Best Lexus ES 350 Auto Insurance in 2024 (Top 10 Companies)

Farmers, Allstate, and USAA offer the best Lexus ES 350 auto insurance, starting at just $75 a month. These companies excel in coverage options, customer service, and value, making them top picks for Lexus ES 350 owners seeking reliable and affordable protection tailored to their needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jul 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,903 reviews

2,903 reviewsCompany Facts

Full Coverage for Lexus ES 350

A.M. Best Rating

Complaint Level

Pros & Cons

2,903 reviews

2,903 reviews 11,413 reviews

11,413 reviewsCompany Facts

Full Coverage for Lexus ES 350

A.M. Best Rating

Complaint Level

Pros & Cons

11,413 reviews

11,413 reviews 6,435 reviews

6,435 reviewsCompany Facts

Full Coverage for Lexus ES 350

A.M. Best Rating

Complaint Level

Pros & Cons

6,435 reviews

6,435 reviews

The top picks for the best Lexus ES 350 auto insurance are Farmers, Allstate, and USAA, known for their superior coverage options and exceptional customer service.

These companies set the standard in auto insurance by combining affordability with comprehensive benefits, ensuring Lexus ES 350 owners receive the protection they deserve. Each insurer provides unique benefits, from discounts to tailored policy customization. Learn more by reading our article titled “Comprehensive Auto Insurance Defined.”

Our Top 10 Company Picks: Best Lexus ES 350 Auto

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 27% A++ Personalized Service Farmers

#2 26% A+ Customizable Policies Allstate

#3 23% A++ Military Benefits USAA

#4 26% A+ Competitive Rates Progressive

#5 22% A Safe Driving Liberty Mutual

#6 25% B Agency Network State Farm

#7 23% A Customer Satisfaction American Family

#8 19% A+ Claims Satisfaction Nationwide

#9 20% A+ Local Agent Erie

#10 19% A+ AARP Benefits The Hartford

This guide will help you navigate through these options to find the insurance plan that best fits your lifestyle and budget.

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Farmers: Top Overall Pick

Pros

- Tailored Discounts: Farmers offers up to 27% off for bundling policies tailored specifically for Lexus ES 350 owners. Take a look at our Farmers insurance company review to learn more.

- Exceptional Customer Service: Known for personalized service, ensuring Lexus ES 350 owners receive dedicated support.

- High A.M. Best Rating: Farmers holds an A++ rating, indicating superior financial stability for Lexus ES 350 insurance.

Cons

- Higher Premiums for Some: Despite discounts, some Lexus ES 350 policies at Farmers may have higher premiums compared to others.

- Restrictive Policy Options: Limited options may be available for Lexus ES 350 owners seeking very specific customizations.

#2 – Allstate: Best for Customizable Policies

Pros

- Customized Policy Options: Allstate offers a 26% multi-policy discount and highly customizable policies for the Lexus ES 350.

- Robust Coverage Selection: Diverse coverage options that cater specifically to the needs of Lexus ES 350 owners.

- Strong Financial Rating: Allstate’s A+ rating by A.M. Best assures strong backing for Lexus ES 350 policies. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Premium Cost Variability: Lexus ES 350 owners may find premiums higher based on their customization needs.

- Complex Policy Structure: Some Lexus ES 350 owners might find the policy structures overly complex.

#3 – USAA: Best for Military Benefits

Pros

- Military-Specific Benefits: USAA provides tailored benefits and a 23% discount on multi-policy bundles for Lexus ES 350 owners in the military.

- Top-tier Financial Stability: An A++ rating from A.M. Best ensures reliability for Lexus ES 350 insurance claims.

- Exclusive Membership Benefits: Specialized services exclusively for military families owning a Lexus ES 350. Check out insurance savings for military members and their families in our complete USAA auto insurance review.

Cons

- Limited Availability: USAA’s services are only available to military members and their families, limiting access for many Lexus ES 350 owners.

- Less Competitive for Non-Military: Non-military Lexus ES 350 owners may find better options elsewhere due to the focused benefits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing: Progressive offers a 26% discount for multi-policy holders, making it a cost-effective option for Lexus ES 350 insurance.

- Flexible Coverage Options: A wide range of coverage choices suits different needs of Lexus ES 350 owners. Our complete Progressive review goes over this in more detail.

