Best Kia Sorento Auto Insurance in 2026 (Find the Top 10 Companies Here)

Best Kia Sorento auto insurance providers, including State Farm, AAA, and USAA, offer rates starting at $41 per month. These companies are renowned for their competitive pricing and comprehensive coverage options. Explore these options for the best Kia Sorento car insurance to meet your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated August 2025

Company Facts

Full Coverage for Kia Sorento

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kia Sorento

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kia Sorento

A.M. Best Rating

Complaint Level

Pros & Cons

When looking for the best Kia Sorento auto insurance, State Farm, AAA, and USAA offer the most competitive rates starting at $41 per month. State Farm excels as the top pick overall, providing comprehensive coverage and excellent service. Explore why is Kia Sorento a good car for affordable insurance.

The article also covers how to choose an auto insurance company by evaluating essential factors like coverage options, rates, and customer service. It provides insights into comparing insurance providers to ensure you select the best plan tailored to your needs and budget.

Our Top 10 Company Picks: Best Kia Sorento Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 12% B Many Discounts State Farm

#2 15% A Local Agents AAA

#3 17% A++ Military Savings USAA

#4 10% A+ Add-on Coverages Allstate

#5 18% A++ Cheap Rates Geico

#6 14% A+ Online Convenience Progressive

#7 13% A++ Accident Forgiveness Travelers

#8 16% A+ Usage Discount Nationwide

#9 11% A Online App Farmers

#10 19% A Customizable Polices Liberty Mutual

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

- Tailored coverage meets specific Kia Sorento needs

- State Farm is the top pick for its comprehensive and affordable coverage

- Discounts available for safe driving and multi-policy bundling

#1 – State Farm: Top Overall Pick

Pros

- Competitive Pricing: State Farm offers a competitive rate of $122 per month for Kia Sorento insurance, which is lower than many other providers. This makes it a cost-effective option for those seeking affordable coverage.

- Strong Coverage Options: State Farm provides comprehensive coverage options for Kia Sorento owners, including liability, collision, and comprehensive coverage, ensuring robust protection against various risks.

- Discount Opportunities: As mentioned in our State Farm auto insurance review, State Farm offers multiple discounts that can reduce your Kia Sorento insurance premiums, such as safe driver discounts and multi-policy savings, making it easier to save on your monthly rates.

Cons

- Limited Advanced Safety Feature Discounts: While State Farm offers discounts for standard safety features, it may not offer significant savings for advanced safety technologies installed in newer Kia Sorento models.

- Customer Service Concerns: Some policyholders report challenges with State Farm’s customer service, which may affect the ease of managing claims or inquiries related to Kia Sorento insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best for Local Agents

Pros

- Comprehensive Coverage Plans: AAA provides extensive coverage plans for the Kia Sorento, including additional protection options like roadside assistance and rental car reimbursement, enhancing overall policy value.

- Member Discounts: AAA members can access exclusive discounts on Kia Sorento insurance premiums, which can significantly lower costs compared to non-member rates.

- Strong Roadside Assistance: AAA’s renowned roadside assistance is a major benefit for Kia Sorento owners, providing peace of mind with services such as towing and emergency fuel delivery.

Cons

- Higher Monthly Premiums: At $150 per month, AAA’s insurance rates for the Kia Sorento are higher compared to some other providers, which might not be ideal for budget-conscious drivers.

- Limited Availability of Discounts: AAA may offer fewer discount opportunities compared to other insurers, potentially limiting ways to reduce insurance costs for Kia Sorento owners.

#3 – USAA: Best for Military Savings

Pros

- Excellent Coverage: As outlined in our USAA auto insurance review, USAA provides top-tier coverage options for Kia Sorento owners, including comprehensive and collision coverage, ensuring robust protection against a wide range of incidents.

- Competitive Rates for Military Families: USAA’s rates, though higher at $180 per month, often come with additional benefits and discounts for military families, offering value through specialized coverage.

- High Customer Satisfaction: USAA is known for its exceptional customer service and high satisfaction rates, which can enhance the insurance experience for Kia Sorento owners through responsive support and efficient claims handling.

Cons

- Higher Premiums: The $180 monthly premium for Kia Sorento insurance is on the higher side compared to competitors, which might not be ideal for those looking to save on insurance costs.

