Lemonade Auto Insurance Review (2026)

In this Lemonade auto insurance review we will first need to acknowledge that Lemonade doesn't sell auto insurance coverage at all. But Lemonade insurance does sell homeowners, renters, and pet coverage. Lemonade’s renters insurance rates are $25 per month, while pet insurance costs $10 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated December 2024

Lemonade does not have traditional agents. As a result, it has fewer employees than many other insurance companies of comparable size. This is another factor that helps keep Lemonade’s premiums low.

Like many other tech start-up users, Lemonade’s customers use artificial intelligence on the company’s mobile app and website in lieu of consulting with an agent.

Policyholders run claims through a chatbot named “A.I. Jim.” The chatbot is designed to review claims while simultaneously running fraud algorithms.

Unlike another major online insurance company, Geico, Lemonade doesn’t use agents in any capacity

What You Should Know About Lemonade Insurance Company

When you hear “lemonade,” you may not think of insurance. Lemonade, however, is the name of an up-and-coming insurance company. But is Lemonade legit? If you’re hoping for a Lemonade auto insurance review, you should know that this provider does not offer auto insurance.

With such an original name, you might ask yourself: is Lemonade a legit insurance company? For the past few years, Lemonade has made a name for itself in the industry.

What coverage options are available through Lemonade? While Lemonade cannot offer you a cheap auto insurance policy, the company is known for its homeowners, renters, and pet insurance.

First, we’ll review Lemonade Insurance’s history, current structure, and the Lemonade claims process. Then, we’ll share the best way to get Lemonade insurance quotes for the policies they do offer.

You can’t buy a Lemonade auto insurance policy, but if you’re ready to get car insurance quotes right now, you can enter your five-digit ZIP code into our FREE quote tool above.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does the Lemonade Insurance Company sell auto insurance?

Does Lemonade do auto insurance? If you own a car, you may wonder about the different types of auto insurance coverage options offered through Lemonade. Unfortunately, Lemonade does not sell auto insurance of any kind, so you’ll be out of luck when looking for a Lemonade auto insurance quote. However, you can purchase Lemonade property insurance.

Lemonade’s property insurance covers several perils, including electrical and water damage. You can also get Lemonade fire insurance, and they insure personal property damage. That means you can even get Lemonade bike insurance.

Lemonade charges less than average by cutting internal costs as much as possible.

According to the company website, you’ll be placed with other customers. A base rate of 20% of your premiums will go directly towards paying for the company’s salaries, running, and technology costs.

The other 80% of your premiums will pay for customer claims. If any money is left at the end of June, all remaining funds are donated to the charity chosen by your group.

The Lemonade Insurance Company claims to charge 80% less than other insurers.

Because automobile accidents are so common, auto insurers must pay out many claims to their customers. This means that auto insurance has a lower profitability rate than other types of insurance.

What an auto insurance specialist says about bundling rates is that for insurance companies to offer both home and auto insurance, it must raise home insurance premiums to offset any losses.

So, since by not offering customers the option of purchasing Lemonade bundle insurance, they can offer home insurance premiums that are lower than average.

Does Lemonade have agents?

Lemonade does not have traditional agents. As a result, it has fewer employees than many other insurance companies of comparable size. This is another factor that helps keep Lemonade’s premiums low.

Like many other tech start-up users, Lemonade’s customers use artificial intelligence on the company’s mobile app and website in lieu of consulting with an agent.

Policyholders run claims through a chatbot named “A.I. Jim.” The chatbot is designed to review claims while simultaneously running fraud algorithms. So, you could say that you’re getting Lemonade AI insurance.

Unlike another major online insurance company, Geico, there is really no such thing as a Lemonade insurance agent.

What is the peer-to-peer insurance process?

Unlike many companies that rely on the traditional model, Lemonade uses the peer-to-peer model but goes above and beyond. The peer-to-peer model removes the middleman, which can lead to borrowers getting access to cheaper loans.

Lemonade underwrites the policies themselves in addition to determining the pricing. Its customers will pay the base premium. An algorithm is used to then determine a client’s monthly fee.

