Best Pay-As-You-Go Auto Insurance in Alabama (Find the Top 9 Providers for 2024)

Nationwide, USAA, and Progressive have the best pay-as-you-go auto insurance in Alabama. If you drive less than 10,000 miles per year, Nationwide can save you money on car insurance with base rates starting at $70/mo. The best AL pay-per-mile auto insurance companies save drivers 30% with low-mileage discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: May 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,019 reviews

3,019 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

3,019 reviews

3,019 reviews 6,435 reviews

6,435 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

6,435 reviews

6,435 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviewsNationwide, USAA, and Progressive sell the best pay-as-you-go auto insurance in Alabama.

The top companies offer pay-per-mile insurance or usage-based insurance discounts on Alabama auto insurance policies. Other great options for usage-based Alabama auto insurance are listed below.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Alabama

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Flexible Plans | Nationwide |

| #2 | 15% | 15% | Military Benefits | USAA | |

| #3 | 15% | 30% | Coverage Options | Progressive | |

| #4 | 25% | 20% | Safe Drivers | Allstate | |

| #5 | 17% | 10% | Local Support | State Farm | |

| #6 | 25% | 15% | Low Rates | Geico | |

| #7 | 10% | 30% | Customizable Policies | Liberty Mutual |

| #8 | 10% | 10% | Discount Variety | Farmers | |

| #9 | 20% | 10% | Membership Benefits | AAA |

Continue reading to discover more about the best Alabama auto insurance companies. Afterward, compare rates with our free quote tool to find cheap auto insurance online.

- Nationwide has the best Alabama pay-per-mile auto insurance

- USAA and Progressive offer great usage-based insurance in Alabama

- Drivers must carry insurance that fulfills Alabama pay-per-mile insurance laws

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Overall Pick

Pros

- Flexible Plans: Choose a regular insurance plan or a pay-per-mile plan at Nationwide.

- Coverage Options: Nationwide offers great add-ons for Alabama drivers, such as 24/7 breakdown assistance.

- Discount Variety: Nationwide offers young drive discounts, bundling discounts, and many more.

Cons

- High-Mileage Rates: You shouldn’t opt for a Nationwide pay-per-mile plan if you have high annual mileage. Learn more in our Nationwide SmartMiles review.

- Telematics Tracking: Nationwide tracks driving data for its pay-per-mile insurance and usage-based discount.

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA members can get discounts on items other than auto insurance.

- Customer Service: USAA’s service in Alabama is highly rated. Find out more in our USAA review.

- Discount Options: Although USAA already offers cheap rates, it offers plenty of discounts for additional savings.

Cons

- Eligibility: Only Alabama drivers who are veterans or service members can purchase insurance.

- Telematics Tracking: If you want to get a usage-based discount, USAA will track your driving data.

#3 – Progressive: Best for Coverage Variety

Pros

- Tight Budgets: If you have budget constraints, use the free Name Your Price tool offered by Progressive.

- Snapshot Program: Alabama drivers can participate in a usage-based discount program.

- Coverage Options: Alabama drivers have numerous coverages to add to their plans. Read more in our review of Progressive.

Cons

- Snapshot Rate Increases: Alabama drivers may have rates raised in the Snapshot program. Learn more in our Progressive Snapshot review.

- Customer Reviews: Claims handling in Alabama has some mixed reviews.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Safe Drivers

Pros

- Safe Drivers: Allstate’s rates in Alabama are cost-effective for safe drivers. Learn more about rates in our Allstate review.

- Pay-Per-Mile Insurance: Allstate offers Milewise pay-per-mile insurance. Read our Allstate Milewise review for more information on Allstate pay-per-mile insurance.

- Coverage Variety: Alabama drivers can choose several add-ons or carry bare minimum coverage.

Cons

- Customer Reviews: Alabama drivers aren’t always satisfied with claims processing at Allstate.

- High-Mileage Drivers: Alabama drivers shouldn’t choose Milewise insurance if they have high annual mileage.

#5 – State Farm: Best for Local Support

Pros

- Local Support: Alabama agents are available throughout the state to offer assistance.

- Usage-Based Discount: State Farm offers a discount based on usage in Alabama. Learn more in our State Farm Drive and Safe review.

- Young Driver Discounts: Families in Alabama can save with good student discounts, student-away discounts, and more.

Cons

- Telematics Tracking: State Farm tracks driving data for its UBI discount in Alabama.

