Texas Minimum Auto Insurance Requirements in 2026 (Coverage You Need in TX)

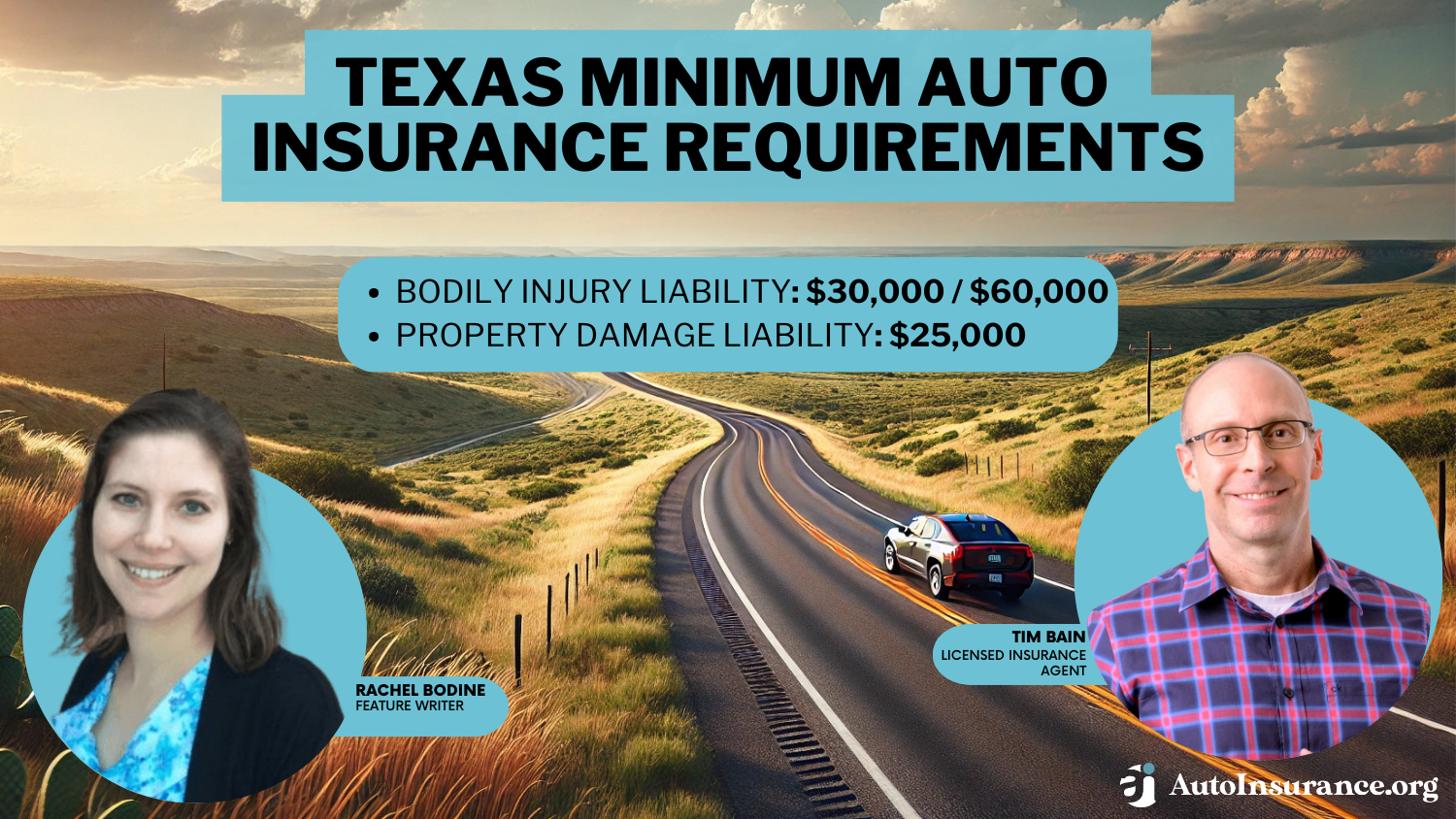

Texas minimum auto insurance requirements are 30/60/25, meaning drivers must carry coverage of $30,000 for bodily injury per person, $60,000 for all injuries in an accident, and $25,000 for property damage. Texas state minimum car insurance rates start at $23/month, making it affordable for drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated November 2024

Texas minimum auto insurance requirements ensure that every driver has basic liability protection, with set limits of $30,000 for injury per person, $60,000 per accident, and $25,000 for property damage.

USAA offers the lowest rates starting at $23 per month, followed by State Farm at $33 and Travelers at $37. These companies fulfill Texas’s required minimums and provide affordable choices for drivers looking to stay compliant without overspending.

