Best Auto Insurance for Walmart Delivery Drivers in 2026 (Top 10 Companies Ranked)

Progressive, Geico, and State Farm have the best auto insurance for Walmart delivery drivers, starting at only $43/month. Progressive stands out with its commercial coverage tailored to delivery drivers, ensuring protection for Walmart delivery drivers. Geico and State Farm also offer affordable, reliable plans.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated January 2025

The best auto insurance for Walmart delivery drivers comes from Progressive, Geico, and State Farm, each offering specialized coverage for delivery needs.

Progressive leads with its commercial coverage tailored for delivery drivers, providing essential protection for Walmart workers

Our Top 10 Company Picks: Best Auto Insurance for Walmart

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Flexible Coverage | Progressive | |

| #2 | 25% | A++ | Affordable Premiums | Geico | |

| #3 | 20% | B | Excellent Service | State Farm | |

| #4 | 10% | A++ | Military Benefits | USAA | |

| #5 | 25% | A+ | Rideshare Insurance | Allstate | |

| #6 | 25% | A | Customizable Policies | Liberty Mutual |

| #7 | 20% | A+ | Competitive Rates | Nationwide |

| #8 | 20% | A | Delivery Coverage | Farmers | |

| #9 | 10% | A++ | High Satisfaction | Auto-Owners | |

| #10 | 25% | A+ | Business Focus | The Hartford |

Geico offers a streamlined claims process perfect for drivers on tight schedules, while State Farm delivers robust liability protection, ideal for high-traffic routes.

Ready to shop for the best Walmart car insurance quote near you? Enter your ZIP code above to compare Walmart auto insurance quotes from the top providers.

- Progressive provides the best auto coverage for Walmart drivers

- Walmart delivery drivers need commercial policies for full protection

- Ensure your insurance covers business use to avoid gaps in coverage

#1 – Progressive: Top Overall Pick

Pros

- Multi-policy Savings: Progressive offers substantial multi-policy discounts tailored for Walmart delivery drivers. See more details in our Progressive auto insurance review.

- Continuous Coverage Benefits: Progressive rewards Walmart delivery drivers with continuous coverage discounts, reducing long-term costs.

- Affordable Full Coverage: Walmart delivery drivers can get full coverage starting as low as $150, making it a great budget option.

Cons

- Higher Rates Without Discounts: Walmart delivery drivers without multi-policy discounts may find Progressive’s rates less competitive.

- Limited Safe Driving Rewards: Compared to other companies, the safe driving benefits for Walmart delivery drivers may not offer as many savings opportunities.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Military Drivers

Pros

- Military Discounts: Geico provides substantial discounts for Walmart delivery drivers with military service, ensuring better affordability.

- Defensive Driving Discounts: Walmart delivery drivers who complete defensive driving courses can save significantly with Geico.

- Low Full Coverage Rates: Walmart delivery drivers benefit from Geico’s competitive full coverage rates, starting at $114. Find more information on our Geico auto insurance review

Cons

- Fewer Policy Customizations: Walmart delivery drivers might find fewer customization options compared to other providers.

- Inconsistent Claims Satisfaction: Some Walmart delivery drivers report slower claims processing times with Geico.

#3 – State Farm: Best for Young Drivers

Pros

- Steer Clear Program: Walmart delivery drivers under 25 can access the Steer Clear program, providing significant discounts for safe driving habits.

- Good Student Discounts: Young Walmart delivery drivers can save with State Farm’s good student discount, helping them reduce insurance costs.

- Affordable Minimum Coverage: State Farm offers Walmart delivery drivers affordable minimum coverage starting at $47/month. More information is available about this provider in our article, “State Farm Auto Insurance Review.”

Cons

- Higher Full Coverage Rates: Walmart delivery drivers may find State Farm’s full coverage premiums higher than competitors.

- Discount Availability Varies: Walmart delivery drivers might not qualify for every discount depending on their location.

#4 – USAA: Best for Military Families

Pros

- Low Rates for Military: Walmart delivery drivers with military affiliations enjoy some of the lowest rates, starting at $32/month for minimum coverage.

- Multi-policy Discounts: USAA offers comprehensive multi-policy discounts tailored for Walmart delivery drivers, making it a cost-effective option.

- Low Annual Mileage Benefits: Walmart delivery drivers who drive fewer miles can benefit from additional low-mileage savings. Learn more in our USAA auto insurance review.

