Best Washington Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

The best Washington auto insurance offers rates starting at $20 per month, with top companies like Progressive, Allstate, and USAA leading the market. These companies provide affordable rates, extensive coverage options, and excellent customer service, making them the best choices for Washington drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated February 2026

Company Facts

Full Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Washington auto insurance are Progressive, Allstate, and USAA, known for their affordable rates starting at just $20 per month. These companies lead the market with extensive coverage options and exceptional customer service, making them the best choices for Washington drivers.

Our comprehensive guide helps you navigate the Washington state auto insurance requirements and auto insurance laws, compare rates based on demographics, and understand the impact of accidents and DUIs on your premiums. Whether you’re a young driver, have a blemished driving record, or live in a high-traffic city, this guide will surely help.

Our Top 10 Company Picks: Best Washington Auto Insurance

Company Rank Safe Driver Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% A+ Roadside Assistance Progressive

#2 18% A+ UBI Discount Allstate

#3 20% A++ Military Benefits USAA

#4 12% A++ Good Drivers Geico

#5 15% B Student Savings State Farm

#6 10% A Safe-Driving Discounts Liberty Mutual

#7 14% A+ Accident Forgiveness Nationwide

#8 11% A+ Organization Discount The Hartford

#9 13% A High-Risk Coverage The General

#10 12% A++ Specialized Coverage Travelers

Find the most suitable and cost-effective auto insurance in Washington. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Progressive offers the best Washington auto insurance from $20 per month

- Compare auto insurance rates by demographics, impact of accidents, and DUIs

- Top company picks provide extensive coverage and exceptional service

- Washington Auto Insurance

- Cheapest SR-22 Insurance in Pennsylvania for 2026 (Save With These 10 Companies)

- Cheapest SR-22 Insurance in Washington for 2026 (10 Best Companies for Savings)

- Cheap Gap Insurance in Washington (Top 10 Low-Cost Companies for 2026)

- Cheap Auto Insurance for High-Risk Drivers in Washington (Top 10 Companies Ranked for 2026)

- Best Pay-As-You-Go Auto Insurance in Washington (Top 9 Companies Ranked for 2026)

- Best Auto Insurance for Seniors in Washington (Find the Top 10 Companies for 2026 Here!)

- Best Yakima, Washington Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Puyallup, Washington Auto Insurance in 2026 (Find the Top 10 Companies Here)

- Best Newport, Washington Auto Insurance in 2026

- Best Kennewick, Washington Auto Insurance in 2026

- Best Kent, Washington Auto Insurance in 2026

- Best Bellingham, Washington Auto Insurance in 2026 (Compare the Top 10 Companies)

- Best Vancouver, Washington Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best Spokane, Washington Auto Insurance in 2026

#1 – Progressive: Top Overall Pick

Pros

- Comprehensive Roadside Assistance: According to our Progressive auto insurance review, Progressive offers robust roadside assistance coverage, including towing, tire changes, and more.

- Competitive Safe Driver Discount: Progressive provides a substantial safe driver discount, making it appealing for those with clean driving records.

- User-Friendly Online Tools: Progressive’s online platform is highly rated for ease of use, allowing customers to manage policies and claims efficiently.

Cons

- Higher Premiums for High-Risk Drivers: Despite competitive discounts, premiums can be higher for drivers with less-than-perfect records.

- Limited Availability of Local Agents: Some customers prefer local agent support, which may not be as accessible with Progressive’s primarily online service model.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for UBI Discount

Pros

- Usage-Based Insurance Savings: Allstate offers significant discounts through its usage-based insurance (UBI) program, DriveWise.

- Extensive Network of Agents: Allstate’s vast network of local agents provides personalized service and support.

- Strong Financial Stability: Our analysis of Allstate auto insurance review reveals Allstate’s A+ rating by A.M. Best, Allstate offers reassurance of financial strength and stability.

Cons

- Higher Premiums Without Discounts: For customers who do not qualify for specific discounts like UBI, Allstate’s premiums might be relatively higher.

- Mixed Customer Service Reviews: Some customers report varying experiences with customer service quality.