- A+ Financial Stability: Progressive’s strong A.M. Best rating ensures reliable claim support for Lexus ES 350 policies.

Cons

- Inconsistent Customer Service: Some Lexus ES 350 owners might experience variability in customer service quality.

- Rate Fluctuations: Premiums may vary significantly for Lexus ES 350 insurance based on driving history and policy terms.

#5 – Liberty Mutual: Best for Safe Driving

Pros

- Safe Driver Rewards: Liberty Mutual offers incentives and discounts for safe driving, beneficial for Lexus ES 350 owners.

- Tailored Add-ons: Options for customized add-ons enhance the insurance experience for Lexus ES 350 drivers. You can learn more about Liberty Mutual’s insurance options in our complete guide: Liberty Mutual auto insurance review.

- Solid Financial Rating: With an A rating from A.M. Best, Liberty Mutual stands as a reliable provider for Lexus ES 350 insurance.

Cons

- Higher Rates for Risk Profiles: Lexus ES 350 owners with less-than-perfect driving records may face higher premiums.

- Coverage Limitations: Some desired coverages may not be available or are more expensive for Lexus ES 350 owners.

#6 – State Farm: Best for Agency Network

Pros

- Extensive Agent Network: State Farm’s robust agency network ensures personalized service for Lexus ES 350 insurance.

- Diverse Coverage Options: Offers a variety of coverage plans, catering to different needs of Lexus ES 350 owners.

- Discounts for Low Mileage: Significant discounts available for Lexus ES 350 owners with low mileage usage. Wondering about their level of customer service? Find out in our State Farm company review.

Cons

- Limited Multi-Policy Discount: At 25%, State Farm’s multi-policy discount is less competitive for Lexus ES 350 insurance.

- Higher Premium Costs: Premiums can be relatively higher for certain coverage levels for Lexus ES 350 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: American Family is noted for its customer service, enhancing the Lexus ES 350 insurance experience.

- Customizable Policies: Tailored insurance solutions are available for Lexus ES 350 owners, with a 23% multi-policy discount.

- Strong Financial Health: An A rating from A.M. Best ensures dependable support for Lexus ES 350 insurance claims. Read our online American Family review to find out more about the company.

Cons

- Premium Variability: Costs may vary for Lexus ES 350 insurance based on personal circumstances and vehicle specifics.

- Limited Availability: American Family’s offerings and discounts for Lexus ES 350 insurance may not be available in all regions.

#8 – Nationwide: Best for Claims Satisfaction

Pros

- Exceptional Claims Service: Nationwide is known for its high claims satisfaction, ensuring a smooth process for Lexus ES 350 owners.

- Broad Coverage Options: Offers a variety of coverage levels tailored to the specific needs of Lexus ES 350 drivers. Explore more add-on options in our Nationwide auto insurance review.

- Competitive Multi-Policy Discount: With a 19% discount on multi-policy bundles, Nationwide provides value to Lexus ES 350 insurance holders.

Cons

- Premium Rates Can Be Higher: Despite the discounts, Lexus ES 350 owners may face higher premiums based on risk assessments.

- Limited Customizability: Some Lexus ES 350 owners may find fewer options for customizing their insurance policies to specific needs.

#9 – Erie: Best for Local Agent

Pros

- Personalized Local Service: Erie provides direct access to local agents who offer personalized service to Lexus ES 350 owners.

- Competitive Pricing: Offers competitive insurance rates with a 20% discount on multi-policy bundles for the Lexus ES 350. Dive into our in-depth Erie auto insurance review to find the best policy for your needs.

- Strong A.M. Best Rating: An A+ financial rating from A.M. Best ensures reliability and stability for Lexus ES 350 insurance claims.

Cons

- Geographic Limitations: Erie’s coverage and services are geographically limited, potentially unavailable for some Lexus ES 350 owners.

- Fewer Online Resources: Lexus ES 350 owners might find fewer digital tools and online resources compared to larger insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for AARP Benefits

Pros

- AARP Member Benefits: The Hartford offers exclusive benefits and discounts for AARP members, ideal for older Lexus ES 350 owners.

