Cheap Auto Insurance for High-Risk Drivers in Pennsylvania (Top 9 Low-Cost Companies for 2026)

State Farm, Allstate, and Progressive have cheap auto insurance for high-risk drivers in Pennsylvania, starting at $28/month. These top providers are known for broad coverage, accident forgiveness, and the Snapshot program, which ensures you get the best cheap auto insurance in Pennsylvania for high-risk drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

Company Facts

Min. Coverage for High-Risk Drivers in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for High-Risk Drivers in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for High-Risk Drivers in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap auto insurance for high-risk drivers in Pennsylvania are State Farm, Allstate, and Progressive for competitive pricing, tailored coverage, and excellent customer service.

By comparing these top providers, you can make an informed decision and find the best cheap high-risk auto insurance companies to meet your needs.

Our Top 9 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Pennsylvania

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $28 B Customer Service State Farm

![]()

#2 $49 A+ Broad Coverage Allstate

#3 $56 A+ Snapshot Program Progressive

#4 $52 A++ IntelliDrive Savings Travelers

#5 $61 A Discounts Variety Farmers

#6 $64 A+ Vanishing Deductible Nationwide

#7 $90 A Customizable Plans Liberty Mutual

#8 $100 A+ Rate Lock Erie

#9 $130 A+ Senior Drivers The Hartford

This article delves into the specifics of each company’s offerings, ensuring high-risk drivers can find the most suitable and cost-effective insurance. Get fast and cheap auto insurance coverage today with our quote comparison tool above.

#1 – State Farm: Top Overall Pick

Pros

- Competitive Pricing: State Farm’s auto insurance review highlights competitive rates for high-risk drivers in Pennsylvania, starting at $175 per month.

- Tailored Coverage: High-risk drivers in Pennsylvania can benefit from tailored coverage options, ensuring policies meet their specific needs.

- Customer Service: State Farm excels in customer service, focusing on affordability and satisfaction for high-risk drivers in Pennsylvania.

Cons

- Limited Discounts: Compared to competitors, State Farm offers fewer discounts, which may reduce savings potential for high-risk drivers in Pennsylvania.

- Higher Rates for Young Drivers: High-risk younger drivers in Pennsylvania face higher rates with State Farm.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate’s auto insurance review shows a wide range of comprehensive coverage options, catering to the varied insurance needs of high-risk drivers in Pennsylvania.

- Strong Financial Health: Known for its financial reliability, Allstate maintains an “A+” A.M. Best rating.

- Customer Service: Allstate provides strong customer support, enhancing the insurance experience for high-risk drivers in Pennsylvania.

Cons

- Higher Premiums: High-risk drivers in Pennsylvania might find Allstate’s premiums higher than other providers.

- Claim Handling Complaints: There are notable complaints about claim handling which could impact high-risk drivers in Pennsylvania.

#3 – Progressive: Best for Innovative Programs

Pros

- Competitive Rates: Progressive offers affordable rates starting at $175 per month for high-risk drivers in Pennsylvania.

- Innovative Programs: Progressive Snapshot is an innovative usage-based insurance program that can lower premiums based on improved driving habits with lower premiums for high-risk drivers in Pennsylvania. Learn how in our Snapshot insurance review.

- Strong Online Tools: Progressive has strong online tools and a mobile app for easy policy management, enhancing convenience for high-risk drivers in Pennsylvania.

Cons

- Variable Rates: Rates may increase for poor driving habits under the Snapshot program for high-risk drivers in Pennsylvania.

- Claim Processing Issues: There are reports of claim processing issues which could affect high-risk drivers in Pennsylvania.

#4 – Travelers: Best for Extensive Coverage Options

Pros

- IntelliDrive Discounts: Learn how high-risk drivers in Pennsylvania can save up to 30% by improving their driving habits in our Travelers IntelliDrive review.

- Solid Financial Standing: Travelers is financially robust, offering reliability for high-risk drivers in Pennsylvania.

