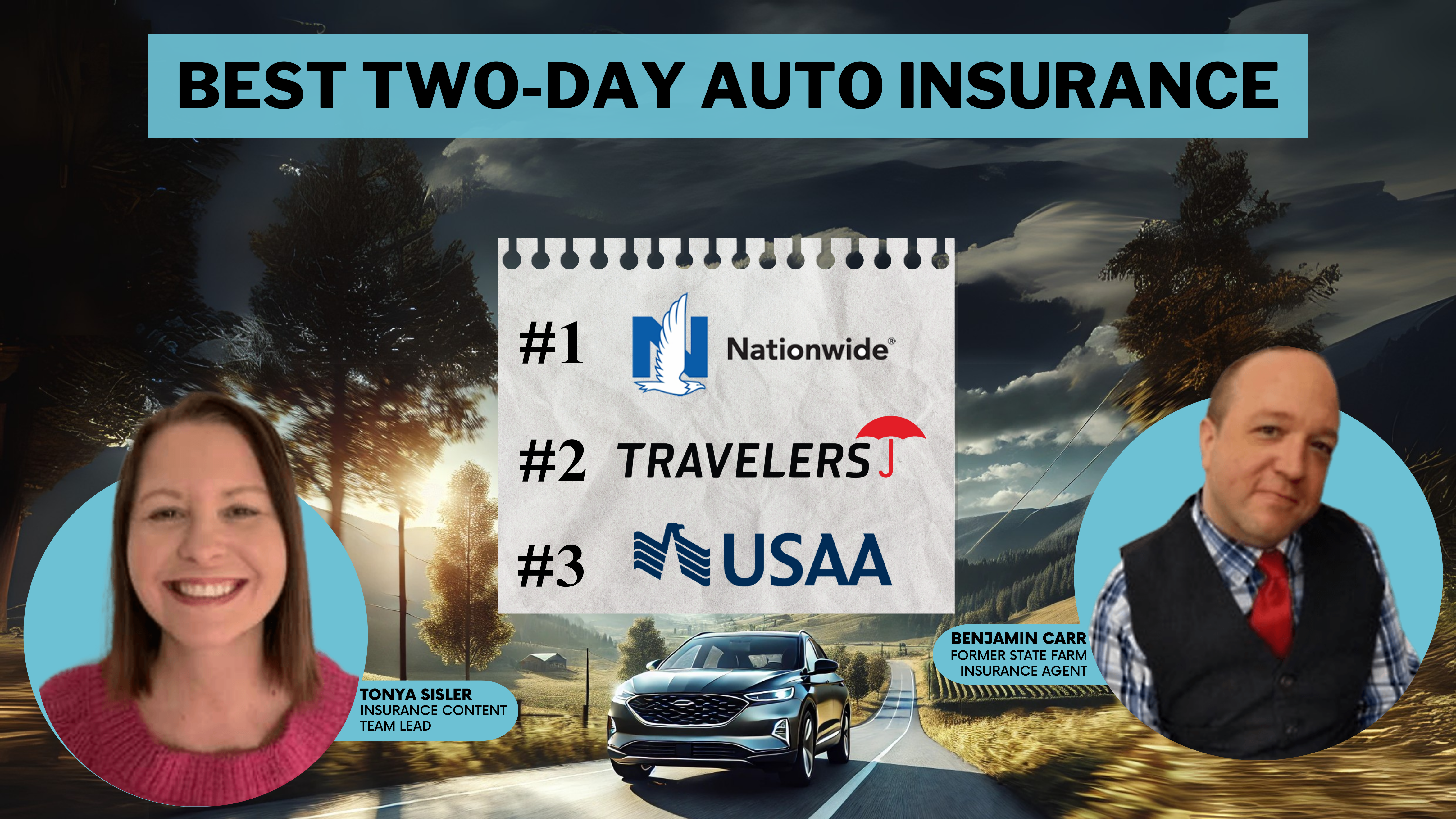

Best Two-Day Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

Nationwide, Travelers, and USAA have the best two-day auto insurance with rates starting at $40/mo. Nationwide is our top choice for its extensive coverage and discounts. Read on to learn how to get affordable car insurance for two days and decide if it's time for you to buy two-day car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated January 2025

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Two-Day Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Two-Day Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Two-Day Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsNationwide, Travelers, and USAA are our top picks for the best two-day auto insurance. Nationwide is our top recommendation with monthly rates starting from $41 for full coverage.

