Best Waco, Texas Auto Insurance in 2026

Waco, TX auto insurance rates average $282/mo or $3,383/yr. USAA and Nationwide offer the cheapest Waco, TX car insurance. You’ll need to buy Waco, TX car insurance that at least meets the state minimum liability requirement of 30/60/25 for bodily injury and property damage coverage. Finding affordable Waco, TX auto insurance is as easy as comparing quotes from multiple companies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

- USAA and Nationwide offer the cheapest Waco, TX car insurance rates

- Waco, TX auto insurance rates average $282 per month and $3,383 per year

- Texas requires all drivers to carry minimum liability coverage of at least 30/60/25 to drive legally

Where can you find great car insurance rates and coverage in Waco, TX? What kind of Waco, TX auto insurance coverage do you need? You’ve come to the right place. Saving on Waco, Texas auto insurance is easy, and we’ve got tips for how to find the best rates for your needs.

Read this article for more on how to get cheap auto insurance in Waco, TX, minimum coverage requirements, and more.

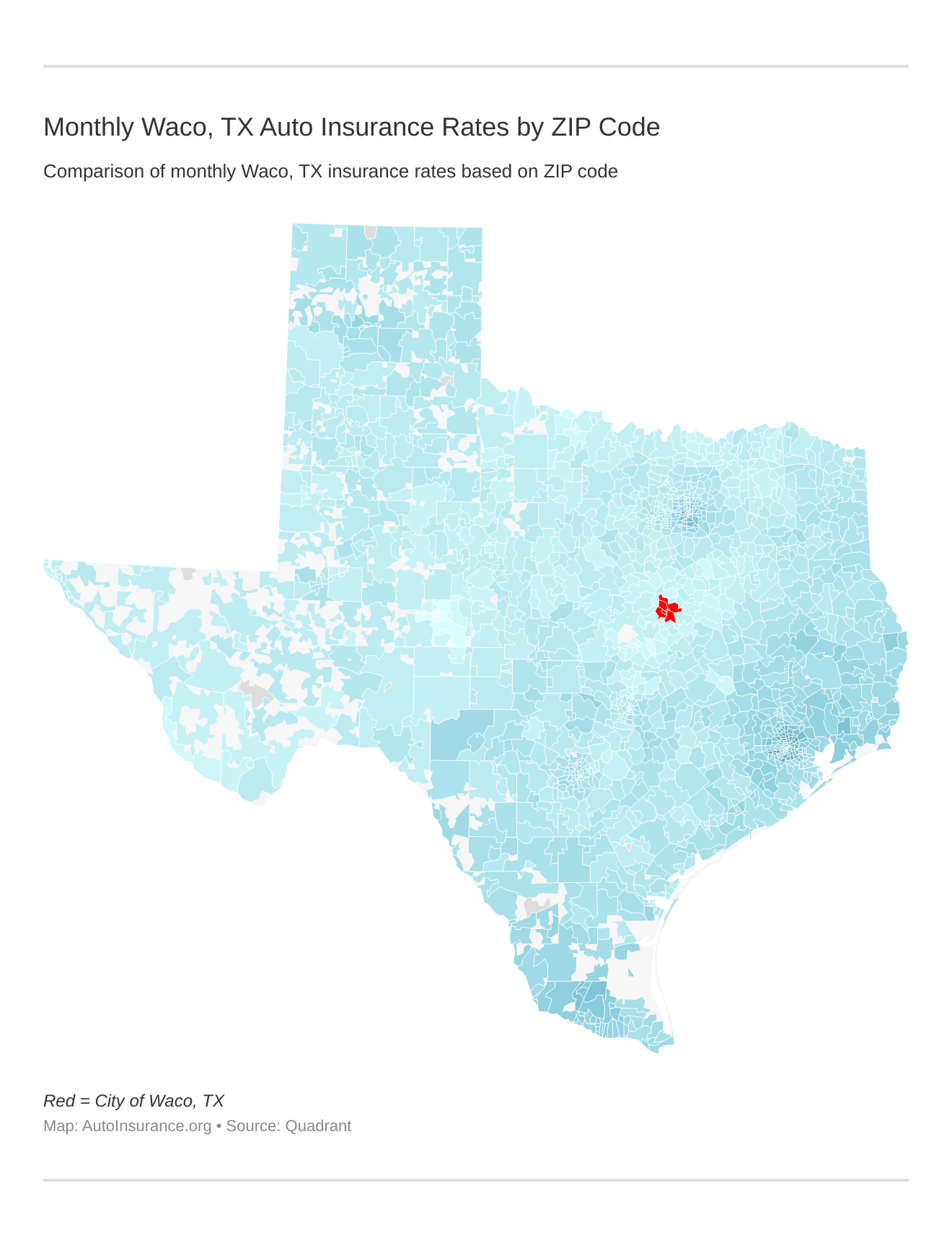

Monthly Waco, TX Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Waco, TX auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

