Cheap Auto Insurance for High-Risk Drivers in Tennessee (10 Best Companies for 2026)

The best providers for cheap auto insurance for high-risk drivers in Tennessee comes from State Farm, Progressive, and USAA, starting at $25/month. USAA is the best cheap high-risk insurance for drivers in the military, but State Farm won't raise Tennessee auto insurance rates as high after an accident or DUI.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated October 2024

Company Facts

Min. Coverage for High-Risk Drivers in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for High-Risk Drivers in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for High-Risk Drivers in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

The best providers for cheap auto insurance for high-risk drivers in Tennessee are with State Farm, Progressive, and USAA, offering competitive rates starting at $25/month.

The best auto insurance companies for high-risk drivers in Tennessee deliver a balance of cost and coverage, combining affordable premiums with comprehensive protection.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Tennessee

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $25 B Reliable Service State Farm

![]()

#2 $32 A+ Competitive Rates Progressive

#3 $34 A++ Military Benefits USAA

#4 $36 A Extensive Coverage Liberty Mutual

#5 $39 A Customizable Policies Farmers

#6 $40 A++ Financial Stability Travelers

#7 $52 A Customer Focus American Family

#8 $62 A+ Infrequent Drivers Allstate

#9 $69 A+ Vanishing Deductibles Nationwide

#10 $100 A++ Online Tools Geico

USAA is one the cheapest TN auto insurance companies but benefits are only available to active and retired military members and their families. Keep reading for the pros and cons of the top ten high-risk insurers.

If you need affordable auto insurance in Tennessee, enter your ZIP code above to compare cheap insurance quotes near you.

- State Farm offers top rates for high-risk drivers in Tennessee, starting at $25/month

- USAA has the best high-risk auto insurance for drivers in the military for $34/month

- High-risk drivers in TN can use the Progressive Name-Your-Price tool to lower rates

#1 – State Farm: Top Overall Pick

Pros

- Reliable Service: State Farm provides reliable customer service for timely support to high-risk drivers in Tennessee. Read our State Farm review to learn what else is offered.

- Strong Local Agent Network: With a widespread network of agents in Tennessee, high-risk drivers can easily find local representatives to help with their insurance needs.

- Consistent Coverage Options: State Farm provides consistent coverage options that cater to high-risk drivers in Tennessee, making it easier to find suitable policies.

Cons

- Inconsistent Rate Comparisons: For high-risk drivers in Tennessee, State Farm’s rates may not be the most competitive, particularly for those with poor driving histories.

- Limited Discounts for High-Risk Profiles: While discounts are available, high-risk drivers in Tennessee may not benefit as much from them compared to drivers with better records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Affordable Rates: Progressive offers some of the lowest TN auto insurance rates for high-risk drivers starting at$32/month for minimum coverage.

- Flexible Policy Customization: Progressive offers customizable coverage options for high-risk drivers in Tennessee, which you can read more about in our review of Progressive.

- Advanced Online Tools: High-risk drivers in Tennessee can benefit from Progressive’s user-friendly online platform for easy policy management and claims.

Cons

- Potential Complexity in Coverage Choices: The variety of options may be overwhelming, making it difficult for TN high-risk drivers to select the most suitable coverage.

- Possible Premium Increases: Even with competitive initial rates, high-risk drivers in Tennessee might face higher costs if their risk profile changes.

#3 – USAA: Cheapest With Member Benefits

Pros

- Exclusive Benefits: USAA offers specialized benefits and financial services that cater to Tennessee high-risk drivers who are military-affiliated.

- Comprehensive Protection: USAA’s insurance policies provide thorough coverage options, addressing the diverse needs of high-risk drivers in Tennessee.

- High Customer Satisfaction: Known for exceptional customer satisfaction, USAA provides reliable service for high-risk drivers in Tennessee. Discover our USAA review for a full list.

Cons

- Eligibility Limitations: USAA auto insurance for TN high-risk drivers is only available to military members and their families.

- Less Physical Presence: The limited number of local offices might be inconvenient for high-risk drivers in Tennessee who prefer in-person service.

#4 – Liberty Mutual: Cheapest for Extensive Coverage

Pros

- Extensive Coverage Options: Liberty Mutual provides a wide range of coverage options for TN high-risk auto insurance. Learn more in our Liberty Mutual review.

- Flexible Policy Adjustments: Liberty Mutual allows for extensive customization of high-risk insurance policies in Tennessee.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program can be advantageous for high-risk drivers in Tennessee, as it may prevent rate increases after their first accident.

