Best Auto Insurance After a DUI in Pennsylvania (Check Out These 9 Companies for 2026)

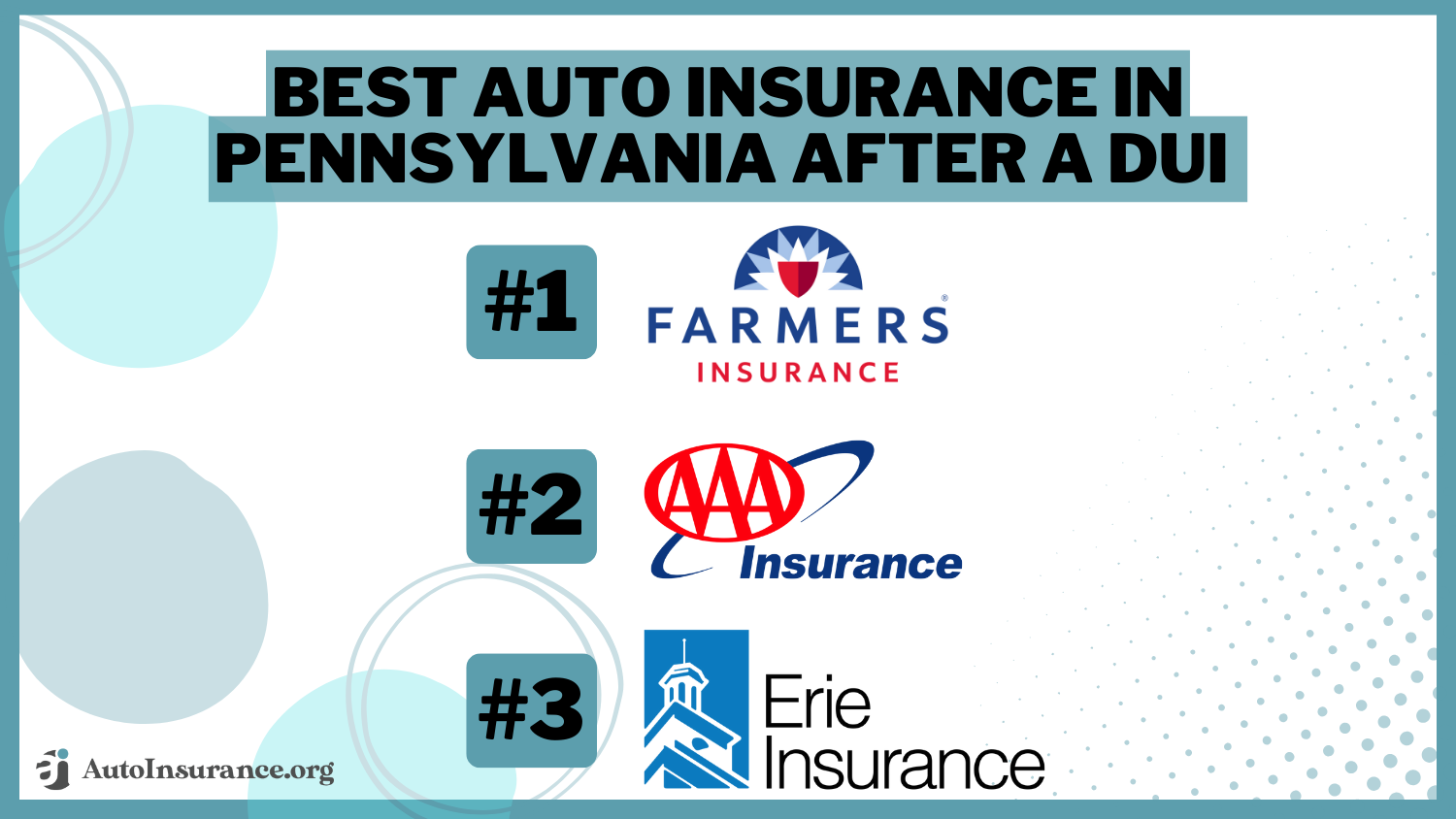

The top picks for best auto insurance after a DUI in Pennsylvania are Farmers, AAA, and Erie. Farmers offers minimum rates starting at $25/month and the most discounts for affordable DUI insurance in Pennsylvania. AAA members pay $57/month for DUI auto insurance but get free perks like roadside assistance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated December 2024

Company Facts

Full Coverage After a DUI in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance after a DUI in Pennsylvania includes top picks like Farmers, AAA, and Erie. Farmers stands out with minimum rates starting at $25/month.