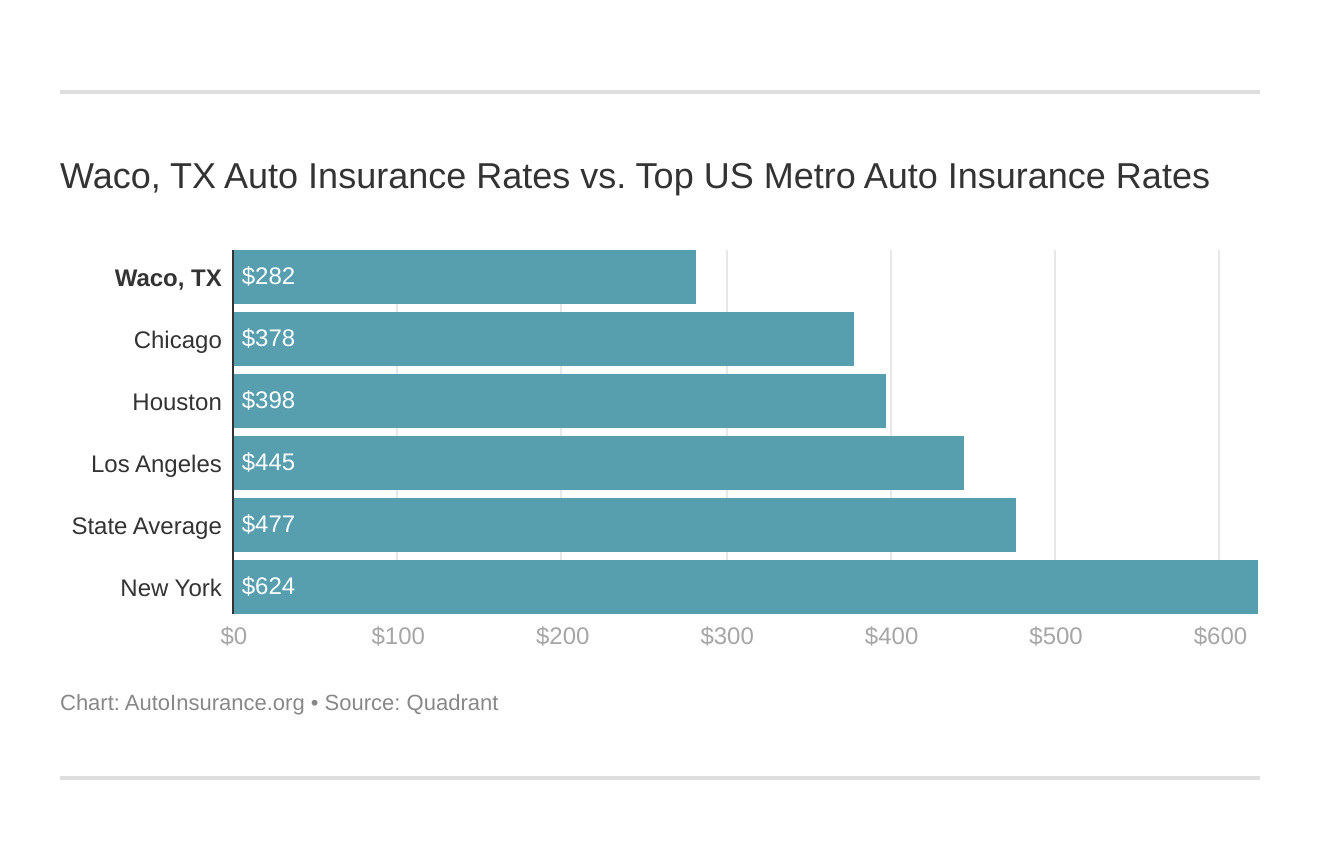

Waco, TX Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Waco, TX against other top US metro areas’ auto insurance costs.

If you’re ready to find affordable Waco, TX car insurance, all you need to do is enter your ZIP code in our free tool to start comparing Waco, TX auto insurance quotes today.

