Best Auto Insurance After a DUI in Virginia (Top 10 Companies for 2026)

State Farm, USAA, and Progressive have the overall best auto insurance after a DUI in Virginia, with rates starting at $29/month. State Farm and USAA have the best customer service out of Virginia high-risk auto insurance companies, and Progressive is notable for its DUI insurance discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated August 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage After a DUI in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage After a DUI in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage After a DUI in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, USAA, and Progressive offer the best auto insurance after a DUI in Virginia, providing reliable coverage options for those with a recent conviction.

These are some of the best auto insurance companies for high-risk drivers in VA with a range of options for various circumstances.

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Virginia

| Company | Rank | Bundling Discounts | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 7% | B | Customer Service | State Farm | |

| #2 | 8% | A++ | Military Benefits | USAA | |

| #3 | 6% | A+ | Discount Variety | Progressive | |

| #4 | 10% | A | Loyalty Rewards | American Family | |

| #5 | 9% | A | Group Discounts | Farmers | |

| #6 | 11% | A+ | Multiple Vehicles | Nationwide |

| #7 | 8% | A+ | Usage-Based Discount | Allstate | |

| #8 | 7% | A++ | Industry Experience | Travelers | |

| #9 | 6% | A++ | Digital Convenience | Geico | |

| #10 | 8% | A | 24/7 Support | Liberty Mutual |

By comparing quotes from these top companies, you can identify the most suitable and cost-effective Virginia insurance plan to fit your requirements. Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

- State Farm is the top pick with affordable rates starting at $29 per month

- Progressive offers a variety of discounts for cheaper Virginia DUI insurance

- DUI coverage options are designed to meet the unique needs of high-risk drivers

#1 – State Farm: Top Overall Pick

Pros

- Agent Availability: State Farm’s broad agent network ensures personalized support for handling insurance after a DUI in Virginia. Read our State Farm review for more.

- Flexible Payments: State Farm’s varied payment options and cheap DUI auto insurance rates help ease the financial burden of securing high-risk insurance in Virginia.

- Mobile App Efficiency: State Farm’s robust mobile app allows seamless management of policies tailored for post-DUI needs after a DUI in Virginia.

Cons

- Poor Financial Ratings: State Farm has a lower rating from A.M. Best than other Virginia DUI auto insurance companies on our list.

- Discount Limitations: State Farm’s discount offerings may become less accessible, impacting insurance affordability after a DUI in Virginia.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Military Focused: USAA’s insurance offerings are specially designed to meet the unique needs of military members after a DUI in Virginia.

- Service Excellence: USAA delivers exceptional customer service, assisting military personnel with the complexities of DUI-related insurance in Virginia.

- Forgiveness Program: USAA offers a forgiveness program that helps minimize premium increases for insurance after a DUI in Virginia. See our USAA review for details.

Cons

- Restricted Access: USAA insurance is only available to military families, limiting options for DUI coverage in Virginia.

- Branch Accessibility: USAA’s limited branch locations may reduce opportunities for in-person assistance with car insurance after a DUI in Virginia.

#3 – Progressive: Best DUI Insurance Discount Variety

Pros

- Usage-Based Savings: Progressive’s Snapshot program can reward safe driving behaviors, even after a DUI in Virginia. Get a complete view in our Progressive Snapshot review.

- Policy Bundling: Progressive’s bundling options help lower overall DUI insurance costs in Virginia with additional discounts.

- Diverse Coverage: Progressive offers a wide range of coverage options tailored to meet the specific insurance needs of drivers after a Virginia DUI.

Cons

- Premium Hikes: Progressive may impose steep premium increases, which can significantly impact insurance affordability after a DUI in Virginia.

- Discount Reduction: Progressive’s discount opportunities may be limited, affecting overall savings on insurance after a DUI in Virginia.

#4 – American Family: Best Loyalty Rewards

Pros

- Loyalty Perks: American Family rewards customer loyalty, helping to offset Virginia insurance rate increases after a DUI. Explore our American Family review to learn more.

- Agent Support: American Family’s dedicated local agents offer personalized guidance, simplifying the process of securing insurance after a DUI in Virginia.

- Advanced Tools: American Family provides cutting-edge tools to help manage insurance policies efficiently after a DUI in Virginia.

Cons

- High Surcharges: American Family may implement substantial surcharges, raising the cost of insurance after a DUI in Virginia.

- Limited Coverage Options: AmFam doesn’t have as flexible insurance options for DUI drivers as some other Virginia car insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best Group Discounts

Pros

- Discount Continuation: Farmers continues to offer group discounts for certain memberships and occupations to help drivers save money on auto insurance after a Virginia DUI.