- Customer Service: Travelers is known for good customer service and support, enhancing the overall customer experience for high-risk drivers in Pennsylvania.

Cons

- Higher Premiums for High-Risk Drivers: Premiums tend to be higher for high-risk drivers in Pennsylvania.

- Limited Local Agents: Fewer local agents available which can affect personalized service for high-risk drivers in Pennsylvania.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Auto Insurance Discounts

Pros

- Comprehensive Coverage: Our Farmers auto insurance review shows a wide range of comprehensive coverage options, offering flexibility and choice for high-risk drivers in Pennsylvania.

- Strong Financial Health: Farmers has strong financial stability and ratings, ensuring a reliable choice insurance for high-risk drivers in Pennsylvania.

- Variety of Discounts: Farmers has more car insurance discounts than any other provider for high-risk drivers in Pennsylvania.

Cons

- Higher Premiums: Farmers has higher premiums compared to some competitors, which might be a concern for cost-sensitive customers for high-risk drivers in Pennsylvania.

- Mixed Reviews on Claims: They receive mixed reviews on the claim handling process, which can impact customer satisfaction for high-risk drivers in Pennsylvania.

#6 – Nationwide: Best for Claim-Free Drivers

Pros

- Wide Coverage Options: Nationwide offers a wide range of coverage options to suit various needs, providing flexibility for high-risk drivers in Pennsylvania.

- Solid Financial Health: Nationwide auto insurance review highlights solid financial health, ensuring reliability and trustworthiness for high-risk drivers in Pennsylvania.

- Vanishing Deductibles: High-risk drivers in Pennsylvania who work to improve driving habits and avoid claims will reduce their deductible by $100 every year.

Cons

- Higher Rates for High-Risk Drivers: Nationwide tends to have higher rates for high-risk drivers in Pennsylvania, which may be a drawback for those seeking lower rates.

- Billing and Policy Issues: Some customers report issues with billing and policy management, which can affect satisfaction for high-risk drivers in Pennsylvania.

#7 – Liberty Mutual: Best for Customizable Plans

Pros

- Discount Options: Liberty Mutual auto insurance review offers a wide range of discounts to help reduce premiums, providing savings opportunities for high-risk drivers in Pennsylvania.

- Strong Financial Health: They have strong financial health, ensuring reliability and trustworthiness for high-risk drivers in Pennsylvania.

- Customizable Coverage: High-risk drivers Pennsylvania can pick from a variety of policy options and endorsements.

Cons

- Higher Premiums for High-Risk Drivers: Liberty Mutual has higher premiums for certain drivers, especially high-risk drivers in Pennsylvania, which may be a concern for cost-sensitive customers.

- Mixed Reviews on Claims: They receive mixed reviews on the claim handling process, which can impact customer satisfaction for high-risk drivers in Pennsylvania.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Customer Service

Pros

- Competitive Rates: Erie offers competitive rates and affordable premiums, making it a cost-effective choice for high-risk drivers in Pennsylvania.

- Rate Lock: High-risk drivers can lock in affordable annual premiums that won’t go up after a claim for high-risk drivers in Pennsylvania.

- Excellent Customer Service: Erie auto insurance review reveals excellent customer service and support, ensuring a positive experience for policyholders for high-risk drivers in Pennsylvania.

Cons

- Limited Availability: Some discounts and coverage options may not be available to high-risk drivers in Pennsylvania.

- Fewer Online Tools: They have fewer online tools compared to larger competitors, which may affect convenience for high-risk drivers in Pennsylvania.

#9 – The Hartford: Best for Senior Drivers

Pros

- Tailored Coverage for High-Risk Drivers: The Hartford auto insurance review offers good coverage options tailored for high-risk drivers in Pennsylvania.

- AARP Discounts: The Hartford partners with AARP to offer exclusive benefits and savings to high-risk drivers in Pennsylvania over 60.

- Financial Stability: They have strong financial stability with a high “A+” A.M. Best rating, ensuring reliability and trustworthiness for high-risk drivers in Pennsylvania.