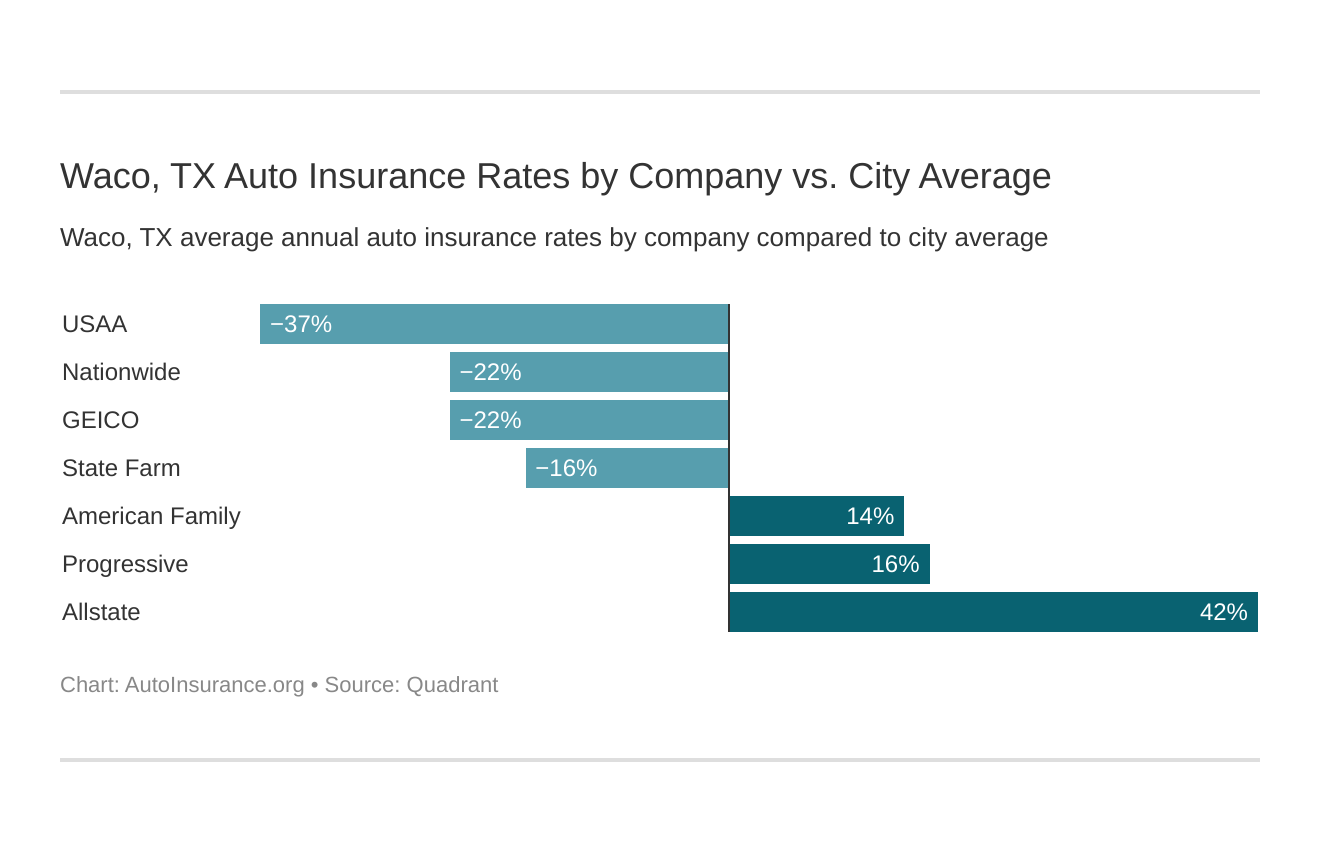

What is the cheapest auto insurance company in Waco, TX?

What’s the cheapest Waco, TX car insurance company? You’ll find USAA and Nationwide offer the best rates.

The cheapest Waco, TX car insurance providers can be found below. You also might be wondering, “How do those Waco, TX rates compare against the average Texas car insurance company rates?” We uncover that too.

Take a look at this list, in which we’ve ranked some of the top car insurance companies in Waco, TX, by least to most expensive.

- USAA – $2,323.17

- Nationwide – $2,712.16

- Geico – $2,722.20

- State Farm – $2,870.35

- American Family – $3,905.68

- Progressive – $3,969.81

- Allstate – $5,175.86

As we noted earlier, these rates are averages, so you can use them as a baseline, but there’s a good chance your rates will vary. This is because car insurance companies consider several personal factors when adjusting rates, including age, gender, marital status, driving history, and credit score.

As you might expect, where you live is also a factor, so if you’re looking for auto insurance in Dallas, Grand Prairie, TX, or anywhere else in the state, you may find your rates change.

