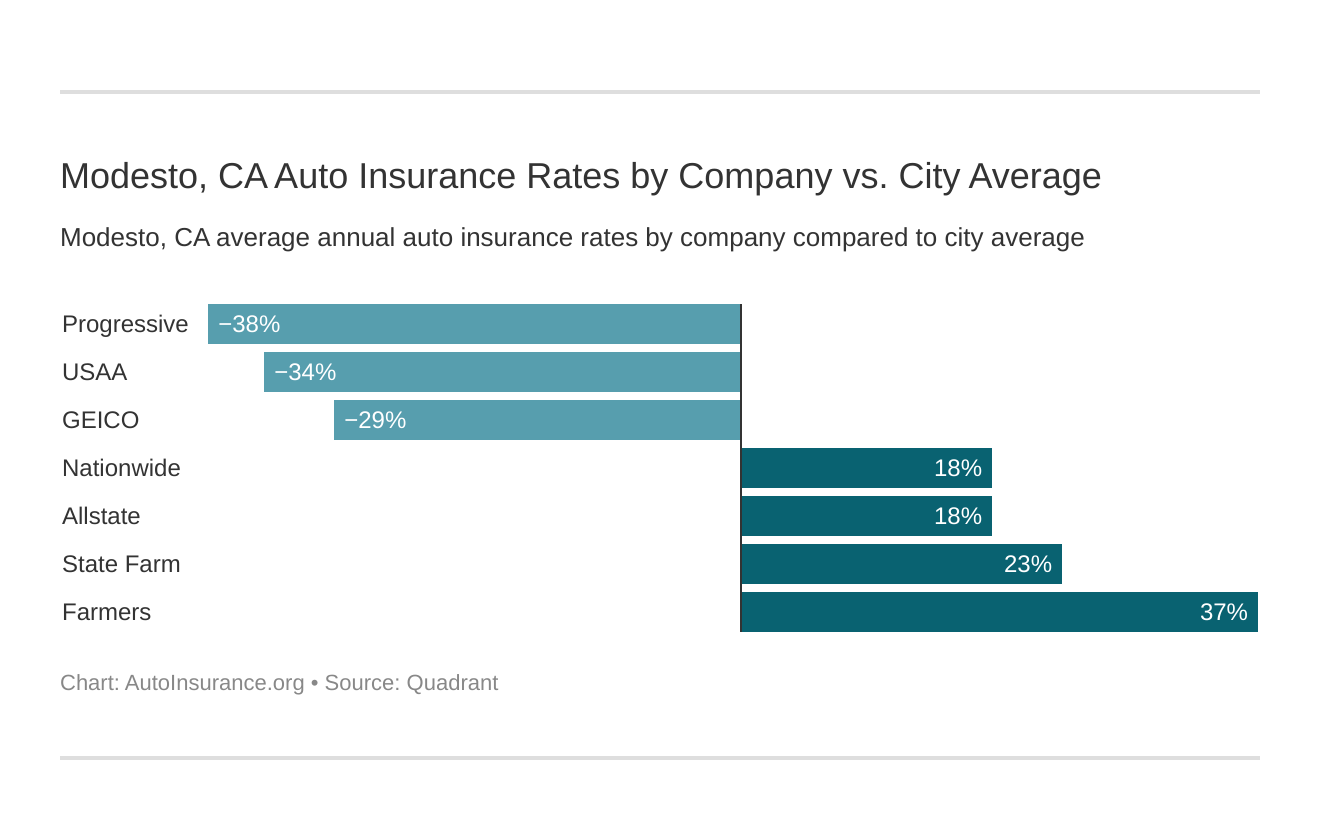

What is the cheapest auto insurance company in Modesto, CA?

The cheapest auto insurance company in Modesto, based on average rates, is Progressive.

Which Modesto, CA car insurance company has the best rates? And how do those rates compare against the average California car insurance company rates? We’ve got the answers below.