Cons

- Increased Rates for Frequent Claims: High-risk drivers in Tennessee with multiple claims may see significantly increased rates with Liberty Mutual, impacting overall affordability.

- Customer Service Concerns: Some high-risk drivers in Tennessee might experience challenges with Liberty Mutual’s customer service, particularly when handling complex claims or disputes.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Farmers allows for significant policy customization, which helps high-risk drivers in Tennessee tailor coverage to their specific needs.

- Wide Range of Coverage Options: Farmers offers a variety of coverage options, making it easier for high-risk drivers in Tennessee to find suitable protection. Find out more in our Farmers review.

- Insurance Discounts: TN high-risk drivers will find more auto insurance discounts at Farmers than an other company.

Cons

- Potential for Elevated Premiums: The level of customization available with Farmers may lead to higher insurance costs for high-risk drivers in Tennessee.

- Variable Agent Expertise: The quality of service can vary depending on the local agent, which may affect high-risk drivers in Tennessee differently.

#6 – Travelers: Best for Financial Stability

Pros

- Reputable Claims Handling: Travelers offers high-risk drivers in Tennessee smoother claims processing, which is vital for those with traffic violations, which you can learn about in our Travelers review.

- Industry Experience: Travelers has provided affordable auto insurance to high-risk drivers for more than a century.

- Competitive Rates: TN auto insurance rates for high-risk drivers start at $40/month with Travelers.

Cons

- Poor Customer Service: Travelers ranks below average for customer and claims satisfaction among high-risk drivers in Tennessee.

- Stringent Underwriting Criteria: Travelers might have stricter underwriting criteria, making it harder for high-risk drivers in Tennessee to qualify for coverage or secure lower rates.

#7 – American Family: Best for Customer Focus

Pros

- Customer-Oriented Approach: American Family is recognized for its customer-centric approach, which benefits high-risk drivers in Tennessee.

- Diverse Coverage Options: The wide variety of coverage options offered can address the specific needs of high-risk drivers in Tennessee, which you can check out in our American Family review.

- Potential for Policy Discounts: American Family provides several discount options that high-risk drivers in Tennessee might be able to use to lower their premiums.

Cons

- Less Competitive Rates: American Family’s rates for high-risk drivers in Tennessee might be less competitive when compared to other providers specifically targeting high-risk individuals.

- Discount Variability: Some of the best auto insurance discounts for high-risk drivers require memberships to save on TN insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Cheapest for Low-Mileage

Pros

- Low-Mileage Savings: Tennessee high-risk drivers who don’t drive often can sign up for Allstate Milewise or Milewise Unlimited to lower insurance costs. See if you qualify in our Milewise review.

- Strong Local Agent Network: Allstate has a strong network of TN insurance agents, making it easier for high-risk drivers to receive personalized support.

- Various Discount Opportunities: Provides multiple discount opportunities that high-risk drivers in Tennessee might qualify for. Read more in our review of Allstate.

Cons

- Higher Premiums: Allstate’s comprehensive coverage can come with higher premiums for high-risk drivers in Tennessee if you don’t qualify for low-mileage savings.

- Poor Customer Service: Allstate ranks below average and below State Farm, Progressive, and Nationwide for customer service among Tennessee high-risk drivers.

#9 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductibles: Tennessee high-risk drivers who improve their habits can reduce deductibles by $50 at every renewal.

- Strong Financial Stability: Nationwide’s financial stability is reassuring for high-risk drivers in Tennessee seeking reliable insurance.

- Multi-Policy Discounts: Drivers who insure their homes or multiple vehicles can save 20% on Tennessee high-risk auto insurance with Nationwide.

Cons

- Higher Premiums: High-risk drivers in Tennessee may experience higher premiums with Nationwide.

- Fewer Discount Opportunities: There may be fewer discount options available for high-risk drivers in Tennessee compared to some other insurers.

#10 – Geico: Best Online Tools

Pros

- 24/7 Customer Service: High-risk drivers in Tennessee can benefit from Geico’s round-the-clock customer support, making it easier to address concerns and manage policies at any time.

- Highly-Rated Mobile App: High-risk drivers in TN can easily navigate their policies, make changes, and file claims from their phones or tablets.

- Employee Discounts: Federal employees, first responders, and drivers with eligible occupations or memberships can lower their Tennessee high-risk car insurance costs.

Cons

- Limited Coverage Options: Tennessee high-risk drivers with auto loans or leases won’t find gap insurance at Geico.

