10 Best Auto Insurance Companies for Women (2026)

The winners for the best auto insurance companies for women are State Farm, Geico, and Progressive, offering budget-friendly rates beginning at just $74 per month for full coverage. Our top pick goes to State Farm for providing full coverage for a 55-year-old female at an affordable monthly cost of only $82.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated February 2026

18,155 reviews

18,155 reviewsCompany Facts

Avg. Monthly Rate for Women

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate for Women

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Avg. Monthly Rate for Women

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe winners for the best auto insurance companies for women are State Farm, Geico, and Progressive. State Farm averages $82/month for full coverage for a 55-year-old female.

State Farm and Geico consistently offer the most affordable rates for women of all ages. In addition, Progressive has the cheapest rates for women after a DUI, while State Farm offers the best rates after an accident. Learn how to compare Progressive and State Farm’s rates in our where to compare auto insurance rates guide.

Our Top 10 Company Picks: Best Auto Insurance for Women

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 30% | Customer Service | State Farm | |

| #2 | 25% | 30% | Many Discounts | Geico | |

| #3 | 10% | 30% | Budgeting Tools | Progressive | |

| #4 | 10% | 30% | UBI Program | Allstate | |

| #5 | 10% | 20% | Military Benefits | USAA | |

| #6 | 25% | 30% | Customizable Policies | Liberty Mutual |

| #7 | 20% | 10% | Safe-Driving Discounts | Farmers | |

| #8 | 20% | 20% | Multi-Policy Savings | Nationwide |

| #9 | 13% | 10% | Coverage Options | Travelers | |

| #10 | 5% | 10% | Exclusive Benefits | The Hartford |

Scroll down to see how the top 10 auto insurance companies for women compare with rates by state for young female drivers, senior drivers, and single women. Try our comparison tool to get free quotes.

- The cheapest auto insurance companies for women are State Farm and Geico

- Women’s car insurance quotes average $111 a month for full coverage

- Women’s car insurance rates vary by insurer and location

#1 – State Farm: Top Pick Overall

Pros

- Excellent customer service: State Farm provides a supportive environment that caters to the needs of women.

- Extensive agent network: Offering personalized assistance tailored to women’s unique preferences and requirements.

- Drive Safe and Save program for safe drivers: Empowering women to prioritize safety and receive potential discounts. You can learn more about State Farm’s Drive Safe and Save program in our State Farm auto insurance review.

Cons

- Rates may be higher for some women: Depending on individual circumstances.

- Limited online quote options: Which may be less convenient for women seeking quick and accessible information.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Runner Up

Pros

- Multi-policy discounts available: Allowing women to bundle and save on multiple insurance needs. You can learn more in our Geico auto insurance review.

- Good customer service reputation: Ensuring women receive reliable and efficient support.

- User-friendly online tools: Providing convenience for women managing their policies online.

Cons

- Rates may not always be the cheapest for women: Depending on individual factors.

- Limited local agents: Which may reduce the personal touch that some women prefer.

#3 – Progressive: Best for Snapshot Program

Pros

- Name Your Price Tool for customization: Allowing women to tailor coverage to fit their budget.

- Variety of discounts available: Providing women with options to maximize savings. You can learn more in our Progressive auto insurance review.

- Excellent online quote process: Offering a streamlined experience for women seeking quotes.

Cons

- Rates may increase after an accident: Impacting women’s overall costs.

- Customer service reviews are mixed: Potentially affecting the overall experience for women.

#4 – Allstate: Best for Drivewise Program

Pros

- Drivewise rewards safe driving habits: Encouraging and benefiting women who prioritize safety.

- Easy-to-use mobile app: Providing convenience for women managing their policies on the go.

- Bundling discounts available: Allowing women to save by combining different insurance needs. You can learn more in our Allstate auto insurance review.

Cons

- Premiums may be higher than some competitors for women: Depending on individual factors.

- Limited local agents: Which may affect the personalized assistance some women prefer.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Members

Pros

- Outstanding customer satisfaction: Ensuring a positive experience for women in military families.

