Best Austin, Texas Auto Insurance in 2026 (Check Out the Top 10 Companies)

Best Austin, Texas auto insurance starts at $110 a month, with Progressive, State Farm, and Travelers and Travelers topping the list. For motorists desiring peace of mind in the Texas capital, these firms provide services tailored to the city's busy roads and distinctive driving environment.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated October 2024

Company Facts

Full Coverage in Austin Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Austin Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Austin Texas

A.M. Best Rating

Complaint Level

Pros & Cons

The best Austin, Texas auto insurance providers are Progressive, State Farm, and Travelers, offering rates from $110 per month. These insurers stand out in their ability to offer affordable options and keep customers happy.

In this article, we will help you achieve cheap car insurance in Austin, Texas. We have provided tables where you can check which provider offers the lowest rates, also, how parking in safe places, and driving carefully can help you get cheaper insurance.

Our Top 10 Company Picks: Best Austin, Texas Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 12% A+ Strong Reputation Progressive

![]()

#2 20% B Comprehensive Plans State Farm

#3 8% A++ Competitive Rates Travelers

#4 10% A++ Military Discounts USAA

#5 20% A Extensive Coverag American Family

#6 10% A+ Excellent Service Erie

#7 25% A Flexible Options Liberty Mutual

#8 25% A+ High Reliability Allstate

#9 25% A++ Affordable Premiums Geico

#10 20% A Broad Coverage Farmers

Stop overpaying for auto insurance. Enter your ZIP code above to get free Austin, Texas auto insurance quotes.

- The average commute length in Austin is 25 minutes

- A DUI increases your car insurance in Austin, TX

- The minimum auto insurance required in Austin, Texas is 30/60/25

#1 – Progressive: Top Overall Pick

Pros

- Austin-Tailored Pricing: Competitive rates designed for Austin’s unique urban driving landscape, taking into account the city’s traffic patterns, accident rates, and vehicle theft statistics to offer fair and affordable premiums to local drivers.

- Customized Safe Driving Rewards: As mentioned in our Progressive auto insurance review, their Snapshot program offers personalized discounts for cautious Austin motorists, using telematics to monitor driving habits and reward those who navigate the city’s streets safely, potentially saving hundreds on annual premiums.

- Diverse Austin Coverage: Extensive options for various vehicle types in Austin, including rideshare insurance, which is crucial for the city’s growing gig economy workforce, ensuring comprehensive protection for both personal and commercial use of vehicles.

Cons

- Less Personal Touch: Customer service may lack the local feel of smaller Austin insurers, as Progressive’s large-scale operations can sometimes result in less personalized attention to individual policyholder needs and local Austin driving concerns.

- Post-Accident Rate Hikes: Premiums can spike significantly after incidents in Austin’s high-traffic zones, potentially offsetting initial savings and causing financial strain for drivers involved in accidents on the city’s busy roads and highways.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Comprehensive Plans

Pros

- Strong Austin Presence: A robust network of agents throughout Austin provides personalized service, ensuring policyholders have easy access to face-to-face consultations and tailored advice for navigating Austin’s unique insurance landscape and traffic conditions.

- Tech-Savvy Savings: The Drive Safe & Save program caters to Austin’s tech-forward drivers, using mobile technology to track driving habits and offer discounts, which is particularly beneficial in a city known for its tech-savvy population and innovation.

- Clean Record Rewards: Competitive rates for Austin drivers with spotless driving histories, offering significant discounts that recognize and reward those who successfully navigate the city’s challenging traffic conditions without incidents or violations.

Cons

- Younger Driver Premiums: As outlined in our State Farm auto insurance review, there are potentially higher costs for Austin’s younger drivers or those with infractions, which can be particularly challenging in a city with a large student population and many young professionals entering the workforce and seeking affordable coverage.

- Digital Limitations: Online tools may lag behind some competitors in the Austin market, potentially frustrating tech-savvy customers who prefer managing their policies entirely through digital platforms, which is increasingly important in Austin’s connected community.

#3 – Travelers: Best for Competitive Rates

Pros

- Austin-Specific Add-Ons: Unique coverage options tailored to Austin drivers, like new car replacement, which is particularly valuable in a city with high rates of vehicle ownership and frequent upgrades to newer models among its affluent population.

- Smart Driving Incentives: The IntelliDrive program rewards safe navigation of Austin roads, as mentioned in our Travelers auto insurance review, using telematics to monitor driving habits and offer discounts, which can be especially beneficial for those who frequently navigate the city’s congested highways and busy downtown areas.

- Bundle Benefits: Competitive rates for Austin homeowners combining policies, offering significant savings for those who insure both their homes and vehicles, which is attractive in a city with a strong real estate market and high rates of homeownership.

Cons

- Limited Local Representation: Fewer Austin-based agents compared to larger insurers, which may result in less personalized service and longer wait times for face-to-face consultations, potentially frustrating for customers who prefer local, in-person support for their insurance needs.

- Customer Satisfaction Concerns: Ratings among Austin policyholders slightly below industry average, indicating potential issues with claims processing or customer service that could be problematic for drivers dealing with accidents or policy changes in the bustling Austin metro area.

#4 – USAA: Best for Military Discounts

Pros

- Military-Friendly Rates: Exceptional pricing for Austin’s substantial military community, offering significant discounts and tailored coverage options that recognize the unique needs of service members, veterans, and their families living in and around the city’s military installations.

- High Austin Satisfaction: Strong customer approval ratings among local policyholders, indicating efficient claims processing and responsive customer service, which is crucial in a city with high traffic volumes and potentially frequent auto-related incidents.

- Austin Traffic Protection: As seen in our USAA auto insurance review, they offer accident forgiveness suited to the city’s busy streets, protecting policyholders from rate increases after their first at-fault accident, which is particularly valuable given Austin’s challenging traffic conditions and high accident rates.

Cons

- Restricted Access: Only available to military members and their families in Austin, limiting access for the general population and potentially leaving many Austin residents unable to take advantage of USAA’s competitive rates and highly-rated services.

- Minimal Local Offices: Fewer physical locations in Austin compared to other major insurers, which may inconvenience customers who prefer in-person service or need to discuss complex policy issues face-to-face, especially in a geographically spread-out city like Austin.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Extensive Coverage

Pros

- Austin Commuter Perks: The KnowYourDrive program is ideal for the city’s daily commuters, offering potential savings based on safe driving habits, which is particularly beneficial in a city known for its traffic congestion and long average commute times.

- Austin Home & Auto Savings: Strong discounts for bundling home and auto policies, providing significant savings for Austin residents who own both homes and vehicles, which is common in this city with a strong real estate market and car-dependent lifestyle.

- New Car Protection: Offers gap insurance, beneficial for Austin’s new vehicle purchasers, protecting against depreciation in a city where new car sales are high and many residents frequently upgrade their vehicles to keep up with the latest automotive trends. (Read More: American Family Auto Insurance Review).

Cons

- Variable Pricing: Higher than average premiums for certain Austin driver profiles, potentially making coverage less affordable for some residents, especially in a city with a diverse population and wide range of driving habits and vehicle types.

