Best Auto Insurance After a DUI in Nevada (Top 10 Companies Ranked for 2026)

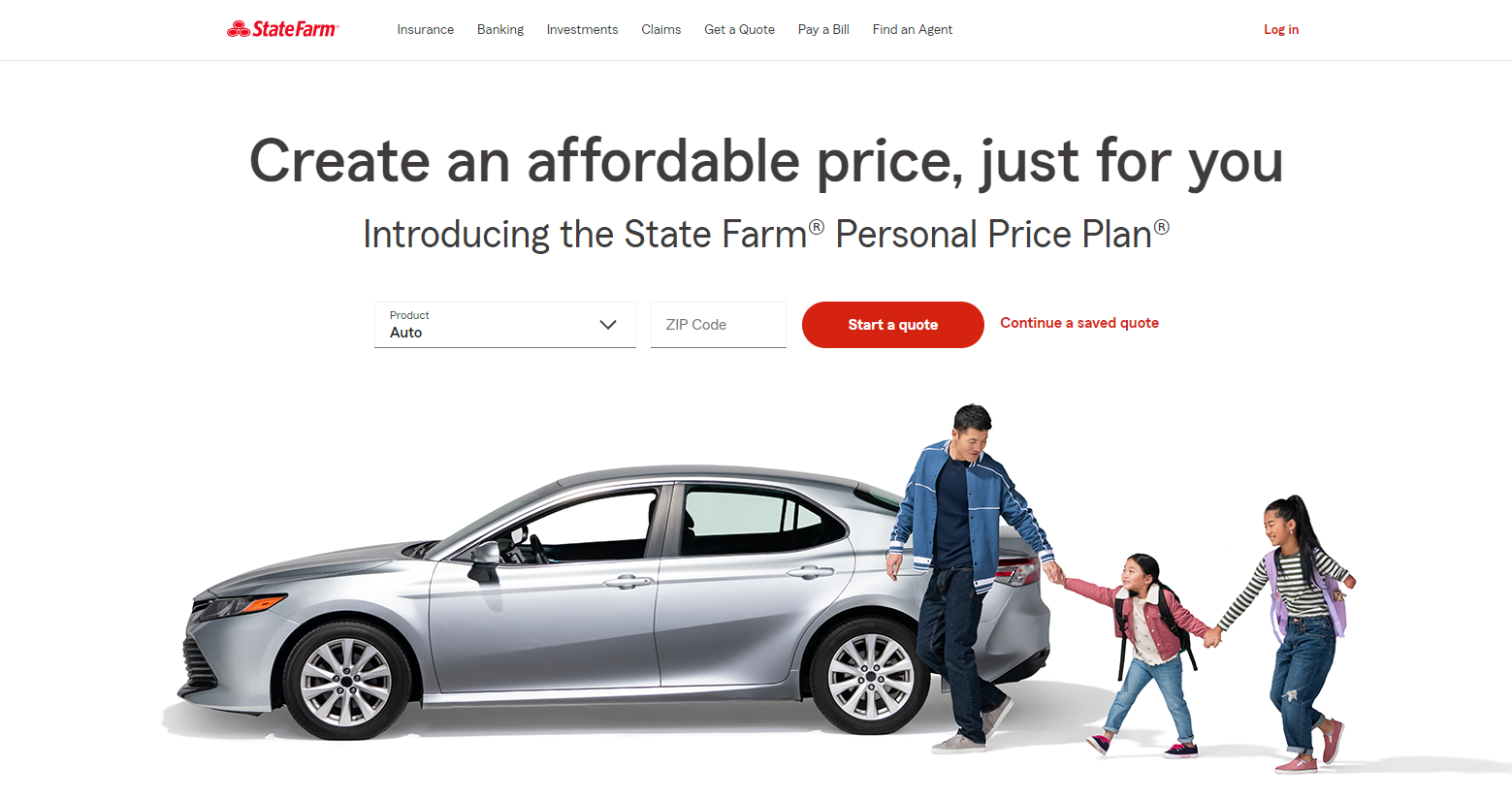

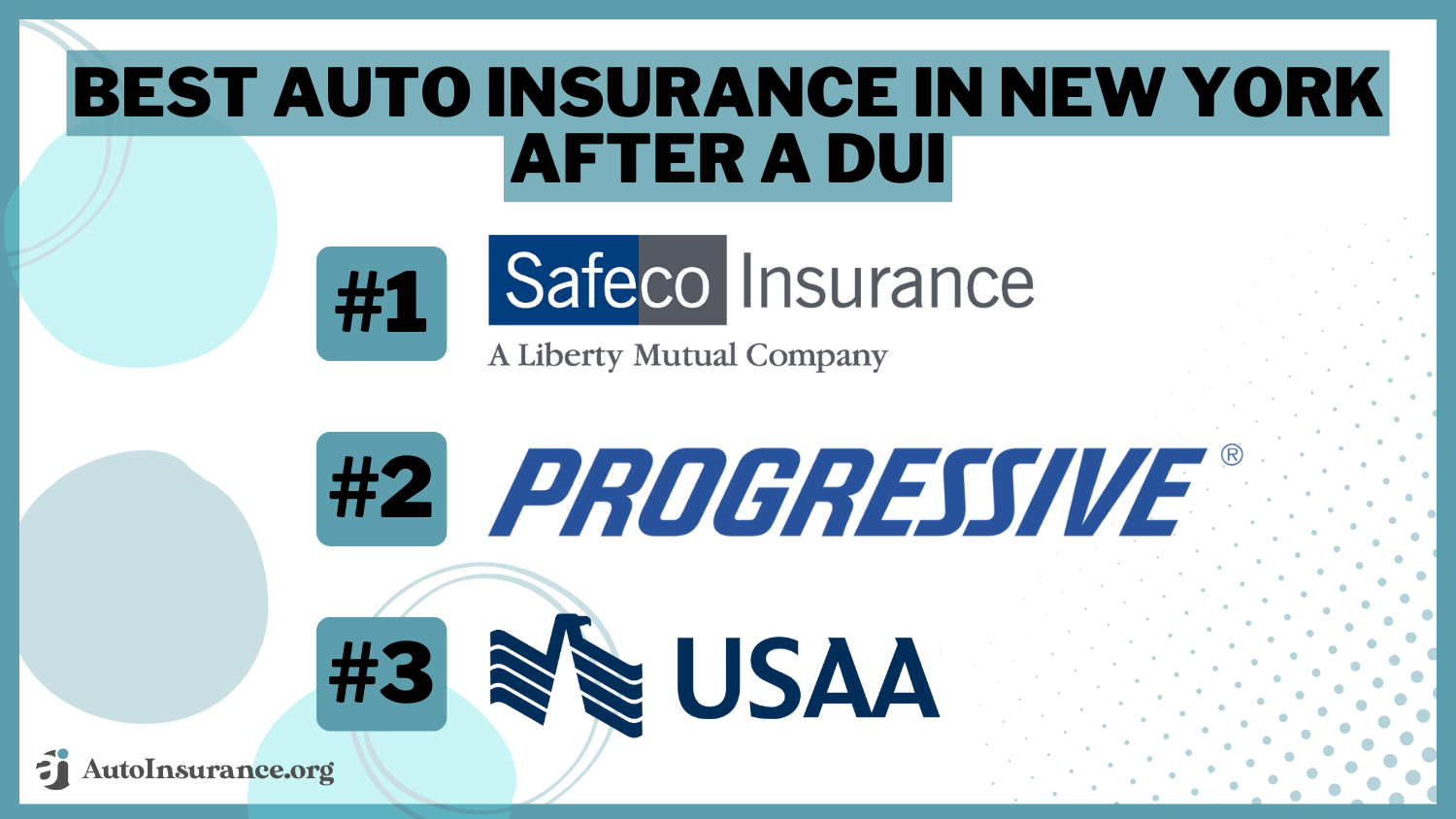

The best auto insurance after a DUI in Nevada comes from State Farm, USAA, and Progressive, with lower and competitive rates starts at $47 per month. These companies provides military savings and stands out for competitive rates, making them the best choices after a DUI in Nevada.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Corporate Paralegal

Brett Surbey is a corporate paralegal specializing in tax reorganizations and the creation of corporations so they can successfully navigate all aspects of their business and mitigate risks where necessary. He has assisted lawyers on a number of enigmatic transactions, including M&As, complex corporate succession plans, and amalgamations. In addition to his legal career, he is a known e...

Brett Surbey

Updated October 2024

Company Facts

Full Coverage After a DUI in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance after a DUI in Nevada comes from State Farm, USAA, and Progressive, offering comprehensive coverage and competitive rates at $47/month.

State Farm offers low rates starting at $47/month, local agents, and great coverage. USAA is best for military families with special discounts. Progressive provides flexible payment plans and handy online tools.

