Best Parked Car Insurance in 2024 (Your Guide to the Top 10 Companies)

State Farm, USAA, and Progressive have the best parked car insurance. At State Farm, rates average just $21/mo for minimum parked vehicle insurance. The best companies will allow drivers to reduce coverage to comprehensive-only insurance and offer discounts for vehicles while they are in storage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: May 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,759 reviews

17,759 reviewsCompany Facts

Full Coverage for Parked Car

A.M. Best Rating

Complaint Level

Pros & Cons

17,759 reviews

17,759 reviews 6,435 reviews

6,435 reviewsCompany Facts

Full Coverage for Parked Car

A.M. Best Rating

Complaint Level

Pros & Cons

6,435 reviews

6,435 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Parked Car

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviewsIf you have a car in storage, State Farm, USAA, and Progressive have the best parked car insurance.

By understanding the risks of storing your vehicle and ensuring you have the right coverage to protect it from the best companies for parked car insurance, you can protect yourself financially — and make sure you have a car to drive when you get back into town.

Our Top 10 Company Picks: Best Parked Car Insurance

| Company | Rank | Anti-Theft Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 6% - 16% | A++ | Agency Network | State Farm | |

| #2 | 8% - 14% | A++ | Military Drivers | USAA | |

| #3 | 7% - 13% | A+ | Online Management | Progressive | |

| #4 | 9% - 19% | A+ | Pay-Per-Mile Rates | Allstate | |

| #5 | 5% - 11% | A+ | Exclusive Benefits | The Hartford |

| #6 | 10% - 15% | A++ | Federal Discounts | Geico | |

| #7 | 12% - 18% | A++ | Unique Coverage | Travelers | |

| #8 | 5% - 20% | A+ | Deductible Options | Nationwide |

| #9 | 14% - 17% | A+ | Personalized Policies | Erie |

| #10 | 6% - 12% | A | Teachers & Students | Liberty Mutual |

Read on to learn more about insuring a stored vehicle, including whether your parked vehicle needs to be insured, whether you can suspend your car insurance for a month, and how much you should expect to pay for car storage insurance. You can also compare quotes for parked car insurance by entering your ZIP code into our free tool.

- State Farm, USAA, and Progressive have the best insurance for parked cars

- When storing cars, you still need to carry a minimum of comprehensive insurance

- Laws regarding minimum insurance for stored vehicles vary between states

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Agency Network: Speak directly to an agent to get help with parked car insurance.

- Financial Stability: Rest assured that State Farm is financially able to pay off any claims you file on your parked car.

- Coverage Options: You can put tailored coverages on your parked car.

Cons

- Discount Availability: Some of State Farm’s discounts aren’t in every state.

- Credit Rates: State Farm charges drivers with poor credit more in some areas. Learn more in our State Farm auto insurance review.

#2 – USAA: Best for Military Drivers

Pros

- Military Drivers: USAA is great for military drivers, as it offers cheap rates and discounts outside of auto insurance.

- Deployment Storage Rates: USAA offers coverage specifically for cars in storage when military members are deployed.

- Customer Service: Customers have mostly positive reviews about customer service at USAA.

Cons

- Limited Eligibility: USAA is only sold to military and veterans. Learn more in our USAA review.

- Primarily Online Services: USAA doesn’t offer many physical locations or local agents.

#3 – Progressive: Best for Online Management

Pros

- Online Management: Manage your parked car insurance policy easily online. Read more in our Progressive auto insurance review.

- Flexible Coverage: You can easily reduce your coverage to a Progressive vehicle storage insurance policy if your car goes into storage.

- UBI Discount: If you choose to take your car out of storage, you can save by participating in a UBI program.

Cons

- Discount Amounts: Progressive’s discounts may not help some customers save as much, depending on location.

- Customer Claims: According to some customers, claims processing can be hit or miss at Progressive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: If you take your car out of storage to drive occasionally, you may want pay-per-mile insurance.