Regarding the fee, Lemonade will take out a flat rate from your monthly premium to pay for client claims. According to the company website, the amount that is leftover in June will be donated to charities chosen by clients. This is one of the strategies employed to discourage fraudulent claims and increase retention.

Lemonade also works with a second company that helps it pay for any potential losses. Called reinsurance, Lemonade shares an amount of the premium with the other company and overall, this process helps to avoid any unnecessary issues that could arise over the premium.

Because of the length of the reinsurance, both Lemonade and its clients don’t have the same problem as other companies who fight with customers over money and claims every year. The system is built without the bureaucratic nightmares and pitfalls that other companies experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do I file a claim with Lemonade?

You might ask how long do Lemonade claims take? The Lemonade claims experience is actually fairly smooth. The company is well known for making its claims process simple and pain-free.

The company’s objective is to compensate policyholders as quickly as possible. So how long does it take Lemonade to process a claim? Well, in 2016, Lemonade set a world record by reviewing, approving, and paying a claim in three seconds.

Here’s the easiest way to file a claim:

- Open the mobile app and click the “Claim” button.

- Complete a claim report. The claim report will ask you basic questions about the incident and prompt you to include relevant receipts. You may also be asked to submit a video explaining your incident and record any visible damages.

- After you complete your report, you will be prompted to submit your bank account information. This will allow the company to send you compensation once your claim has been approved.

The Lemonade claim process is very unique.

Every part of filing your claim will be done online or through the mobile app. That’s all there is to it. There’s no Lemonade claims phone number to call and then sit on hold.

This claims filing process is touted as being streamlined and easily accessible to consumers.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