- Limited Eligibility: USAA’s coverage is exclusively available to military members and their families, which may exclude many Kia Sorento owners from accessing its benefits.

#4 – Allstate: Best for Add-on Coverages

Pros

- Affordable Rates: As mentioned in our Allstate auto insurance review, Allstate offers a competitive monthly rate of $105 for Kia Sorento insurance, making it one of the more affordable options available in the market.

- Broad Coverage Options: Allstate provides comprehensive coverage options for Kia Sorento, including liability, collision, and comprehensive, ensuring that various risks are well covered.

- Discount Programs: Allstate’s various discount programs, such as safe driver and multi-car discounts, can further reduce the cost of Kia Sorento insurance, making it a budget-friendly choice.

Cons

- Limited Advanced Safety Feature Discounts: Allstate’s discounts for advanced safety features in newer Kia Sorento models may not be as substantial as those offered by some other providers.

- Customer Service Issues: Some customers report less satisfactory experiences with Allstate’s customer service, which might affect the overall ease of managing a Kia Sorento insurance policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Cheap Rates

Pros

- Wide Range of Coverage Options: Geico offers a comprehensive range of coverage options for Kia Sorento, including liability, collision, and comprehensive insurance, ensuring extensive protection for various scenarios.

- Discounts for Safe Drivers: As mentioned in our Geico auto insurance review, Geico provides significant discounts for safe drivers, which can help reduce the $164 monthly premium for Kia Sorento insurance, particularly beneficial for those with clean driving records.

- Convenient Online Services: Geico’s user-friendly online platform allows Kia Sorento owners to easily manage their policies, file claims, and access customer support, enhancing overall convenience.

Cons

- Higher Monthly Costs: At $164 per month, Geico’s insurance rates for the Kia Sorento are higher compared to some other providers, which might be a concern for those seeking lower premiums.

- Limited Local Agent Support: Geico’s emphasis on online services may result in limited availability of local agents, potentially affecting the personalized support for Kia Sorento insurance policyholders.

#6 – Progressive: Best for Online Convenience

Pros

- Flexible Coverage Options: Progressive offers a range of flexible coverage options for the Kia Sorento, including liability, collision, and comprehensive insurance, allowing policyholders to tailor their coverage to their needs.

- Discounts for Bundling: As mentioned in Progressive auto insurance review, Progressive provides discounts for bundling Kia Sorento insurance with other policies, such as home or renters insurance, which can lead to significant savings on overall premiums.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving behavior with potential discounts, making it a valuable option for Kia Sorento owners who maintain a clean driving record.

Cons

- Moderate Premiums: The $148 monthly premium for Kia Sorento insurance is moderate and may be higher compared to some budget-focused competitors, which could be a drawback for cost-conscious drivers.

- Customer Service Variability: Progressive’s customer service experiences can vary, and some policyholders may find inconsistencies in service quality when managing Kia Sorento insurance.

#7 – Travelers: Best for Accident Forgiveness

Pros

- Comprehensive Coverage: Travelers provides extensive coverage options for Kia Sorento, including liability, collision, and comprehensive insurance, ensuring broad protection against various risks.

- Discounts for Safety Features: Travelers auto insurance review highlights their discounts for advanced safety features installed in newer Kia Sorento models, which can help reduce the $159 monthly premium.

- Strong Financial Stability: Travelers is known for its financial stability, which can be reassuring for Kia Sorento owners seeking reliable and dependable insurance coverage.

Cons

- Higher Premiums: At $159 per month, Travelers’ insurance rates for Kia Sorento are higher than some competitors, which might not be the best option for those looking to minimize their insurance expenses.

- Limited Local Agent Network: Travelers may have a more limited local agent network compared to other insurers, which could affect the availability of personalized support for Kia Sorento insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Usage Discount

Pros

- Wide Range of Coverage Options: In our Nationwide auto insurance review, Nationwide offers extensive coverage options for Kia Sorento owners, including accident forgiveness and vanishing deductibles, allowing for a customized policy to meet individual needs.

