Best Windshield Replacement Coverage in Utah (Top 10 Companies in 2026)

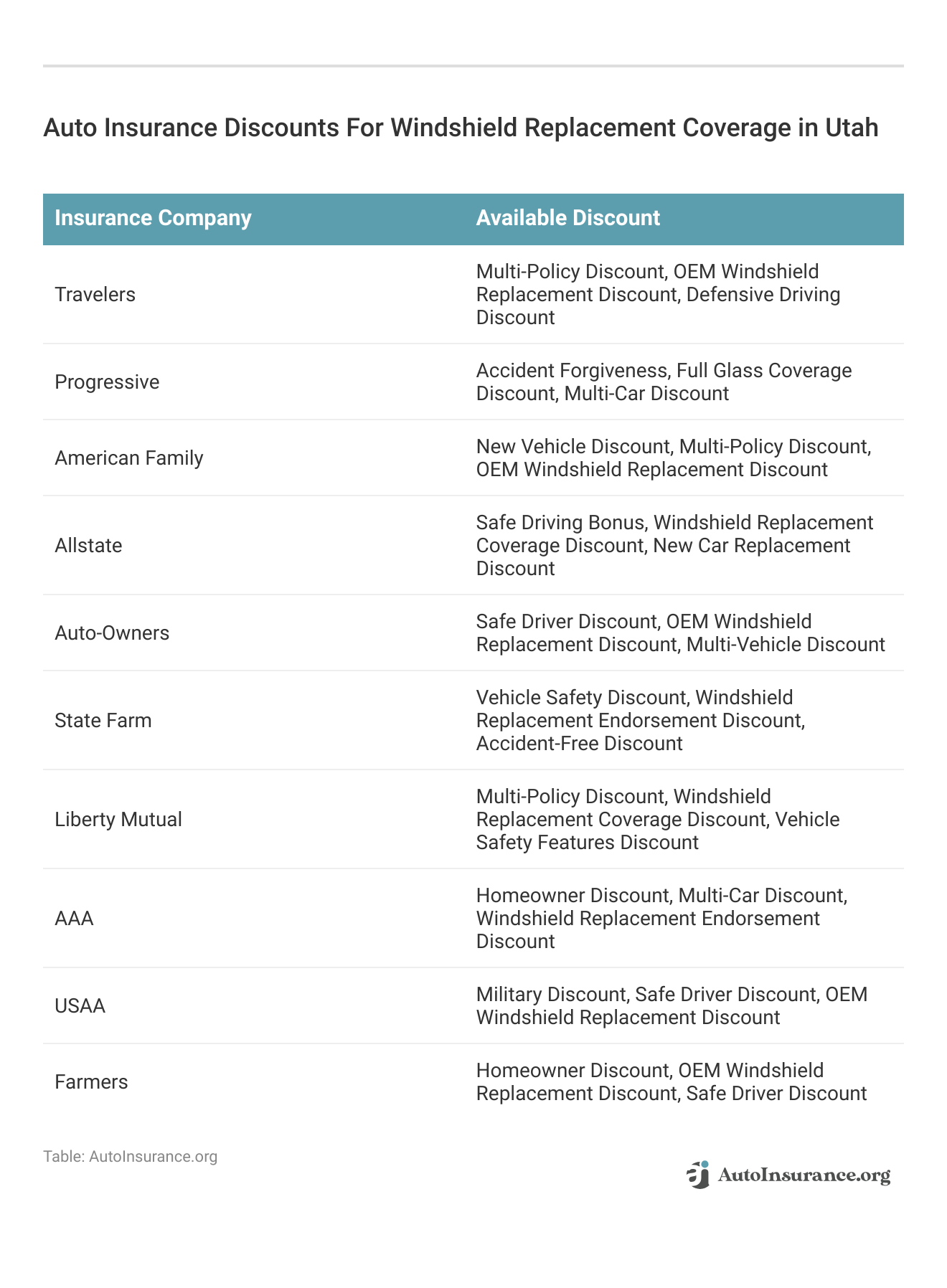

Travelers, Progressive, and American Family offer the best windshield replacement coverage in Utah, with premiums starting at $55 per month. We aim to assist you in comparing quotes from these trusted insurers, helping you secure the best coverage while enjoying tailored discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage Windshield Replacement in Utah

