Cheap Auto Insurance for Learner’s Permit Drivers in 2026 (Save With These 10 Companies!)

Geico, State Farm, and Auto-Owners have cheap auto insurance for learner’s permit drivers. Geico has the lowest rates at $106/mo, but State Farm gives a 30% discount to safe drivers with a permit. Auto insurance discounts are the easiest way to save money on learner's permit insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated January 2025

19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate for Learners Permit

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Avg. Monthly Rate for Learners Permit

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 563 reviews

563 reviewsCompany Facts

Avg. Monthly Rate for Learners Permit

A.M. Best Rating

Complaint Level

Pros & Cons

563 reviews

563 reviewsGeico has the cheapest auto insurance for learner’s permit drivers at $106/mo, with usage-based discounts up to 25%.

If you’re trying to figure out how to get car insurance with a permit, take note of the ten cheapest companies for permit driver insurance:

Our Top 10 Company Picks: Cheap Auto Insurance for Learner's Permit Drivers

| Company | Rank | Monthly Rates | Student Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $106 | 15% | Cheap Rates | Geico | |

| #2 | $124 | 25% | Safe Drivers | State Farm | |

| #3 | $156 | 20% | Accidents | Auto-Owners | |

| #4 | $161 | 15% | Teen Drivers | AAA |

| #5 | $167 | 15% | Usage-Based | Nationwide |

| #6 | $214 | 20% | High-Risk Drivers | National General | |

| #7 | $222 | 20% | Insurance Discounts | Allstate | |

| #8 | $271 | 15% | Customized Policy | Farmers | |

| #9 | $278 | 15% | Teachers & Students | Liberty Mutual |

| #10 | $280 | 10% | Loyalty Programs | Progressive |

Teens and new drivers significantly benefit from car insurance because they’re statistically more likely to get into accidents, but finding cheap auto insurance for teens is challenging. Read on to learn more about permit driver insurance and compare quotes with as many companies as possible.

- New drivers get the cheapest rates from Geico, State Farm, and Auto-Owners

- Auto insurance with a learner’s permit is more expensive due to driver inexperience

- Permit drivers can lower rates with student discounts and defensive driving classes

#1 – Geico: Cheapest Overall

Pros

- Cheapest rates: Lowest rates for learner’s permit drivers on average

- Geico DriveEasy: Save up to 25% by tracking safe driving habits

- Good student discount: Save 15% with a 3.0 GPA or higher (See More: Geico Auto Insurance Discounts)

- Defensive driving course: Take an approved driving course to get 15% off rates

- High UBI satisfaction: Ranks in the top three in annual J.D. Power survey

Cons

- Expensive after an accident: Raises rates higher than its competitors after a claim

- Poor claims satisfaction: Ranks below average in J.D. Power annual survey

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best Rates for Safe Drivers

Pros

- Drive Safe & Save: Usage-based insurance savings up to 30%

- Steer Clear & Save: State Farm learner’s permit insurance can save an extra 15%

- Good driving discount: Up to 30% for safe drivers (See More: State Farm Auto Insurance Discounts)

- Defensive driving course: Take an approved driving course to get 15% off rates

- High claims satisfaction: Top five company in J.D. Power annual survey

Cons

- 25 and younger: Older learner’s permit drivers aren’t eligible for Steer Clear & Save

- 21 and younger: Drivers over 21 cannot earn defensive driving discount

#3 – Auto-Owners: Cheapest After an Accident

Pros

- Fewer rate increases: One of the cheapest companies for permit driver insurance after an accident. See our review of Auto-Owners auto insurance for more details.