- Higher Rates: Geico raises Tennessee high-risk auto insurance rates more after an accident or claim than other companies on this list.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost-Effective Auto Insurance Options for High-Risk Drivers in Tennessee

In Tennessee, monthly auto insurance rates for high-risk drivers vary by coverage level and provider. Minimum coverage ranges from $25 with State Farm to $100 with Geico. For full coverage, rates span from $79 with State Farm to $322 with Geico.

Tennessee High-Risk Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $62 $200

American Family $52 $169

Farmers $39 $125

Geico $100 $322

Liberty Mutual $36 $303

Nationwide $69 $224

Progressive $32 $103

State Farm $25 $79

Travelers $40 $129

USAA $34 $110

The most affordable high-risk insurance companies in Tennessee are State Farm and Progressive, while Geico and Liberty Mutual are the most expensive for minimum and full coverage auto insurance.

A history of traffic violations, accidents, and claims significantly impacts insurance premiums, with multiple incidents or serious violations like DUIs leading to higher rates, as each point on the driving record can cause a substantial increase in premiums. Check out how auto insurance companies check driving records.

Your insurance history, including gaps or frequent policy changes, can lead to higher premiums, as insurers perceive lapses as increased risk, while maintaining continuous coverage without claims can help keep rates lower.

The level and type of coverage you choose also greatly influence your premium, with full coverage and lower deductibles typically increasing costs, especially for high-risk drivers who may need additional protection to meet state requirements.

By recognizing and addressing these key factors — driving record, coverage level, and insurance history — high-risk drivers in Tennessee can better navigate their insurance options and find ways to reduce their premiums.

Strategies for Tennessee Drivers with High Risk to Reduce Auto Insurance Expenses

