Cheap Gap Insurance in Kentucky (Top 9 Low-Cost Companies for 2026)

For the best cheap gap insurance in Kentucky, State Farm, Progressive, and The Hartford offer top-rated coverage starting at just $121 monthly. These Kentucky auto insurance companies provide reliable, affordable plans. Choose State Farm for overall value or Progressive and The Hartford for additional savings.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated August 2024

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Gap in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Gap in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 765 reviews

765 reviewsCompany Facts

Min. Coverage for Gap in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsState Farm, Progressive, and The Hartford stand out as the top picks for cheap gap insurance in Kentucky, offering unmatched value and comprehensive coverage.

These providers excel in affordability, reliability, and tailored options, making them the best choices for cheap guaranteed auto protection insurance, also known as gap insurance or loan/lease protection.

Our Top 9 Company Picks: Cheap Gap Insurance in Kentucky

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | B | Comprehensive Coverage | State Farm | |

| #2 | $25 | A+ | Competitive Rates | Progressive | |

| #3 | $28 | A+ | Senior Benefits | The Hartford |

| #4 | $30 | A | Customizable Plans | Liberty Mutual |

| #5 | $33 | A++ | Industry Experience | Geico | |

| #6 | $36 | A | Customer Support | Travelers | |

| #7 | $39 | A | Discounts Available | American Family | |

| #8 | $42 | A+ | Coverage Options | Farmers | |

| #9 | $45 | A+ | Claim Satisfaction | Nationwide |

| #10 | $48 | A+ | Local Agents | Allstate |

State Farm gap insurance is only available to policyholders with auto loans through State Farm, and The Hartford only sells gap insurance to AARP members. However, Progressive offers the cheapest gap insurance to Kentucky drivers no matter their lender.

If you’re looking to cover your new car or auto loan, enter your ZIP code above to compare cheap Kentucky auto insurance quotes near you.

- State Farm is the top pick for gap insurance in Kentucky at the best rates

- The Hartford has the best gap insurance for senior drivers in Kentucky

-

Some Kentucky gap insurance policies require memberships

#1 – State Farm: Top Overall Pick

Pros

- Affordable Premiums: State Farm provides gap insurance in Kentucky at an attractive rate of $39/month. Compare costs in our State Farm auto insurance review.

- Dependable Coverage: Known for offering robust and reliable gap insurance in Kentucky, State Farm ensures thorough protection for new and financed vehicles.

- High Customer Approval: State Farm consistently garners positive reviews for its gap insurance in Kentucky, with high levels of customer satisfaction.

Cons

- Average Digital Resources: While functional, State Farm’s online and mobile tools for managing gap insurance in Kentucky may not be as advanced as those from other insurers.

- Coverage Requirements: State Farm only offers Kentucky gap insurance on auto loans it provides to existing policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Attractive Rates: Kentucky gap insurance rates are only $52/month with Progressive, making it an appealing choice for those balancing cost and coverage.

- Innovative Tools: Progressive’s digital platform and mobile app are user-friendly, making it easy for Kentucky drivers to manage their gap insurance policies.

- Extensive Discounts: Read our Progressive auto insurance review for a variety of discounts on gap insurance in Kentucky, including for safe driving and bundling multiple policies.

Cons

- Higher Cost Than State Farm: Although competitively priced, Progressive gap insurance in Kentucky is more expensive than State Farm’s, which may influence some drivers’ decisions.

- Restrictive Discounts: Some of the discounts on Kentucky gap insurance rates come with strict eligibility requirements, limiting access for some customers.

#3 – The Hartford: Best for Senior Benefits

Pros

- Senior-Specific Coverage: The Hartford offers gap insurance in Kentucky tailored to the needs of senior drivers, with age-specific benefits and options.

- Strong Financial Foundation: With an A+ rating from A.M. Best, The Hartford gap insurance in Kentucky is backed by solid financial security.