Texas Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $25,000 per accident |

Since accident costs can easily exceed minimum coverage, many drivers in Texas also explore options for added protection.

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Texas minimum auto insurance requirements mandate 30/60/25 liability coverage

- USAA, State Farm, and Travelers offer affordable rates meeting Texas minimums

- Compare quotes to ensure compliance with Texas auto insurance requirements

Texas Minimum Coverage Requirements & What They Cover

Texas auto insurance requirements specify minimum coverage limits that are written in a set format, which includes amounts in thousands of dollars for bodily injury or death for one person, multiple people, and property damage.

- Bodily Injury Liability: Bodily injury liability auto insurance is meant to protect you if you’re found liable (or at fault) in a car crash. This specific type is meant to cover bodily injuries for passengers in other vehicles that are involved in the crash. This is usually rolled into one plan with property damage insurance.

- Property Damage Liability: Like bodily injury liability insurance, this type is meant to cover the driver who is found to be at fault. This type protects against financial liabilities if the property is destroyed in a car crash, often (but not always) involving the other car. This is often combined into one plan with bodily injury coverage. Learn more about property damage liability (PDL) auto insurance companies to explore providers that offer tailored policies to suit your needs.

Under Texas’s state minimum car insurance laws, the minimum auto insurance limits are set as follows: $30,000 for bodily injury or death per person, $60,000 for total bodily injury or death per accident, and $25,000 for total property damage per accident. These minimum limits are required to ensure basic coverage for drivers in the state.

These limits are expressed as 30/60/25 coverage, which is a standard format for Texas minimum liability insurance. While understanding Texas auto insurance laws can seem difficult at first, once you are familiar with this structure, it becomes easier to interpret the required coverage limits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Texas