- DUI Rates: Alabama drivers with DUIs will find rates more expensive. Find out more in our State Farm review.

#6 – Geico: Best for Low Rates

Pros

- Low Rates: Geico’s rates are consistently low for the majority of Alabama drivers. Read our Geico review for more rate information.

- Usage-Based Discount: Alabama drivers can join Geico’s DriveEasy Program to save. Learn more in our Geico DriveEasy review.

- Coverage Options: Alabama auto insurance plans include options to add roadside assistance, gap insurance, and more.

Cons

- Local Agent Availability: Most services are conducted virtually, limiting in-person assistance.

- Telematics Tracking: Alabama drivers must let Geico track driving data for a UBI discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Alabama drivers can customize their policy plans at Liberty Mutual. See what is offered in our Liberty Mutual auto insurance review.

- Usage-Based Discount: Liberty Mutual offers RightTrack to Alabama drivers. Read more in our Liberty Mutual RightTrack review.

- Roadside Assistance: Available around the clock to Alabama drivers who add it to their policy plan.

Cons

- Telematics Tracking: Alabama drivers must let Liberty Mutual track data with the RightTrack app.

- High-Risk Rates: DUIs, at-fault accidents, and other incidents will raise Alabama drivers’ rates past the average.

#8 – Farmers: Best for Discount Variety

Pros

- Discount Variety: Learn about the various discounts offered in our Farmers review.

- Usage-Based Discount: Alabama drivers can save with the Signal program. See how in our Farmers Signal review.

- Vehicle Safety Discounts: Alabama drivers with safe cars will have lower rates.

Cons

- Telematics Tracking: Alabama drivers will have their data tracked for the UBI discount.

- Customer Satisfaction: Alabama drivers don’t always rate Farmers highly.

#9 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: AAA members can use their member ID to get discounts on some items when shopping.

- Roadside Assistance: Alabama drivers can choose from several different plan options.

- Good Driver Discount: Participate in AAA’s good driver program for a discount. See what other discounts AAA offers in our AAA auto insurance review.

Cons

- Additional Fee: Alabama drivers must pay a small membership fee each year.

- Telematics Tracking: AAA tracks driving data before issuing a good driver discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Alabama Pay-As-You-Go Auto Insurance Works