- Strong Financial Stability: With an A.M. Best rating of A+, Nationwide is financially robust, ensuring reliable claims handling and payouts, which is essential for Kia Sorento drivers seeking dependable coverage.

- Convenient Online Tools: Nationwide provides a variety of online tools and resources, including a mobile app for easy policy management, claims filing, and accessing insurance ID cards, enhancing convenience for Kia Sorento owners.

Cons

- Higher Average Premiums: Nationwide’s premiums tend to be higher than average, with an average cost of $250 per month, which may not be ideal for Kia Sorento owners looking for budget-friendly options.

- Limited Local Agents: While they have a national presence, the availability of local agents may be limited in some areas, potentially reducing personalized service for Kia Sorento drivers.

- Discount Availability: Although they offer many discounts, some of the more substantial savings opportunities might be less accessible compared to other providers, affecting affordability for Kia Sorento owners.

#9 – Farmers: Best for Online App

Pros

- Exceptional Customer Service: Farmers is renowned for its top-tier customer service, offering personalized support through local agents and 24/7 claims assistance, which is beneficial for Kia Sorento owners needing reliable support.

- Comprehensive Policy Options: Farmers provides a wide array of coverage options and add-ons for Kia Sorento, such as rideshare insurance and new car replacement, allowing for highly tailored policies.

- Discount Opportunities: Farmers offers a variety of discounts, including those for safe driving, multi-policy bundling, and vehicle safety features, helping to reduce the average cost of $183 per month for Kia Sorento owners. Learn more in page, Farmers auto insurance discounts.

Cons

- Higher Rates for High-Risk Drivers: Farmers tends to charge higher premiums for drivers with less-than-perfect records, making it a less attractive option for high-risk Kia Sorento drivers.

- Complex Discount Structures: The discount structures can be complex and may require significant documentation and verification to qualify, potentially complicating savings for Kia Sorento owners.

- Average Mobile App: Farmers’ mobile app has received mixed reviews, which could affect the overall convenience for Kia Sorento drivers seeking seamless digital interactions.

#10 – Liberty Mutual: Best for Customizable Polices

Pros

- Competitive Premiums: In our Liberty Mutual auto insurance review, Liberty Mutual offers competitive rates, with an average cost of $142 per month, making it an attractive option for Kia Sorento owners seeking affordable insurance.

- New Car Replacement: Liberty Mutual provides new car replacement coverage, which is beneficial for Kia Sorento drivers who want protection against significant depreciation in the event of a total loss.

- Extensive Discounts: Liberty Mutual offers a wide range of discounts, including those for bundling policies, safe driving, and specific vehicle safety features, helping Kia Sorento owners save on their premiums.

Cons

- Mixed Customer Satisfaction: While Liberty Mutual provides robust coverage options, customer satisfaction ratings can be inconsistent, potentially impacting the overall experience for Kia Sorento owners.

- Complex Claims Process: Some customers have reported a complicated claims process, which could be frustrating for Kia Sorento drivers needing swift resolution after an incident.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kia Sorento Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Kia Sorento from various providers.

Kia Sorento Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $47 $150

Allstate $34 $105

Farmers $60 $183

Geico $58 $164

Liberty Mutual $46 $142

Nationwide $82 $250

Progressive $49 $148

State Farm $41 $122

Travelers $52 $159

USAA $59 $180

Choosing the right insurance provider for your Kia Sorento can significantly impact your monthly premiums. Compare rates and coverage options to find the best fit for your budget and needs.

Kia Sorento Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $118 |

| Discount Rate | $69 |

| High Deductibles | $102 |

| High Risk Driver | $251 |

| Low Deductibles | $148 |

| Teen Driver | $431 |

Understanding the factors that influence Kia Sorento insurance rates can help you make informed decisions. Consider your risk profile and deductible preferences to secure the best possible rate for your situation.

Read More: Cheap Auto Insurance for Teens After an Accident

Why Kia Sorentos are Expensive to Insure

The chart below details how Kia Sorento insurance rates compare to other SUVs like the Acura RDX, GMC Yukon, and Dodge Durango.