- Outstanding Customer Service: Scroll through The Hartford auto insurance review to learn more about its high customer service ratings among Kentucky seniors who need gap insurance.

Cons

- Higher Premiums: Kentucky gap insurance rates are priced at $53/month with The Hartford, which is higher than some competitors, potentially deterring cost-sensitive drivers.

- Limited Availability: Kentucky drivers can only buy gap insurance from The Hartford if they are seniors and members of AARP.

#4 – Liberty Mutual: Best for Customizable Plans

Pros

- Financially Strong: With an A rating from A.M. Best, Liberty Mutual provides a stable financial foundation for its gap insurance policies in Kentucky.

- Advanced Digital Tools: Liberty Mutual’s online platform and mobile app are highly advanced, making it easy for Kentucky drivers to manage their gap insurance policies.

- Flexible Coverage Terms: Our Liberty Mutual auto insurance review shows how Kentucky drivers can choose from a range of term lengths for their gap insurance.

Cons

- Higher Premiums: Liberty Mutual gap insurance rates in Kentucky is priced at $73/month, which is higher than many competitors, making it less attractive for budget-conscious drivers.

- Bundling Often Necessary: To obtain the most competitive rates for gap insurance in Kentucky, customers may need to bundle their policy with other Liberty Mutual insurance products.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Reliable Support

Pros

- Outstanding Industry Experience: Travelers has over 100 years of experience selling auto insurance in Kentucky. Read our Travelers auto insurance review to learn more.

- Strong Financial Backing: Travelers ensures financial security and stability for its gap insurance in Kentucky, backed by an A++ rating from A.M. Best.

- User-Friendly Digital Access: The company’s sophisticated digital tools and mobile app allow easy management of gap insurance policies and quick claims processing in Kentucky.

Cons

- Higher Cost: At $92/month, Travelers gap insurance in Kentucky is more costly than many other providers, which might deter price-sensitive drivers.

- Complex Policy Details: Travelers’ extensive coverage options can make their gap insurance policies in Kentucky challenging to understand and navigate.

#6 – American Family: Best Customer Support

Pros

- Flexible Coverage Customization: Our American Family auto insurance review shows how Kentucky drivers can personalize their gap insurance policies.

- Excellent Local Support: With a strong presence in Kentucky, American Family’s local agents offer personalized service and expert advice on gap insurance.

- Variety of Discounts: American Family offers multiple discounts for gap insurance in Kentucky, including savings for safe driving and policy bundling.

Cons

- Higher Rates Compared to Some: While competitive, American Family’s gap insurance rates in Kentucky are higher than those from some leading competitors.

- Limited Digital Capabilities: The online tools and platform for managing gap insurance in Kentucky may not be as advanced as those offered by other insurers.

#7 – Farmers: Best Gap Insurance Discounts

Pros

- Extensive Discounts: Farmers offers a broad range of discounts for gap insurance in Kentucky, including incentives for good driving. Here’s a list of Farmers auto insurance discounts.

- Personalized Service: Farmers’ network of local agents across Kentucky ensures that customers receive personalized service and tailored advice on gap insurance.

- Strong Claims Assistance: Farmers is recognized for providing robust support during the claims process for gap insurance in Kentucky, making it easier for customers to navigate.

Cons

- Inconsistent Service Quality: The quality of customer service for gap insurance in Kentucky can vary depending on the specific agent, leading to inconsistent experiences.

- Discount Eligibility Constraints: Some discounts on Kentucky gap insurance rates through Farmers have strict eligibility requirements, limiting access for certain drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Coverage Options

Pros

- Wide Range of Coverage: Nationwide offers an extensive array of coverage options for gap insurance in Kentucky, allowing drivers to find a policy that fits their needs.

- High Customer Service Standards: Nationwide is known for delivering reliable customer service, offering consistent support for gap insurance customers across Kentucky. Explore more add-on options in our Nationwide auto insurance review.

- Nationwide Service Network: As a national provider, Nationwide ensures consistent and reliable service for gap insurance customers throughout Kentucky.