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Nevada

Company Rank Safety Features Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 9% B Local Agents State Farm

![]()

#2 10% A++ Military Savings USAA

#3 8% A+ Competitive Rates Progressive

#4 7% A++ Coverage Options Travelers

#5 9% A Add-on Coverages Liberty Mutual

#6 11% A++ Online Tools Geico

#7 10% A+ Infrequent Drivers Allstate

#8 11% A+ Multi-Policy Savings Nationwide

#9 8% A Safe-Driving Discounts Farmers

#10 10% A Loyalty Rewards American Family

These companies combine affordability, reliability, and tailored options, making them the best choices for drivers with a DUI in Nevada.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool above.

- State Farm offers top rates and local support for NV auto insurance after a DUI

- USAA offers the best NV insurance rates to DUI drivers in the military

- Tailored discounts and flexible payment options help DUI drivers stick to a budget

#1 – State Farm: Top Overall Pick

Pros

- Personalized Local Service: State Farm provides local agents who offer personalized support for drivers needing auto insurance after a DUI in Nevada. For a complete list, read our State Farm review.

- Cost-Effective Premiums: With rates starting as low as $47/month, State Farm is a budget-friendly option for those looking for affordable coverage after a DUI in Nevada.

- Diverse Coverage Choices: The company provides a broad array of coverage options, making it easier to find a policy that meets your needs after a DUI in Nevada.

Cons

- Fewer Specialized DUI Discounts: State Farm might offer fewer specialized discounts for those with a DUI conviction, which could result in lower savings after a DUI in Nevada.

- Variability in Coverage Options: Depending on your location within Nevada, the availability and pricing of coverage options might differ, affecting consistency in rates after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exclusive Military Benefits: USAA offers specialized discounts for military personnel, which can significantly lower your rates after a DUI in Nevada if you qualify.

- Top-Tier Customer Service: Renowned for exceptional customer service, USAA can offer valuable support and guidance for auto insurance after a DUI in Nevada.

- Strong Rate Competitiveness: USAA’s rates are generally very competitive, making it a solid choice for affordable coverage after a DUI in Nevada, which you can learn about in our USAA review.

Cons

- Eligibility Restrictions: Only military members and their families are eligible, limiting access to their benefits for non-military drivers seeking insurance after a DUI in Nevada.

- Limited In-Person Interaction: USAA’s online-only approach may not suit those who prefer in-person discussions about their insurance policy after a DUI in Nevada.

#3 – Progressive: Best for Competitive Rates

Pros

- Affordable Premium Options: Progressive provides competitive insurance rates starting at $55/month, making it a budget-friendly choice after a DUI in Nevada.

- Flexible Financial Plans: They offer various payment plans that can be adjusted to fit your financial situation following a DUI in Nevada. Find out more in our Progressive review.

- Advanced Digital Tools: Progressive’s comprehensive online platform allows for easy management and comparison of policies after a DUI in Nevada.

Cons

- Reduced Personal Agent Interaction: Progressive’s online model might lack the personal touch that some drivers prefer when handling insurance matters after a DUI in Nevada.

- Potentially High Risk Rates: Drivers after a DUI in Nevada may encounter higher premiums, which might be less competitive compared to those offered by other insurance providers.

#4 – Travelers: Best Coverage Options

Pros

- Broad Coverage Flexibility: Travelers offers extensive coverage options, allowing for customization based on individual needs after a DUI in Nevada.

- Solid Service Reputation: Travelers is known for reliable customer service, aiding in navigating your insurance policy effectively after a DUI in Nevada.

- Various Discount Opportunities: The company provides numerous discount options that could help reduce your premium after a DUI in Nevada, which is covered in our Travelers review.

Cons

- Possibly Higher Rates: Travelers may impose elevated rates for drivers with a DUI, which could be less advantageous compared to more budget-friendly alternatives after a DUI in Nevada.

- State-Specific Rate Variability: Discounts and rates can fluctuate depending on the state, which might impact your DUI insurance costs if you move to another state

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best Add-on Coverages

Pros

- Versatile Add-On Coverages: Liberty Mutual allows for a range of add-on coverages, which can enhance your policy to better fit your needs after a DUI in Nevada.

- Policy Customization: They offer customizable policies that can be tailored to your specific situation following a DUI in Nevada, which you can read more about in our review of Liberty Mutual.

- Diverse Discount Options: Liberty Mutual provides multiple discounts that could make your insurance more affordable after a DUI in Nevada.

Cons

- Potentially Higher Premiums: Liberty Mutual’s starting rates might be elevated for individuals after a DUI in Nevada, making it potentially less cost-effective.