Situations you’ll want to look for two-day car insurance quotes can include: Borrowing a friend’s car when moving to new accommodations, using a car-sharing service, taking a driving test, transporting a vehicle from one place to another.

Our Top 10 Company Picks: Best Two-Day Auto Insurance

Company Rank Occupational Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Simple Claims Nationwide

#2 12% A++ Unique Coverage Travelers

#3 3% A++ Military Drivers USAA

#4 7% A+ Customer Service Progressive

#5 9% A++ Many Discounts Geico

#6 11% A Coverage Options Liberty Mutual

#7 10% B Good Student State Farm

#8 5% A+ Exclusive Benefits The Hartford

#9 9% A+ Usage-Based Discount Allstate

#10 8% A Group Discounts Farmers

The common theme in all of these situations is the need for whoever is driving the vehicle to have some type of insurance coverage. Enter your ZIP to find the cheapest car insurance for 2 days.

- Nationwide has the best two-day auto insurance

- Carefully selecting coverages offers effective protection for short-term drivers

- Comparison shopping can save drivers a lot on car insurance

#1 – Nationwide: Top Pick Overall

Pros

- Wide Coverage Options: Nationwide offers a variety of coverage options, including liability, collision, and comprehensive coverage, allowing customers to tailor their insurance to fit their specific needs. See average Nationwide rates in our Nationwide auto insurance review.

- Discounts Available: Nationwide offers discounts for safe driving, bundling policies, and having certain safety features installed in your vehicle.

- 24/7 Claim Service: Nationwide has a 24/7 claims service, allowing customers to file a claim at any time and receive assistance from their team.

Cons

- Limited Availability: Nationwide is not available in all states, so it may not be an option for some individuals looking for two-day auto insurance.

- Higher Premiums: While Nationwide may offer discounts, their premiums tend to be higher than other companies on this list.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Unique Coverage

Pros

- Strong Financial Ratings: Travelers has strong financial stability ratings from various rating agencies, giving customers peace of mind that they are with a reliable and secure company.

- Policy Bundling: Travelers offer discounts for bundling policies, making it a great option for individuals who need more than just auto insurance. Read our full review of Travelers insurance for more information.

- Accident Forgiveness: Travelers offer accident forgiveness for safe drivers, so your rates won’t go up after your first at-fault accident.

Cons

- Limited Coverage Options: Some customers may find that Travelers has limited coverage options compared to other insurance companies on this list, which may not meet their specific needs.

- Below Average Customer Claims Satisfaction: According to a J.D. Power survey, Travelers ranks below the industry average for customer satisfaction with their claims process.

#3 – USAA: Best for Military Drivers

Pros

- Highly Rated Customer Service: USAA consistently ranks highly in customer service satisfaction surveys, providing excellent support to their policyholders.

- Affordable Rates: USAA offers competitive premiums for their policies, making it a great option for individuals on a budget. More information is available about USAA in our USAA auto insurance review.

- Military and Veteran Focus: USAA is known for its focus on serving military members and veterans, providing specialized coverage and discounts for those who have served.

Cons

- Limited Eligibility: USAA is only available to military members, veterans, and their immediate family members, limiting its availability to the general public.

- Some Policies Not Available in All States: Certain policies, such as SafePilot, may not be available in all states where USAA operates.

#4 – Progressive: Best for Customer Service

Pros

- 24/7 Customer Service: Progressive has a reputation for providing excellent customer service, with representatives available around the clock to assist with any questions or concerns.

- Accident Forgiveness: Similar to Travelers, Progressive offers accident forgiveness for safe drivers. Our complete Progressive review goes over this in more detail.

- Rideshare Coverage: Progressive offers coverage for individuals who drive for rideshare companies like Uber and Lyft.

