Kemper Auto Insurance Review for 2026 (Check Out Their Score!)

Our Kemper auto insurance review found that Kemper is best for high-risk drivers looking for nonstandard coverage. Kemper insurance for car owners also offers many coverage options, though Kemper car insurance reviews reveal it has many customer complaints. Kemper rates for good drivers start at $47/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated December 2024

Our Kemper auto insurance review found that Kemper can benefit high-risk drivers, such as teens or drivers with multiple accidents, who may have trouble finding an insurer elsewhere. Its unique add-on coverages allow drivers to build high-risk auto insurance policies that fit their needs and budget.

Kemper writes SR-22 auto insurance policies for drivers with DUIs, traffic violations, or coverage lapses. It also offers various discounts to help drivers save on high-risk coverage, particularly families.

Kemper Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 3.5 |

| Claim Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 2.8 |

| Digital Experience | 4.0 |

| Discounts Available | 4.7 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 3.8 |

| Savings Potential | 4.1 |

Keep reading our Kemper insurance review to learn more about Kemper auto customer service performance and average rates.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code above to find the most affordable auto insurance quotes in your area instantly.

- Kemper specializes in high-risk driver auto insurance

- A.M. Best gave Kemper an A- financial rating

- Kemper has a higher number of customer complaints

Kemper Auto Insurance Rates

Kemper rates will vary among customers. For an idea of what you’ll pay at Kemper based on age, gender, and coverage type, view the table below.