Cons

- Higher Premiums for Younger Drivers: The Hartford tends to have higher premiums for younger high-risk drivers in Pennsylvania and certain demographics, which may be a drawback for these groups.

- Limited Local Agents: They have limited availability of local agents in some areas, which can affect personalized service for high-risk drivers in Pennsylvania.

Comparing Pennsylvania Auto Insurance Rates for High-Risk Drivers

When seeking cheap auto insurance for high-risk drivers in Pennsylvania, several factors influence rates and coverage options. Driving history, including accidents and traffic violations, significantly impacts auto insurance premiums. Where you live in Pennsylvania also impacts costs, with urban areas typically having higher car insurance premiums than rural areas.

This table shows monthly insurance rates for high-risk drivers in Pennsylvania from various providers. For minimum coverage, State Farm offers the lowest rate at $28, followed by Allstate at $49 and Travelers at $52. For full coverage, State Farm also has the lowest rate at $83, with Allstate at $148 and Progressive at $168.

High-Risk Auto Insurance Monthly Rates in Pennsylvania by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $49 $148

Erie $100 $100

Farmers $61 $182

Liberty Mutual $90 $270

Nationwide $64 $191

Progressive $56 $168

State Farm $28 $83

The Hartford $130 $240

Travelers $52 $156

The highest rates are from The Hartford, with $130 for minimum and $240 for full coverage. Other providers include Erie, Farmers, Liberty Mutual, and Nationwide, with varying rates for both coverage levels.

State Farm offers the best overall coverage for high-risk drivers in Pennsylvania with competitive pricing and excellent service.Dani Best Licensed Insurance Producer

By considering these factors and comparing quotes from providers like State Farm, Allstate, and Progressive, you can find cheap auto insurance and suitable auto insurance coverage. Use the free quote comparison tool to explore your options and secure the best rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