- UBI Discounts: If you don’t want pay-per-mile insurance, you can still earn a discount based on your driving habits.

- Deductible Decreases: Drivers can save up to $500 on a deductible if they don’t file claims.

Cons

- Higher Rates For Some: High-risk demographics, such as drivers with DUIs, will have expensive rates.

- Claim Processing: Allstate’s claims processing reviews can be hit or miss. Read about Allstate’s ratings in our Allstate review.

#5 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford offers exclusive benefits to AARP members. Find out more in our review of The Hartford.

- Bundling Options: You can buy more than just auto insurance from The Hartford.

- Customer Service: The Hartford has earned good ratings.

Cons

- Young Driver Rates: The Hartford’s rates aren’t as competitive for young drivers.

- Limited Digital Tools: The Hartford’s online services may not be as detailed as other companies.

#6 – Geico: Best for Federal Discounts

Pros

- Federal Discounts: Geico offers discounts to federal employees on Geico storage insurance.

- Competitive Rates: Geico’s rates are competitive for parked vehicle insurance. Our Geico review provides more rate information.

- Financial Stability: Rest easy knowing your car storage insurance is backed by a financially strong company.

Cons

- Discount Availability: Geico has plenty of discounts, but some may not be available where you live.

- Customer Service: Geico’s customer service isn’t as personalized due to fewer local agents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage: You can choose unique coverage options for your parked vehicle policy. Read our Travelers review to learn more about its coverage.

- Online Management: You can make changes to your vehicle storage insurance online.

- UBI Discount: If you take your car out of storage to drive, you may be able to get a discount with Travelers’ UBI program.

Cons

- Young Driver Rates: Young drivers who are buying their own policies will find Travelers’ rates expensive.

- UBI Rate Increases: Travelers may actually increase rates for bad drivers rather than giving a discount.

#8 – Nationwide: Best for Deductible Options

Pros

- Deductible Options: You can choose from several deductibles for your parked car insurance policy.

- Discount Options: Most drivers will qualify for several discounts. Read our Nationwide review for discount information.

- Pay-Per-Mile Insurance: If you occasionally drive your parked car, you may want pay-per-mile insurance.

Cons

- Availability: Three states don’t carry insurance.

- DUI Rates: DUI rates at Nationwide are expensive.

#9 – Erie: Best for Personalized Policies

Pros

- Personalized Policies: You can adjust your coverages for your parked car policy.

- Personalized Service: Local agents offer personalized assistance. Learn more about Erie’s customer service in our Erie review.

- Competitive Rates: Erie’s rates for storage insurance for cars are competitive.

Cons

- Availability: Only a few select states carry Erie insurance.

- Discount Availability: Some discounts may not be offered in every state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Teachers & Students

Pros

- Teachers and Students: Liberty Mutual has discounts for teachers and students. Learn about its other discounts in our Liberty Mutual review.

- 24/7 Support: Get help at any hour from a Liberty Mutual representative.

- Discount Options: Most drivers will be able to get at least a few discounts on their parked car insurance.

Cons

- Rates for Violations: Liberty Mutual’s rates aren’t cheap for bad driving records.

- Claim Ratings: There are some complaints about claims processing.

How Car Storage Insurance Works

Technically, “car storage insurance” isn’t insurance coverage offered by insurance providers. Instead, the term refers to removing non-essential insurance coverage on a vehicle that will remain undriven and parked or stored for an extended period.

Even if you plan to park your undriven vehicle away from public roads in a garage or other private location, it is advisable to carry a minimum amount of insurance on your stored vehicle.

By maintaining minimum essential insurance — sometimes called “comprehensive-only coverage” —you can protect yourself financially if your stored vehicle is damaged by fire, theft, vandalism, natural disasters, or other events outside of your control.Daniel Walker Licensed Insurance Agent

It’s important to remember that reducing your insurance coverage can be risky. Before making changes to your policy, talk to your insurance agent about which types of auto insurance coverage you should maintain for a vehicle you aren’t using to limit potential liabilities. If you decide to remove some coverage from your vehicle’s existing insurance policy after putting it in storage, remember to revert to your previous policy’s coverage before driving it.