Kemper Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $239 | $619 |

| Age: 16 Male | $258 | $639 |

| Age: 18 Female | $194 | $456 |

| Age: 18 Male | $221 | $520 |

| Age: 25 Female | $57 | $152 |

| Age: 25 Male | $58 | $156 |

| Age: 30 Female | $53 | $141 |

| Age: 30 Male | $54 | $145 |

| Age: 45 Female | $48 | $128 |

| Age: 45 Male | $47 | $125 |

| Age: 60 Female | $44 | $114 |

| Age: 60 Male | $46 | $117 |

| Age: 65 Female | $48 | $125 |

| Age: 65 Male | $46 | $122 |

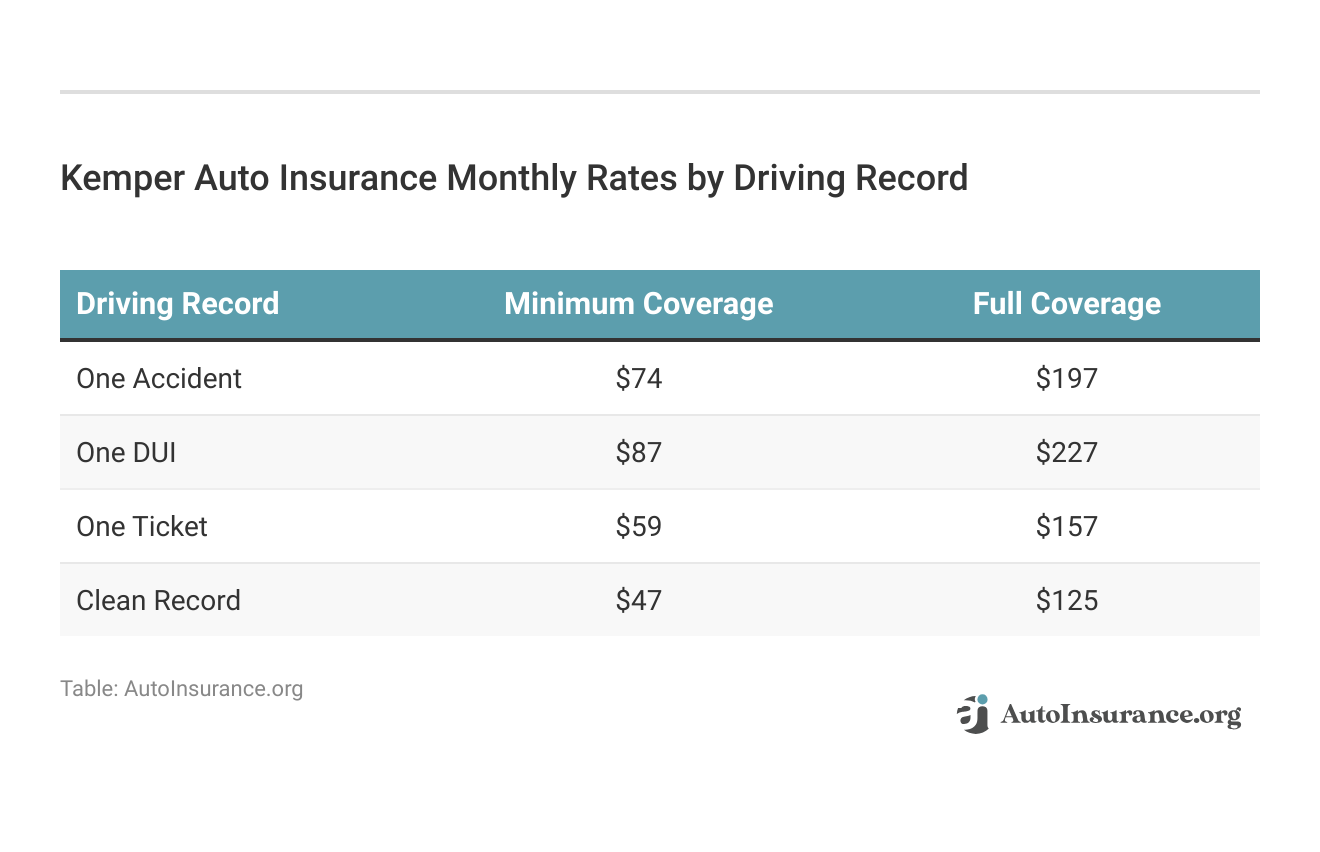

Of course, your driving record will also impact your monthly auto insurance rates, with DUIs raising rates the most at Kemper.

Since so many factors impact rates, it’s best to get quotes from Kemper to see if they actually offer the most affordable coverage. Drivers with clean records will have the most affordable monthly rates, but Kemper’s rates for drivers with tickets are fairly affordable, too.

Here are the factors Kemper may use to set car insurance rates:

- Age and Gender: Younger drivers, specifically anyone under 25, have less experience behind the wheel, so they’re more likely to be involved in an accident and file a claim. Female drivers are also less likely to file a claim because they’re often safer and more responsible than male drivers.

- Driving Record and Credit Score: Drivers with a history of accidents and/or traffic violations are high-risk. Drivers with poor or bad credit are seen as irresponsible, meaning there’s a good chance they’ll file a claim.

- Location and Annual Mileage: Vandalism, theft, and accident rates in your state impact the likelihood of you filing a claim. Additionally, drivers not on the road often are less likely to file a claim.

- Type of Vehicle: Repair costs, theft rate, and safety features determine how risky it would be to insure a driver (Read More: Compare Auto Insurance Rates by Vehicle Make and Model).

- Coverage Type: The more coverage a driver has, the higher their car insurance rate will be.

Rating systems vary among companies, so drivers will see different pricing options at Kemper compared to other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kemper Auto Insurance Rates vs. the Competition

It’s also important to compare Kemper’s quotes to other companies to make sure that you’re actually getting a good deal on insurance. Here’s how Kemper’s auto insurance rates compare to its competitors based on coverage type.

Kemper Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| $160 | $47 | |

| $117 | $44 | |

| $139 | $53 | |

| $80 | $30 | |

| $125 | $47 | |

| $174 | $68 |

| $115 | $44 |

| $105 | $39 | |

| $86 | $33 | |

| $99 | $37 | |

| U.S. Average | $119 | $45 |

The coverage level you choose is just one factor that affects your rates. Your age and gender will also affect how much auto insurance costs, with some auto insurance companies offering better rates for your demographic than others. View average rates based on age and gender below.

Kemper Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $104 | $105 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $120 | $128 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | $74 | |

| $456 | $520 | $141 | $145 | $128 | $125 | $114 | $117 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $303 | $387 | $124 | $136 | $113 | $115 | $99 | $104 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | $95 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 | $90 | |

| $180 | $203 | $74 | $79 | $59 | $59 | $53 | $53 |

Age is a big factor in auto insurance rates because young drivers are more likely to file claims than older drivers. If you are a young driver, shop at the cheaper companies for younger drivers.

Driving records also play a role, as insurance companies check driving records to determine risk (Learn More: How Auto Insurance Companies Check Driving Records).

See what Kemper charges based on driving record in comparison to other top companies below.

Kemper Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $125 | $157 | $197 | $227 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

If you have a poor driving record, make sure to compare several companies’ quotes to see if Kemper offers the best deal on auto insurance coverages.