Kia Sorento Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Acura RDX | $26 | $44 | $26 | $108 |

| Dodge Durango | $29 | $47 | $31 | $120 |

| GMC Terrain | $27 | $47 | $26 | $111 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| GMC Yukon XL | $30 | $47 | $31 | $121 |

| Nissan Armada | $26 | $45 | $28 | $110 |

Kia Sorento insurance costs can be higher than some other SUVs due to its comprehensive and collision coverage rates.

Comparing rates with similar vehicles helps identify the best options to manage your insurance expenses effectively.

Read More: Acura Auto Insurance

Factors Influencing the Cost of Kia Sorento Insurance

The Kia Sorento trim and model you choose can significantly impact the total price you will pay for auto insurance coverage. Higher trim levels with more advanced safety features and technology can lead to lower premiums, as they are often seen as less risky to insure.

However, models with powerful engines or sporty characteristics may result in higher insurance costs due to the increased potential for accidents and theft. Additionally, the vehicle’s age, mileage, and overall condition play a role in determining insurance rates.

Newer models typically cost more to insure because of their higher market value and the expense of repairs.Jeff Root LICENSED INSURANCE AGENT

On the other hand, older models might be cheaper to insure but could incur higher premiums if they lack modern safety features. Finally, your location, driving history, and credit score are also crucial factors that insurers consider when calculating your premium.

Read More: What is a good auto insurance score?

Age of the Vehicle

Older Kia Sorento models generally cost less to insure. For example, auto insurance for a 2020 Kia Sorento costs $118 while 2011 Kia Sorento insurance costs are $98, a difference of $19.

Kia Sorento Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Kia Sorento | $28 | $49 | $32 | $122 |

| 2023 Kia Sorento | $28 | $49 | $32 | $121 |

| 2022 Kia Sorento | $28 | $48 | $32 | $120 |

| 2021 Kia Sorento | $27 | $48 | $31 | $119 |

| 2020 Kia Sorento | $27 | $47 | $31 | $118 |

| 2019 Kia Sorento | $26 | $45 | $33 | $116 |

| 2018 Kia Sorento | $25 | $45 | $33 | $116 |

| 2017 Kia Sorento | $24 | $44 | $35 | $115 |

| 2016 Kia Sorento | $23 | $42 | $36 | $114 |

| 2015 Kia Sorento | $22 | $40 | $37 | $112 |

| 2014 Kia Sorento | $21 | $38 | $38 | $109 |

| 2013 Kia Sorento | $20 | $35 | $38 | $107 |

| 2012 Kia Sorento | $19 | $32 | $38 | $102 |

| 2011 Kia Sorento | $18 | $29 | $38 | $99 |

Insurance costs for Kia Sorento models tend to decrease with the vehicle’s age, reflecting lower market values and repair costs. As shown, a 2020 Kia Sorento costs more to insure than a 2011 model, emphasizing the savings potential with older vehicles.

Driver Age

Driver age can have a significant effect on Kia Sorento insurance rates. For example, 30-year-old drivers pay $5 more for Kia Sorento auto insurance than 40-year-old drivers.

Kia Sorento Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $608 |

| Age: 18 | $431 |

| Age: 20 | $267 |

| Age: 30 | $122 |

| Age: 40 | $118 |

| Age: 45 | $112 |

| Age: 50 | $108 |

| Age: 60 | $105 |

Driver age is a crucial factor in determining Kia Sorento insurance rates, with younger drivers typically paying significantly more. As drivers age, the rates decrease, highlighting the benefits of experience and a clean driving record.

Driver Location

Where you live can have a large impact on Kia Sorento insurance rates. For example, drivers in Phoenix may pay $65 a month less than drivers in Los Angeles.

Kia Sorento Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $156 |

| Columbus, OH | $98 |

| Houston, TX | $185 |

| Indianapolis, IN | $100 |

| Jacksonville, FL | $171 |

| Los Angeles, CA | $202 |

| New York, NY | $186 |

| Philadelphia, PA | $158 |

| Phoenix, AZ | $137 |

| Seattle, WA | $114 |

Driver location plays a significant role in Kia Sorento insurance rates, with costs varying widely across different cities. For instance, living in Phoenix can lead to substantially lower insurance premiums compared to higher-cost areas like Los Angeles.

Your Driving Record

Your driving record can have an impact on the cost of Kia Sorento auto insurance. Teens and drivers in their 20’s see the highest jump in their Kia Sorento insurance rates with violations on their driving record.