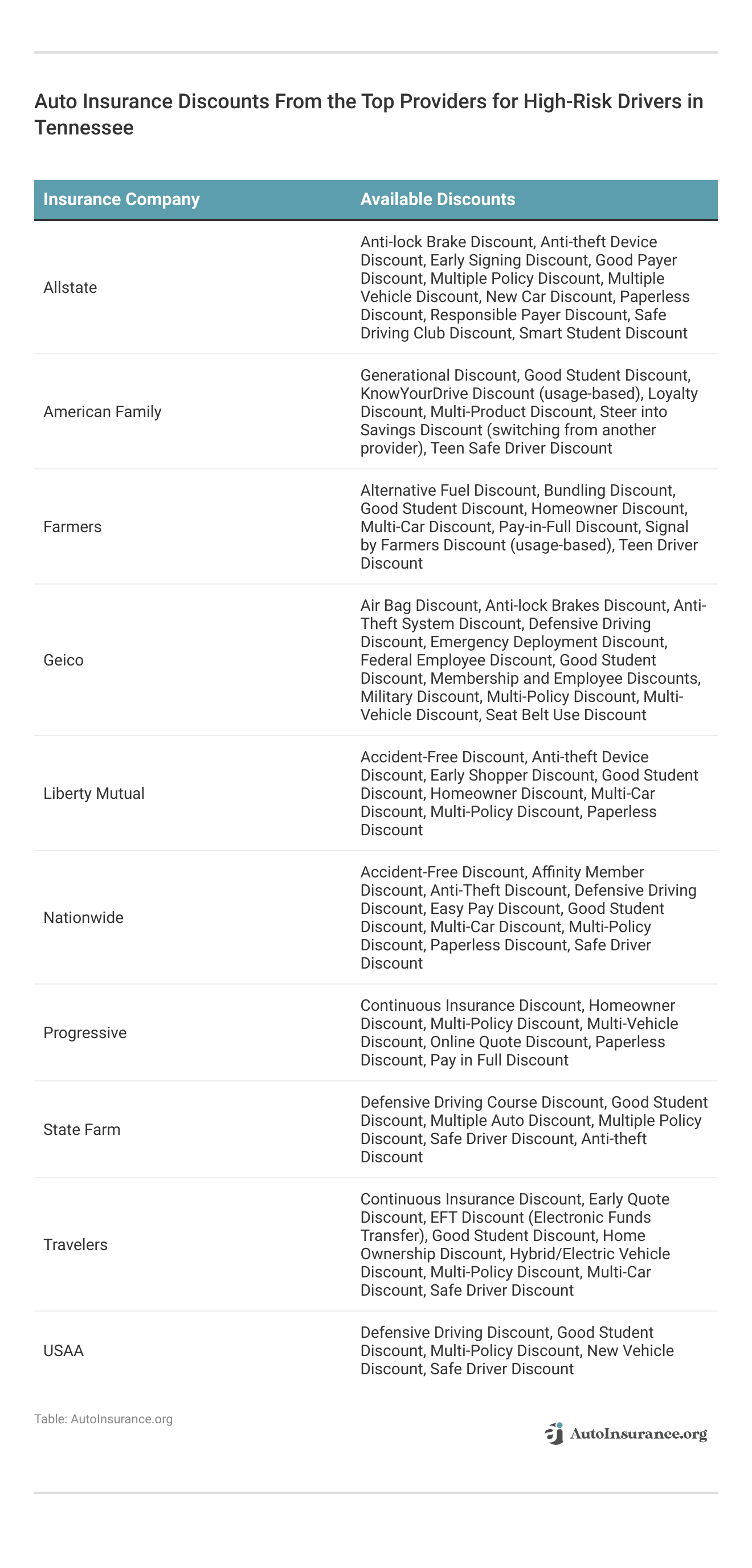

High-risk drivers in Tennessee can find significant savings with various discounts, such as multi-policy, good student, and anti-theft insurance discounts.

Adding anti-theft devices or etching the VIN to your car can help lower your insurance rates, especially if you’re considered a high-risk driver. Insurance companies often offer discounts that aren’t tied to your driving record, so you can lower your Tennessee insurance costs just by making your car harder to steal.

These discounts can help reduce premiums and make insurance more affordable for high-risk drivers. By comparing monthly rates and taking advantage of available discounts, you can find coverage that fits your budget and needs.

Discover Budget-Friendly High-Risk Insurance Options in Tennessee

For high-risk drivers in Tennessee, affordable auto insurance options include State Farm, Progressive, and USAA, with rates starting around $25/month. These providers are noted for their competitive pricing and strong customer service.

State Farm stands out for high-risk drivers in Tennessee with its unbeatable combination of competitive rates and comprehensive coverage.Laura Berry Former Licensed Insurance Producer

High-risk drivers in Tennessee can reduce their car insurance costs by maintaining a clean driving record, choosing vehicles with lower repair costs and better safety ratings, opting for higher deductibles, and taking advantage of available discounts. Low-mileage drivers can sign up for pay-as-you-go auto insurance in Tennessee to get cheaper high-risk auto insurance.

Regularly comparing quotes from different insurers can also help find the most competitive rates and uncover savings. To find out if you can get cheaper TN auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

What is the best insurance for high-risk drivers in Tennessee?

The best insurance for high-risk drivers in Tennessee often includes companies like State Farm, Progressive, and USAA. These providers are known for offering competitive rates and robust coverage options tailored to high-risk individuals.

Who has the cheapest insurance for high-risk drivers in Tennessee?

For high-risk drivers in Tennessee, State Farm and Progressive are generally known for offering some of the most affordable rates, starting at around $25 per month for minimum coverage.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

What is the average cost of auto insurance in Tennessee?

The average cost of auto insurance in Tennessee varies based on coverage and driver risk level. For high-risk drivers, rates can range from $25 per month for minimum coverage to over $300 per month for full coverage. Get cheap full coverage auto insurance here.

Do I need proof of insurance to register a car in Tennessee?

Yes, proof of insurance is required to register a car in Tennessee. You must provide documentation showing that you have at least the minimum liability coverage required by law.

Which types of insurance involve the highest risk?

Insurance types that generally involve the highest risk include high-risk auto insurance policies for drivers with poor driving records or significant claims history. Additionally, policies with low deductibles and high coverage limits can also be considered higher risk due to the potential for larger payouts.

Which kind of auto insurance is required in Tennessee?

In Tennessee, drivers are required to carry liability insurance, which includes bodily injury liability and property damage coverage. The minimum coverage required is $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $15,000 for property damage.

Does Tennessee require uninsured motorist coverage?

Tennessee does not require uninsured motorist coverage by law, but it is available as an optional coverage. It can provide protection if you are involved in an accident with an uninsured or underinsured driver.

What is the term for high-risk insurance?

The term often used for high-risk insurance is “non-standard insurance.” This type of insurance is designed for drivers who have a history of accidents, violations, or other factors that make them higher risk to insure.

How can high-risk drivers find affordable insurance in Tennessee?

High-risk drivers can find affordable insurance by comparing quotes from multiple providers, maintaining a clean driving record, opting for higher deductibles, and taking advantage of available discounts for safe driving and bundling policies. Learn how to save money bundling insurance policies.

Can high-risk drivers in Tennessee get discounts on insurance?

Yes, high-risk drivers in Tennessee may still qualify for discounts. Providers often offer discounts for factors such as safe driving, installing anti-theft devices, completing defensive driving courses, and bundling auto insurance with other policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.