Best Auto Insurance for Marco’s Pizza Delivery Drivers in 2026 (See the Top 10 Providers Here!)

Allstate, USAA, and Nationwide have the best auto insurance for Marco's Pizza delivery drivers, with rates beginning at just $48 per month. These top providers offer tailored coverage options and competitive pricing, making them ideal for ensuring comprehensive protection while on the job.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated December 2024

Company Facts

Full Coverage for Marco Pizza Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Marco Pizza Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Marco Pizza Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Allstate, USAA, and Nationwide stand out as the best auto insurance for Marco’s Pizza delivery drivers, offering competitive rates starting at $48 per month for minimum coverage.

Among these, Allstate is particularly notable for its comprehensive policies tailored to meet the specific needs of delivery drivers. For a comprehensive review, see our in-depth guide titled “Comprehensive Auto Insurance Explained.”

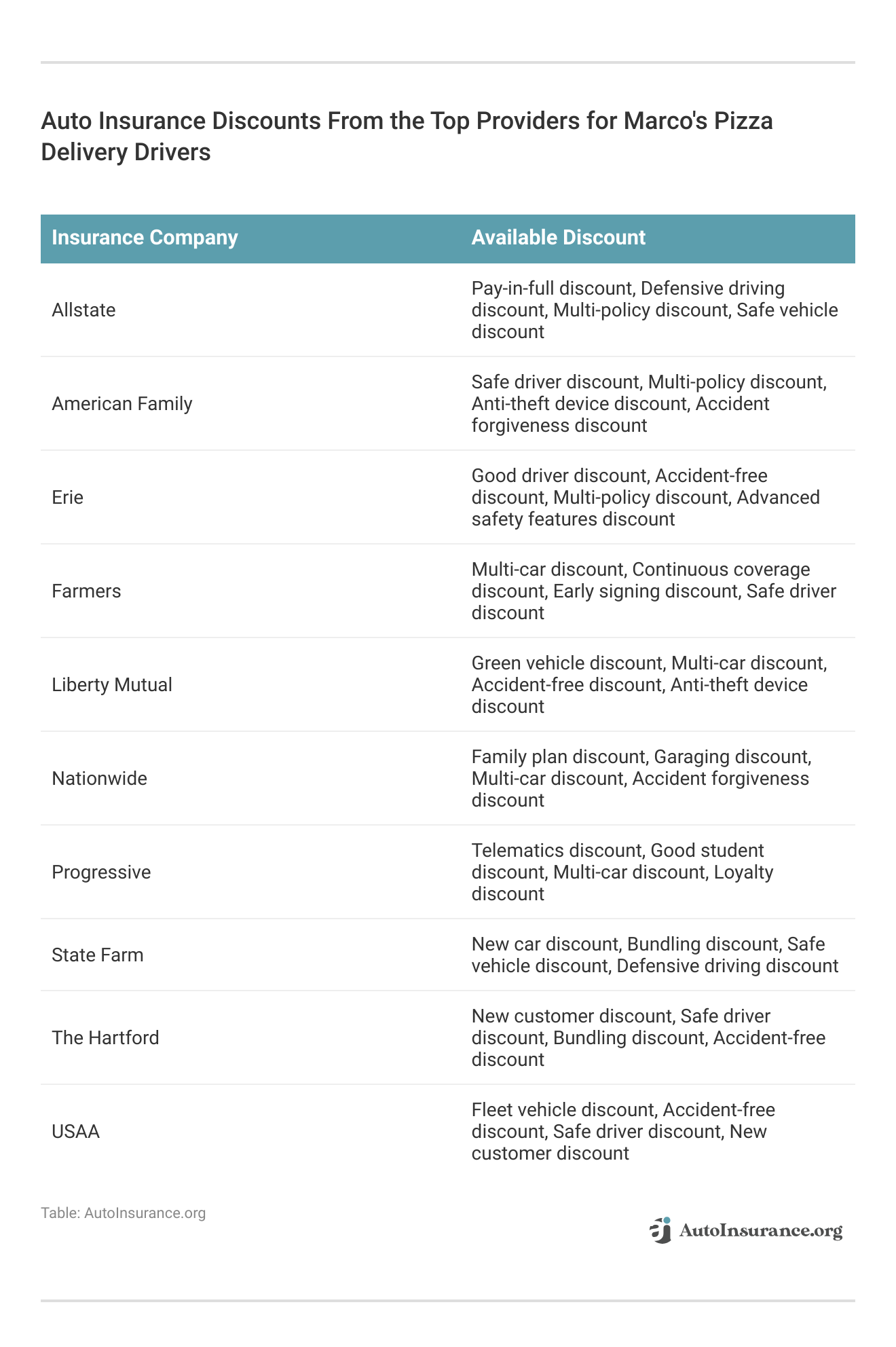

Our Top 10 Company Picks: Best Auto Insurance for Marco's Pizza Delivery Drivers

Company Rank Good Driver Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 28% A+ Comprehensive Coverage Allstate

![]()

#2 26% A++ Exclusive Benefits USAA

#3 24% A+ Multiple Discounts Nationwide

#4 22% A Delivery Endorsement Farmers

#5 21% A Flexible Policies Liberty Mutual

#6 18% B Agent Network State Farm

#7 16% A+ Delivery Coverage Progressive

#8 13% A+ Competitive Rates Erie

#9 11% A Discount Options American Family

#10 10% A+ Delivery Program The Hartford

Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

With a strong reputation for customer service and extensive coverage options, Allstate ensures drivers are well-equipped for any challenges they may face on the job.

- Allstate offers tailored auto insurance for Marco’s Pizza drivers at $48/month

- Policies address unique risks of frequent driving and delivery activities

- Ensures reliable coverage and peace of mind on delivery routes

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Coverage Options: Allstate auto insurance review showcase the company’s wide array of coverage options tailored to various needs, ensuring customers can find suitable protection.

- Strong Financial Stability: A+ rated by A.M. Best, indicating excellent financial strength and stability, reassuring customers of reliable claims payment.

- Nationwide Availability: Provides coverage across the United States, making it accessible to a wide range of customers seeking dependable insurance solutions.