Cons

- Limited Eligibility: Only Walmart delivery drivers with military ties are eligible for USAA’s plans, restricting access.

- Limited Local Agents: Walmart delivery drivers may find fewer USAA agent offices for personalized service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Safe Drivers

Pros

- Safe Driving Discounts: Walmart delivery drivers can significantly reduce premiums with Allstate’s safe driving rewards program.

- Anti-theft Savings: Walmart delivery drivers who install anti-theft devices receive additional savings on their premiums.

- Multi-policy Discounts: Our Allstate review offers information about how Walmart delivery drivers can bundle and save with multi-policy discounts.

Cons

- Higher Full Coverage Rates: Walmart delivery drivers seeking full coverage might find Allstate’s rates higher, starting at $228.

- Premium Increases: Walmart delivery drivers may face premium hikes after claims, even if they have a good driving record.

#6 – Liberty Mutual: Best for Vehicle Safety Discounts

Pros

- Vehicle Safety Features Discounts: Walmart delivery drivers with modern safety features in their cars get additional discounts.

- Multi-policy Savings: Liberty Mutual offers Walmart delivery drivers significant savings through bundling auto with other insurance types.

- Safe Driving Discounts: Walmart delivery drivers can lower their premiums with safe driving records and monitoring apps. See how you can save on insurance in our Liberty Mutual auto insurance review.

Cons

- Expensive Full Coverage: Walmart delivery drivers will find Liberty Mutual’s full coverage starts higher at $248, making it one of the costlier options.

- Fewer Discounts for Older Vehicles: Walmart delivery drivers with older cars may not qualify for some of Liberty Mutual’s vehicle-related savings.

#7 – Nationwide: Best for Accident-Free Drivers

Pros

- Accident-Free Discount: Walmart delivery drivers with accident-free records can enjoy significant savings with Nationwide.

- Multi-policy Discounts: Walmart delivery drivers can bundle their insurance policies with Nationwide for additional savings. Learn more about offerings in our Nationwide auto insurance review.

- Defensive Driving Discounts: Walmart delivery drivers who complete defensive driving courses are eligible for further discounts.

Cons

- Higher Full Coverage Rates: Walmart delivery drivers looking for full coverage might find Nationwide’s $164 rate higher than some competitors.

- Fewer Digital Tools: Walmart delivery drivers may find Nationwide’s digital tools and app features less advanced than other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Green Vehicles

Pros

- Alternative Fuel Discounts: Walmart delivery drivers with eco-friendly vehicles receive discounts from Farmers.

- Multi-policy Savings: Farmers offers Walmart delivery drivers the chance to bundle policies for additional savings. Get detailed insights in our Farmers auto insurance review.

- Good Student Discounts: Walmart delivery drivers who are students can benefit from Farmers’ good student discount program.

Cons

- Higher Full Coverage Rates: Walmart delivery drivers seeking full coverage will find Farmers’ rates higher at $197/month.

- Limited Digital Claims Tools: Walmart delivery drivers may find Farmers’ digital claims process less streamlined than competitors.

#9 – Auto-Owners: Best for Customizable Coverage

Pros

- Customizable Policies: Auto-Owners allows Walmart delivery drivers to tailor their policies to fit specific needs. Explore our review of Auto-Owners auto insurance.

- Safe Driver Discounts: Walmart delivery drivers with good driving records can lower their premiums through safe driver programs.

- Student Discounts: Walmart delivery drivers who are students can save further with Auto-Owners’ student discounts.

Cons

- Fewer Nationwide Offices: Walmart delivery drivers may struggle to find local offices or agents with Auto-Owners.

- Higher Premium Variability: Walmart delivery drivers may find that rates can fluctuate more compared to other providers.

#10 – The Hartford: Best for Defensive Driver Discounts

Pros

- Defensive Driver Savings: Walmart delivery drivers who take defensive driving courses can benefit from significant discounts. Find insights in our complete The Hartford auto insurance review.

- Vehicle Safety Features Discounts: Walmart delivery drivers with modern vehicle safety features can reduce their premiums.

- Hybrid Vehicle Discounts: Walmart delivery drivers with hybrid or eco-friendly vehicles receive special discounts from The Hartford.

Cons

- Higher Minimum Coverage Rates: Walmart delivery drivers will find The Hartford’s minimum coverage rates start at $61, higher than many competitors.