- Highly Rated for Service: Known for excellent customer service, supporting Lexus ES 350 insurance holders effectively. Our article, The Hartford auto insurance review, provides more detail about what this provider has to offer.

- Comprehensive Coverage Options: Provides a range of options that cater well to the needs of the Lexus ES 350 demographic.

Cons

- Age-Specific Restrictions: Benefits and discounts primarily target older individuals, limiting appeal for younger Lexus ES 350 owners.

- Higher Costs Without AARP: Non-AARP members may face higher premiums and fewer benefits for Lexus ES 350 insurance.

Comparative Monthly Insurance Rates for Lexus ES 350

The following data provides an overview of the monthly insurance rates for a Lexus ES 350, differentiated by minimum and full coverage across various insurance providers. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

Lexus ES 350 Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $90 $195

American Family $86 $192

Erie $79 $182

Farmers $85 $190

Liberty Mutual $88 $200

Nationwide $82 $187

Progressive $80 $185

State Farm $83 $188

The Hartford $87 $193

USAA $75 $180

The table illustrates how monthly premiums can vary significantly depending on the level of coverage and the insurer. For instance, USAA offers the most competitive rates with minimum coverage starting at $75 and full coverage at $180.

In contrast, Liberty Mutual presents the highest rates for full coverage at $200, although its minimum coverage is competitively priced at $88. Other notable entries include Erie, which offers one of the lowest full coverage rates at $182, and Progressive, closely aligned with Nationwide and State Farm, offering full coverage rates under $190.

This variation in pricing highlights the importance of comparing rates to ensure Lexus ES 350 owners secure insurance that not only fits their budget but also provides adequate coverage.

Lexus ES 350 Insurance Cost

The average Lexus ES 350 auto insurance rates are $123 a month. Our auto insurance experts share more in our article titled “Cheap Lexus Auto Insurance.”

Lexus ES 350 Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $123 |

| Discount Rate | $72 |

| High Deductibles | $106 |

| High Risk Driver | $261 |

| Low Deductibles | $154 |

| Teen Driver | $448 |

Overall, while the average monthly insurance rate for a Lexus ES 350 is $123, factors like deductibles and driver risk can significantly influence the final cost.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Are Lexus ES 350s Expensive to Insure

The chart below details how Lexus ES 350 insurance rates compare to other luxury cars like the Jaguar XE, Acura TLX, and Audi A6.

Read more: Jaguar Auto Insurance

Lexus ES 350 Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Lexus ES 350 | $30 | $55 | $26 | $123 |

| Jaguar XE | $32 | $65 | $33 | $143 |

| Acura TLX | $28 | $57 | $33 | $131 |

| Audi A6 | $32 | $62 | $33 | $140 |

| Lexus GS 350 | $31 | $60 | $28 | $130 |

| Mercedes-Benz E300 | $33 | $62 | $28 | $134 |

| Audi S6 | $37 | $75 | $33 | $158 |

However, there are a few things you can do to find the cheapest Lexus insurance rates online.

What Impacts the Cost of Lexus ES 350 Insurance

The Lexus ES 350 trim and model you choose can impact the total price you will pay for Lexus ES 350 insurance coverage. Explore more add-on options in our article titled “Compare Auto Insurance Rates by Vehicle Make and Model.”

Age of the Vehicle

Older Lexus ES 350 models generally cost less to insure. For example, auto insurance for a 2020 Lexus ES 350 costs about $123 monthly, while 2010 Lexus ES 350 insurance costs approximately $96 monthly, a difference of about $27 monthly.

Lexus ES 350 Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Lexus ES 350 | $31 | $56 | $27 | $123 |

| 2023 Lexus ES 350 | $30 | $55 | $27 | $123 |

| 2022 Lexus ES 350 | $30 | $54 | $26 | $122 |

| 2021 Lexus ES 350 | $30 | $54 | $26 | $122 |

| 2020 Lexus ES 350 | $30 | $55 | $26 | $123 |

| 2019 Lexus ES 350 | $29 | $53 | $28 | $120 |

| 2018 Lexus ES 350 | $28 | $52 | $28 | $119 |

| 2017 Lexus ES 350 | $27 | $51 | $30 | $118 |

| 2016 Lexus ES 350 | $26 | $49 | $30 | $116 |

| 2015 Lexus ES 350 | $24 | $47 | $31 | $114 |

| 2014 Lexus ES 350 | $24 | $44 | $32 | $111 |

| 2013 Lexus ES 350 | $23 | $41 | $32 | $107 |

| 2012 Lexus ES 350 | $22 | $37 | $33 | $102 |

| 2011 Lexus ES 350 | $20 | $34 | $33 | $98 |

| 2010 Lexus ES 350 | $20 | $32 | $33 | $96 |

Overall, the cost of insuring a Lexus ES 350 decreases with the age of the vehicle, reflecting lower comprehensive, collision, and total insurance costs for older models.