- Exclusive benefits for military members: Extending to women within military families, which you can learn more about in our USAA auto insurance review.

- Competitive rates: Offering women cost-effective insurance options.

Cons

- Limited eligibility (only available to military members and their families): Restricting access for some women.

- Limited physical branches: Which may reduce in-person support for women.

#6 – Liberty Mutual: Best for RightTrack’s Personalized Discounts

Pros

- RightTrack program rewards safe driving: Encouraging women to adopt and benefit from safe driving habits.

- Numerous coverage options: Providing women with choices to tailor coverage to their unique needs. You can learn more in our Liberty Mutual auto insurance review.

- Online quote process is straightforward: Offering convenience for women seeking quick quotes.

Cons

- Rates may be higher for some women: Depending on individual circumstances.

- Mixed customer service reviews: May impact the overall experience for women.

#7 – Farmers: Best for Diverse Coverage Options and Safe Driving Discounts

Pros

- Diverse coverage options: Catering to the specific needs and preferences of women.

- Signal app rewards safe driving: Encouraging women to adopt safe driving habits.

- Multiple discounts available: Providing women with opportunities to save on their policies. You can learn more in our Farmers auto insurance review.

Cons

- Higher rates for some women: Depending on individual factors.

- Mixed customer service reviews: May affect the overall satisfaction for women.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for SmartRide Program

Pros

- SmartRide rewards safe driving habits: Benefiting women who prioritize safety on the road.

- Multi-policy discounts available: Allowing women to bundle and save on various insurance needs. You can learn more in our Nationwide auto insurance review.

- Strong financial ratings: Providing confidence and security for women insured with Nationwide.

Cons

- Rates may be higher for some women: Depending on individual circumstances.

- Limited local agents: May impact the level of personalized assistance women prefer.

#9 – Travelers: Best for Wide Range of Coverage Options and Discounts

Pros

- Various discounts available: Providing women with opportunities to maximize savings. You can learn more in our Travelers auto insurance review.

- Competitive rates: Offering cost-effective insurance solutions for women.

- Good financial strength: Instilling confidence in women insured with Travelers.

Cons

- Mixed customer service reviews: May impact the overall experience for some women.

- Limited local agents: May reduce the personal touch women prefer.

#10 – The Hartford: Best for Exclusive Benefits and Discounts

Pros

- AARP discounts available: Providing exclusive benefits for women who are AARP members. You can learn more in our Hartford auto insurance review.

- RecoverCare assistance for daily living expenses after an accident: Offering additional support for women.

- Excellent claims handling: Ensuring a smooth and efficient process for women filing claims.

Cons

- Limited availability to AARP members: Restricting access for some women.

- Rates may be higher for some women: Depending on individual factors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