Kemper Auto Insurance Coverage Options

If you have specific coverage needs, evaluating a company’s types of auto insurance coverage options is important before committing.

Kemper offers standard coverage and various add-ons, allowing you to customize your coverage and ensure you're protected financially in any situation.Michelle Robbins Licensed Insurance Agent

Kemper offers standard coverages like Kemper liability insurance and add-on auto insurance coverage options, such as Kemper roadside assistance. Check the table below for a full list of Kemper car insurance options.

Kemper Auto Insurance Coverage Options

| Type | Description |

|---|---|

| Collision Coverage | Pays for damage to your car after an accident, regardless of fault. |

| Comprehensive Coverage | Covers damage to your car from non-collision events like theft, fire, or weather. |

| Custom Equipment Coverage | Covers aftermarket additions or enhancements to your vehicle. |

| Gap Insurance | Covers the difference between what you owe on your car and its actual cash value if it's totaled. |

| Liability Coverage | Covers bodily injury and property damage to others if you're at fault. |

| Medical Payments Coverage | Pays for medical expenses for you and your passengers, regardless of fault. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers after an accident. |

| Rental Reimbursement Coverage | Covers the cost of a rental car if your vehicle is being repaired due to a covered claim. |

| Roadside Assistance | Provides help if your car breaks down, including towing, battery jump-starts, and flat tire changes. |

| SR-22 Insurance | Provides proof of insurance for high-risk drivers required to file an SR-22 form. |

| Uninsured/Underinsured Motorist | Protects you if you're in an accident with a driver who has no insurance or insufficient coverage. |

Different add-on coverage options are available through Kemper depending on the type of auto insurance policy you purchase. For example, the Kemper Prime Auto Enhanced package includes the following add-on options:

- First accident or minor traffic violation waived

- Deductible for vehicles damaged while parked waived

- Diminishing deductible and trip interruption expenses

- Personal property protection

- Replacement of key or entry transmitter device

On the other hand, the Kemper Total package is designed for new car owners, offering broad protection for high-value vehicles. Certain add-on options aren’t available in all states, so contact a Kemper insurance agent to see what you can buy.

Additional Kemper Insurance Products

Similar to other car insurance companies, Kemper offers other types of insurance besides Kemper automobile insurance to its customers. Kemper offers the following additional insurance products:

- Renters, Condo, & Mobile Home

- Umbrella & Flood

- Business

- Supplemental Health & Life

- RV, Boat, Motorcycle, & ATV

Some insurance products, such as Kemper renters insurance, are available through third parties, not Kemper itself.

Kemper Auto Insurance Discounts Available

Discounts are a great way to make Kemper auto insurance rates more affordable. Kemper offers the following auto insurance discounts to customers:

Kemper Auto Insurance Discounts

| Discount Type | Potential Savings |

|---|---|

| Anti-Theft Discount | 10% |

| Continuous Coverage Discount | 15% |

| Defensive Driving Discount | 10% |

| Early Signing Discount | 7% |

| Good Student Discount | 15% |

| Homeowner Discount | 10% |

| Multi-Car Discount | 20% |

| Multi-Policy Discount | 20% |

| Paid-in-Full Discount | 10% |

| Safe Driver Discount | 25% |

Kemper’s car insurance discounts vary based on state and policy type, so not all customers can access every discount. The best way to determine what you’ll pay after discounts is to get a Kemper auto insurance quote.

Discounts🤑 are motivating! Who doesn’t love saving money? If you want to get a discount on your car 🚘insurance, https://t.co/27f1xf131D has the scoop. Get started saving money today by checking out our tips and tricks👉: https://t.co/JEnTbtVlQv pic.twitter.com/HEBkAh77o4

— AutoInsurance.org (@AutoInsurance) January 18, 2024

Now that we’ve covered rates, coverages, and discounts, keep reading to evaluate Kemper auto insurance reviews from customers and rating agencies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kemper Auto Insurance Customer Reviews

Reading customer reviews is a great way to see what others think of the company’s customer service with claims handling, policy changes, and more (Read More: Auto Insurance Companies With the Best Customer Service).

Kemper mostly has just average ratings from customers, and there are some negative Kemper insurance claims reviews on sites like Reddit, as you can see from the review below.

Posts from the insurance

community on Reddit

When checking Kemper insurance company reviews on popular sites like Reddit, the main issue with Kemper’s customer service seems to be responsiveness during claims. Delays with claims processing or rejection of claims is problematic, and is something to consider when researching a company like Kemper.