Cons

- Customer Service Variability: Reviews on customer service can vary, with some customers reporting inconsistent experiences.

- Higher Premiums: Policies may be priced higher compared to some competitors, potentially impacting affordability for budget-conscious customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Exclusive Benefits

Pros

- Exclusive Benefits: Tailored specifically for military members, veterans, and their families, offering unique benefits and personalized service.

- Exceptional Customer Service: USAA auto insurance review demonstrate the company’s outstanding service and support, with dedicated representatives knowledgeable about military-specific needs.

- Financial Stability: A++ rated by A.M. Best, demonstrating superior financial strength, ensuring stability and reliability for policyholders.

Cons

- Limited Eligibility: Only available to military personnel, veterans, and their families, restricting access to a broader customer base.

- Limited Branch Locations: Physical branch locations may be sparse in some areas, potentially affecting in-person service convenience.

#3 – Nationwide: Best for Multiple Discounts

Pros

- Multiple Discount Opportunities: Offers a variety of discounts to help lower premiums, making insurance more affordable for policyholders.

- Strong Financial Reputation: A+ rated by A.M. Best, indicating stability and reliability in financial commitments and claims handling.

- Diverse Coverage Options: Nationwide auto insurance review exhibit the company’s range of insurance products beyond auto insurance, catering to varied customer needs.

Cons

- Customer Service Issues: Some customers report dissatisfaction with service experiences, particularly in claims processing and responsiveness.

- Policy Flexibility: Policies may have less flexibility compared to other insurers, limiting customization options for specific coverage needs.

#4 – Farmers: Best for Delivery Endorsement

Pros

- Specialized Coverage Endorsements: Farmers auto insurance discounts highlight the company’s endorsements tailored to specific needs such as delivery drivers, providing comprehensive protection.

- Strong Financial Stability: A rated by A.M. Best, indicating solid financial health and reliability in meeting policyholder obligations.

- Established Reputation: Long-standing history and reputation in the insurance industry, instilling confidence among customers.

Cons

- Higher Premiums: Policies may be priced higher due to extensive coverage options and specialized endorsements, potentially impacting affordability.