Comprehensive-Only Insurance Coverage For Parked Cars

Although legally required insurance minimums vary by location, insurers often refer to the minimum coverage for a stored vehicle as “comprehensive-only coverage.” What does parked car insurance cover? This type of coverage, also called “parked car insurance” or “car storage insurance,” covers repair or replacement costs while your car is stored or parked for a minimum amount of time, such as 30 days or more.

Although comprehensive auto insurance benefits vary by insurer, examples of damages typically covered by comprehensive-only insurance (after deductible) include the following:

- Your stored vehicle is stolen in the middle of the night.

- A natural disaster, such as an earthquake, damages your vehicle while in storage.

- The garage your vehicle is being stored in for the winter catches fire and damages the car.

- The exterior of a vehicle stored in your backyard is damaged by large hail.

- A tree falls on your vehicle while it’s parked in storage.

Although comprehensive-only coverage has benefits like lower premiums and preventing gaps in insurance coverage, there can be challenges associated with obtaining it, depending on your situation. For example, many states don’t allow drivers to carry comprehensive-only coverage on their vehicles.

If your vehicle is financed, your lender might also require you to carry full coverage insurance until your loan is paid off.

It’s also important to remember that you should avoid driving your vehicle while it’s insured with comprehensive-only coverage, even if you’re only traveling a short distance. This is because comprehensive-only coverage doesn’t include liability insurance, collision insurance, or uninsured motorist coverage, so you won’t be insured if you’re in an accident or cause damage to someone’s property while driving.

Parked Car Accidents

What happens if someone hits your parked car? When an unstored and fully-insured car is hit by another driver while parked, the owner will handle it like a normal insurance claim. Comprehensive-only coverage, however, might not cover repair costs if your stored vehicle is hit while parked.

Read more: Hitting a Parked Car, Auto Insurance Implications

Because keeping your stored vehicle off the road is usually a stipulation of car storage insurance, comprehensive-only coverage doesn’t include liability, collision, or uninsured motorist coverage. Since drivers aren’t legally permitted to park their vehicles on public roads without liability insurance, comprehensive-only coverage likely wouldn’t pay for the damages caused by another driver hitting your parked vehicle. However, if the other driver is insured, it might be possible to file a claim for damages under their liability property damage coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get Insurance for a Stored Car

Most insurance companies allow policyholders to change their auto insurance policies at any time during their coverage period, except when a natural disaster is anticipated. Because reducing your insurance coverage can involve financial and other risks, check with your insurance agent to learn about coverage options for insuring a stored vehicle before making any changes to your policy.

Auto Insurance Monthly Rates for Parked Cars by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $25 | $75 |

| Erie | $20 | $60 |

| Geico | $22 | $66 |

| The Hartford | $28 | $84 |

| Liberty Mutual | $24 | $72 |

| Nationwide | $23 | $69 |

| Progressive | $26 | $115 |

| State Farm | $21 | $58 |

| Travelers | $27 | $81 |

| USAA | $19 | $63 |

It’s also a good idea to check with your state’s motor vehicles department to find out about the minimum insurance requirements in your state before reducing your insurance coverage. You can also shop for discounts at the best companies to try and reduce your rates.

Finally, if you financed your vehicle, remember to check with your lender about your auto loan insurance requirements before changing your existing policy or purchasing insurance for your stored vehicle. It’s recommended that all vehicles remain insured even if they’re not regularly driven.

If your vehicle is registered with your state and parked on a public road, you must likely carry a minimum amount of insurance under state law. Beyond legal requirements, events like fire, vandalism, theft, bad weather, and natural disasters can occur anytime — leaving you on the hook to pay for losses and repairs out-of-pocket if your vehicle isn’t insured.

