American National Auto Insurance Review (2026)

American National Insurance Company began selling personal insurance products in 1973, including auto, home, life, and renters. The company touts a financial rating of A (excellent) from A.M. Best. Our American National auto insurance review below explains all you need to know about the company.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated December 2024

Founded in 1905, American National Insurance Company has been selling personal insurance since 1973. American National Insurance, a Texas-based company, offers a diverse array of insurance types, allowing drivers to save on American National car insurance by bundling policies.

American National offers the auto insurance you need to drive legally, alongside optional coverages like ANPAC roadside assistance. Other add-ons, like Gap insurance, are also available with American National.

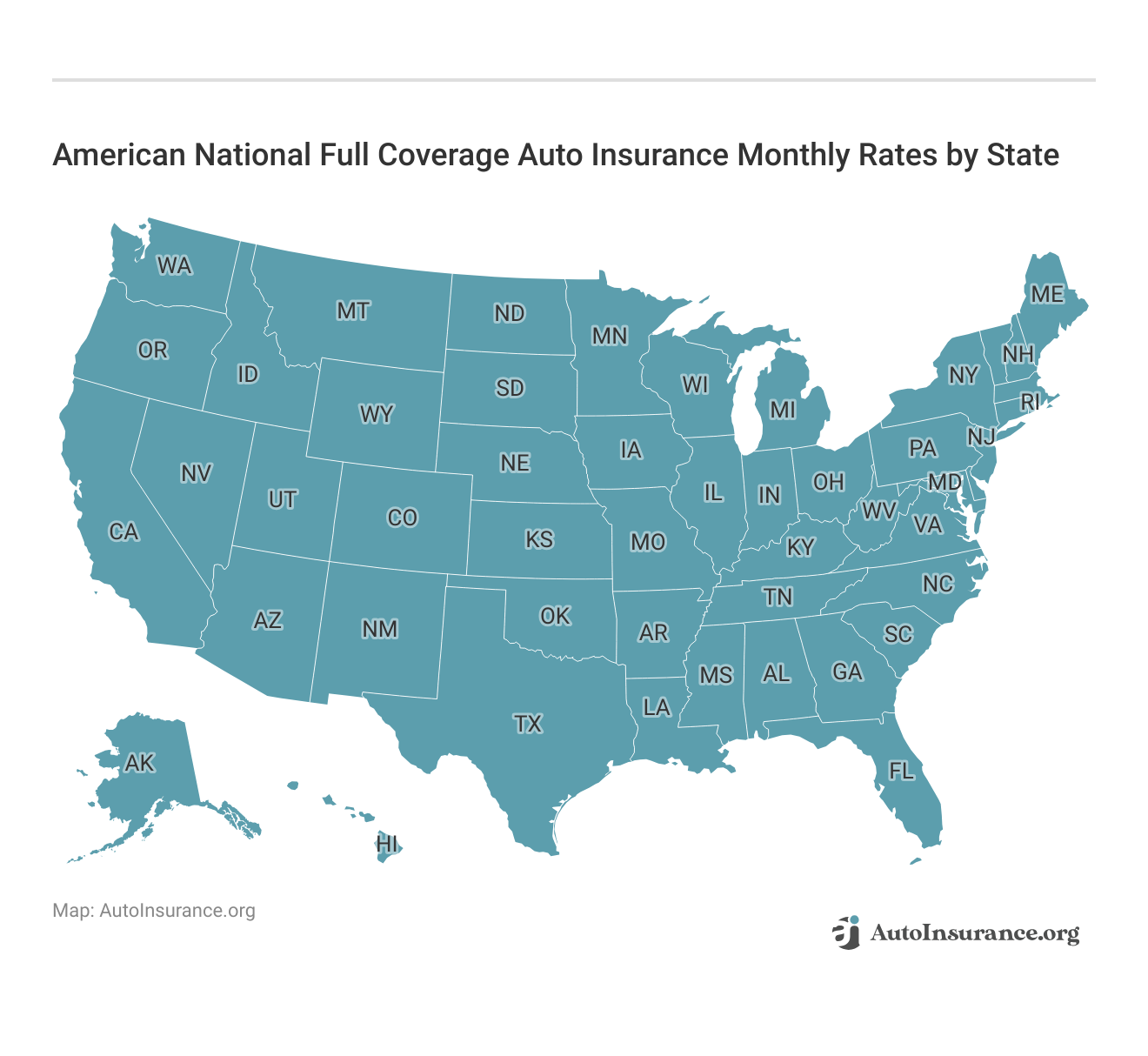

You won’t have issues finding coverage in the United States, as the company sells insurance in all 50 states and Puerto Rico. While American National doesn’t provide many discount opportunities to customers, its standard auto insurance policies come with several unique perks, though they may not be available in every state. Some perks include a cash-back program, rental car reimbursement, and discounted or no deductible if you get in an accident with another American National driver.

Since rates vary based on your unique profile and the coverage amount, you won’t know how much you’ll pay for auto insurance until you get a quote. So, if you want to keep your insurance with one company and save money in the process, you should get an American National Insurance quote.

Keep reading to learn more about American National’s bundling discount and coverages.

What You Should Know About American National Insurance Company

American National, also sometimes referred to as America National Insurance, American Insurance, or ANPAC insurance, has been in business for over 100 years selling personal insurance products.

For questions about the company’s coverage options, the American National Insurance customer service number is 1-800-899-6519.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American National Insurance Ratings

Over the years, the Am National Insurance Company has established excellent financial stability.

In fact, A.M. Best, an agency that rates the financial strength of insurance companies, gave American National Insurance Company an A, or excellent rating. This rating indicates the company can pay out claims to its policyholders, so drivers shopping for insurance don’t have to worry about the company going bankrupt.

In addition, the Standard & Poor rating for American National is an A, indicating the company is likely to meet its financial obligations.

ANPAC Insurance Reviews From Customers