- Limited Flexibility: Fewer customization options compared to some Austin competitors, which may not adequately address the varied needs of Austin’s diverse driving population, from urban commuters to suburban families with multiple vehicles.

#6 – Erie: Best for Excellent Service

Pros

- Stable Austin Premiums: The Rate Lock program helps maintain consistent pricing for Austin drivers, protecting them from unexpected rate increases in a city where living costs are constantly on the rise, providing financial stability and predictability for auto insurance expenses.

- Local Austin Expertise: Strong presence of local agents for personalized Austin service, offering in-depth knowledge of the city’s unique traffic patterns, accident hotspots, and local regulations, ensuring policyholders receive tailored advice and support for their specific needs.

- Comprehensive Austin Package: The Auto Plus package offers valuable add-ons for city drivers, including features like diminishing deductible and increased limits for specific coverages. For more information, read our article titled “Erie auto insurance review.”

Cons

- Tech Limitations: Limited availability of online tools compared to larger Austin insurers, potentially frustrating tech-savvy customers in this innovation-focused city who prefer managing their policies and claims entirely through digital platforms, without the need for phone calls or in-person visits.

- Fewer Low-Mileage Options: Limited discounts for Austin’s infrequent drivers, which may not adequately serve residents who primarily use public transportation or work from home, a growing trend in Austin’s evolving work culture and improving public transit system.

#7 – Liberty Mutual: Best for Flexible Options

Pros

- Austin Safe Driving Rewards: The RightTrack program incentivizes careful navigation of city streets, offering personalized discounts based on driving habits, which is particularly valuable in Austin’s complex urban driving environment with its mix of highways, busy downtown areas, and residential neighborhoods.

- Tailored Austin Coverage: As mentioned in our Liberty Mutual auto insurance review, they have customizable options for diverse Austin driver needs, allowing policyholders to create a unique insurance package that addresses specific concerns.

- Austin Education Discounts: Special rates for the city’s large teacher and student population, recognizing the significant presence of educational institutions in Austin and offering affordable coverage options for those in academia, from university students to faculty members.

Cons

- Premium Variations: Potentially higher rates for some Austin driver categories, which could make coverage less affordable for certain residents, particularly in a city with a diverse population and wide range of socioeconomic backgrounds.

- Complex Policies: Coverage options may be overwhelming for some Austin customers, potentially leading to confusion or difficulty in choosing the right policy, especially for newcomers to the city who may be unfamiliar with Texas auto insurance requirements and local driving conditions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for High Reliability

Pros

- Austin Claims Satisfaction: Known for efficient handling of claims in the Austin area, with a streamlined process that takes into account local traffic patterns and common accident scenarios, ensuring quick resolution and minimal disruption for policyholders involved in incidents on Austin’s busy roads.

- Local Austin Support: As mentioned in our Allstate auto insurance review, they offer personalized advice on coverage options that address specific local concerns, from protection against severe weather events to coverage for popular local vehicle types.

- Austin Safe Driving Bonus: Offers cash back for accident-free periods on Austin roads, rewarding cautious drivers who successfully navigate the city’s challenging traffic conditions, potentially saving hundreds of dollars over time for consistently safe Austin motorists.

Cons

- Higher Austin Premiums: Rates may be above average for some Austin driver profiles, potentially making coverage less affordable for certain residents, especially in a city with a diverse population and varying income levels across different neighborhoods.

- Limited Austin-Specific Discounts: Fewer localized savings opportunities compared to some competitors, which may result in missed savings for Austin drivers with unique circumstances or those seeking highly tailored policies to match their specific driving habits and vehicle usage in the city.

#9 – Geico: Best for Affordable Premiums

Pros

- Austin Budget Option: Often offers some of the lowest rates for basic coverage in Austin, making insurance accessible to a wide range of residents, from students at the University of Texas to young professionals and families looking to minimize their auto insurance expenses.

- Austin Digital Experience: User-friendly app and website for easy policy management, catering to Austin’s tech-savvy population and allowing for quick adjustments, claims filing, and policy reviews, which is particularly valuable in a city known for its fast-paced, connected lifestyle.

- Wide-Ranging Austin Discounts: Numerous savings opportunities for various Austin driver types, including discounts for good students, military personnel, and safe drivers, helping to make coverage more affordable across the city’s diverse population and driving scenarios. Learn more details in our page titled, Geico auto insurance discounts.

Cons

- Minimal Austin Presence: Limited local offices and agents in the Austin area, which may frustrate customers who prefer face-to-face interactions or need personalized advice on complex coverage issues specific to Austin’s unique driving environment and insurance requirements.

- Basic Austin Packages: Standard policies may lack some features offered by other Austin insurers, potentially leaving gaps in coverage for drivers with specific needs, such as those requiring specialized protection for high-end vehicles or additional coverage for frequent long-distance travel.

#10 – Farmers: Best for Broad Coverage

Pros

- Comprehensive Austin Protection: Wide range of coverage options suited to Austin’s diverse drivers, from basic liability policies to premium packages that include features like custom equipment coverage, catering to the varied needs of Austin’s eclectic vehicle owner population.

- Austin Claims Forgiveness: Accident forgiveness can prevent rate increases after the first incident, which is particularly valuable in Austin’s high-traffic environment where even careful drivers may occasionally find themselves involved in minor fender-benders or weather-related accidents.

- Austin Rideshare Coverage: Offers policies tailored to Austin’s growing rideshare driver community, providing seamless protection for personal and commercial use of vehicles, essential in a city with a thriving gig economy and numerous rideshare service users.

Cons

- Austin Premium Fluctuations: Rates can vary significantly based on individual Austin driver factors, potentially leading to unexpected cost increases and making it difficult for some residents to budget for their auto insurance expenses in a city with an already high cost of living. See more details in our page titled Farmers auto insurance review.

- Complex Austin Policies: Coverage options may be confusing for some Austin customers, with numerous add-ons and policy features that can be overwhelming to navigate, especially for new residents or first-time car owners unfamiliar with Texas auto insurance requirements and local driving conditions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Austin, Texas Auto Insurance Requirements

Compare auto insurance in Austin to other Texas cities, including Houston auto insurance rates, Arlington auto insurance rates, and El Paso auto insurance rates to see how Austin auto insurance rates stack up.

Austin, Texas auto insurance laws require that you have at least the Texas minimum auto insurance to be financially responsible in the event of an accident. Take a look at the required auto insurance in Austin, Texas.

- Bodily Injury Liability: $30,000 per person and $60,000 per accident.

- Property Damage Liability: $25,000 per accident.

- Personal Injury Protection (PIP): Although optional, insurance companies must offer PIP, which covers medical expenses and lost wages. The default coverage amount is $2,500, but you can choose higher limits.

- Uninsured/Underinsured Motorist Coverage: This optional coverage protects you if the at-fault driver has insufficient or no insurance, covering medical and repair costs.

These limits ensure basic protection but might not cover all costs in severe accidents, leaving you responsible for additional expenses. It’s recommended to consider higher coverage limits or additional options like PIP and Uninsured/Underinsured Motorist Coverage for better financial security.