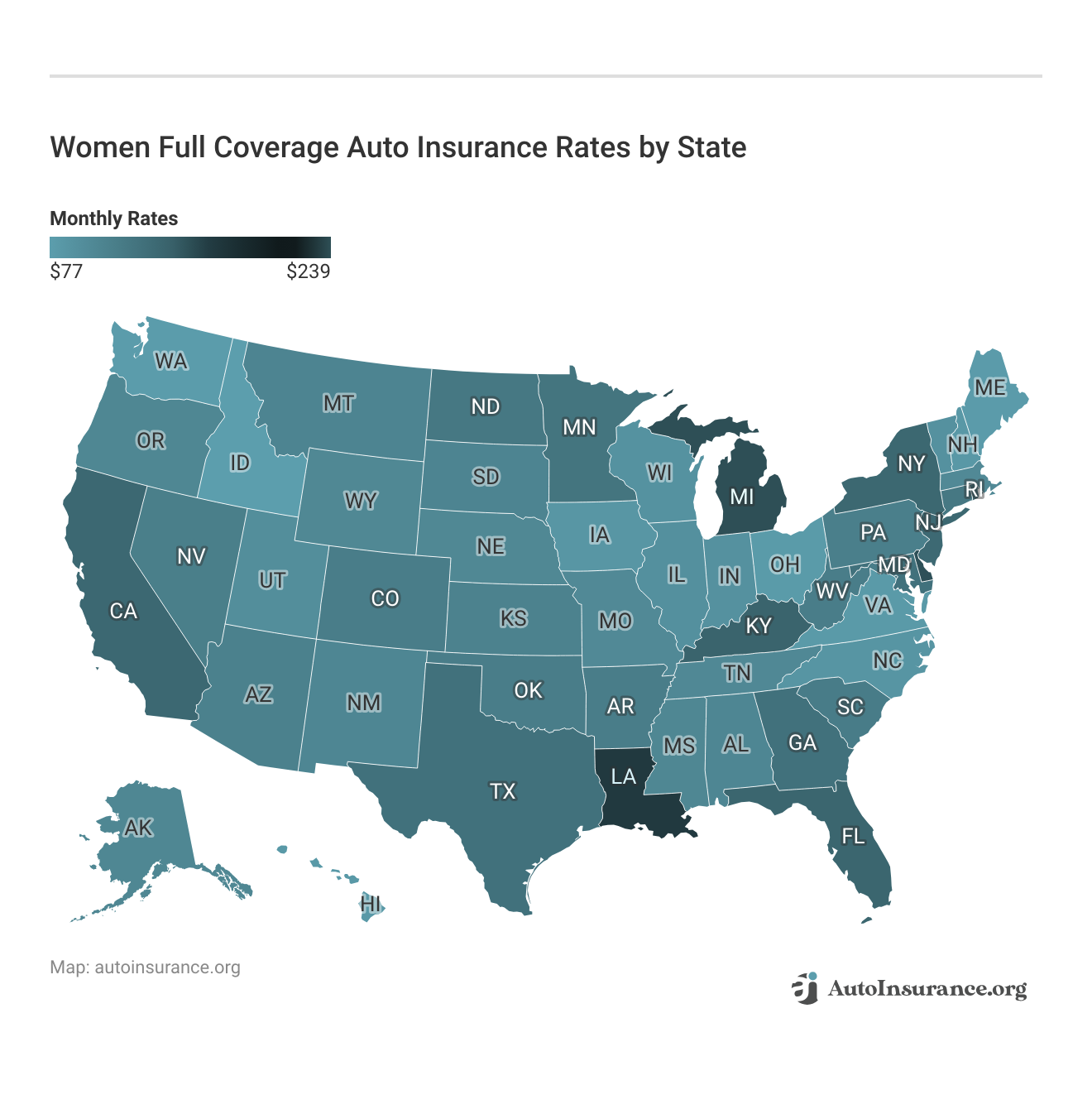

Best Cheap Auto Insurance for Women by State

Location has a significant impact on auto insurance for women. Factors such as accident rates, vehicle thefts, and the average cost of new vehicles in your state affect how much women pay for car insurance.

This map shows the average cost of full coverage by state to give you an idea of how rates can vary:

New York, Louisiana, and Florida are the most expensive states for women. However, these states are more expensive than average for most drivers due to high traffic and accident rates.

If you’re a female driver in one of these three states, compare auto insurance quotes every month to guarantee you’re paying the lowest possible rates.

What are the cheapest states for women? Idaho, Maine, New Hampshire, Ohio, and Vermont are the top five cheapest states for women’s auto insurance.Daniel Walker Licensed Auto Insurance Agent

Still, some states don’t allow insurers to use gender when setting rates. So if you live in a state where auto insurance is the same for men and women — California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, or Pennsylvania — female drivers may notice they pay the same rates as males based on age and driving record.

Best Cheap Auto Insurance for New Female Drivers

According to the National Highway Traffic Safety Administration (NHTSA), young drivers have the second-highest number of accident-related deaths in the country. The NHTSA also reports that more than twice the number of males were involved in fatal accidents than female drivers.