Cons

- Mixed Customer Service Reviews: While some customers report positive experiences with Progressive’s customer service, others have reported issues with long wait times and unhelpful representatives.

- Higher Premiums for High-Risk Drivers: If you have a history of accidents or traffic violations, your auto insurance rates with Progressive may be higher than other insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Many Discounts

Pros

- Low Rates: Geico is known for its low rates on car insurance policies, making it a popular choice for budget-conscious individuals. Read more here: Geico Auto Insurance Review

- A++ Financial Rating: Geico has a strong financial rating, indicating that it is a stable and reliable company to do business with.

- Discounts Available: Geico offers a variety of discounts for safe driving, bundling policies, and more.

Cons

- Below Average Claims Satisfaction: While Geico has competitive rates, its claims satisfaction ratings are slightly below average compared to other insurance companies.

- Limited Availability: Geico has few local agents, which may make it difficult for some individuals to receive in-person assistance with their policies.

#6 – Liberty Mutual: Best for Coverage Options

Pros

- Available Nationwide: Liberty Mutual has a strong presence nationwide.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling policies, such as auto and home insurance.

- Multiple Options and Add-Ons: Liberty Mutual offers a variety of coverage options and add-ons.

Cons

- Mixed Customer Service Reviews: While some customers report positive experiences with Liberty Mutual’s customer service, others have reported issues with long wait times and unhelpful representatives.

- Higher Premiums for High-Risk Drivers: If you have a history of accidents or traffic violations, your premiums may be higher with Liberty Mutual compared to other insurance companies. To see monthly premiums and honest rankings, read our Liberty Mutual review.

#7 – State Farm: Best for Good Student

Pros

- Strong Financial Rating: State Farm has a strong financial rating, indicating its stability and ability to pay out claims. See the reviews and rankings in our full State Farm Auto Insurance Review.

- Extensive Coverage Options: State Farm offers many coverage options, including policies for homeowners, renters, and businesses.

- Student Discounts: State Farm offers discounts for students with good grades, making it a popular choice for young drivers.

Cons

- No Gap Insurance: State Farm does not offer gap insurance, which covers the difference between a car’s actual value and the amount owed on a lease or loan.

- Inconsistent Agent Experience: Some customers have reported inconsistent experiences with State Farm agents, noting that their level of knowledge and helpfulness can vary.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Exclusive Benefits

Pros

- Ranks High in Auto Claims Satisfaction: The Hartford ranks high in terms of customer satisfaction for auto insurance claims, making it a reliable choice for those who value efficient and effective claims handling.

- Unique Features for Senior Drivers: The Hartford offers specific features and discounts tailored to senior drivers, including accident forgiveness after 50 years of age. Our auto insurance experts share more in our The Hartford company review.

- Disaster Preparedness Tools: The Hartford offers tools and resources to help customers prepare for natural disasters, including evacuation planning and emergency supply checklists.

Cons

- AARP Membership Mandatory: In order to be eligible for coverage with The Hartford, customers must be members of AARP (American Association of Retired Persons).

- Higher Premiums for Some Policies: While The Hartford may offer competitive rates for some policies, its rates for other policies may be higher than its competitors.

#9 – Allstate: Best for Usage-Based Discount

Pros

- Easy To Use Plug-In Device: Allstate offers a plug-in device called Drivewise that monitors driving behavior and can potentially save customers money on their premiums.

- Drivewise Program: Allstate’s Drivewise program rewards safe driving habits with lower rates, making it appealing to conscientious drivers.

- Loyalty Points Redeeming: Allstate’s loyalty program allows customers to redeem points for rewards, providing added value to their policies. Read more: Allstate Auto Insurance Company Review

Cons

- High Premiums for High Mileage Drivers: Allstate’s rates may be higher for those who drive more than the average number of miles per year.

- Limited Availability: Allstate is not available in all states, limiting its accessibility to potential customers.

#10 – Farmers: Best for Group Discounts

Pros

- Nationwide Availability: Farmers is available in all 50 states, making it a convenient option for many customers. Take a look at our Farmers insurance company review to learn more.