- Driver Monitoring discount: Save an extra 5% when tracking driving habits

- Favorable loss history discount: Exclusive savings for claim-free drivers

- High claims satisfaction: Among top ten companies in J.D. Power annual survey

Cons

- Age restrictions: Driver monitoring discount only available to teen drivers

- Raises rates for bad credit: Learner’s permit drivers with bad credit scores get better rates elsewhere

#4 – AAA: Cheapest for Teens With Learner’s Permits

Pros

- New young driver discount: Exclusive savings for policies with new drivers

- Safe driver discount: TeenSMART program helps new drivers save up to 24% (Learn more: AAA Car Insurance Review)

- Good student discount: Get up to 14.5% off with a 3.0 GPA or higher

- AAADrive Discount: Usage-based savings up to 30%

Cons

- Age restrictions: Must be under 20 to qualify for teenSmart and new young driver discounts

- Membership restrictions: Car insurance only available to AAA members

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Cheapest Usage-Based Insurance

Pros

- Nationwide SmartRide: Biggest usage-based insurance savings up to 40% (Compare rates in our Nationwide SmartRide App Review.)

- Nationwide SmartMiles: Low-mileage drivers save 20% or more

- Good student discount: Get up to 15% off with a 3.0 GPA or higher

- Defensive driving course: Take an approved driving course to get 10% off rates

Cons

- Poor customer service: Customer satisfaction ranks below average in most regions

- Low UBI satisfaction: Drivers prefer Geico, State Farm, and Progressive UBI programs

#6 – National General: Cheapest High-Risk Permit Driver Insurance

Pros

- Affordable high-risk insurance: Competitive rates for drivers with DUIs or multiple accidents. Learn more about National General’s affordable high-risk insurance in our National General auto insurance review.

- Emergency expense allowance: All policies include $500 for expenses if stranded after an accident

- DynamicDrive discounts: Save 10% for signing up and more with safe driving habits

- Good student discount: Save up to 20% off with a 3.0 GPA or higher

- Lifetime repair guarantee: Applies to all repairs completed at a Gold Medal Repair Shop

Cons

- Fewer opportunities to save: Other companies offer more auto insurance discounts

- Poor claims satisfaction: Ranks among the bottom five companies in J.D. Power annual survey

#7 – Allstate: Cheapest With Discounts

Pros

- Safe driver discount: Get up to 20% off by avoiding tickets and accidents

- Good student discount: Get up to 20% off with a 3.0 GPA or higher

- Defensive driving course: Take an approved driving course to get 10% off rates

- TeenSMART discounts: Helps young drivers practice safe habits and save up to 15%

- Usage-based discounts: Allstate DriveWise and MileWise save drivers 40%

Cons

- Low UBI satisfaction: Drivers prefer Geico, State Farm, and Progressive UBI programs

- Expensive: Higher rates for drivers in most states. Find more information about Allstate’s rates in our review of Allstate insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Cheapest for Customized Coverage

Pros

- Varied policy options: Guaranteed value, customized equipment, spare parts coverage, and more

- Multiple discounts: More discounts than any other insurers (See More: Farmers Auto Insurance Discounts)

- Driver Safety Agreement: Only company to offer 10% for creating and signing driver safety agreements

- Safe driver discount: Get up to an additional 30% off with safe driving habits

- Good student discount: Get up to 15% off with a 3.0 GPA or higher

Cons

- Expensive: Permit driver insurance rates over $250/mo

- Poor customer satisfaction: Ranks below average in all regions

#9 – Liberty Mutual: Cheapest for Students and Teachers

Pros

- New graduate discount: Get 5% off your graduation year and 1% every following year

- Good student discount: Get up to 15% off with a 3.0 GPA or higher (See More:

- Teen driving discount program: Save 10% by taking Liberty Mutual’s driving course online

- Teacher auto insurance: Offers extra coverage when vehicle is on school grounds

- Deductible fund: Diminishing deductible by $100 every year without an accident

Cons

- Expensive: Permit driver insurance rates over $250/mo

- Poor claims satisfaction: Ranks below average in J.D. Power annual survey. To see monthly premiums and honest rankings, read our Liberty Mutual review.

#10 – Progressive: Cheapest for Loyal Customers

Pros

- Loyalty perks: Continous insurance discounts after six months and accident (large) forgiveness after five years. Our complete Progressive review goes over this in more detail.

