Progressive SR-22 Insurance Review (2026)

This Progressive SR-22 insurance review details when to file an SR-22 and how to get coverage. You may be able to have Progressive file SR-22 insurance for a one-time fee of about $25 but expect rates to increase significantly. However, Progressive is one of the few major insurers offering SR-22 coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated May 2024

- If you have an insurance policy with Progressive, its agents can help you apply for an SR-22 certificate

- Being classified as a high-risk driver usually means an increase in insurance rates, but Progressive offers affordable prices and various discounts

- Apply for SR-22 online, over the phone, or through the Progressive app

If you’ve received a notification from the department of motor vehicles (DMV) that you’re required to obtain SR-22 insurance, you might be confused about what step to take next, especially if your insurance agency doesn’t offer this service. This isn’t unusual since most insurance companies don’t provide SR-22 certificates. Also, an SR-22 will raise your insurance rates.

One company that can accommodate you while offering affordable rates is the Progressive Insurance Company. This article explains the basics of Progressive SR-22 car insurance, how to apply for it, and why Progressive’s SR-22 certificate might be the right choice for you.

Keep reading our Progressive SR-22 insurance review to learn more.

Who Needs Progressive SR-22 Insurance

Progressive SR-22 auto insurance can help you meet your SR-22 insurance requirements as defined by your state.

Technically, an SR-22 filing is not insurance but a certificate of financial responsibility. In other words, Progressive’s SR-22 is a proof that you meet the minimum insurance requirements defined by your state.

You might require an SR-22 with Progressive in the following cases:

- You were caught driving without insurance. Whether you haven’t obtained an insurance policy in the first place or your existing one lapsed, you might need an SR-22 certificate to be able to drive again.

- You’re a high-risk driver. If you’ve been convicted of driving under the influence or driving while intoxicated, you might be classified as a high-risk driver. You could also fit into this category if you had repeated offenses in a short period of time or multiple accidents in which you were at fault.

- You haven’t paid child support. Failing to fulfill your court-ordered financial obligations can also require you to obtain an SR-22.

- You need to obtain a hardship license. This license will allow you to drive only under predefined and restricted circumstances, such as to and from work or to receive medical treatment.

If you need an SR-22, you’ll be notified during your court hearing or by your local DMV. Depending on your violation, you can be required to file for an SR-22 certificate for one to three years.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Obtaining SR-22 Insurance Through Progressive

Progressive car insurance has been in business for over 80 years and serves more than 18 million customers. Unlike most major insurance providers, Progressive does offer SR-22 insurance at an affordable cost.