The Cost of Car Insurance in Austin

The first part of auto insurance you might be thinking about (as you are stranded in the five-hour-long line at Franklin’s) might be what goes into it. What are the factors that determine my auto insurance rates?

Austin, Texas Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $140 $365

American Family $135 $355

Erie $145 $380

Farmers $125 $350

Geico $110 $330

Liberty Mutual $150 $390

Progressive $125 $350

State Farm $130 $360

Travelers $140 $370

USAA $120 $340

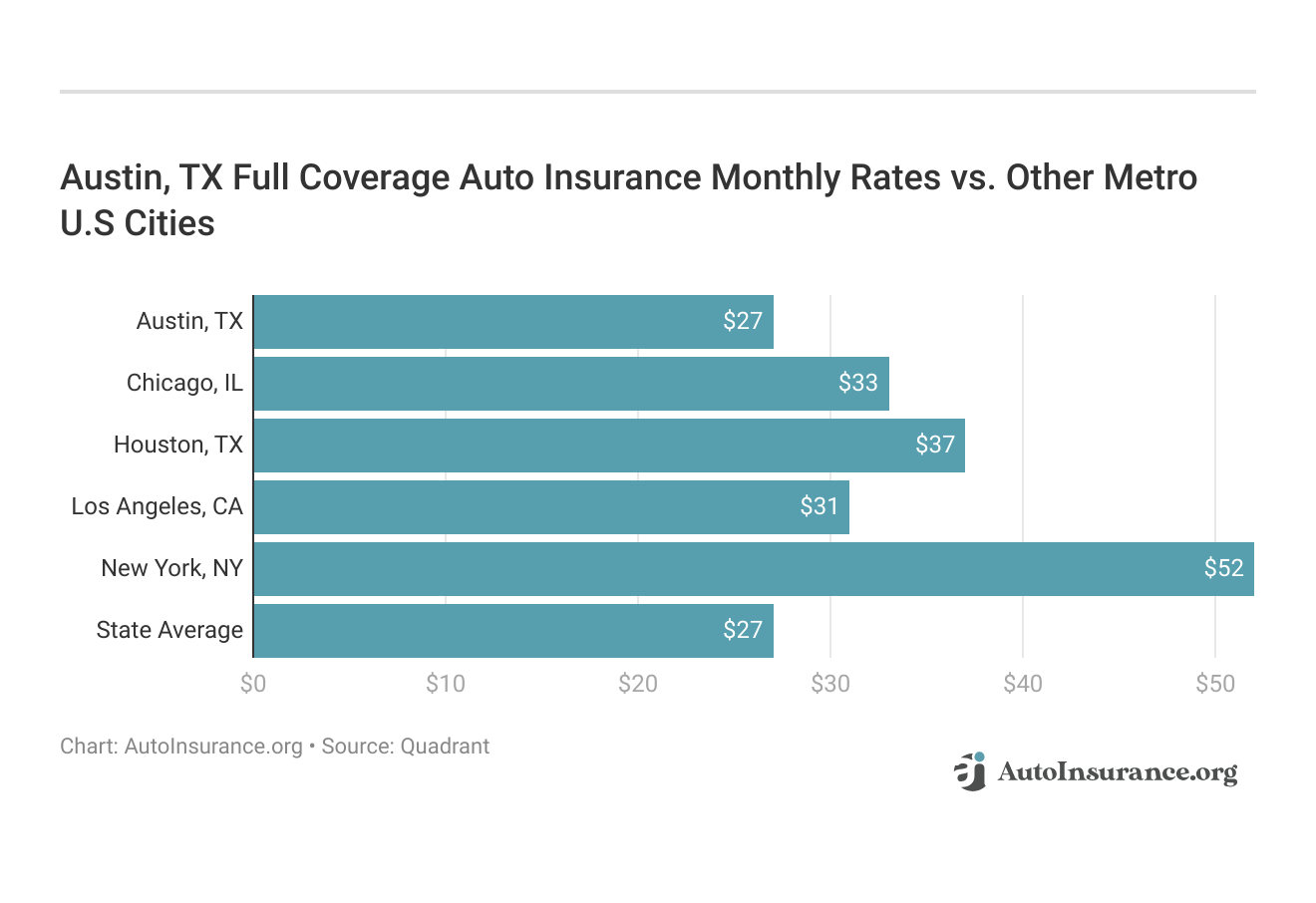

You might find yourself asking how does my Austin, TX insurance stack up against other top metro auto insurance rates? We’ve got your answer below.

We’re here to tell you, There are many. Gender, age, marital status, driving record, credit history, and more. So how much will you pay?