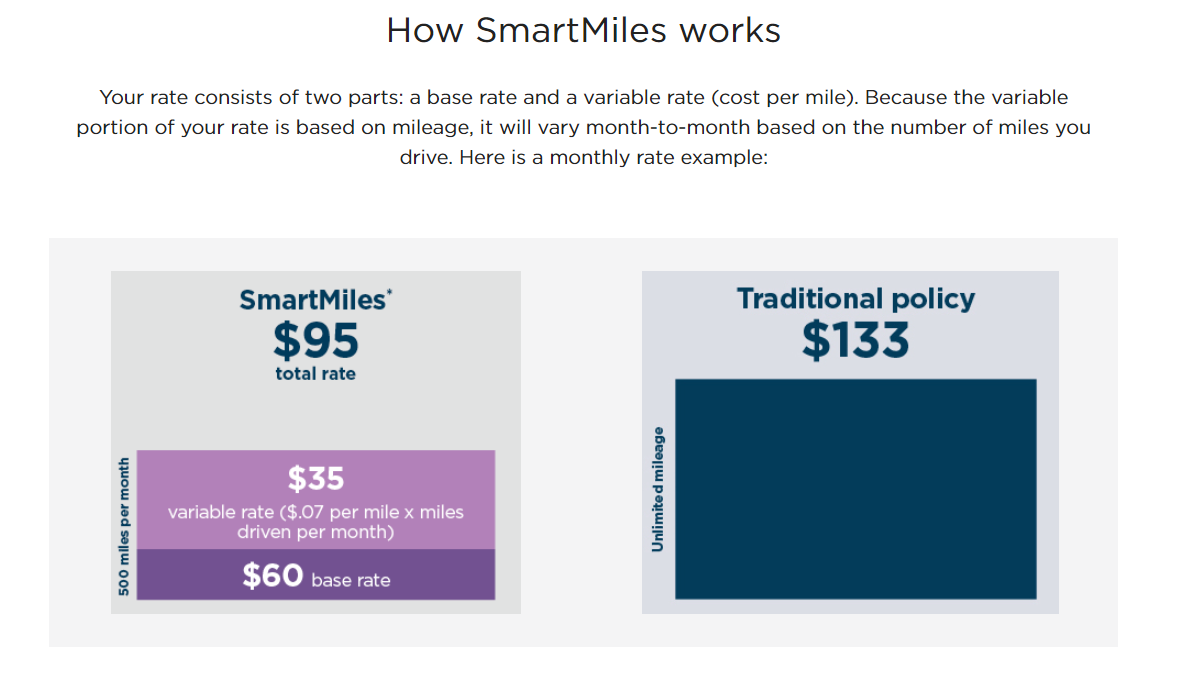

For traditional pay-per-mile companies, customers will be charged a base monthly fee and a pay-per-mile fee each month, unless they choose more non-traditional companies like Hugo car insurance.

Most of the best pay-as-you-go auto insurance companies work similarly, whether you are buying Alabama pay-per-mile motorcycle insurance or car insurance. Rates will be higher for riskier drivers or more dangerous vehicles, but payment schedules are the same. Learn more about motorcycle vs. car accident statistics and high-risk insurance.

If pay-as-you-go companies don’t offer a pay-per-mile plan, then they often offer a usage-based discount that is calculated based on driving habits. The average amount charged by the top companies is listed below.

Pay-As-You-Go Auto Insurance in Alabama: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $70 | $150 |

| Allstate | $75 | $160 |

| Farmers | $70 | $150 |

| Geico | $65 | $130 |

| Liberty Mutual | $75 | $160 |

| Nationwide | $70 | $150 |

| Progressive | $65 | $140 |

| State Farm | $70 | $150 |

| USAA | $60 | $130 |

While you may be tempted to carry only minimum coverage, this doesn’t offer much financial protection in most accident cases.

When You Want Pay-As-You-Go Insurance in Alabama

All drivers must carry Alabama minimum auto insurance requirements, even if they don’t drive often. Low-mileage drivers who want to cut back on insurance costs should consider pay-as-you-go insurance.

Alabama Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $215 | $255 | $280 | $310 |

| 16-Year-Old Male | $230 | $265 | $295 | $320 |

| 20-Year-Old Female | $200 | $235 | $255 | $280 |

| 20-Year-Old Male | $220 | $250 | $270 | $300 |

| 30-Year-Old Female | $170 | $195 | $215 | $235 |

| 30-Year-Old Male | $180 | $205 | $225 | $245 |

| 40-Year-Old Female | $160 | $180 | $200 | $220 |

| 40-Year-Old Male | $170 | $190 | $210 | $230 |

| 50-Year-Old Female | $150 | $170 | $190 | $210 |

| 50-Year-Old Male | $160 | $180 | $200 | $220 |

| 60-Year-Old Female | $140 | $155 | $175 | $195 |

| 60-Year-Old Male | $150 | $165 | $185 | $205 |

| 70-Year-Old Female | $130 | $140 | $155 | $175 |

| 70-Year-Old Male | $140 | $150 | $165 | $185 |

Low-mileage insurance can also help drivers cut costs if they live in one of Alabama’s more expensive cities.

Alabama Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Birmingham | Huntsville | Mobile | Montgomery | Tuscaloosa |

|---|---|---|---|---|---|

| 16-Year-Old Female | $180 | $170 | $190 | $175 | $185 |

| 16-Year-Old Male | $190 | $180 | $200 | $185 | $195 |

| 20-Year-Old Female | $160 | $150 | $170 | $155 | $165 |

| 20-Year-Old Male | $170 | $160 | $180 | $165 | $175 |

| 30-Year-Old Female | $140 | $130 | $150 | $135 | $145 |

| 30-Year-Old Male | $150 | $140 | $160 | $145 | $155 |

| 40-Year-Old Female | $130 | $120 | $140 | $125 | $135 |

| 40-Year-Old Male | $140 | $130 | $150 | $135 | $145 |

| 50-Year-Old Female | $120 | $110 | $130 | $115 | $125 |

| 50-Year-Old Male | $130 | $120 | $140 | $125 | $135 |

| 60-Year-Old Female | $110 | $100 | $120 | $105 | $115 |

| 60-Year-Old Male | $120 | $110 | $130 | $115 | $125 |

| 70-Year-Old Female | $100 | $90 | $110 | $95 | $105 |

| 70-Year-Old Male | $110 | $100 | $120 | $105 | $115 |

Some cities have higher average insurance rates due to traffic patterns and crash statistics.