- Limited Online Tools: Online service options and tools may be less developed compared to larger insurers, affecting digital service experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Flexible Policy

Pros

- Flexible Policy Options: Offers customizable policies to meet individual needs, allowing customers to tailor coverage according to their specific requirements.

- Strong Financial Stability: Liberty Mutual auto insurance review feature the company’s A rated by A.M. best, ensuring reliability and strength in financial commitments and claims settlement.

- Additional Coverage Benefits: Provides optional coverage enhancements for added protection, catering to diverse customer preferences.

Cons

- Higher Premiums: Policies may be more expensive compared to some competitors, potentially influencing affordability for price-sensitive customers.

- Customer Service Concerns: Some customers report dissatisfaction with claims processing efficiency and support responsiveness, impacting overall satisfaction.

#6 – State Farm: Best for Agent Network

Pros

- Extensive Agent Network: Offers personalized service through a vast network of local agents, providing face-to-face assistance and support.

- Established Reputation: Recognized for reliability and customer trust over decades, earning a strong reputation in the insurance industry.

- Variety of Insurance Products: State Farm auto insurance review highlight the company’s range of insurance products in addition to auto insurance, offering comprehensive coverage options.

Cons

- Higher Premiums: Policies may be priced higher due to personalized service and extensive agent network, potentially affecting cost competitiveness.

- Limited Online Tools: Online and mobile app functionalities may be less advanced compared to larger insurers, impacting digital service experience.

#7 – Progressive: Best for Delivery Coverage

Pros

- Specialized Coverage Options: Progressive auto insurance review showcase the company’s tailored coverage for unique needs such as delivery drivers, providing comprehensive protection against specific risks.

- Superior Financial Strength: A+ rated by A.M. Best, indicating strong financial stability and reliability in claims payment and service delivery.

- Innovative Tools: Provides advanced online tools and resources for policy management, enhancing convenience and accessibility for customers.

Cons

- Higher Premiums: Policies may be more expensive due to specialized coverage options and comprehensive protection, potentially impacting affordability.

- Customer Service Challenges: Some customers report issues with claims processing efficiency and support responsiveness, affecting overall satisfaction levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Competitive Rates

Pros

- Competitive Rates: Known for offering competitive premiums without compromising on coverage quality, ensuring affordability for policyholders.

- Excellent Customer Service: Erie auto insurance review demonstrate the company’s personalized service and support, providing a positive experience for customers.

- Strong Financial Stability: A+ rated by A.M. Best, ensuring financial reliability and security for policyholders.

Cons

- Limited Availability: Policies may only be available in select regions, potentially restricting access for customers outside of these areas.

- Limited Online Presence: Online service options and tools may be less extensive compared to larger insurers, affecting digital service capabilities.

#9 – American Family: Best for Discount Options

Pros

- Discount Options: Offers a variety of discounts to help lower insurance costs, making coverage more affordable for policyholders.

- Solid Financial Stability: A rated by A.M. Best, indicating stability and reliability in financial commitments and claims handling.

- Customer Satisfaction: American Family auto insurance review highlight the company’s high customer satisfaction ratings in various surveys, reflecting positive service experiences.

Cons

- Limited Availability: Policies may be restricted to certain regions or demographic groups, potentially limiting accessibility for new customers.

- Coverage Limitations: Policy options and coverage may not be as extensive as larger insurers, limiting customization for specific needs.

#10 – The Hartford: Best for Delivery Program

Pros

- Specialized Insurance Programs: The Hartford auto insurance review exhibit the company’s tailored programs and coverage options for unique needs, ensuring comprehensive protection.

- Strong Financial Stability: A+ rated by A.M. Best, demonstrating financial strength and stability in meeting policyholder obligations.

- Long-standing Reputation: Recognized for reliability and longevity in the insurance industry, earning trust among customers.

Cons

- Higher Premiums: Policies may be priced higher due to specialized coverage and comprehensive protection, potentially impacting affordability.