- Specialized Programs: Farmers provides specialized programs designed to make insurance more affordable after a DUI in Virginia. Find more in our Farmers review.

- Expert Guidance: Farmers’ local agents deliver tailored advice, ensuring that insurance coverage meets your needs after a DUI in Virginia.

Cons

- Price Increases: Farmers may raise insurance premiums more than average, reflecting higher risks after a DUI in Virginia.

- Discount Access: Farmers may limit access to certain safe driving discounts, making insurance more costly after a DUI in Virginia if you don’t qualify for group discounts.

#6 – Nationwide: Best for Multiple Vehicles

Pros

- Multi-Vehicle Discounts: Drivers who insure more than one car with Nationwide can earn 20% off Virginia DUI auto insurance rates.

- Bundle Savings: Nationwide offers 20% savings through multi-policy bundles, which can help manage the cost of insurance after a DUI in Virginia. Learn more in our Nationwide review.

- Financial Security: Nationwide’s strong financial backing ensures reliable support and coverage for Virginia drivers who need to file insurance claims after a DUI.

Cons

- Forgiveness Limits: Nationwide provides fewer DUI forgiveness options, impacting the ability to manage Virginia high-risk insurance costs.

- Premium Surge: Nationwide may significantly increase premiums, reducing overall savings on insurance after a DUI in Virginia.

#7 – Allstate: Best Usage-Based Discounts

Pros

- Driving Habit Discounts: Allstate’s usage-based discounts remain available to low-mileage drivers, helping to lower VA insurance costs following a DUI. Learn more in our Allstate Milewise review.

- Forgiveness Features: Allstate’s accident forgiveness options offer relief from steep premium hikes after a DUI in Virginia. Discover details in our Allstate review.

- Educational Resources: Allstate provides extensive resources to help policyholders improve their habits and lower their Virginia DUI auto insurance costs over time.

Cons

- Surcharge Penalties: Allstate may impose high surcharges, leading to increased insurance expenses after a DUI in Virginia.

- Discount Efficiency: Allstate’s discounts may lose effectiveness, making insurance less affordable after a DUI in Virginia.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Industry Experience

Pros

- Industry Knowledge: Travelers leverages its extensive industry experience to offer reliable DUI-related insurance advice to drivers in Virginia.

- Claim Support: Travelers excels in claims support, ensuring that post-DUI insurance processes in VA are handled smoothly.

- Cost-Effective Bundles: Travelers provides bundling options that can help lower the overall cost of DUI auto insurance in Virginia. Find the full list in our Travelers review.

Cons

- Rate Increases: Travelers may impose substantial rate hikes, impacting the affordability of insurance after a DUI in Virginia.

- Discount Constraints: Travelers offers fewer discount opportunities, potentially affecting the cost of insurance after a DUI in Virginia.

#9 – Geico: Best for Digital Convenience

Pros

- Digital Convenience: Geico’s user-friendly online tools simplify policy management for those dealing with DUI-related insurance after a DUI in Virginia. Check out our Geico review for insights.

- 24/7 Assistance: Geico’s round-the-clock customer service ensures that support is always available after a DUI in Virginia.

- Financial Strength: With an A++ financial grade from A.M. Best, Geico is equipped to pay out DUI auto insurance claims in Virginia.

Cons

- Agent Access: Geico’s limited availability of in-person agents may pose challenges for managing DUI-related insurance needs in Virginia.

- Customization Limits: Geico may offer fewer options for personalizing insurance coverage to address the specific challenges after a DUI in Virginia.

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- Continuous Support: Liberty Mutual’s 24/7 customer service ensures continuous assistance for managing insurance after a DUI in Virginia. Find additional info in our Liberty Mutual review.

- Tailored Policies: Liberty Mutual offers customizable insurance policies that address the specific needs after a DUI in Virginia.

- Forgiveness Options: Liberty Mutual provides accident forgiveness to help reduce the financial impact of insurance after a DUI in Virginia.

Cons

- Higher Costs: Liberty Mutual may impose higher insurance premiums, reflecting the increased risk associated after a DUI in Virginia.

- Discount Availability: Liberty Mutual’s discount options may be restricted, affecting the overall cost of insurance after a DUI in Virginia.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding How Much Virginia DUI Auto Insurance Costs

Rates for auto insurance after a DUI in Virginia are generally higher due to the increased risk insurers associate with DUI convictions, but State Farm and USAA remain the cheapest companies for drivers with DUIs.

