Best Pay-As-You-Go Auto Insurance in Georgia (Our Top 10 Picks for 2024)

Nationwide, Geico, and Progressive have the best pay-as-you-go auto insurance in Georgia. Auto insurance rates average $48/mo in GA, but mileage-based insurance starts at only $45/mo with Nationwide. Despite a higher base rate, Nationwide has the best per-mile rate at an average of $0.08/mi.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: May 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,019 reviews

3,019 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

3,019 reviews

3,019 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviewsNationwide, Geico, and Progressive have the best pay-as-you-go auto insurance in Georgia.

Other great companies to buy Georgia auto insurance from include Allstate, Root, Farmers, and many more.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Georgia

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A+ | Usage-Based Savings | Nationwide |

| #2 | 25% | A++ | Competitive Rates | Geico | |

| #3 | 12% | A+ | Low Mileage | Progressive | |

| #4 | 25% | A+ | Coverage Variety | Allstate | |

| #5 | 20% | A++ | Consistent Rates | State Farm | |

| #6 | 25% | A | 24/7 Support | Liberty Mutual |

| #7 | 15% | A++ | Good Drivers | Root | |

| #8 | 20% | A | First-Responder Discount | Farmers | |

| #9 | 20% | A | Loyalty Discounts | American Family | |

| #10 | 25% | A | High-Risk Drivers | The General |

Read on to learn where to get auto insurance in Georgia and how to save. After reading our Georgia mileage-based insurance reviews of the best companies, you can also compare rates with our free tool to quickly find the best pay-per-mile insurance in Georgia.

- Nationwide is the best of the Georgia mileage-based insurance providers

- Root has the cheapest Georgia auto insurance quotes

- Pay-as-you-go insurance is great if you want temporary auto insurance in Georgia

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Overall Pick

Pros

- Usage-Based Savings: Nationwide’s SmartMiles insurance offers great savings for low-mileage drivers. Learn more in our Nationwide SmartMiles review.

- Bundling Discounts: Purchase more insurance, like home insurance, to save on your Georgia auto insurance rates at Nationwide.

- Roadside Assistance: Available 24/7 when added to an auto insurance policy.

Cons

- High-Mileage Drivers: Nationwide’s SmartMiles insurance won’t be as cost-effective.

- Data Tracking: Nationwide needs to track driving data for its low mileage insurance.

#2 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico has some of the cheapest car insurance quotes in Georgia for good drivers.

- Roadside Assistance: A great add-on for Georgia car owners who want an affordable option for simple repairs or tows.

- Discount Variety: Georgia drivers can save on their Georgia pay-as-you-drive insurance costs with discounts.

Cons

- Local Support: There is a lack of local agents available in Georgia.

- DUI Rates: Geico is less cost-effective for Georgia drivers who have a DUI. Learn more by reading our review of Geico.

#3 – Progressive: Best for Low Mileage

Pros

- Low Mileage: Progressive offers great rates for good drivers with low annual mileage.

- Online Tools: Progressive offers a great app, an easy-to-use website, and a free budgeting tool.

- Coverage Options: Progressive sells everything from roadside assistance to gap coverage. Read more in our Progressive review

Cons

- Snapshot Rate Increases: Joining Snapshot could end up increasing your rates if you drive poorly. Learn more in our Progressive Snapshot review.

- Telematics Tracking: Progressive tracks your data before giving a usage-based discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Coverage Variety

Pros

- Coverage Variety: Learn about the various coverages you can buy from Allstate in our Allstate review.

- Milewise Coverage: Allstate’s Milewise insurance lets you pay a per-mile rate. Learn more in our Allstate Milewise review.

- Mobile App: Allows drivers to pay bills, file claims, and more.

Cons

- Complaints: Not all customers are satisfied with the level of service they received from Allstate.

- Telematics Tracking: Alsltate will track your driving data for its pay-per-mile insurance or good driver discount.

#5 – State Farm: Best for Consistent Rates

Pros

- Consistent Rates: State Farm’s high financial stability allows it to maintain consistent rates for drivers who don’t make major changes to their policy or driving record.

- Local Agent: Agents are widely available throughout Georgia.

- Coverage Variety: Our State Farm review goes over the various coverages available, from roadside assistance to comprehensive insurance.

Cons

- Telematics Tracking: State Farm will track drivers’ data before it issues a low mileage or good driver discount.