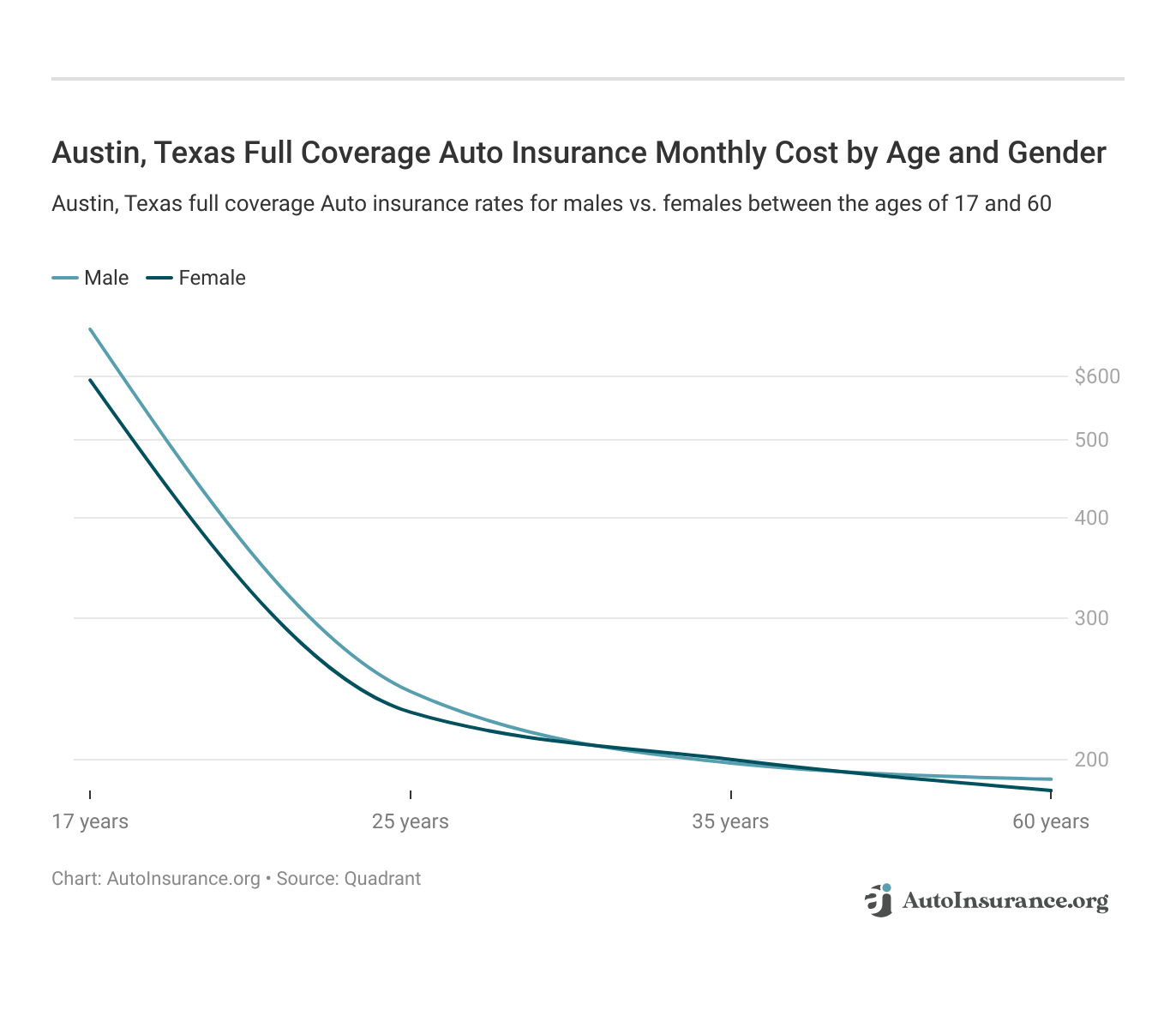

Male vs. Female vs Age

Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania are states that won’t use gender to calculate car insurance rates anymore. But age is still a major factor because young drivers seeking auto insurance are often considered high-risk.

Texas does take into account the gender of the man or woman for auto insurance rates, so check out the average car insurance cost in Austin, TX by age and gender.

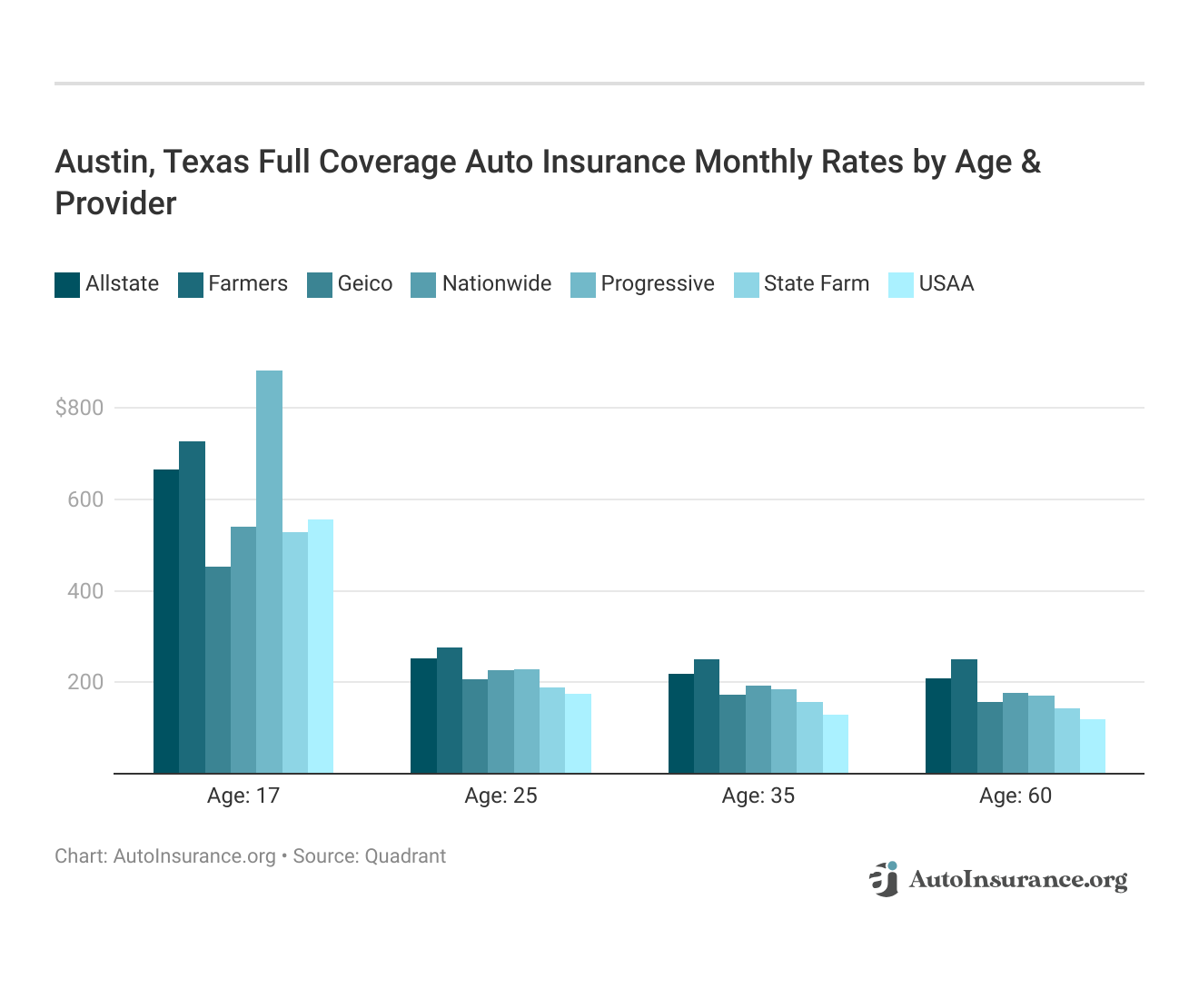

Austin, TX car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

For high-risk drivers who have an SR-22 certificate and can’t find insurance through the voluntary marketplace, Texas created the Texas Automobile Insurance Plan. It currently only offers the minimum coverage—30/60/25—and is available only to those who possess a Texas driver’s license (or SR-22 and applying) and can show they’ve been rejected from two insurance companies in the 60 days prior to applying.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Austin Auto Insurance Rates by Demographics

There are some major players in Austin: Allstate, State Farm, Progressive, just to name three.

Now, which company fits your budget? Here is a list of rates, organized by company and broken down by age, gender, and provider:

Austin, Texas Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $790 | $951 | $366 | $380 | $296 | $298 | $292 | $292 |

| American Family | $647 | $848 | $338 | $387 | $230 | $258 | $220 | $253 |

| Geico | $479 | $496 | $232 | $232 | $213 | $231 | $205 | $233 |

| Nationwide | $508 | $651 | $210 | $227 | $179 | $181 | $158 | $167 |

| Progressive | $808 | $902 | $229 | $233 | $192 | $184 | $172 | $175 |

| State Farm | $439 | $562 | $195 | $201 | $179 | $179 | $160 | $160 |

| USAA | $378 | $409 | $176 | $187 | $133 | $133 | $127 | $126 |

There’s a steep drop off from those three to the next highest for that demographic: $285 for Nationwide. If you have a teenager (male or female) keep in mind that price difference.

However, it is important to not just consider rates when signing up with an insurance company. Many factors influence the rates, including the quality of the insurance plan.