Canceling Insurance for Cars in Storage

Drivers planning to store their car or truck probably wonder, “Can I have a car parked without insurance?” Although it might be tempting to cancel your car insurance if you know you won’t be driving it for an extended period, canceling your policy is not recommended. In addition to potentially violating state laws and having to pay out-of-pocket for repairs, canceling your car insurance while your vehicle is in storage can also create issues when it comes to buying insurance in the future, including:

- Insurance Coverage Gaps: Because insurance companies view lapses in your insurance coverage history as high-risk, your insurance premiums could increase if you cancel insurance coverage after storing your vehicle, as you can’t prove you weren’t driving without insurance.

- Potential Policy Violations: Depending on your policy, canceling your insurance coverage might violate your insurer’s policies. If you financed your vehicle, your lender might also require that you continue to insure your vehicle until the loan is paid off fully.

While saving money on car insurance while your vehicle is in storage is possible, canceling your policy isn’t the smartest — or safest — way to do it. Instead, stored vehicle owners should consider carrying at least comprehensive coverage and get quotes from companies like State Farm to ensure they get the best deal.

By ensuring that the minimum essential coverage covers your stored car, you can protect yourself financially while avoiding gaps in your auto insurance history that can increase your future premiums.

Who Should Buy Parking Insurance

When you aren’t planning to drive your vehicle for a long time, it can be tempting to cancel your auto insurance coverage. You may wonder, “Is it possible to pause car insurance?” What happens if your car is damaged or stolen while it’s stored? Whether you’re going on an extended vacation or being deployed by the military to a location where you can’t take your vehicle, knowing how to insure your stored car or truck is important properly.

If you drive your vehicle frequently or leave it in the garage for the weekend, parked car insurance probably isn’t the best option for you. However, suppose you’re planning to store your vehicle for an extended period without driving it. In that case, car storage insurance could save money while ensuring that your parked vehicle remains protected. A few examples of vehicle owners that might benefit from car storage insurance include:

- People living abroad for extended durations who intend to leave their vehicles at home in the U.S.

- Members of the military who will be deployed to locations where they cannot bring their vehicles (read more: Best Auto Insurance for Military Families and Veterans).

- Someone who inherited a vehicle they don’t plan to drive but aren’t ready to sell.

- A driver with a hobby vehicle or summer car that will be stored for the winter.

- Any car owner planning to store their undriven vehicle for extended durations of time.

Because reducing your car insurance coverage can have risks, it’s important to weigh the benefits and disadvantages of car storage insurance. Before making any changes to your current policy, speak with an insurance agent to understand your options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Car Storage Insurance: The Lowdown

If you’re planning to park your vehicle for an extended period, you might be able to save money on your car storage insurance with garaging and storing auto insurance discounts. By maintaining at least comprehensive-only coverage on your stored vehicle, you can reduce your monthly insurance payments while protecting yourself financially and remaining compliant with state laws and your insurer’s coverage policies.

However, reducing your car insurance to comprehensive-only coverage can have risks, so it’s important to speak with your insurance agent or provider before making any changes to your existing policy.

Now that you know the answer to what does storage car insurance cover, shop around for quotes to get the best deal on storage insurance. Compare rates now with our free tool.

Frequently Asked Questions

Do I need to insure a stored vehicle?

Since most states require the owners of registered vehicles parked or driven on public roads to carry a minimum amount of insurance, you are likely required to insure your stored vehicle. Beyond legal requirements, insuring your parked vehicle can avoid insurance policy violations and gaps in your insurance coverage history that can lead to higher premiums in the future. Carrying insurance can also protect you financially if your car is damaged or stolen while it’s being stored.