Driver Age

Driver age can significantly impact Lexus ES 350 auto insurance rates. For instance, a 30-year-old driver may pay about $5 more each month for Lexus ES 350 auto insurance than a 40-year-old driver. Check out our “Reasons Auto Insurance Costs More for Young Drivers” for more details rates, coverages, and discounts.

Lexus ES 350 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $728 |

| Age: 18 | $448 |

| Age: 20 | $278 |

| Age: 30 | $128 |

| Age: 40 | $123 |

| Age: 45 | $118 |

| Age: 50 | $112 |

| Age: 60 | $109 |

Age is a decisive factor in determining Lexus ES 350 auto insurance rates, with younger drivers typically paying more than their older counterparts.

Driver Location

Where you live can have a large impact on Lexus ES 350 insurance rates. For example, drivers in Los Angeles may pay approximately $67 a month more than drivers in Phoenix.

Lexus ES 350 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $210 |

| New York, NY | $194 |

| Houston, TX | $192 |

| Jacksonville, FL | $178 |

| Philadelphia, PA | $164 |

| Chicago, IL | $162 |

| Phoenix, AZ | $142 |

| Seattle, WA | $119 |

| Indianapolis, IN | $104 |

| Columbus, OH | $102 |

The location of a driver plays a critical role in determining Lexus ES 350 insurance rates, as evidenced by the significant cost differences between cities like Los Angeles and Phoenix.

Your Driving Record

Your driving record can have an impact on your Lexus ES 350 auto insurance rates. Teens and drivers in their 20’s see the highest jump in their Lexus ES 350 auto insurance with violations on their driving record.

Lexus ES 350 Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $728 | $942 | $1,205.00 | $819 |

| Age: 18 | $448 | $586 | $865.00 | $549 |

| Age: 20 | $278 | $364 | $595.00 | $336 |

| Age: 30 | $128 | $184 | $324.00 | $157 |

| Age: 40 | $123 | $178 | $313.00 | $152 |

| Age: 45 | $118 | $170 | $302.00 | $147 |

| Age: 50 | $112 | $162 | $291.00 | $141 |

| Age: 60 | $109 | $158 | $283.00 | $138 |

Maintaining a clean driving record is crucial, as accidents and violations can significantly increase Lexus ES 350 auto insurance costs, particularly for younger drivers.

Lexus ES 350 Safety Ratings

The Lexus ES 350’s safety ratings will affect your Lexus ES 350 auto insurance rates. See the chart below:

Lexus ES 350 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The consistently good safety ratings of the Lexus ES 350 across various tests contribute to potentially lower auto insurance rates for this reliable vehicle.

Lexus ES 350 Crash Test Ratings

Lexus ES 350 crash test ratings can impact the cost of your Lexus ES 350 auto insurance. See Lexus ES 350 crash test results below:

Lexus ES 350 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2015 Lexus ES 350 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

The superior crash test ratings of the Lexus ES 350, as evidenced by consistent high scores across multiple categories, underscore its reliability and may contribute to lower insurance costs.

Lexus ES 350 Safety Features

Having a variety of safety features on your Lexus ES 350 can help lower your Lexus ES 350 insurance costs. The Lexus ES 350’s safety features include:

- Comprehensive Airbag System: Includes dual-stage front, knee, side-impact, and curtain airbags for both rows.

- Advanced Stability and Traction Control: Features Electronic Stability Control (ESC) and Driveline Traction Control for enhanced vehicle grip.

- Lexus Safety System+: Integrates Lane Departure Alert with Steering Assist, Lane Keeping Assist, and Lane Departure Warning for proactive safety.