Commuting Factors in Austin, Texas Auto Insurance

According to the Federal Highway Administration, the average American drives 13,476 miles per year, which is like making two round-trips across the Atlantic Ocean by technology-enabled vehicles to London. Commute expenses can vary by city, both in safety and duration.

Males drive considerably more than females, with 20-54-year-old males and females comprising the bulk of miles overall.

What is the average amount of miles driven in Texas? 15,533.

Insurers sometimes look at commute distances to gauge rates and whether to increase or decrease them. Here is a look at the major insurers in Austin:

Austin, Texas Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $447 | $469 |

| American Family | $397 | $397 |

| Geico | $285 | $295 |

| Nationwide | $285 | $285 |

| Progressive | $362 | $362 |

| State Farm | $259 | $259 |

| USAA | $206 | $211 |

| U.S. Average | $320 | $326 |

As in the previous chart, Allstate, American Family, and Progressive have the highest insurance rates overall. Geico, State Farm, and Nationwide are in the middle, with USAA at the lowest.

What’s interesting? More than half of the insurance companies don’t adjust rates by commute distance. Only Allstate, Geico, and USAA do, and only Allstate raises them by more than $130 or so.

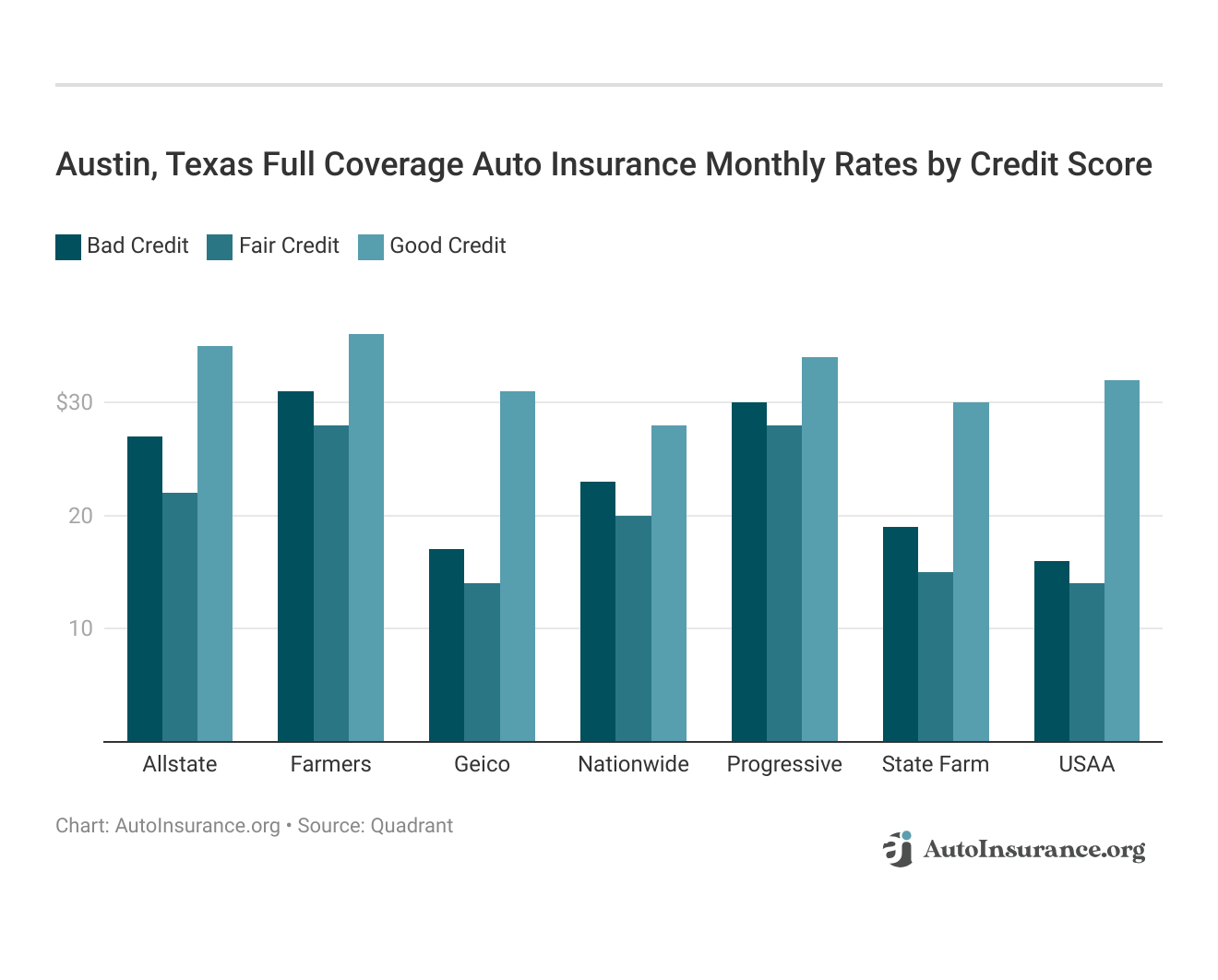

Car Insurance Costs by Credit Score

Credit history can also affect your car insurance rates. Auto insurers use credit scores to form the basis on which they predict how much you’ll pay back, or if you will. This may affect the overall rate that you have to pay.

The difference is significant. Having a poor credit history versus a good history can cost you around $31 for Geico.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