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in Utah

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage Windshield Replacement in Utah

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews- Travelers provides competitive rates starting at $55 per month

- Leading insurance providers offer opportunities to save on windshield replacements

- Multiple discount options are available for windshield replacement coverage

#1 – Travelers: Top Overall Pick

Pros

- Comprehensive Coverage Options: Our Travelers auto insurance review reveals that Travelers offers a wide range of coverage options, including excellent windshield replacement coverage, ensuring customers can tailor their policies to their specific needs.

- Competitive Rates: With premiums starting at $55 per month in Utah, Travelers provides affordable insurance options without compromising on coverage quality.

- Strong Reputation: Travelers is well-known for its financial stability and reliability, instilling confidence in policyholders that their claims will be handled efficiently and fairly.

Cons

- Limited Accessibility: Travelers may not be available in all areas, limiting options for potential customers in regions where coverage is not offered.

- Complex Claims Process: Some customers have reported difficulties navigating Travelers’ claims process, which could lead to frustration and delays in receiving reimbursement for covered damages.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Loyalty Rewards

Pros

- Innovative Features: In our Progressive auto insurance review, Progressive is known for its innovative offerings such as Snapshot, which rewards safe driving behavior with discounts, making it appealing to tech-savvy drivers.

- Wide Range of Discounts: Progressive offers numerous discounts, including multi-policy, multi-car, and safe driver discounts, helping customers save on their premiums.

- Transparent Pricing: Progressive’s transparent pricing model allows customers to see how different factors affect their rates, promoting trust and understanding.

Cons

- Average Customer Service: While Progressive offers competitive rates and innovative features, some customers have reported average or below-average experiences with their customer service, citing long wait times and difficulty reaching representatives.

- Limited Coverage Options: Progressive’s coverage options may not be as extensive as some other providers, potentially leaving customers with specific needs searching for additional coverage elsewhere.

#3 – American Family: Best for Young Volunteers

Pros

- Personalized Service: American Family prides itself on providing personalized service, with agents who take the time to understand each customer’s unique needs and find the best coverage options for them.

- Community Involvement: American Family is actively involved in supporting local communities through various initiatives and sponsorships, fostering a positive brand image and connection with customers.

- Strong Financial Stability: With a solid financial standing, American Family offers reassurance to policyholders that their claims will be paid promptly and reliably.

Cons

- Limited Availability: American Family’s coverage may be limited to certain regions, potentially excluding customers outside of those areas from accessing their services. Read more through our American Family auto insurance review.

- Higher Premiums: While American Family offers quality coverage and personalized service, some customers may find their premiums to be slightly higher compared to other providers offering similar coverage options.

#4 – Allstate: Best for Full Coverage

Pros

- Comprehensive Coverage: Allstate offers a wide range of coverage options, including excellent windshield replacement coverage, ensuring customers have peace of mind on the road.

- User-Friendly Tools: Allstate provides user-friendly tools and resources, such as the Allstate mobile app, making it easy for customers to manage their policies, file claims, and access assistance whenever needed.

- Discount Opportunities: Allstate offers various discount opportunities, such as the Drivewise program, which rewards safe driving habits with discounts on premiums, helping customers save money on their insurance. Use our Allstate auto insurance review as your guide.

Cons

- Higher Premiums: While Allstate offers comprehensive coverage and valuable features, some customers may find their premiums to be higher compared to other providers offering similar coverage options.

- Mixed Customer Service Reviews: Allstate’s customer service reputation varies, with some customers reporting positive experiences while others have encountered challenges with claim processing or communication with representatives.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Add-ons

Pros

- Excellent Customer Service: Auto-Owners is known for its exceptional customer service, with agents who are dedicated to providing personalized assistance and promptly addressing customer inquiries and concerns.