- Limited Availability: Walmart delivery drivers may not find The Hartford as widely available in certain areas, limiting access.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Walmart Delivery Drivers Auto Insurance Monthly Rates by Provider & Coverage Level

This table highlights the monthly rates for Walmart delivery drivers across various providers, showcasing the minimum and full coverage options. By comparing these rates, drivers can identify the most suitable plan for their budget and coverage needs.

Walmart Delivery Drivers Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $47 | $124 | |

| $75 | $197 | |

| $43 | $114 |

|

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $61 | $161 |

| $32 | $84 |

Progressive and Auto-Owners stand out, offering both affordable minimum coverage at $40 and $160 for full coverage, making them ideal for drivers seeking reliable protection at lower costs. Geico leads with the cheapest full coverage rate at $114, while State Farm offers a balanced option with $47 for minimum and $123 for full coverage.

For those looking for budget-friendly coverage, USAA provides the lowest rates across the board, with $32 for minimum and $84 for full coverage. Each of these companies caters to specific needs for Walmart delivery drivers, ensuring essential protection without breaking the bank.

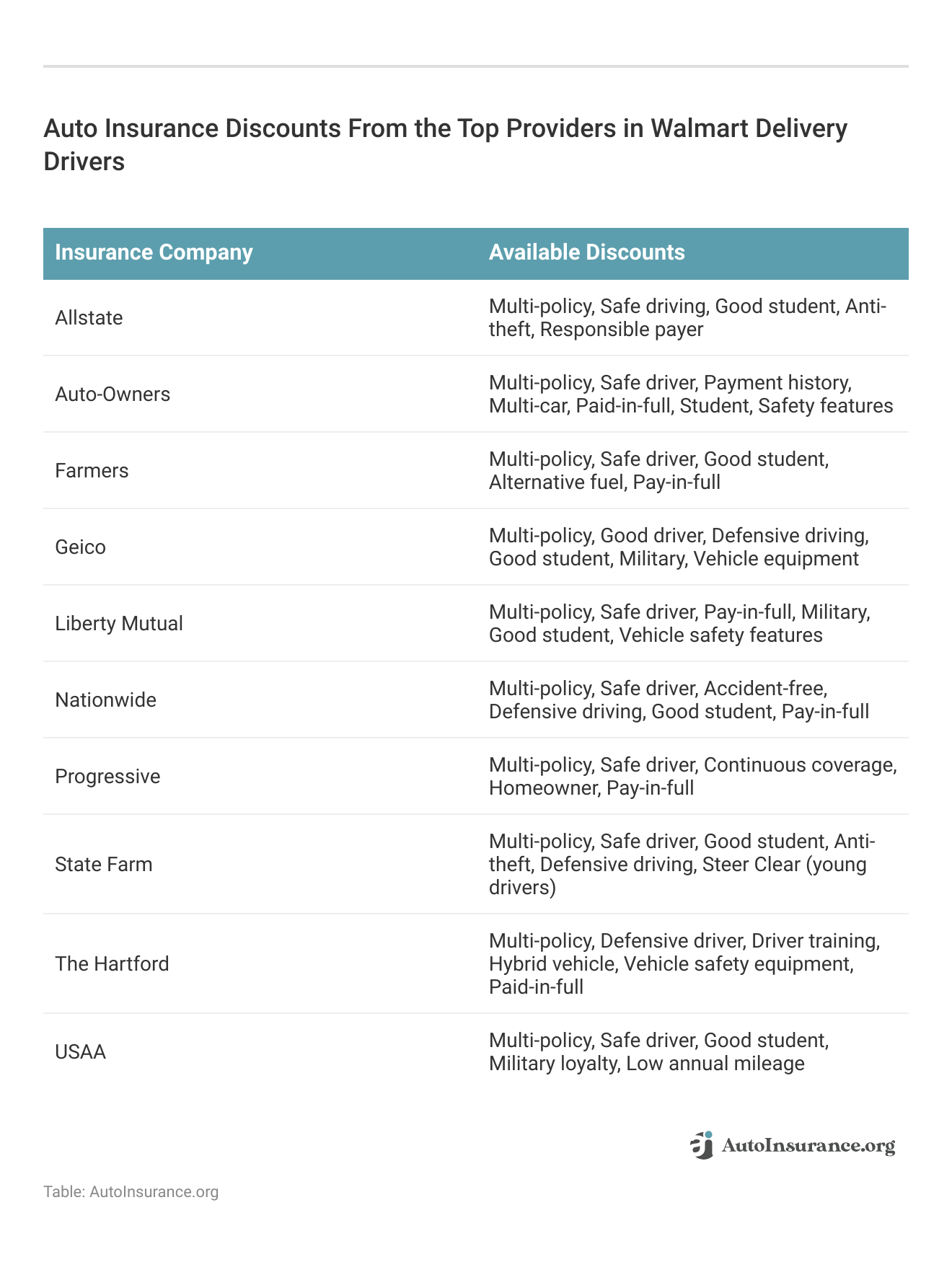

This table outlines the range of discounts available to Walmart delivery drivers from top insurance providers. By leveraging these discounts, drivers can significantly reduce their monthly premiums while ensuring they meet their unique coverage needs.

Read More: Best Business Auto Insurance

Walmart Delivery Auto Insurance vs. Rideshare Auto Insurance

Insurance companies view delivery driving differently from carrying passengers. Most auto insurance companies won’t provide personal insurance coverage for delivering groceries or packages for compensation.

If you deliver groceries for Walmart through Uber, the company’s $1 million commercial general liability insurance will cover the actual delivery. Uber’s commercial liability policy covers grocery deliveries for Walmart, but drivers must meet their state’s auto insurance minimums to apply.

However, if you’re an independent delivery driver from a company besides Uber, you may need civil auto coverage for Walmart deliveries. Compare commercial car insurance rates by vehicle and types of auto insurance coverage in the table below:

Commercial Auto Insurance Monthly Rates by Vehicle Type

| Car Type | Minimum Coverage | Full Coverage |

|---|---|---|

| Car | $50 | $200 |

| Semi | $667 | $1,042 |

| Cargo/Delivery Van | $275 | $517 |