American National car insurance reviews from customers seem mixed, but it has a good index score from the NAIC. The NAIC scores companies based on the number of complaints they receive relative to other companies similar in size.

The average complaint index score is 1.00, and American National has a 0.87 from the NAIC. So, American National Insurance Company complaints are slim compared to company’s similar in size.

However, American National lacks accreditation and rating from the Better Business Bureau (BBB), a worrying sign for those seeking coverage with the company. In addition, American National insurance reviews with BBB are poor, with an average rating of 1.5/5 stars, though only 16 customers reviewed.

Most American National Insurance reviews from customers complain that the company didn’t pay out certain claims they should have and that the company has poor customer service.

Before you get a policy with American National or any other company, review its customer and financial ratings. Doing so ensures you pick a company with happy customers and good finances.

Pros and Cons of American National Auto Insurance

Like any auto insurance company you’re considering, it’s important to evaluate the pros and cons before buying an auto insurance policy with the American National Property and Casualty Company. Doing so helps ensure you buy insurance from a company that fits your needs.

Some of the benefits of a car insurance policy with American National include the following:

American National: List of Pros

| Pros |

|---|

| Various policy types besides auto insurance |

| Auto insurance policies come with unique perks like cash back and discounted or no deductible if you get in an accident with an American National driver |

| Coverage available in all 50 U.S. states and Puerto Rico |

| Whole life options with dividends |

| Riders available for American National insurance life policies |

| Lower-than-average complaint index score from the NAIC |

While the company has various pros, no insurance company is perfect. Understanding the downsides of a company allows you to see if the negatives outweigh the positives.

If you’re considering getting an American National Insurance car insurance quote, evaluate the following cons of an American National auto policy:

American National: List of Cons

| Cons |

|---|

| Few discount options |

| Doesn’t have a rating or accreditation from the BBB |

| Not every auto insurance perk is available in all states |

| Customers complain of a buggy app that isn’t user friendly |

| Limited policy information available online |

As you can see, American National auto insurance has some downsides. If customer service is important to you, American National may not be the best fit, as it doesn’t have a BBB rating.

However, for someone who wants a financially stable insurer that offers unique benefits to policyholders, American National could be the right choice.