- High-Risk Rates: State Farm’s Georgia mileage-based insurance isn’t as cheap for bad drivers.

#6 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual offers constant representative support to Georgia drivers.

- Online Convenience: Georgia drivers can use Liberty Mutual’s online tools to make quick policy changes or claims.

- Add-On Coverages: Our Liberty Mutual review discusses coverages Georgia drivers can purchase, such as roadside assistance.

Cons

- Telematics Tracking: Drivers must let Liberty Mutual track their driving data in order to earn a usage-based discount.

- High-Risk Rates: Liberty Mutual’s Georgia insurance is best for good drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Root: Best for Good Drivers

Pros

- Good Drivers: Root bases its rates on driving behaviors, so good drivers will get the cheapest pay-per-mile insurance in Georgia. Read more in our review of Root Insurance.

- Online Convenience: Manage your Root policy from your smartphone.

- Coverage Variety: Root offers more coverage options than other pay-per-mile companies.

Cons

- High-Risk Rate Increases: Because Root’s rates are based on driving behaviors, drivers who speed or are on the road at night will pay more.

- Telematics Tracking: Root does require Georgia drivers to use a tracking app.

#8 – Farmers: Best for First-Responder Discount

Pros

- First-Responder Discount: First responders will get a small discount on their Farmers’ insurance policy.

- Family Plans: Families get multi-car discounts. Learn more in our review of Farmers Insurance.

- Coverage Variety: Georgia drivers will have plenty of options for their cars.

Cons

- High-Risk Rates: Georgia rates will be less cheap for higher-risk drivers.

- Customer Satisfaction: Claims processing isn’t always rated positively.

#9 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Discounts: A discount for Georgia drivers who keep their policy at American Family.

- Accident Forgiveness: Georgia drivers may qualify for accident forgiveness if they are good drivers.

- Customer Service: Learn about the positive feedback from customers in our American Family review.

Cons

- Telematics Tracking: American Family does track data for its usage-based discount.

- High-Risk Rates: Georgia rates will be best for good drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The General: Best for High-Risk Drivers

Pros

- High-Risk Drivers: The General will insure Georgia drivers who might be unable to find insurance elsewhere due to their poor driving records.

- Online Convenience: The General’s app helps drivers file claims, pay bills, and more.

- Discount Options: Georgia drivers may be able to get a multi-car discount, a good student discount, and more. Learn more in our review of The General.

Cons

- Higher Rates: The General’s Georgia rates are higher than the average because it insures high-risk drivers.

- Coverage Options: The Genera’s selection of Georgia coverages isn’t as robust as its competition.

Georgia Auto Insurance Requirements vs. Pay-As-You-Go Coverage

Georgia auto insurance requirements are the same for all drivers.

Georgia drivers must carry, at the bare minimum, 25/50/25 of bodily injury and property damage liability coverage.Dani Best Licensed Insurance Producer

However, most drivers will benefit from carrying more than the Georgia minimum auto insurance requirements. Minimum insurance provides the least amount of protection possible, which is where pay-as-you-go coverage can be useful.

With pay-as-you insurance, you can get full coverage at a cheaper rate if you drive less than the average driver in Georgia. Take a look below to get an idea of Georgia rates by age and gender.

Georgia Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $260 | $520 |

| 16-Year-Old Male | $280 | $560 |

| 20-Year-Old Female | $220 | $440 |

| 20-Year-Old Male | $240 | $480 |

| 30-Year-Old Female | $160 | $320 |

| 30-Year-Old Male | $170 | $340 |

| 40-Year-Old Female | $140 | $280 |

| 40-Year-Old Male | $150 | $300 |

| 50-Year-Old Female | $130 | $260 |

| 50-Year-Old Male | $135 | $270 |

| 60-Year-Old Female | $120 | $240 |

| 60-Year-Old Male | $125 | $250 |

| 70-Year-Old Female | $125 | $250 |

| 70-Year-Old Male | $130 | $260 |

If you are pulled over in Georgia, the police will request Georgia auto insurance verification to check that you have the proper coverage.

Calculating Georgia Pay-As-You-Go Insurance Rates

Wondering how annual mileage affects your auto insurance rates? Less-frequent drivers are less likely to get into an accident, so insurance companies often charge them less. For example, drivers who work from home aren’t driving during rush hour, which is when numerous crashes happen.