- Emergency and Assistance Features: Equipped with Lexus Enform Safety Connect Emergency SOS and a standard back-up camera.

- Additional Safety Measures: Includes side impact beams, tire-specific low tire pressure warning, rear child safety locks, and pretensioners on seat belts.

The extensive safety features of the Lexus ES 350 not only enhance protection but also offer the potential for reduced insurance costs, making it a smart choice for cost-conscious drivers.

Lexus ES 350 Insurance Loss Probability

Review the Lexus ES 350 auto insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury. Dive into our in-depth “Do you need medical payment coverage on auto insurance?” to find the best policy for your needs.

The lower percentage means lower Lexus ES 350 auto insurance costs; higher percentages mean higher Lexus ES 350 auto insurance costs.

Lexus ES 350 Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | 26% |

| Property Damage | -21% |

| Comprehensive | 60% |

| Personal Injury | -9% |

| Medical Payment | 0% |

| Bodily Injury | -22% |

Understanding the insurance loss probability rates for the Lexus ES 350, such as the higher rates for comprehensive coverage and lower rates for property damage, is crucial for selecting the coverage that best balances cost and protection.

Lexus ES 350 Finance and Insurance Cost

If you are financing a Lexus ES 350, you will pay more if you purchase Lexus ES 350 auto insurance at the dealership, so be sure to shop around and compare Lexus ES 350 auto insurance quotes from the best companies using our free comparison tool below. Unlock details in our guide titled “Best Auto Insurance for Dealerships.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Lexus ES 350 Insurance

There are several ways you can save even more on your Lexus ES 350 auto insurance rates. Take a look at the following five tips:

- Watch your insurer closely when your Lexus ES 350 needs repairs.

- Get cheaper Lexus ES 350 insurance rates as a full-time parent.

- Consider Lexus ES 350 insurance costs before buying a Lexus ES 350.

- Ask about usage-based insurance for your Lexus ES 350.

- Understand that insurance companies can’t change your Lexus ES 350 auto insurance rate mid-term based on changes to your credit score.

To optimize your savings on Lexus ES 350 auto insurance, it’s essential to be proactive and informed.

By considering the vehicle’s insurance costs before purchase, exploring usage-based options, and understanding your rights concerning rate changes, you can ensure that you secure the most cost-effective coverage for your needs. See more details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Top Lexus ES 350 Insurance Companies