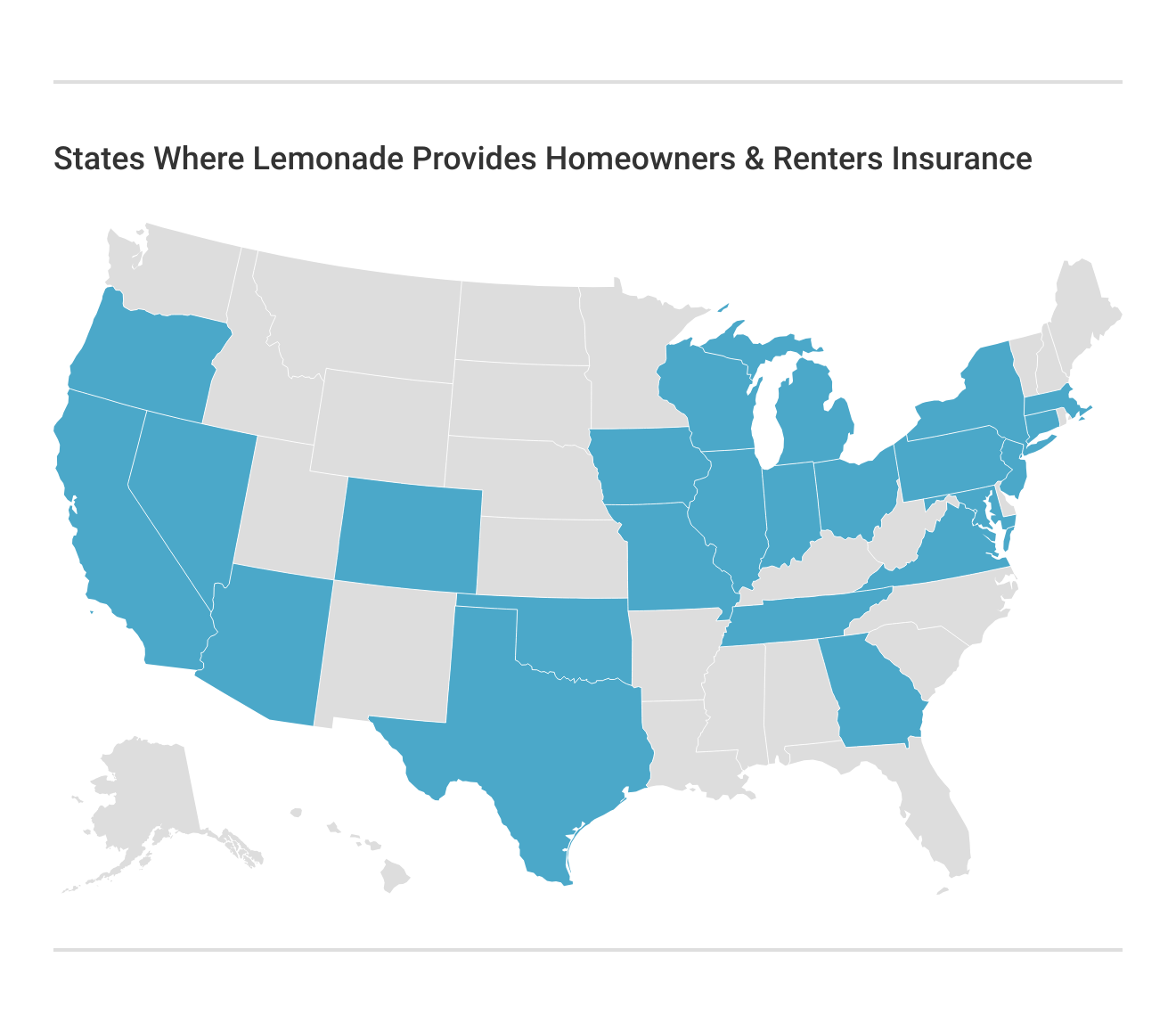

Where is Lemonade insurance available?

Where is Lemonade available? The company was founded in New York City but has since expanded across the United States. But remember, if you’re wondering where is Lemonade car insurance available? That answer is unfortunately nowhere since Lemonade doesn’t sell car insurance.

Today, renters, condo, and homeowners insurance policies are available in 24 states.

This provider also offers renters and condo insurance in Rhode Island and renters insurance in Arkansas and New Mexico.

Its landlord insurance is available in New York, California, Texas, Illinois, Pennsylvania, Washington D.C., and New Jersey. However, policies have only recently been made available in these states.

In late 2019, Lemonade home insurance programs were brought to Massachusetts and Missouri. The company has stated that it plans to roll out insurance coverage in additional states in the future.

Lemonade does not offer walk-in agencies or locations. Instead, Lemonade’s features are accessed through the company’s mobile app and website.

That includes proof of insurance, which will be sent to your mortgage company directly. You can find a Lemonade homeowners insurance quote a well as Lemonade home insurance reviews online.

What are the benefits of Lemonade?

Is Lemonade a good insurance company? It offers many appealing benefits for many folks looking for home, renter, and pet insurance.

While the low price is a major plus, the company also offers clients different add-ons and extras. You might still have questions about Lemonade. Is Lemonade pet insurance good? Is Lemonade home insurance good? Is Lemonade renters insurance legit?

Keep reading to learn more.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lemonade Insurance Company Insurance Coverage Options

Lemonade allows you to add extra coverage at any time. The current list includes musical instruments, bicycles, and even Lemonade jewelry insurance.

You will not need to purchase extra coverage for basic things, like garments and clothing.

Lemonade gives ample instructions on its website about what to do to add extra coverage and will provide you with your new premium that will need to be paid.

Lemonade Storage Insurance

If you’re interested, you can have Lemonade insurance for storage units. Any personal items that clients of Lemonade maintain in a self-storage unit, separate from where they live, are covered up to $1,000. In fact, the company claims to cover your property anywhere in the world.

For some states, the policy covers possessions in a self-storage locker for up to a certain percentage and a personal property limit.

Family Coverage

While a roommate is not covered through renters insurance, Lemonade’s policy does cover residents living within the client’s household. Significant others are also covered.

If you do not live with your significant other, the other individuals must be related to you, either adopted or by blood, to be protected by the Lemonade homeowners policy.

On its website, Lemonade does claim that adding a significant other to your policy will come at an extra cost.

Lemonade Insurance Company Insurance Rates Breakdown

If you own a car, you may wonder about the different types of auto insurance coverage options as well as Lemonade car insurance prices. Unfortunately, Lemonade does not sell auto insurance of any kind. However, the Lemonade Insurance Company does offer property coverage.

Lemonade’s property insurance covers a number of perils, including electrical and water damage. You can also get Lemonade fire insurance and they insure personal property damage. That means you can even get Lemonade bike insurance.

