Best Auto Insurance for Seniors in South Carolina (Your Guide to the Top 9 Companies for 2026)

Leading for best auto insurance for seniors in South Carolina are State Farm, Progressive, and Farmers. These companies are preferred among senior drivers in South Carolina for their personalized coverage and excellent customer support. SC senior car insurance rates start at $36/month with State Farm.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated October 2024

Company Facts

Full. Coverage for Seniors in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance for seniors in South Carolina includes State Farm, Progressive, and Farmers. These companies offer the best combination of affordable rates, starting at just $36 per month, and tailored coverage options.

State Farm stands out as the best auto insurance in South Carolina for seniors with comprehensive benefits and customer service, making it the top choice. Progressive offers competitive pricing with flexible policy options, while Farmers is known for its discounts and personalized coverage.

Our Top 9 Company Picks: Best Auto Insurance for Seniors in South Carolina

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 10% B Competitive Rates State Farm

#2 13% A+ Flexible Policies Progressive

#3 8% A Personalized Coverage Farmers

#4 12% A+ Strong Discounts Allstate

#5 10% A Broad Coverage Liberty Mutual

#6 12% A+ Robust Coverage Nationwide

#7 10% A+ Senior Coverage The Hartford

#8 8% A++ Financial Strength Travelers

#9 9% A Comprehensive Coverage American Family

Seniors looking for reliable, cost-effective South Carolina auto insurance should consider these providers. Start saving on your car insurance by entering your ZIP code above and comparing quotes.

- State Farm is the best auto insurance for seniors in SC starting at $36/month

- Progressive Snapshot UBI can help reduce SC senior auto insurance rates

- Safe drivers will get the cheapest senior car insurance in South Carolina

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers some of the lowest minimum coverage senior auto insurance rates in South Carolina, starting at just $36 per month. Get quotes in State Farm insurance review.

- Comprehensive Coverage: This provider provides robust options for comprehensive coverage, ensuring senior drivers in South Carolina are well-protected.

- Safe Driver Discounts: Seniors with safe driving habits can save up to 30% on senior auto insurance costs with State Farm.

Cons

- Limited Multi-Policy Discount: The 10% multi-policy discount offered by State Farm may not be as substantial as those provided by some competitors for auto insurance for seniors in South Carolina.

- Premium Costs: Despite low minimum coverage rates, auto insurance for seniors in South Carolina might find State Farm’s premiums higher for certain full coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Policies

Pros

- Snapshot Program: Seniors in South Carolina can benefit from Progressive’s Snapshot program, which rewards safe driving habits with further discounts.

- Flexible Payment Options: Progressive allows seniors in South Carolina to choose from flexible payment plans, easing the financial burden. Our Progressive review goes over this in more detail.

- Discount Opportunities: Progressive provides numerous senior auto insurance discounts in SC, making auto insurance more affordable with minimum coverage rates as low as $42/month.

Cons

- Higher Full Coverage Costs: Seniors in South Carolina might find that Progressive’s full coverage auto insurance rates, though competitive, can be higher than those of some other providers.

- Complex Discount Structure: Understanding and qualifying for all the discounts Progressive offers can be challenging for auto insurance for seniors in South Carolina.

#3 – Farmers: Best for Personalized Coverage

Pros

- Personalized Coverage: Farmers stands out for offering highly personalized auto insurance coverage for seniors in South Carolina, tailored to individual needs.

- Solid Financial Strength: With an A rating from A.M. Best, Farmers provides reliable financial stability for senior auto insurance in South Carolina. Take a look at our Farmers review to learn more.

- Ease of Use: Farmers’ user-friendly online tools and customer service make it easy for seniors in South Carolina to manage their auto insurance policies.

Cons

- Higher Minimum Coverage Rates: With minimum coverage starting at $68 per month, Farmers’ auto insurance for seniors in South Carolina rates are higher than some competitors.

- Limited Discounts: Farmers offers fewer discount opportunities compared to other companies, which might limit savings for seniors on their auto insurance in South Carolina.

#4 – Allstate: Best for Strong Discounts

Pros

- Strong Discounts: Allstate offers robust discount options that can significantly lower auto insurance costs for seniors in South Carolina, with minimum coverage starting at $54 per month.