These statistics are reflected below in the auto insurance rates for new and young female drivers compared to males:

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $608 | $638 | $448 | $519 | |

| $452 | $456 | $333 | $371 | |

| $778 | $742 | $573 | $603 | |

| $298 | $312 | $220 | $254 | |

| $716 | $778 | $528 | $633 |

| $411 | $476 | $303 | $387 |

| $801 | $814 | $591 | $662 | |

| $311 | $349 | $229 | $284 | |

| $709 | $897 | $523 | $729 |

Drivers under 25 years old pay the most for car insurance due to their inexperience and increased risk on the road. However, young female drivers still pay less than their male counterparts.

Geico offers insurance quotes for teen drivers that often cost half that of other companies, but the rates are still more expensive because of the added risk of insuring teens. So comparing auto insurance quotes from multiple companies is essential.

For example, we found that the best auto insurance for drivers under 25 comes from regional insurers, like Erie auto insurance and Metromile.

Read More: Erie Auto Insurance review

So while Geico and State Farm are popular companies providing cheap auto insurance for new female drivers, you may find more affordable quotes for young drivers with a smaller local company.

Best Cheap Auto Insurance for Women Over 50

Auto insurance rates decrease as drivers age, and women over 50 often pay the lowest rates. Insurance rates can start to increase after drivers turn 65, but senior women still pay less than men and younger drivers.

Use this table to compare auto insurance quotes for women over 50 from the top insurers in the country:

Senior Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 55 Male | Age: 55 Female | Age: 60 Male | Age: 60 Female | Age: 65 Male | Age: 65 Female |

|---|---|---|---|---|---|---|

| $152 | $153 | $154 | $150 | $157 | $158 | |

| $92 | $92 | $89 | $86 | $95 | $95 | |

| $131 | $132 | $128 | $120 | $136 | $136 | |

| $76 | $76 | $74 | $73 | $78 | $78 | |

| $165 | $162 | $159 | $148 | $170 | $167 |

| $109 | $107 | $104 | $99 | $112 | $111 |

| $100 | $106 | $95 | $92 | $103 | $109 | |

| $82 | $82 | $76 | $76 | $84 | $84 | |

| $107 | $109 | $103 | $101 | $109 | $112 |

| $94 | $93 | $90 | $89 | $97 | $96 |

Again, State Farm and Geico are the best auto insurance companies based on price. However, these quotes are for drivers with clean records, so your rates will likely be higher if you’ve been in an accident or cited for speeding.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Cheap Auto Insurance for Single Women

Marital status affects women’s car insurance rates because married couples are statistically less likely to file a claim. Insurance companies also consider couples more financially stable and, therefore, more likely to choose higher deductibles in exchange for lower rates.

Single women pay less than single men, but married couples save more on car insurance. The best auto insurance companies for married couples offer multi-car discounts when you insure more than one vehicle. Keep reading for more ways to find car insurance discounts for women.

How to Find Auto Insurance Discounts for Women

Auto insurance companies don’t offer specific discounts for women, but they can still save with occupational or membership discounts.

For example, Geico offers discounts to female drivers who are members of the Society of Women Engineers. Many sorority members and university alumna can also earn discounts from other insurers.

Below are discounts you should ask for as a female driver:

- Group affiliation discounts: Employers, unions, and universities often negotiate with insurance companies to discount member rates.

- Bundling discounts: If you have more than one insurance policy with a company, you can bundle your coverage for up to 25% off with some insurers.

- Equipment discounts: Did you recently install new safety or anti-theft equipment in your car? Update your insurance policy and ask your insurer how much you can save with an equipment discount.

- Early signing discounts: Most insurers offer 10% to 15% off your rates when you buy new auto insurance before your old policy ends.

- Usage-based discounts: Female drivers with safe driving habits and short commutes can secure cheaper rates with usage-based auto insurance and discounts.

- Safe driving discounts: Safe drivers pay less for auto insurance, and many companies reduce rates yearly if you remain accident-free.