#3 – USAA: Best for Military Benefits

Pros

- Exclusive Benefits for Military Members: USAA offers tailored insurance products and discounts specifically for military members and their families.

- Excellent Customer Service: Our USAA auto insurance review indicates USAA’s consistent high marks for customer service satisfaction.

- Strong Financial Ratings: USAA is rated A++ by A.M. Best, reflecting superior financial stability.

Cons

- Limited to Military Members: USAA insurance products are only available to current and former military members and their families.

- Potentially Higher Premiums for Non-Military: Non-military customers may find USAA’s premiums less competitive compared to other insurers.

#4 – Geico: Best for Good Drivers

Pros

- Low-Cost Options for Good Drivers: Geico offers competitive rates and Geico auto insurance discounts tailored for drivers with good records.

- User-Friendly Mobile App: Geico’s mobile app is highly rated for its functionality and ease of use.

- Quick and Efficient Claims Process: Geico is known for its streamlined claims handling process.

Cons

- Limited Agent Availability: Geico primarily operates through online and phone channels, which may not suit customers preferring face-to-face interactions.

- Fewer Discounts for High-Risk Drivers: High-risk drivers may not find as many discount opportunities compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Student Savings

Pros

- Student Discounts: State Farm offers significant savings opportunities for student drivers.

- Wide Range of Coverage Options: State Farm provides various coverage options that can be tailored to individual needs.

- Established Agent Network: Our examination of State Farm auto insurance review shows State Farm has extensive network of agents provides personalized service across the country.

Cons

- Higher Premiums for Certain Demographics: Despite discounts, premiums for some demographics, such as young drivers, may be higher.

- Average Claims Satisfaction: Some customers report average satisfaction with the claims process compared to competitors.

#6 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Safe-Driving Incentives: Liberty Mutual offers various discounts and incentives for safe drivers.

- Customizable Coverage Options: Liberty Mutual allows customers to tailor policies to their specific needs.

- Additional Policy Features: The results of our Liberty Mutual auto insurance review suggests Liberty Mutual includes additional features like new car replacement and better car replacement options.

Cons

- Mixed Customer Service Reviews: Some customers have reported issues with claims handling and customer service responsiveness.

- Limited Availability of Discounts: Liberty Mutual may offer fewer discounts compared to some other major insurers.

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Nationwide’s accident forgiveness program helps prevent rate increases after an accident.

- Range of Coverage Options: Nationwide provides a wide array of coverage options to meet different customer needs.

- Strong Customer Satisfaction Ratings: Our assessment of Nationwide auto insurance review illustrates Nationwide receives positive feedback for customer service and claims handling.

Cons

- Availability of Accident Forgiveness: The accident forgiveness program may not be available in all states or for all policyholders.

- Potentially Higher Premiums: Some customers report higher premiums compared to other insurers offering similar coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Organization Discount

Pros

- Discounts for Organization Members: The Hartford auto insurance discounts are available for members of various organizations, such as AARP.

- Specialized Coverage Options: The Hartford provides specialized coverage options for specific needs, such as classic cars.

- Strong Financial Stability: Rated A+ by A.M. Best, The Hartford demonstrates strong financial stability.

Cons

- Limited Availability for Non-Members: Discounts and specialized coverage may be restricted to members of certain organizations.

- Higher Premiums Without Discounts: Customers who do not qualify for specific discounts may find premiums to be higher.

#9 – The General: Best for High-Risk Coverage

Pros

- Specialized High-Risk Coverage: Based on The General auto insurance review, The General specializes in providing insurance for high-risk drivers who may have difficulty obtaining coverage elsewhere.

- Quick Quotes and Coverage: The General offers fast quotes and coverage options tailored for drivers needing immediate insurance.

- Affordable Options for High-Risk Drivers: The General provides affordable insurance options tailored specifically for high-risk drivers.

Cons

- Higher Premiums for Non-High-Risk Drivers: Customers with good driving records may find premiums to be less competitive.

- Limited Coverage Options: The General’s coverage options may be more limited compared to other insurers.