- Comprehensive Coverage Options: Auto-Owners offers a wide range of coverage options, including windshield replacement coverage, allowing customers to customize their policies to meet their specific needs and preferences.

- Financial Stability: With a strong financial standing, Auto-Owners provides reassurance to policyholders that their claims will be handled promptly and efficiently, even in challenging situations.

Cons

- Limited Availability: Auto-Owners may not be available in all areas, limiting options for potential customers in regions where coverage is not offered. Read more through our Auto-Owners auto insurance review.

- Less Transparent Pricing: Some customers have reported that Auto-Owners’ pricing and discount opportunities may be less transparent compared to other providers, making it difficult to understand how rates are determined and how to qualify for discounts.

#6 – State Farm: Best for Local Agents

Pros

- Extensive Network of Agents: State Farm boasts a vast network of local agents, providing personalized assistance and guidance to customers, ensuring they find the right coverage options for their needs.

- Variety of Discounts: State Farm offers a variety of discounts, including multi-policy, multi-car, and safe driving discounts, helping customers save on their premiums and maximize their coverage benefits.

- Financial Stability: With a long-standing reputation for financial stability, State Farm provides customers with confidence that their claims will be paid promptly and reliably, even in times of economic uncertainty.

Cons

- Potentially Higher Premiums: While State Farm offers comprehensive coverage and personalized service, some customers may find their premiums to be higher compared to other providers offering similar coverage options.

- Limited Online Presence: State Farm’s online tools and resources may be less robust compared to some other providers, potentially limiting convenience for customers who prefer managing their policies digitally. Find out more in our State Farm auto insurance review.

#7 – Liberty Mutual: Best for Policy Customization

Pros

- Customizable Coverage Options: Liberty Mutual offers customizable coverage options, allowing customers to tailor their policies to meet their specific needs and budget requirements.

- Discount Opportunities: Liberty Mutual provides various discount opportunities, such as bundling policies, installing safety devices in vehicles, and maintaining a good driving record, helping customers save on their premiums. For further insights, refer to our Liberty Mutual auto insurance review.

- User-Friendly Online Tools: Liberty Mutual offers user-friendly online tools and resources, making it easy for customers to manage their policies, file claims, and access assistance whenever needed, enhancing overall customer experience.

Cons

- Mixed Customer Service Reviews: Liberty Mutual’s customer service reputation varies, with some customers reporting positive experiences while others have encountered challenges with claim processing or communication with representatives.

- Potentially Complex Pricing: Some customers may find Liberty Mutual’s pricing structure to be complex, with rates that may vary depending on various factors such as location, driving history, and coverage options, making it difficult to understand how premiums are determined.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance Benefits: AAA offers comprehensive roadside assistance benefits, including services such as towing, fuel delivery, battery jump-starts, and flat tire assistance, providing extensive coverage and peace of mind to members in emergency situations. Read more through our AAA auto insurance review.

- Member Discounts and Rewards: AAA members can access a wide range of discounts and rewards on travel, shopping, entertainment, and more, helping them save money on everyday expenses and enhancing their overall membership experience.

- Travel Services: AAA provides members with travel planning services, including assistance with booking hotels, car rentals, and vacation packages, as well as access to exclusive travel deals and perks, making it a valuable resource for travelers.

Cons

- Limited Availability: AAA membership and insurance coverage may be limited to certain regions, potentially excluding customers outside of those areas from accessing their services.

- Membership Fees: While AAA provides valuable benefits and discounts, some customers may find the membership fees to be relatively high compared to other roadside assistance providers, especially if they do not utilize all the available benefits.

#9 – USAA: Best for Military Drivers

Pros

- Exclusive Membership Benefits: USAA offers exclusive benefits and discounts to military members and their families, including competitive insurance rates, personalized customer service, and financial products tailored to their unique needs, ensuring they receive exceptional value and support.

- Top-Rated Customer Service: USAA consistently receives high ratings for customer service satisfaction, with dedicated representatives who understand the specific needs of military members and provide exemplary assistance and support, fostering strong relationships and loyalty among members. Read more through our USAA auto insurance review.