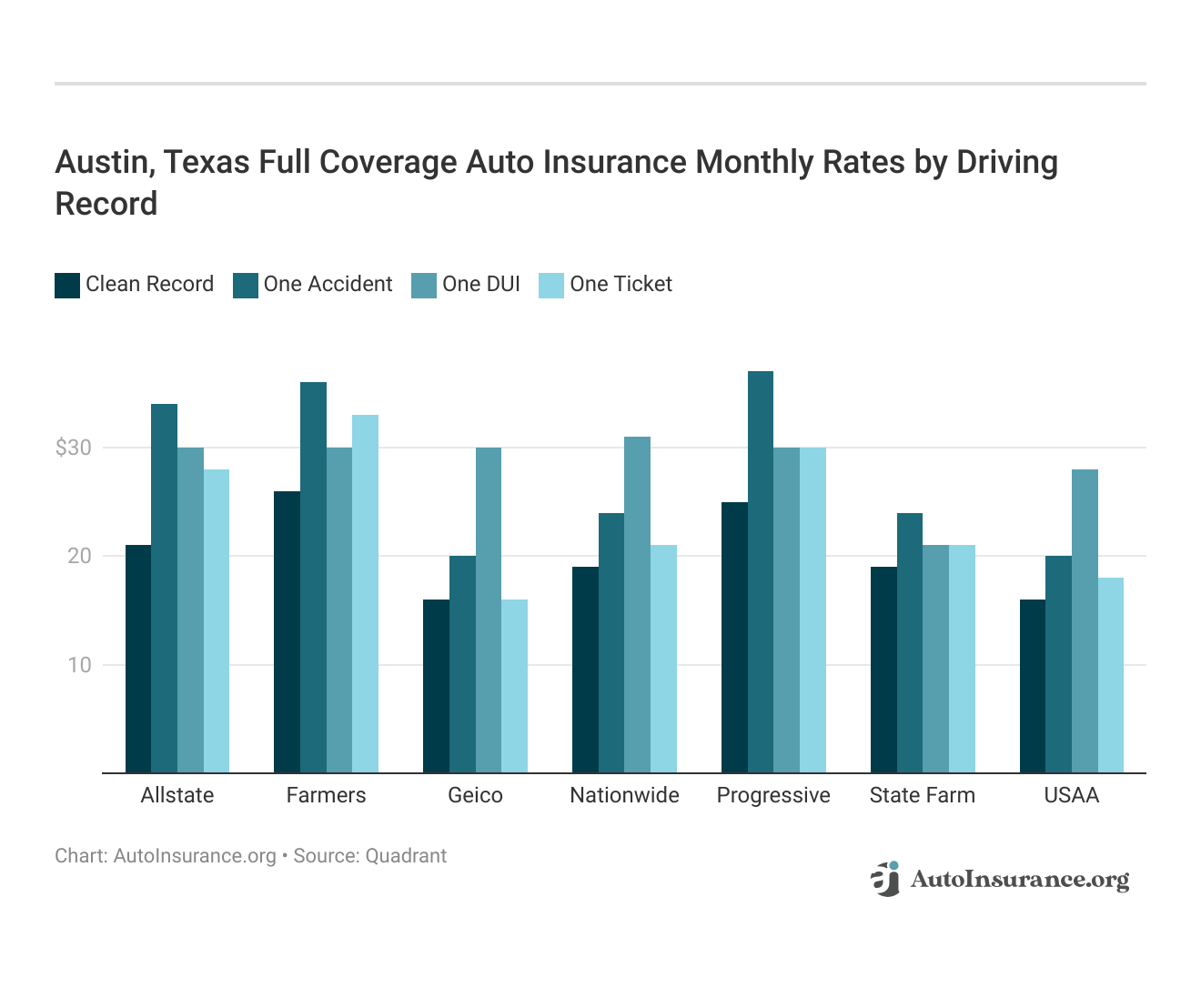

Insurance Rates Based on Driving History

Your driving record is checked by auto insurance companies, as well. Take a look at the differences between a clean record compared to with a DUI, accident, or speeding violation:

A single accident or DUI can cost a driver thousands of dollars. And that’s, of course, beyond the deductible needing to be met or the general court costs and fines of a DUI.

What’s interesting? Generally, a speeding ticket means you are more inclined to aggressive or reckless driving, at a higher risk of having an accident, and other negative factors on your customer profile. So, there are still options if you have a bad driving record for auto insurance.

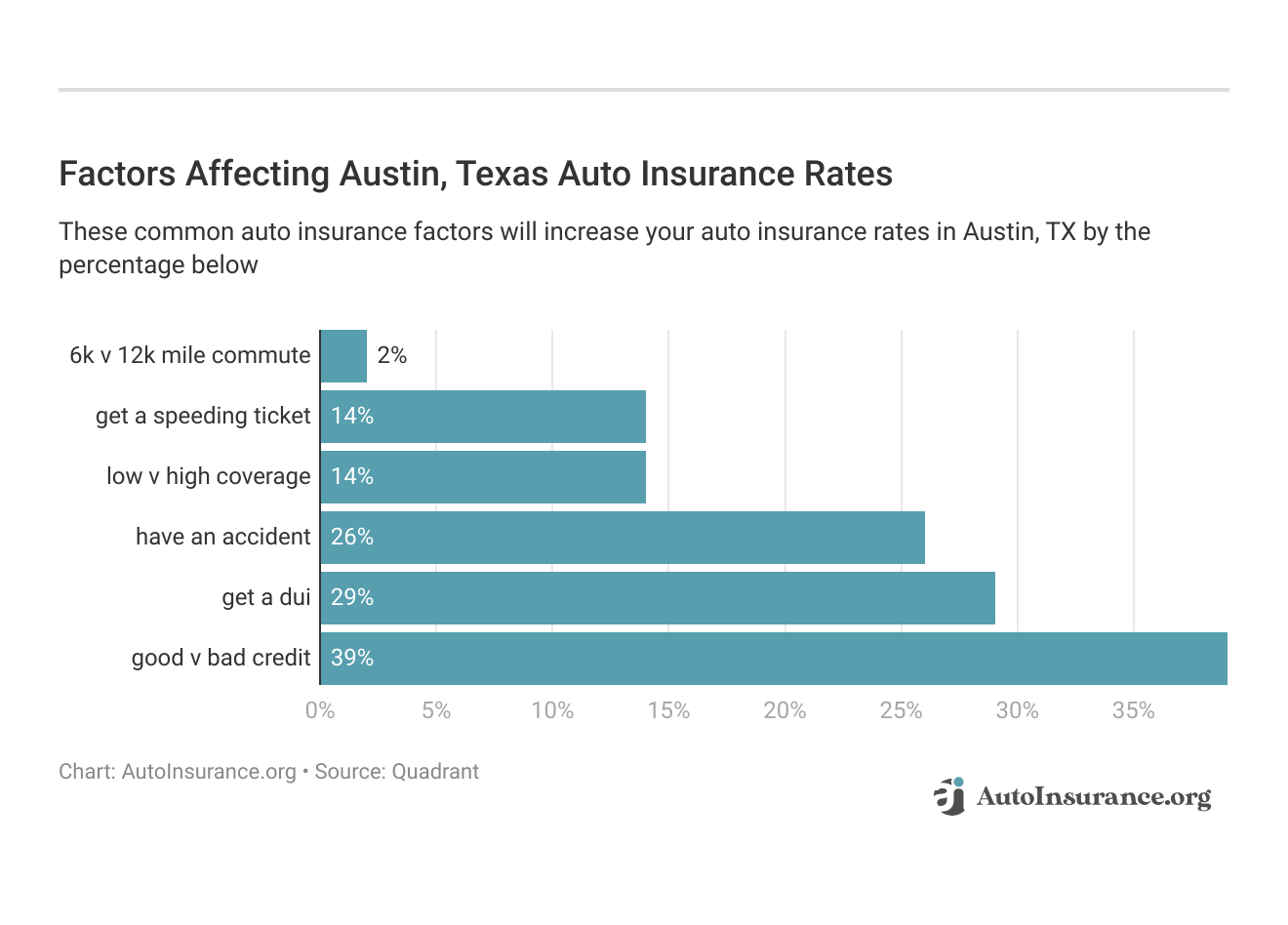

Car Insurance Factors in Austin, Texas

Aside from commute times, credit history, driving record, and the demographic details mentioned above, there are other surprising factors that influence your car insurance rate. They require a holistic look at Austin.

Whether you are looking for cheap car insurance in Austin TX or want to improve your existing coverage. By understanding these factors, you can proactively take measures to control your premiums. This includes keeping a clean driving record and working on improving your credit score.

Read More: Top 7 Factors That Affect Auto Insurance Rates

Vehicle Theft in Austin

Stolen vehicles are a major concern. Experiencing the theft of your vehicle, even when you are not present, can be an incredibly distressing situation. It not only disrupts your daily life but also causes significant financial and emotional strain as you navigate the recovery process.