- Complex Coverage Choices: The array of add-on coverages might be overwhelming, making it difficult to select the most appropriate options after a DUI in Nevada.

#6 – Geico: Best for Mobile Access

Pros

- Efficient Online Management: Geico’s user-friendly online tools make it easy to manage your policy and explore options after a DUI in Nevada. Read our Geico review to learn what else is offered.

- Wide Mobile Accessibility: Geico’s extensive online network ensures that its services are readily available across Nevada, including those seeking insurance after a DUI.

- Low-Cost Insurance Rates: Geico’s competitive pricing starts at $86/month, offering an affordable option for auto insurance after a DUI in Nevada.

Cons

- Limited Personal Contact: The focus on online interactions might not provide the personal assistance that some drivers need after a DUI in Nevada.

- Mixed Customer Service Feedback: Geico has received varied reviews on customer service, which could affect your experience after a DUI in Nevada.

#7 – Allstate: Best for Infrequent Drivers

Pros

- Discounts for Light Drivers: Allstate Milewise for infrequent drivers can reduce DUI insurance costs for those who drive less after a DUI in Nevada. Discover our Allstate Milewise review to learn more.

- Tailored Insurance Solutions: The company provides personalized coverage options to suit individual needs following a DUI in Nevada.

- Flexible Policy Terms: Allstate’s flexibility in policy terms allows you to adjust your coverage based on your situation after a DUI in Nevada.

Cons

- Higher Risk Premiums: Premiums for high-risk drivers, such as those who have a DUI, may be higher compared to rates offered by other insurance providers after a DUI in Nevada.

- Discount Availability Variance: Discounts and benefits might vary based on location, affecting how much you can save after a DUI in Nevada.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best Multi-Policy Savings

Pros

- Multi-Policy Savings Potential: Nationwide’s multi-policy discounts can help lower Nevada DUI auto insurance rates if you bundle different types of insurance.

- Comprehensive Coverage Selection: They offer a wide range of coverage options to address various needs following a DUI in Nevada, which you can check out in our Nationwide review.

- Strong Customer Support: Nationwide is known for its dependable customer support, assisting with policy management after a DUI in Nevada.

Cons

- Potentially Elevated DUI Premiums: Nationwide’s rates might be elevated for drivers after a DUI in Nevada when compared to those offered by other insurance providers.

- Variable Discount Impact: The effectiveness of multi-policy discounts can vary, which might impact savings after a DUI in Nevada.

#9 – Farmers: Best Safe-Driving Discounts

Pros

- Safe-Driving Incentives: Farmers provides discounts for safe driving, which can benefit drivers who maintain a clean record post-DUI in Nevada.

- Extensive Coverage Options: The company offers a range of coverage options that cater to various needs after a DUI in Nevada. Read more in our review of Farmers.

- Reliable Customer Service: Farmers is recognized for its strong customer service, which is helpful when navigating insurance after a DUI in Nevada.

Cons

- Potentially Higher Rates for High-Risk Drivers: Farmers’ rates could be higher for drivers after a DUI in Nevada, which may make their insurance less cost-effective.

- Discount Eligibility Restrictions: Not all available discounts may apply to high-risk drivers, limiting potential savings after a DUI in Nevada.

#10 – American Family: Best for Loyalty Rewards

Pros

- Rewards for Loyalty: American Family offers loyalty rewards that can benefit long-term customers, even for those with a DUI in Nevada.

- Variety of Coverage Options: They provide a broad spectrum of coverage options to suit various needs after a DUI in Nevada. Learn more in our American Family review.

- Discount Opportunities: American Family offers several discount options that might help lower your insurance premiums following a DUI in Nevada.

Cons

- Higher Premiums for DUI Drivers: American Family’s rates could be higher for individuals with a DUI, which might affect the overall affordability of their coverage after a DUI in Nevada.