#10 – Travelers: Best for Specialized Coverage

Pros

- Extensive Range of Specialized Coverage: Travelers offers a broad array of specialized insurance products, including umbrella and niche market coverages.

- Strong Financial Ratings: Insights from our Travelers auto insurance reviews shows Travelers is rated A++ by A.M. Best, indicating excellent financial stability.

- Global Presence and Expertise: With a global footprint, Travelers brings extensive experience and expertise to its insurance offerings.

Cons

- Higher Premiums for Basic Coverage: Customers seeking basic insurance coverage may find Travelers’ premiums to be higher.

- Complex Policy Options: The range of specialized coverage options can sometimes be overwhelming for customers seeking simple solutions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Rates in Washington by Coverage Level

Below is a comparative overview of monthly auto insurance rates in Washington state, categorized by coverage level and insurance providers. This information provides a snapshot of current premiums offered by various companies for both minimum and full coverage options.

Allstate offers minimum coverage for $50 and full coverage auto insurance for $114, while Geico provides minimum coverage at $32 and full coverage at $75. Liberty Mutual charges $40 for minimum coverage and $92 for full coverage, and Nationwide’s rates are $30 for minimum coverage and $70 for full coverage. Progressive offers minimum coverage for $26 and full coverage for $60.

Washington Auto Insurance Monthly Rates by Coverage Level & Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $50 | $114 |

| Geico | $32 | $75 |

| Liberty Mutual | $40 | $92 |

| Nationwide | $30 | $70 |

| Progressive | $26 | $60 |

| State Farm | $30 | $69 |

| The General | $54 | $232 |

| The Hartford | $43 | $113 |

| Travelers | $35 | $81 |

| USAA | $20 | $46 |

State Farm’s rates stand at $30 for minimum coverage and $69 for full coverage. The General has higher rates, with minimum coverage at $54 and full coverage at $232, and The Hartford charges $43 for minimum and $113 for full. Travelers offers minimum coverage at $35 and full coverage at $81, and USAA provides the most affordable auto insurance in Washington state at $20 for minimum coverage and $46 for full coverage.

Full Coverage Auto Insurance Rates in Washington

While Washington doesn’t require drivers to carry full coverage, you’ll probably need it if you have a car loan or lease. Full coverage offers valuable protection, and even drivers who own their car outright can benefit from buying it. In Washington, full coverage includes the following insurance:

- Liability: Consisting of bodily injury and property damage coverages, liability auto insurance pays for damage you cause in an accident. It doesn’t cover your car.

- Comprehensive: Comprehensive auto insurance covers car damage aside from collisions, including weather, fire, theft, and vandalism.

- Collision: You need collision auto insurance if you want help from your insurance company to pay for damages to your car after an accident.

- Uninsured Motorist: Although Washington requires drivers to carry minimum insurance, not everyone follows the law. Uninsured/Underinsured motorist coverage protects you from drivers with inadequate insurance.

- Personal Injury Protection: Medical bills can get expensive after an accident, but personal injury protection (PIP) auto insurance will help cover them for you and your passengers.

These five types of insurance together provide comprehensive coverage for your vehicle, ensuring you’re financially protected in various scenarios.

However, it’s important to note that while full coverage offers extensive benefits, it typically comes at a higher cost than the minimum required insurance.

Washington Auto Insurance Rates by Age and Gender

Top auto insurance companies in Washington State consider several factors to determine rates. This can be through auto insurance by age and gender. Statistically, young people and men tend to have higher accident rates and file more claims than other groups. Men, in particular, exhibit higher tendencies to speed, not wear seatbelts, carry multiple passengers, and engage in reckless driving behaviors compared to women.