Kia Sorento Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $608 | $913 | $1,060 | $850 |

| Age: 18 | $431 | $647 | $752 | $602 |

| Age: 20 | $267 | $400 | $465 | $372 |

| Age: 30 | $122 | $183 | $213 | $170 |

| Age: 40 | $118 | $177 | $206 | $165 |

| Age: 45 | $112 | $168 | $196 | $157 |

| Age: 50 | $108 | $162 | $189 | $151 |

| Age: 60 | $105 | $157 | $183 | $146 |

Your driving record significantly influences Kia Sorento insurance costs, with violations and accidents leading to much higher premiums. Younger drivers, in particular, face steeper increases in insurance rates compared to those with clean driving records.

Safety Ratings

The insurance rates for your Kia Sorento can be influenced by its safety ratings. Below is a detailed breakdown of the Kia Sorento’s performance in various safety tests.

Kia Sorento Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

These safety ratings highlight the Kia Sorento’s strong performance in critical areas, which can contribute to more favorable insurance premiums. A higher safety rating typically translates to lower insurance costs due to reduced risk.

Crash Test Ratings

The insurance rates for your Kia Sorento can be influenced by its safety ratings. Below is a detailed breakdown of the Kia Sorento’s performance in various safety tests.

Kia Sorento Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Kia Sorento SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Kia Sorento SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

These safety ratings highlight the Kia Sorento’s strong performance in critical areas, which can contribute to more favorable insurance premiums. A higher safety rating typically translates to lower insurance costs due to reduced risk.

Kia Sorento Safety Features

Having a variety of safety features on your Kia Sorento can help lower your Kia Sorento insurance costs. The Kia Sorento’s safety features include:

- Comprehensive Airbag System: Includes driver, passenger, front head, rear head, and front side airbags.

- Advanced Braking Features: Equipped with 4-wheel ABS, 4-wheel disc brakes, and brake assist.

- Electronic Stability and Traction Control: Features electronic stability control and traction control for enhanced safety.

- Child Safety and Visibility: Includes child safety locks and integrated turn signal mirrors.

- Enhanced Safety Technology: Offers modern safety technologies like electronic stability control.

These advanced safety features not only provide peace of mind but can also contribute to more affordable insurance rates. By prioritizing safety, you can potentially lower your Kia Sorento’s insurance costs and enjoy enhanced protection on the road.

Loss Probability

Review the Kia Sorento auto insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury. The lower percentage means lower Kia Sorento auto insurance costs; higher percentages mean higher Kia Sorento auto insurance costs.

Kia Sorento Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | -20% |

| Property Damage | -14% |

| Comprehensive | -18% |

| Personal Injury | 10% |

| Medical Payment | 11% |

| Bodily Injury | -6% |

The Kia Sorento’s loss probability rates for various coverage types can significantly influence your insurance premiums. Lower loss rates generally lead to reduced insurance costs, while higher rates can increase expenses.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kia Sorento Finance and Insurance Cost

If you are financing a Kia Sorento, you will pay more if you purchase Kia Sorento auto insurance at the dealership, so be sure to shop around, get fast and free auto insurance quotes for Kia Sorento auto insurance quotes from the best companies using our free tool below.

Ways to Save on Kia Sorento Insurance

Although it may seem like your Kia Sorento insurance rates are set, there are a few measures that you can take to secure the best Kia Sorento insurance rates possible. Take a look at the following five ways to save on Kia Sorento auto insurance.

- Park your Kia Sorento somewhere safe – like a garage or private driveway.

- Ask about Kia Sorento discounts if you were listed on someone else’s policy.

- Start searching for new Kia Sorento auto insurance a month before your renewal.

- Compare Kia Sorento insurance rates online.

- Install an aftermarket anti-theft device for your Kia Sorento.