Cons

- High Premiums: Priced at $137/month, Nationwide gap insurance quotes in Kentucky are among the more expensive options, which may deter budget-conscious drivers.

- Limited Discount Opportunities: Despite the extensive coverage options, Nationwide offers fewer discounts for gap insurance in Kentucky, potentially increasing overall costs.

#9 – Allstate: Best Claim Satisfaction

Pros

- High Claims Satisfaction: Allstate is renowned for its excellent claims process, making it a reliable choice for gap insurance in Kentucky.

- Comprehensive Coverage: Allstate offers a wide range of coverage options for gap insurance in Kentucky, allowing drivers to choose the best protection for their needs.

- Strong Local Agent Network: Check out our Allstate auto insurance review of its robust network of local agents in Kentucky who provide personalized service and advice on gap insurance.

Cons

- High Premiums: At $145/month, Allstate gap insurance rates in Kentucky are one of the most expensive options, which may not be suitable for all drivers.

- Inconsistent Service Quality: The quality of customer service for gap insurance in Kentucky can vary depending on the local agent, leading to inconsistent support.

Comparing Gap Insurance Rates in Kentucky for Any Budget

In Kentucky, State Farm stands out as the most affordable option, offering minimum coverage for just $39 per month, making it an ideal pick for those seeking cost-effective solutions. Conversely, Allstate’s rates are the steepest, with minimum coverage priced at $145 per month.

Kentucky Gap Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $202 |

| American Family | $166 |

| Farmers | $327 |

| Geico | $133 |

| Liberty Mutual | $201 |

| Nationwide | $146 |

| Progressive | $198 |

| State Farm | $121 |

| The Hartford | $231 |

| Travelers | $142 |

For full coverage, State Farm remains the leader with the lowest rate at $106 per month, while Allstate tops the chart again with a rate of $398 per month. This comparison emphasizes the wide range of rates between providers, highlighting the need to evaluate your choices carefully to find the best coverage at the right price.

Read More: Best Kentucky Auto Insurance Companies

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Expert Tips for Reducing Kentucky Gap Insurance Rates

When it comes to managing your Kentucky auto insurance expenses, being proactive and informed can lead to significant savings. Understanding the various factors that influence gap insurance costs in Kentucky is a great place to start:

- Vehicle Make and Model: High-value vehicles, especially luxury or newer models, often come with higher gap insurance rates due to expensive repair costs.

- Driving History: A spotless driving record can lead to lower insurance costs, while a history of accidents, tickets, or other violations may result in substantially higher premiums.

- Financial Health: Your credit score is a significant factor; lower scores suggest higher risk to insurers, often resulting in steeper premiums, whereas higher scores can help reduce costs.

By thoroughly understanding how these various factors influence your KY insurance premiums, you can strategically choose gap coverage that aligns perfectly with your specific needs but also stays within your financial limits.

Start by shopping around and comparing quotes from multiple insurers to ensure you’re getting the best rate. Maintaining a clean driving record is one of the most effective ways to keep your premiums low, as insurers reward safe drivers.

