Best Pay-As-You-Go Auto Insurance in Virginia (See the Top 10 Companies for 2026)

The leading providers for the best pay-as-you-go auto insurance in Virginia are Geico, Nationwide, and Allstate. Geico pay-as-you-go rates start at $20/month. Nationwide and Allstate offer usage-based auto insurance in Virginia that only tracks mileage, so rates don't go up for bad driving.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsGeico, Nationwide, and Allstate are the leading companies for the best pay-as-you-go auto insurance in Virginia, making it a top choice for flexible and budget-friendly coverage.

Signing up for pay-as-you-go (PAYG) coverage can help you get cheaper Virginia auto insurance. PAYG auto insurance tracks driving habits and mileage to set rates, and the best companies offer big discounts for bundling multiple policies.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Virginia

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% A++ Loyalty Rewards Geico

#2 17% A+ Diminishing Deductible Nationwide

#3 12% A+ Claims Service Allstate

#4 19% A Personalized Policies Liberty Mutual

#5 11% B Customer Service State Farm

#6 10% A+ Coverage Options Progressive

#7 15% A- Low Mileage Metromile

#8 10% A+ Safe Drivers Root

#9 16% A++ High-Value Vehicles Travelers

#10 15% A Competitive Rates Safeco

Metromile and Geico have the lowest rates, but Nationwide and Liberty Mutual have bigger discounts. Keep reading to compare VA pay-as-you-go auto insurance companies.

If you’re just looking for cheap coverage, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Geico offers top pay-as-you-go auto insurance in VA starting at $25/month

- Metromile has the cheapest pay-as-you-go insurance rates for $21/month

- High-risk drivers get better rates with Allstate Milewise PAYG insurance

#1 – Geico: Top Overall Pick

Pros

- Attractive Loyalty Savings: Geico usage-based in Virginia offers significant discounts for loyal customers. Find out more in our Geico DriveEasy review.

- User-Friendly Digital Experience: Geico offers a streamlined online experience for managing pay-as-you-go auto insurance in Virginia, making policy adjustments and tracking easy.

- Consistent Rate Reductions: Frequent users of Geico pay-as-you-go auto insurance in VA may see steady rate reductions, thanks to its loyalty program.

Cons

- Limited Incentives for Low Mileage: Geico’s pay-as-you-go auto insurance in Virginia might not provide significant incentives for drivers with very low mileage.

- Inconsistent Customer Service Feedback: Some users report variability in customer service quality when handling pay-as-you-go auto insurance claims in Virginia.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductibles: Nationwide’s pay-as-you-go insurance in Virginia reduces deductibles over time with a clean driving record.

- Discounts for Low Mileage: Nationwide SmartMiles provides substantial discounts for low-mileage drivers in Virginia. Compare rates in our Nationwide SmartMiles review.

- Flexible Usage-Based Options: Nationwide auto insurance in Virginia allows flexible PAYG insurance with SmartMiles for low-mileage drivers and SmartRide for safe drivers.

Cons

- Higher Base Rates: Nationwide pay-as-you-go car insurance may have higher base rates compared to other VA insurance companies.

- Limited Availability: Vanishing deductibles might not be available to high-risk drivers, potentially limiting the benefits of Nationwide PAYG auto insurance in Virginia.

#3 – Allstate: Best for Claims Service

Pros

- Streamlined Claims Process: Allstate pay-as-you-go auto insurance in Virginia features a straightforward claims process, ensuring quick and efficient handling of issues.

- High Claim Satisfaction: Top ten for PAYG insurance claims satisfaction in annual J.D. Power surveys. For complete ratings, read our Allstate review.

- Flexible Policies: Allstate Milewise helps low-mileage drivers save money on Virginia car insurance, and Allstate Drivewise rewards safe drivers with cheaper rates.

Cons

- Potentially Higher Initial Rates: VA pay-as-you-go auto insurance from Allstate may have higher starting premiums compared to some competitors.

- Discount Availability Limitations: Allstate auto insurance discounts in Virginia might not be as extensive or varied as those offered by other insurers.