Kemper Auto Insurance Business Reviews

In addition to checking customer reviews, check what popular business rating sites are saying about Kemper. The most important Kemper auto insurance ratings from businesses are listed below.

Kemper Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 795 / 1,000 Avg. Satisfaction |

|

| Score: A Financial Strength |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: A++ Superior Financial Strength |

According to the J.D. Power, Kemper is below average. J.D. Power ranks auto insurance companies in 11 geographical regions based on customer satisfaction with policy information, policy offerings, billing, claims, interaction, and price.

The NAIC also found that Kemper has a higher-than-average number of customer complaints. This could indicate issues with Kemper’s claims process and customer service.

Learn More: Best Auto Insurance Companies for Paying Claims

However, the Kemper insurance rating from A.M. Best is A-, so the company is financially stable. In addition, it has a Better Business Bureau rating of A+, meaning most Kemper insurance reviews are good.

Kemper Auto Insurance Pros and Cons

We’ve covered a lot of ground on Kemper auto insurance, so we want to take a minute to recap the main pros and cons of the company. Some of the positives that attract drivers to Kemper include:

- SR-22 Insurance: Kemper offers SR-22 insurance coverage to drivers who may have trouble finding coverage elsewhere.

- Local Agents: Most customers will be able to find a local Kemper agent near them.

- Coverage Options: Kemper has a good selection of auto insurance coverages that meet state requirements.

Of course, there are also cons to Kemper that could result in dissatisfied customers. The main cons we found are:

- Higher Rates for Good Drivers: Kemper isn’t one of the cheapest auto insurance companies for good drivers.

- Customer Service: Kemper has a higher number of complaints than average and poor customer service reviews.

It’s important to fully consider the perks and disadvantages of Kemper insurance policies by reading Kemper auto reviews before committing to a policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding if Kemper Auto Insurance is Right for You

Reading Kemper auto insurance reviews should help you decide on the company. Kemper is ideal for high-risk drivers needing SR-22 auto insurance, but other drivers may want to avoid the company due to its higher rates and poor customer service reviews.

Though Kemper works for anyone needing car insurance, high-risk drivers with revoked, suspended, or canceled licenses may find Kemper appealing as it files SR-22 forms.

Founded in 1990, Kemper offers various insurance products, including auto, life, and health insurance. Its subsidiaries, Kemper Auto and Kemper Personal Insurance provide auto insurance in all 50 states and Washington, D.C. However, available coverage options vary by state.

Before committing to a company, make sure to compare Kemper car insurance quotes against top competitors. To compare quotes today, enter your ZIP code into our free comparison tool below.

Frequently Asked Questions

Is Kemper insurance good?

Kemper auto insurance has an A- rating from A.M. Best, and an A+ from the Better Business Bureau. However, the company has a high volume of customer complaints in Kemper reviews.

However, the company offers other insurance products, with a specific focus on life insurance. Check out Kemper life insurance reviews to see if it offers the coverage you need to secure your family’s financial future.

How can I request a Kemper car insurance quote?

To request a quote from Kemper, drivers can contact a local agent or customer service by phone at 877-352-0068 for Kemper Auto or 800-216-6347 for Kemper Personal Insurance. You can also enter your ZIP in our free quote tool to compare multiple companies’ quotes simultaneously.

How do I file a car insurance claim with Kemper?

You can file a claim using the mobile app, online form, or by contacting customer service at 800-782-1020 for Kemper Auto & Commercial Vehicle or at 888-252-2799 for Personal Insurance. When filing a Kemper claim, whether using the Kemper claims email or app, drivers must submit the following information:

- Policyholder’s Name, Contact Information, & Policy Number

- Policyholder’s Vehicle Information

- Description of Incident (Date, Time, Damages, and Injuries)

- Claimant Name

- Claimant Vehicle Information

If drivers prefer, local agents can also assist them with filing Kemper claims (Read More: How to File an Auto Insurance Claim).

What states does Kemper offer car insurance?

Kemper offers car insurance in all 50 states and Washington, D.C. However, certain car insurance coverage options aren’t available in all states.

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

How can I contact Kemper auto insurance?

You can contact Kemper by phone at 800-353-6737 for claims and 800-782-1020 for customer service. Kemper is also available by email at [email protected]. Kemper’s address for filing claims is P.O. Box 2843, Clinton, IA 52733.