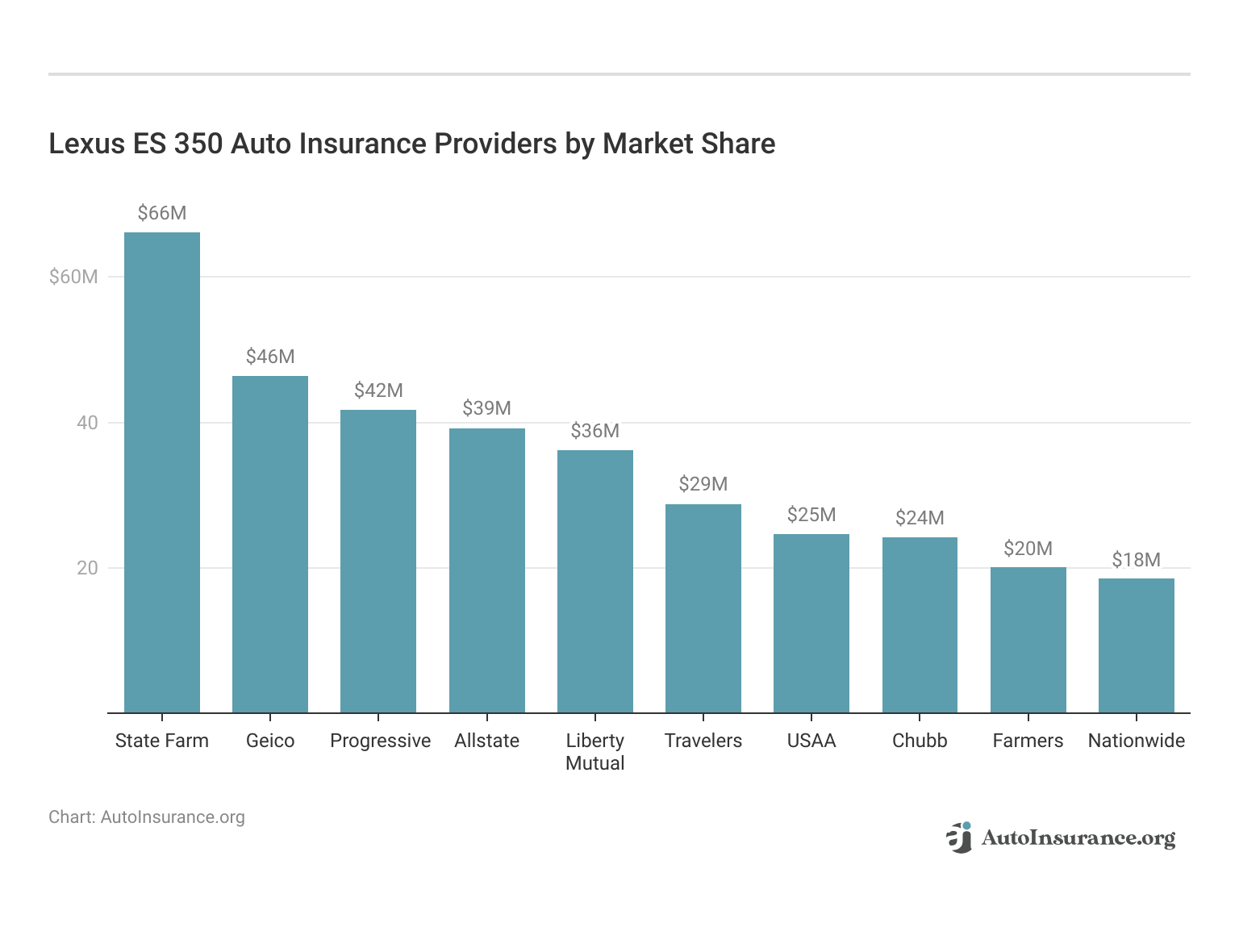

Who is the top auto insurance company for Lexus ES 350 insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Lexus ES 350 auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Lexus ES 350 offers.

Lexus ES 350 Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

When choosing the best auto insurance for your Lexus ES 350, consider top companies like State Farm, Geico, and Progressive, which lead the market in share and customer volume.

These providers offer competitive rates and discounts, especially for vehicles equipped with advanced safety features like the Lexus ES 350, ensuring both value and security for your investment.

Compare Free Lexus ES 350 Insurance Quotes Online

To find the best rates and coverage for your Lexus ES 350, comparing quotes for Lexus ES 350 auto insurance rates from top providers is a crucial step. The top three insurers for the Lexus ES 350—Farmers, Allstate, and USAA—offer competitive pricing and tailored policies to suit the specific needs of Lexus owners.

Farmers stands out for Lexus ES 350 insurance with a remarkable 27% bundling discount, ensuring both comprehensive coverage and value.Chris Abrams Licensed Insurance Agent

By using our free online comparison tool, you can quickly gather quotes from these leading companies. This approach not only helps you assess which provider offers the best value for your budget but also allows you to see how different coverages stack up against each other, ensuring you make an informed decision tailored to the protection your vehicle needs.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What types of coverage are typically included in Lexus ES 350 auto insurance?

Lexus ES 350 auto insurance typically includes liability coverage for damages or injuries you cause, collision coverage for your vehicle in accidents, and comprehensive coverage for non-collision incidents like theft or fire. It also offers personal injury protection (PIP) for medical expenses and uninsured/underinsured motorist coverage for accidents with underinsured drivers.

To find out more, explore our guide titled “Best Uninsured and Underinsured Motorist (UM/UIM) Coverage.”

How are auto insurance premiums for the Lexus ES 350 determined?

Auto insurance premiums for the Lexus ES 350 depend on factors such as the driver’s age and experience, vehicle location, driving history, the car’s value, model year, safety features, annual mileage, credit history, and the chosen deductible and coverage limits.

Are there any specific considerations for insuring a Lexus ES 350?

When insuring a Lexus ES 350, consider its status as a luxury vehicle, which may lead to higher insurance costs due to expensive repairs and replacements. Lower your premiums by installing anti-theft devices and taking advantage of discounts for multi-policy bundling, safe driving, and having safety features in your vehicle.