- Claim-free discounts: Insurance companies also reduce rates for drivers who avoid filing claims before their renewal period, and drivers can double their savings when stacking this with safe driving discounts.

Auto insurance discounts for women will depend heavily on where you live and your unique insurance profile.

Most companies automatically apply discounts you qualify for based on your application but don’t hesitate to ask insurers about additional discounts. If your insurer doesn’t provide the discounts you want, shop for new auto insurance quotes with different companies to save.

Best Auto Insurance Companies: Available Discounts by Provider

| Discount Name |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Adaptive Headlights | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Anti-lock Brakes | 10% | ✓ | ✓ | 5% | 5% | 5% | ✓ | 5% | ||

| Anti-Theft | 10% | ✓ | 23% | 20% | 25% | ✓ | 15% | |||

| Claim Free | 35% | ✓ | ✓ | 26% | ✓ | 10% | ✓ | 15% | 23% | 12% |

| Continuous Coverage | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | ||

| Daytime Running Lights | 2% | ✓ | 3% | 5% | 5% | ✓ | ✓ | |||

| Defensive Driver | 10% | 10% | ✓ | ✓ | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | ✓ | ✓ | ✓ | ✓ | 10% | ✓ | 7% | ||

| Driver's Ed | 10% | ✓ | ✓ | ✓ | 10% | ✓ | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | ✓ | ✓ | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | ✓ | ✓ | ✓ | ✓ | 8% | ✓ | ✓ | 10% | 12% |

| Electronic Stability Control | 2% | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Emergency Deployment | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Engaged Couple | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Family Legacy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 10% |

| Family Plan | ✓ | ✓ | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ |

| Farm Vehicle | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Fast 5 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Federal Employee | ✓ | ✓ | 12% | 10% | ✓ | ✓ | ✓ | ✓ | ||

| Forward Collision Warning | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Full Payment | 10% | ✓ | ✓ | $50 | ✓ | ✓ | ✓ | 8% | ✓ | |

| Further Education | ✓ | ✓ | 10% | 15% | ✓ | ✓ | ||||

| Garaging/Storing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 90% | ||

| Good Credit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Good Student | 20% | ✓ | 15% | 23% | 10% | ✓ | 25% | 8% | 3% | |

| Green Vehicle | 10% | ✓ | 5% | ✓ | 10% | ✓ | ✓ | ✓ | 10% | ✓ |

| Homeowner | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | 3% | 5% | ✓ | |

| Lane Departure Warning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Life Insurance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Low Mileage | ✓ | ✓ | ✓ | 30% | ||||||

| Loyalty | ✓ | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | |

| Married | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Membership/Group | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | |||

| Military | ✓ | ✓ | 15% | 4% | ✓ | ✓ | ||||

| Military Garaging | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% |

| Multiple Drivers | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Multiple Policies | 10% | 29% | ✓ | 10% | 20% | 10% | 12% | 17% | 13% | |

| Multiple Vehicles | ✓ | ✓ | 25% | 10% | 20% | 10% | 20% | 8% | ||

| New Address | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Customer/New Plan | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| New Graduate | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Vehicle | 30% | ✓ | ✓ | 15% | ✓ | 40% | 10% | 12% | ||

| Newly Licensed | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Newlyweds | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Non-Smoker/Non-Drinker | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Occasional Operator | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Occupation | ✓ | 10% | 15% | ✓ | ✓ | ✓ | ||||

| On-Time Payments | 5% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | |

| Online Shopper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7% | ✓ | ✓ | ✓ |

| Paperless Documents | 10% | ✓ | ✓ | ✓ | 5% | $50 | ✓ | ✓ | ✓ | |

| Paperless/Auto Billing | 5% | ✓ | ✓ | ✓ | $30 | ✓ | $20 | 3% | 3% | |

| Passive Restraint | 30% | 30% | 40% | 20% | ✓ | 40% | ||||

| Recent Retirees | ✓ | ✓ | ✓ | ✓ | 4% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Renter | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Roadside Assistance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Safe Driver | 45% | ✓ | 15% | ✓ | 35% | 31% | 15% | 23% | 12% | |

| Seat Belt Use | ✓ | ✓ | ✓ | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Senior Driver | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Stable Residence | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Students & Alumni | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | ✓ | ||

| Switching Provider | ✓ | ✓ | 10% | ✓ | ✓ | ✓ | ✓ | |||

| Utility Vehicle | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Vehicle Recovery | 10% | ✓ | ✓ | 15% | 35% | 25% | ✓ | 5% | ||

| VIN Etching | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | |||

| Volunteer | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Young Driver | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | $75 |