The top auto insurance companies in Modesto, CA, ranked from cheapest to most expensive are:

- Progressive – $2,597.74

- USAA – $2,688.44

- Geico – $2,822.26

- Liberty Mutual – $3,165.15

- Travelers – $3,528.14

- Nationwide – $4,544.54

- Allstate – $4,555.55

- State Farm – $4,767.26

- Farmers – $5,512.56

There are a lot of factors that determine your auto insurance rates. The cheapest company for you will depend on your personal factors, including what part of the city you call home, your driving record, what kind of car you drive, and the coverage level you choose.

What auto insurance coverage is required in Modesto, CA?

All Modesto drivers have to meet the California state law minimum requirements to buy auto insurance.

In California, you have to carry at least:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

It’s recommended that most drivers carry more than the state minimum.

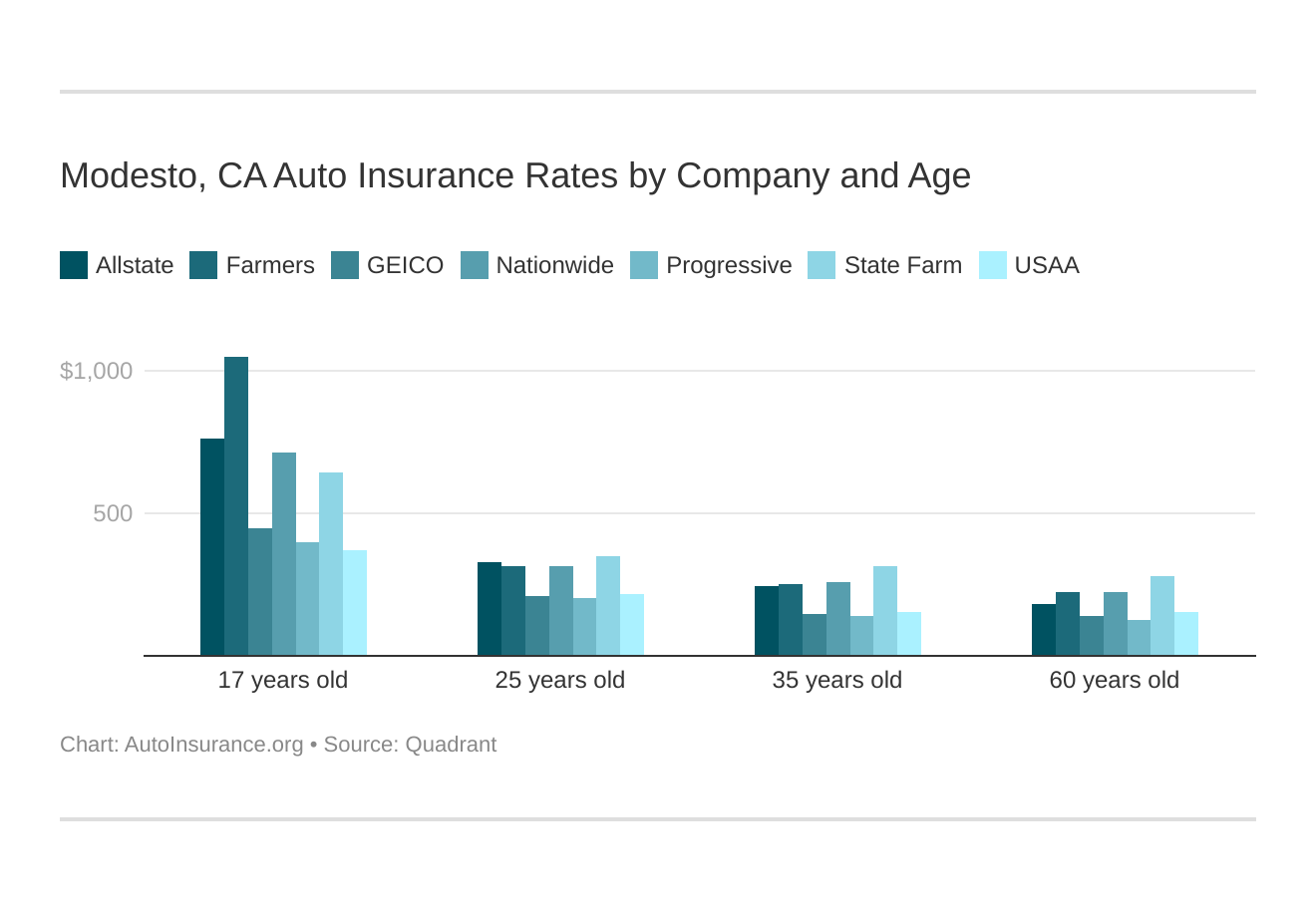

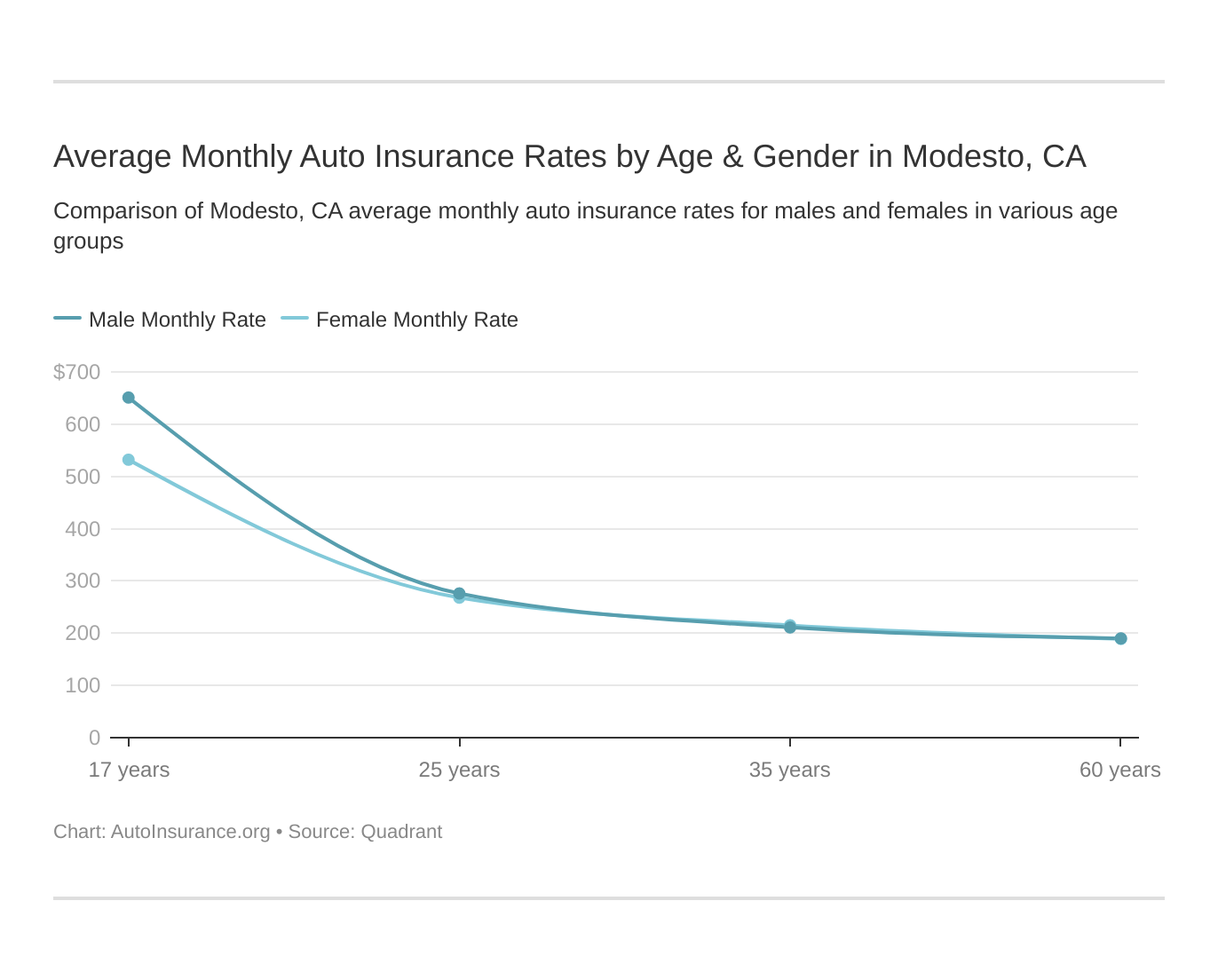

Modesto, CA car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

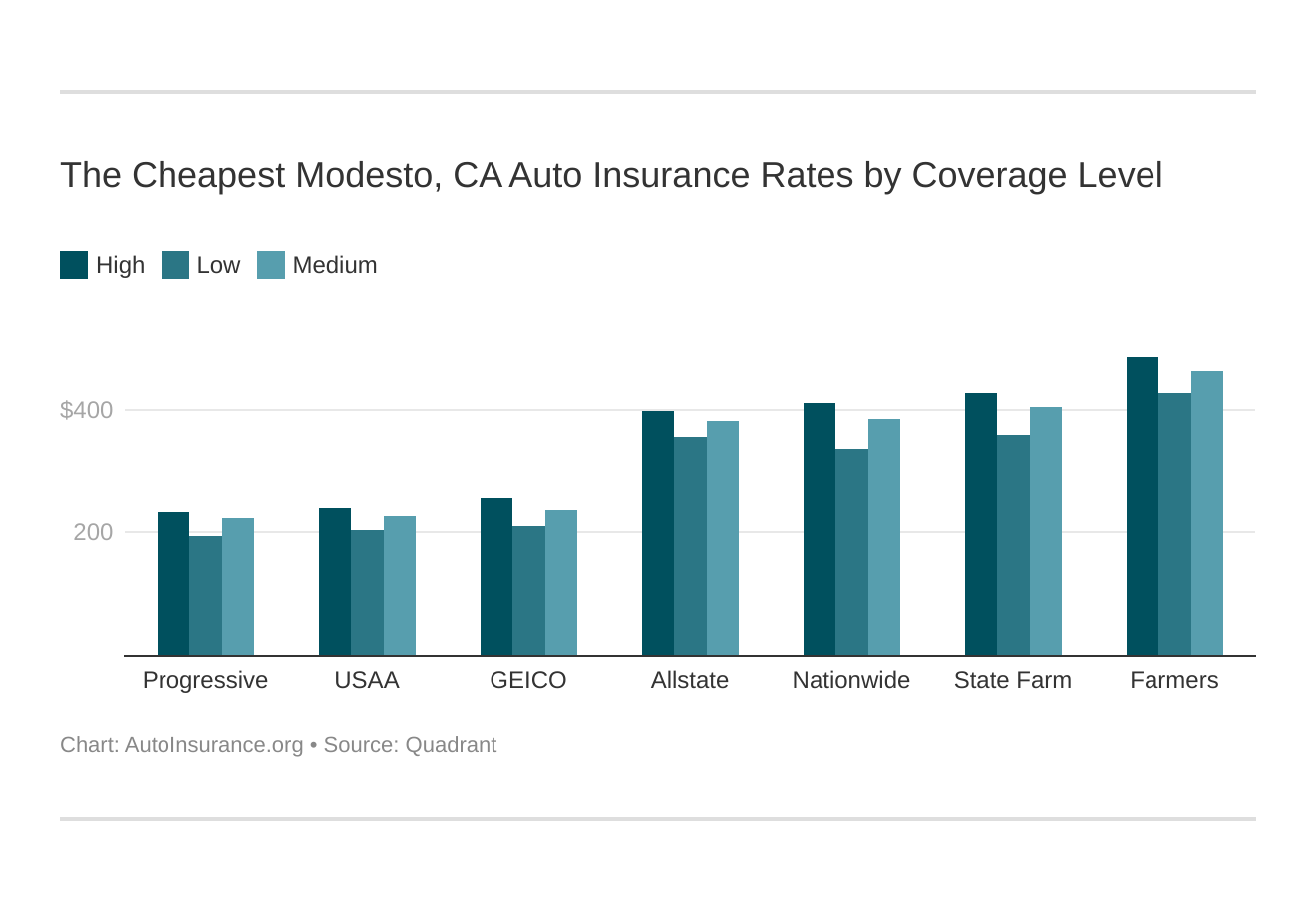

Your coverage level will play a major role in your Modesto car insurance rates. Find the cheapest Modesto, CA car insurance rates by coverage level below:

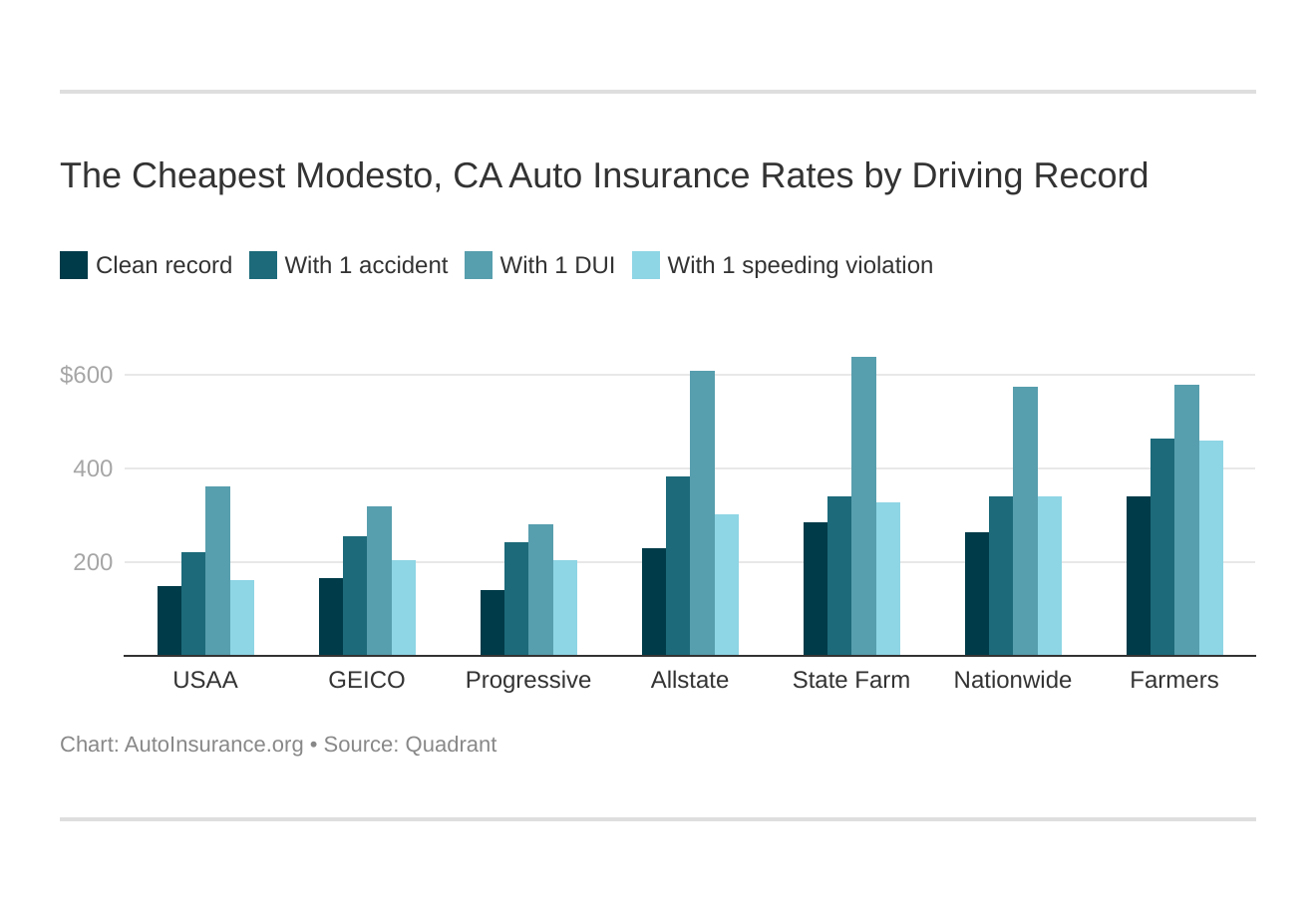

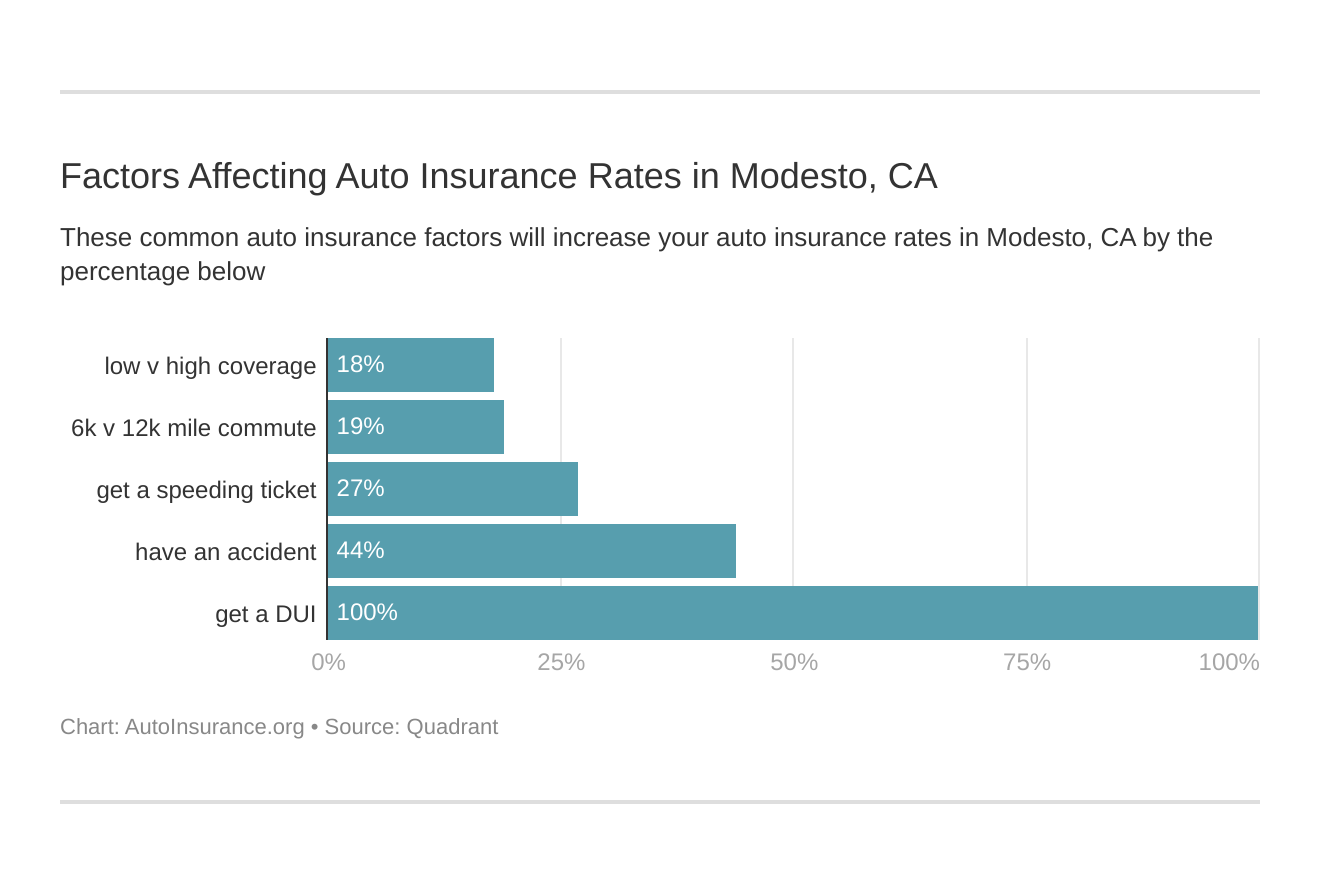

Your driving record will play a major role in your Modesto car insurance rates. For example, other factors aside, a Modesto, CA DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Modesto, CA car insurance rates by driving record.

Factors affecting car insurance rates in Modesto, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Modesto, California car insurance.

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. CA does use gender, so check out the average monthly car insurance rates by age and gender in Modesto, CA.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Modesto, CA?

Modesto is the 19th-largest city in California and about a 30-minute drive south of Stockton. Let’s take a look at how annual Modesto car insurance rates compare to other cities in California.

- Beverly Hills, CA — $6,188.41 (most expensive)

- Stockton, CA — $3,872.69 (next closest city)

- Modesto, CA — $3,797.96

- Los Ranchos, CA — $2,731.32 (cheapest)

INRIX ranks Stockton as the 211th-most congested city in the U.S. but has no specific information for Modesto. Modesto is south of Stockton, so traffic heading to a larger city can affect auto insurance rates.