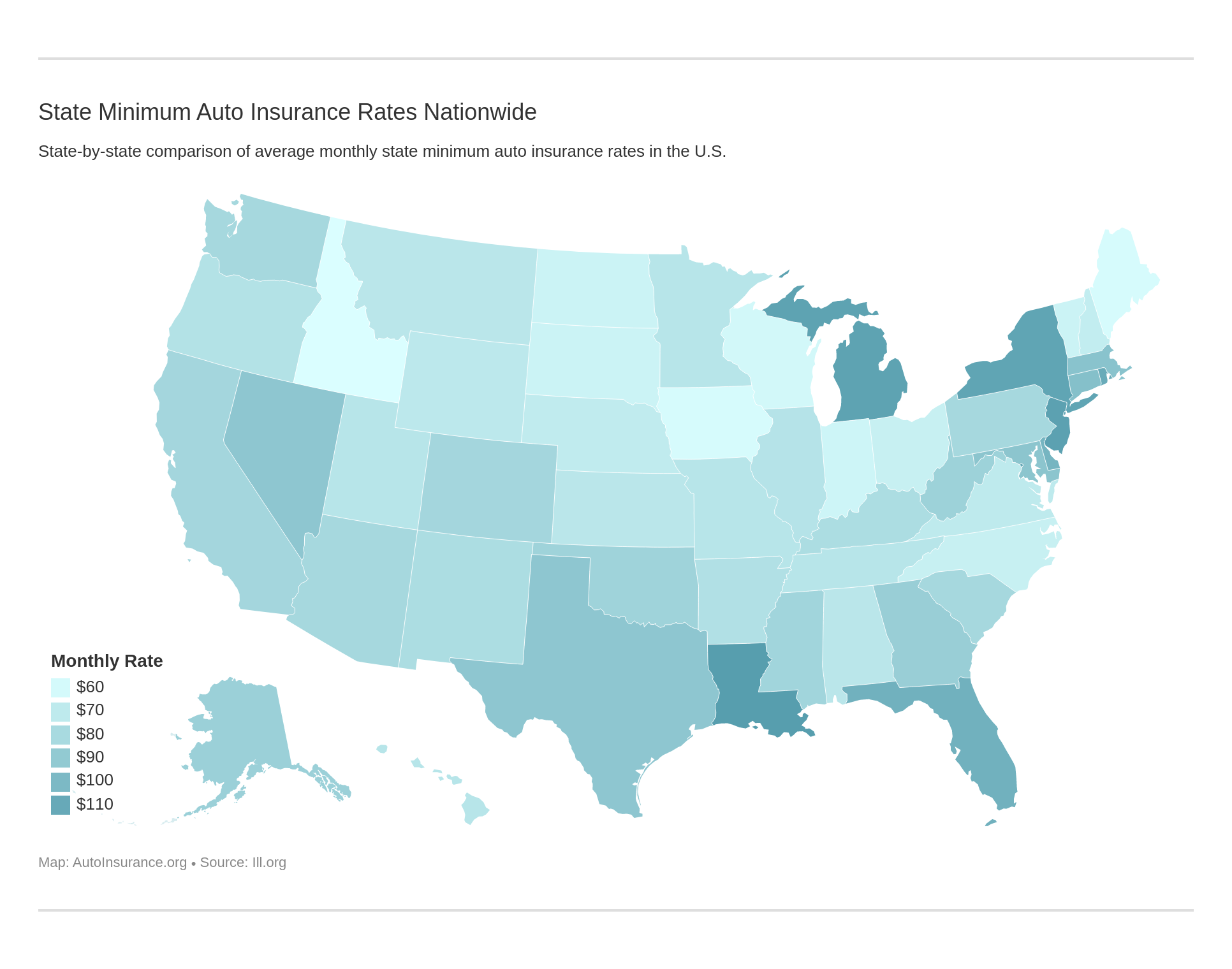

Finding the cheapest car insurance in Texas requires understanding Texas state auto insurance laws and comparing rates among top providers. Texas law requires drivers to carry Texas liability insurance requirements at the Texas state minimum auto insurance limits of $30,000 per person, $60,000 per accident, and $25,000 for property damage.

Company Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Meeting these minimums ensures drivers are legally covered, though some may choose higher coverage for added protection.

Texas Min. Coverage Auto Insurance Monthly Rates by City

City Rates

Arlington $191

Austin $177

Corpus Christi $180

Dallas $206

El Paso $183

Fort Worth $183

Houston $241

Irving $185

Lubbock $177

McAllen $189

Plano $185

San Antonio $182

Among the most affordable options, USAA offers the lowest rates at $23 per month, followed by State Farm at $33 and Travelers at $37. Even though Texas state minimum auto insurance coverage would be the cheapest for drivers, most of them prefer more comprehensive coverage for more protection against increased losses in case of major accidents.

Drivers can compare various providers and learn the state’s minimum requirements so as to receive the best rates they may need.

Read more: What does standard auto insurance cover?

Other Coverage Options to Consider in Texas

There are several different types of automotive insurance, providing for different occasions and types of accidents. In general, these different types can be explained as follows:

- Personal Injury Protection (PIP): Personal injury protection auto insurance is meant to insure the driver against injuries inflicted upon themself and anyone in the vehicle with them, regardless of who is found liable for the crash. It can also be used to account for wages lost as a result of a crash, often from drivers missing work after collisions. The state of Texas requires all insurance companies to offer their customers PIP, with most benefits ranging between $2,500 and $5000.

- Collision: Collision auto insurance covers damage to the driver’s own car, designed to repair or replace parts after a crash. This coverage does not only provide financial safety in the event of a two-car collision but also in the event of a crash into a tree or other inanimate object.

- Comprehensive: Considered a vital type of coverage to hold, comprehensive auto insurance plans protect against financial debt in instances that do not always involve a car crash. These plans cover automotive theft, fires that damage the vehicle, hitting animals, and a variety of other conditions.

- Uninsured and Underinsured Motorist Coverage: Although all drivers in the state of Texas are required to have insurance, that is not always the case. This coverage protects against collisions where another driver is found to be at fault but either doesn’t have insurance, doesn’t have enough insurance, or if it’s a hit-and-run.

In Texas, it’s crucial to meet the minimum liability insurance requirements in Texas and the state required minimum car insurance coverage in Texas to stay compliant with the law.

Understanding your options, such as Bodily Injury Liability, Property Damage Liability, and Personal Injury Protection (PIP), can help you choose the right coverage for added protection and peace of mind on the road.

Penalties for Driving Without Auto Insurance in Texas

Driving in Texas without insurance coverage will seriously endanger you. Texas requires every driver to maintain auto insurance, protecting all drivers on Texas roads. In a situation where you are caught driving without insurance coverage, you might be dealt a set of the following penalties:

- Fines: Up to $350 for a first offense, with higher fines for repeat offenses.

- License Suspension: Your driver’s license could be suspended for up to one year.

- Vehicle Impoundment: Your vehicle may be impounded, and you’ll have to pay towing and storage fees.

- SR-22 Requirement: You may need to file an SR-22 auto insurance form to show proof of insurance.

- Increased Penalties for Repeat Offenders: If caught multiple times, penalties become more severe.

It’s important to know that car insurance is required in Texas and to meet the state of Texas minimum auto insurance requirements to avoid these penalties.

To comply with Texas law, drivers must have liability insurance covering at least $30,000 for injuries per person, $60,000 for total injuries per accident, and $25,000 for property damage.Michelle Robbins Licensed Insurance Agent

Following auto insurance laws in the state of Texas ensures you stay protected and avoid unnecessary legal and financial issues.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Other Texas Car Insurance Laws

Texas insurance requirements state that drivers also need to prove that they can be financially responsible for any fees that might result from an automotive accident. They are considered to have taken financial responsibility when a vehicle has been officially and legally registered in their name.