- Financial Stability and Trust: USAA’s strong financial standing and reputation for reliability instill confidence in members that their insurance claims will be handled promptly and fairly, even in challenging circumstances, providing peace of mind and security for themselves and their families.

Cons

- Membership Eligibility Restrictions: USAA membership is limited to current and former military members and their families, potentially excluding a significant portion of the population from accessing their insurance products and services.

- Limited Branch Locations: USAA primarily operates online and over the phone, with limited branch locations for in-person assistance, which may be less convenient for customers who prefer face-to-face interactions with their insurance provider.

#10 – Farmers: Best for Great Add-ons

Pros

- Comprehensive Coverage Options: Farmers, as mentioned in our Farmers auto insurance review, offers a wide range of coverage options, including customizable policies tailored to meet the specific needs of individual customers, ensuring they have the protection they need for their vehicles and assets.

- Strong Customer Support: Farmers is known for its strong customer support, with dedicated agents who provide personalized assistance and guidance to customers, helping them navigate their insurance options and address any concerns or questions they may have.

- Innovative Features: Farmers offers innovative features such as Signal® app, which tracks driving behavior and rewards safe driving habits with potential discounts on premiums, encouraging and incentivizing responsible driving among policyholders.

Cons

- Potentially Higher Premiums: While Farmers offers comprehensive coverage and strong customer support, some customers may find their premiums to be higher compared to other providers offering similar coverage options, potentially impacting affordability for certain policyholders.

- Limited Accessibility: Farmers’ coverage may not be as widely available in certain regions compared to other insurance providers, potentially limiting options for customers seeking coverage in those areas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Utah Cracked Windshield Laws: Replacement and Repairs

Zero Deductible Windshield Repair Explained

The States With Zero Deductible Windshield Repairs

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

When to Use Utah Windshield Replacement Insurance to Fix a Crack

Utah Windshield Replacement Insurance: The Bottom Line

Frequently Asked Questions

Does auto insurance in Utah cover windshield replacement?

Yes, auto insurance policies in Utah typically include coverage for windshield replacement under comprehensive coverage. This coverage helps pay for the cost of repairing or replacing your windshield if it is damaged due to covered perils such as accidents, vandalism, or falling objects.

Is windshield replacement covered under liability insurance in Utah?

No, liability insurance, which is required in Utah to cover damages you cause to others, does not typically cover windshield replacement. It is important to have comprehensive coverage in addition to liability insurance to protect your windshield from damage. Enter your ZIP code now to start.

Are there any deductibles for windshield replacement claims in Utah?

Will filing a windshield replacement claim in Utah affect my insurance rates?

In Utah, windshield replacement claims are generally classified as “no-fault” claims, which means they should not impact your insurance rates or result in a surcharge. However, it is always a good idea to check with your insurance provider to understand their specific policies regarding windshield replacement claims.

Can I choose any windshield repair shop for replacement covered by my insurance in Utah?

Insurance companies in Utah often have a network of preferred windshield repair shops with which they have established partnerships. These shops are typically approved by the insurance company and may offer certain benefits, such as direct billing to your insurance. However, you are not obligated to use a preferred shop, and you can choose any reputable windshield repair shop for the replacement. Be sure to check your insurance policy for any specific requirements or recommendations. Enter your ZIP code now to start.

Which insurance providers offer the best windshield replacement coverage in Utah?

What are some key factors to consider when evaluating windshield replacement insurance in Utah?

Key factors to consider include the need for comprehensive coverage, understanding deductible requirements, and exploring options for zero deductible coverage.

Which states mandate zero deductible coverage for windshield repairs?

Some states mandate zero deductible coverage for windshield repairs, while others may require deductibles for replacements or repairs. Enter your ZIP code now to start.

How do deductible-free windshield repairs differ between states?

What are some frequently asked questions addressed regarding windshield replacement insurance in Utah?

Frequently asked questions addressed include coverage for windshield replacement under auto insurance in Utah, deductible requirements, the impact of filing a windshield replacement claim on insurance rates, and the ability to choose any windshield repair shop covered by insurance in Utah.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.