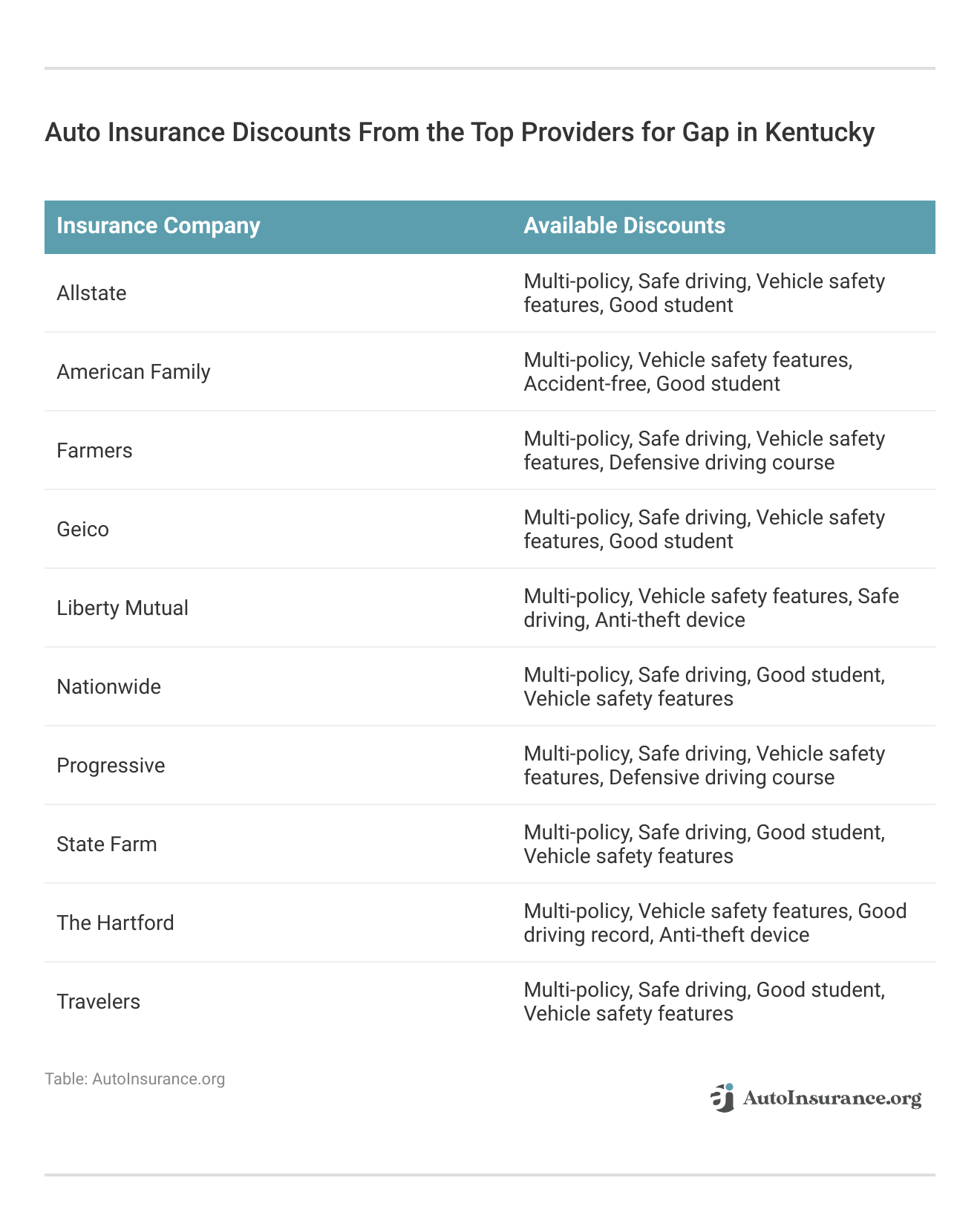

Taking advantage of discounts for safe driving, low mileage, or anti-theft devices can lower your Kentucky car insurance costs when adding gap insurance. Get a complete list of gap insurance discounts below:

Maximizing discounts for safe driving, low mileage, and anti-theft devices can significantly lower your insurance costs and boost coverage value. Consider bundling your auto insurance with other policies like home or renter’s insurance for multi-policy discounts.

Increasing your deductible can also lower your monthly Kentucky auto insurance payments. It’s important to ensure you can afford the higher out-of-pocket costs in the event of a claim. To find out more, explore our guide titled, “How to Pay Your Auto Insurance Deductible.”

Kentucky Auto Insurance Review: Gap Insurance Case Studies

Choosing the right gap insurance in Kentucky can make all the difference in safeguarding your vehicle and finances. The following case studies illustrate how State Farm, Progressive, and The Hartford offer unique solutions that cater to different customer needs:

- Case Study #1 – State Farm’s Affordable Coverage: After purchasing a new sedan, Laura needed gap insurance that wouldn’t stretch her budget. State Farm provided her with the most cost-effective solution, giving her complete coverage without breaking the bank.