Keep reading this American National Insurance review to learn more about the company, its coverage offerings, customer service reviews, and financial ratings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American National Insurance Company Insurance Coverage Options

American National offers the auto coverages you need to drive legally in all 50 U.S. states and Puerto Rico, as well as a full coverage policy. A full coverage policy includes the minimum car insurance required in your state coupled with collision and comprehensive coverages. Almost all states have a minimum coverage requirement, but the limits vary.

Below are the standard auto insurance coverages offered by almost all companies:

- Bodily injury liability. Bodily injury liability pays for damages resulting from injuries to others in an accident you cause. However, it doesn’t cover your medical bills.

- Property damage liability. Property damage liability pays for the vehicle or property damage you caused to others in an accident. This coverage doesn’t cover your vehicle or property.

- Collision coverage. Collision insurance coverage pays for your vehicle damages if you crash into another object, like another vehicle or stationary object, regardless of fault. It isn’t legally required, but some lenders may require it if you have a vehicle loan or lease.

- Comprehensive coverage. Comprehensive car insurance coverage pays for your vehicle damages resulting from non-collision incidents, like weather, falling objects, vandalism, animal damage, or theft.

- Uninsured/underinsured motorist coverage. Uninsured/underinsured motorist coverage helps cover your injuries or property damage caused by another driver with no insurance, insufficient insurance, or a hit-and-run driver.

- Medical payments/personal injury protection. These coverages pay for your injury-related expenses after an accident. However, medical payments (MedPay) and personal injury protection coverage (PIP) aren’t the same, since MedPay covers less than PIP.

- Roadside assistance. You can call the American National General Insurance roadside assistance phone number at 800-333-2860 to request the following: flat tire change, jump start, gas delivery, lock out service, tow, emergency help, or windshield chip repair.

You can find all of these coverages at just about any insurance company. The only coverage required by law is liability. Coverages like collision and comprehensive are optional unless your lender requires them on your car loan contract.

Since each state has different insurance requirements, contact American National to see which coverages you need to be street-legal.

Also, American National’s website doesn’t say if all of these coverages are available, so call to speak with a representative about coverage options.

What perks come with an American National auto policy?

One way American National automobile insurance stands out from its competitors is the unique benefits it offers with its auto insurance policies. The benefits are free and apply automatically to your policy. However, not all states offer each of these perks, so speak with an American National representative to see what your state offers.

The following perks come with every American National car insurance policy:

- If you have an auto and home policy, you can earn a percentage of your rates back if you go three years without filing a claim. You’ll also receive a check every year afterward if you maintain your claim-free status.

- If you have home and auto policies with American National and your home and vehicle are both damaged in the same incident, you only pay one deductible, which is the amount your insurer deducts from your claim check.

- Your deductible is discounted or free if you’re in a car accident with an American National policyholder.

Additionally, you can receive the following benefits if you have comprehensive and collision policies:

- Customized equipment coverage. Customized equipment coverage covers permanently installed parts besides those installed by the original manufacturer. American National offers policyholders a $2,000 limit for this coverage.

- Rental car reimbursement. American National rental car reimbursement covers the cost of a rental car while yours gets repaired after a covered claim. However, you can’t use this coverage for business or personal travel expenses.

American National offers perks that most other insurance companies either don’t offer or only offer in exchange for a fee. So if these special coverages fit your needs, you should consider an auto policy with American National.

What other auto coverages does American National sell?

While you can get a full coverage policy with American National, the company also sells other add-on coverages to maximize protection for your vehicle. However, you’ll pay more for insurance if you have add-on coverages, so make sure you need the coverage and can afford it.

Below are additional coverages offered by American National:

- Gap insurance. Gap insurance pays the difference between your vehicle’s cash value and your auto loan after it gets totaled or stolen. If you total your vehicle, insurance only pays for the car’s cash value at the time of the accident, which could be less than what you still owe on the loan.

- ACE insurance. ACE insurance, or “added coverage endorsement,” helps pay to replace broken parts on your car.

- Accidental death and dismemberment. Accidental death and dismemberment coverage through American National offers a cash payment to you or your family if you die or get in an accident that causes vision or limb loss.