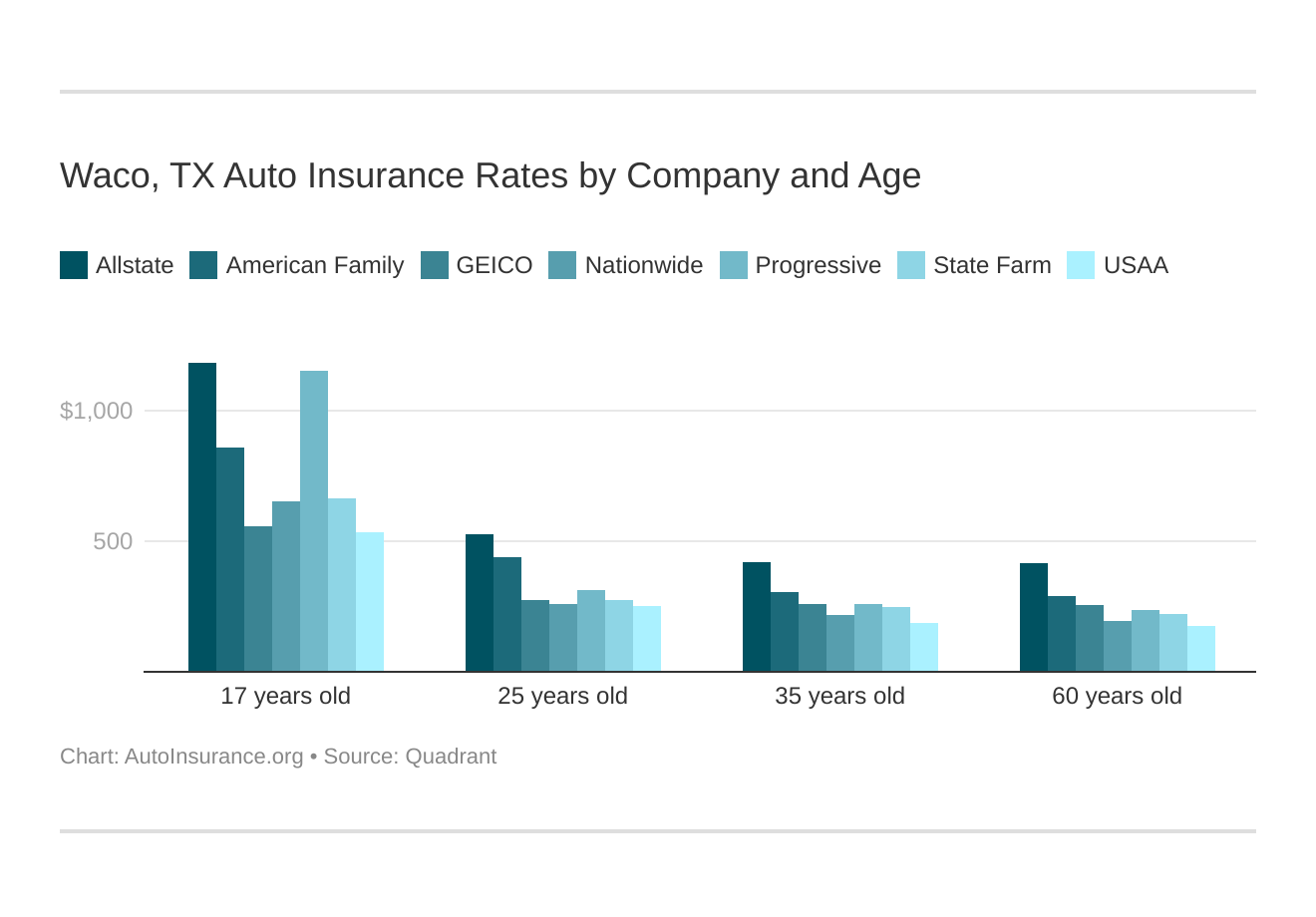

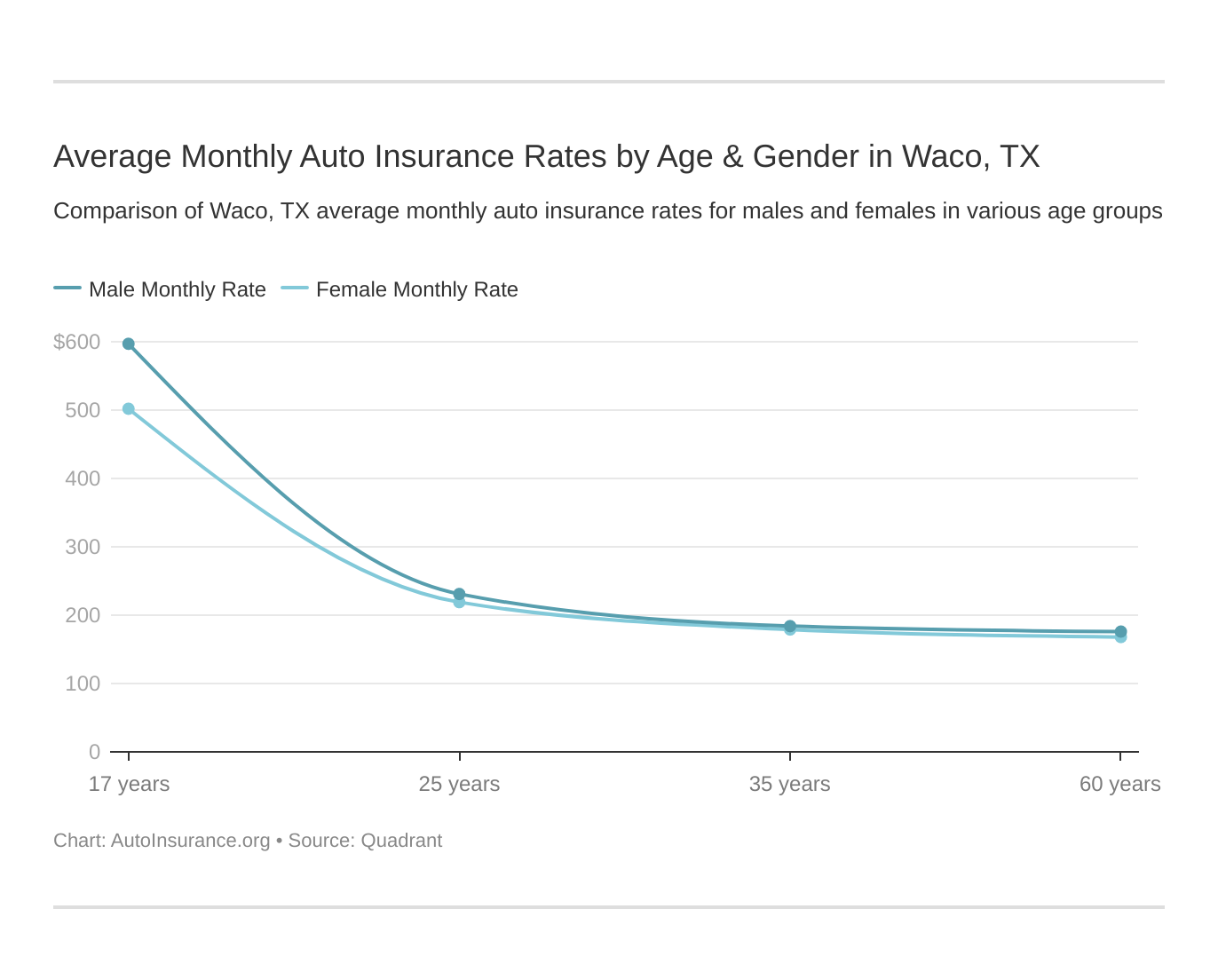

Waco, Texas car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

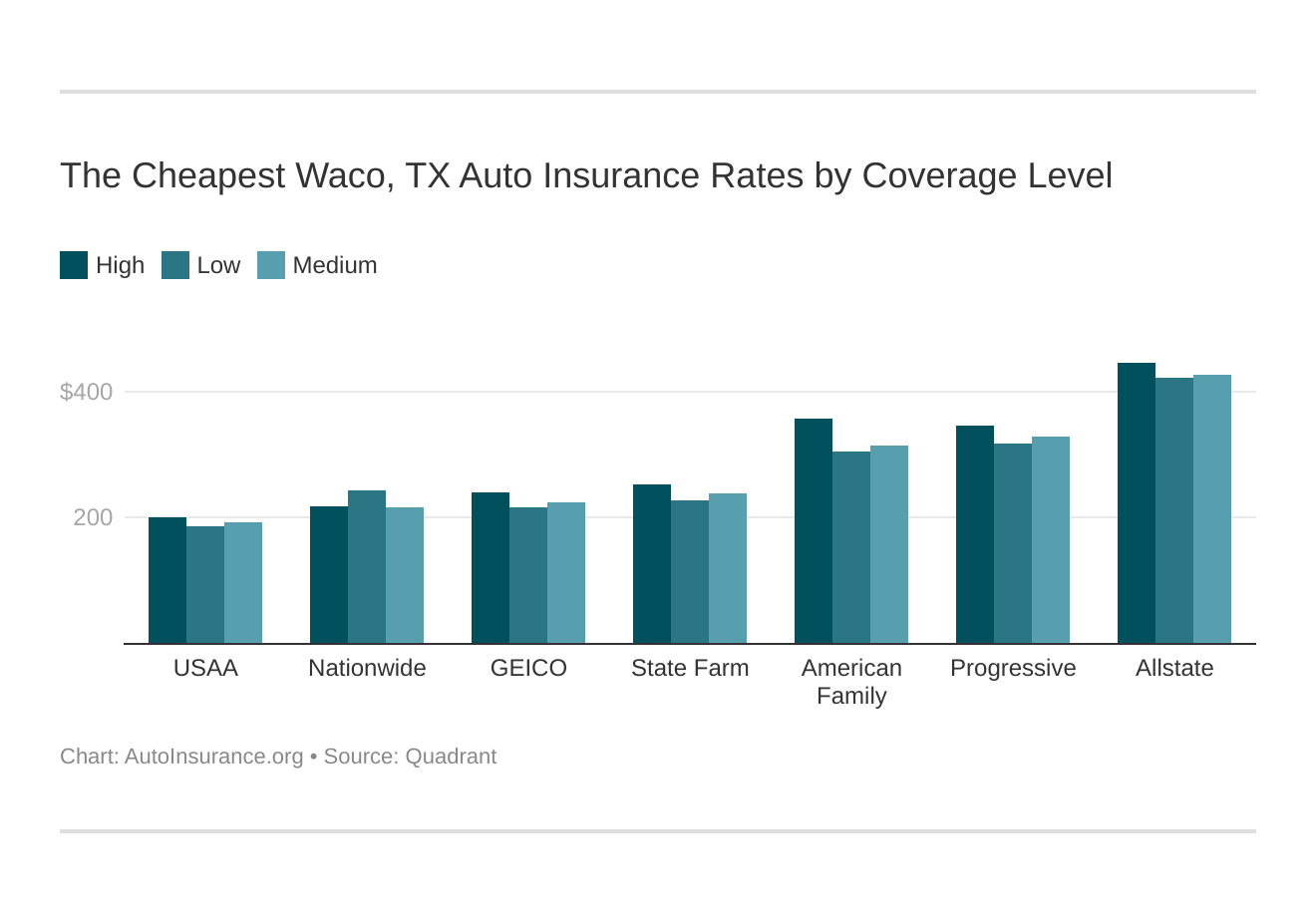

Your coverage level will play a major role in your Waco, TX car insurance costs. Find the cheapest Waco, Texas car insurance costs by coverage level below:

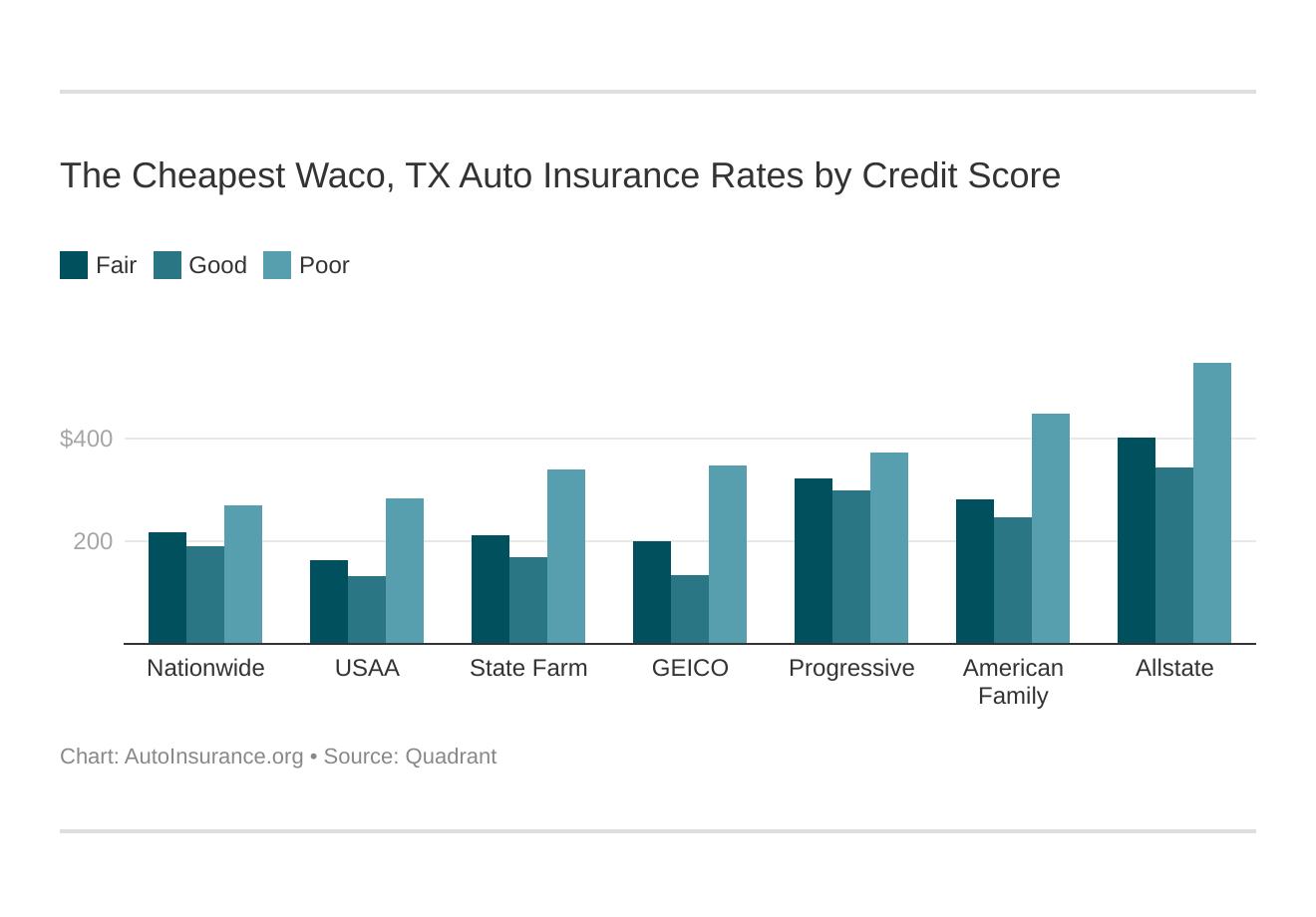

Your credit score will play a major role in your Waco, TX car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Waco, Texas car insurance costs by credit score below.