Now, here’s a look at Austin’s vehicle theft statistics: According to FBI content released to Neighborhood Scout, there were 2,090 vehicle thefts in Austin in 2017

- Austin: 118 crimes per square mile

- Texas: 29 crimes per square mile

- National median: 31.1 crimes per square mile

In general, like many urban areas, Austin’s crimes per square mile are much higher than Texas or national averages. These crimes vary according to violence or property:

Austin, Texas Crime Rate

| Crime Type | Crime Total | Crime Rate |

|---|---|---|

| Violent | 4,134 | 400 |

| Property | 36,789 | 3560 |

As you can see, the rate of property crime is much higher than violent crime. Here are the total property crimes committed in Austin versus the totals in the United States:

Austin USA Property Crimes

| Area | Burglary | Burglary Rate | Theft | Theft Rate | Motor Vehicle Theft | Motor Vehicle Theft Rate |

|---|---|---|---|---|---|---|

| Austin | 4,414 | 5 | 25,288 | 27 | 2,090 | 2 |

| United States | 1.4 million | 4 | 5.5 million | 17 | 773,139 | 2 |

Your chances of becoming a victim of property crime in Austin are 1 in 30. In Texas generally, your chances are 1 in 39.

Austin, for property crime, is less safe than in Texas as a whole. Here are violent crimes listed with Austin totals versus totals for the United States:

Austin USA Violent Crimes

| Area | Murder | Murder Rate | Rape | Rape Rate | Robbery | Robbery Rate | Assault | Assault Rate |

|---|---|---|---|---|---|---|---|---|

| Austin | 26 | 1 | 840 | 1 | 993 | 1 | 2,199 | 2 |

| United States | 17,284 | 1 | 135,755 | 1 | 319,356 | 1 | 810,825 | 2 |

Your chances of becoming a victim of violent crime in Austin are 1 in 234. In Texas, it is 1 in 228. Austin, for violent crime, is safer than Texas as a whole

Traffic Congestion in Texas

Have you believed that—as you’re sitting, angry, in traffic—that Austin is one of the most congested cities in the world? Turns out: You’re not wrong. Austin is consistently ranked among the top congested cities in the world.

INRIX, a company that wants to make traffic more intelligent, ranks Austin as the 84th most congested city in the world in 2018 and the 14th most congested city in the United States.

Austin ranked 104 in time spent in congestion and 13th in inner-city last-mile speed.

The average cost for the congestion per driver was $123 per month

The overall speed was 23.55 miles per hour during peak hours (rush hour) and roughly 46 mph during off-hours or free-flow traffic.

Transportation

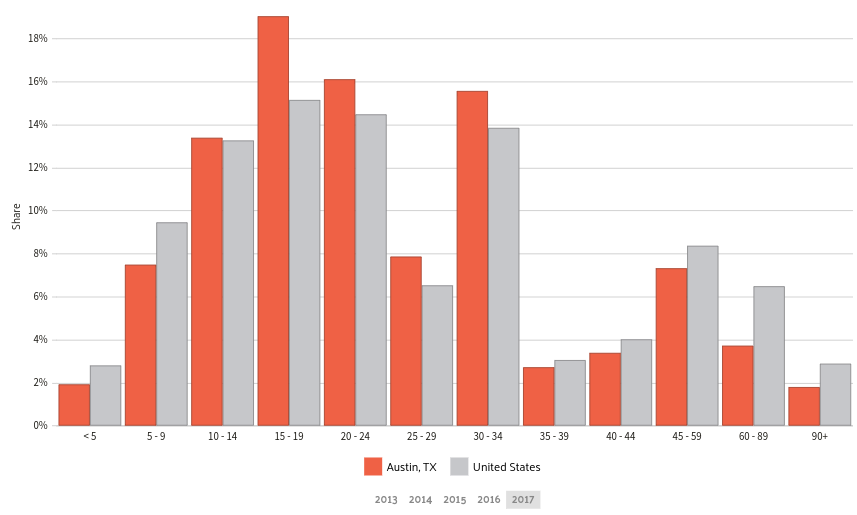

Rarin’ to go to take a look at commute times and commuter methods of transportation? Let’s take a look. Here’s a graph for commute times in Austin from Datausa.io:

Datausa.io has commute times a little differently than INRIX because these are the commute times just within city limits: The average Austin commute time is 22.7 minutes, which is less than the national average (25.5 minutes)

Most Austinites have a commute time between 15 and 34 minutes, although 19 percent of Austinites have a commute of 35 minutes or longer. And commute mileage compared to pleasure mileage affects auto insurance rates. In fact:

1.75 percent of Austinites have a “super commute,” which is one longer than 90 minutes Here’s a graph that covers commuter methods of transportation:

74 percent of Austinites drove alone, while 9.23 percent carpooled and 8.76 percent worked from home. While Austin has a commuter rail service (MetroRail), it only runs from downtown Austin to the northern Austin suburbs. In general:

Austinites are heavily reliant on cars.

How Safe are Austin’s Streets and Roads

Fatalities are grim statistics but they are important to know. All the following statistics are provided by the National Highway Traffic Safety Administration. Let’s start this off with total fatalities for the three counties that Austin intersects:

- Travis (1.2 million population)

- Hays (214,000 population)

- Williamson (220,000 population)

Travis County, which encompasses much of Austin, is the leader with consistently over 100 vehicle-related fatalities. Total fatalities (by county):

Austin Total Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 150 | 165 | 180 | 195 | 190 |

| Hays | 30 | 35 | 40 | 42 | 40 |

| Williamson | 60 | 65 | 70 | 75 | 73 |

While Harris and Williamson Counties have much fewer fatalities, they, like Travis County, have experienced a rise in the five-year period. This might be due to the general growth in the population of the Austin-Round Rock area. Here is a look at fatalities related to drunk drivers:

Austin BAC Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 45 | 50 | 55 | 60 | 58 |

| Hays | 12 | 14 | 16 | 18 | 17 |

| Williamson | 25 | 27 | 30 | 32 | 30 |

Again, the numbers stay about proportional between the counties. However, Harris and Williamson continue their overall rise in fatalities with Harris jumping over 100 percent and Williamson jumping a little less than 70 percent. Now, a look at single-vehicle fatalities:

Austin Counties Single Vehicle Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 50 | 55 | 60 | 65 | 63 |

| Hays | 15 | 18 | 20 | 22 | 21 |

| Williamson | 25 | 28 | 32 | 34 | 33 |

With the exception of Williamson, everything stays level for a five-year period. Travis leads with the highest, due, in likelihood, to its larger population. Let’s take a look at speeding fatalities:

Austin Counties Speeding Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 40 | 45 | 50 | 55 | 53 |

| Hays | 10 | 12 | 15 | 17 | 16 |

| Williamson | 20 | 23 | 27 | 30 | 28 |

Overall, speeding fatalities have declined, with Travis and Hays Counties’ numbers dropping. Williamson stays even. For highway departure fatalities:

Austin Counties Roadway Departure Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 35 | 40 | 45 | 50 | 48 |

| Hays | 12 | 14 | 16 | 18 | 17 |

| Williamson | 22 | 25 | 29 | 32 | 30 |

This is an interesting set of statistics. Although Travis dwarfs the other two counties (almost 6x their populations), the total number of fatalities is much smaller proportionally when compared to their respective populations.