- Safe Driving Bonus: Seniors in South Carolina can earn bonuses for safe driving, further reducing insurance costs. Read more about this provider in our Allstate auto insurance review.

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options, ensuring that auto insurance for seniors in South Carolina is a good protection they need.

Cons

- Premium Costs: Allstate’s full coverage rates, at $131 per month, may be higher than those offered by some other insurers for auto insurance for seniors in South Carolina.

- Customer Service Concerns: Some seniors in South Carolina might find Allstate’s customer service less responsive compared to other auto insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Broad Coverage

Pros

- Broad Coverage: Liberty Mutual excels in offering a wide array of coverage auto insurance options for seniors in South Carolina. Learn more in our Liberty Mutual review.

- New Car Replacement: Seniors in South Carolina can benefit from Liberty Mutual’s new auto insurance replacement program, which replaces a totaled car with a new one.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, preventing rate increases after the first accident, a valuable perk for auto insurance for seniors in South Carolina.

Cons

- Higher Minimum Coverage Costs: At $75 per month, Liberty Mutual’s minimum coverage rates for auto insurance for seniors in South Carolina are higher than many other providers.

- Average Multi-Policy Discount: The 10% multi-policy discount might not offer as much savings for auto insurance for seniors in South Carolina as some competing offers.

#6 – Nationwide: Best for Robust Coverage

Pros

- Robust Coverage: Nationwide offers extensive coverage options that are particularly well-suited for auto insurance for seniors in South Carolina, with minimum coverage starting at $48/month.

- Vanishing Deductible: Seniors in South Carolina can take advantage of Nationwide’s auto insurance vanishing deductible program, which lowers the deductible for each year of safe driving.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide ensures reliable financial backing for senior auto insurance in South Carolina. Get full ratings in our Nationwide review.

Cons

- Complex Discount Eligibility: Some seniors in South Carolina may find it difficult to qualify for all available auto insurance discounts with Nationwide.

- Higher Full Coverage Costs: Nationwide’s full coverage rates for auto insurance for seniors in South Carolina are slightly higher, potentially affecting budget-conscious drivers.

#7 – The Hartford: Best for Senior-Friendly Policies

Pros

- Senior-Friendly Policies: The Hartford is specifically tailored to meet the needs of seniors in South Carolina, with minimum auto insurance coverage starting at $55 per month.

- AARP Member Benefits: Seniors in South Carolina who are AARP members can enjoy exclusive auto insurance benefits and discounts with The Hartford. Get more info in The Hartford review.

- RecoverCare Program: The Hartford’s auto insurance RecoverCare program helps seniors in South Carolina with home services after an accident, adding a layer of support.

Cons

- Higher Premium Costs: The Hartford’s full coverage rates, at $135/month, might be higher than other options for auto insurance for seniors in South Carolina.

- Limited Availability: Some seniors in South Carolina may find The Hartford’s specialized auto insurance services available only through AARP membership, limiting access.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best Financial Strength

Pros

- Flexible Options: Travelers excels in offering flexible coverage options tailored to the needs of seniors in South Carolina, with minimum auto insurance coverage rates starting at $43 per month.

- Superior Financial Strength: With an A++ rating from A.M. Best, Travelers provides top-tier financial security for auto insurance for seniors in South Carolina. Read our Travelers company review.

- Optional Coverage Add-Ons: Auto insurance for seniors in South Carolina is customizable with various add-ons, such as gap coverage and accident forgiveness.

Cons

- Complex Policy Options: Some seniors in South Carolina might find Travelers’ auto insurance wide array of options overwhelming and difficult to navigate.

- Premium Costs: Though competitive, Travelers’ full coverage rates might be higher than expected for auto insurance for seniors in South Carolina.

#9 – American Family: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: American Family offers extensive coverage options for auto insurance for seniors in South Carolina, with competitive minimum coverage rates starting at $50 per month.

- Generous Discounts: Seniors in South Carolina can take advantage of American Family’s various auto insurance discount programs. Find out more in our American Family review.