However, while the American National car insurance company offers various auto insurance coverages to protect you and your vehicle fully, you won’t know how much you’ll pay for it until you get an American National Insurance quote.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other insurance types does American National sell?

In addition to auto insurance, American National sells various other types of insurance products. Policyholders can save on their rates by bundling policies with the company.

Below is a list of other insurance offerings with American National:

- Whole life insurance. An American National whole life insurance policy lasts for the policyholders entire life, and premiums remain fixed. The Amerian National Life Insurance Company also sometimes pays dividends to policyholders, though it’s not guaranteed.

- Indexed universal life. Like whole life, universal life insurance includes a cash value and death benefit, but it offers greater flexibility. With indexed universal life, you can tie your policy to a stock index, like the S&P 500, and borrow against it. Check out American National life insurance reviews from customers to see if the company is right for you.

- Term life insurance. Term ANICO life insurance offers coverage for a specific period, usually a 10-, 20-, or 30-year period, and is significantly cheaper than a universal or whole life insurance policy. Visit your American National life insurance login at www.americannational.com for more policy details.

- Guaranteed universal life. With American National’s guaranteed universal life, you can adjust your policy’s length if you only need coverage for a certain period. You can also cash out the policy if you no longer need it or you become terminally ill. For more questions about life insurance with American National, the Ameican National life insurance phone number is 1-800-899-6808.

- Annuities. American National also sells several annuity types to supplement your retirement income. However, these annuities are underwritten by an American National subsidiary.

- Business insurance. You can get a business insurance policy with American National, including liability, property coverage, workers compensation, a pension plan, and commercial auto insurance.

- Homeowners insurance. American National’s homeowners insurance covers your home, possessions, and other structures should they get damaged. The policy also covers personal liability, medical payments, and temporary relocation expenses. Check out American National home insurance reviews online before buying a policy.

- Renters insurance. If you’re renting, renters insurance covers personal property and temporary relocation expenses. American National also offers optional coverage where covered property gets replaced with new items rather than depreciating in value.

- Classic car insurance. You could get classic car insurance, or collector car insurance, with American National if you have an older vehicle. This policy covers the agreed value of the vehicle and offers spare parts coverage.

- Farm and ranch insurance. American National offers farm family insurance for liability and property coverage to protect vehicles, livestock, farm equipment, crops, and farm buildings.

- RV insurance. You can get insurance coverage for other recreational vehicles like motorcycles, RVs, off-road vehicles, and boats.

While American National sells the car insurance products customers need to stay safe on the road, drivers can also bundle their auto policy with one of the other insurance types listed above.

However, not all insurance types listed are underwritten by American National. For example, annuity products are underwritten by subsidiaries of the company.

Does American National Insurance Company have any online insurance tools?

As is necessary for the technological age, American National offers several online insurance tools to make doing business with the company easier for policyholders. For example, customers can evaluate insurance types, get a quote, and speak with a virtual assistant with your ANPAC insurance login.

You can also log into your American National account to view more policy information. From here, you can pay your car insurance bill too.

Does American National have a mobile app?

ANPAC auto insurance has a mobile app available for download on the App Store or Google Play Store so that you can take your policy anywhere. The app is free and allows you to access your policy information. You can also pay your bill, file a claim, request American National Insurance roadside assistance, and view your insurance ID through American National’s mobile app.

While managing most policy types through American National’s app is simple, you currently can’t see policy information for your business insurance or farm and ranch insurance.

However, the mobile app doesn’t have the greatest reviews. It received an average of 2.8/5 stars on the App Store and 2.5/5 stars on the Google Play Store. Most customers complain of a buggy and unreliable mobile app that isn’t user-friendly.

Can I file an American National claim online?

American National is available 24/7 for online claims filing. If you’d like to file a claim, log into your account and select the “Start Claim Online” button under the “Claims” tab. The company will ask for information about the accident, like time of day, weather conditions, vehicle information, and names of all involved. You will also be asked to provide pictures if possible.

How else can I file a claim with American National?