This article highlights these providers as the best choices for DUI insurance in Pennsylvania for competitive rates, extensive coverage options, and additional benefits like defensive driver auto insurance discounts.

Our Top 9 Company Picks: Best Auto Insurance in Pennsylvania After a DUI

Company Rank Defensive Driving Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 10% A Youth Discounts Farmers

#2 15% A Coverage Options AAA

#3 12% A+ Cost Savings Erie

#4 18% A+ Loyalty Discounts Progressive

#5 17% A+ Dividend Payments Amica Mutual

#6 13% B High-Value Vehicles State Farm

#7 16% A Add-on Coverages Liberty Mutual

#8 11% A+ Filing Claims The Hartford

#9 19% A++ Personalized Policies USAA

By choosing Farmers, AAA, or Erie, drivers with DUIs can ensure they receive quality Pennsylvania car insurance. If you’re looking for coverage to drive legally, enter your ZIP code to compare cheap DUI auto insurance quotes near you.

- These providers provide affordable DUI insurance in Pennsylvania

- Farmers is the top pick for auto insurance in Pennsylvania after a DUI

- AAA has the best coverage options for Pennsylvania DUI insurance

#1 – Farmers: Top Overall Pick

Pros

- Youth Discounts: Farmers offers tailored discounts for younger drivers in Pennsylvania to help reduce insurance costs after a DUI. Find out more in our Farmers review.

- Low Entry-Level Rates: Farmers provides an impressive starting rate of $25/month for minimum coverage auto insurance after a DUI in Pennsylvania.

- Flexible Policy Structures: Farmers offers flexible policy options that can be tailored to adjust DUI insurance coverage as needed, specifically for those in Pennsylvania after a DUI.

Cons

- Potential for Rate Fluctuations: DUI auto insurance rates might fluctuate more than expected in Pennsylvania, even with initial low rates.

- Geographic Rate Variability: Discount and rate availability can vary widely across Pennsylvania, potentially limiting benefits for some drivers after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best for Coverage Options

Pros

- Broad Coverage Range: AAA offers Pennsylvania drivers with a DUI various coverage options to suit their needs, which you can learn about in our AAA review.

- Exclusive Membership Benefits: AAA members in Pennsylvania after a DUI gain extra benefits, including travel services and roadside assistance.

- Discounts for Safe Driving: AAA’s focus on safe driving discounts can help Pennsylvania drivers with a DUI reduce their overall insurance costs.

Cons

- Higher Overall Premiums: The broad coverage range may result in higher overall DUI insurance rates in Pennsylvania, despite potential discounts.

- Membership Costs: Access to AAA auto insurance benefits requires membership, which adds an extra cost for drivers in Pennsylvania after a DUI.

#3 – Erie: Best for Cost Savings

Pros

- Exceptional Savings on Full Coverage: Erie’s full coverage plans start at just $107/month, providing significant cost savings on Pennsylvania DUI insurance.

- Innovative Discount Programs: Erie’s discounts for safe drivers and multi-policy holders can help Pennsylvania drivers save on DUI insurance costs. For a complete list, read our Erie review.

- Local Expertise and Support: Erie’s strong presence in Pennsylvania means they offer tailored support and local expertise to assist drivers after a DUI.

Cons

- Limited Customization Options: Erie coverage options might be less customizable than other DUI insurance companies in Pennsylvania.

- Renewal Rate Hikes: Despite initial savings, drivers with a DUI might face substantial Pennsylvania car insurance rate increases.

#4 – Progressive: Best for Loyalty Discounts

Pros

- Rewarding Loyalty With Lower Rates: Progressive’s loyalty discounts are designed to reward long-term policyholders, which can benefit Pennsylvania drivers after a DUI who stick with the insurer.