We found that Nationwide offers more discounts and higher percentages than other companies on our list.

In addition, Travelers and American Family offer more discounts to senior drivers. If you’re interested in usage-based discounts, consider comparing Allstate insurance quotes against other insurers in your area.

Read More: Travelers Auto Insurance Review & American Family Auto Insurance Review

As you can see, discounts vary from company to company, so shop around and compare multiple insurers to find one offering the most policy discounts.

The Gender That Pays More for Auto Insurance

Statistically, men drive more than women, increasing their risk of an accident or collision. Male drivers are also more likely to engage in risky driving behaviors, like speeding and driving under the influence of drugs or alcohol. All of these factors increase car insurance rates for men.

On average, female drivers over 25 pay 5% less than men for auto insurance coverage. Teen female drivers pay around 7% less than teen males.

Why Auto Insurance Companies Use Gender to Set Rates

Gender is a standard variable many research industries use to analyze auto accident and collision data, including the NHTSA, the U.S. Department of Transportation, and the Insurance Institute for Highway Safety.

Insurance companies use this safety data, combined with individual driving records and local accident and auto theft statistics, to determine rates for male and female drivers.

Ultimately, it all comes down to risk — since male drivers are more likely to get into an accident than female drivers, insurance companies offer women car insurance that is cheaper.

However, female drivers with accidents pay higher rates than males with clean driving records or claim-free insurance histories. Multiple accidents or DUIs will lead to increased rates for both male and female drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Women’s Auto Insurance

The easiest way to find cheap car insurance for women is by avoiding accidents, speeding tickets, and maintaining a good driving record. Companies give the lowest auto insurance quotes to women with clean driving records and more experience behind the wheel.

Women can also earn discounts on auto insurance, including good driver, good student, claim-free, low mileage, and membership discounts. Insurance discounts vary by company, so ask for a company’s discount offerings when comparing quotes.

Read More:

- How to Get a Good Driver Auto Insurance Discount

- How to Get a Low Mileage Auto Insurance Discount

- How to Get a Good Student Auto Insurance Discount

- How to Get a Membership Auto Insurance Discount

Even if you don’t qualify for multiple discounts or have an accident on your record, you can still save money on women’s car insurance by making policy changes.

Reduce Your Auto Insurance Coverage

Lowering your coverage levels decreases your auto insurance rates. For example, if you drive an older vehicle that costs more to repair than it’s worth, you can reduce your coverage to liability-only.

Buying only liability auto insurance is the best way to get the cheapest policy — just ensure you maintain the minimum coverage required in your state. If you fail to carry enough car insurance, you could lose your driver’s license.

Read your policy closely before changing coverage. While nearly every state requires liability insurance, you often need full coverage if you lease a vehicle or pay an auto loan. Therefore, you may not be able to change coverages until your loan is paid in full.

Before making any changes, you should also consider your budget and coverage needs. Auto insurance protects drivers from paying out of pocket for repairs and medical costs. If you reduce your coverage, you’ll be responsible for all expenses exceeding your policy limits.

Increase Your Auto Insurance Deductibles

If reducing coverage isn’t an option, consider raising your deductibles to get cheaper auto rates. Deductibles are how much you pay upfront before the insurance policy starts to cover costs. The more you pay, the less risk to the insurance company, and you’ll see lower rates at your next renewal.

However, like with reducing coverage, consider your budget and needs. Decide how much you’re willing to pay for repairs out of pocket, and don’t pick deductible amounts exceeding your budget.