In the table below, look at the starting monthly Lemonade insurance prices for homeowners insurance, renters insurance, and pet insurance.

Lemonade Monthly Starting Prices by Policy Type

| Lemonade Insurance Policy Type | Starting Monthly Rates |

|---|---|

| Homeowners Insurance | $5 |

| Renters Insurance | $25 |

| Pet Insurance | $10 |

The company also claims you’ll save money by switching to its services. In the table below, check out how much users, on average, have saved from going from a major national company to Lemonade.

Lemonade Average Annual Percent Saved by Switching Providers by Company

| Companies | Percent of Average Savings by Switching to Lemonade |

|---|---|

| Progressive | 31% |

| Allstate | 19% |

| Liberty Mutual | 10% |

| State Farm | 16% |

| Travelers | 14% |

| Geico | 10% |

Now that you’ve seen its prices, you’re probably wondering why is Lemonade insurance so cheap? One of the biggest benefits is that Lemonade is significantly cheaper than Lemonade insurance’s competitors. This is because it is a peer-to-peer insurance company.

Lemonade charges less than average by cutting internal costs as much as possible.

According to the company website, you’ll be placed with other customers. A base rate of 20% of your premiums will go directly towards paying for the company’s salaries, running, and technology costs.

The other 80% of your premiums will pay for customer claims. If any money is left at the end of June, all remaining funds are donated to the charity chosen by your group.

The Lemonade Insurance Company claims to charge 80% less than other insurers.

Because automobile accidents are so common, auto insurers must pay out many claims to their customers. This means that auto insurance has a lower profitability rate than other types of insurance.

What an auto insurance specialist says about bundling rates is that for insurance companies to offer both home and auto insurance, they must raise home insurance premiums to offset any losses.

By not offering auto insurance, Lemonade can offer home insurance premiums that are lower than average.

Frequently Asked Questions

What is Lemonade auto insurance?

Lemonade auto insurance is an insurance product offered by Lemonade, a digital insurance company. But is Lemonade legit? Yes, it provides coverage for your vehicle against various risks, such as accidents, theft, vandalism, and damage.

How does Lemonade auto insurance work?

Lemonade car insurance operates on a digital platform, allowing you to easily get a quote, purchase coverage, and file claims through their mobile app or website.

Lemonade utilizes artificial intelligence and automation to streamline the insurance process and provide fast and efficient service.

What are the types of Lemonade insurance coverage ?

So you’re wondering about Lemonade coverage. You might want to know if Lemonade has full coverage car insurance or not. Well, Lemonade auto insurance offers comprehensive coverage, including liability coverage, collision coverage, and comprehensive coverage.

Liability coverage protects you if you cause damage to others, while collision and comprehensive coverage provide protection for your vehicle.

Is Lemonade auto insurance available in all states?

What states is Lemonade car insurance in? Lemonade auto insurance is currently available in select states within the United States. As September 2021, Lemonade Auto Insurance was available in Arizona, California, Connecticut, Georgia, Illinois, Indiana, Maryland, Michigan, Nevada, New Jersey, New York, Ohio, Oregon, Pennsylvania, Tennessee, Texas, and Virginia.

It’s advisable to check with Lemonade directly or visit their website for the most up-to-date information when you’re asking what states is Lemonade available in.

How are Lemonade auto insurance rates determined?

Lemonade car insurance rates are calculated based on various factors, including your driving history, location, type of vehicle, coverage limits, and deductible choices.

Lemonade rates ae sometimes set when the company utilizes algorithms and data analysis to assess the risk associated with each policyholder and determine an appropriate premium.

Where can I find Lemonade Insurance Company reviews?

You might be wondering where you can find Lemonade car insurance reviews, Lemonade life insurance reviews, and Lemonade renters insurance reviews.

If you google Lemonade Insurance reviews, you will find results from a variety of websites. You can check out reviews on reputable websites by looking up Lemonade Insurance reviews on BBB or read a Lemonade car insurance review from Consumer Reports.

Is Lemonade car insurance good?

So you want to know is Lemonade auto insurance good? Well, Lemonade does not sell auto insurance, so you will have to find a car insurance policy with a different insurance provider.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.