| Limo | $333 | $500 |

| Cab | $417 | $833 |

Various state governments have worked with insurers to develop ridesharing policy add-ons for drivers who work for Transportation Network Companies (TNC) such as Uber or Lyft.

Often, state insurance websites list the best rideshare auto insurance companies that provide TNC driver insurance. To find cheap Walmart auto insurance near me at prices that don’t break the bank, shop around for quotes and coverage options from the best providers.

Walmart Spark Driver Insurance Requirements

While Walmart may offer liability Spark driver car insurance to its delivery drivers, they’ll need to carry a personal policy to qualify for Walmart Spark. Check out the table below to see each state’s minimum requirements for Spark driver car insurance:

Minimum Liability Auto Insurance Requirements by State

| States | Coverages | Liability Limits | PIP Limit | No-Fault/At-Fault |

|---|---|---|---|---|

| Alabama | Bodily injury & property damage liability | 25/50/25 | X | At-Fault |

| Alaska | Bodily injury & property damage liability | 50/100/25 | X | At-Fault |

| Arizona | Bodily injury & property damage liability | 25/50/15 | X | At-Fault |

| Arkansas | Bodily injury & property damage liability, personal injury protection (PIP) | 25/50/25 | $5,000, optional | At-Fault |

| California | Bodily injury & property damage liability | 15/30/5 | X | At-Fault |

| Colorado | Bodily injury & property damage liability | 25/50/15 | X | At-Fault |

| Connecticut | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 | X | At-Fault |

| Delaware | Bodily injury & property damage liability, personal injury protection (PIP) | 25/50/10 | $30,000 | At-Fault |

| Florida | Property damage liability, personal injury protection (PIP) | 10/20/10 | $10,000 | No-Fault |

| Georgia | Bodily injury & property damage liability | 25/50/25 | X | At-Fault |

| Hawaii | Bodily injury & property damage liability, personal injury protection (PIP) | 20/40/10 | $10,000 | No-Fault |

| Idaho | Bodily injury & property damage liability | 25/50/15 | X | At-Fault |

| Illinois | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/20 | X | At-Fault |

| Indiana | Bodily injury & property damage liability | 25/50/25 | X | At-Fault |

| Iowa | Bodily injury & property damage liability | 20/40/15 | X | At-Fault |

| Kansas | Bodily injury & property damage liability, personal injury protection (PIP) | 25/50/25 | $9,000 | No-Fault |

| Kentucky | Bodily injury & property damage liability, personal injury protection (PIP), uninsured motorist, underinsured motorist | 25/50/25 | $10,000 | No-Fault |

| Louisiana | Bodily injury & property damage liability | 15/30/25 | X | At-Fault |