- Adaptable Coverage Plans: Progressive offers flexible coverage plans that suit Pennsylvania drivers with a DUI. Read more in our review of Progressive.

- Bundling Savings: Progressive’s bundling options provide substantial savings when combining multiple insurance types, helping Pennsylvania drivers manage DUI insurance costs.

Cons

- Higher Initial Costs: Drivers with a DUI might face higher initial rates before benefiting from loyalty discounts in Pennsylvania.

- Complex Discount System: Navigating and optimizing savings can be particularly challenging for drivers in Pennsylvania after a DUI due to the complexity of Progressive’s discount system.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Amica: Best for Dividend Payments

Pros

- Additional Earnings: Amica’s dividend payments provide a unique opportunity for extra savings, which can be beneficial for Pennsylvania drivers dealing with a DUI.

- High Satisfaction Ratings: Amica’s top customer satisfaction ratings offer peace of mind for Pennsylvania drivers dealing with DUI insurance, which you can check out in our Amica review.

- Robust Coverage Options: Extensive coverage options cater well to the diverse needs of drivers with a DUI in Pennsylvania, providing comprehensive protection.

Cons

- Higher Initial Costs: Drivers with a DUI in Pennsylvania might face higher premiums upfront, potentially diminishing the benefits of dividend payments.

- Dividend Eligibility Complexity: The process for qualifying for dividends can be complex, which may be challenging for drivers with a DUI in Pennsylvania to navigate.

#6 – State Farm: Best for High-Value Vehicles

Pros

- Specialized Coverage for High-Value Assets: State Farm’s specialized coverage for high-value vehicles is particularly beneficial for Pennsylvania drivers with a DUI who own expensive cars.

- Full Coverage Rates: State Farm provides full coverage starting at $83/month, ideal for Pennsylvania drivers needing insurance post-DUI. Read our State Farm review to learn what else is offered.

- Extensive Agent Network: State Farm’s wide network of agents offers personalized assistance, which is especially valuable for Pennsylvania drivers navigating insurance challenges after a DUI.

Cons

- Rate Increases for High-Value Vehicles: Coverage for high-value vehicles might result in higher premiums for drivers with a DUI in Pennsylvania.

- Limited Discount Opportunities: Fewer discount options for DUI drivers in Pennsylvania compared to some other insurers.

#7 – Liberty Mutual: Best for Add-on Coverages

Pros

- Variety of Add-On Options: Liberty Mutual offers Pennsylvania drivers customizable DUI add-on coverages for their insurance, which you can read more about in our review of Liberty Mutual.

- Significant Savings through Bundling: Offers substantial savings for bundling auto with home or other types of insurance, helping Pennsylvania drivers manage expenses after a DUI.

- Flexible Policy Adjustments: The flexibility in Liberty Mutual’s policy options enables drivers in Pennsylvania to tailor their coverage to their unique needs post-DUI.

Cons

- Increased Costs for Add-Ons: Adding extra coverages may result in higher premiums, which could be a burden for drivers with a DUI in Pennsylvania.

- Complex Coverage Selection: Choosing the most affordable DUI coverage can be difficult due to the overwhelming variety of add-on options, especially in Pennsylvania after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Filing Claims

Pros

- Streamlined Claims Process: The Hartford’s efficient and streamlined claims process offers valuable support to Pennsylvania drivers dealing with DUI insurance claims.

- Extensive Claims Support: Provides comprehensive support and resources for managing claims, which is beneficial for Pennsylvania drivers navigating post-DUI insurance issues.

- Customizable Coverage Options: Offers customizable policies that cater specifically to auto insurance in Pennsylvania after a DUI. Read our The Hartford review for a full list.

Cons

- Elevated Premiums: DUI insurance premiums may be higher for drivers in Pennsylvania

- Limited Discount Programs: The Hartford may offer fewer discount opportunities compared to other insurers for drivers with a DUI in Pennsylvania.

#9 – USAA: Best for Personalized Policies

Pros

- Highly Customized Policies: USAA provides DUI policies in Pennsylvania that are customized to fit individual requirements. Learn more in our USAA review.