They are, however, required to return their state-issued license plates to a DMV location to insure that the vehicle is not used. They can also submit their vehicle and title to the DMV for demolition.

These car insurance laws in Texas are designed to ensure that every vehicle on the road has someone who takes financial responsibility for any damages that result from its operation.

In subsequent offenses, these fines increase to between $350 and $1,000, and the driver can have their license and registration revoked until proof of insurance is provided to a local DMV.

Read more: How to Get Auto Insurance Without a License

Understanding Texas Auto Insurance Coverage and Requirements

In Texas, the Texas requirements for auto insurance outline the minimum coverage needed for basic protection. However, drivers who frequently drive or have a history of accidents may want to consider higher coverage.

The minimum requirements for full coverage auto insurance in Texas often offer better protection than the state’s basic minimums. Experts usually recommend at least $100,000 in coverage per person and $300,000 for the entire accident to cover the higher costs associated with more serious accidents.

State Farm General is accused of boosting profits at policyholders’ expense:

🚩 $100s of millions in excess reinsurance from parent company

🚨Claimed financial distress

🚨Applied for a 30% rate hikeLouisiana cannot trust big insurance. #LaGov #LaLege https://t.co/AI6JPFQtXy

— Real Reform Louisiana (@RealReformLA) November 11, 2024

The Texas requirements for full coverage auto insurance can differ depending on the provider, so it’s important for drivers to compare options.

Every driver has unique needs, and taking the time to shop around ensures they find the coverage that best fits their situation, providing the right protection and peace of mind on the road.

Read more: When to Buy More Than Minimum Auto Insurance

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

What is the minimum required car insurance coverage in Texas?

Texas minimum insurance requirements are as follows:

- $30,000 bodily injury liability coverage per person

- $60,000 bodily injury liability coverage per accident if multiple people are injured

- $25,000 property damage liability coverage per accident

Are these minimum policy limits in Texas sufficient?

These Texas insurance limits are the legal minimum for driving legally in the state. However, the state minimum car insurance in Texas may not always be sufficient to cover the full costs of an accident. If the damages exceed your coverage limits, you may be personally responsible for the remaining expenses. It is often advisable to consider purchasing higher coverage limits than Texas state minimum car insurance to protect yourself financially. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Does Texas require uninsured motorist coverage?

Uninsured/underinsured motorist (UM/UIM) coverage provides protection if you are involved in an accident with a driver who has no insurance or inadequate coverage. Uninsured motorist coverage is not required by Texas law, but insurance companies are required to offer it to you when you purchase an auto insurance policy. It is highly recommended that you consider adding this coverage, as it can help protect you in case of an accident with an uninsured or underinsured driver.

Are there any other types of coverage I should consider beyond the minimum car insurance coverage in Texas?

Yes, there are several additional types of auto insurance coverage you may want to consider, beyond Texas state minimum auto insurance coverage. These can include:

- Collision Coverage: This covers the cost of repairs to your own vehicle in case of a collision, regardless of fault.

- Comprehensive Coverage: Protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage: Helps pay for medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): Similar to medical payments coverage, PIP provides broader coverage for medical expenses, lost wages, and other related costs.

- Rental Reimbursement Coverage: Reimburses you for the cost of a rental car while your vehicle is being repaired after an accident.

- Towing and Labor Coverage: This covers the cost of towing your vehicle and any necessary labor, such as roadside assistance.

What does liability insurance cover in Texas?

Texas liability auto insurance covers the costs associated with injuries or property damage that you cause to others in a car accident.

Is PIP required in Texas?

Personal Injury Protection (PIP) is not required in Texas, but it can be beneficial because it covers your own medical expenses and lost wages regardless of who is at fault in an accident.

Read more: 10 Best Auto Insurance Companies

What is commercial insurance in Texas?

Commercial insurance in Texas protects businesses and organizations against various risks, including liability, property damage, workers’ compensation, and commercial vehicle accidents.

What is the minimum commercial auto insurance in Texas?

Texas state auto insurance laws for commercial coverage are the same as for personal auto insurance, which includes liability coverage for bodily injury and property damage.

How much is commercial truck insurance in Texas?

The cost of commercial truck insurance in Texas varies based on factors such as the type of truck, its use, driving history, and coverage needs.

Read more: Florida Minimum Auto Insurance Requirements

What is the limit on commercial insurance in Texas?

The limit can vary depending on the type of policy and the needs of the insured party.

Do you have to have Texas car insurance in Texas?

What are the requirements for full coverage auto insurance in Texas?

Is auto insurance mandatory in Texas?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.