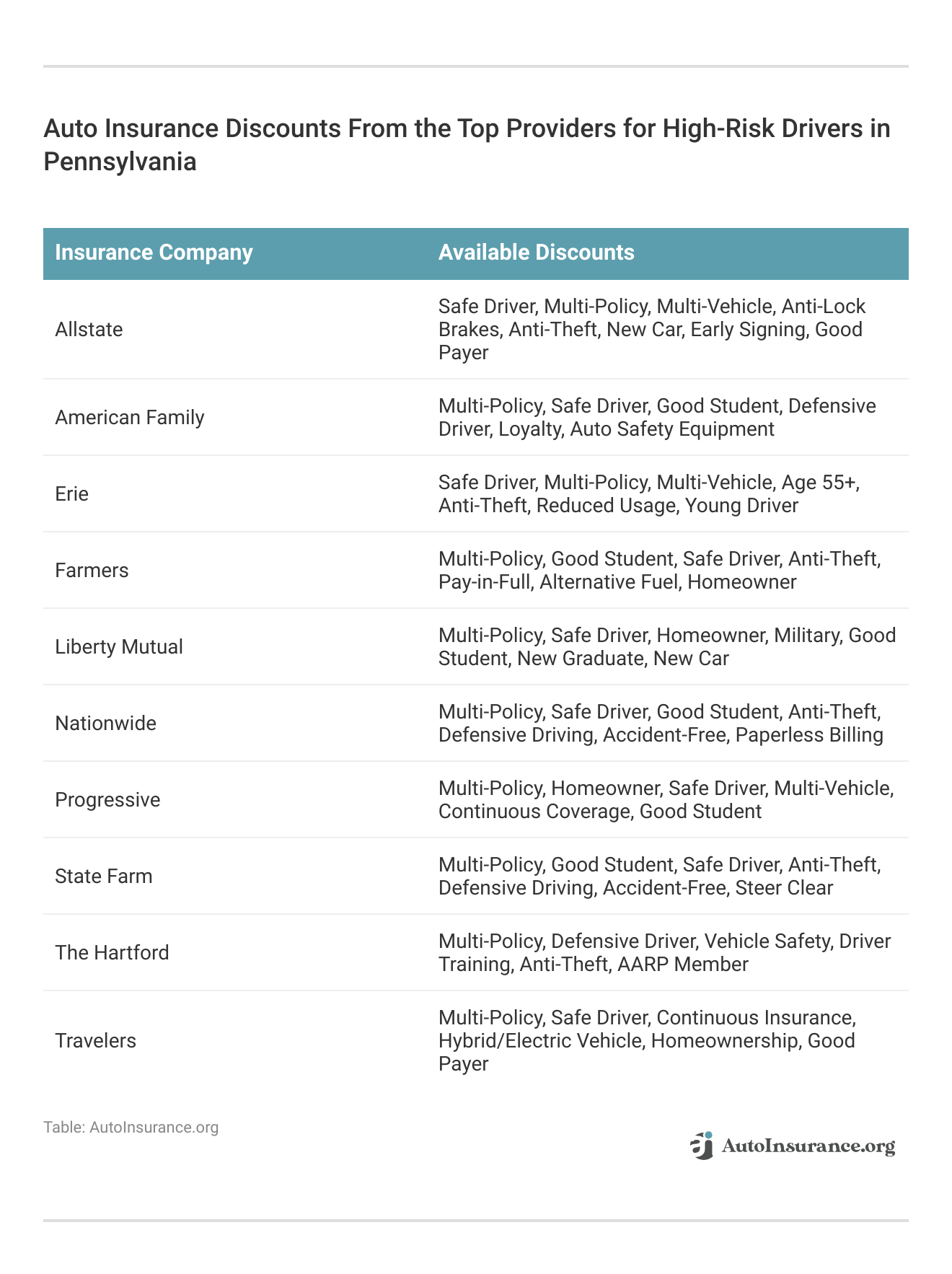

Maximizing Auto Insurance Discounts for High-Risk Drivers in Pennsylvania

Auto insurance discounts can significantly reduce premiums for high-risk drivers in Pennsylvania, with companies like Farmers offering the most variety of savings for safe driving, bundling policies, and vehicle safety features.