- Affordable Base Rates: Recognized for affordable DUI car insurance rates beginning at $25 per month in Pennsylvania after a DUI.

- Member-Only Benefits: USAA provides unique benefits for military families, including extra support with DUI insurance, particularly relevant for situations like a DUI in Pennsylvania.

Cons

- Restricted Membership Eligibility: Coverage is limited to military members and their families, potentially excluding some Pennsylvania drivers after a DUI.

- Regional Discrepancies: The availability of policies and benefits may vary by city, impacting auto insurance in Pennsylvania after a DUI

Affordable DUI Auto Insurance in Pennsylvania

Discover which companies offer cheap high-risk auto insurance in Pennsylvania and explore various discounts that could lower your premiums.

DUI Auto Insurance Monthly Rates in Pennsylvania by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $57 | $148 |

| Amica Mutual | $86 | $283 |

| Erie | $42 | $107 |

| Farmers | $61 | $182 |

| Liberty Mutual | $90 | $270 |

| Progressive | $56 | $168 |

| State Farm | $28 | $83 |

| The Hartford | $65 | $167 |

| USAA | $25 | $75 |

For minimum coverage, USAA offers the lowest rate at $25/month, while State Farm provides the cheapest full coverage at $83/month. Rates for full coverage vary, with Amica Mutual at $283 and Erie at $107.

Factors Influencing Auto Insurance Rates in Pennsylvania After a DUI

Several key factors will impact your insurance rates after a DUI. This includes meeting the Pennsylvania minimum auto insurance requirements, along with your overall driving record and more:

- DUI Conviction Severity: The impact of the DUI on rates depends on whether it’s a first-time or repeat offense and its legal consequences.

- Insurance Provider Policies: Different insurers have varying risk assessments and pricing strategies, which can lead to significant rate differences.

- Vehicle Type and Usage: The make and model of your vehicle, as well as how frequently and for what purposes you use it, can influence your insurance costs.

- Available Discounts: Discounts for completing DUI education programs, maintaining a good driving record, or bundling policies can help lower your premiums.

By being aware of these key factors, you can better manage your DUI auto insurance premiums and explore options for better rates. Understand that a DUI increases premiums due to higher perceived risk.

Shop around for quotes, as different insurers may offer varying rates. Consider enrolling in a DUI education program, which can sometimes reduce premiums. (Check out our ranking: Best States for Affordable DUI Auto Insurance.)