#4 – Liberty Mutual: Best for Personalized Policies

Pros

- Personalized Policies: Liberty Mutual offers RightTrack pay-as-you-go auto insurance policies in Virginia. Read how it works in our Liberty Mutual RightTrack review.

- Varied Coverage Choices: Provides a wide range of coverage add-ons, making it easy to tailor a pay-as-you-go auto insurance policy to specific Virginia drivers.

- Accident Forgiveness: Safe drivers get the lowest rates and Virginia auto insurance costs won’t increase after your first accident.

Cons

- Higher Premiums for Customization: Personalized policies may come with higher premiums for pay-as-you-go auto insurance in Virginia compared to standard options.

- Complex Policy Details: The detailed customization options can make managing a pay-as-you-go auto insurance policy in Virginia more difficult.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Customer Service

Pros

- Efficient Claims Filing: State Farm is known for its efficient claims filing process, which is advantageous for managing pay-as-you-go auto insurance in Virginia. Learn more in our State Farm review.

- Great Customer Service: State Farm auto insurance in VA is in the top two for customer satisfaction and individual agent support according to J.D. Power.

- Affordable PAYG Rates: State Farm Drive Safe & Save rewards safe drivers who track their habits with VA pay-as-you-go car insurance with 30% discounts.

Cons

- Lower Discount Amounts: State Farm Drive Safe & Save will reduce discounts on pay-as-you-go insurance in Virginia for bad driving. Learn more in our State Farm Drive Safe and Save review.

- Financial Downgrade: A.M. Best recently downgraded State Farm insurance in VA to a “B” for an increased amount of property claims.

#6 – Progressive: Best Coverage Options

Pros

- Extensive Coverage Options: Progressive pay-as-you-go auto insurance in Virginia offers a broad array of coverage options, allowing you to tailor your policy to your specific needs and driving habits.

- Flexible Usage-Based Rates: Progressive Snapshot offers flexible VA insurance rates that save low-mileage drivers money. Discover additional details in our Progressive Snapshot review.

- Discounts for Bundling: Progressive offers bundling discounts with their pay-as-you-go auto insurance in Virginia, making it a cost-effective choice for multiple insurance needs.

Cons

- Potential for Higher Costs: Depending on driving behavior, Progressive Snapshot pay-as-you-go auto insurance in Virginia might not always be the cheapest option, especially for high-mileage drivers.

- Poor Customer Service: Reviews in the Mid-Atlantic region rate Progress auto insurance in Virginia below-average for claims service and customer support.

#7 – Metromile: Best for Infrequent Drivers

Pros

- Cost-Efficient for Infrequent Drivers: Metromile has the cheapest pay-as-you-go auto insurance quotes in Virginia at $20/month for low-mileage drivers. Learn more by reading our review of Metromile.

- No Rate Increases: Metromile doesn’t raise Virginia PAYG insurance rates for bad driving because it only tracks mileage.

- Mobile App: The Metromile app tracks mileage, gas levels, GPS, and helps Virginia drivers understand what the warning lights mean in their vehicle.

Cons

- Limited Coverage Options: Metromile pay-as-you-go auto insurance in Virginia might have fewer coverage options compared to other providers.

- Mobile Data Required: The mobile app must be able to track every trip at all times to calculate Virginia pay-per-mile insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Root: Best for Safe Drivers

Pros

- Discounts for Safe Driving: Root pay-as-you-go auto insurance in Virginia is only available to safe drivers and rewards good drivers with low rates starting at $28/month.

- User-Friendly App: Root provides a convenient app for managing pay-as-you-go auto insurance in Virginia. Find out how it works in our Root review.

- Free Roadside Assistance: All Root Virginia auto insurance policies come with roadside assistance.

Cons

- Driving Behavior Monitoring: Root’s pay-as-you-go auto insurance in Virginia requires monitoring of driving behavior, which may not appeal to drivers who value privacy.

- Policy Limitations: Drivers won’t be able to customize Root pay-as-you-go auto insurance in Virginia since it doesn’t offer as many policy types or add-ons as other companies.

#9 – Travelers: Best for High-Value Vehicles

Pros

- Specialized Coverage for Premium Vehicles: Travelers offers specialized coverage tailored to high-value vehicles under pay-as-you-go auto insurance in Virginia.