| Maine | Bodily injury & property damage liability, uninsured motorist, underinsured motorist, medical payments | 50/100/25 | X | At-Fault |

| Maryland | Bodily injury & property damage liability, personal injury protection (PIP), uninsured motorist, underinsured motorist | 30/60/15 | $2,500, optional | At-Fault |

| Massachusetts | Bodily injury & property damage liability, personal injury protection (PIP) | 20/40/5 | $8,000 | No-Fault |

| Michigan | Bodily injury & property damage liability, personal injury protection (PIP) | 20/40/10 | $50,000 | No-Fault |

| Minnesota | Bodily injury & property damage liability, personal injury protection (PIP), uninsured motorist, underinsured motorist | 30/60/10 | $40,000 | No-Fault |

| Mississippi | Bodily injury & property damage liability | 25/50/25 | X | At-Fault |

| Missouri | Bodily injury & property damage liability, uninsured motorist | 25/50/25 | X | At-Fault |

| Montana | Bodily injury & property damage liability | 25/50/20 | X | At-Fault |

| Nebraska | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 | X | At-Fault |

| Nevada | Bodily injury & property damage liability | 25/50/20 | X | At-Fault |

| New Hampshire | Financial responsibility only | 25/50/25 | X | At-Fault |

| New Jersey | Bodily injury & property damage liability, personal injury protection (PIP), uninsured motorist, underinsured motorist | 15/30/5 | $15,000 | No-Fault |

| New Mexico | Bodily injury & property damage liability | 25/50/10 | X | At-Fault |

| New York | Bodily injury & property damage liability, personal injury protection (PIP), uninsured motorist, underinsured motorist | 25/50/10 | $50,000 | No-Fault |

| North Carolina | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 30/60/25 | X | At-Fault |

| North Dakota | Bodily injury & property damage liability, personal injury protection (PIP), uninsured motorist, underinsured motorist | 25/50/25 | $30,000 | No-Fault |

| Ohio | Bodily injury & property damage liability | 25/50/25 | X | At-Fault |

| Oklahoma | Bodily injury & property damage liability | 25/50/25 | X | At-Fault |

| Oregon | Bodily injury & property damage liability, personal injury protection (PIP), uninsured motorist, underinsured motorist | 25/50/20 | $15,000 | At-Fault |

| Pennsylvania | Bodily injury & property damage liability, personal injury protection (PIP) | 15/30/5 | $5,000 | No-Fault |

| Rhode Island | Bodily injury & property damage liability | 25/50/25 | X | At-Fault |

| South Carolina | Bodily injury & property damage liability, uninsured motorist | 25/50/25 | X | At-Fault |

| South Dakota | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 | X | At-Fault |

| Tennessee | Bodily injury & property damage liability | 25/50/15 | X | At-Fault |

| Texas | Bodily injury & property damage liability, personal injury protection (PIP) | 30/60/25 | $2,500, optional | At-Fault |

| Utah | Bodily injury & property damage liability, personal injury protection (PIP) | 25/65/15 | $3,000 | No-Fault |

| Vermont | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/10 | X | At-Fault |

| Virginia | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/20 | X | At-Fault |

| Washington | Bodily injury & property damage liability | 25/50/10 | $10,000, optional | At-Fault |

| Washington, D.C. | Bodily injury & property damage liability, uninsured motorist | 25/50/10 | $50,000, optional | At-Fault |

| West Virginia | Bodily injury & property damage liability, uninsured motorist, underinsured motorist | 25/50/25 | X | At-Fault |

| Wisconsin | Bodily injury & property damage liability, uninsured motorist, medical payments | 25/50/10 | X | At-Fault |

| Wyoming | Bodily injury & property damage liability | 25/50/20 | X | At-Fault |

As you can see, requirements for Walmart automobile insurance vary by state, meaning rates do too. So, don’t go with the first Walmart auto insurance quote you get — always compare quotes from various providers to find the best deal on Walmart insurance for cars. Read more in our article titled, “Auto Insurance Rates by State.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance at Walmart: How Accidents and Claims Work

Uber Eats drivers picking up and delivering food from Walmart have coverage through Uber’s $1 million commercial policy after they’ve picked up food at the store and while they’re en route to drop off the food. Uber’s $1 million liability coverage will pay for bodily injury to passengers or third-party vehicle damage.