- Limited Availability: Policies may not be widely available compared to larger insurers, limiting access for customers in certain regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Marco’s Pizza Auto Insurance

Marco’s Pizza doesn’t offer employees commercial auto insurance when they’re on the job. While some delivery companies provide their employees with insurance coverage, Marco’s requires its drivers to find proper coverage on their own. For a detailed overview, refer to our extensive guide called “Best Business Auto Insurance.”

If you want to work for Marco’s, you must have a liability policy that meets your state’s requirements in terms of coverage limits. You’re also welcome to have additional coverage to protect you and your vehicle after an accident.

Affordable Auto Insurance Tips for Marco’s Pizza Delivery Drivers

The more Marco’s Pizza employee insurance coverage you carry on your vehicle, the higher your insurance rates will be. However, there’s still a chance you can find relatively cheap coverage as a Marco’s delivery driver.

Shopping online and comparing quotes from multiple insurance companies is the best way to find affordable rates for car insurance. Comparing quotes will help you see which companies are willing to offer you the coverage you need at a price that works with your budget.

Marco's Pizza Delivery Drivers Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $48 $120

American Family $66 $165

Erie $64 $160

Farmers $54 $135

Liberty Mutual $58 $145

Nationwide $52 $130

Progressive $62 $155

State Farm $60 $150

The Hartford $68 $170

USAA $50 $125

Once you find a few companies you’re interested in, you can call and speak to a representative about the cost of coverage. Ensure the coverage you’re looking into will help when driving for work, and ask questions if you’re unsure about anything.

Marco’s Pizza Delivery Driver Auto Insurance Requirements

All you must have as a Marco’s delivery driver is liability coverage. The amount you must have depends on where you live.

Each state has minimum auto insurance requirements regarding how much liability coverage you must carry. In addition, each state has specific requirements for both bodily injury and property damage coverage. For an in-depth investigation, peruse our comprehensive guide named “Minimum Auto Insurance Requirements by State.“

The table below outlines the different coverage amounts required in each state:

Liability Auto Insurance Requirements by State

| State | Coverages | Limits |

|---|---|---|

| Alabama | Bodily injury & property damage liablity | 25/50/25 |

| Alaska | Bodily injury & property damage liablity | 50/100/25 |

| Arizona | Bodily injury & property damage liablity | 15/30/10 |

| Arkansas | Bodily injury, property damage liablity, & personal injury protection | 25/50/25 |

| California | Bodily injury & property damage liablity | 15/30/5 |

| Colorado | Bodily injury & property damage liablity | 25/50/15 |

| Connecticut | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Delaware | Bodily injury, property damage liablity, & personal injury protection | 25/50/10 |

| Florida | Property damage liablity, & personal injury protection | 10/20/10 |

| Georgia | Bodily injury & property damage liablity | 25/50/25 |

| Hawaii | Bodily injury, property damage liablity, & personal injury protection | 20/40/10 |

| Idaho | Bodily injury & property damage liablity | 25/50/15 |

| Illinois | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Indiana | Bodily injury & property damage liablity | 25/50/25 |

| Iowa | Bodily injury & property damage liablity | 20/40/15 |

| Kansas | Bodily injury, property damage liablity, & personal injury protection | 25/50/25 |

| Kentucky | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/25 |

| Louisiana | Bodily injury & property damage liablity | 15/30/25 |

| Maine | Bodily injury, property damage liablity, uninsured motorist/underinsured motorist, & MedPay | 50/100/25 |

| Maryland | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 30/60/15 |

| Massachusetts | Bodily injury, property damage liablity, & personal injury protection | 20/40/5 |

| Michigan | Bodily injury, property damage liablity, & personal injury protection | 20/40/10 |

| Minnesota | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 30/60/10 |

| Mississippi | Bodily injury & property damage liablity | 25/50/25 |

| Missouri | Bodily injury, property damage liablity, & Uninsured Motorist | 25/50/25 |

| Montana | Bodily injury & property damage liablity | 25/50/20 |

| Nebraska | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Nevada | Bodily injury & property damage liablity | 25/50/20 |

| New Hampshire | Financial responsibility (None required) | 25/50/25 |

| New Jersey | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 15/30/5 |

| New Mexico | Bodily injury & property damage liablity | 25/50/10 |

| New York | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/10 |

| North Carolina | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 30/60/25 |