Read More: How to Get an Anti-Theft Auto Insurance Discount

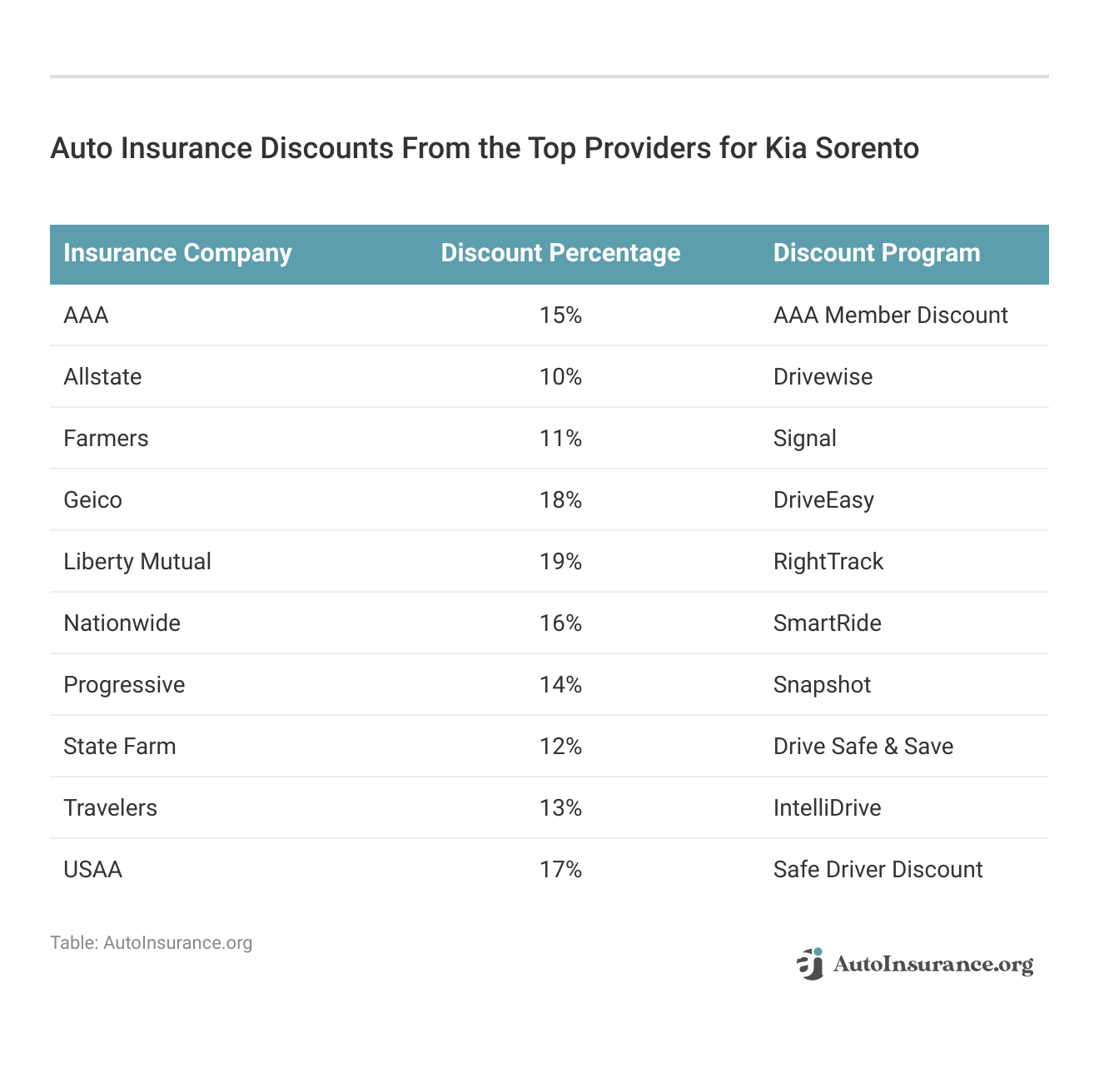

Discover the variety of auto insurance discounts offered by top providers for Kia Sorento to help you save on your premiums.

These discounts from top insurance providers for Kia Sorento offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Kia Sorento Insurance Companies

Who is the top auto insurance company for Kia Sorento insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Kia Sorento auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Kia Sorento offers.

Kia Sorento Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 6% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

When choosing insurance for your Kia Sorento, consider companies with significant market share, as they often provide competitive rates and discounts for the vehicle’s safety features. State Farm, Geico, and Progressive are among the top providers to explore for optimal coverage and savings.