- Limited High-Risk Discounts: Discounts available for drivers after a DUI in Nevada might be more limited compared to those offered by other insurance providers, which could impact the overall savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

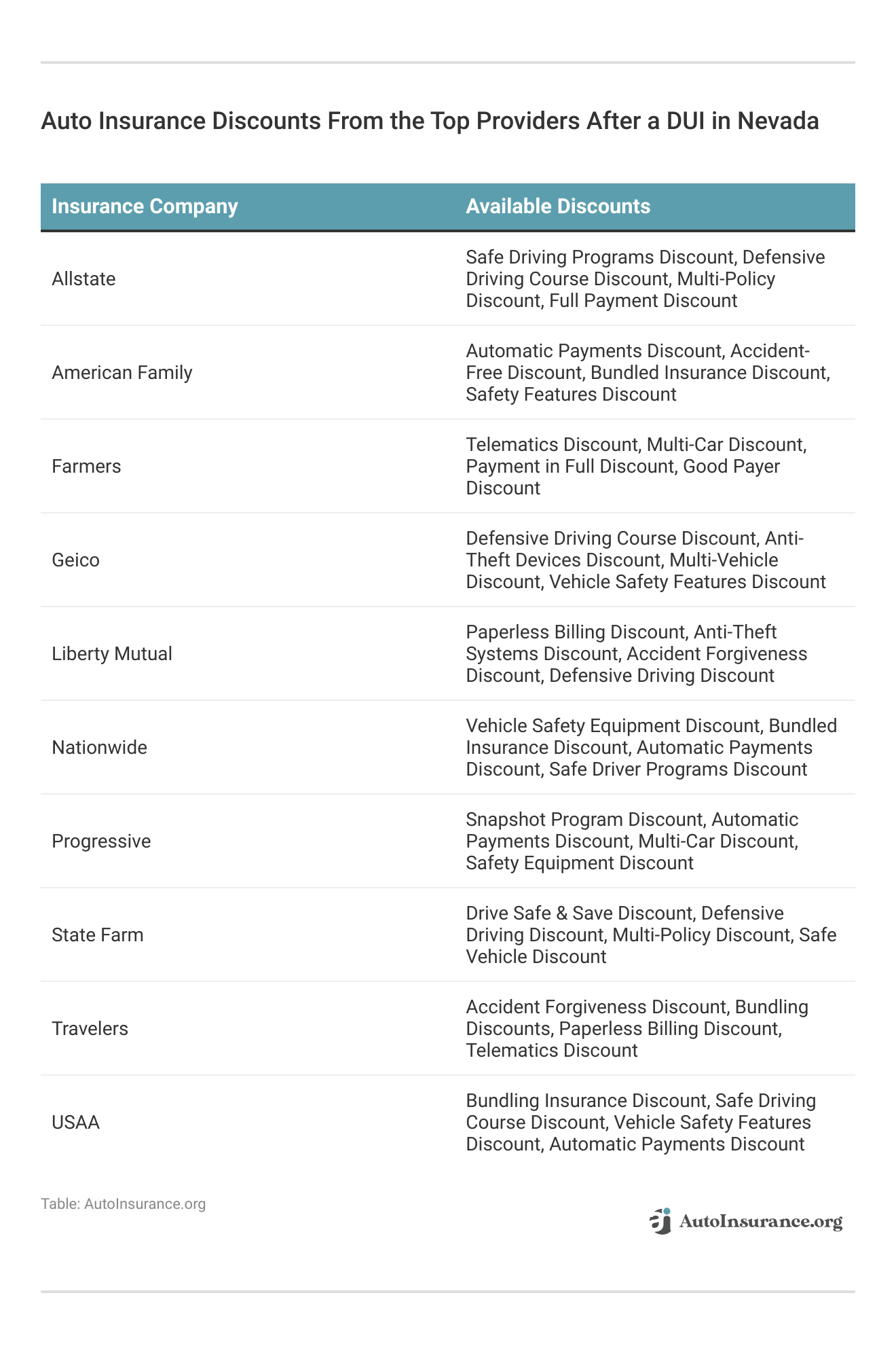

Nevada DUI Auto Insurance Rates and Savings Options

Learn how a DUI affects auto insurance rates and savings opportunities in Nevada, including where to compare auto insurance rates to find the best discounts and coverage options. Start comparing Nevada DUI auto insurance rates by coverage level with top providers.

Nevada DUI Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $227

American Family $116 $278

Farmers $98 $234

Geico $86 $204

Liberty Mutual $74 $176

Nationwide $96 $228

Progressive $55 $131

State Farm $47 $112

Travelers $73 $175

USAA $55 $130

State Farm offers the lowest monthly rates at $47 for minimum and $112 for full coverage, while Progressive and USAA also provide competitive pricing. Rates for full coverage vary from $112 with State Farm to $278 with American Family.

State Farm is the top choice for auto insurance after a DUI in Nevada, delivering unbeatable rates and reliable coverage.Jeff Root Licensed Insurance Agent

Getting auto insurance after a DUI in Nevada can be challenging, as insurers consider drivers with a DUI as high-risk. Other traffic citations in your driving history, as well as your age and gender, will increase your level of risk to Nevada insurers.