Compare Female Auto Insurance Quotes

You can compare auto insurance quotes online once you know how much coverage you need and how high your deductibles can be. As a rule of thumb, older vehicles and female drivers with clean records will get the cheapest online insurance quotes.

Each company assesses driver risk differently. So look for auto insurance companies for women that offer discounts and affordable rates.

Geico offers the cheapest rates to young female drivers, but State Farm offers more affordable coverage after an accident. If you’re looking for discounts, Nationwide has the largest list of auto insurance discounts for female and male drivers.

While these national companies offer competitive rates, you may still find cheaper quotes with a local insurer. So compare quotes from at least three companies in your neighborhood before buying to guarantee you’re paying the lowest possible rates for women drivers in your area. Try our comparison tool today to easily compare prices and get free quotes.

Frequently Asked Questions

Is auto insurance more expensive for male or female drivers?

Car insurance is more expensive for males than female drivers since male drivers are more likely to engage in reckless driving behaviors and be the victims of fatal auto accidents, especially young male drivers.

Who has cheap auto insurance quotes for female drivers?

The cheapest auto insurance quotes for female drivers are with Geico. State Farm offers the most reasonable quotes after an accident, and Progressive gives lower car insurance quotes to female drivers with DUI or DWI charges.

Which group pays more for auto insurance: single or married women?

Single women pay more for auto insurance than married women since insurers consider married couples more financially secure and less risky to insure. Find the best auto insurance for single females by comparing rates from several companies.

At what age does insurance go down for female drivers?

Young drivers pay the most for auto insurance, but auto insurance rates go down for female drivers after they turn 25. Rates remain low until women turn 65, but senior women still pay less for car insurance than female drivers under 25 years old.

What factors should women consider when choosing an insurance company?

When selecting an insurance company, women should consider the following factors:

- Coverage options: Ensure the company offers a range of coverage options that meet your specific needs, including liability, collision, comprehensive, and additional coverage types.

- Customer service: Evaluate the insurer’s reputation for customer service, including accessibility, responsiveness, and ease of communication when dealing with claims or inquiries.

- Rates and discounts: Compare rates from different insurance companies and inquire about any discounts or incentives available to women, such as safe driver discounts, loyalty discounts, or bundling multiple policies.

- Financial stability and reputation: Research the company’s financial stability and customer reviews to ensure their reliability and claims handling capabilities.

- Additional benefits: Look for insurers that offer benefits or programs specifically designed to cater to women’s needs, such as discounts for women-focused organizations or services like roadside assistance tailored for women.

Can women benefit from women-only auto insurance companies?

While there are no specific auto insurance companies exclusively for women, there are insurers that cater to women’s needs and preferences by providing tailored coverage options, additional benefits, and programs designed with women in mind. These insurers may emphasize customer service, women-focused discounts, or resources that address specific concerns women may have when it comes to auto insurance.

How can women find the best insurance rates?

To find the best insurance rates, women can consider the following steps:

- Shop around. Obtain quotes from multiple insurance companies to compare rates and coverage options.

- Maintain a good driving record. A clean driving record can often result in lower insurance premiums. Practice safe driving habits and avoid traffic violations or accidents.

- Ask about discounts. Ask insurance companies about discounts available specifically for women, such as safe driver discounts, good student discounts, or discounts for being a member of women-focused organizations.

- Consider bundling. Check if bundling your auto insurance with other policies, such as home or renters insurance, can provide cost savings.

- Review deductibles and coverage limits. Assess the deductibles and coverage limits to find the right balance between affordability and adequate protection.

Which insurance company has the highest customer satisfaction?

Geico has the highest customer satisfaction, with a 8.89%.

Which states provide the cheapest auto insurance for women?

The cheapest states for women’s auto insurance include Idaho, Maine, New Hampshire, Ohio, and Vermont.

Which states do women face the highest auto insurance costs?

Women experience the highest auto insurance costs in New York, Louisiana, and Florida.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.