Fortunately, if you need Kemper insurance in Birmingham, AL, the company’s general address is P.O. Box 830189, Birmingham, AL 35283-0189 (Read More: Best Birmingham, AL Auto Insurance). You can also submit a message through its online contact form.

What is Kemper car insurance?

Kemper car insurance is a type of auto insurance provided by Kemper Corporation, a leading insurance provider in the United States. It offers coverage for personal vehicles to protect against financial loss in case of accidents, theft, or other damages.

What types of car insurance coverage does Kemper offer?

Kemper offers various types of car insurance coverage, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and rental reimbursement coverage.

How can I get a quote for Kemper car insurance?

To get a quote for Kemper car insurance, you can visit their website or contact their customer service. You will typically need to provide information about your vehicle, driving history, and personal details to obtain an accurate quote (Read More: How to Get an Auto Insurance Quote Without Giving Personal Information).

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

Does Kemper offer pay-per-mile car insurance?

Does Kemper offer rideshare insurance?

Does Kemper offer usage-based car insurance?

Does Kemper have a mobile app?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

Kemper auto insurance has an A- rating from A.M. Best, and an A+ from the Better Business Bureau. However, the company has a high volume of customer complaints in Kemper reviews.

However, the company offers other insurance products, with a specific focus on life insurance. Check out Kemper life insurance reviews to see if it offers the coverage you need to secure your family’s financial future.

To request a quote from Kemper, drivers can contact a local agent or customer service by phone at 877-352-0068 for Kemper Auto or 800-216-6347 for Kemper Personal Insurance. You can also enter your ZIP in our free quote tool to compare multiple companies’ quotes simultaneously.

How do I file a car insurance claim with Kemper?

You can file a claim using the mobile app, online form, or by contacting customer service at 800-782-1020 for Kemper Auto & Commercial Vehicle or at 888-252-2799 for Personal Insurance. When filing a Kemper claim, whether using the Kemper claims email or app, drivers must submit the following information:

- Policyholder’s Name, Contact Information, & Policy Number

- Policyholder’s Vehicle Information

- Description of Incident (Date, Time, Damages, and Injuries)

- Claimant Name

- Claimant Vehicle Information

If drivers prefer, local agents can also assist them with filing Kemper claims (Read More: How to File an Auto Insurance Claim).

What states does Kemper offer car insurance?

Kemper offers car insurance in all 50 states and Washington, D.C. However, certain car insurance coverage options aren’t available in all states.

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

How can I contact Kemper auto insurance?

You can contact Kemper by phone at 800-353-6737 for claims and 800-782-1020 for customer service. Kemper is also available by email at [email protected]. Kemper’s address for filing claims is P.O. Box 2843, Clinton, IA 52733.

Fortunately, if you need Kemper insurance in Birmingham, AL, the company’s general address is P.O. Box 830189, Birmingham, AL 35283-0189 (Read More: Best Birmingham, AL Auto Insurance). You can also submit a message through its online contact form.

What is Kemper car insurance?

Kemper car insurance is a type of auto insurance provided by Kemper Corporation, a leading insurance provider in the United States. It offers coverage for personal vehicles to protect against financial loss in case of accidents, theft, or other damages.

What types of car insurance coverage does Kemper offer?

Kemper offers various types of car insurance coverage, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and rental reimbursement coverage.

How can I get a quote for Kemper car insurance?

To get a quote for Kemper car insurance, you can visit their website or contact their customer service. You will typically need to provide information about your vehicle, driving history, and personal details to obtain an accurate quote (Read More: How to Get an Auto Insurance Quote Without Giving Personal Information).

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

Does Kemper offer pay-per-mile car insurance?

Does Kemper offer rideshare insurance?

Does Kemper offer usage-based car insurance?

Does Kemper have a mobile app?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

You can file a claim using the mobile app, online form, or by contacting customer service at 800-782-1020 for Kemper Auto & Commercial Vehicle or at 888-252-2799 for Personal Insurance. When filing a Kemper claim, whether using the Kemper claims email or app, drivers must submit the following information:

- Policyholder’s Name, Contact Information, & Policy Number

- Policyholder’s Vehicle Information

- Description of Incident (Date, Time, Damages, and Injuries)

- Claimant Name

- Claimant Vehicle Information

If drivers prefer, local agents can also assist them with filing Kemper claims (Read More: How to File an Auto Insurance Claim).