- Case Study #2 – Progressive’s Flexible Options: Mark, a recent college graduate, was looking for gap insurance that balanced cost with reliability. Progressive’s flexible pricing and comprehensive protection allowed him to secure his vehicle with confidence while keeping his monthly expenses low.

- Case Study #3 – The Hartford’s Tailored Senior Benefits: James, a retired teacher, wanted gap insurance that acknowledged his specific needs as a senior. The Hartford offered him a policy designed for older drivers, giving him peace of mind with coverage tailored to his lifestyle.

Regularly reviewing and updating your coverage to reflect your current driving habits and needs ensures that you’re not overpaying for unnecessary coverage.

Read More: How to Get a New Car Auto Insurance Discount

The Top Gap Insurance Providers in Kentucky

When it comes to securing cheap gap insurance in Kentucky, State Farm, Progressive, and The Hartford consistently rise to the top, offering a blend of affordability, comprehensive coverage, and exceptional customer service.

State Farm offers the most affordable gap insurance rates in Kentucky, starting at just $39 per month, making it the top choice for budget-conscious driversJeff Root Licensed Insurance Agent

State Farm stands out with its competitive rates, but it only provides gap insurance on auto loans underwritten by State Farm. Progressive, known for its flexible plans and strong financial backing, provides a perfect balance between cost and coverage no matter your lender.

The Hartford, with its tailored policies and unique benefits for senior drivers, delivers specialized coverage that ensures peace of mind for those looking for a more personalized approach.

Find your cheapest Kentucky auto insurance quotes by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

How much is gap insurance in Kentucky?

Cheap gap insurance in Kentucky typically costs between $2-$30 per month, increasing average monthly rates in Kentucky to $39 for minimum coverage and around $145 for full coverage.

How do you figure the cost of gap insurance in Kentucky?

To figure out the cost of Kentucky gap insurance rates, get the recommended auto insurance coverage levels from your lender and compare quotes from multiple insurers. Consider factors like vehicle value, coverage level, and available discounts.

Is Kentucky gap insurance actually worth it?

Gap insurance is worth it in Kentucky if you owe more on your car loan than the vehicle’s current value, as it covers the difference in case of total loss.

What are the cons of gap insurance in Kentucky?

The cons of gap insurance in Kentucky include additional monthly costs, limited applicability if your car’s value exceeds the loan balance and coverage exclusions.

What does “gap” mean in Kentucky auto insurance?

In auto insurance, “gap” refers to the difference between the amount you owe on your auto loan and the auto’s actual cash value, which gap insurance is designed to cover in the event of a total loss. (Learn More: Replacement Cost vs. Actual Cash Value)

Does gap insurance always pay the difference?

Gap insurance generally pays the difference between your car’s value and the remaining loan balance, but it may not cover any additional fees or past-due amounts.

Is Kentucky gap insurance the same as full coverage?

No, gap insurance is not the same as full coverage. Gap insurance only covers the difference between the car’s value and the loan balance, while full coverage includes liability, collision, and comprehensive protection.

Does gap insurance cover past-due balances in Kentucky?

Gap insurance in Kentucky typically does not cover past due balances or late payments on your car loan, It only covers the difference between the vehicle’s value and the remaining loan amount if the car is totaled in a claim.

What does Kentucky gap insurance exclude?

Gap insurance in Kentucky typically excludes coverage for past due balances, extended warranties, and other add-ons like maintenance plans or negative equity from a previous loan.

Is collision insurance the same as gap insurance in Kentucky?

No, collision auto insurance covers damage to your vehicle in an accident, while gap insurance covers the difference between the vehicle’s value and the loan balance if the car is totaled.

Is it bad to have a gap in insurance in Kentucky?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.