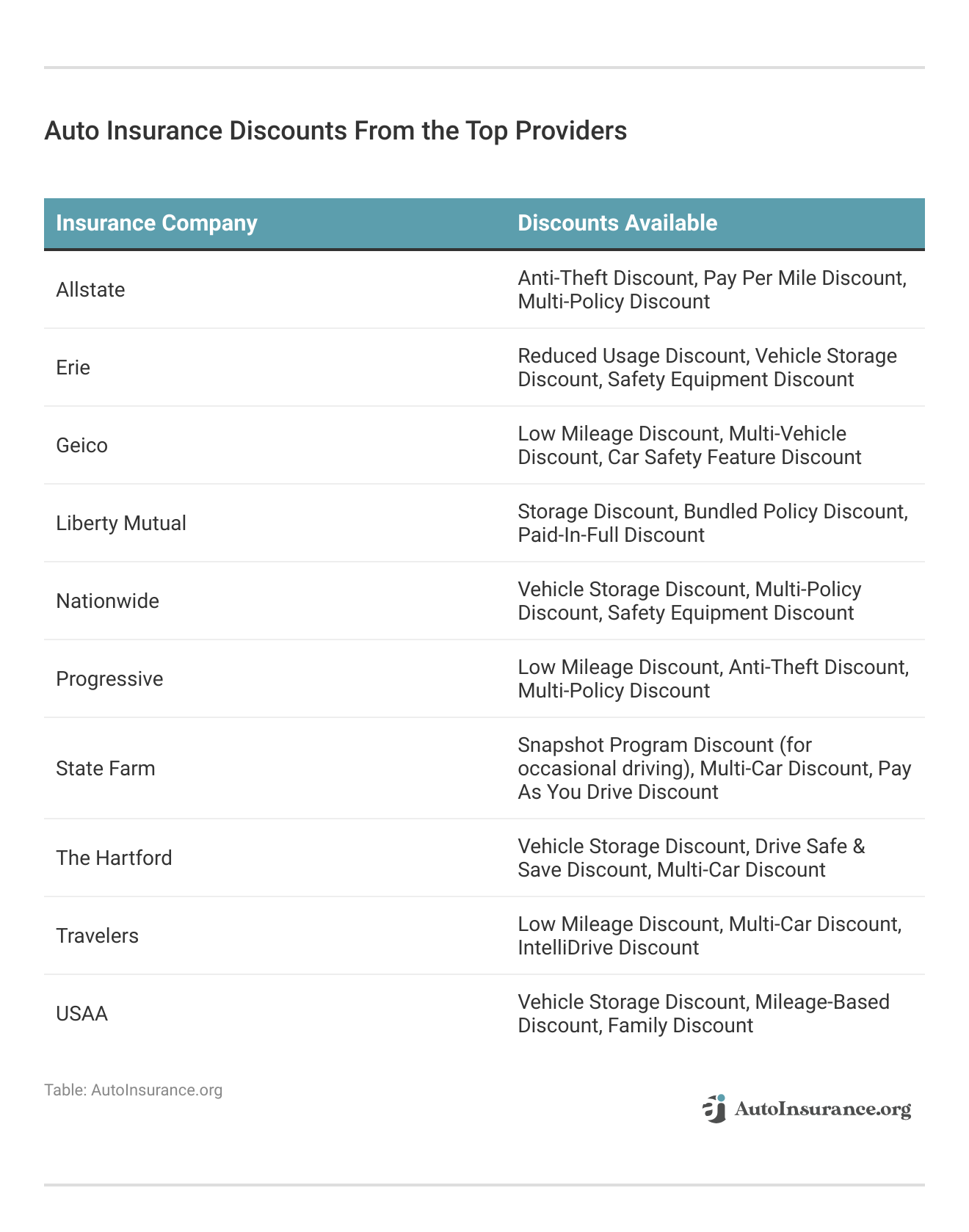

Are there discounts available for insuring stored cars?

Although programs vary, some insurance companies offer auto insurance discounts for stored vehicles under certain circumstances. Below are a few examples of discounts related to stored vehicles:

- Erie Insurance offers a discount for vehicles stored for longer than 90 days in most states (excluding Kentucky).