- Discounts and Rewards Program: Farmers offer various discounts and rewards programs to help customers save money on their premiums.

- Wide Coverage Options: Farmers offer various coverage options, including specialized policies for unique situations such as ranch and farm properties.

Cons

- Higher Rates for Some Policies: While Farmers may offer competitive rates for some policies, its rates for other policies may be higher than its competitors.

- Customer Review Below National Average: According to J.D. Power’s insurance study, Farmers received below average ratings for customer satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mandatory Coverages That Comparison Shoppers Can Save On

These coverages are required by law in just about every state or jurisdiction and include bodily injury liability and property damage liability.

- Property Damage Liability Coverage: This pays for any damage caused by policyholders to the vehicles or property of others.

- Bodily Injury Liability: It covers costs that are associated with injuries caused by the vehicle of the policyholder during an accident.

- Personal Injury Protection: Also known as PIP, this kind of coverage pays for the medical care of the driver and passengers of the insured vehicle.

Even if you are looking for car insurance for two days, you will still need to meet the state requirements. Temporary auto insurance will offer you the coverage you need, if only for a couple of days.

What does two-day car insurance cost?

The average cost of short-term car insurance is about $10 a day. Standard policies are less expensive if you need auto insurance long-term.

Take a look at this table to see what the average cost of car insurance is for different types of coverages.

Two-Day Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $20 | $40 |

| Farmers | $22 | $42 |

| Geico | $18 | $38 |

| The Hartford | $25 | $45 |

| Liberty Mutual | $23 | $43 |

| Nationwide | $21 | $41 |

| Progressive | $19 | $39 |

| State Farm | $20 | $40 |

| Travelers | $24 | $44 |

| USAA | $20 | $40 |

Whether you are looking for two-day car insurance coverage or a standard policy, the exact coverage options you need will be up to you for your situation.

Optional Coverages Auto Insurance Shoppers Should Consider

Since there are most likely car insurance requirements in your state, drivers must have certain forms of insurance coverage. Many other insurance options are left at the discretion of the insurance shopper.

While optional coverages aren’t necessarily required, many of these options are smart for short-term drivers to have.Michelle Robbins Licensed Insurance Agent

Included in this list of common non-mandatory coverages are collision, comprehensive, and glass coverages.

These are common coverages offered:

- Glass Coverage: Covers any damages to the windows of insured vehicles.

- Comprehensive Insurance: It takes care of any damages that may be caused by non-collisions. These can include vandalism, storms, fires, and the like.

- Collision Auto Insurance coverage: This coverage pays for damages sustained by the vehicle of the policyholder in the event of a collision with another vehicle or object.

- Uninsured Motorist Coverage: It pays for costs incurred if policyholders get in accidents with uninsured drivers.

- Underinsured Motorist Coverage: This coverage makes up the difference in cases where the at-fault driver has insufficient coverage limits.

- Loss Damage Waivers: These LDW’s are special additions that work to protect those who borrow or rent a vehicle if the car in question is stolen or damaged when in their custody.

- Personal Effects Plans: These coverage plans pay for any personal property that may be lost if a car that is being rented or borrowed is broken into.

Watch this video to learn more about the types of coverage that are available.

Uninsured and underinsured driver coverages can be either mandatory or non-mandatory, depending on the jurisdiction.

Numbers Associated With Auto Insurance Limits

Whether individuals are shopping for mandatory or elective insurance, it pays dividends to understand what coverage limit numbers signify.

One way to do this is to remember that insurance policies usually include a maximum group loss amount and a personal loss amount.

An example would be a liability policy that offers 150/400/75 coverage. The first number means that each individual would have $150,000 worth of bodily liability coverage.

The second number means that the total bodily liability coverage per accident would be $400,000, and the third means that there would be $75,000 worth of property liability coverage per accident.

Understanding how these figures work can go a long way towards helping those who are comparison shopping to make better purchasing decisions.

Ways to Save Money When Using Short-Term Insurance

While short-term insurance may sometimes be a little more expensive than longer-term policies, there are some easy methods that savvy auto insurance shoppers can use to reduce their overall bills.