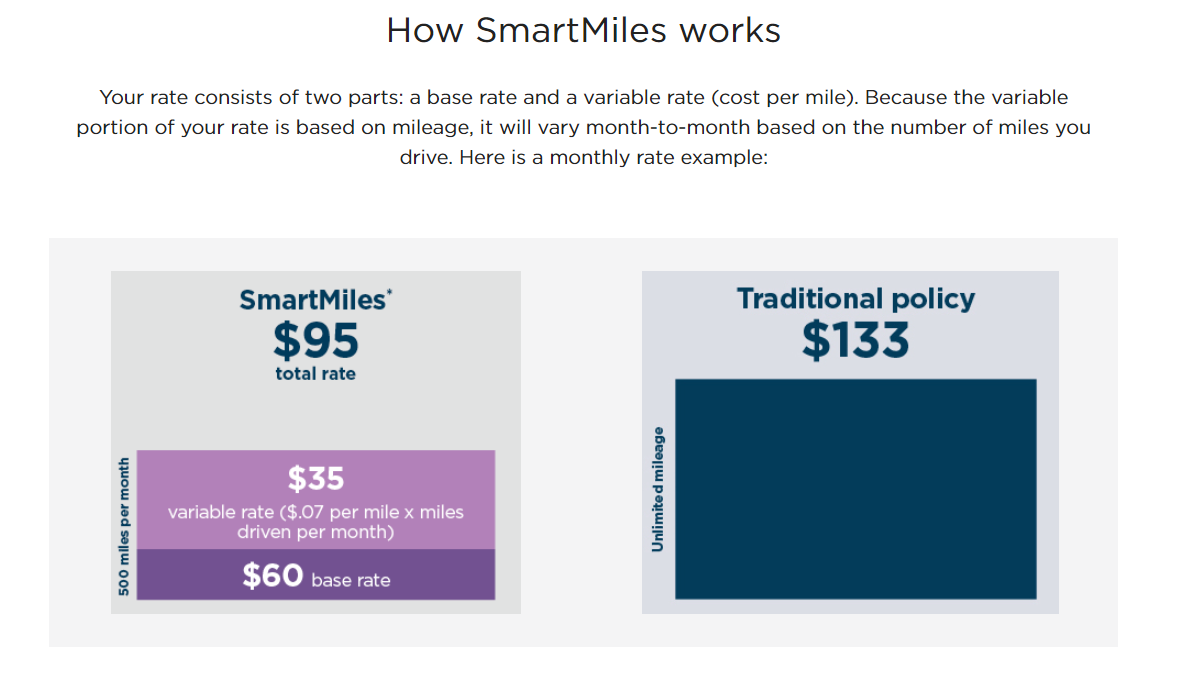

So, how are pay-per-mile rates calculated? At most companies, you will pay a base rate and then a per-mile fee.

The per-mile fee makes it easy to calculate the cost of each trip, and you’ll pay less the months you drive less.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Georgia Pay-As-You-Go Insurance For Infrequent Drivers

For a Georgia mileage-based insurance comparison, take a look at the rates below.

Georgia Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $275 | $295 | $310 | $330 |

| 16-Year-Old Male | $300 | $320 | $335 | $355 |

| 20-Year-Old Female | $230 | $245 | $260 | $280 |

| 20-Year-Old Male | $250 | $265 | $280 | $300 |

| 30-Year-Old Female | $180 | $190 | $200 | $215 |

| 30-Year-Old Male | $190 | $200 | $210 | $225 |

| 40-Year-Old Female | $160 | $170 | $180 | $190 |

| 40-Year-Old Male | $165 | $175 | $185 | $195 |

| 50-Year-Old Female | $150 | $155 | $160 | $170 |

| 50-Year-Old Male | $155 | $160 | $165 | $175 |

| 60-Year-Old Female | $145 | $150 | $155 | $165 |

| 60-Year-Old Male | $150 | $155 | $160 | $170 |

| 70-Year-Old Female | $150 | $155 | $160 | $170 |

| 70-Year-Old Male | $155 | $160 | $165 | $175 |

Your rates for cheap usage-based auto insurance will also be partly based on where you live in Georgia.