Progressive is the best Washington auto insurance company offering rates starting at $20 per month, making it the top choice for Washington drivers seeking affordable and reliable auto insurance.Chris Abrams Licensed Insurance Agent

Likewise, young drivers tend to drive distracted and lack the experience to handle dangerous situations. As a result, auto insurance for young drivers comes with some of the highest rates. You can check below to see how much Washington drivers pay based on age and gender:

Washington Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | 16-Year-Old Female | 16-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $496 | $520 | $118 | $122 | $115 | $114 | $107 | $111 |

| American Family | $565 | $704 | $88 | $117 | $91 | $91 | $84 | $84 |

| Farmers | $403 | $392 | $128 | $135 | $98 | $102 | $84 | $100 |

| Geico | $265 | $328 | $155 | $102 | $75 | $75 | $67 | $67 |

| Liberty Mutual | $604 | $606 | $90 | $98 | $85 | $92 | $71 | $81 |

| Nationwide | $297 | $336 | $82 | $90 | $68 | $70 | $62 | $65 |

| Progressive | $676 | $695 | $79 | $80 | $65 | $60 | $55 | $56 |

| State Farm | $248 | $285 | $76 | $87 | $69 | $69 | $62 | $62 |

| Travelers | $591 | $748 | $81 | $88 | $80 | $81 | $73 | $74 |

| USAA | $253 | $272 | $58 | $63 | $46 | $46 | $43 | $43 |

| U.S. Average | $566 | $618 | $128 | $139 | $119 | $119 | $106 | $110 |

Although rates are high when you’re young, the good news is that you won’t be stuck with them forever. If you keep your driving record clean, your rates will drop around 25. Until then, make sure you find the best auto insurance coverage for drivers under 25.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Washington Auto Insurance Rates After an Accident

One of the best ways for auto insurance companies to predict how risky you’ll be as a driver is to look at how many accidents you have on your record. If you have too many, standard insurance companies might not be willing to insure you, and you’ll have to find high-risk auto insurance.

An at-fault accident typically raises your rates by 42%, though the actual amount you’ll see depends on your company. Even an accident you’re not responsible for can raise your rates, though the increase is usually much less. Check below to see which companies have the best rates in Washington after an accident:

Washington Full Coverage Auto Insurance Monthly Rates by Provider: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| Allstate | $156 | $114 |

| American Family | $136 | $91 |

| Farmers | $139 | $102 |

| Geico | $116 | $75 |

| Liberty Mutual | $127 | $92 |

| Nationwide | $117 | $70 |

| Progressive | $144 | $60 |

| State Farm | $83 | $69 |

| Travelers | $114 | $81 |

| USAA | $62 | $46 |

| U.S. Average | $173 | $119 |

Although your rates will increase after an at-fault accident, they’ll eventually drop if you keep your driving record clean. While state laws vary, for Washington auto insurance laws, the average wait time for an accident to stop affecting your rates is three years.

Washington Auto Insurance Rates by City

From Seattle to Spokane, there’s no denying the beauty of Washington’s cities. However, like most states, living in a bigger city usually comes with higher rates, while small towns enjoy more affordable insurance. Below, you can check the average cost of auto insurance in Washington state.

This table compares auto insurance costs in cities across Washington state: Bellingham, Puyallup, Kennewick, Spokane, Kent, Vancouver, Newport, and Yakima. Understanding these variations helps residents make informed coverage decisions. Whether in urban centers or rural areas, drivers can use this data to assess their insurance needs and find competitive rates tailored to their location

Washington Auto Insurance Cost by City

As you might expect of the most populous city, auto insurance in Seattle has some of the highest rates. You might also struggle to find cheapest auto insurance companies in Tacoma, Washington’s third-largest city.

On the other hand, Spokane has rates a little lower than the average, despite being the second-largest city in Washington. Moreover, with low traffic and decent car theft rates, insurance companies consider Spokane a relatively safe place for drivers.

Washington Auto Insurance With a DUI

While at-fault accidents have a fairly substantial effect on your rates, DUIs are much worse. Aside from the legal fees, potential license suspension, and possible jail time, increased auto insurance rates are one of the most impactful consequences of a DUI.