Saving is the easy part. Deciding what to spend it on, now that’s where it gets tricky! Drivers who switch and save with Progressive save hundreds on average. Screenshot and share your results. We bet they’re totally fly! pic.twitter.com/k2wGKNsG78

— Progressive (@progressive) March 29, 2024

The following items are examples of some discounts commonly offered to insurance customers.

- Bundling: This technique involves buying insurance coverage for different things from the same company. An individual could purchase home, life, and auto insurance from the same company, saving a little bit on each kind of policy along the way. Learn how to save money by bundling insurance policies in our guide.

- Safe Vehicle Discounts: If the vehicle that will be driven has modern car safety features such as anti-lock brakes or anti-theft systems, such a car will often qualify for a discount.

- Safe Driver Discounts: If the driver of a given vehicle has an outstanding safety record, they will often qualify for lower rates.

- Comparison Shopping: Individuals can often save large amounts of cash by comparing the policies of various insurance providers.

Check out these discounts from our top providers.

By using the services of a comparison shopping site, customers can quickly and easily compare auto insurance rates from hundreds of insurance companies, and save large amounts of effort, time, and cash along the way.

Drivers may need to borrow vehicles for very short periods from time to time, and there is a lot to consider when seeking coverage for such vehicles.

That being said, individuals who apply the lessons from this article will be positioning themselves not only for safe passage but for significant savings.

Ready to buy cheap two-day car insurance? Comparison shop today for two-day car insurance rates by using our free tool. Enter your ZIP to get cheap two-day insurance quotes.

Frequently Asked Questions

Can I get auto insurance for just two days?

Yes, it is possible to get short-term auto insurance coverage for two days. Some insurance companies offer temporary policies to meet such needs.

What is 2-day auto insurance?

2-day car insurance is a type of short-term car insurance that provides coverage for two days. It is helpful for individuals who only need temporary car insurance for a specific situation, such as borrowing or renting a car.

How much is car insurance for 2 days?

Two-day car insurance typically costs around $20. However, the actual cost can vary depending on several factors such as the type of coverage needed, the location where the car will be driven, and the driver’s age and driving history.

How much does short term car insurance cost?

On average, short term car insurance car insurance can range from $10 to $50. The cost of short-term car insurance can depend on various factors like the type of coverage, the duration of the insurance, and the driver’s profile. Short term car insurance is usually more expensive compared to traditional annual or monthly car insurance policies because it provides coverage for a shorter period of time.

How much does two-day car insurance cost?

So, how much is insurance for two days? The average cost of short-term car insurance is around $10 per day. Keep in mind that long-term policies tend to be more affordable than temporary coverage. Read more: What is the average auto insurance cost per month?

What does a two-day car insurance cover?

A two-day insurance policy typically covers the same things as a standard long-term car insurance policy, including liability, collision, and comprehensive coverage. However, it may have different limits and deductibles compared to a longer-term policy.

Is it possible to buy daily car insurance instead of getting a long-term plan?

Yes, it’s possible to opt for daily, weekly, or monthly car insurance. While some lesser-known insurers might offer such short-term policies, caution is advised since these could potentially be scams or offer inadequate coverage. On the other hand, established auto insurance companies usually offer policies for a minimum duration of six months or a year.

What optional coverages should I consider when shopping for auto insurance?

While certain types of coverage are mandatory based on state requirements, there are optional coverages you can consider. Examples include rental reimbursement and mechanical breakdown coverage.

What do the numbers associated with auto insurance limits mean?

Insurance policies often include coverage limit numbers that signify the maximum amount of coverage available. For instance, a liability policy with 150/400/75 coverage means $150,000 of bodily liability coverage per individual, $400,000 total bodily liability coverage per accident, and $75,000 of property liability coverage per accident.

How can I save money on short-term insurance?

Savvy auto insurance shoppers can use several methods to reduce their overall bills for short-term insurance. One approach is to utilize comparison shopping sites to easily compare short term car insurance offerings from different insurance companies. Additionally, taking advantage of auto insurance discounts offered by insurers can help save money.

Get temporary car insurance quotes today with our quote comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.