Best Windshield Replacement Coverage in Washington (Top 10 Companies in 2026)

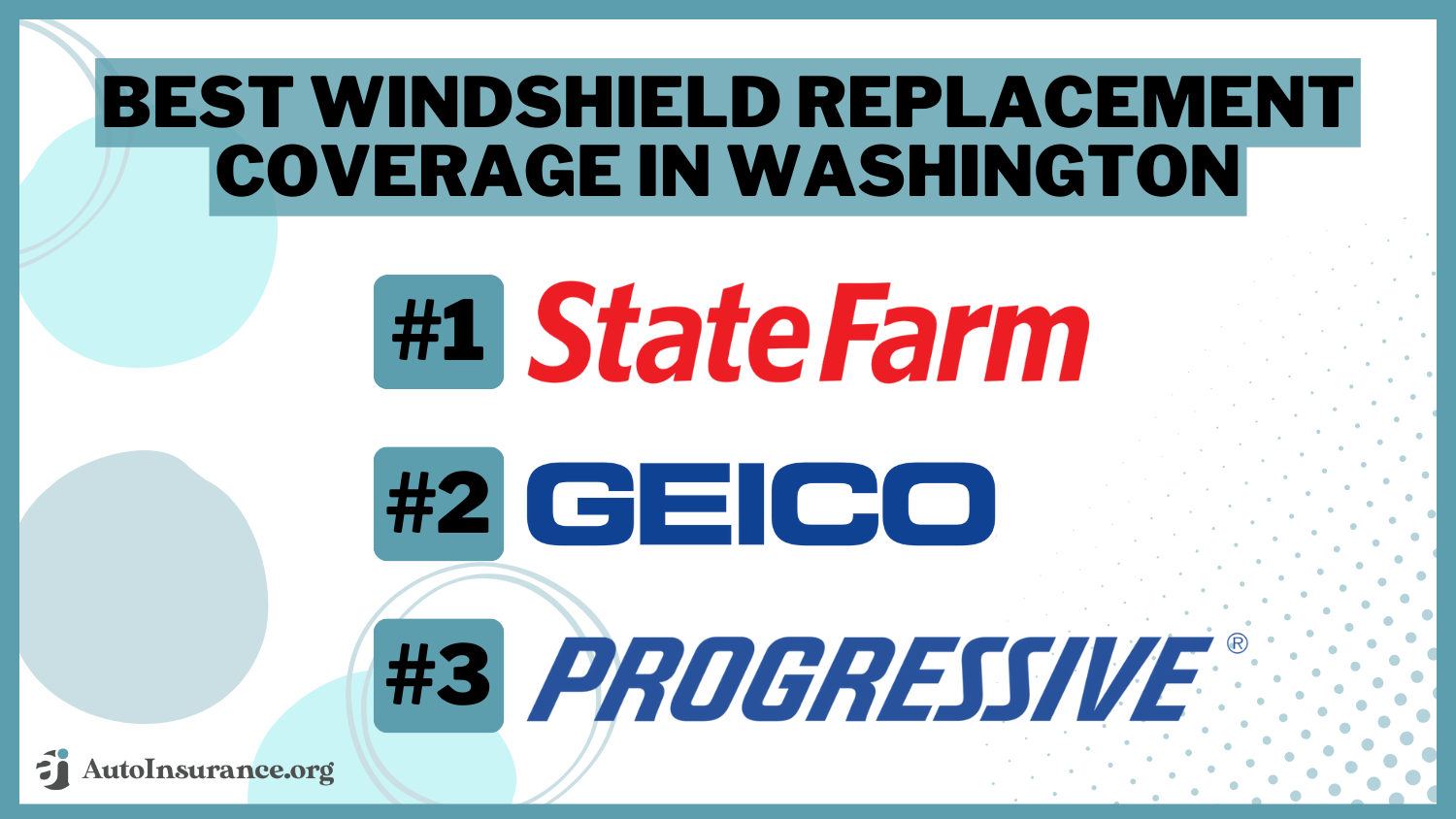

State Farm, Geico, and Progressive offer the best windshield replacement coverage in Washington, with monthly premiums starting at an affordable $70. Our objective is to help you compare quotes from these providers, ensuring you secure the most suitable coverage and personalized discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews- State Farm offers competitive rates starting at $70 per month

- Leading insurance companies provide options for windshield replacements

- Numerous discount are available for windshield replacement coverage

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm has a vast network of repair shops and service providers, making it convenient for policyholders to access windshield replacement services.

- Personalized Service: They offer personalized customer service, with agents available to assist policyholders with claims and coverage questions.

- Financial Stability: State Farm has a strong financial stability rating, providing assurance that they can fulfill their obligations to policyholders. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Premiums: While State Farm offers comprehensive coverage, their premiums may be slightly higher compared to some competitors.