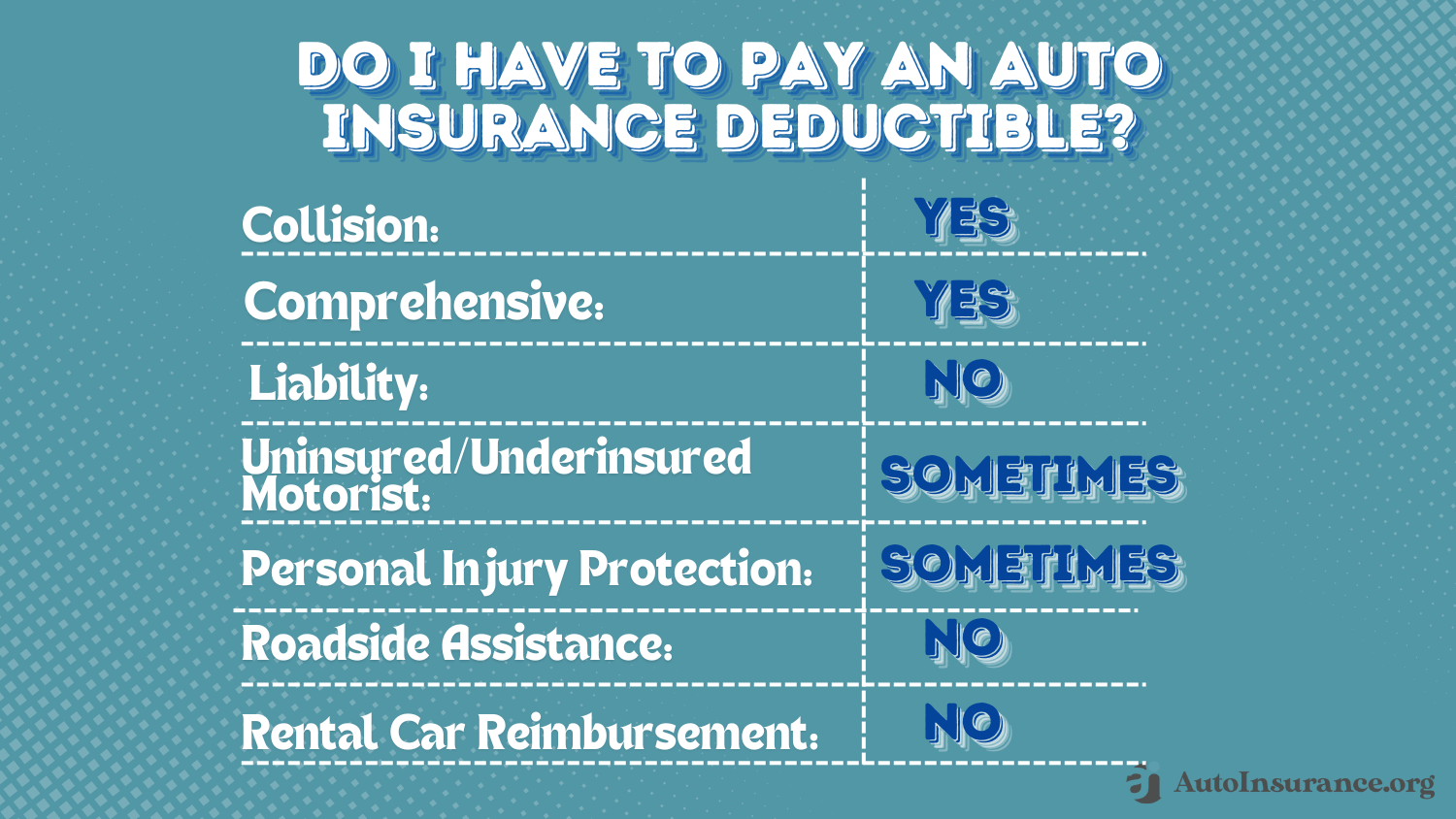

State Farm, Erie, and Progressive also provide specialized discounts aimed at promoting safe driving, policy bundling, and enhancing vehicle security. These discounts can be particularly beneficial for high-risk drivers who otherwise might have to pay auto insurance deductible amounts that are higher due to their risk status.

Tailoring Insurance Premiums for High-Risk Drivers in Pennsylvania

High-risk drivers in Pennsylvania face unique challenges when it comes to securing affordable insurance premiums. Several critical factors must be weighed, including past driving behavior, selected coverage levels, deductible amounts, and potential discounts. A pristine driving record can significantly reduce premiums, while past incidents like accidents or traffic violations can lead to higher costs.

The choice between essential liability coverage and comprehensive auto insurance also plays a pivotal role in premium determination. Opting for a higher deductible can help lower monthly costs, providing some financial relief.

High-risk drivers should meticulously compare quotes from different insurers, taking into account their driving patterns, vehicle specifics, and Pennsylvania auto insurance laws.

Read More: Pennsylvania Minimum Auto Insurance Requirements

Effective Strategies to Lower High-Risk Auto Insurance Costs

High-risk drivers can adopt several effective strategies on how to lower auto insurance rates. Firstly, explore discounts such as those for safe driving, multi-policy bundling, and installing anti-theft devices. Comparing Pennsylvania high-risk auto insurance companies online will help you determine who has the best rates and discounts.

Maintaining a spotless driving record over time can help improve your risk profile and reduce rates. Enrolling in a defensive driving course not only enhances driving skills but can also lead to premium reductions. Combining auto insurance with other policies like home or renters insurance will also yield significant savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: High-Risk Auto Insurance in Pennsylvania

High-risk drivers in Pennsylvania often face higher auto insurance premiums. These case studies illustrate how individuals can secure affordable and comprehensive coverage by choosing the right provider and leveraging available discounts.