According to City-Data, the average commute time in Modesto is 26.6 minutes.

Auto theft in Modesto also affects rates, and the most recent annual statistics list 1,412 auto thefts in a city population of 213,677. That’s a rate of 151 cars stolen per 100,000 population.

Modesto, CA Auto Insurance: The Bottom Line

Modesto has some of the lowest car insurance rates in California, but you can still save by shopping around and comparing.

Before you buy auto insurance in Modesto, CA, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Modesto, CA auto insurance quotes.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a contract between you and an insurance company that protects you financially in case of damages or injuries resulting from a car accident or other covered incidents. It provides coverage for liability, property damage, and medical expenses.

Is auto insurance mandatory in Modesto, CA?

Yes, auto insurance is mandatory in Modesto, CA, as it is in the entire state of California. All drivers are required to carry liability insurance coverage to legally operate a vehicle on the road.

What is liability insurance?

Liability insurance covers the costs associated with injuries or property damage caused by you in an accident. It typically includes bodily injury liability, which pays for medical expenses and lost wages of the other party, and property damage liability, which covers the repair or replacement costs for the other person’s vehicle or property.

What are the minimum liability insurance requirements in Modesto, CA?

The minimum liability insurance requirements in Modesto, CA are as follows: $15,000 for injury or death to one person, $30,000 for injury or death to multiple people, and $5,000 for property damage. These are the minimum limits, but it’s often recommended to consider higher coverage amounts for better protection.

What other types of auto insurance coverage are available?

In addition to liability insurance, there are various other types of auto insurance coverage available, including:

- Collision coverage: Pays for damages to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive coverage: Covers damages to your vehicle caused by non-collision incidents such as theft, vandalism, fire, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

- Medical payments coverage: Pays for medical expenses for you and your passengers regardless of fault in an accident.

- Personal injury protection (PIP): Similar to medical payments coverage, PIP covers medical expenses, lost wages, and other related costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.