Alabama Auto Insurance Requirements And Laws

Drivers must make sure to follow auto insurance laws in Alabama, which means they must carry the required coverages and obey traffic laws.

Alabama requires drivers to carry liability insurance with the limits of 25/50/25. These limits mean if you cause an accident, insurance will cover other parties' costs of up to $25,000 of bodily injury for one person, up to $50,000 of bodily injury per accident, and up to $25,000 of property damage per accident.Dani Best Licensed Insurance Producer

It’s important to note that liability insurance doesn’t pay for your own accident bills, but full coverage will. See the differences in cost between the two coverages below.

Alabama Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $186 | $382 |

| 16-Year-Old Male | $145 | $326 |

| 20-Year-Old Female | $135 | $310 |

| 20-Year-Old Male | $155 | $335 |

| 30-Year-Old Female | $125 | $298 |

| 30-Year-Old Male | $135 | $304 |

| 40-Year-Old Female | $115 | $275 |

| 40-Year-Old Male | $130 | $292 |

| 50-Year-Old Female | $110 | $251 |

| 50-Year-Old Male | $120 | $268 |

| 60-Year-Old Female | $105 | $238 |

| 60-Year-Old Male | $115 | $242 |

| 70-Year-Old Female | $95 | $212 |

| 70-Year-Old Male | $105 | $224 |

Teen drivers will have lower insurance costs if they join an existing policy, such as their parents, rather than buying their own Alabama policy.

Learn more: Cheapest Teen Driver Auto Insurance in Alabama

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Low-Mileage Drivers in Alabama Save Money on Auto Insurance

Even if a company doesn’t offer pay-per-mile coverage, they often offer plenty of discounts, such as a low-mileage auto insurance discount.

Some low mileage discounts can save up to 30% on a policy.

In addition to low mileage discounts, companies also offer bundling discounts, paperless discounts, and more.

Get The Best Pay-As-You-Go Auto Insurance in Alabama

The best companies for the best Alabama usage-based auto insurance are Nationwide, USAA, and Progressive. These companies offer cheap usage-based auto insurance, good customer service, and plenty of coverage options.

Ready to shop for Alabama car insurance today? Enter your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What does pay-as-you-go auto insurance mean?

Pay-as-you-go auto insurance typically refers to insurance companies that charge based on mileage or usage. We recommend reading Alabama pay-per-mile car insurance reviews of popular companies like Nationwide or Hugo auto insurance before committing to a company.

Is pay-as-you-go car insurance worth it?

Pay-as-you-go auto insurance is worth it for drivers who have low annual mileages (learn more: How Annual Mileage Affects Your Auto Insurance Rates).

What is the maximum mileage for pay-as-you-go insurance?

The maximum mileage for Alabama pay-per-mile insurance coverage depends on the company.

How do Alabama pay-as-you-go insurance companies verify mileage?

The best pay-per-mile insurance companies typically track mileage through an app or odometer device. Other companies may only require a picture of the odometer each month.

Who has the cheapest full coverage insurance in Alabama?

USAA and Geico have the cheapest Alabama auto insurance rates for full coverage (learn more: What is full coverage auto insurance?).

What is the minimum auto insurance coverage in Alabama?

Minimum auto insurance consists of liability insurance for bodily injuries and property damage. The Alabama pay-per-mile insurance statute has the same requirements as a normal auto insurance policy.

Why is Alabama auto insurance so expensive?

Alabama auto insurance costs can be expensive if drivers have poor driving records or are shopping at expensive companies. We recommend using an Alabama car payment calculator to determine rates.

What happens if you drive without insurance in Alabama?

Alabama auto insurance requirements require all drivers to have auto insurance. If caught driving without auto insurance, you face fines, license suspensions, and more.

Which pay-as-you-go company has the highest customer satisfaction in Alabama?

USAA has some of the highest Alabama usage-based car insurance reviews.

Does credit score affect pay-as-you-go car insurance in Alabama?

Yes, credit scores can impact the cheapest pay-per-mile insurance rates (read more: How Credit Scores Affect Auto Insurance Rates).

How much is auto insurance in Alabama per month?

Minimum coverage in Alabama is an average of $40/mo, though rates vary drastically based on driving record. Use our free quote tool to find the best rate for your vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.