- Limited Online Tools: Their online tools and mobile app may be less robust compared to some other insurance companies, which could be a drawback for tech-savvy customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cost Savings

Pros

- Competitive Rates: Geico is known for offering competitive rates, making it an attractive option for budget-conscious drivers. Read more through our Geico auto insurance review.

- User-Friendly Technology: Geico provides a user-friendly website and mobile app, allowing customers to manage their policies and file claims easily.

- Strong Financial Standing: Geico is backed by the financial strength of Berkshire Hathaway, providing stability and reliability to policyholders.

Cons

- Limited Agent Interaction: Geico primarily operates online and over the phone, which may be a drawback for customers who prefer face-to-face interactions with agents.

- Less Personalized Service: Some customers may find that Geico’s customer service lacks the personal touch offered by traditional insurance agents.

#3 – Progressive: Best for UBI Discount

Pros

- Innovative Tools: In our Progressive auto insurance review, Progressive offers innovative tools like Snapshot, which tracks driving behavior to potentially lower premiums for safe drivers.

- Quick Claims Processing: Progressive is known for its efficient claims processing, providing prompt assistance to policyholders in need of windshield replacement.

- Flexible Coverage Options: They offer a wide range of coverage options, allowing customers to customize their policies to suit their needs and budget.

Cons

- Rates Can Increase: While Progressive may offer initial competitive rates, premiums can increase over time, especially for drivers with multiple claims.

- Limited Local Agents: Progressive’s focus on online and phone-based interactions means there may be fewer opportunities for face-to-face support from local agents.

#4 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Coverage: Allstate offers comprehensive coverage options, including windshield replacement, to ensure policyholders have protection against various risks.

- Wide Range of Discounts: They provide numerous discount opportunities, such as safe driver discounts and bundling discounts, helping customers save on their premiums. Read more through our Allstate auto insurance review.

- Accessible Customer Service: Allstate offers multiple channels for customer support, including local agents, online chat, and a mobile app, making it easy for policyholders to get assistance when needed.

Cons

- Higher Premiums for Some Drivers: While Allstate offers extensive coverage and discounts, some drivers may find their premiums to be higher compared to other insurance providers.

- Mixed Customer Service Reviews: Customer experiences with Allstate’s claims process and customer service can vary, with some policyholders reporting dissatisfaction with response times and communication.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Coverage Options

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor their coverage to meet their specific needs and budget. Read more through our Liberty Mutual auto insurance review.

- Online Tools and Resources: They provide a range of online tools and resources, including a mobile app, making it convenient for policyholders to manage their policies and file claims.

- Multiple Discounts Available: Liberty Mutual offers various discounts, such as multi-policy discounts and safety feature discounts, helping customers save on their premiums.

Cons

- Complex Claims Process: Some policyholders may find Liberty Mutual’s claims process to be complex or lengthy, leading to frustration and delays in getting repairs or replacements.

- Limited Local Agents: While Liberty Mutual has local agents in many areas, some regions may have fewer agents available, limiting face-to-face support options for customers.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Strong Financial Stability: Nationwide boasts a strong financial stability rating, providing policyholders with confidence in the company’s ability to fulfill claims and obligations. Read more through our Nationwide auto insurance review.

- Wide Range of Coverage Options: Nationwide offers a variety of coverage options, including windshield replacement coverage, allowing customers to tailor their policies to their individual needs.

- Good Customer Service: Nationwide is known for its responsive and helpful customer service, with representatives available to assist policyholders with claims and inquiries.

Cons

- Higher Premiums in Some Areas: While Nationwide offers comprehensive coverage, premiums may be higher in certain regions or for drivers with specific risk factors.

- Limited Local Agents: Nationwide’s network of local agents may be more limited compared to some other insurance providers, potentially limiting face-to-face support options for customers.

#7 – Farmers: Best for Available Discounts

Pros

- Multiple Coverage Options: Farmers Insurance offers a wide range of coverage options, including windshield replacement coverage, allowing customers to customize their policies to suit their needs. Read more through our Farmers auto insurance review.

- Discount Opportunities: Farmers provides various discount opportunities, such as multi-policy discounts and good student discounts, helping policyholders save on their premiums.

- Personalized Service: Farmers agents offer personalized service, working closely with policyholders to understand their needs and provide tailored insurance solutions.

Cons

- Higher Premiums for Some Drivers: While Farmers offers comprehensive coverage and discounts, premiums may be higher for drivers with certain risk factors or in certain regions.

- Mixed Customer Reviews: Some policyholders have reported mixed experiences with Farmers’ claims process and customer service, with occasional delays or communication issues.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Industry Experience

Pros

- Extensive Coverage Options: Travelers offers a wide range of coverage options, including windshield replacement coverage, allowing customers to build policies that meet their specific needs.