On average, a DUI will increase your rates by 74%, though some companies are more forgiving than others. Check below to see how much Washington auto insurance providers charge for coverage after a DUI:

Washington Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $114 | $156 | $152 | $126 |

| American Family | $91 | $136 | $179 | $130 |

| Farmers | $102 | $139 | $163 | $134 |

| Geico | $75 | $116 | $204 | $75 |

| Liberty Mutual | $92 | $127 | $129 | $113 |

| Nationwide | $70 | $117 | $159 | $80 |

| Progressive | $60 | $144 | $79 | $86 |

| State Farm | $69 | $83 | $76 | $76 |

| Travelers | $81 | $114 | $170 | $110 |

| USAA | $46 | $62 | $92 | $53 |

| U.S. Average | $119 | $173 | $209 | $147 |

Like at-fault accidents, a DUI won’t affect your auto insurance rates forever. However, you’ll pay higher prices for much longer with a DUI — the average DUI takes about seven years before falling off your insurance record. As always, it’s vital to compare auto insurance quotes in Washington state from several companies to find the best rates in any scenario.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Washington State DUI Laws

Washington drivers usually face a gross misdemeanor when charged with a DUI. A gross misdemeanor carries a maximum sentence of 365 days in jail and a $5,000 fine. The consequences you’ll face after a DUI depend on the severity of the incident and your driving history.

Washington splits its DUI consequences into two categories. The first is for drivers with a blood alcohol content (BAC) of .15 or less or who didn’t need to take a test. These drivers face the following consequences:

- First Offense in Seven Years: Up to 365 days in jail, 15 days of electronic home monitoring, a $5,000 fine, an ignition interlock device, and a 90-day license suspension.

- Second Offense in Seven Years: Up to 365 days in jail, 60 days of electronic home monitoring, a $5,000 fine, an IID, and a two-year license revocation. A second DUI in seven years comes with a minimum 30-day jail sentence.

- Third or More Offenses in Seven Years: Up to 365 days in jail, 120 days of electronic home monitoring, a $5,000 fine, an IID, and a three-year license suspension. Subsequent DUIs come with a minimum 90-day jail sentence.

The second category of consequences goes to those with a BAC of .15 or more who refused to test. These drivers face the following consequences:

- First Offense in Seven Years: Up to 365 days in jail, 30 days of electronic home monitoring, a $5,000 fine, an IID, and a one-year license revocation. You’ll lose your license for two years if you refuse to test.

- Second Offense in Seven Years: Up to 365 days in jail, 90 days of electronic home monitoring, a $5,000 fine, an IID, and a two-year license revocation. You’ll lose your license for three years and spend at least 45 days in jail if you refuse to test.

- Third or More Offenses in Seven Years: Up to 365 days in jail, 150 days of electronic home monitoring, a $5,000 fine, an IID, and a four-year license revocation. Subsequent DUIs come with a minimum 120-day jail sentence.

You may also need to attend substance abuse educational courses before you can get your license reinstated. You’ll also face harsher punishments if you had a minor under 16 in the vehicle with you, including higher fees and more jail time.

Washington keeps DUIs on your record for seven years, which means it’ll affect your insurance prices, background checks, and even your employment opportunities for a long time. A final DUI law in Washington states that any driver convicted of a DUI will enter a five-year probationary period. The best auto insurance for drivers with a DUI may be able to help you find affordable coverage.

Washington State Auto Insurance Laws

Before hitting the road, both car and motorcycle drivers are required to have a minimum amount of liability insurance. They must be able to provide proof of this insurance upon request by any law enforcement officer; failure to do so will lead to a ticket.

However, not all vehicles necessitate insurance. For instance, motor scooters and mopeds, state or publicly-owned vehicles, specially licensed horseless carriages over 40 years old, and contract carriers regulated by the Washington Utilities and Transportation Commission do not require proof of insurance.

Learn more information on our “Minimum Auto Insurance Requirements by State.”

Getting insurance on these vehicles is wise to cover potential damages you might cause. If you’re unable to obtain coverage due to your driving history, contacting the Automobile Insurance Plan in Washington is recommended. While it may not offer the best auto insurance in Washington State, it provides an affordable option regardless of being a high-risk driver.

Driving without auto insurance in Washington incurs consequences ranging from fines starting at $465 to possible community service. Failure to pay the fine results in license revocation, with penalties varying based on the severity of the incident.