- Local Agents: American Family provides a personalized touch with local agents available throughout the whole auto insurance process for seniors in South Carolina.

Cons

- Premium Costs: The full coverage rate, at $117 per month, may be higher for auto insurance for seniors in South Carolina compared to some other options.

- Limited Online Tools: Some seniors in South Carolina may find American Family’s online tools less comprehensive than those offered by other auto insurance competitors.

Understanding Auto Insurance Rates for Seniors in South Carolina

The cost of auto insurance can vary significantly depending on whether one opts for minimum coverage or full coverage auto insurance. For seniors, understanding these differences and the offerings from each provider can lead to significant savings and better protection on the road.

South Carolina Senior Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $54 $131

American Family $50 $117

Erie $63 $150

Farmers $68 $163

Liberty Mutual $75 $181

Nationwide $48 $115

Progressive $42 $102

State Farm $36 $86

The Hartford $55 $135

Travelers $43 $102

Allstate, for example, offers minimum coverage at $54 per month and full coverage at $131 per month. While this might seem competitive, other options like State Farm provide a more affordable rate with minimum coverage costing just $36 per month and full coverage at $86.

However, State Farm’s lower rates might come with fewer perks compared to what Allstate offers, making it crucial for seniors to weigh the benefits against the costs. On the higher end of the spectrum, Liberty Mutual charges $75 for minimum coverage and $181 for full coverage, which is the most expensive among the listed providers.

Seniors might find this pricing steep, but Liberty Mutual could offer additional services or better customer support that justifies the higher rates. In contrast, Nationwide and Progressive offer some of the lowest rates, with Nationwide’s minimum coverage at $48 and Progressive’s at $42, making them appealing choices for budget-conscious seniors who still need reliable coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Senior Auto Insurance Requirements in South Carolina

Understanding the South Carolina minimum auto insurance requirements will ensure that senior drivers carry enough insurance to avoid fines and fees.

- Liability Coverage: This is the most basic coverage and is often required by law. It covers the costs if you are responsible for an accident, including property damage and medical expenses for the other party. While it’s the least expensive option, it provides minimal protection.

- Collision Coverage: Collision auto insurance coverage covers damage to your vehicle resulting from a collision with another car or object, regardless of who is at fault. It’s a valuable add-on for seniors who want to ensure their vehicle is protected in case of an accident.

- Comprehensive Coverage: Comprehensive coverage protects against non-collision-related damages such as theft, vandalism, natural disasters, or hitting an animal. This is ideal for those who want broad protection beyond just accidents.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial for protection if you are in an accident with a driver who has no insurance or insufficient coverage. It ensures that your expenses are covered even if the other driver cannot pay

Selecting the right combination of these coverage options can help ensure that seniors in South Carolina are adequately protected on the road while managing their insurance costs effectively.