Georgia Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Atlanta | Augusta | Macon | Marietta | Savannah |

|---|---|---|---|---|---|

| 16-Year-Old Female | $280 | $250 | $240 | $270 | $260 |

| 16-Year-Old Male | $300 | $270 | $260 | $290 | $280 |

| 20-Year-Old Female | $230 | $210 | $200 | $220 | $215 |

| 20-Year-Old Male | $250 | $230 | $220 | $240 | $235 |

| 30-Year-Old Female | $170 | $160 | $150 | $165 | $160 |

| 30-Year-Old Male | $180 | $170 | $160 | $175 | $170 |

| 40-Year-Old Female | $160 | $150 | $140 | $155 | $150 |

| 40-Year-Old Male | $165 | $155 | $145 | $160 | $155 |

| 50-Year-Old Female | $150 | $140 | $130 | $145 | $140 |

| 50-Year-Old Male | $155 | $145 | $135 | $150 | $145 |

| 60-Year-Old Female | $145 | $135 | $125 | $140 | $135 |

| 60-Year-Old Male | $150 | $140 | $130 | $145 | $140 |

| 70-Year-Old Female | $145 | $135 | $125 | $140 | $135 |

| 70-Year-Old Male | $150 | $140 | $130 | $145 | $140 |

Residents of Macon, Georgia, will have slightly cheaper rates on their permanent or temporary car insurance in Georgia.

How to Get Cheaper Georgia Auto Insurance Rates

Want to know how to get auto insurance in Georgia at an affordable rate? Start by reading Georgia pay-per-mile auto insurance reviews and choosing one of the best companies listed below.

Pay-As-You-Go Auto Insurance in Georgia: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $50 | $120 |

| American Family | $46 | $112 |

| Farmers | $47 | $118 |

| Geico | $40 | $105 |

| Liberty Mutual | $48 | $125 |

| Nationwide | $45 | $110 |

| Progressive | $42 | $108 |

| Root | $35 | $95 |

| State Farm | $43 | $115 |

| The General | $52 | $130 |

Once you’ve picked an affordable company, make sure to utilize all their discounts.

Even if a company doesn’t offer pay-per-mile insurance, most companies still offer a low-mileage auto insurance discount.

Get The Best Pay-As-You-Go Auto Insurance in Georgia

The best pay-as-you-go auto insurance companies offer affordable coverage for infrequent drivers and have great Georgia pay-per-mile car insurance reviews. Some of the top picks for Georgia usage-based insurance include Nationwide, Geico, and Progressive.

Looking for the best car insurance quotes in Georgia? Use our tool to compare rates from top Georgia companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What insurance companies offer pay-per-mile in Georgia?

Numerous companies offer pay-per-mile insurance in Georgia, such as Nationwide. Pay-per-mile insurance can be a great option for infrequent drivers looking for temporary auto insurance.

What is the best pay-as-you-go auto insurance company in Georgia?

Nationwide has the best pay-as-you-go insurance in Georgia.

Does credit score affect pay-as-you-go insurance?

Yes, Georgia allows companies to use credit scores as a pricing factor.

Can you ask auto insurance companies to lower the price?

Some insurance companies will work with you to lower your rates, whether by adjusting your auto insurance deductibles or applying discounts.

How can I lower my Georgia auto insurance rates?

Look for Georgia auto insurance with no down payment to lower initial costs, and get plenty of quotes. You can find quotes today by entering your ZIP into our free tool.

Can I take insurance off my car if I’m not driving it in Georgia?

You must cancel your registration on your car before canceling insurance. You may also want to look into garaging or storing insurance, or how to insure a car for one month if you just need temporary auto insurance.

Do you need full coverage auto insurance in Georgia?

The state doesn’t require you to have full coverage, but lenders will require you to carry full coverage. Shop around for quotes to find the cheapest full coverage car insurance in Georgia.

What is full coverage car insurance in Georgia?

Full coverage car insurance includes liability coverage, comprehensive coverage, and collision coverage.

How much is full coverage car insurance in Georgia?

Full coverage is an average of $133/mo in Georgia. To find cheap full coverage auto insurance, compare quotes from popular companies.

What are Georgia’s minimum auto insurance requirements?

Georgia requires all drivers to carry bodily injury liability insurance and property damage liability insurance.

What happens if someone else is driving my car and gets in an accident in Georgia?

Your insurance company will cover the accident unless the driver takes your car without permission.

Can I self-insure my car in Georgia?

Yes, you can self-insure your car in Georgia if you wish. However, carrying a regular auto insurance policy is generally much more cost-effective.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.