- Wide Range of Coverage Options: Travelers offers extensive pay-as-you-go auto insurance in Virginia for various vehicles and driver needs.

- Flexible Policy Terms: Flexible policy terms, including pay-as-you-go auto insurance in Virginia, enhance coverage for high-value vehicles. Read our Travelers IntelliDrive review to learn what else is offered.

Cons

- Fewer Discount Opportunities: Travelers may offer fewer specific discounts for pay-as-you-go auto insurance in Virginia, impacting overall savings.

- Poor Customer Service: Travelers ranks below average in customer satisfaction for Virginia car insurance policyholders.

#10 – Safeco: Best for Competitive Rates

Pros

- Affordable Usage-Based Insurance: Safeco RightTrack can lower Virginia auto insurance rates to $26/month. Compare free quotes in our Safeco RightTrack review.

- Customizable Policy Features: Safeco’s policies for pay-as-you-go auto insurance in Virginia allow for extensive customization, tailoring coverage to individual preferences.

- Diminishing Deductible: Safeco rewards safe drivers in Virginia by reducing PAYG insurance deductibles every year they go without filing a claim.

Cons

- Policy Management Complexity: Some users find Safeco’s pay-as-you-go auto insurance policies in Virginia to be complex, requiring more effort to manage effectively.

- Poor Customer Service: Although it ranks high for national claims satisfaction, Virginia auto insurance customers have more negative experiences on average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Pay-As-You-Go Auto Insurance Costs in Virginia

In Virginia, monthly rates for auto insurance vary widely depending on the provider and the level of coverage you choose. You want to buy enough pay-as-you-go insurance to meet VA auto insurance requirements and the terms of your auto loan or lease.

This table compares monthly car insurance rates for both minimum and full coverage options across the top VA insurance companies:

Virginia Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $35 | $100 |

| Geico | $25 | $90 |

| Liberty Mutual | $31 | $92 |

| Metromile | $20 | $90 |

| Nationwide | $34 | $97 |

| Progressive | $30 | $95 |

| Root | $28 | $93 |

| Safeco | $26 | $89 |

| State Farm | $27 | $91 |

| Travelers | $29 | $94 |

In Virginia, auto insurance monthly rates vary by coverage level and provider. For minimum coverage, prices range from $21 with Metromile to $34 with Nationwide. For full coverage, rates are more expensive, with Safeco the cheapest at $89/month and Allstate the most expensive at $100/month.

Geico offers the best pay-as-you-go auto insurance in Virginia with its unbeatable rates and reliable customer service.Michelle Robbins Licensed Insurance Agent

When searching for affordable pay-as-you-go auto insurance in Virginia, several critical factors come into play. Consider factors like driving habits, vehicle make and model, and available discounts to maximize savings.

- Driving Record: How you drive has the biggest impact on pay-as-you-go insurance in Virginia if you choose a usage-based insurance plan.

- Mileage: Annual mileage affects insurance rates, with VA drivers who drive less than 10,000 miles per year saving the most money with PAYG auto insurance.

- Vehicle Type: Choose vehicles with high safety ratings and lower repair costs to reduce insurance pay-as-you-go insurance premiums.

- Location: Your ZIP code affects your Virginia auto insurance due to local factors like accident rates and theft.

The best auto insurance companies offer discounts for bundling policies, clean driving records, vehicle safety features, and good student status, which can reduce your auto insurance premium.

Continue reading to discover a range of discounts available from pay-as-you-go car insurance companies in Virginia, which can help you save on your premium.