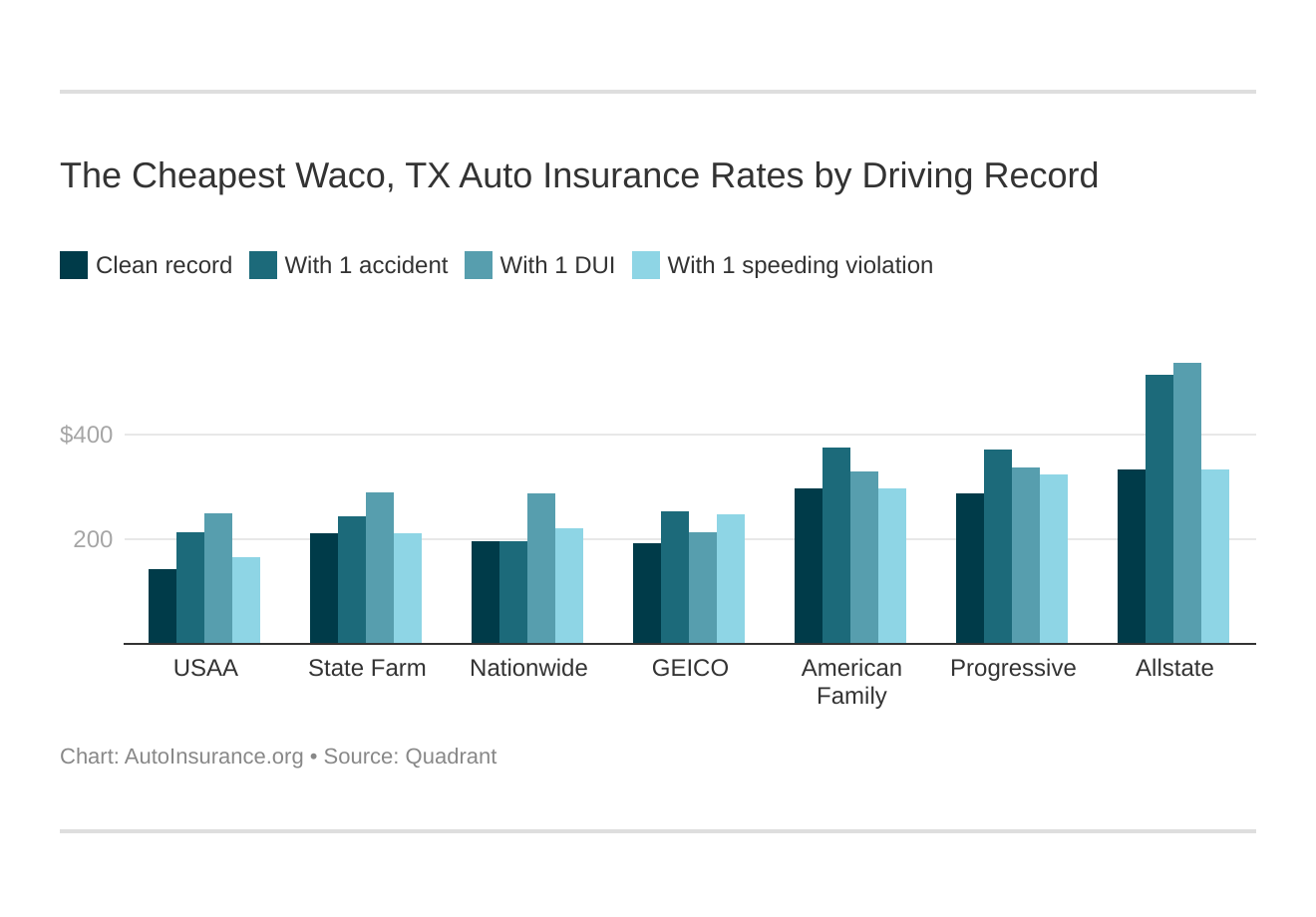

Your driving record will affect your Waco, TX car insurance costs. For example, a Waco, Texas DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Waco, Texas car insurance costs by driving record.

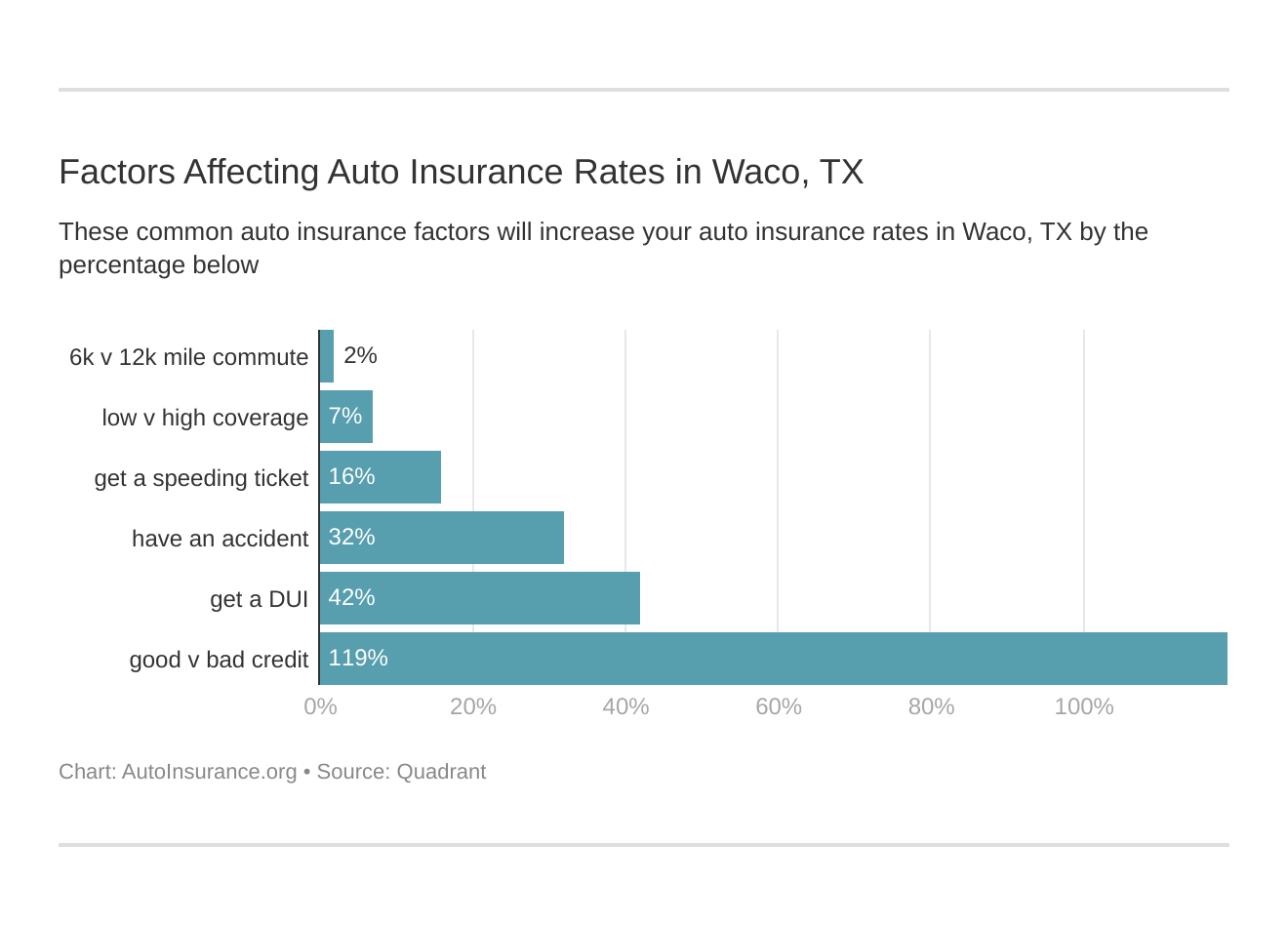

Controlling these risk factors will ensure you have the cheapest Waco, Texas car insurance. Factors affecting car insurance rates in Waco, TX may include your commute, coverage level, tickets, DUIs, and credit.