| North Dakota | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/25 |

| Ohio | Bodily injury & property damage liablity | 25/50/25 |

| Oklahoma | Bodily injury & property damage liablity | 25/50/25 |

| Oregon | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/20 |

| Pennsylvania | Bodily injury, property damage liablity, & personal injury protection | 15/30/5 |

| Rhode Island | Bodily injury & property damage liablity | 25/50/25 |

| South Carolina | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| South Dakota | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Tennessee | Bodily injury & property damage liablity | 25/50/15 |

| Texas | Bodily injury, property damage liablity, & personal injury protection | 30/60/25 |

| Utah | Bodily injury, property damage liablity, & personal injury protection | 25/65/15 |

| Vermont | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/10 |

| Virginia | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Washington | Bodily injury & property damage liablity | 25/50/10 |

| Washington, D.C. | Bodily injury, property damage liablity, & Uninsured Motorist | 25/50/10 |

| West Virginia | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Wisconsin | Bodily injury, property damage liablity, uninsured motorist, & MedPay | 25/50/10 |

| Wyoming | Bodily injury & property damage liablity | 25/50/20 |

If you live in a state requiring lower coverage limits, your Marco’s Pizza insurance rates may be relatively low compared to rates in states that require higher levels of liability coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Marco’s Pizza Employee Auto Insurance Cost

The amount you’ll pay for car insurance as a Marco’s delivery driver depends on several factors, including your age, gender, location, the car you drive, how often you drive, whether you use your car for business purposes, credit score, driving history, and marital status. For a thorough examination, take a look at our detailed guide entitled “Auto Insurance Rates by Age.”

If someone drives their car for personal use and has a good driving record, their rates for auto insurance could be fairly low. However, your auto insurance rates may be higher if you plan to use your personal vehicle as a delivery driver.

The table below shows the average auto insurance rates for food delivery drivers.

Delivery Driver Full Coverage Auto Insurance Monthly Rates by Delivery Type

Delivery Type Monthly Rates

Catering

(Business Only)$217

Catering

(Business/Personal)$235

Food Delivery

(Business Only)$273

Pizza Delivery

(Business Only)$273

Food Delivery (Business/Personal) $297

Pizza Delivery (Business/Personal) $297

Food Truck

(Business Only)$434

Food Truck (Business/Personal) $763

A pizza delivery driver’s insurance rates are significantly higher than the average auto policy because most people in the food delivery industry choose to carry higher coverage levels.

Marco’s Pizza Commercial Auto Insurance Coverage

If you’re considering commercial insurance as a Marco’s delivery driver, ensure you get adequate coverage for your job.

- Part-time delivery drivers may not need the extensive coverage of a commercial insurance policy.

- Commercial auto insurance includes high levels of bodily injury liability, property damage liability, personal injury protection, medical payments, and legal expenses.

- Marco’s Pizza commercial coverage offers extensive protection but comes with higher monthly or annual rates. For a comprehensive assessment, read through our detailed guide titled “Best Commercial Auto Insurance Companies.”

If you drive for Marco’s full-time, you should consider a commercial insurance policy on your vehicle. However, if you only work for the restaurant a few days a week and drive your car to make deliveries for fewer than 20 hours per week, you may qualify for hired and non-owned coverage.

Hired and Non-Owner Auto Insurance for Marco’s Pizza Delivery

Hired and non-owned car insurance is an add-on for your Marco’s Pizza auto insurance policy that covers you if you get in an accident or your car gets damaged while driving for the company.

Though your standard auto policy could deny your claim while working, hired and non-owned coverage allows you to have the proper liability coverage and personal protection when working. For a thorough understanding, refer to our detailed analysis titled “How to File an Auto Insurance Claim.”

Most companies have exceptions for this coverage type, so if you work full-time or drive a company-owned vehicle, hired and non-owned car insurance may not be an option.