Washington Auto Insurance Coverage Options

Washington state law requires a minimum amount of liability insurance, and car lenders usually require full coverage. While you don’t technically need more coverage than this, most insurance companies offer add-ons to increase the value of your policy. Popular add-ons with Washington drivers include:

- Roadside Assistance: Roadside assistance coverage comes to the rescue when stranded on the side of the road. Most plans include towing, battery jumps, tire changes, fuel delivery, and locksmith services.

- Rental Car Reimbursement: If you buy this add-on, your insurance company will pay for a rental car while yours gets repaired after a covered incident.

- Accident Forgiveness: For accident forgiveness, your insurance company will forgive your first accident and not increase your rates with this add-on. Most companies require you to be accident-free for some time before signing up.

- Gap Coverage: If you total a new car, you might owe more on the loan than the vehicle is worth. Gap insurance pays the difference, so you’re not stuck paying for a vehicle you no longer own.

- Custom Parts and Equipment: Standard insurance policies only cover the original parts of your car. If you’ve made modifications, this add-on covers them.

While add-ons increase your policy’s value, you should only buy what you need. Add-ons can significantly increase auto insurance rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying SR-22 Auto Insurance in Washington

Although referred to as insurance, SR-22s are a necessary form some drivers must submit to their local DMV to prove they carry Washington’s required minimum insurance. This requirement follows events such as a DUI/DWI charge, driving without insurance, driving with a suspended license, or multiple traffic tickets in a short period.

Every state is different, but you’ll most likely receive notice that you must file SR-22 auto insurance through the mail. While most states require SR-22 forms, some use FR-44 forms instead. FR-44 forms are similar to SR-22 but require more coverage than state minimum insurance.

Obtain more information about FR-44 auto insurance.

When you need SR-22 or FR-44 insurance, you’ll need to file forms with your DMV for about three years. Most states require a licensed insurance company to handle filing your SR-22 forms. Getting SR-22 insurance in Washington is relatively straightforward. It costs more than a standard insurance policy, but finding a company to work with you isn’t usually difficult.

You’ll need to search for the right plan. Drivers who already have auto insurance will likely have an easier time, as most companies don’t drop drivers needing SR-22 insurance. If you already have a policy, contact a representative and inform them you need SR-22 insurance. Your current rates will likely increase, and there will be a filing fee, but you won’t have to worry about driving illegally.

Progressive stands out as the top choice for Washington auto insurance, offering comprehensive coverage and competitive rates.Daniel Walker Licensed Auto Insurance Agent

If you don’t have insurance, buying SR-22 insurance is similar to purchasing a standard policy. When you fill out an application, let the company know you need SR-22 insurance. Your application might be rejected, but you probably won’t face any issues.

Washington may suspend your license until you submit your first SR-22 form. While it’s relatively easy if you have a car, how do you buy insurance if you don’t own a vehicle?

Using a car you don’t own?🚗You might think you don’t need insurance, but you still do!😱But what is non-owner car insurance and what does it cover?🤔At https://t.co/27f1xf131D, we can help!📑 Learn more about obtaining this policy here👉: https://t.co/DGt7s31JM1 pic.twitter.com/H6bHFocldA

— AutoInsurance.org (@AutoInsurance) June 2, 2023

People in this situation should consider a non-owner policy. Non-owner auto insurance covers you in any vehicle you drive and allows you to prove financial responsibility to the state. It also costs about 15% less than a standard auto insurance policy.