- Strong Financial Standing: Travelers is financially stable and has a good reputation for fulfilling claims promptly and fairly, providing peace of mind to policyholders.

- Online Tools and Resources: They provide a range of online tools and resources, making it easy for policyholders to manage their policies, file claims, and access important information.

Cons

- Potentially Higher Premiums: While Travelers offers comprehensive coverage and financial stability, premiums may be higher compared to some other insurance providers.

- Limited Local Agents: Travelers’ network of local agents may be more limited in some areas, potentially reducing the availability of face-to-face support for customers. Read more through our Travelers auto insurance review.

#9 – American Family: Best for Claims Service

Pros

- Customizable Policies: American Family offers customizable policies, allowing customers to tailor their coverage to their specific needs and budget. Read more through our American Family auto insurance review.

- Good Customer Service: They are known for providing attentive and helpful customer service, with representatives available to assist policyholders with questions and claims.

- Innovative Coverage Options: American Family offers innovative coverage options, such as their KnowYourDrive program, which rewards safe driving behavior with potential discounts on premiums.

Cons

- Limited Availability: American Family may have limited availability in certain regions, which could be a drawback for customers seeking a local agent or face-to-face support.

- Average Rates: While American Family offers comprehensive coverage and good customer service, their rates may be average compared to some competitors, which could be a consideration for budget-conscious customers.

#10 – AAA: Best for Roadside Assistance

Pros

- Member Benefits: AAA members may enjoy additional benefits and discounts on insurance premiums, as well as access to roadside assistance services.

- Trusted Brand: AAA is a well-known and trusted brand, with a long history of providing reliable insurance and roadside assistance services to members. Read more through our AAA auto insurance review.

- Convenient Services: AAA offers convenient services, such as online policy management and 24/7 customer support, making it easy for members to access assistance and information.

Cons

- Membership Required: To access AAA insurance products, customers must be members of AAA, which involves an additional membership fee.

- Limited Availability: AAA insurance may have limited availability in certain regions, which could be a drawback for customers seeking coverage outside of AAA’s service areas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Washington State Windshield Replacement Laws for Repair Service Choice

Washington State Windshield Replacement Laws for Deductibles

Washington State Windshield Replacement Laws for Used or Aftermarket Glass

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Bottom Line on Washington State Windshield Replacement Laws

Frequently Asked Questions

Can I choose my own repair service for windshield replacement in Washington?

Yes, Washington allows car owners to choose their own repair service for windshield replacement. However, if you opt for a different repair service than the one recommended by your insurance company, you may be responsible for any additional costs beyond the original quote.

Can I choose a repair service and windshield replacement company outside of Washington?

Yes, you have the flexibility to choose a repair service or windshield replacement company from outside of Washington. However, keep in mind that you may need to consider additional costs or logistics involved in using an out-of-state service. Enter your ZIP code now to begin.

Will my insurance company raise my deductibles if I file a full glass coverage claim in Washington?

Can I handle windshield repairs or replacement on my own without involving insurance in Washington?

Yes, you have the option to handle windshield repairs or replacement on your own without involving your insurance company in Washington. However, it’s important to consider the costs involved and assess whether filing an insurance claim may be more beneficial in your situation.

Does my Washington auto insurance policy automatically include full glass coverage?

Full glass coverage may not be automatically included in your Washington auto insurance policy. It’s important to review your policy documents or contact your insurance agent to determine if you have this coverage and if any additional riders or endorsements are needed. Enter your ZIP code now to start.

What happens if I don’t repair or replace my cracked windshield in Washington?

What are the top three insurance providers offering the best windshield replacement coverage in Washington?

The top three insurance providers offering the best windshield replacement coverage in Washington are State Farm, Geico, and Progressive.

What are they key considerations for drivers regarding windshield replacement laws in Washington?

Key considerations for drivers regarding windshield replacement laws in Washington include understanding their rights to choose their repair provider, the availability of full glass coverage under their insurance policy, and the potential impact on deductibles and premiums. Enter your ZIP code now to start.

How do Washington’s auto insurance laws differ from states with zero-deductible full glass coverage laws?

Washington’s types of auto insurance laws differ from states with zero-deductible full glass coverage laws by not mandating insurers to offer zero-deductible policies. Instead, insurers in Washington may offer full glass coverage at their discretion, and policyholders may be responsible for covering deductibles when filing claims.

What options do policyholders in Washington have regarding choosing their own repair service and windshield replacement company?

Policyholders in Washington have the option to choose their own repair service and windshield replacement company. While insurance companies may recommend a repair provider, policyholders have the right to select a different service. However, any additional costs beyond the original quote must be covered by the policyholder.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.