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

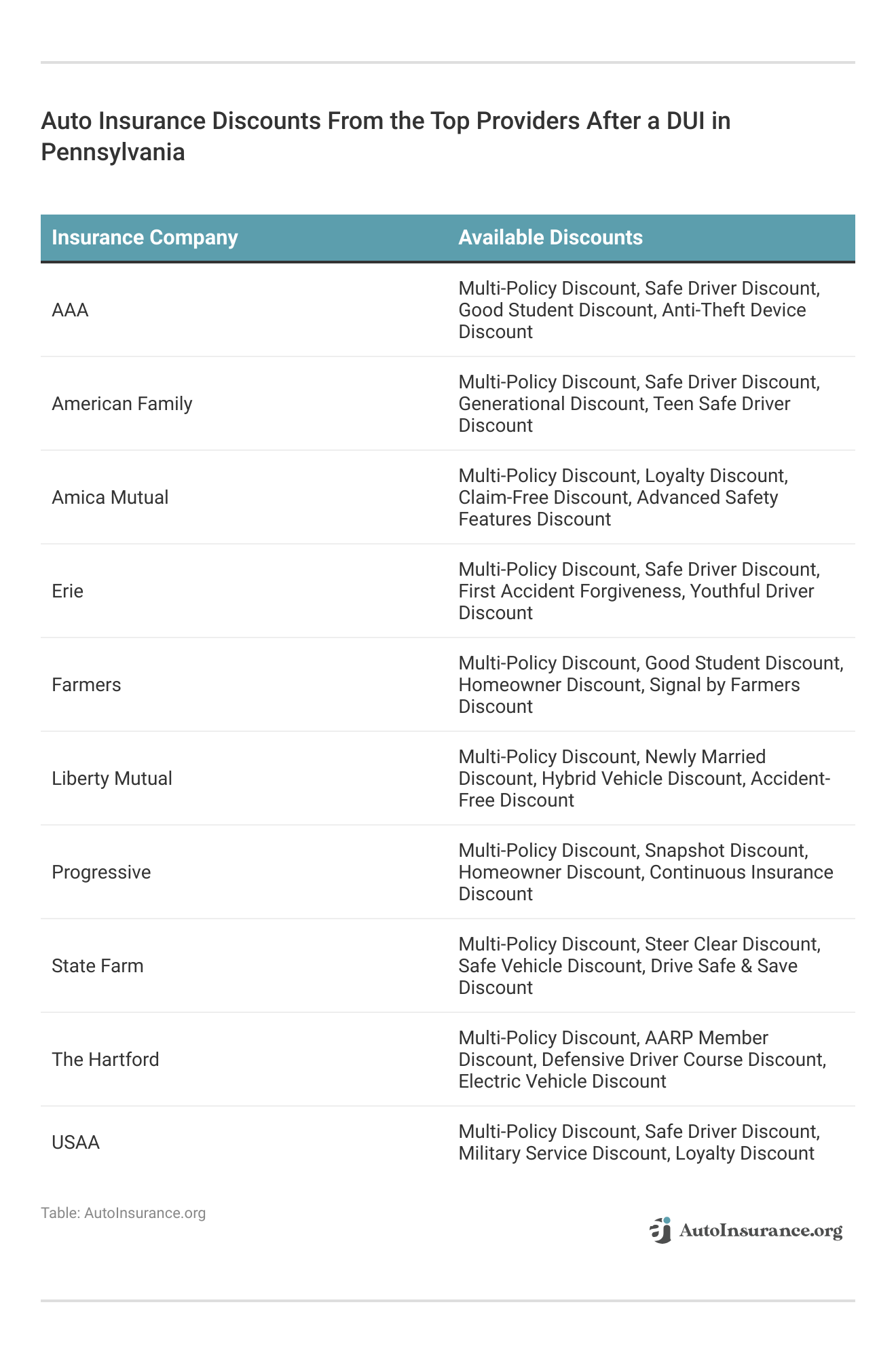

Reducing Auto Insurance Costs in Pennsylvania After a DUI

Securing affordable auto insurance in Pennsylvania following a DUI can be challenging, but employing the right strategies can help manage costs. Start by comparing multiple insurers to find the most competitive rates, discounts, and policy options.

Take advantage of auto insurance discounts after a DUI in Pennsylvania, such as those for bundling policies, completing defensive driving courses, or maintaining a clean driving record.

Farmers is the top choice for DUI insurance in Pennsylvania, providing plenty of discounts and value-driven options tailored to high-risk drivers.Daniel Walker Licensed Auto Insurance Agent

This table highlights key discounts offered by leading companies, including multi-policy, safe driver, and good student discounts.

Compare options from Farmers, AAA, Erie, and others to find the best DUI auto insurance in Pennsylvania. Additionally, consider adjusting your coverage levels to match your needs and budget despite a DUI conviction.

By comparing rates and leveraging available discounts, you can secure the best DUI auto insurance in Pennsylvania. Start by comparing options from top insurers and take advantage of discounts to save on your monthly premiums.

Case Studies: Finding Affordable DUI Insurance in Pennsylvania

Let’s examine three real-life case studies to illustrate how drivers can successfully find affordable auto insurance after a DUI:

- Case Study #1 – Finding Affordable Coverage: John, 35, from Pittsburgh, sought cheap car insurance after a DUI. Farmers provided competitive rates, allowing him to get comprehensive coverage within his budget while benefiting from discounts for his previous clean driving record.

- Case Study #2 – Maximizing Coverage Options: Lisa, 28, from Harrisburg, seeks a comprehensive insurance policy with extras like roadside assistance. She chooses AAA for its extensive coverage options, appreciating the added benefits despite the higher cost.