There may be an explanation. The FHA data shows that over half of all fatal crashes happen in rural areas, even though just 19 percent of people live there. More than two-thirds of these crashes involve roadway departure. Perhaps because the other two counties are less urbanized, this plays a role. Next, to intersections:

Austin Counties Intersection-Related Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 30 | 34 | 38 | 42 | 40 |

| Hays | 8 | 10 | 12 | 13 | 12 |

| Williamson | 15 | 17 | 20 | 22 | 21 |

Williamson here has a high rate compared to normal. This trend indicates potential underlying issues that need addressing. On to passenger car occupants:

Austin Counties Passenger Car Occupant Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) | Total |

|---|---|---|---|---|---|---|

| Travis | 35 | 40 | 45 | 50 | 48 | 214 |

| Hays | 8 | 10 | 12 | 14 | 13 | 59 |

| Williamson | 18 | 20 | 24 | 26 | 25 | 78 |

Overall, fatalities rising here throughout the five-year period. This upward trend is alarming and calls for immediate safety measures. Now, for pedestrian deaths:

Austin Counties Pedestrian Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 35 | 38 | 42 | 45 | 44 |

| Hays | 8 | 9 | 11 | 12 | 11 |

| Williamson | 15 | 17 | 20 | 22 | 21 |

Here, Travis County is the highest, both in terms of total and proportion when compared to the others. Because it contains most of Austin, and Austin is urbanized, it makes sense (though no less sad) that that would occur. Onto pedal cyclist deaths:

Austin Counties Pedalcyclist Fatalities

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 5 | 6 | 7 | 8 | 7 |

| Hays | 1 | 1 | 2 | 2 | 2 |

| Williamson | 2 | 2 | 3 | 3 | 3 |

Hays with zero and Travis with 13, over a five-year period. This stark contrast highlights the varying levels of pedestrian safety across counties. What is the most dangerous type of roadway?

Austin Roadway Type Fatalities

| Type | Total |

|---|---|

| Rural | 40 |

| Urban | 120 |

The Federal Highway Administration has definitions on road types. Understanding these can help identify where most accidents occur. Okay, how about railway incidents?

Austin Railway Incidents

| County | Total Fatalities (2019) | Total Fatalities (2020) | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|---|---|

| Travis | 5 | 6 | 7 | 7 | 6 |

| Hays | 2 | 2 | 3 | 3 | 3 |

| Williamson | 3 | 3 | 4 | 4 | 4 |

The Koenig Lane railway stop(/stops) seems to be a real problem in Travis County. Addressing this issue could significantly reduce the risk of future incidents.

Austin Car Insurance: The Bottom Line

Texas is an “at-fault” state, meaning that the person found responsible for an accident is responsible for the financial costs—to their vehicle and whoever they hit. Generally, this means your insurance company will be paying theirs (and them too, of course). You’ll have to pay out-of-pocket if you exceed your insurance limits.

Read More: Can you claim auto insurance if it’s your fault?

Alright, you’ve crossed the finish line and have everything you need to make an informed decision about car insurance in Austin, TX. Clear eyes, full hearts. Happy driving.

Uncover affordable auto insurance quotes in Austin, TX from the top providers by entering your ZIP code below.

Frequently Asked Questions

Is Austin, auto insurance mandatory?

Yes, Austin, auto insurance is mandatory, as in the rest of Texas. Drivers in Austin, TX are required by law to carry at least the minimum liability coverage to protect against costs incurred in an accident where they are at fault. This helps ensure that all drivers on the road are financially responsible in the event of an accident.

Read More: Auto Insurance Laws

What types of Austin TX Auto Insurance are available?

In Austin, TX, drivers have access to various types of Austin TX Auto Insurance coverage. These include liability insurance, which is mandatory, as well as optional coverages such as collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each type of coverage serves different purposes, providing financial protection against various risks.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

How much Auto Insurance in Austin coverage do I need?

Texas state law requires drivers to carry a minimum of 30/60/25 coverage, which means $30,000 per person, $60,000 per accident for bodily injury liability, and $25,000 for property damage liability. However, many experts recommend purchasing higher limits or additional coverages, like collision or comprehensive, to ensure better protection, especially in severe accidents. This is particularly important given the average cost of car insurance in Austin, TX.

What factors can affect my auto insurance in Austin TX?

Several factors can influence your auto insurance in Austin TX. These include your age, gender, marital status, driving record, credit history, and the type of vehicle you drive. Additionally, where you live in Austin, your annual mileage, and whether you qualify for discounts can also impact your premium.

Are there any discounts available for cheap auto insurance in Austin?

Yes, there are multiple discounts available for cheap auto insurance in Austin. These can include safe driver discounts, multi-policy discounts, good student discounts, and discounts for having safety features in your vehicle. Some insurance companies also offer discounts for completing defensive driving courses or for being a member of certain organizations. More information is available in our article titled “Auto Insurance Discounts to Ask for.”

How can I find the best cheap auto insurance in Austin TX?

To find the best cheap auto insurance in Austin TX, start by comparing quotes from multiple insurers. Consider using online tools to gather quotes, and check for any available discounts that you may qualify for. Additionally, it’s wise to regularly review your coverage and shop around when your policy is up for renewal to ensure you’re getting the best deal.

What should I do if I get into an accident and need car insurance in Austin Texas?

If you get into an accident and need car insurance in Austin Texas, the first step is to ensure everyone’s safety and call 911 if there are any injuries. Next, exchange information with the other driver(s), including names, contact details, insurance information, and vehicle details.

It’s also important to document the scene with photos and, if possible, gather witness statements. Then, report the accident to your insurance company as soon as possible. Learn more in our article titled “How long does an accident stay on your record?”

Can I use my Cheap Car Insurance in Austin TX coverage for rental cars?

Whether your cheap car insurance in Austin TX covers rental cars depends on your specific policy. Many auto insurance policies do extend coverage to rental vehicles, but it’s crucial to verify this with your insurer before you rent a car. Alternatively, some credit cards offer rental car insurance coverage if you use them to pay for the rental.

How can I lower my car insurance in Austin Texas premiums?

To lower your car insurance in Austin, Texas premiums, you can take several steps. Start by maintaining a clean driving record, as avoiding accidents and tickets will keep your rates lower. Additionally, consider increasing your deductibles, bundling your insurance policies, or taking advantage of available discounts. Shopping around and comparing rates regularly is another effective way to ensure you’re paying the lowest possible premium.

Are there any specific insurance considerations for flood-prone areas in Austin, TX?

Yes, if you live in a flood-prone area of Austin, TX, it’s advisable to consider adding comprehensive coverage to your auto insurance in Austin TX policy. This optional coverage protects against non-collision-related damages, including those caused by flooding. Given Austin’s history with floods, this additional coverage can be essential for safeguarding your vehicle.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.