Kemper offers car insurance in all 50 states and Washington, D.C. However, certain car insurance coverage options aren’t available in all states.

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

How can I contact Kemper auto insurance?

You can contact Kemper by phone at 800-353-6737 for claims and 800-782-1020 for customer service. Kemper is also available by email at [email protected]. Kemper’s address for filing claims is P.O. Box 2843, Clinton, IA 52733.

Fortunately, if you need Kemper insurance in Birmingham, AL, the company’s general address is P.O. Box 830189, Birmingham, AL 35283-0189 (Read More: Best Birmingham, AL Auto Insurance). You can also submit a message through its online contact form.

What is Kemper car insurance?

Kemper car insurance is a type of auto insurance provided by Kemper Corporation, a leading insurance provider in the United States. It offers coverage for personal vehicles to protect against financial loss in case of accidents, theft, or other damages.

What types of car insurance coverage does Kemper offer?

Kemper offers various types of car insurance coverage, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and rental reimbursement coverage.

How can I get a quote for Kemper car insurance?

To get a quote for Kemper car insurance, you can visit their website or contact their customer service. You will typically need to provide information about your vehicle, driving history, and personal details to obtain an accurate quote (Read More: How to Get an Auto Insurance Quote Without Giving Personal Information).

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

Does Kemper offer pay-per-mile car insurance?

Does Kemper offer rideshare insurance?

Does Kemper offer usage-based car insurance?

Does Kemper have a mobile app?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

You can contact Kemper by phone at 800-353-6737 for claims and 800-782-1020 for customer service. Kemper is also available by email at [email protected]. Kemper’s address for filing claims is P.O. Box 2843, Clinton, IA 52733.

Fortunately, if you need Kemper insurance in Birmingham, AL, the company’s general address is P.O. Box 830189, Birmingham, AL 35283-0189 (Read More: Best Birmingham, AL Auto Insurance). You can also submit a message through its online contact form.

What is Kemper car insurance?

Kemper car insurance is a type of auto insurance provided by Kemper Corporation, a leading insurance provider in the United States. It offers coverage for personal vehicles to protect against financial loss in case of accidents, theft, or other damages.

What types of car insurance coverage does Kemper offer?

Kemper offers various types of car insurance coverage, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and rental reimbursement coverage.

How can I get a quote for Kemper car insurance?

To get a quote for Kemper car insurance, you can visit their website or contact their customer service. You will typically need to provide information about your vehicle, driving history, and personal details to obtain an accurate quote (Read More: How to Get an Auto Insurance Quote Without Giving Personal Information).

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

Does Kemper offer pay-per-mile car insurance?

Does Kemper offer rideshare insurance?

Does Kemper offer usage-based car insurance?

Does Kemper have a mobile app?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

Kemper car insurance is a type of auto insurance provided by Kemper Corporation, a leading insurance provider in the United States. It offers coverage for personal vehicles to protect against financial loss in case of accidents, theft, or other damages.

Kemper offers various types of car insurance coverage, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and rental reimbursement coverage.

How can I get a quote for Kemper car insurance?

To get a quote for Kemper car insurance, you can visit their website or contact their customer service. You will typically need to provide information about your vehicle, driving history, and personal details to obtain an accurate quote (Read More: How to Get an Auto Insurance Quote Without Giving Personal Information).

Does Kemper offer SR-22 car insurance?

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

Does Kemper offer pay-per-mile car insurance?

Does Kemper offer rideshare insurance?

Does Kemper offer usage-based car insurance?

Does Kemper have a mobile app?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

To get a quote for Kemper car insurance, you can visit their website or contact their customer service. You will typically need to provide information about your vehicle, driving history, and personal details to obtain an accurate quote (Read More: How to Get an Auto Insurance Quote Without Giving Personal Information).

Yes, Kemper offers SR-22 car insurance to drivers with revoked, canceled, or suspended licenses.

Does Kemper offer pay-per-mile car insurance?

Does Kemper offer rideshare insurance?

Does Kemper offer usage-based car insurance?

Does Kemper have a mobile app?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

Does Kemper offer usage-based car insurance?

Does Kemper have a mobile app?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

What factors affect the cost of Kemper car insurance?

Does Kemper insurance cover rental cars?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

What is Kemper Direct renters insurance?

How are Kemper home insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How are Kemper health insurance reviews?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.