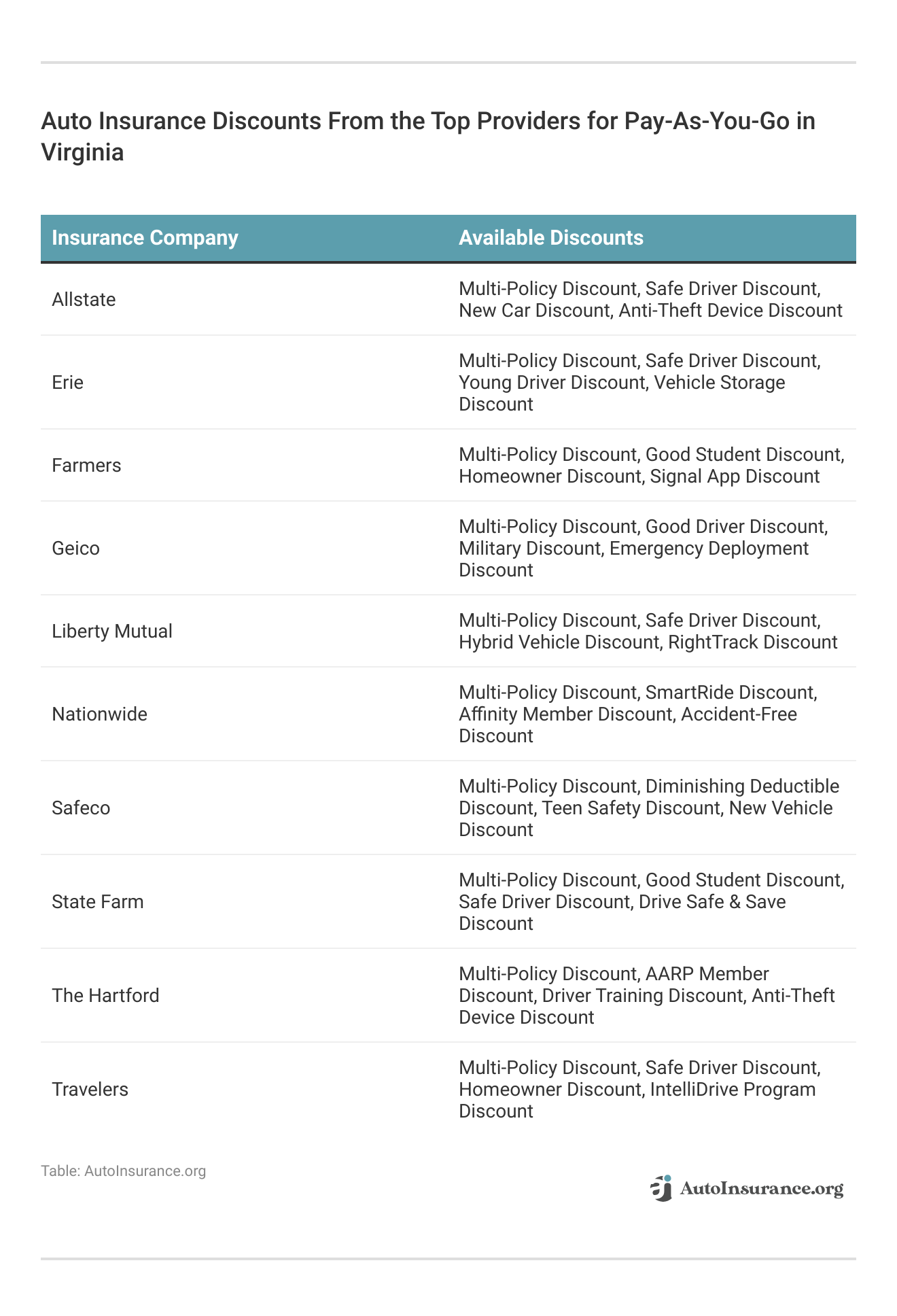

Ways to Lower Pay-As-You-Go Auto Insurance Rates in Virginia

In Virginia, top auto insurers like Allstate, Erie, and Geico offer various pay-as-you-go discounts for factors such as multi-policy holdings, safe driving, and more. Discounts can apply to new cars, good students, military service, and anti-theft features

To lower your pay-as-you-go auto insurance costs in Virginia, compare quotes from various providers and use available discounts for safe driving, anti-theft devices, low mileage, and bundling policies.

Opt for a higher deductible to lower your premium, maintain a good credit score, and consider vehicle safety features. By understanding and leveraging these factors, you can effectively manage your pay-as-you-go auto insurance costs in Virginia.