You can also call the American National auto insurance phone number for claims at 1-800-333-2860 to file a claim. To check on the status of your claim, reach out to the company at [email protected]. Alternatively, you can fax your claim to the number 518-533-4589.

If you’d like to mail in your claim, the claims service address is 1949 E. Sunshine, Springfield, Missouri, 65899.

Unfortunately, American National doesn’t specify a guaranteed response time for claims.

How do I contact American National?

For questions about your bill or policy, the American National insurance 24-hour number is 1-800-899-6519, or you can email [email protected]. American National’s bill pay and policy service is available Monday to Friday from 6 a.m. to 10 p.m., Saturday from 7 a.m. to 7 p.m., and Sunday from 9 a.m. to 7 p.m.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Final Word on American National Car Insurance

American National Insurance Company offers the auto insurance coverages drivers need to drive legally, and many other coverages as well. It also offers unique policy perks that come with all auto insurance policies, but not every perk is available nationwide.

American National has positive ratings from A.M. Best, indicating it has the financial stability to pay out claims to policyholders. However, the company doesn’t have a BBB rating or accreditation, which could be concerning to customers who want a reliable insurance company with high customer satisfaction.

If you’re looking for an insurance company offering various discounts, you’ll have better luck with a different insurance company. While you can earn bundling discounts by purchasing other products alongside auto, American National only offers a few other discounts.

American National’s online presence allows policyholders to access insurance information, pay bills, file a claim, request American National roadside assistance, and much more. Visit www.americannational.com to pay bill. The mobile app offers similar features, but customer American National Insurance Company reviews say it’s buggy and not user-friendly.

American National could be the right choice for you if you’re in the market for a new auto insurance policy. To find the best car insurance policy for your unique needs, it’s important to compare quotes with as many companies as possible — you could overpay for coverage if you fail to do so.

American National Insurance Company Insurance Rates Breakdown

There are many factors that affect your car insurance rates to offset the risk you pose to insurance companies as a policyholder.

Most standard insurance companies look at the following when deciding how much you’ll pay for auto coverage:

- Age

- Location

- Credit score

- Gender

- Marital status

- Occupation

- Car make and model

- Driving record

- Coverage amount

To provide a clear comparison of average minimum coverage auto insurance rates, the following table showcases how American National stacks up against its main competitors, as sourced from top insurance providers in the U.S.

American National vs. Competitors: Minimum Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $61 |

| American Family | $44 |

| American National | $42 |

| Farmers | $53 |

| Geico | $30 |

| Liberty Mutual | $67 |

| Nationwide | $44 |

| Progressive | $39 |

| State Farm | $33 |

| Travelers | $38 |

| USAA | $22 |

| U.S. Average | $45 |

The table below presents a detailed comparison of average monthly rates for full coverage auto insurance, highlighting where American National stands in relation to its competitors across major U.S. insurance providers.

American National vs. Competitors: Full Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $160 |

| American Family | $117 |

| American National | $120 |

| Farmers | $139 |

| Geico | $80 |

| Liberty Mutual | $174 |

| Nationwide | $115 |

| Progressive | $105 |

| State Farm | $86 |

| Travelers | $99 |

| USAA | $59 |

| U.S. Average | $119 |

Companies also consider various factors when setting rates, and some could cause higher rates than others. For example, a young driver with a moving violation will likely pay higher rates than a middle-aged driver with good credit, since insurers view the young driver as riskier to insure.

Your location also has a significant impact on your car insurance rates. For example, almost all states require a certain amount of auto coverage — some require higher limits, while others may require lower amounts. So if you live in a state with high coverage limits, like Florida, you could pay higher car insurance rates.

While American National considers some or all of the above factors when setting your rates, specific rate information for the company isn’t available. You won’t know how much an American National car insurance policy would cost for you until you get an American National auto quote.

American National Insurance Company Discounts Available

One of American National’s negative qualities is that it doesn’t offer a diverse set of auto insurance discounts for drivers. However, it does offer some.

Since American National sells other insurance products besides auto insurance, you can also save by purchasing another policy — or bundling — with the company. Often, certain discounts are only available in certain states, so speak with an American National representative to see how you can save.