Age is a significant factor for Waco, TX car insurance rates. Young drivers are often considered high-risk. This Waco, Texas does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Waco, TX.

What auto insurance coverage is required in Waco, TX?

Drivers in Waco, TX, are required to maintain auto insurance coverage that meets the minimum liability limits set in Texas.

To legally drive in Texas, you’ll need to carry:

- $30,000 per person and $60,000 per incident for bodily injury liability

- $25,000 per incident for property damage

As an at-fault state, Texas requires drivers to be accountable for their actions in an accident, meaning whoever is at fault will be financially responsible for the cost of injuries and damages.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Waco, TX?

Take a look at these Waco, TX driving facts for more on the variables that can affect your rates.

INRIX reports that Waco, TX, is 242nd in the nation for traffic congestion. This is significantly less congestion than in larger cities in Texas, so your Waco rates may be lower than auto insurance in Houston (which is ranked 8th for traffic congestion) or auto insurance in Austin (ranked 29th), for example.

Commutes in Waco average 16.1 minutes, as reported by City-Data.

Crime rates, specifically auto theft, are another factor auto insurance companies consider when adjusting rates. The FBI reports that 140 cars are stolen per 100,000 population in Waco.

Waco, TX Auto Insurance: The Bottom Line

The best way to get affordable Waco, TX auto insurance is to compare Waco, TX car insurance quotes from multiple companies. You should also look for discounts and ask about what you may qualify for.

Keep in mind that auto insurance rates vary based on where you live (as well as other factors we mentioned earlier). So you’ll find that auto insurance in San Antonio, TX will probably be different than your Waco, TX rates.

Ready to buy Waco, TX auto insurance? Use your ZIP code in the free tool on this page to start comparing Waco, TX auto insurance rates right now.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a type of insurance coverage that provides financial protection against physical damage or bodily injury resulting from traffic collisions and other incidents involving your vehicle.

Is auto insurance mandatory in Waco, TX?

Yes, auto insurance is mandatory in Waco, TX, as it is in most states. The minimum required coverage in Texas includes liability insurance, which covers the costs if you cause an accident resulting in injury or property damage to others.

What does liability insurance cover?

Liability insurance covers the costs associated with injuries or property damage that you may cause to others in an accident. It typically includes two types of coverage: bodily injury liability and property damage liability.

What other types of coverage are available besides liability insurance?

In addition to liability insurance, there are several other types of coverage available for auto insurance in Waco, TX. These may include collision coverage (pays for damage to your vehicle in an accident), comprehensive coverage (covers damage from non-accident-related incidents), uninsured/underinsured motorist coverage (protects you if you’re in an accident with a driver who doesn’t have insurance or has insufficient coverage), and medical payments coverage (pays for medical expenses for you and your passengers).

How are auto insurance premiums determined?

Auto insurance premiums are determined based on several factors, including your driving record, age, gender, type of vehicle, location, and coverage options chosen. Insurance companies also consider statistical data and actuarial tables to assess risk and set premiums accordingly.

Can I get discounts on my auto insurance?

Yes, many insurance companies offer various discounts that can help lower your auto insurance premiums. Common discounts include multi-policy discounts (for bundling multiple insurance policies with the same company), safe driving discounts, good student discounts, and discounts for certain safety features on your vehicle.

What should I do if I’m involved in an accident?

If you’re involved in an accident, it’s important to prioritize your safety and the safety of others involved. After ensuring everyone is okay, exchange information with the other driver(s), take photos of the accident scene if possible, and report the incident to your insurance company. They will guide you through the claims process and help you with any necessary documentation.

How can I save on auto insurance in Waco, TX?

To potentially save on auto insurance in Waco, TX, you can compare quotes from multiple insurance companies to find the best rates and coverage options for your needs. Additionally, maintaining a good driving record, bundling multiple policies with the same insurer, and taking advantage of available discounts can help reduce your premiums.

What should I consider when choosing an auto insurance policy?

When choosing an auto insurance policy in Waco, TX, consider factors such as the coverage options available, the deductibles and limits that suit your needs, the financial stability and reputation of the insurance company, and the overall cost of the policy. It’s also helpful to read reviews and seek recommendations from friends or family who have experience with different insurers.

Can I cancel my auto insurance policy?

Yes, you can typically cancel your auto insurance policy. However, it’s important to review the terms and conditions of your policy and consult with your insurance provider to understand any potential penalties or consequences of cancellation. It’s generally advisable to have a new policy in place before canceling the existing one to avoid any gaps in coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.