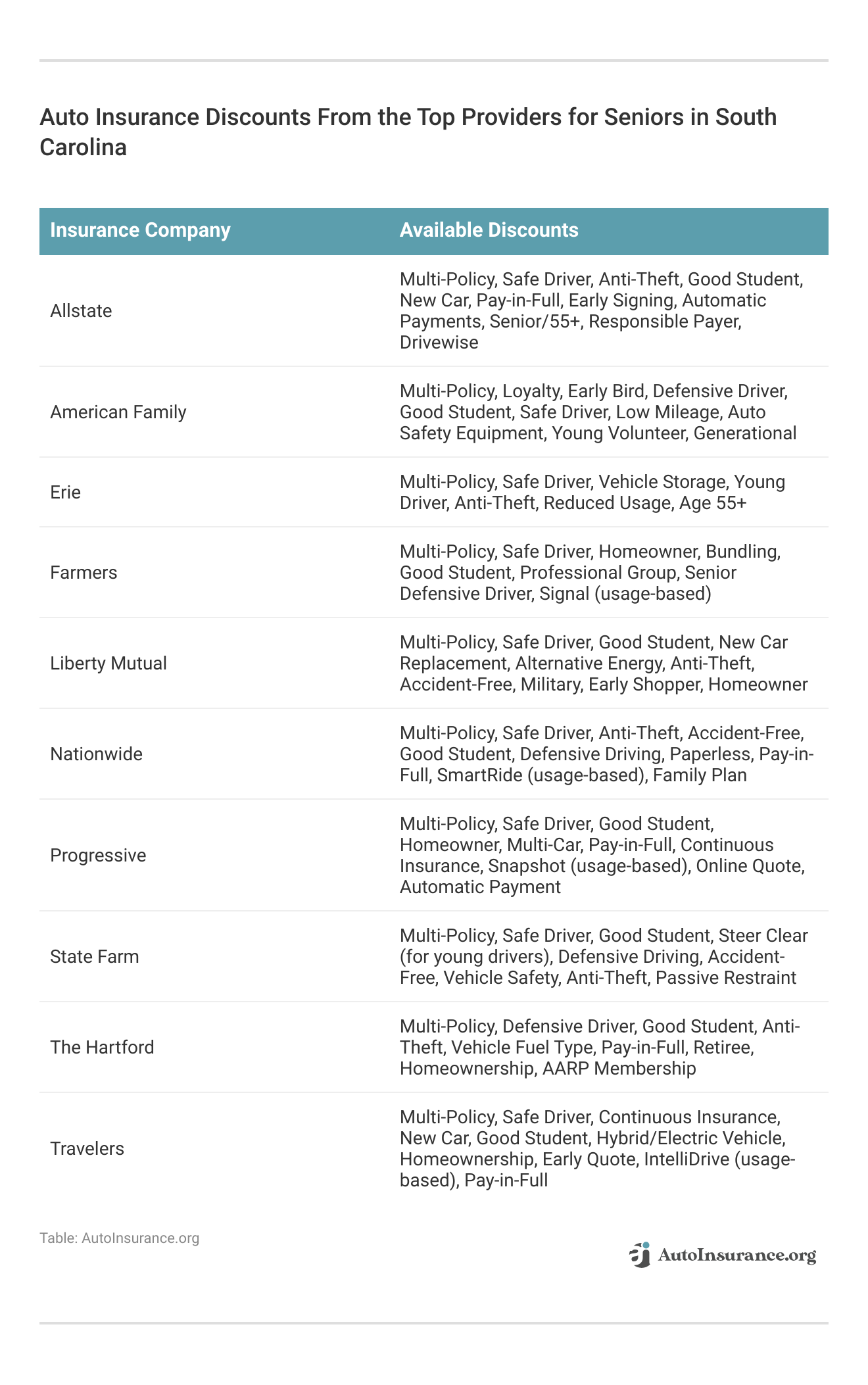

Senior Insurance Discount Opportunities in South Carolina

When it comes to auto insurance, seniors in South Carolina have access to a variety of discounts that can make a significant difference in their premiums. These discounts are designed to reward safe driving habits, loyalty, and other factors that contribute to lower risk.

These discounts are just the beginning. Many insurance companies offer even more ways to save, so it’s worth asking your provider about any available discounts that might apply to your situation. Make sure to discuss all available options with your insurance provider to ensure you’re getting the best possible rates.

How to Secure an Online Auto Insurance Quote

Getting and evaluating online auto insurance quotes is a simple and efficient way to save both time and money. Start by going to an insurance comparison website or the website of a particular insurer.

Typically, you’ll be asked to provide essential details, including your ZIP code, vehicle information, and personal details such as your age and driving history. This data helps insurers assess your risk profile and provide an accurate quote. Be prepared to answer questions about your driving habits, vehicle usage, and any prior claims or accidents.

Once you’ve entered all the necessary information, the system will generate a list of quotes from various companies. Review these quotes carefully, paying attention to coverage options, deductibles, and overall costs. If you have specific requirements or need additional coverage, you can often customize your senior insurance quotes to reflect these needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Seniors in South Carolina Saved on Auto Insurance

Finding the best senior auto insurance in South Carolina can make a significant difference in both cost and coverage. Below are real-world examples of how different seniors save money on SC car insurance and get the protection they need.

- Case Study #1 – Retirement Bliss With State Farm: A 67-year-old retiree switched to State Farm and saw her premiums drop by 20% while gaining personalized coverage tailored to her limited driving habits.