- Case Study #3 – Leveraging Discounts: Mike, 45, from Philadelphia, seeks cost-effective auto insurance following a DUI. Erie’s low rates and additional discounts help him secure comprehensive coverage while minimizing expenses.

Facing a DUI conviction can significantly impact your auto insurance rates and options. In Pennsylvania, a DUI typically leads to much higher premiums, and some insurers may not renew your policy.

Smart Strategies for Affordable Auto Insurance in Pennsylvania After a DUI

Insurance providers like Farmers, AAA, and Erie are notable for their competitive rates and comprehensive coverage. Whether it’s adjusting your coverage or seeking out discounts, these Pennsylvania auto insurance companies offer the most favorable insurance terms after a DUI.

Farmers stands out for its exceptional affordability and comprehensive coverage for drivers in Pennsylvania dealing with the aftermath of a DUI.Michelle Robbins Licensed Insurance Agent

Farmers, for instance, offers affordable rates starting at $25 per month, while Erie provides full coverage starting at $107 per month. AAA is known for its extensive coverage options.

Despite the higher costs associated with a DUI conviction, there are ways to mitigate expenses. Taking advantage of discounts, such as those for bundling policies or completing defensive driving courses, can help reduce premiums.

Comparing quotes from multiple insurers is the easiest way to get the best auto insurance in Pennsylvania after a DUI. Enter your ZIP code to start comparing Pennsylvania car insurance quotes for free.

Frequently Asked Questions

How much does your insurance go up after a DUI in Pennsylvania?

On average, DUI offenders have to pay 109% more than drivers with a clean record. While the average annual auto insurance rate in Pennsylvania is around $1,500, the average annual rate for DUI offenders is around $3,000.

How long does DUI stay on insurance in Pennsylvania?

A DUI conviction has the ability to affect your insurance rates for at least three years or if not more. Once your insurance company finds out that you have been convicted of a DUI, there are several possible outcomes with your existing insurance policy.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

What is full coverage auto insurance in Pennsylvania?

Full coverage auto insurance in Pennsylvania is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $15,000 in bodily injury coverage per person, up to $30,000 per accident, and $5,000 in property damage coverage.

How long does a DUI stay on your background check in Pennsylvania?

A DUI conviction remains on your driving record in Pennsylvania for 10 years. However, it may impact your insurance rates and job prospects beyond that period. The record may be visible to potential employers, particularly if a background check is conducted.

How do you get a DUI off your driving record in Pennsylvania?

In Pennsylvania, you cannot completely remove a DUI from your driving record. Do auto insurance companies check police records? Yes, but you may be able to have the conviction expunged if you meet certain conditions. This typically involves waiting for a certain period and demonstrating good behavior since the conviction.

How much does it cost to expunge a DUI in Pennsylvania?

Expunging a DUI conviction in Pennsylvania can cost between $500 and $2,000. The cost varies depending on factors like legal fees and court costs. It’s recommended to consult with a lawyer to get an accurate estimate based on your specific case.

How do you clean your driving record in Pennsylvania?

Pennsylvania does not allow a person to remove convictions or notations of suspensions from a Pennsylvania driving record. (Learn More: How Auto Insurance Companies Check Driving Records.)

What is the 5-day rule for DUI in Pennsylvania?

The 5-day rule in Pennsylvania requires that you request a formal hearing with the Pennsylvania Department of Transportation (PennDOT) within 5 days of receiving a notice of suspension or revocation of your driver’s license. Failing to do so may result in an automatic suspension without a hearing.

How do you beat a DUI in Pennsylvania?

Beating a DUI charge in Pennsylvania involves several strategies, including challenging the legality of the traffic stop, the accuracy of breathalyzer or blood test results, and the procedures followed during arrest. It’s essential to work with an experienced DUI attorney to explore these options and build a strong defense.

How do I get my license back after a DUI in Pennsylvania?

To get your license back after a DUI in Pennsylvania, you must complete all the requirements set by PennDOT, which may include serving a suspension period, attending DUI programs, and paying reinstatement fees. You’ll also need to provide proof of insurance and possibly complete additional requirements like a substance abuse evaluation. (Read More: Does a suspended license affect auto insurance rates?)

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.