- USAA offers a discount to military members that garage their vehicles on military installations.

- Other insurance companies, like Nationwide, offer usage-based programs for low-mileage drivers with a safe driving record.

Since storage and pay-per-mile insurance varies by insurer and location, check with your insurance agent or provider to learn more about the discounts available when insuring your stored vehicle.

What are the advantages of insuring a car in storage?

In addition to saving money on insurance premiums, insuring a stored vehicle can reduce the amount you’ll have to pay out-of-pocket if your vehicle is damaged or stolen while in storage. Additionally, carrying at least comprehensive-only coverage on a stored vehicle can prevent potential insurance policy violations and coverage gaps that could increase your premiums in the future.

Do parked cars need auto insurance?

Yes, parked cars should have auto insurance coverage. While they may not be actively driven, they are still at risk of damage or theft. Auto insurance for parked cars provides financial protection in such situations (learn more: Does auto insurance cover stolen vehicles?).

What types of coverage are available for parked cars?

The two main types of coverage for parked cars are comprehensive insurance and storage insurance. Comprehensive insurance covers various non-collision incidents like theft, vandalism, fire, natural disasters, and falling objects. Storage insurance is specifically designed for cars that are not in use for an extended period, such as during winter storage.

Is auto insurance mandatory for parked cars?

The requirement for auto insurance varies by jurisdiction. In many places, auto insurance is mandatory regardless of whether the car is parked or actively driven. It’s essential to check the specific laws and regulations of your location to determine the requirements.

What are the benefits of having auto insurance for parked cars?

Some benefits include:

- Financial Protection: Auto insurance safeguards your parked car against a wide range of risks, including theft, vandalism, fire, and natural disasters.

- Peace of Mind: Knowing that your parked car is insured provides peace of mind, eliminating worries about unexpected damages or losses.

- Liability Coverage: Some auto insurance policies include liability coverage, which protects you if your parked car causes damage to someone else’s property.

Are there any drawbacks to having auto insurance for parked cars?

Some drawbacks of storage car insurance include:

- Cost: Auto insurance comes with a premium cost, and adding coverage for a parked car can increase the overall expense.

- Deductibles: Insurance policies often have deductibles, which means you’ll have to pay a certain amount out of pocket before the coverage kicks in.

- Claims Impact: Making claims on your auto insurance, even for parked cars, can potentially impact your future premiums.

Can I modify my existing auto insurance policy to include coverage for a parked car?

Yes, in most cases, you can modify your existing auto insurance policy to include coverage for a parked car. Contact your insurance provider and discuss your specific needs to make the necessary changes for insurance for a car in storage.

How can I lower the cost of auto insurance for my parked car?

Some ways to lower the cost of auto insurance for your parked car include:

- Comparing quotes from multiple insurance providers to find the best rates.

- Increasing your deductibles, which can lower the premium.

- Installing security features such as alarms, immobilizers, or tracking devices, which can qualify for discounts (Read more: How to Get an Anti-Theft Auto Insurance Discount).

- Storing your car in a secure location like a locked garage or monitored parking lot.

How much does parked car insurance cost?

Many factors affect car insurance rates, including age, credit score, location, driving history, vehicle make and model, and more. To ensure you’re getting the best rates, shop around and compare parked car insurance quotes before purchasing car storage insurance for your vehicle.

Can you put a hold on car insurance?

Suppose you’re planning to store your vehicle. In that case, you might be wondering if you can request that your insurance company issue a “car insurance hold” or “car insurance pause” for your stored vehicle instead of canceling your policy outright. Although suspending or “pausing” your auto insurance policy isn’t typically an option offered by insurers, some insurance companies will allow you to reduce your coverage to comprehensive-only insurance. Because policies vary by company, it’s best to speak with an insurance agent or insurer before making any changes to your current car insurance storage policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.