- Case Study #2 – Progressive Savings for a Senior Traveler: A 72-year-old senior who frequently travels opted for Progressive and saved $10 monthly by bundling his auto insurance with his RV coverage.

- Case Study #3 – Farmers’ Personalized Approach: After reviewing his policy with Farmers, a 75-year-old driver reduced his premium by 15% by adding usage-based insurance, which better matched his low-mileage driving.

- Case Study #4 – Allstate’s Strong Discounts for Low-Mileage Drivers: An 80-year-old widow reduced her insurance costs by 25% with Allstate by taking advantage of discounts for her minimal driving and safe driving history.

- Case Study #5 – Liberty Mutual’s Comprehensive Coverage for Peace of Mind: A 68-year-old former teacher chose Liberty Mutual, where she secured broad coverage and saved $17 monthly by applying for senior discounts and good driver auto insurance discount rewards.

These case studies demonstrate the importance of shopping around and tailoring auto insurance to meet individual needs. Seniors in South Carolina have multiple options to explore, and by comparing rates and taking advantage of discounts, they can achieve substantial savings.

Choosing the Best Auto Insurance for Seniors in South Carolina

Selecting the best auto insurance for seniors in South Carolina requires careful consideration of both cost and coverage. While best auto insurance companies like State Farm, Progressive, and Farmers offer affordable rates, it’s important to evaluate the specific benefits each company provides.

State Farm offers the best overall value for seniors in South Carolina, with rates starting as low as $36 per month and exceptional customer service.Daniel Walker Licensed Auto Insurance Agent

Don’t forget to explore available discounts that can further reduce your premium. By taking the time to research and compare, you can secure a policy that offers both savings and comprehensive protection.

Comparing multiple quotes ensures you receive the best value for your money. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Who has the best South Carolina auto insurance for senior citizens?

State Farm stands out for its comprehensive benefits and customer service, making it the top choice for senior auto insurance.

How is South Carolina senior auto insurance calculated?

Insurance premiums depend on a variety of factors, including the type of coverage being purchased by the auto insurance policyholder, the age of the policyholder, where the policyholder lives, and the claim history of the policyholder.

Which South Carolina insurance companies are best for senior citizens?

State Farm stands out for its comprehensive benefits and customer service, making it the top choice for senior auto insurance. Enter your ZIP code below to find out if you can get a better deal.

What is the cheapest auto insurance in South Carolina?

State Farm offers the best and cheapest overall value for seniors in South Carolina, with rates starting as low as $36 per month and exceptional customer service.

What is the minimum auto insurance required in South Carolina?

Drivers are required to comply the minimum auto insurance requirements by state, which isliability and uninsured motorist coverage with $25,000 bodily injury per person, $50,000 bodily injury per accident, and $25,000 property damage per accident in South Carolina.

What is the average cost of auto insurance in South Carolina?

In South Carolina, car insurance costs an average of $47 monthly for minimum coverage and $150 for full coverage. These rates are notably lower than the average cost of car insurance in the U.S., which stands at $53 per month for minimum coverage and $194 for full coverage.

Which type of insurance is best for old cars in South Carolina?

If your vehicle is older and is not worth as much, you may be able to reduce your insurance premium by avoiding comprehensive and collision coverage. However, if you have a loan on the vehicle or drive a leased vehicle, you may be required to have comprehensive coverage.

Is auo insurance cheaper in North Carolina or South Carolina?

Yes, car insurance in North Carolina is cheaper than in South Carolina. North Carolina car insurance rates are an average of $81 per month cheaper than South Carolina, in part because North Carolina is typically less risky for drivers due to a lower rate of car accidents and weather-related vehicle damage.

Learn more: Best North Carolina Auto Insurance (Check Out the Top 10 Companies)

Why is car insurance so expensive in South Carolina?

Car insurance in South Carolina is expensive because drivers are required to have personal injury protection and some drivers can legally drive uninsured if they pay a fee to the state. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Which type of vehicle insurance is best?

The top five types of car insurance coverage are third-party liability only cover, own damage cover, personal accident cover, uninsured motorist protection, and comprehensive car insurance.

Which is the most expensive form of auto insurance in South Carolina?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.