To get the most out of your coverage, work with an independent insurance agent to find a plan that fits your budget. American National might be the best fit for you if these discounts apply to you.

However, if discounts are important to you, or not many of the above discounts apply to you, consider a policy with a company offering more savings opportunities.

How else can I save on American National coverage?

Since American National doesn’t offer many discount options, you might want to consider other options to lower your monthly premiums. Though there are several factors outside of your control that insurers consider when setting rates, there are some you can control.

Below is a list of other ways American National policyholders can save on auto insurance coverage:

- Lower your deductible. Your deductible is the amount you pay before insurance kicks in, so the lower it is, the lower your car insurance rates. However, don’t lower your deductible to an amount you can’t afford to pay out of pocket.

- Insure a cheap vehicle. If you want to save on your American National car insurance, you could purchase a vehicle with low value or one that would be cheap to repair, as insurers generally charge these vehicles lower rates.

- Practice safe driving. Your car insurance company will take note if you practice safe driving, avoid accidents, and remain ticket-free.

- Drop unnecessary coverages. If you have an older car that’s depreciated in value, you could drop collision and comprehensive coverages and only carry liability. In general, it’s best to drop full coverage if insurance rates are higher than the potential payout.

Consider the tips above and see if you qualify for any vehicle- or policy-based discounts on your American National car insurance.

Frequently Asked Questions

Is American National Insurance good?

You may be wondering, “Is American National a good insurance company?” Yes, American National is a legitimate insurer you can trust, offering coverage in all 50 U.S. states. In addition, the company has strong financial stability, touting an A, or excellent, rating from A.M. Best. However, the company has no rating or accreditation from the Better Business Bureau.

Who owns American National Insurance Company?

The parent company of American National Insurance is Brookfield Asset Management Reinsurance Partners Ltd.

How long has American National been operational?

American National Insurance Company was founded in 1905, and its headquarters is in Galveston, Texas. It covers over seven million policyholders in the United States, Canada, Guam, American Samoa, and Western Europe. William Lewis Moody, Jr. is the founder of American National.

How do I pay my American National auto insurance bill?

At www.americannational.com, login to your account to pay your car insurance bill on the website, or you can also pay on the mobile app. With ANPAC Easy Pay through your American National insurance login, you can set up automatic payments for insurance premiums to avoid late payments.

Where can I buy American National car insurance?

You can get an American National car insurance policy in all U.S. states and territories. However, certain discounts, coverage options, and unique perks may not be available in every state. So, call an American National representative to learn more about the options that are available to you.

What types of auto insurance coverage does American National Auto Insurance offer?

American Property and Casualty Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. The specific coverage options may vary based on the policy and state regulations.

For more questions about its insurance products, the American National Property and Casualty Company phone number is 1-800-899-6519.

How can I contact American National Auto Insurance?

The American National insurance phone number is 1-800-899-6519 for the auto customer service department. You can also speak with American National Property and Casualty Insurance by email or other contact methods provided on their official website or policy documents.

How can I file a claim with American National Auto Insurance?

To file a claim with American National Auto Insurance, you can contact their claims department directly. Contact the ANPAC insurance phone number for claims at 1-800-333-2860 to file a claim.

They will guide you through the claims process, provide the necessary forms, and assist you in gathering any required information. It is important to report accidents or incidents promptly to initiate the claims process. You can also use your ANPAC login to pay your bill.

Does American National Auto Insurance offer roadside assistance?

American National Auto Insurance may offer optional roadside assistance coverage as an add-on to their policies. Roadside assistance can provide services such as towing, jump-starts, fuel delivery, and lockout assistance in case of emergencies or breakdowns while on the road. The availability of this coverage may vary based on the policy and state regulations.

Contact the ANPAC insurance phone number for claims at … to file a claim

Can I manage my American National Auto Insurance policy online?

Yes, at www.anpac.com, login to your account to manage your American National auto insurance policy, or use the mobile app. You can also use your American National login to pay your bill.

This may include tasks such as making payments, viewing policy documents, updating personal information, and accessing digital ID cards.

What is the lawsuit against American National?

Does American National have life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.