- Case Study #1 – Affordable High-Risk Coverage: James, a high-risk driver in Pennsylvania, chose State Farm for its competitive rates and excellent customer service. By taking advantage of the multi-policy auto insurance discount, bundling his auto and homeowners insurance, and maintaining a safe driving record, he reduced his premium to $83/month for full coverage.

- Case Study #2 – Comprehensive Savings: Rachel, seeking cheap full coverage auto insurance as a high-risk driver, opted for Allstate. Utilizing multi-vehicle, good payer, and early signing discounts, she lowered her premium to $148 per month.

- Case Study #3 – Cost Management: Michael, a high-risk driver in Pennsylvania, selected Progressive for cheap usage-based insurance. By maintaining continuous coverage and bundling policies, he reduced his monthly premium to $168, leveraging Progressive’s tools and discounts for additional savings.

By selecting the right insurance provider and utilizing discounts, high-risk drivers in Pennsylvania can get cheap car insurance rates while maintaining comprehensive coverage. This strategic approach ensures they do not compromise on necessary protection despite their high-risk status.

Bottom Line on Securing Cheap High-Risk Auto Insurance in Pennsylvania

State Farm, Allstate, and Progressive have cheap auto insurance for high-risk drivers in Pennsylvania. You can access affordable and comprehensive auto insurance by exploring personalized options tailored to your specific needs and comparing rates from various providers.

State Farm offers the best overall coverage for high-risk drivers in Pennsylvania with competitive pricing and excellent service.Justin Wright Licensed Insurance Agent

Utilize available discounts such as safe driver, multi-policy, and anti-theft to further reduce premiums. By taking the time to understand and apply these discounts, you can get cheap auto insurance for high-risk drivers and remain well-protected on the road.

Uncover affordable high-risk auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

What is the cheapest auto insurance for high-risk drivers in Pennsylvania?

The cheapest car insurance for high-risk drivers in Pennsylvania is typically provided by State Farm for $28/month for minimum coverage.

What is the best insurance for high-risk drivers in Pennsylvania?

The best insurance for high-risk drivers in Pennsylvania includes top providers like State Farm, Allstate, and Progressive, which offer tailored coverage, competitive pricing, and programs designed for high-risk individuals.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Which insurance involves the highest risk for drivers in Pennsylvania?

High-risk car insurance covers individuals with factors like past accidents, traffic violations, or young age, which typically result in higher premiums.

What age is Pennsylvania auto insurance most expensive?

Teen drivers under 21 are considered to be high-risk and have the most expensive car insurance rates.

What is the best insurance company in PA for high-risk drivers?

The best insurance company in PA for high-risk drivers is State Farm, known for its broad coverage options, excellent customer service, and high satisfaction ratings.

Who is known for the cheapest car insurance for high-risk drivers in Pennsylvania?

State Farm, Allstate, and Progressive are known for offering the cheapest car insurance for high-risk drivers in Pennsylvania, providing affordable rates along with programs such as accident forgiveness and Snapshot.

What is the cheapest high risk car insurance in Pennsylvania?

The cheapest full coverage auto insurance for high-risk drivers in Pennsylvania is State Farm at $83/month.

How much is car insurance per month in Pennsylvania for high-risk drivers?

Car insurance per month in Pennsylvania for high-risk drivers can vary, but companies like State Farm offer rates starting as low as $28 per month, depending on individual circumstances and coverage needs.

Who is the most trusted insurance company for high-risk drivers in Pennsylvania?

State Farm is often regarded as the most trusted insurance company for high-risk drivers in Pennsylvania due to its comprehensive coverage options and strong customer satisfaction ratings.

What is the minimum auto insurance in PA for high-risk drivers?

The minimum auto insurance in PA for high-risk drivers includes the state-required liability coverage of $15,000 per person, $30,000 per accident for bodily injury, and $5,000 for property damage liability.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.