The primary benefit of this policy type is that you can get higher coverage levels and ensure you’ll be covered if your claim is work-related. Additionally, you can avoid paying premiums as high as those associated with a commercial policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Marco’s Pizza Auto Insurance for Delivery Drivers

Delivering pizzas for Marco’s requires you have a personal auto insurance policy. While you only have to carry liability auto insurance to work for the company, it’s good to purchase additional coverage to be protected if you get in an accident. For a thorough analysis, consult our comprehensive guide named “Cheapest Liability-Only Auto Insurance.”

Commercial auto insurance or a hired and non-owned policy may work for you, depending on how often you deliver for Marco’s. Comparing auto insurance quotes for Marco’s Pizza delivery online will help ensure you don’t pay too much for coverage.

Frequently Asked Questions

Does Marco’s Pizza require commercial auto insurance for pizza delivery drivers?

Yes, Marco’s Pizza requires its delivery drivers to have commercial auto insurance if they use their personal vehicles for pizza delivery. This insurance ensures coverage for both personal and business use of the vehicle.

How much do Marco’s Pizza delivery drivers make on average per hour, and do they need specialized insurance?

Marco’s Pizza delivery drivers earn an average of around $15 per hour, including tips. They typically need specialized insurance like hired and non-owned auto insurance to cover liability while making deliveries with their personal vehicles.

Find your best auto insurance quotes by entering your ZIP code below into our free comparison tool.

What are the insurance requirements for Marco’s Pizza delivery drivers, and can they find cheap pizza delivery insurance?

Marco’s Pizza delivery drivers are required to have commercial auto insurance or hired and non-owned auto insurance to cover liability while on the job. They can find affordable insurance options by comparing quotes from various providers specializing in pizza delivery coverage.

For additional details, explore our comprehensive resource titled “Best Commercial General Liability Insurance.”

Does Marco’s Pizza provide employees with an employee handbook, and what does it cover regarding insurance and benefits?

Yes, Marco’s Pizza provides an employee handbook that typically covers information about insurance options, including health benefits and possibly guidance on obtaining commercial auto insurance for delivery drivers.

How does hired and non-owned auto insurance for pizza delivery differ from commercial auto insurance, and which one is recommended for Marco’s Pizza drivers?

Hired and non-owned auto insurance covers liability when using personal vehicles for work-related purposes, such as pizza delivery. It’s recommended for Marco’s Pizza drivers who use their cars part-time for deliveries. Commercial auto insurance is more comprehensive and may be required for full-time delivery drivers.

What is the average cost of commercial auto insurance for pizza delivery drivers, and does Marco’s Pizza help cover this expense?

The cost of commercial auto insurance for pizza delivery drivers varies based on factors like location and driving history. Marco’s Pizza typically does not cover insurance costs directly but may provide guidance on finding affordable coverage.

To learn more, explore our comprehensive resource on commercial auto insurance titled “How Auto Insurance Companies Check Driving Records.”

Are there discounts available for Marco’s Pizza delivery drivers when purchasing auto insurance, and how can they qualify?

Yes, insurance providers often offer discounts for Marco’s Pizza delivery drivers, such as safe driving discounts or bundling policies. To qualify, drivers should maintain a clean driving record and explore available discounts through comparison shopping.

Does Marco’s Pizza require background checks or driving record checks for potential delivery drivers, and how do these affect insurance premiums?

Yes, Marco’s Pizza may conduct background checks and review driving records for prospective delivery drivers. A clean driving record can help qualify for lower insurance premiums, while infractions may result in higher rates.

What are the coverage limits typically recommended for Marco’s Pizza delivery drivers under commercial auto insurance policies?

Marco’s Pizza delivery drivers should consider coverage limits that meet state requirements for liability insurance and include sufficient coverage for vehicle damage and medical expenses in case of accidents. Insurance experts recommend discussing specific coverage needs with providers.

To delve deeper, refer to our in-depth report titled “Best Property Damage Liability (PDL) Auto Insurance Companies.”

Can Marco’s Pizza delivery drivers use personal auto insurance for pizza delivery, or is commercial insurance mandatory?

Personal auto insurance typically excludes coverage for commercial activities like pizza delivery. Marco’s Pizza delivery drivers are generally required to obtain commercial auto insurance or a hired and non-owned auto insurance policy to ensure adequate coverage while on delivery routes.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.