- High UBI satisfaction: Ranks in the top three in annual J.D. Power survey

- Affordable high-risk insurance: Competitive rates for drivers with DUIs and bad credit

Cons

- Expensive: Permit driver insurance rates over $250/mo

- Model restrictions: No longer insures certain Kia or Hyundai models

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Insurance With a Learner’s Permit

Be prepared to pay high rates when getting insurance with a learner’s permit. Due to your lack of experience behind the wheel, insurers will consider you a higher risk and charge you for it.

Learner's Permit Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company 16-Year-Old 18-Year-Old 21-Year-Old 25-Year-Old 35-Year-Old 45-Year-Old

$664 $540 $528 $158 $237 $122

$910 $740 $843 $271 $368 $228

$638 $610 $597 $159 $276 $125

$1,103 $897 $957 $256 $654 $198

$445 $362 $328 $133 $176 $115

$1,120 $893 $954 $306 275 $248

$893 $726 $328 $268 $239 $230

$679 $552 $528 $213 $179 $164

$1,161 $944 $864 $209 $197 $150

$498 $405 $397 $158 $176 $123

Geico, State Farm, and Auto-Owners have cheap auto insurance for learner’s permit drivers, with Geico being the cheapest at $154/mo on average. Your rates will vary based on the kind of car you drive and the level of coverage you need.

While other various factors affect auto insurance rates, the most common reasons why permit drivers pay more for insurance are:

- Driving experience: New drivers don’t have the experience to rely on in tricky situations on the road, such as bad weather, construction, or other obstacles.

- Distracted driving: Teens and new drivers are more likely to drive while distracted, primarily due to passengers and phone use.

- Reckless driving: New drivers — especially males — are statistically more likely to speed or act impulsively.

- More accidents: Lack of experience and impulsive driving behavior culminate in three times as many accidents as older drivers.

Due to these risks, companies charge much higher rates for permit driver insurance. The good news is that your rates won’t stay high forever. Rates tend to drop around 25 if your driving record is clean, and there are also plenty of car insurance discounts to help new drivers save money.