Virginia DUI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $63 | $151 |

| American Family | $58 | $138 |

| Farmers | $58 | $139 |

| Geico | $80 | $191 |

| Liberty Mutual | $98 | $233 |

| Nationwide | $63 | $150 |

| Progressive | $34 | $81 |

| State Farm | $29 | $69 |

| Travelers | $64 | $153 |

| USAA | $34 | $80 |

A DUI typically leads to elevated premiums, reflecting the perceived risk. Different insurance companies handle these risks differently. Companies review your entire driving history, including any additional violations, to determine your risk level and set premiums accordingly.

Different insurance providers have distinct approaches to high-risk drivers. Some insurers may impose more substantial rate increases than others, so it’s crucial to compare quotes from multiple companies to find the best possible Virginia DUI auto insurance.

Additionally, some insurers offer discounts for completing DUI education programs or installing safety devices in your vehicle. Keep reading to find out which auto insurance discounts to ask for after a DUI.

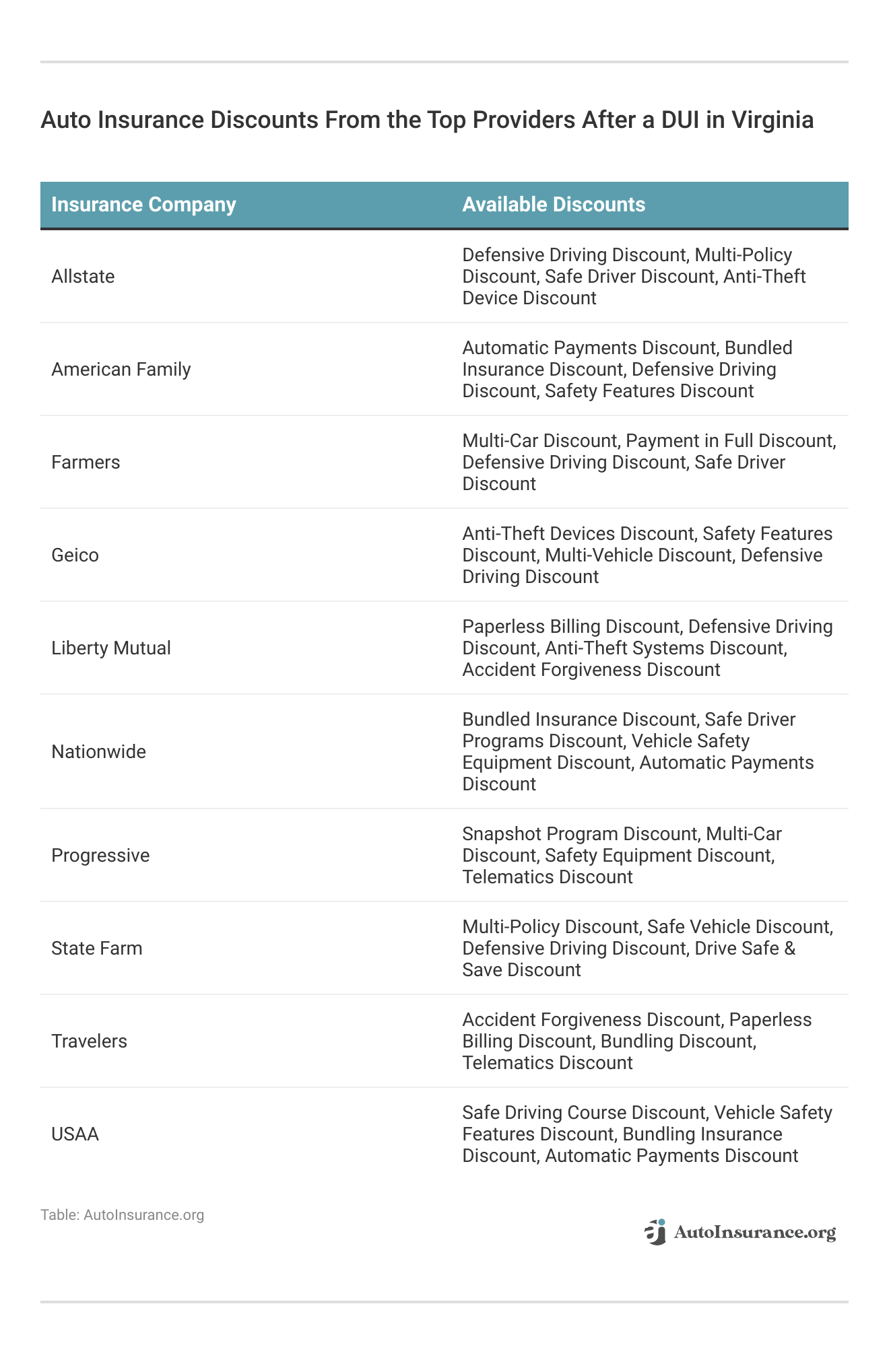

Maximizing Discounts for Virginia Auto Insurance After a DUI

Finding auto insurance discounts after a DUI in Virginia can help reduce your premiums. Many insurers offer savings for completing DUI rehabilitation programs, which demonstrates a commitment to safer driving. Some companies also provide reduced rates for maintaining a clean driving record following your DUI.

Installing advanced safety features in your vehicle, such as anti-theft devices or driver-assistance systems, can qualify you for discounts. Exploring these discount opportunities and discussing them with your insurer can lead to more affordable coverage despite your high-risk status.

Scroll down for more ways to find cheap auto insurance with a bad driving record.

Getting Cheaper Auto Insurance Rates After a DUI in Virginia

A DUI typically results in higher premiums due to increased risk. It’s crucial to compare quotes from various insurers, as each company has different policies for handling DUI convictions. Shop around and compare quotes from multiple insurers, as rates can vary significantly.

Coverage options also impact premiums, so decide if you need basic liability or more comprehensive protection. Understanding Virginia DUI laws and insurance regulations is important, as these affect your rates. Consider raising your deductible to lower premiums, but ensure you can cover the higher out-of-pocket costs if needed.

Did you know? Sending or reading a text takes your eyes off the road for about 5 seconds. At 55 mph, that’s like driving the length of a football field with your eyes closed. 🚗 #DistractedDrivingAwarenessMonth pic.twitter.com/uFsDHfqZMj

— State Farm (@StateFarm) April 24, 2023

Some insurers offer discounts for taking defensive driving courses, completing rehabilitation programs, or installing safety features, which can help lower costs. Also, maintaining a clean driving record can help lower your risk profile and reduce future premiums.