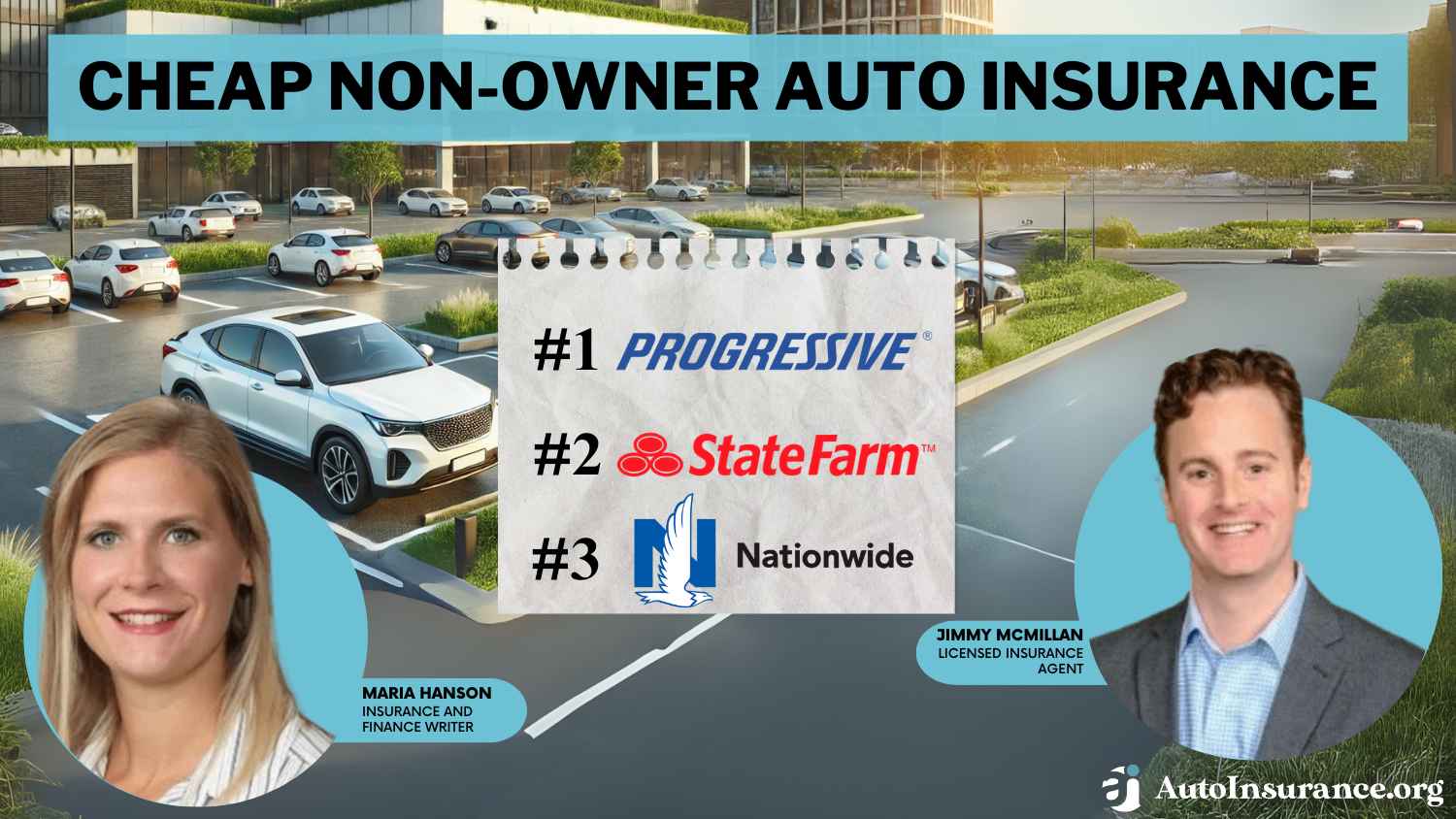

You’ll be able to obtain a SR-22 insurance even if you don’t own a car. Non-owner SR-22 insurance with Progressive will cover injuries and property damage caused by you when driving someone else’s car.

Being a high-risk driver usually means that your rates will go up significantly. However, Progressive offers many discounts that could help you offset the difference in rates.

Progressive SR-22 Insurance Cost

The filling cost for an SR-22 through Progressive is approximately $25, although this fee might vary slightly depending on your state. The cost of SR-22 insurance varies based on the following:

- Where you live

- Your driving history

- Previous driving infractions

- Coverage limits

- Additional factors

For an accurate price of SR-22 insurance, it’s best to request a Progressive SR-22 insurance quote directly.

How to Get an SR-22 From Progressive

To get an SR-22 certificate of insurance through Progressive, you must first obtain an insurance policy.

If you’re an existing customer, contact Progressive’s SR-22 customer service phone number at 1-866-749-7436. An agent will review your policy and, if needed, file the SR-22 with your local DMV. You can also request an SR-22 online by logging into your Progressive account or using the app.

If you’re currently not insured by Progressive, first you’ll need to send Progressive a request for an SR-22 quote and then purchase a policy that suits your needs. Once you obtain your policy, your Progressive insurance agent will file your SR-22 with your local DMV.

Remember to remove your SR-22 when it’s no longer needed, as it doesn’t run out automatically. Simply call your agent and request for the SR-22 to be removed from your policy.

Progressive Insurance SR-22 Coverage: The Bottom Line

Being classified as a high-risk driver usually means an increase in your insurance rate. However, Progressive does SR-22 at affordable rates, allowing you to get back behind the wheel without breaking the bank. The process is straightforward, and once you’re no longer required to carry Progressive’s SR-22 form, you can easily remove it from your policy and see your rates drop.

Since Progressive offers SR-22 coverage, it may be a good fit for your insurance needs.

Frequently Asked Questions

When do you need to file an SR-22 and does Progressive have SR-22 insurance?

You need to file an SR-22 when required by the DMV or court. Progressive offers SR-22 insurance, making it convenient for those in need.

Do I need an SR-22 or regular insurance through Progressive?

Anyone who needs to fulfill SR-22 insurance requirements set by their state can turn to Progressive for assistance.

How to file for an SR-22 with Progressive?

Whether you own a vehicle or not, you can add an SR-22 through Progressive. Existing customers can contact Progressive’s Customer Service, while new customers can request a quote, purchase a policy, and have their SR-22 filed with the DMV.

How much does Progressive charge for SR-22 insurance?

So, how much is an SR-322 with Progressive? The price for an SR-22 through Progressive is approximately $25, but the overall cost may vary depending on your state and individual circumstances.

What happens when you no longer need an SR-22?

When the SR-22 requirement is no longer necessary, you can request its removal from your policy by contacting your Progressive agent.

Is Progressive a good option for SR-22 coverage?

Progressive is a reliable choice for SR-22 insurance as it offers affordable rates and has a long-standing reputation in the insurance industry.

What is an SR-22?

So, what is the meaning of SR-22? An SR-22 is not actually an insurance policy but rather a certificate of financial responsibility that proves a driver has the minimum required insurance coverage mandated by the state. The SR-22 form filed by Progressive serves as a proof of insurance.

How does SR-22 insurance work?

When you’re required to have an SR-22, you’ll need to contact your insurance company and request that they file the SR-22 form with the state on your behalf. This form verifies that you have the required insurance coverage.

How much will an SR-22 increase my insurance rates?

Having an SR-22 on your policy will result in higher insurance premiums since it’s often required after serious driving violations. On average, you’ll pay $993 a year more.

How to find SR-22 on Progressive?

If you’re a Progressive customer, you can contact their customer service or log in to your online account to inquire about obtaining an SR-22.

How to remove SR-22 in California?

Does Progressive offer non-owner car insurance?

Does Root insurance have SR-22 insurance?

How to get a non-owner policy through Progressive?

Can you get an SR-22 certificate through Progressive in Florida?

Can you get a Progressive quote with an SR-22 online?

Does Progressive offer affordable rates with an SR-22 certificate?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.