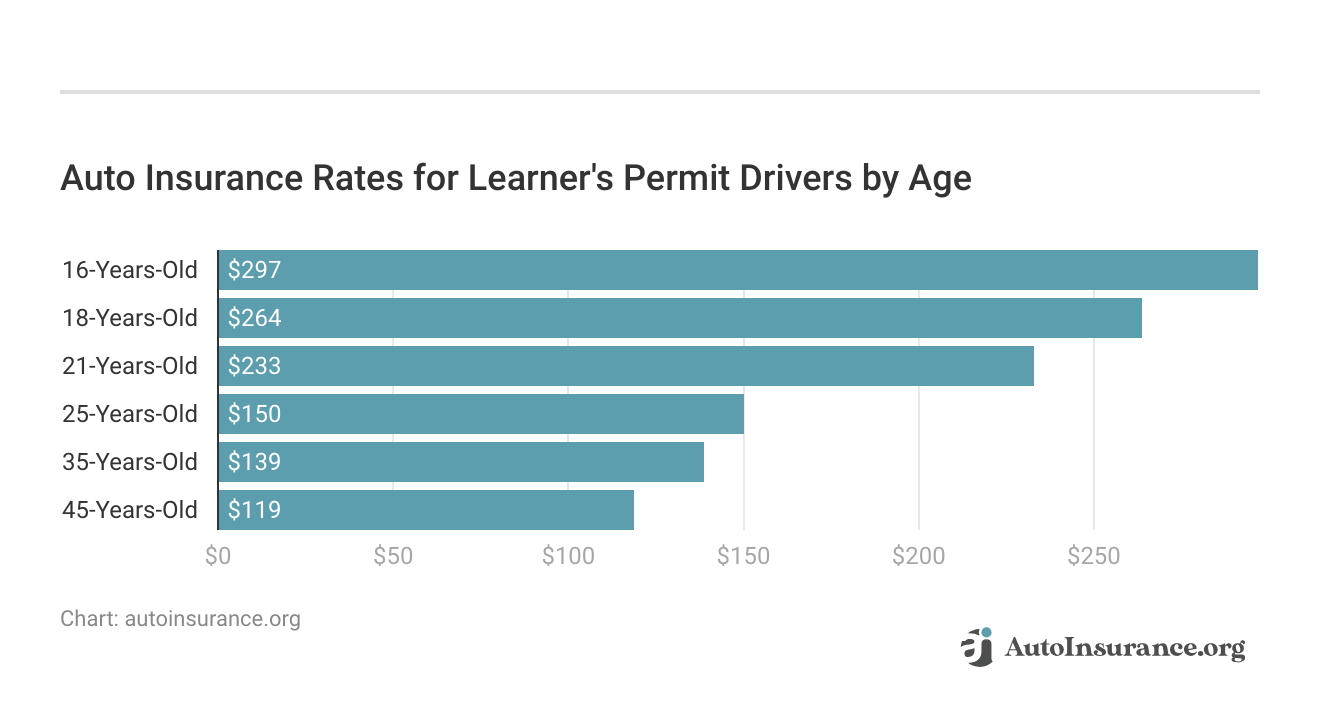

Permit Driver Insurance Rates by Age

Teens pay the highest rates on average, but even older drivers with a permit get stuck with higher costs due to lack of experience.

The average monthly rate for teen auto insurance with a learner’s permit is $280, but costs can double or triple if you’re caught speeding or in an accident. However, a parent or guardian who adds a teen to an existing auto insurance policy can cut their rates in half.

It’s crucial to compare quotes when looking for cheap auto insurance for learner’s permit drivers — rates vary dramatically, and you might overpay by selecting the first company you find. Check our guide to the best auto insurance companies for teens to compare quotes head-to-head.

Insurance Tips for Older Drivers With Learner’s Permits

While joining a parent or guardian’s insurance policy is the best way to save money on permit driver insurance, not all new drivers are teens. People learn how to drive at all stages of life, and there are ways to find cheap car insurance no matter your age:

- Get added to a partner’s policy. A partner or spouse you live with can likely add you to their policy. Their rates might increase, but most insurance companies offer discounts to married couples. Compare auto insurance rates for married vs. single drivers to learn more.

- Drive an older vehicle. Older cars are cheaper to insure because replacement parts are less expensive, and you can also lower your rates by carrying less coverage. For example, you might get away with liability-only coverage on an old vehicle that would cost more to repair than it’s worth.

- Take a defensive driving class. Both Geico and State Farm offer 15% off to new drivers who take an approved course, and you’ll find many other auto insurance companies with this kind of discount. Our guide on how to get a defensive driver auto insurance discount provides a company list.

You’ll always find the lowest rates on auto insurance when you compare online. Use our comparison tool above to get free car insurance quotes from insurance companies that accept permit drivers in your city.

Auto Insurance Discounts for Learner’s Permit Drivers

It’s important to look at car insurance discounts when considering a company, and most offer discounts to help new drivers save.

Whether you’re buying a new policy or adding a teen to an existing plan, check for the following discounts:

- Good student: High school and college students who maintain a GPA of 3.0 or higher are often eligible for a good student discount.

- Driver education: Teens who complete an approved driving course can lower their rates. While this discount will eventually expire, it usually lasts around three years.

- Tracking devices: Most companies offer usage-based insurance discounts, which track driving habits and mileage. Safe drivers can earn significant savings by signing up.

- Student away from home: Many companies offer a discount if you attend a school more than 100 miles from home and leave your car behind.

- Pay upfront: Most insurance companies will give you a small discount if you pay for your entire policy at once rather than monthly.

Read our guide to auto insurance discounts for a more extensive list of discounts offered by national and regional insurers.

Permit Driver Insurance Requirements

A permit driver can’t legally drive without the minimum insurance required by the state. The good news is that most drivers don’t need individual permit driver insurance. Instead, the policy of the car they practice in often covers them.