Read More: How to Get a Low Mileage Auto Insurance Discount

Case Studies: Save Money With VA Pay-As-You-Go Auto Insurance

In Virginia, pay-as-you-go auto insurance offers a flexible and cost-effective option for drivers seeking cheaper rates that align with their driving habits:

- Case Study #1 – Navigating Savings: Jessica, a 28-year-old freelancer in Richmond, cut her full coverage auto insurance premium from $120 to $90 monthly by switching to Geico DriveEasy.

- Case Study #2 – Maximizing Coverage and Savings: Michael, a 35-year-old sales manager with a high-value SUV, saved on premiums and got comprehensive coverage by switching to Travelers IntelliDrive.

- Case Study #3 – Finding the Perfect Fit: Emily, a 22-year-old college student, reduced her auto insurance premium from $95 to $35/month by switching to Allstate DriveWise, saving $73 each month while getting the coverage she needed.

Choosing the right pay-as-you-go auto insurance can make a substantial difference in your overall expenses and coverage quality.

Remember, the key to maximizing your VA auto insurance and ensuring adequate coverage lies in comparing options and leveraging available discounts. Learn how to save money bundling insurance policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Pay-As-You-Go Auto Insurance in Virginia

The leading pay-as-you-go auto insurance options in Virginia are Geico, Nationwide, and Allstate, with rates starting as low as $25 per month. Metromile is cheaper at $21/month, but Geico offers more comprehensive coverage.

Geico stands out as the top choice for pay-as-you-go auto insurance in Virginia, thanks to its competitive pricing and excellent coverage options.Daniel Walker Licensed Auto Insurance Agent

To find the best deal, compare quotes from multiple companies and take advantage of discounts for safe driving and bundling multiple policies. See which companies have the cheapest rates by entering your ZIP code in our free comparison tool below.

Frequently Asked Questions

What is pay-as-you-go auto insurance?

Pay-as-you-go auto insurance, also known as usage-based auto insurance, adjusts your premium based on your driving habits, mileage, and sometimes vehicle usage. It’s ideal for those who drive infrequently or want to save money by paying only for the insurance they need.

How does pay-as-you-go auto insurance work in Virginia?

In Virginia, pay-as-you-go auto insurance calculates your premium based on your actual driving patterns. This often involves using a telematics device or app that tracks your mileage and driving behavior, which then adjusts your premium according to the data collected.

What are the benefits of choosing pay-as-you-go auto insurance?

Benefits include lower premiums for low-mileage drivers, potential discounts for safe driving, and flexibility in payment options. It can be a cost-effective choice if you don’t drive frequently or want to reduce insurance costs based on your driving habits. Learn more about auto insurance for different types of drivers.

Which companies offer the best pay-as-you-go auto insurance in Virginia?

In Virginia, some of the top providers for pay-as-you-go auto insurance include Geico, Nationwide, and Allstate. These companies are known for their competitive rates, discounts, and flexible coverage options.

How can I lower my pay-as-you-go auto insurance rates in Virginia?

To lower your rates, consider driving less, maintaining a good driving record, utilizing available discounts, choosing a higher deductible, and comparing quotes from multiple providers.

What discounts are available with pay-as-you-go auto insurance in Virginia?

Common discounts include low mileage, safe driving, anti-theft devices, bundling policies, and good student insurance discounts.

Can VA pay-as-you-go auto insurance help me save money?

Yes, pay-as-you-go auto insurance can help you save money, especially if you drive infrequently or have a good driving record. By paying based on your actual usage, you may avoid overpaying for coverage you don’t need.

What factors affect my pay-as-you-go auto insurance premium?

Factors include your driving habits, total mileage, type of vehicle, location, and any applicable discounts. Insurers use this information to calculate your premium based on your usage.

Are there any drawbacks to pay-as-you-go auto insurance?

Potential drawbacks include the need to track your driving habits, which might not be ideal for frequent drivers. Some providers may also have higher rates for drivers with high mileage or less favorable driving records. Learn how to check your auto insurance claims history to see if you can save money with PAYG insurance in VA.

How do I get a quote for pay-as-you-go auto insurance in Virginia?

To get a quote, you can use online comparison tools by entering your ZIP code and details about your vehicle and driving habits. This will provide quotes from multiple insurers, allowing you to compare rates and find the best option for your needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.