Who needs the drama? Use Progressive’s AutoQuote Explorer® to find yourself the best rate.

@josh_dobbs1 @casekeenum @ColtMcCoy pic.twitter.com/3oClgg9eoU— Progressive (@progressive) September 24, 2024

However, if you have Spark delivery insurance with Walmart, its liability policy covers you, but you’ll still need to carry personal coverage. It’s crucial to understand how your policy interacts with commercial insurance, whether you need Walmart car insurance for employees or you’re an Uber driver. Check out Walmart car insurance reviews to find the best policy for you.

Learn More: How to File an Auto Insurance Claim

Risks of Delivering Food to Walmart

You can be responsible for carrying large orders, including heavy bags of pet food or flats of soft drinks. You could experience a higher accident risk because these items might unexpectedly shift while you’re driving. Dive into our analysis of best delivery driver auto insurance.

For full coverage, Progressive’s $150 rate provides solid protection for Walmart delivery drivers.Brandon Frady Licensed Insurance Producer

Even if you’re a Walmart employee occasionally dropping groceries off on the way home, car insurance companies see delivery driving as risky. Each state has penalties for car insurance fraud, which include fines and potential jail time. You already know that your car insurance could be canceled. If your insurance is canceled, then you could face a suspended driving license or vehicle registration.

Next Steps to Get Walmart Delivery Auto Insurance

Some insurance providers offer commercial or small business insurance designed for people who have to drive their cars as part of their job. These policies could have begun as products for on-the-road salespeople, floral delivery drivers, or even pizza delivery drivers.

Dive into the intriguing history of auto insurance with our latest article. 🚗📜 Discover the pivotal moments and unique circumstances that led to its global legislation. A must-read! #AutoInsuranceHistory #CarTrivia 👉https://t.co/yr7DaPsFwe pic.twitter.com/gRKGQO6zlK

— AutoInsurance.org (@AutoInsurance) June 30, 2024

Insurance for delivering food for Walmart can be available in your state and city. An insurance policy for small business delivery services can be affordable, especially if you speak with the company before you start making deliveries (To learn more, see our “Best Auto Insurance for Uber Eats Delivery Drivers”).

Companies and insurance commissions are working out the details of fair pricing and responsibility and have already helped to make add-ons for Uber and Lyft driving for passengers available in nearly every state. Compare your Walmart car insurance quote online against other providers by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What is the Walmart auto insurance phone number?

For Spark support and inquiries about Walmart delivery auto insurance, call 1-855-743-0457. Delve deeper into our detailed guide about what are the benefits of auto insurance.

Where can I find Walmart auto insurance reviews?

You can find Walmart auto insurance reviews by checking customer feedback on trusted insurance review websites like Trustpilot or Google Reviews.

Does Walmart have car insurance?

No, Walmart does not sell car insurance directly but may offer liability protection for Spark drivers. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

What Walmart car insurance plans are available?

Walmart does not offer specific Walmart auto insurance plans but partners with companies to provide liability coverage for delivery drivers through Spark. Find out more about the cheapest liability-only auto insurance.

Does Walmart have auto insurance?

No, Walmart does not provide auto insurance directly but may offer commercial liability coverage to its Spark delivery drivers.

Is there a Walmart car insurance discount?

Yes, Walmart employees can often qualify for car insurance discounts through affiliated providers, but Walmart itself does not offer the insurance.

Is there an insurance company inside Walmart?

Walmart does not have an insurance company inside its stores, but it partners with third-party insurers for specific delivery insurance needs.

Are there civil auto coverage Walmart reviews?

You can find civil auto coverage Walmart reviews online, with platforms like Reddit and Google offering insights from Walmart delivery drivers. Gain further insights by exploring how to buy auto insurance online instantly.

What does Walmart Spark insurance cover?

Walmart Spark insurance typically offers liability coverage for drivers delivering through Walmart’s Spark program.

Does Walmart offer full coverage car insurance?

No, Walmart does not offer full coverage car insurance directly, but delivery drivers can obtain full coverage from partnered insurers.

Does Walmart offer auto insurance in Georgia?

Does Walmart have car insurance in Texas?

Can I get Walmart auto insurance in Florida?

What is Walmart liability insurance?

Does Walmart offer health insurance?

Does Walmart provide home insurance?

Do Walmart employees get a car insurance discount?

Where can I find Walmart auto insurance reviews on BBB?

Where can I find a Walmart pet insurance review?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.