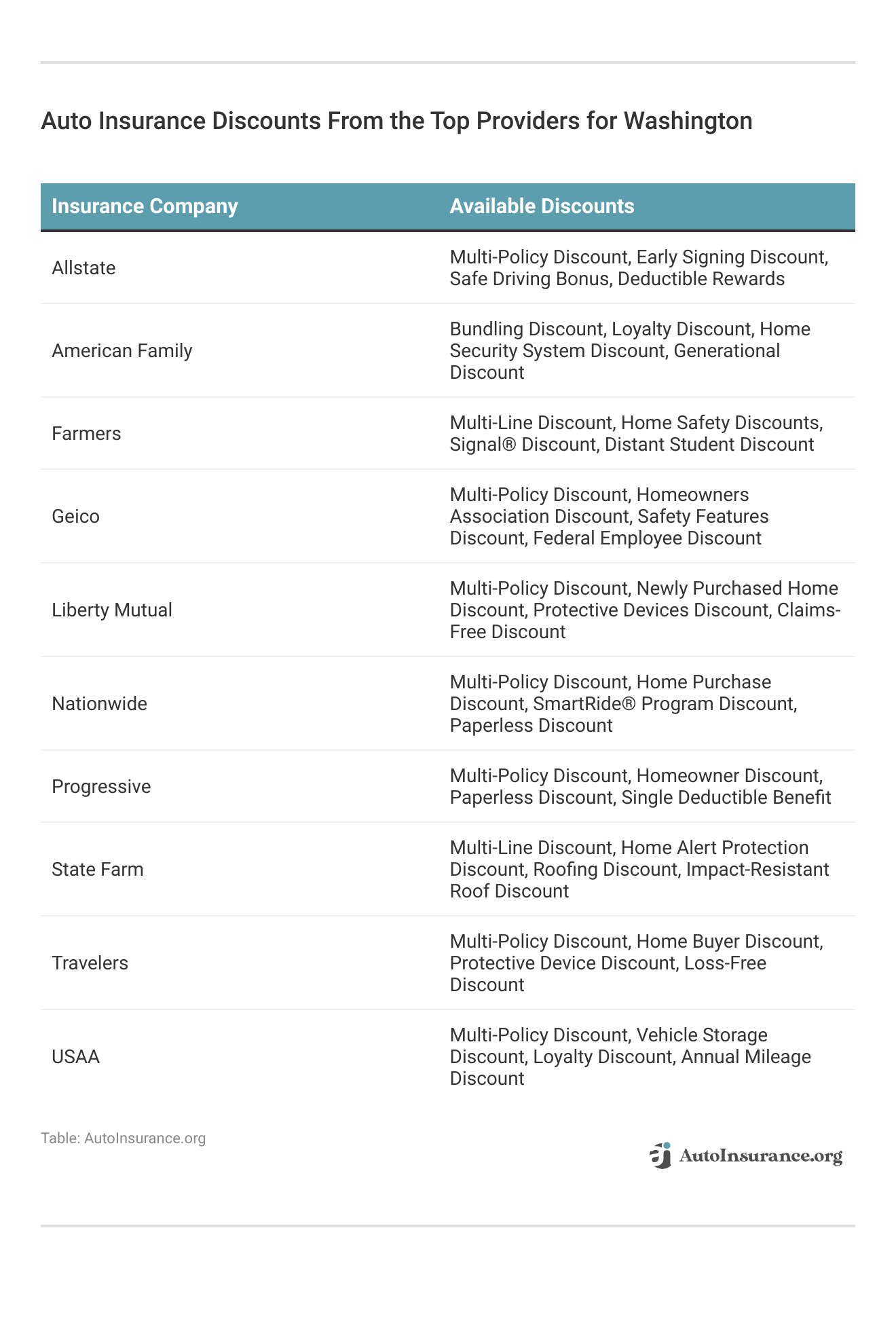

Save Money on Washington Auto Insurance

Washington drivers pay about 20% less than the national average for auto insurance. To save on affordable insurance in Washington, adjust your coverage to match your needs and consider raising your auto insurance deductible to lower monthly premiums. Look for discounts offered by insurance companies, such as those for safe driving or policy bundling.

A clean driving record also helps in securing lower insurance rates. Usage-based insurance is another option for saving, especially if you drive infrequently or practice safe driving habits. Finally, compare quotes from different insurers to find the best rate based on your specific circumstances.

The most crucial part of finding affordable insurance, no matter what state you live in, is to compare quotes. Even if you already have a policy, it’s not a bad idea to occasionally look at other companies to ensure you’re not overpaying.

Case Studies: Highlighting Auto Insurance Realities in Washington State

In this section, we delve into real-world case studies that illuminate various aspects of auto insurance in Washington State. Each case study showcases how different factors such as accidents, demographics, and coverage decisions influence insurance premiums and choices.