While it might be a bit of a hassle, you should always contact your insurance company and ask if you need to list a permit driver. Insurers can deny claims if a driver isn’t correctly listed on the policy, leaving you financially responsible for any damage after an accident.Tim Bain Licensed Insurance Agent

Usually, insurance companies don’t require you to add a new driver to your family policy until they officially have a license. However, you may need to notify your insurer when a permit driver is about to start using your car. Regardless of whether you need to list a permit driver on your policy, your rates won’t change until the new driver gets their license.

Learn More:

- How much car insurance do I need?

- Do you have to have auto insurance in every state?

- Minimum Auto Insurance by State

- What are the recommended car insurance levels?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find Cheap Auto Insurance for Learner’s Permit Drivers Today

The most common and cheapest way to insure a new driver is to add them to a partner’s, roommate’s, or guardian’s policy. Allowing new drivers to join your policy rather than start their own can cut their insurance rates in half.

However, not everyone has the opportunity to join someone else’s policy. If that’s the case, read our Geico vs. State Farm auto insurance review to see which offers the lowest rates for new drivers. Auto-Owners also offers cheap car insurance for learner’s permit drivers, so check out our Auto-Owners auto insurance review to compare rates.

Comparing companies is integral to finding affordable rates if you need to find a new policy. Whether you want to add a teen driver to your policy or you need new insurance for yourself, looking at rates from multiple companies will help you find the lowest price.

Frequently Asked Questions

Can you get auto insurance with a permit?

Yes, insurance companies that accept permits include Geico and State Farm, but you’ll likely get cheaper rates if a roommate or guardian adds you to their policy instead.

How much car insurance does a permit driver need?

The coverage amount you need depends on your state but usually includes liability coverage. Since new drivers are more likely to get into an accident or file other claims, having more coverage is never bad.

Can you add a driver with a permit to your car insurance policy?

Most insurance companies will let you add a driver with a permit to your policy without raising your rates. Some companies require parents or guardians to add teen drivers to a policy as soon as they get their permits.

Does learner’s insurance cover driving tests?

Insurance will cover you while taking your test if you’re on the policy. If you borrow a friend or family member’s car, their insurance will probably cover you for a single occasion. However, you should always check with an insurance representative to make sure.

Is it mandatory for learner’s permit drivers to have insurance?

Insurance requirements for learner’s permit drivers vary depending on the jurisdiction. Some regions may require learner’s permit drivers to have insurance coverage, while others may not. It’s important to check with your local Department of Motor Vehicles (DMV) or equivalent authority to understand the specific legal requirements in your area.

How much does insurance for a learner’s permit driver cost?

The cost of insurance for a learner’s permit driver can vary depending on several factors, including the insurance company, the driver’s age, the type of vehicle, and the coverage options selected. Generally, adding a learner’s permit driver to an existing policy is more affordable than purchasing a separate policy.

What is the cheapest insurance for a 16-year-old?

Geico and State Farm are the cheapest auto insurance companies for 16-year-olds.

How much is insurance for a new driver?

New driver insurance rates are the most expensive, but you can get affordable permit driver coverage with Geico and State Farm for under $150/mo.

What types of coverage are available for learner’s permit drivers?

Learner’s permit drivers can typically access the same types of coverage as licensed drivers, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. The availability and specific terms of coverage may depend on the insurance provider.

Are there any restrictions or limitations for learner’s permit drivers with insurance?

Insurance companies may impose certain restrictions or limitations for learner’s permit drivers. Common restrictions include driving only with a licensed adult in the vehicle, maintaining a clean driving record, and adhering to any specific conditions outlined by the insurance provider. It’s important to review the terms and conditions of your insurance policy to understand any applicable restrictions.

Does auto insurance for learner’s permit drivers automatically go down at 25?

What age is auto insurance cheapest?

Why do teens pay higher rates for auto insurance?

Can you buy a car with just a permit?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.