How can I find affordable auto insurance for my Lexus ES 350?

To secure affordable auto insurance for your Lexus ES 350, compare quotes from multiple providers, especially those offering luxury car discounts. Maintain a good driving record and consider increasing your deductible to lower premiums. Also, inquire about additional discounts or programs from your insurer to reduce costs further.

To learn more, explore our comprehensive resource on “How to Get a Good Driver Auto Insurance Discount.”

Can I get specialized insurance coverage for modifications made to my Lexus ES 350?

Yes, if you have made modifications to your Lexus ES 350, such as aftermarket parts or performance enhancements, you may need specialized insurance coverage. Standard auto insurance policies may not fully cover the added value of modifications. It’s important to inform your insurance provider about any modifications and discuss the need for additional coverage options to protect the customized aspects of your vehicle.

What is the average 2016 Lexus ES 350 insurance cost?

The average insurance cost for a 2016 Lexus ES 350 typically ranges between $117 and $133 per month, depending on various factors such as location and driver history.

How much does Lexus ES 350 insurance cost according to Reddit users?

Reddit users report that Lexus ES 350 insurance costs vary widely but generally align with industry averages of about $125 monthly, influenced by driving records and regional differences.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

What can I expect for a 2007 Lexus ES 350 insurance cost?

Insurance for a 2007 Lexus ES 350 is generally cheaper due to the vehicle’s age, with monthly premiums often falling between $100 and $117.

What is the typical 2015 Lexus GS 350 insurance cost?

The insurance cost for a 2015 Lexus GS 350 typically ranges from $133 to $150 per month, reflecting the model’s luxury status and performance features.

Are Lexus expensive to insure?

Yes, Lexus vehicles are generally more expensive to insure than average due to their high repair costs and the vehicle’s status as a luxury brand.

Access comprehensive insights into our guide titled “Best Auto Insurance for Luxury Cars.”

Where can I find cheap Lexus ES 350 insurance?

Cheap Lexus ES 350 insurance can be found by comparing quotes from multiple insurers, looking for discounts, and choosing a policy that balances coverage with deductible costs.

Which company offers the cheapest insurance for Lexus ES 350?

The cheapest insurance for Lexus vehicles varies by region, but companies like Geico and State Farm often provide competitive rates for these luxury cars.

What is the cheapest Lexus to insure?

Generally, the Lexus UX is considered the cheapest Lexus model to insure due to its smaller size and lower cost relative to other models in the lineup.

For additional details, explore our comprehensive resource titled “Best Lexus NX 300 Auto Insurance.”

How much is insurance for Lexus ES 350?

Insurance for the Lexus ES 350 typically costs between $117 and $142 monthly, depending on factors such as your driving history, location, and the level of coverage you select.

How does the insurance cost for a Lexus ES 350 compare to that of a Toyota?

Typically, insurance for a Lexus ES 350 is higher than for most Toyota models due to its classification as a luxury vehicle, which increases the perceived risk and repair costs associated with it.

What do reviews say about Lexus ES 350 car insurance?

Reviews often highlight that while Lexus ES 350 car insurance is higher due to the brand’s luxury status, customer satisfaction with claims handling and service is generally high.

Learn more by reading our guide titled “How to File an Auto Insurance Claim.”

What does car insurance for Lexus ES 350 typically cover?

Car insurance for Lexus ES 350 generally includes coverage for damages due to accidents, theft, and natural disasters, as well as liability protection for injuries and property damage caused to others.

How should I approach Lexus ES 350 car insurance?

When seeking Lexus ES 350 car insurance, consider factors like comprehensive and collision coverage due to the car’s value, and seek out discounts for safety features and low mileage.

What are typical Lexus ES350 insurance costs?

Typical insurance costs for the Lexus ES350 range from $117 to $142 monthly, varying primarily based on your location, insurance provider, and personal driving history.

Enter your ZIP code below to explore which companies have the cheapest auto insurance rates for you.

How can I compare Lexus ES 350 auto insurance quotes online?

To compare Lexus ES 350 auto insurance quotes online, use a comparison tool where you can enter your vehicle details and driving history to receive personalized quotes from various insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.