- Case Study 1 – Impact of Moving to a High-Traffic Area: A 25-year-old driver from Bellevue experienced a 40% increase in auto insurance premiums after relocating to Seattle due to higher traffic density. Despite maintaining a clean driving record, the driver found that location significantly influenced insurance costs in urban settings.

- Case Study 2 – Effect of Multiple Accidents on Premiums: A 40-year-old driver in Spokane faced a 60% hike in insurance rates after being involved in two at-fault accidents within a three-year period. Despite opting for accident forgiveness coverage, the driver struggled to find affordable premiums, emphasizing the long-term financial impact of multiple incidents.

- Case Study 3 – Benefits of Bundling Policies for Savings: A married couple in Tacoma saved 25% on their auto insurance premiums by bundling their home and auto policies with the same insurer. This decision not only reduced costs but also simplified their insurance management and enhanced overall coverage benefits.

These case studies underscore the diverse factors influencing auto insurance rates and decisions in Washington State. By considering location, driving history, coverage options, and policy bundling opportunities, drivers can effectively navigate insurance choices to optimize coverage and minimize costs.

Always explore different insurers and policies to find the best fit for your unique circumstances and financial goals.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Conclusion: Choosing the Best Auto Insurance in Washington

Navigating the best auto insurance in Washington State can be complex, but understanding the state’s minimum requirements and additional coverage options is crucial for every driver. Whether you’re seeking affordable rates, comprehensive coverage, or specialized insurance like SR-22 filings, comparing quotes from multiple providers remains the best strategy.

Factors such as age, driving record, and location influence insurance premiums, making it essential to tailor your policy to your specific needs. By staying informed about available discounts and state laws, Washington drivers can make confident decisions to protect themselves and their vehicles on the road. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Is Washington a no fault state?

No, Washington is an at-fault state, and drivers are responsible for their share of an auto accidents and collisions.

How much is auto insurance per month in Washington?

Finding cheap auto insurance in Washington State isn’t difficult — the average minimum insurance policy costs $43 a month, while full coverage costs about $102. Some companies are more expensive, but Washington auto insurance isn’t usually too costly.

Can I have out of state auto insurance in Washington?

If you’re just visiting, your out-of-state insurance will follow you. However, if you’re moving to Washington and registering a vehicle, you will need to buy coverage from a local Washington auto insurance company. Enter your ZIP code below to find out if you can get a better deal.

Does insurance follow the car or the driver in Washington state?

Washington liability insurance will follow the vehicle, not the driver. So if someone gets into an accident while borrowing your car, your insurance will cover any damage or injuries they cause.

Are there any discounts available for Washington auto insurance?

Insurance companies in Washington offer various auto insurance discounts that can help reduce your auto insurance premiums. Some common discounts include safe driver discounts, good student discounts, multi-policy discounts (if you have multiple policies with the same insurer), and anti-theft device discounts.

Why are insurance rates going up in Washington state?

Rising medical costs are a major reason why Washington auto insurance rates are going up.

What happens if you don’t have auto insurance in Washington state?

In Washington, the minimum fine for driving without insurance is $550. Your license may be suspended if you’re in an accident without insurance.

What are the Washington auto insurance requirements?

Washington auto insurance requirements mandate that drivers carry a minimum amount of liability coverage, which includes $25,000 for bodily injury liability per person, $50,000 for bodily injury per accident, and $10,000 for property damage. These minimums ensure that drivers can cover damages or injuries they may cause in an accident.

What factors affect the cost of cheap auto insurance in Washington?

The cost of cheap auto insurance in Washington is influenced by various factors, including your driving record, age, gender, vehicle type, and location. Maintaining a clean driving record and taking advantage of discounts offered by insurance companies can help you secure lower premiums.

How can I obtain Washington auto insurance quotes?

You can obtain Washington auto insurance quotes by visiting insurance company websites, using online comparison tools, or contacting insurance agents directly. By entering your ZIP code and providing some basic information about your vehicle and driving history, you can receive multiple quotes to compare.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Who offers the cheapest auto insurance in Washington?

How much is auto insurance in Washington state on average?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.