Improving your driving record, selecting the right coverage, and considering location can help you make smarter choices. Despite higher premiums, you can still find coverage that fits your needs and budget.

Read More: Reasons Auto Insurance Costs More for Young Drivers

Effective Strategies to Lower Nevada Auto Insurance Costs After a DUI

To get cheap auto insurance after a DUI in Nevada, shop around and compare quotes, including from smaller companies. Our table highlights various discounts available from leading companies, including safe driving programs, multi-policy savings, and accident forgiveness.

Companies like State Farm, Geico, and USAA offer a range of options to help reduce your premiums and find the best coverage. Drivers can also opt for higher deductibles, complete a defensive driving course, and use discounts for safe driving or policy bundling.

Paying your premium in full and exploring non-standard insurers for high-risk drivers can also help. Opting for full coverage with lower deductibles will increase rates, while higher deductibles or minimum coverage may reduce premiums but offer less protection.

By comparing rates and exploring available discounts, you can find affordable auto insurance options that meet your needs after a DUI. Use this information to make informed decisions and secure the best coverage for your situation.

Bottom Line on Top Auto Insurance Providers in Nevada After a DUI

For the best auto insurance after a DUI in Nevada, consider State Farm, USAA, and Progressive. State Farm offers low rates starting at $47/month and strong coverage options.

USAA is ideal for military families with special discounts, while Progressive provides competitive rates and flexible payment plans. Notable options like Travelers, Liberty Mutual, and Geico offer varied coverage or low rates.

By comparing quotes, choosing higher deductibles, enrolling in defensive driving courses, bundling policies, and understanding how auto insurance companies check driving records, you can further reduce your premiums.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

What is the best auto insurance in Nevada after a DUI?

The best auto insurance in Nevada after a DUI often includes providers like State Farm, USAA, and Progressive. These companies are known for offering competitive rates and comprehensive coverage options for high-risk drivers.

What is the minimum insurance limit in Nevada for drivers with a DUI?

In Nevada, the minimum insurance limits required are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage. However, drivers with a DUI may be required to purchase higher limits to meet state requirements or to secure insurance.

Don’t let expensive insurance rates hold you back. Enter your ZIP code below and shop for affordable premiums from the top companies.

How much is SR-22 insurance in Nevada after a DUI?

SR-22 auto insurance itself does not have a set cost — it’s an endorsement added to your existing auto insurance policy. The cost to file SR-22 insurance can vary between $10 and $30, depending on your insurance provider. Typically, drivers with a DUI might see their premiums increase significantly, ranging from $100 to $300 annually for the SR-22 filing.

How long do you need an SR-22 in Nevada after a DUI?

In Nevada, you typically need to maintain an SR-22 for three years following a DUI conviction. This period may vary based on the specifics of your case and compliance with state requirements.

Does insurance cover DUI accidents in Nevada?

Yes, insurance can cover DUI accidents in Nevada, but this coverage may be limited and come with higher deductibles. Insurance companies may also deny claims if the driver is found to be driving under the influence, depending on the policy terms.

How much does your insurance go up after a DUI in Nevada?

Insurance rates can increase significantly after a DUI in Nevada. On average, drivers may see their premiums rise by 30% to 100%, depending on their driving history, insurance provider, and other factors. Explore the best states for affordable DUI auto insurance to learn more.

How much is auto insurance in Nevada per month after a DUI?

Auto insurance costs in Nevada vary widely, but after a DUI, you can expect higher premiums. On average, drivers with a DUI may pay between $100 and $300 per month, depending on the coverage level and insurer.

What is full coverage auto insurance in Nevada?

Full coverage auto insurance in Nevada typically includes liability coverage (meeting the state’s minimum requirements), comprehensive coverage, and collision coverage. This type of policy provides more extensive protection, covering damages to your vehicle and others’ vehicles in various scenarios, including after a DUI.

How do I clear a suspended registration in Nevada after a DUI?

To clear a suspended registration in Nevada, you must fulfill all legal requirements related to your DUI, such as paying fines, completing any required programs, and maintaining SR-22 insurance. Once these requirements are met, you can contact the Nevada Department of Motor Vehicles (DMV) to reinstate your registration.

What is the minimum auto insurance coverage required in the state of Nevada?

Nevada minimum auto insurance requires drivers to have at least $25,000 in bodily injury coverage per person, $50,000 per accident, and $20,000 in property damage coverage. These limits are designed to ensure that drivers have adequate coverage in the event of an accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.