Read More: Why You Should Take a Defensive Driving Class

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Auto Insurance After a DUI in Virginia

A DUI conviction can significantly raise Virginia high-risk auto insurance for up to five years, making finding the best coverage options crucial. Geico, Progressive, and State Farm are top choices for high-risk drivers, offering the best auto insurance after a DUI in Virginia

State Farm offers the best overall value for auto insurance after a DUI in Virginia, with monthly rates starting at just $29.Laura Berry Former Licensed Insurance Producer

By completing rehabilitation programs, choosing appropriate coverage, and maintaining a clean driving record, you will see your expensive Virginia DUI auto insurance rates start to drop over time.

To find cheap high-risk auto insurance after a DUI in Virginia, enter your ZIP code below to compare insurance quotes from local companies.

Frequently Asked Questions

What is the best auto insurance for a DUI in Virginia?

USAA, Progressive, and State Farm are top choices for DUI insurance in Virginia due to their competitive rates and tailored coverage for high-risk drivers. Compare State Farm vs. USAA auto insurance.

How long does a Virginia DUI affect auto insurance?

A DUI in Virginia can affect your insurance rates for up to five years.

What is the most trusted auto insurance company in Virginia for a DUI?

State Farm is one of the most trusted car insurance companies in Virginia for a DUI.

Which car insurance is cheaper in Virginia for high-risk drivers?

Geico often offers more affordable rates for high-risk drivers in Virginia. Read our Geico auto insurance review to compare free quotes.

What car gets the most DUIs in Virginia?

The Ford F-150 is known for having a high number of DUIs.

How can I lower my VA auto insurance rates for high-risk drivers?

To lower car insurance in Virginia, consider shopping around for the best rates and improving your driving record.

Which Virginia company is best for insurance claims?

State Farm is highly recommended for handling insurance claims efficiently. Learn how to file an auto insurance claim.

Is auto insurance in Virginia high?

Car insurance rates in Virginia can be relatively high, especially for high-risk drivers. Progressive and State Farm offer some of the best insurance options for high-risk drivers in the state.

How much is auto insurance per month in VA for high-risk drivers?

Car insurance for high-risk drivers in Virginia can range from $150 to $300 per month. State Farm is one of the most trusted companies in the state, providing reliable coverage for high-risk drivers.

What state has the most DUIs in the U.S.?

California has the most DUIs in the U.S. Learn more about high-risk auto insurance in California.

What is the best insurance for a DUI in Virginia?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.