Read More: State Farm Auto Insurance Discount

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Kia Sorento Insurance Quotes Online

You can start comparing quotes for Kia Sorento insurance rates from some of the best auto insurance companies using our free online tool. This tool allows you to quickly and easily obtain competitive quotes from top providers like State Farm, Geico, and Progressive, ensuring you find the best coverage at the lowest rates.

By comparing multiple options, you can secure the most affordable and comprehensive auto insurance for your Kia Sorento, tailored to your specific needs and preferences.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

How does having a garage affect my Kia Sorento auto insurance rates?

Having a garage can lower your Kia Sorento auto insurance rates. Insurance companies often offer discounts for vehicles that are stored in a garage because it reduces the risk of theft, vandalism, and weather-related damage. Providing evidence that your Kia Sorento is parked in a garage may help you qualify for these savings.

Read More: 10 Best Auto Insurance Companies That Don’t Require Proof of Garaging

What is Kia Sorento auto insurance?

Kia Sorento auto insurance refers to the insurance coverage specifically designed for the Kia Sorento SUV model. It provides financial protection in case of accidents, damages, theft, or other incidents involving the Kia Sorento.

Enter your ZIP code below to explore which companies have the cheapest auto insurance rates for you.

Can I use my Kia Sorento auto insurance for off-road use?

Most standard auto insurance policies are designed to cover the vehicle’s use on public roads. Off-road use of your Kia Sorento, such as driving on trails or in rugged terrains, may not be covered under a standard auto insurance policy.

It’s important to review your policy or contact your insurance provider to understand the limitations and exclusions regarding off-road use. If you frequently engage in off-road activities, you may need to consider specialized insurance options.

How does the safety rating of a Kia Sorento impact insurance premiums?

The safety rating of a Kia Sorento can positively impact insurance premiums. Vehicles with higher safety ratings typically qualify for lower premiums due to reduced risk of accidents and injuries, which insurance companies view favorably.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Is auto insurance mandatory for a Kia Sorento?

Yes, auto insurance is mandatory for all vehicles, including the Kia Sorento. The specific insurance requirements may vary depending on your location and local regulations. It’s important to comply with the legal requirements and have the necessary insurance coverage for your Kia Sorento.

What types of coverage are available for Kia Sorento auto insurance?

Kia Sorento auto insurance typically offers a range of coverage options. These may include liability coverage (which is often required by law), collision coverage (for damages caused by collisions), comprehensive coverage (for non-collision-related damages like theft or vandalism), uninsured/underinsured motorist coverage, and personal injury protection (PIP) coverage.

How can I find affordable auto insurance for my Kia Sorento?

To find affordable auto insurance for your Kia Sorento, it’s recommended to shop around and obtain quotes from multiple insurance providers. Factors such as your driving record, age, location, and the coverage options you choose can affect the cost of insurance. Comparing quotes, considering available discounts, and maintaining a good driving record can help you find more affordable rates.

Are there any discounts available specifically for Kia Sorento auto insurance?

While specific discounts can vary among insurance providers, many companies offer discounts that may apply to Kia Sorento auto insurance. These could include discounts for safety features installed in the Kia Sorento, good driver discounts, multi-policy discounts (if you bundle your auto insurance with other policies), or loyalty discounts. It’s recommended to inquire about available discounts when obtaining insurance quotes.

Does the size or model year of the Kia Sorento affect insurance rates?

The size and model year of the Kia Sorento can potentially have an impact on insurance rates. Generally, larger vehicles like SUVs may have higher insurance premiums due to factors such as potential repair costs and increased damage to other vehicles in an accident.

Newer model years may also have higher insurance premiums due to the cost of replacement parts. However, the specific details can vary, so it’s best to consult with insurance providers to understand how these factors can impact your rates.

What should I do if I need to file an auto insurance claim for my Kia Sorento?

If you need to file an auto insurance claim for your Kia Sorento, you should contact your insurance provider as soon as possible. They will guide you through the claims process and provide instructions on what information or documentation is required.

Be prepared to provide details about the incident, such as the date, time, location, and any necessary supporting evidence, such as photographs or witness statements.

Read More: How to File an Auto Insurance Claim

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.